Uncategorized

Adam Back Wants CBDCs Dead

If you asked a cypherpunk in the 1990s about their worst-case scenario for the future of money, they probably would have described something very close to Central Bank Digital Currencies (CBDCs). The fight against financial surveillance was fundamental for Bitcoin’s early instigators, and CBDCs go against everything they stand for: privacy, decentralization and individual sovereignty.

In “The Cypherpunk Manifesto” (1993), Eric Hughes argued that cryptography should protect individual freedoms, not be a tool for centralized control. Bitcoin, born out of concerns over financial censorship and systemic instability, represents an alternative to traditional monetary systems. While central banks typically operate with a degree of independence from governments, CBDCs raise questions about financial privacy and the potential for increased state oversight over transactions. As such, CBDCs are the antithesis of Bitcoin.

CBDCs, which are being adopted and trialled throughout the world, have been marketed as a tool for financial inclusion. But, to most Bitcoiners, they are a Trojan horse for reinforcing state control rather than granting individuals true financial ownership. They represent the exact kind of Big Brother system that cypherpunks fought to prevent.

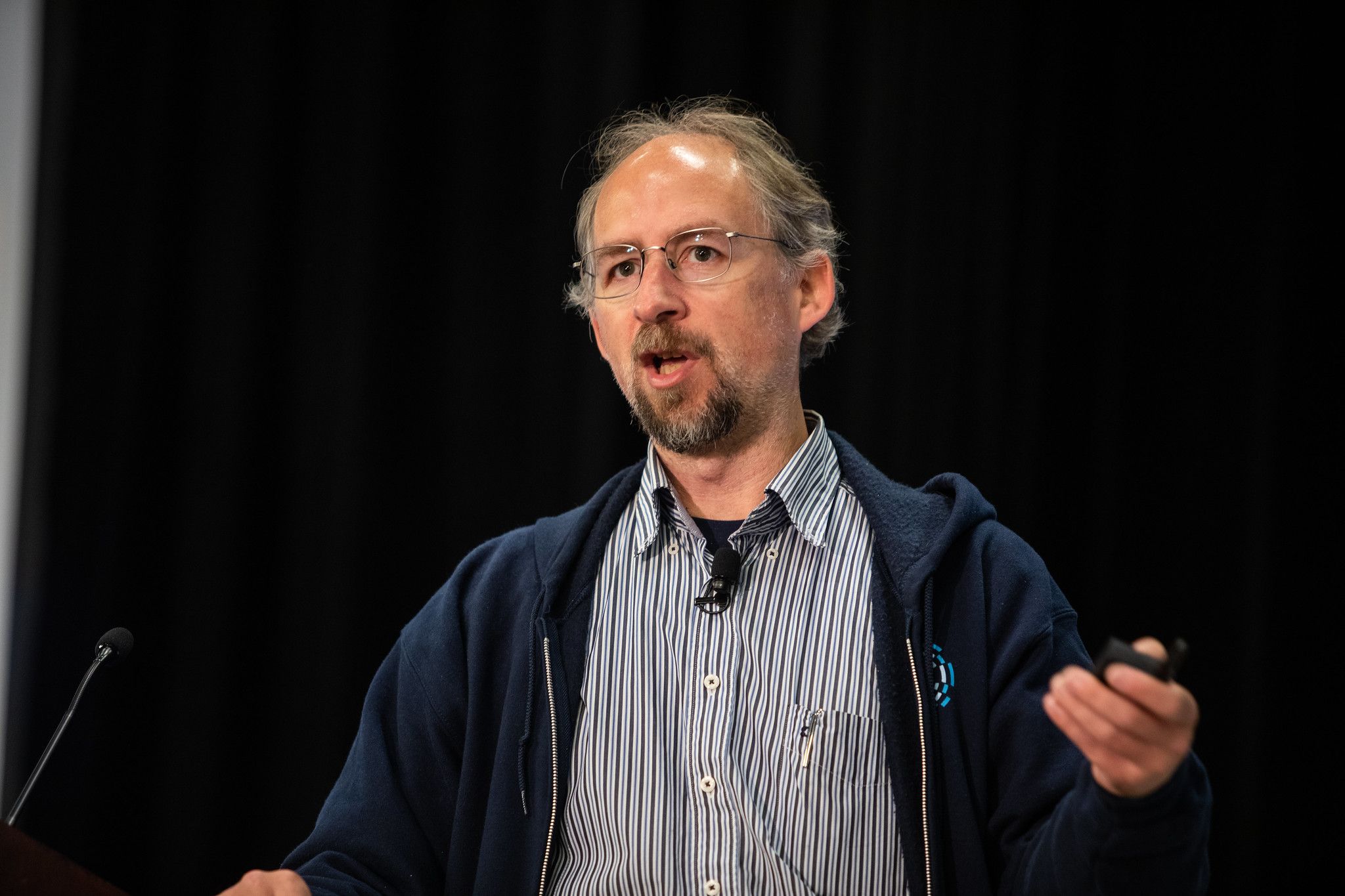

This is why Adam Back — one of the all-time most influential figures in Bitcoin, the inventor of HashCash, and the founder of Blockstream — has been vocal about the dangers of CBDCs and the role of the World Economic Forum’s (WEF) in promoting them. He sees this for what it is: a power-play by global elites, many of whom either misunderstand — or actively oppose — Bitcoin. If Bitcoin was designed to take control away from the state, CBDCs are designed to return it.

According to Back, a speaker at Consensus Hong Kong, CBDCs did not emerge as a natural evolution of money; they were a reactionary move by regulators — a panic response to the threat of private-sector digital currency. He pointed to Facebook’s Libra as the moment that freaked the central banks out, when we caught up for a chat on Google Meets.

«Regulators saw that a company with a billion-plus users could launch corporate electronic cash, and they realized they might lose control. So they tried to get ahead of it with their own government electronic cash,” Back said. “But the problem is, it’s systemically impossible for them to create something that the average person would want to use because they have such control-oriented ideas.»

Adam Back is a speaker at Consensus Hong Kong. Come and experience the most influential event in Web3 and digital assets, Feb.18-20. Register today and save 15% with the code CoinDesk15.

Back isn’t just criticizing CBDCs in theory; he is actively building an alternative. In the past year, Blockstream has launched the Jade Plus hardware wallet — a Bitcoin-only hardware wallet designed for privacy-conscious users, offering an open-source alternative to Ledger and Trezor — and Greenlight, a non-custodial Lightning-as-a-Service platform that simplifies Bitcoin payments for developers.

Blockstream has also expanded Bitcoin’s financial infrastructure with new institutional-grade investment funds, offering regulated Bitcoin-based financial products for high-net-worth investors. They’re also advancing Layer 2 scaling solutions through the Liquid Network, a Bitcoin sidechain enabling faster and confidential transactions. These initiatives build on Blockstream’s long-standing satellite network, which allows Bitcoin transactions without internet access, and its mining operations, which strengthen decentralization.

Together, they reflect a clear vision: a Bitcoin-based financial system independent of traditional banks and centralized authorities.

Some might argue that state involvement in Bitcoin is a growing concern. With Bitcoin ETFs gaining traction, discussions around a U.S. Strategic Bitcoin Reserve, and institutions stockpiling the asset, isn’t there a risk that governments and large entities will gain centralized control over Bitcoin? Isn’t individual self-custody and self-sovereignty the whole point?

Back, a British cryptographer, aged 54, who speaks with a quiet humility that belies his influence, remains unbothered. Moisturized. Happy. In his lane. Focused. Flourishing.

«ETFs and other investment products built around Bitcoin just give people a simpler way to start,» he said, with the cool resolve of a man on a mission.

«Hopefully, they take some physical Bitcoin later and learn how to store it. What matters is that a good number of people hold Bitcoin in its bearer electronic cash format, so it doesn’t become overly concentrated in ETFs or institutions, and that’s still the case today — the majority of it is in individual ownership, some in cold storage, some in exchanges and things like that.»

While it’s hard to to predict exactly how the balance between self-custody and institutional holdings will shift over time, Back believes the broader trend is clear.

He’s been involved in Bitcoin long enough to see how adoption plays out. His well-documented email exchanges with Satoshi Nakamoto suggest he might understand Bitcoin’s trajectory better than anyone else. The way he sees it, Bitcoin’s top-of-the-funnel has widened. Sure, ETFs and institutional funds bring Bitcoin into the mainstream, but ultimately, this just means more people will be pulled into the Bitcoin network. At its core, Bitcoin remains opt-in, censorship-resistant, and free from government interference. CBDCs are the exact opposite.

Currently, 44 countries are at the CBDC pilot stage, according to a tracker from the Atlantic Council. Some claim to preserve privacy, but the reality is that these are poorly veiled efforts to maintain centralized power over money. For a while, the push for state-backed digital currencies seemed inevitable — until political opposition in the U.S. turned it into a battleground issue. Reflecting the sharp Republican turn against CBDCs in the last 18 months, Trump recently announced he would ban the development of CBDCs in the U.S.

Back points this out as a sign that the tide is shifting in favor of Bitcoin. «A number of people in the Trump cabinet are Bitcoin-enthusiasts with relevant experience, so perhaps we’ll see an improvement because it’s partly the participants to date that would probably have preferred that Bitcoin didn’t exist,” he said.

He referenced the former SEC Chair Gary Gensler, who, despite his background teaching blockchain at MIT, took an aggressive stance against the industry. “Hopefully there will be some more common sense and forward-looking regulations and recognition of individual rights to self-sovereignty,” Back said.

Financial surveillance

For Back, he doesn’t just want Bitcoin to win, he wants CBDCs to die. And he believes CBDCs aren’t just a monetary issue — they’re part of a broader agenda of financial surveillance, social credit systems, and state control. “The social media interference in elections in the U.S. and expression of interest in CBDCs in Europe where they’re clearly envious of Chinese social credit scores and things like that which are very dystopian, some of the things the WEF has been coming out with.. They really do not sound good.»

The WEF, in particular, has been leading the charge on CBDCs and other centralized control mechanisms. «I mean, they’ve generally been in favor of all kinds of illiberal things like CBDCs and loss of individual men in power. I mean, they will come out with trial balloons that just sound horrendous and then delete their own tweets.»

He’s not wrong. The WEF has a history of floating controversial ideas, and scrubbing them when the backlash hits. As just one example, in 2021, they tweeted that the pandemic was “quietly improving cities” by reducing air pollution. The suggestion that the lockdowns were a net positive for the environment was met with outrage, so WEF deleted the tweet.

Blockstream is betting that high-net-worth individuals and institutions won’t want their assets trapped in a WEF-endorsed CBDC system controlled by centralized entities. That’s why they’ve launched a suite of institutional-grade Bitcoin funds designed for those looking to preserve their wealth in a system that cannot be arbitrarily manipulated. Recent events have only reinforced why this matters so much. The collapse of FTX, Celsius, and other crypto companies in 2022, has further eroded trust in centralized institutions, whether in traditional finance or crypto.

Back, however, is nothing like Sam Bankman-Fried, the disgraced FTX founder who cared little for individual privacy and was proudly anti-decentralization. He is also nothing like Alex Mashinsky, the Celsius CEO who recklessly gambled with user funds. Back is a cypherpunk continuing to execute on the master plan to ensure that Bitcoin is rolled out exactly as Satoshi intended: as a decentralized, trustless, and censorship-resistant monetary network.

For him, this is more than just a battle between Bitcoin and CBDCs. It’s about freedom. «It’s a renaissance for cypherpunk thinking,» Back told me, explaining that once people are drawn into Bitcoin, they start to grasp its deeper implications, and they see what it means for privacy, sovereignty, and control. He added that when the original Cypherpunk Manifesto was written in the 1990s, its authors may not have fully anticipated how deeply digital technology would eventually permeate every aspect of our lives.

“So in a way, the [Manifesto’s] concerns are even more pressing now because everything is online,» he said, laser eyes twinkling.

Uncategorized

Elon Musk vs. the regulators

Welcome back to TechCrunch Mobility, your hub for all things “future of transportation.”

Uncategorized

Nvidia’s AI empire: A look at its top startup investments

Over the last two years, Nvidia has used its ballooning fortunes to invest in over 100 AI startups. Here are the giant semiconductor’s largest investments.

Uncategorized

Dating app Cerca will show how Gen Z really dates at TechCrunch Disrupt 2025

Cerca is a dating app that sets users up with mutual friends.

-

Business12 месяцев ago

Business12 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion12 месяцев ago

Fashion12 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business12 месяцев ago

Business12 месяцев ago15 Habits that could be hurting your business relationships

-

Uncategorized4 месяца ago

Uncategorized4 месяца agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton