Uncategorized

A Pre-Consensus Lift Amidst Lingering Recession Whispers

Like springtime in New York City, the crypto market got hot, all at once, in early May. After weeks of navigating choppy seas, influenced in part by anxieties surrounding the administration’s trade brinksmanship, a palpable shift in sentiment propelled the crypto sphere into a notable rally.

Bitcoin shape-shifted from a tariff tantrum mooring into a determined hunter of all-time highs. This bullish resurgence was not isolated. Ether, having endured a significant drawdown of over 50% since the start of the year, staged an impressive bounce, gaining 36% in the five days following the much-anticipated Pectra upgrade.

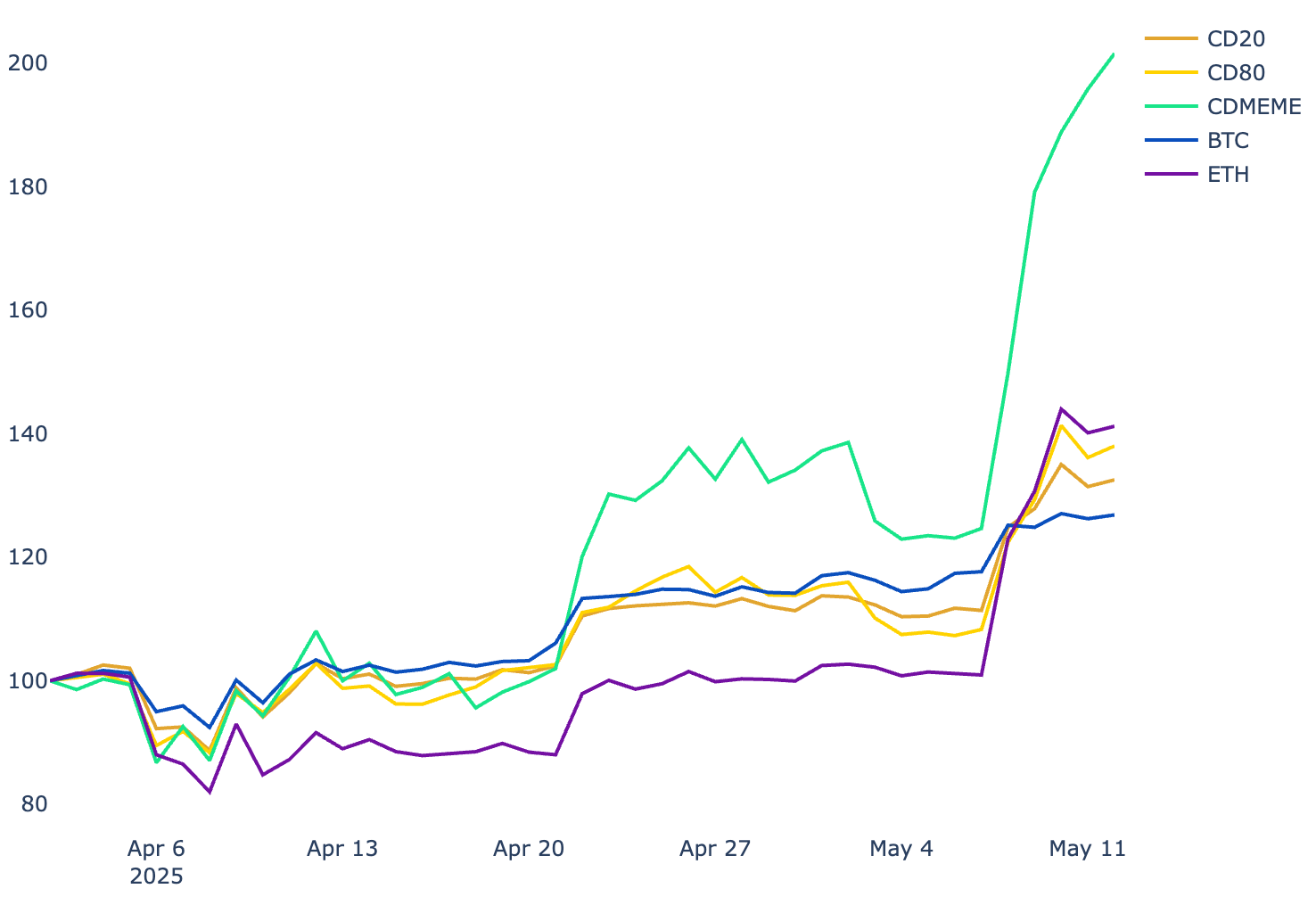

The broader blockchain market mirrored this enthusiasm. The CoinDesk 20 Index, the benchmark for the performance of top digital assets, added nearly 18% in the past week, bringing its 30-day return to over 33%. Further down the capitalization spectrum, the CoinDesk 80 Index, which tracks assets beyond the top 20, also rebounded strongly from its lows, delivering 37% over the past month. Demonstrating truly epic participation breadth, the 50-constituent CoinDesk Memecoin Index added a 55% on the week and a whopping 86% in the last month.

Given the fundamentally limited (zero) direct impact of tariff and trade news on the intrinsic value of most (all) crypto assets, this lunge higher feels like what they call a «sentiment shift.» With CoinDesk’s Consensus conference unfolding this week in Toronto, the timing couldn’t be more opportune. The vibes are good.

Performance of CoinDesk 20, CoinDesk 80, CoinDesk Memecoin Index, bitcoin, and ether since Liberation Day, April 2, 2025

Source: CoinDesk Indices

The specter of recession

This recent market exuberance, both within digital assets and across traditional risk-on asset classes, has not quelled the underlying concerns of those who believe the United States is gradually inching towards a recession. Official recessions, as declared by the National Bureau of Economic Research (NBER), are indeed relatively infrequent. Yet, today’s unusual confluence of macroeconomic factors provides fertile ground for wariness.

To wit, the initial estimate for first-quarter 2025 GDP showed a contraction of 0.3% at an annualized rate, a notable reversal from the 2.4% growth in the previous quarter. True, this figure was skewed downwards by a surge in imports as businesses rushed to beat anticipated tariff increases, yet a contraction in GDP is nonetheless a concerning data point. Adding to this unease is plunging consumer confidence. The Conference Board’s Consumer Confidence Index fell sharply in April to 86.0, its lowest level in nearly five years, with the Expectations Index hitting its lowest point since October 2011 — a level often associated with recessionary signals. The University of Michigan’s Consumer Sentiment Index echoed this weakness, falling to 52.2 in its preliminary May reading, driven by concerns over trade policy and the potential resurgence of inflation. Furthermore, their survey highlighted a surge in year-ahead inflation expectations to 6.5%, the highest since 1981.

The growing U.S. debt burden and the persistent inability of the administration to tame the 10-year Treasury yield, despite apparent efforts, also contribute to the sense of economic fragility. Finally, the potential for collateral damage from ongoing or escalating trade wars, including businesses potentially reducing their workforce in response to disrupted supply chains and increased costs, adds another layer of concern.

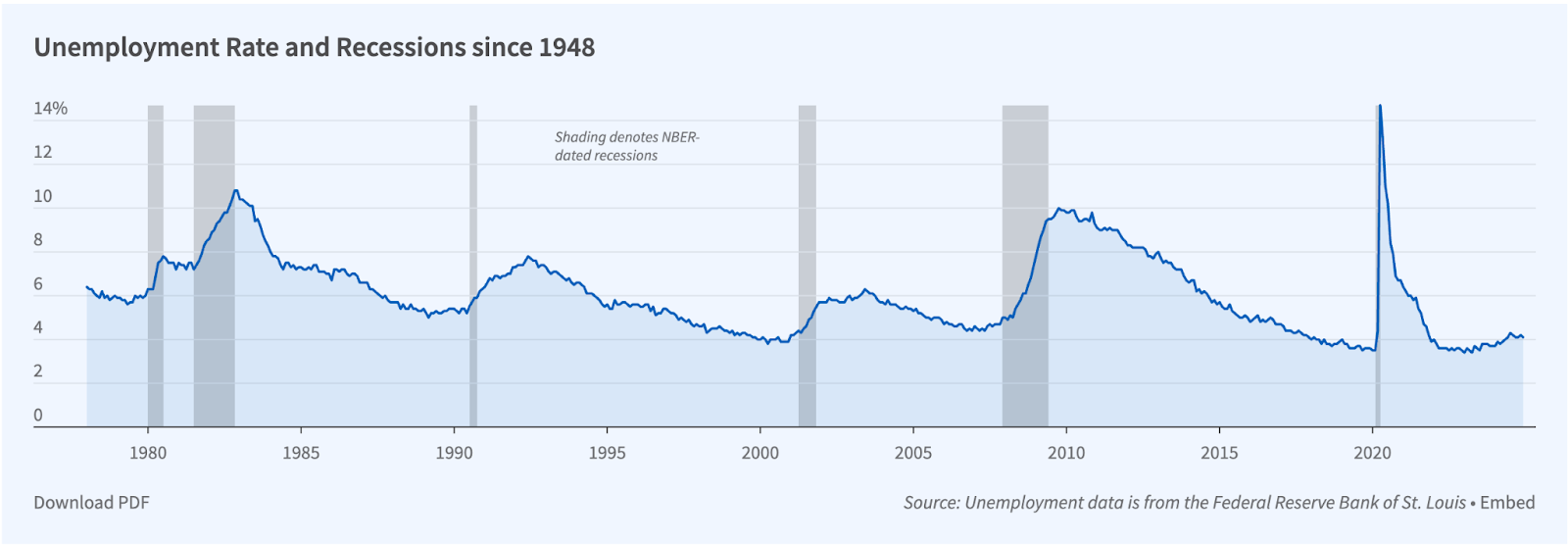

NBER Chart of US Unemployment Levels and Recession Periods Since 1978

Source: NBER.org (Hey, NBER, should that read «since 1978?»)

To be clear, the prevailing sentiment among our network still leans against an imminent recession, and we don’t make predictions. However, to dismiss the possibility of a recession in the current environment seems imprudent.

Bitcoin vs. other digital assets in a downturn

Crypto has only experienced one NBER-declared recession, during the worst of COVID. While the market crisis caused a liquidity panic and significant drawdowns, the subsequent $5 trillion ocean of emergency fiscal stimulus (and millions of homebound people discovering crypto) pointed things north and delivered the 2021 bubble. We may not expect the same path in a future recession. So, what might we expect?

On the one hand, there’s a compelling argument to be made that bitcoin has now achieved a level of adoption and established a user base sufficient to begin fulfilling its long-touted destiny as a safe haven asset during times of economic turmoil. With the U.S. dollar potentially facing pressure amidst high inflation and a swelling debt burden, bitcoin’s inherent scarcity and decentralized (and apolitical) nature are increasingly attractive.

On the other hand, traditional recessionary environments are typically characterized by scarce liquidity, heightened risk aversion, a dominant focus on capital preservation and a diminished appetite for exploring nascent and volatile asset classes. A contraction in overall economic activity would also lead to reduced funding for entrepreneurial and even established ventures within the blockchain space. Finally, retail users, feeling the financial pinch of a recession, would likely have less «experimental money» to allocate to decentralized finance (DeFi) and other novel crypto applications.

Therefore, even if bitcoin manages to attract safe-haven flows, other blockchain assets, particularly those promising future growth and innovation, could face significant headwinds and continued price pressure. In our view, one of the least constructive outcomes for the broader digital asset ecosystem would be a further increase in bitcoin’s dominance at the expense of innovation and growth in other areas.

The resilience of trading

What might provide a degree of resilience for the digital asset class and the industry as a whole is its energy for trading. Crypto functions more as a trading asset class than a predominantly investment-driven one. In both favorable and unfavorable economic conditions, trading volumes within the crypto markets have generally remained robust and resilient. It’s conceivable that the active trading community could sustain the asset class until broader economic conditions improve.

Navigating uncertainty

While a recession in the United States is a scenario few desire and one that remains outside the highest probability outcomes in most forecasts, and despite the recent sentiment shift, its possibility cannot be entirely dismissed. And, as a matter of economic cycles, periods of contraction are not entirely avoidable. For the sake of our burgeoning industry and the progress made in integrating digital assets into the fabric of global financial services — across trading, investing, lending, saving, and yield generation — we sincerely hope that even a modest stream of support will continue to drive technological development, investor education, accessibility, and broader adoption. Perhaps this will be fueled by one of crypto’s original notions: that the traditional economic system has faltered.

Uncategorized

Elon Musk vs. the regulators

Welcome back to TechCrunch Mobility, your hub for all things “future of transportation.”

Uncategorized

Nvidia’s AI empire: A look at its top startup investments

Over the last two years, Nvidia has used its ballooning fortunes to invest in over 100 AI startups. Here are the giant semiconductor’s largest investments.

Uncategorized

Dating app Cerca will show how Gen Z really dates at TechCrunch Disrupt 2025

Cerca is a dating app that sets users up with mutual friends.

-

Business12 месяцев ago

Business12 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion12 месяцев ago

Fashion12 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business12 месяцев ago

Business12 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Uncategorized4 месяца ago

Uncategorized4 месяца agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts