Uncategorized

Aave Labs Debuts Horizon to Let Institutions Borrow Stablecoins Against Tokenized Assets

Aave Labs has launched Horizon, its new platform dedicated to institutional borrowers to access stablecoins using tokenized versions of real-world assets (RWAs) like U.S. Treasuries as collateral.

At launch, institutions will be able to borrow Circle’s USDC, Ripple’s RLUSD and Aave’s GHO against a set of tokenized assets, including Superstate’s short-duration U.S. Treasury and crypto carry funds, Circle’s yield fund, and Centrifuge’s tokenized Janus Henderson products.

The platform aims to offer qualified investors with short-term financing on their RWA holdings and allow them to deploy yield strategies.

With Horizon, first announced in March, Aave aims to tap into the rapidly growing, $26 billion tokenized asset market and turning those assets into usable capital for institutions. Tokenized assets are projected to balloon into a multiple trillion-dollar market over the next few years as major banks and asset managers increasingly place traditional instruments like bonds, equities, real estate on blockchain rails as a token for operational efficiency.

However, efforts to make RWA tokens useful in the decentralized finance (DeFi) lending markets are in the early innings, limiting their practical use.

«Horizon delivers the infrastructure and deep stablecoin liquidity that institutions require to operate on-chain, unlocking 24/7 access, transparency and more efficient markets,» Aave Labs founder Stain Kulechov said in a statement.

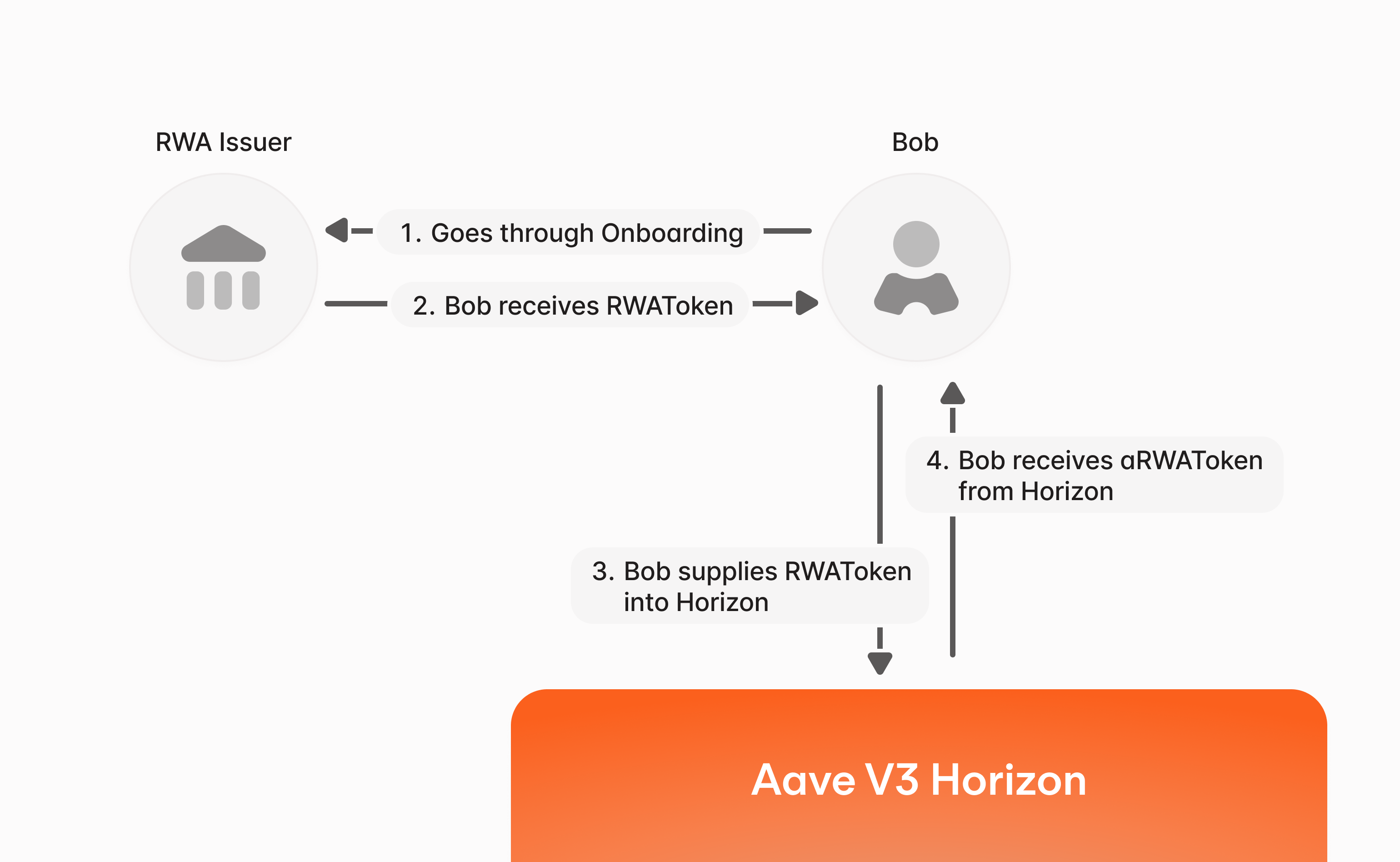

The protocol runs on Aave V3, which is the largest decentralized lending protocol with more than $66 billion in assets on the platform, according to DefiLlama data.

The platform’s setup blends permissioned and permissionless features: collateral tokens embed issuer-level compliance checks, while the lending pools remain open and composable.

Chainlink’s oracle services supply real-time pricing data, starting with NAVLink, delivering net asset values of tokenized funds directly on-chain to ensure the loans are appropriately collateralized.

Launch partners include a range of asset issuers including Ethena, OpenEden, Securitize, VanEck, Hamilton Lane and WisdomTree, with plans to expand collateral selection to more tokenized assets.

Read more: Tokenization of Real-World Assets is Gaining Momentum, Says Bank of America

Uncategorized

Elon Musk vs. the regulators

Welcome back to TechCrunch Mobility, your hub for all things “future of transportation.”

Uncategorized

Nvidia’s AI empire: A look at its top startup investments

Over the last two years, Nvidia has used its ballooning fortunes to invest in over 100 AI startups. Here are the giant semiconductor’s largest investments.

Uncategorized

Dating app Cerca will show how Gen Z really dates at TechCrunch Disrupt 2025

Cerca is a dating app that sets users up with mutual friends.

-

Business12 месяцев ago

Business12 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion12 месяцев ago

Fashion12 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business12 месяцев ago

Business12 месяцев ago15 Habits that could be hurting your business relationships

-

Uncategorized4 месяца ago

Uncategorized4 месяца agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton