Uncategorized

Crypto for Advisors: Crypto Universe

In today’s Crypto for Advisors, Fabian Dori, Chief Investment Officer at Sygnum Bank, explores why crypto is more than just an asset class and looks at the institutional adoption of decentralized finance.

Then, Abhishek Pingle, co-founder of Theo, answers questions about how risk-adverse investors can approach decentralized finance and what to look for in Ask an Expert.

Crypto Is Not an Asset Class — It’s an Asset Universe

Moody’s recently warned that public blockchains pose a risk to institutional investors. At the same time, U.S. bitcoin ETFs are drawing billions in inflows. We’re seeing the start of a long-awaited shift in institutional adoption. But crypto’s real potential lies far beyond passive bitcoin exposure. It’s not just an asset class — it’s an asset universe, spanning yield-generating strategies, directional plays, and hedge fund-style alpha. Most institutions are only scratching the surface of what’s possible.

Institutional investors may enhance their risk-return profile by moving beyond a monolithic view of crypto and recognizing three distinct segments: yield-generating strategies, directional investments, and alternative strategies.

Like traditional fixed income, yield-generating strategies offer limited market risk with low volatility. Typical strategies range from tokenized money market funds that earn traditional yields to approaches engaging with the decentralized crypto finance ecosystem, which deliver attractive returns without traditional duration or credit risk.

These crypto yield strategies may boast attractive Sharpe ratios, rivalling high-yield bonds’ risk premia but with different mechanics. For example, returns can be earned from protocol participation, lending and borrowing activities, funding rate arbitrage strategies, and liquidity provisioning. Unlike bonds that face principal erosion in rising rate environments, many crypto yield strategies function largely independently of central bank policy and provide genuine portfolio diversification precisely when it’s most needed. However, there is no such thing as a free lunch. Crypto yield strategies entail risks, mainly centered around the maturity and security of the protocols and platforms a strategy engages with.

The path to institutional adoption typically follows three distinct approaches aligned with different investor profiles:

- Risk-averse institutions begin with yield-generating strategies that limit direct market exposure while capturing attractive returns. These entry points enable traditional investors to benefit from the unique yields available in the crypto ecosystem without incurring the volatility associated with directional exposure.

- Mainstream institutions often adopt a bitcoin-first approach before gradually diversifying into other assets. Starting with bitcoin provides a familiar narrative and established regulatory clarity before expanding into more complex strategies and assets.

- Sophisticated players like family offices and specialized asset managers explore the entire crypto ecosystem from the outset and build comprehensive strategies that leverage the full range of opportunities across the risk spectrum.

