Uncategorized

Bitcoin Slips Below $104K, Cryptos Slide as U.S.-China Tariff Tensions Flare Up

Markets went red on Friday on renewed tariff-related apprehensions.

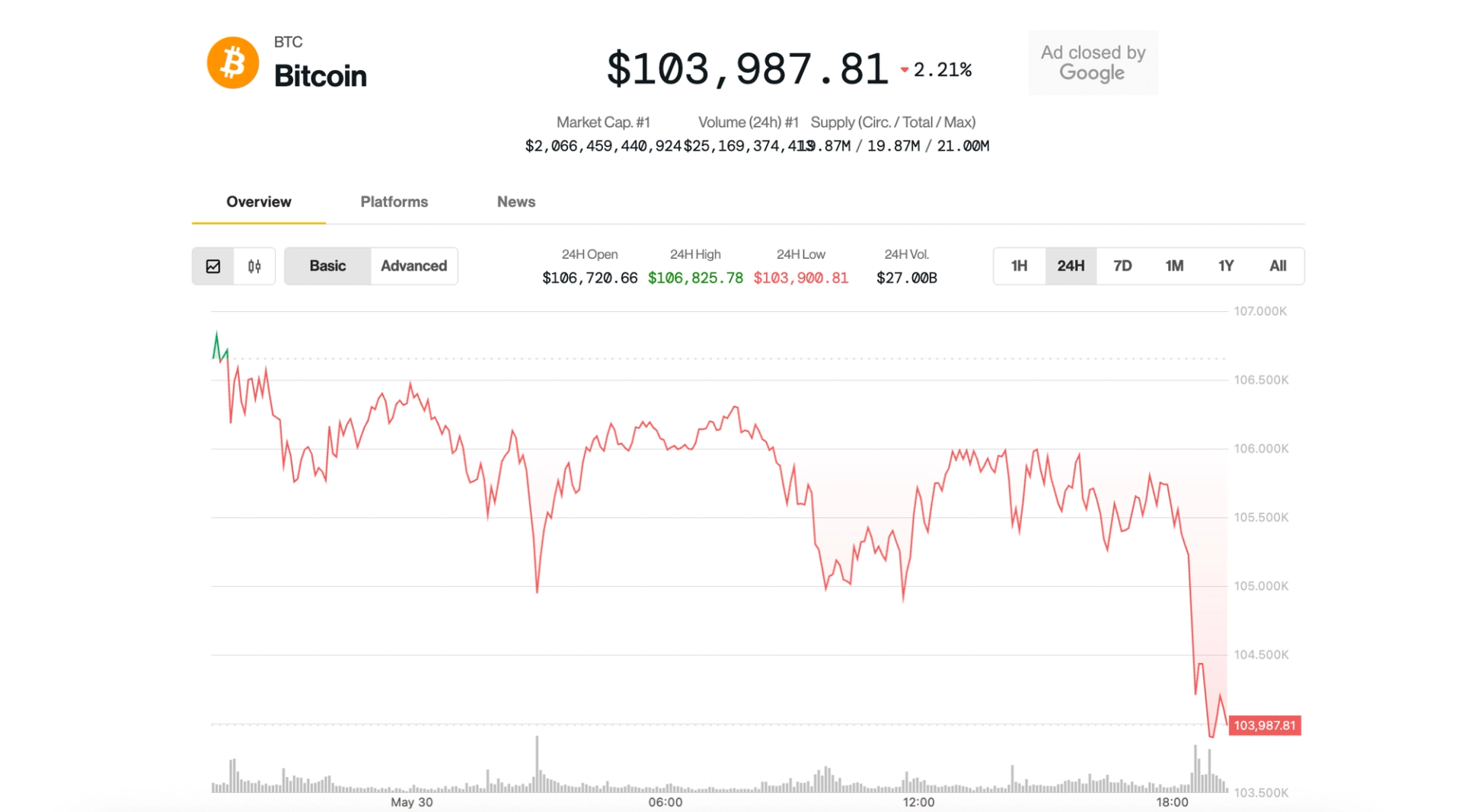

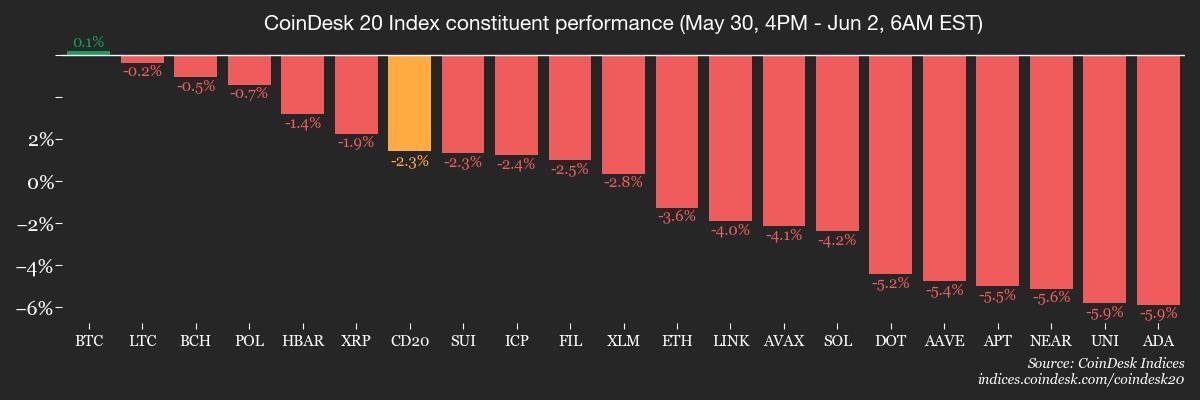

Bitcoin BTC is down 2.1% in the last 24 hours, trading just above $104,000 after briefly hitting a session low of $103,900. The CoinDesk 20 — an index of the top 20 cryptocurrencies by market capitalization, except for stablecoins, memecoins and exchange coins — slumped even further, by 4.2%.

Smart contract platforms were particularly affected, with solana SOL, sui SUI and avalanche AVAX losing 6.3%, 7.8% and 7.3% respectively.

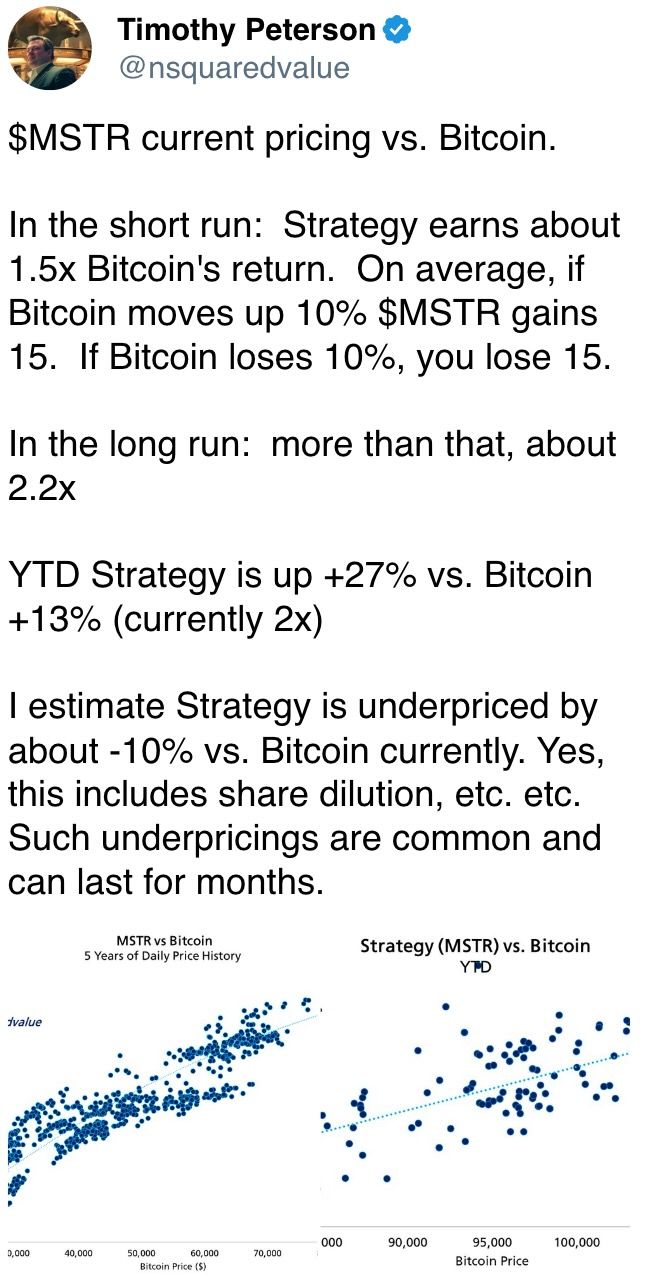

Crypto stocks also took a hit, especially bitcoin mining firm Bitdeer (BTDR), down 8.3% on the day after a run-up that saw the stock rise 132% from April 16 to May 21. Strategy (MSTR) slid 2.7%, and Coinbase (COIN) 1.3%.

The bleeding wasn’t contained to crypto. The S&P 500 and Nasdaq are down 1% and 1.5% respectively, while gold lost 0.7%.

U.S.-China tariff clash: Round 2?

Behind the price action was the flare-up of U.S. trade tensions once again after an agreement was struck earlier this month. The concerns came after President Donald Trump accused China in a post on Truth Social of «violating» the tariff truce between the countries.

Meanwhile, Treasury Secretary Scott Bessent said in a Fox News interview that talks had «stalled» with the Chinese representatives.

China, in response, urged the U.S. to «immediately correct its erroneous actions, cease discriminatory restrictions,» BBC reported.

The cool-off between U.S. and China helped risk assets rally in May, providing a tailwind for BTC to clinch a new record high. The re-escalation now threatens to unwind some of those gains.

Read more: Bitcoin Whales Seem to Be Calling a Top as BTC Price Consolidates

Uncategorized

SHIB Under Pressure, Below Ichimoku Cloud After High-Volume Overnight Selling

Shiba inu SHIB, the world’s second-largest meme token by market value, trades in the bearish territory below the Ichimoku cloud after facing high-volume selling overnight.

The Ichimoku Cloud, a technical indicator developed by a Japanese journalist in the 1960s, is used to analyze market trends, identify support and resistance levels, and gauge momentum. It is composed of several lines and a cloud-like area, all of which provide insights into potential price movements.

Crossovers above and below the cloud represent bullish and bearish shifts in market trends.

SHIB experienced high-volume selling at key resistance at 0.00001307 on Sunday between 6:00 and 22:00 UTC, and subsequently fell back to 0.00001274, staying in the bearish territory below the Ichimoku cloud.

Geopolitical tensions and shifting trade policies continue to influence cryptocurrency markets, with Shiba Inu (SHIB) demonstrating resilience amid broader economic uncertainty.

While maintaining its newly established higher range, SHIB faces significant resistance as global trade disputes impact investor sentiment across both traditional and digital asset classes.

Key technical insights

- Key resistance emerged at 0.00001307, with high volume selling pressure during the 16:00 and 22:00 sessions.

- Strong support formed at 0.00001275, backed by above-average volume during the 03:00 reversal.

- In the last hour, SHIB experienced significant volatility with a notable price surge from 0.00001289 to 0.00001293 during the 07:13-07:19 period.

This bullish momentum reversed sharply at 07:27, when prices dropped 1.2% to 0.00001283, forming a clear resistance zone around 0.00001293. - The final 30 minutes showed consolidation between 0.00001283 and 0.00001285, with decreasing volume suggesting exhaustion following the earlier volatility.

Uncategorized

Strategy Expands Bitcoin Holdings by 705 BTC, Lifts Total BTC Stash to Over $60B

Strategy (MSTR) has expanded its bitcoin BTC holdings with the purchase of an additional 705 BTC for approximately $75 million, bringing the company’s total bitcoin holdings to 580,955 BTC.

This latest acquisition was made at an average price of $106,495 per bitcoin, which adjusts the company’s overall average purchase price to $70,023 per bitcoin.

To fund this purchase, Strategy utilized a series of at-the-market (ATM) equity offerings, drawing from the perpetual preferred share classes STRK and STRF.

Between May 26 and June 1, the company raised capital by selling 353,511 shares of STRK preferred stock for $36.2 million and 374,968 shares of STRF preferred stock for $38.4 million.

At the current market price of $104,000 per bitcoin, the company’s total bitcoin holdings are now valued at roughly $60 billion, reinforcing its position as the largest corporate holder of bitcoin and underlining its continued commitment to bitcoin as a core treasury asset.

Uncategorized

Crypto Daybook Americas: Tariffs to Dominate Narrative as BTC ETF Volumes Surge

By Omkar Godbole (All times ET unless indicated otherwise)

The recent TACO tease, implying «Trump Always Chickens Out» on tariffs, likely didn’t go down well with the President, who raised the stakes in the ongoing trade war on Friday, leading to broad-based risk aversion, which persists as of writing.

On Friday, Trump said that on June 4, the U.S. tariffs on imported aluminum and steel would go from 25% to 50%, triggering a broad-based risk-off move across global markets. Bitcoin has since traded in the range of $103,000-$106,000, with little to no excitement in the broader crypto market. Notably, BlackRock’s spot bitcoin ETF (IBIT) registered an outflow of $430 million, ending a prolonged inflows streak.

«Tariff tensions will likely dominate the macro narrative through June, with meaningful policy deadlines only kicking in from 8 July. In the absence of fresh catalysts, BTC could remain rangebound, with the $100k and $110k levels critical to watch given their status as strikes with the highest month-end open interest,» Singapore-based trading firm QCP Capital said.

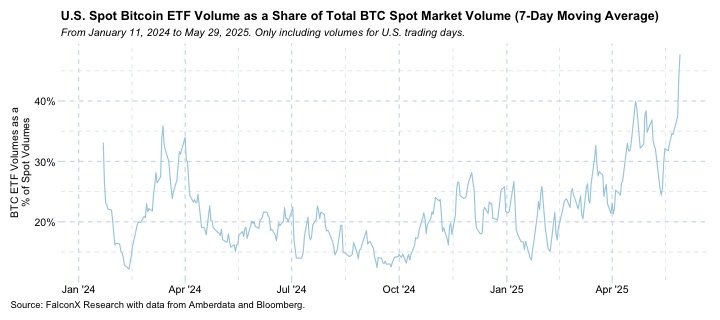

ETFs are becoming increasingly important to the market. Data shared by FalconX’s David Lawant shows that the cumulative trading volume in the 11 spot BTC ETFs listed in the U.S. is now well over 40% of the spot volume. The data supports the «Bitcoin ETFs are the new marginal buyer» hypothesis, according to Bitwise’s Head of Research — Europe, Andre Dragosch.

Meanwhile, on-chain data tracked by Glassnode showed a drop in momentum buyers alongside a sharp rise in profit takers last week. «This trend often shows near local tops, as traders begin locking in gains instead of building exposure,» Glassnode said.

High-stakes crypto trader James Wynn opened a fresh BTC long trade with 40x leverage and a liquidation price of $104,580, according to blockchain sleuth Lookonchain.

In other news, Japan’s “MicroStrategy” Metaplanet announced an additional purchase of 1,088 BTC, and billionaire entrepreneur Elon Musk announced a new XChat with Bitcoin-like encryption.

Binance’s founder CZ said on X that now might be a good time to develop a dark pool-style perpetual-focused decentralized exchange, noting that real-time order visibility can lead to MEV attacks and malicious liquidations.

In traditional markets, gold looked to break out of its recent consolidation, hinting at the next leg higher as Bank of America and Morgan Stanley forecast continued dollar weakness. Friday’s U.S. nonfarm payrolls release will be closely watched for signs of labor market weakness. Stay Alert!

What to Watch

- Crypto

- June 3, 1 p.m.: The Shannon hard fork network upgrade will get activated on the Pocket Network (POKT).

- June 4, 10 a.m.: U.S. House Financial Services Committee will hold a hearing on “American Innovation and the Future of Digital Assets: From Blueprint to a Functional Framework.” Livestream link.

- June 6: Sia (SC) is set to activate Phase 1 of its V2 hard fork, the largest upgrade in the project’s history. Phase 2 will get activated on July 6.

- June 9, 1-5 p.m.: U.S. SEC Crypto Task Force roundtable on «DeFi and the American Spirit»

- June 10, 10 a.m.: U.S. House Final Services Committee hearing for Markup of Various Measures, including the crypto market structure bill, i.e. the Digital Asset Market Clarity (CLARITY) Act.

- Macro

- June 2, 1 p.m.: Federal Reserve Chair Jerome H. Powell will deliver a speech at the Federal Reserve Board’s International Finance Division 75th Anniversary Conference in Washington. Livestream link.

- June 2, 9:45 a.m.: S&P Global releases (Final) May U.S. Manufacturing PMI data.

- Manufacturing PMI Est. 52.3 vs. Prev. 50.2

- June 2, 10 a.m.: The Institute for Supply Management (ISM) releases May Manufacturing PMI.

- Manufacturing PMI Est. 49.5 vs. Prev. 48.7

- June 3: South Koreans will vote to choose a new president following the ouster of Yoon Suk Yeol, who was dismissed after briefly declaring martial law in December 2024.

- June 3, 10 a.m.: The U.S. Bureau of Labor Statistics releases April U.S. labor market data.

- Job Openings Est. 7.10M vs. Prev. 7.192M

- Job Quits Prev. 3.332M

- June 3, 1 p.m.: Federal Reserve Governor Lisa D. Cook will deliver a speech on economic outlook at the Peter McColough Series on International Economics in New York. Livestream link.

- June 4, 12:01 a.m.: U.S. tariffs on imported steel and aluminum will increase from 25% to 50%, according to a Friday evening Truth Social post by President Trump.

- Earnings (Estimates based on FactSet data)

- None in the near future.

Token Events

- Governance votes & calls

- Sui DAO is voting on moving to recover approximately $220 million in funds stolen from the Cetus Protocol hack via a protocol upgrade. Voting ends June 3.

- Uniswap DAO is voting on a proposal to fund the integration of Uniswap V4 and Unichain support in Oku. The goal is to expand V4 adoption, support hook developers, and improve tools for LPs and traders. Voting ends June 6.

- June 4, 6:30 p.m.: Synthetix to host a community call.

- June 10, 10 a.m.: Ether.fi to host an analyst call followed by a Q&A session.

- Unlocks

- June 5: Ethena (ENA) to unlock 0.7% of its circulating supply worth $14.18 million.

- June 12: Aptos (APT) to unlock 1.79% of its circulating supply worth $57.11 million.

- June 13: Immutable (IMX) to unlock 1.33% of its circulating supply worth $13.24 million.

- June 15: Starknet (STRK) to unlock 3.79% of its circulating supply worth $17.11 million.

- June 15: Sei (SEI) to unlock 1.04% of its circulating supply worth $10.64 million.

- Token Launches

- June 3: Bondex (BDXN) to be listed on Binance, Bybit, Coinlist, and others.

- June 16: Advised deadline to unstake stMATIC as part of Lido on Polygon’s sunsetting process ends.

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN), & Synapse (SYN).

Conferences

- Day 1 of 6: SXSW London

- June 3: World Computer Summit 2025 (Zurich)

- June 3-5: Money20/20 Europe 2025 (Amsterdam)

- June 4-6: Non Fungible Conference (Lisbon)

- June 5-6: 2025 Crypto Valley Conference (Zug, Switzerland)

- June 19-21: BTC Prague 2025

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26-27: Istanbul Blockchain Week

Token Talk

By Shaurya Malwa

- At 11:26 p.m. on Sunday, billionaire tech entrepreneur Elon Musk tweeted “Kekius Maximus pit level 117, hardcore rank 1,” and meme-coin traders pounced on frog-themed tokens and low-cap KEKIUS memecoins.

- The Ethereum version surged over 25% in minutes, pushing its market cap to about $33 million. In comparison, a Solana-based KEKIUS zoomed as much as 30%, showing the same “Musk effect” despite far lower liquidity.

- Musk adopted the “Kekius Maximus” persona on New Year’s Eve 2024 and has repeatedly juiced the token with profile changes and gaming references.

- The name fuses crypto-native “Pepe the Frog” lore with Gladiator’s Maximus Decimus Meridius.

- These tokens thrive (and falter) on social media hype; they lack solid fundamentals and can reverse just as quickly.

Derivatives Positioning

- HBAR, DOT and LTC lead the majors in terms of growth in open interest in perpetual futures in the past 24 hours.

- Annualized funding rates for majors remains positive or bullish, except for XLM and TON.

- On the CME, one-month annualized basis in the BTC futures has pulled back to around 6.5% from the recent high of 9.5%. ETH’s basis remains relatively elevated above 8%.

- On Deribit, BTC and ETH one and two-week options exhibit downside fears. Other expiries show call bias.

Market Movements

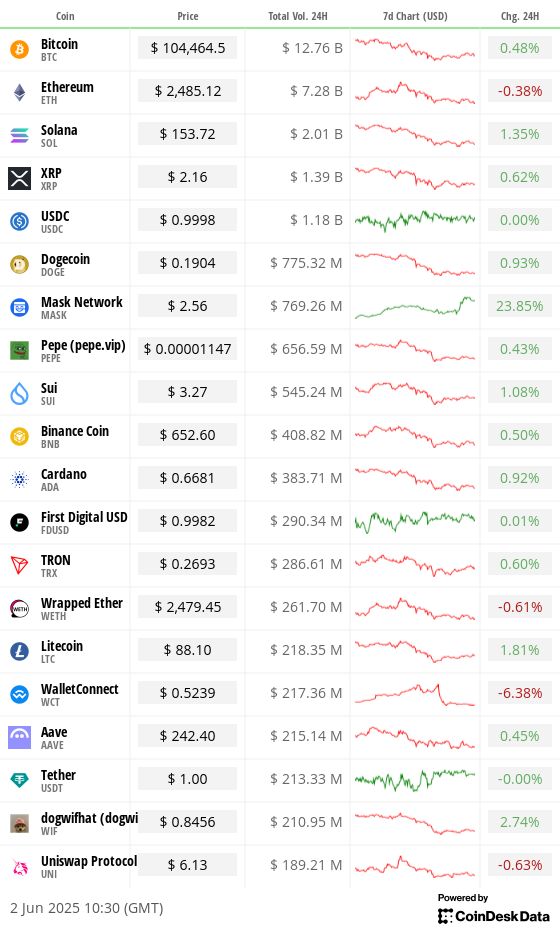

- BTC is unchanged from 4 p.m. ET Friday at $104,642.17 (24hrs: +0.51%)

- ETH is down 3.78% at $2,480.24 (24hrs: +0.47%)

- CoinDesk 20 is down 2.28% at 3,028.20 (24hrs: +0.35%)

- Ether CESR Composite Staking Rate is down 21 bps at 2.97%

- BTC funding rate is at 0.003% (3.2949% annualized) on Binance

- DXY is down 0.51% at 98.82

- Gold is up 2.19% at $3,372.00/oz

- Silver is up 1.65% at $33.44/oz

- Nikkei 225 closed -1.3% at 37,470.67

- Hang Seng closed -0.57% at 23,157.97

- FTSE is unchanged at 8,768.28

- Euro Stoxx 50 is down 0.74% at 5,327.14

- DJIA closed on Friday +0.13% at 42,270.07

- S&P 500 closed unchanged at 5,911.69

- Nasdaq closed -0.32% at 19,113.77

- S&P/TSX Composite Index closed -0.14% at 26,175.10

- S&P 40 Latin America closed -1.77% at 2,554.48

- U.S. 10-year Treasury rate is up 3 bps at 4.44%

- E-mini S&P 500 futures are down 0.63% at 5,879.00

- E-mini Nasdaq-100 futures are down 0.77% at 21,212.25

- E-mini Dow Jones Industrial Average Index futures are down 0.56% at 42,056.0

Bitcoin Stats

- BTC Dominance: 64.62 (0.21%)

- Ethereum to bitcoin ratio: 0.02375 (-1.17%)

- Hashrate (seven-day moving average): 931 EH/s

- Hashprice (spot): $52.3

- Total Fees: 3.47 BTC / $364,001

- CME Futures Open Interest: 146,575 BTC

- BTC priced in gold: 31.8 oz

- BTC vs gold market cap: 9.02%

Technical Analysis

- Gold is looking to establish a foothold above the upper end of the falling channel.

- A potential breakout would signal a resumption of the broader uptrend, offering bullish cues to bitcoin.

Crypto Equities

- Strategy (MSTR): closed on Friday at $369.06 (-0.42%), unchanged in pre-market

- Coinbase Global (COIN): closed at $246.62 (-0.89%), unchanged in pre-market

- Galaxy Digital Holdings (GLXY): closed at C$24.92 (-7.87%)

- MARA Holdings (MARA): closed at $14.12 (-3.35%), unchanged in pre-market

- Riot Platforms (RIOT): closed at $8.07 (-1.34%), -0.25% at $8.05 in pre-market

- Core Scientific (CORZ): closed at $10.65 (-0.37%), -1.5% at $10.49

- CleanSpark (CLSK): closed at $8.63 (-1.71%), -0.35% at $8.60

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $16.47 (-2.54%)

- Semler Scientific (SMLR): closed at $40 (-0.2%), +1.72% at $40.69

- Exodus Movement (EXOD): closed at $28.5 (-5.97%), +0.39% at $28.61

ETF Flows

Spot BTC ETFs

- Daily net flow: $616.1 million

- Cumulative net flows: $44.35 billion

- Total BTC holdings ~ 1.20 million

Spot ETH ETFs

- Daily net flow: $70.2 million

- Cumulative net flows: $3.06 billion

- Total ETH holdings ~ 3.66 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The chart shows that the cumulative volume in U.S.-listed spot BTC ETFs as a share of the total bitcoin spot market volume has risen to record highs.

- The data supports the «Bitcoin ETFs are the new marginal buyer» hypothesis.

While You Were Sleeping

- Metaplanet Acquires 1,088 Bitcoin to Bring BTC Stash to Over $930M (CoinDesk): The Japanese firm paid an average of 15.5 million yen ($108,051) per bitcoin for its latest purchase, bringing its total holdings to more than 8,888 BTC.

- Post Pectra ‘Malicious’ Ethereum Contracts Are Trying to Drain Wallets, But to No Avail: Wintermute (CoinDesk); EIP-7702 lets Ethereum wallets act like smart contracts, but over 97% of delegations use identical code tied to wallet-draining attacks, highlighting growing security concerns.

- Taiwanese Crypto Exchange BitoPro Likely Hacked for $11M in May, ZachXBT Says (CoinDesk): The blockchain analyst claims the tokens allegedly stolen on May 8 were funneled through Tornado Cash, Thorchain and Wasabi Wallet to obscure their origin.

- China Hits Back Against Trump Claims That It Broke Trade Truce (The Wall Street Journal): Responding to Trump’s accusation that China violated the Geneva trade truce, Beijing blamed the U.S. for escalating tensions, citing new export controls and student visa restrictions.

- Ukraine and Russia to Meet for Second Round of Talks as Attacks Escalate (The New York Times): As Russia and Ukraine meet today in Istanbul, both sides remain entrenched under pressure from Trump, with no mutually acceptable terms for a peace deal likely to emerge.

- Putin’s Central Banker Under Pressure to Cut Record-High Rates (Bloomberg): Officials want rates cut from 21% as high borrowing costs squeeze civilian industries, but with inflation easing mainly due to a stronger ruble, policymakers remain cautious about loosening too soon.

In the Ether

-

Fashion8 месяцев ago

Fashion8 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion8 месяцев ago

Fashion8 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoThe old and New Edition cast comes together to perform

-

Business8 месяцев ago

Business8 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports8 месяцев ago

Sports8 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment8 месяцев ago

Entertainment8 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoDisney\’s live-action Aladdin finally finds its stars