Uncategorized

CoinDesk 20 Performance Update: NEAR Drops 5.4% as Almost All Assets Trade Lower

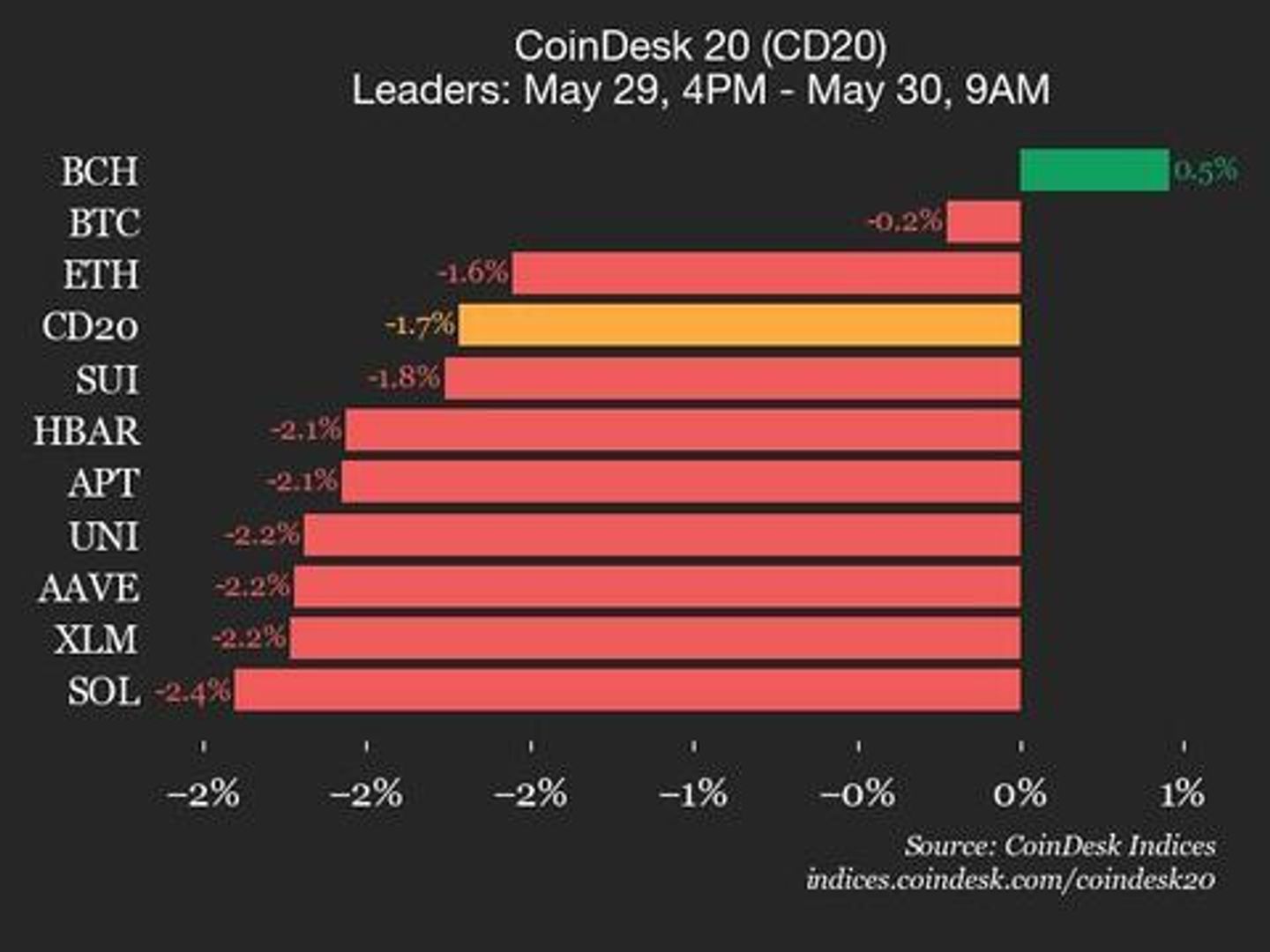

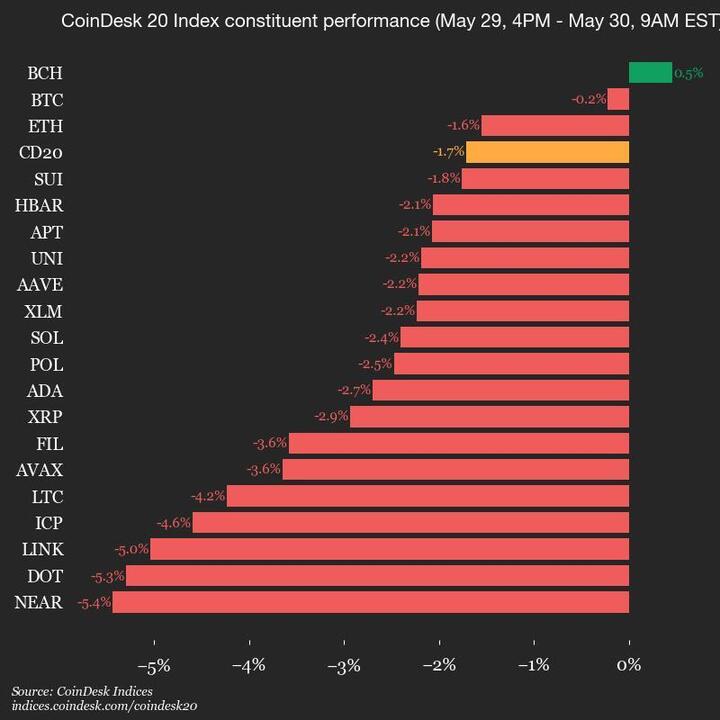

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 3130.42, down 1.7% (-54.58) since 4 p.m. ET on Thursday.

One of 20 assets are trading higher.

Leaders: BCH (+0.5%) and BTC (-0.2%).

Laggards: NEAR (-5.4%) and DOT (-5.3%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Uncategorized

U.S Dollar to Slide Further This Summer, Bank of America Warns

Bank of America has warned that the U.S. dollar could be in for a rough summer, having already dropped sharply this year.

The dollar index, which tracks the value of the U.S. dollar against major currencies, has dropped nearly 9% to 99.74 this year, as President Donald Trump’s tariff war triggered a shift away from U.S. assets.

Bank of America expects continued data-driven drubbing over the Summer. Weakness in the U.S. dollar is widely seen as positive for dollar-denominated assets, such as gold and bitcoin BTC.

The global FX research team led by Athanasios Vamvakidis stated in a report to clients Friday that tariffs are more detrimental to the U.S. economy as the country trades more with the rest of the world than perhaps any other nation.

The report acknowledged recent resilience in the U.S. economy and growth-supportive developments, such as President Donald Trump’s tax cuts and the abandonment of extreme fiscal spending cuts, but stated that «negatives dominate.»

«Policy uncertainty on multiple fronts remains. Companies may pause hiring and investment plans until there is greater clarity. In most scenarios, we see tariffs much higher than the starting point, with current levels being the minimum,» the report said.

It added that the market is reacting negatively to the loosening of fiscal policy at a time when debt levels are at record highs, leading to higher borrowing costs. Meanwhile, the Federal Reserve is unable to take significant action due to rising inflation expectations.

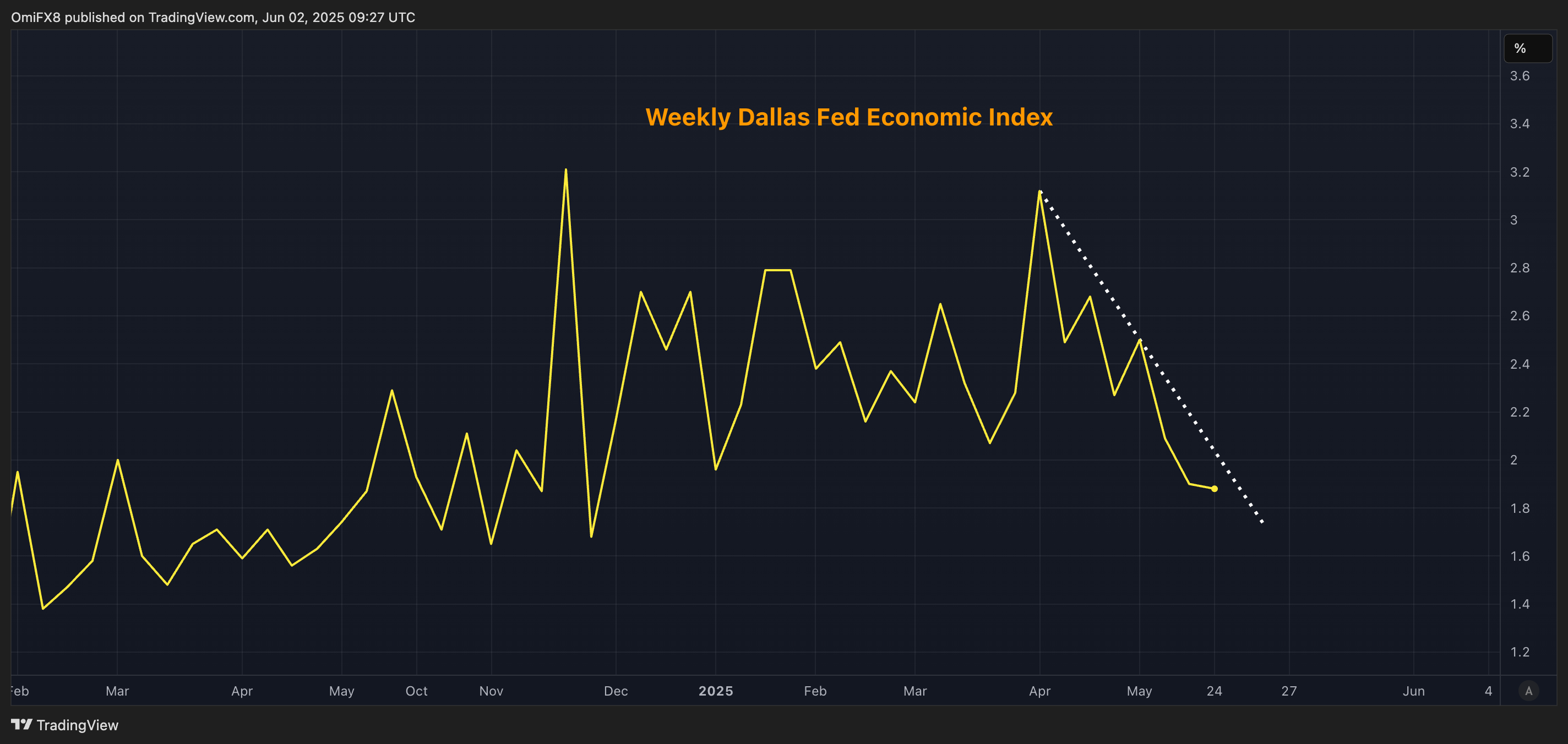

«Migration flows have collapsed. Demand increased in Q1 [front running] ahead of tariffs but may be about to fall,» strategists noted, pointing to weakness in high-frequency indicators such as the ISM data and weekly Dallas Fed economic index.

The weekly Dallas Fed economic index has resumed the downtrend following the brief spike in early April and hit the lowest since December, according to data source TradingView.

«Such high-frequency indicators tend to be very noisy but could still point to a slowdown of the economy in the coming months,» strategists said.

Uncategorized

Taiwanese Crypto Exchange BitoPro Likely Hacked for $11M in May, ZachXBT Says

Taiwanese cryptocurrency exchange BitoPro is suspected to have lost over $11.5 million worth of tokens in a May 8 exploit, widely-followed blockchain sleuth ZachXBT said in his Telegram group on Monday.

The exploit involved unauthorized access to BitoPro’s hot wallets across multiple blockchains, including Ethereum, Tron, Solana, and Polygon.

The stolen assets were then sold on decentralized exchanges, with proceeds laundered through privacy protocols such as Tornado Cash and Thorchain, and eventually moved to Wasabi Wallet, a Bitcoin mixing service.

BitoPro has not issued any public statements acknowledging the breach since the supposed explicit. Users were informed of a temporary service suspension due to «system maintenance” last month, and there was little social chatter in popular crypto X circles around the incident at the time.

“BitoPro has yet to formally disclose the incident on X or Telegram and told users the exchange was just offline for «maintenance,” ZachXBT said.

BitoPro has been based in Taiwan since 2018 and is operated by BitoGroup. It is mostly focused on the local market and mainly supports Taiwanese dollar (TWD) fiat pairs for major tokens such as bitcoin BTC, ether ETH and others.

It processed over $20 million in trading volumes in the past 24 hours, data shows, and is the top locally-focused exchange by that metric.

Uncategorized

Post Pectra ‘Malicious’ Ethereum Contracts Are Trying to Drain Wallets, But to No Avail: Wintermute

Malicious Ethereum contracts designed to drain wallets with weak security aren’t profiting from the operation, crypto market maker Wintermute said Friday, identifying these contracts as «CrimeEnjoyors.»

The whole issue is tied to the Ethereum Improvement Proposal (EIP)-7702, part of the Pectra upgrade that went live early last month. It allows regular Ethereum addresses, secured by private keys, to temporarily operate as smart contracts, facilitating batched transactions, password authentication and spending limits.

The regular Ethereum addresses delegate control of their wallets to smart contracts, granting them permission to manage or move their funds. While it has simplified the user experience, it has also created a risk of malicious contracts draining funds.

As of Friday, more than 80% of delegations made through EIP-7702 involved reused, copy-and-paste contracts designed to automatically scan and identify weak wallets for potential theft.

«Our Research team found that over 97% of all EIP-7702 delegations were authorized to multiple contracts using the same exact code. These are sweepers, used to automatically drain incoming ETH from compromised addresses,» Wintermute said on X.

«The CrimeEnjoyor contract is short, simple, and widely reused. This copy-pasted bytecode now represents the majority of all EIP-7702 delegations. It’s funny, dark, and fascinating all at once,» the market maker added.

Notable cases include a wallet that lost nearly $150,000 through malicious batched transactions in a fishing attack, as anti-scam tracker Scam Sniffer noted.

Still, the large-scale money drain has not been profitable for the attackers. The CrimeEnjoyors spent approximately 2.88 ETH to authorize around 79,000 addresses. One particular address –0x89383882fc2d0cd4d7952a3267a3b6dae967e704 – handled more than half of these authorizations, with 52,000 permissions granted to it.

Per Wintermute’s researcher, the stolen ether can be traced by analyzing the code of these contracts. For the above example, the ETH is destined to flow the address –0x6f6Bd3907428ae93BC58Aca9Ec25AE3a80110428.

However, as of Friday, it had no inbound ETH transfers. The researcher added that this pattern appears consistent across other CrimeEnjoyors as well.

-

Fashion8 месяцев ago

Fashion8 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion8 месяцев ago

Fashion8 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoThe old and New Edition cast comes together to perform

-

Business8 месяцев ago

Business8 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports8 месяцев ago

Sports8 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment8 месяцев ago

Entertainment8 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoDisney\’s live-action Aladdin finally finds its stars