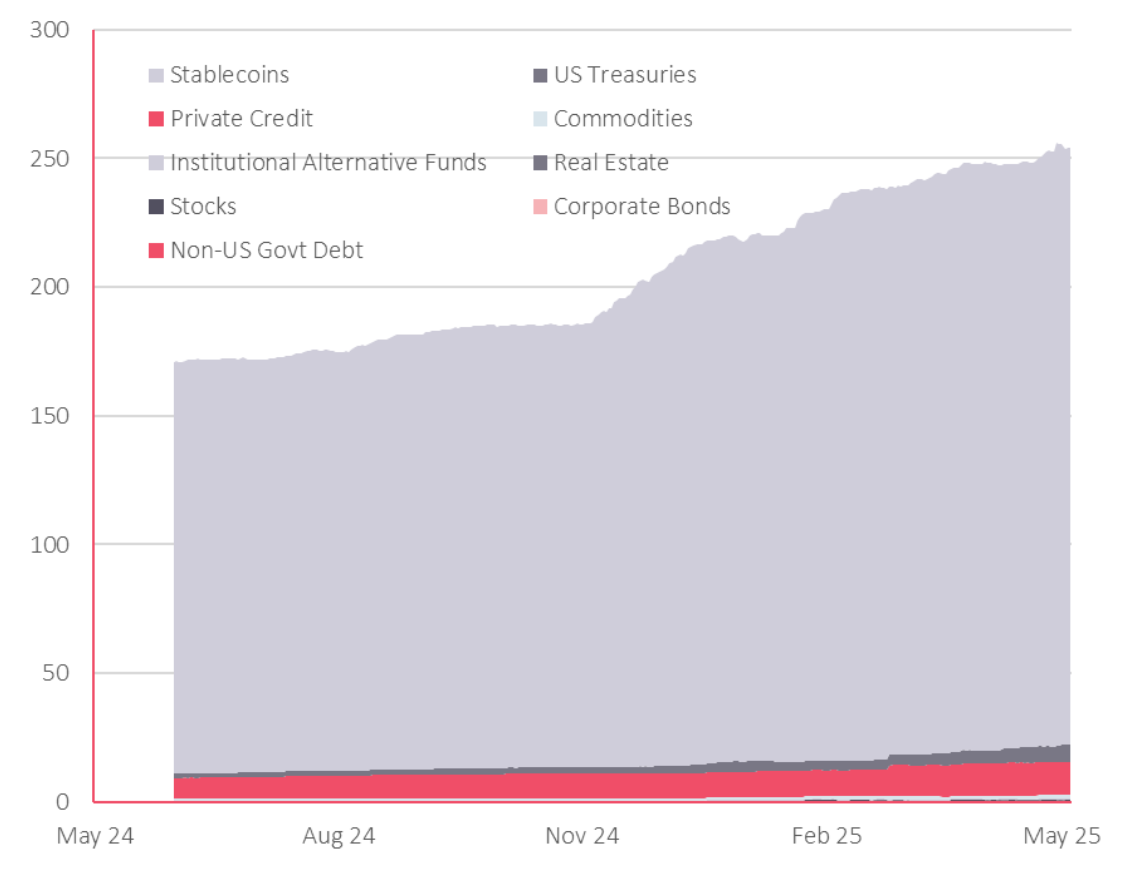

Contrary to early industry predictions, tokenization is progressing from liquid assets like stablecoins and money market funds upward, driven by liquidity and familiarity, not promises of democratizing illiquid assets. More complex assets are following suit, revealing a pragmatic adoption curve.

Moody’s caution about protocol risk exceeding traditional counterparty risk deserves scrutiny. This narrative may deter institutions from crypto’s yield layer, yet it highlights only one side of the coin. While blockchain-based assets introduce technical risks, these risks are often transparent and auditable, unlike the potentially opaque risk profiles of counterparties in traditional finance.

Smart contracts, for example, offer new levels of transparency. Their code can be audited, stress-tested, and verified independently. This means risk assessment can be conducted with fewer assumptions and greater precision than financial institutions with off-balance-sheet exposures. Major decentralized finance platforms now undergo multiple independent audits and maintain significant insurance reserves. They have, at least partially, mitigated risks in the public blockchain environment that Moody’s warned against.

While tokenization doesn’t eliminate the inherent counterparty risk associated with the underlying assets, blockchain technology provides a more efficient and resilient infrastructure for accessing them.

Ultimately, institutional investors should apply traditional investment principles to these novel asset classes while acknowledging the vast array of opportunities within digital assets. The question isn’t whether to allocate to crypto but rather which specific segments of the crypto asset universe align with particular portfolio objectives and risk tolerances. Institutional investors are well-positioned to develop tailored allocation strategies that leverage the unique characteristics of different segments of the crypto ecosystem.

— Fabian Dori, chief investment officer, Sygnum Bank

Ask an Expert

Q: What yield-generating strategies are institutions using on-chain today?

A: The most promising strategies are delta-neutral, meaning they are neutral to price movements. This includes arbitrage between centralized and decentralized exchanges, capturing funding rates, and short-term lending across fragmented liquidity pools. These generate net yields of 7–15% without wider market exposure.

Q: What structural features of DeFi enable more efficient capital deployment compared to traditional finance?

A: We like to think of decentralized finance (DeFi) as “on-chain markets”. On-chain markets unlock capital efficiency by removing intermediaries, enabling programmable strategies, and offering real-time access to on-chain data. Unlike traditional finance, where capital often sits idle due to batch processing, counterparty delays, or opaque systems, on-chain markets provide a world where liquidity can be routed dynamically across protocols based on quantifiable risk and return metrics. Features like composability and permissionless access enable assets to be deployed, rebalanced, or withdrawn in real-time, often with automated safeguards. This architecture supports strategies that are both agile and transparent, particularly important for institutions that optimize across fragmented liquidity pools or manage volatility exposure.

Q: How should a risk-averse institution approach yield on-chain?

A: Many institutions exploring DeFi take a cautious first step by evaluating stablecoin-based, non-directional strategies, as explained above, that aim to offer consistent yields with limited market exposure. These approaches are often framed around capital preservation and transparency, with infrastructure that supports on-chain risk monitoring, customizable guardrails, and secure custody. For firms seeking yield diversification without the duration risk of traditional fixed income, these strategies are gaining traction as a conservative entry point into on-chain markets.

— Abhishek Pingle, co-founder, Theo

Keep Reading

- Bitcoin reached a new all-time high of $111,878 last week.

- Texas Strategic Bitcoin Reserve Bill passed the legislature and advances to the governor’s desk for signature.

- U.S. Whitehouse Crypto Czar David Sacks said regulation is coming in the crypto space in August.

Uncategorized

Chart of the Week: Crypto May Now Have Its Own ‘Inverse Cramer’ and Profits Are in the Millions

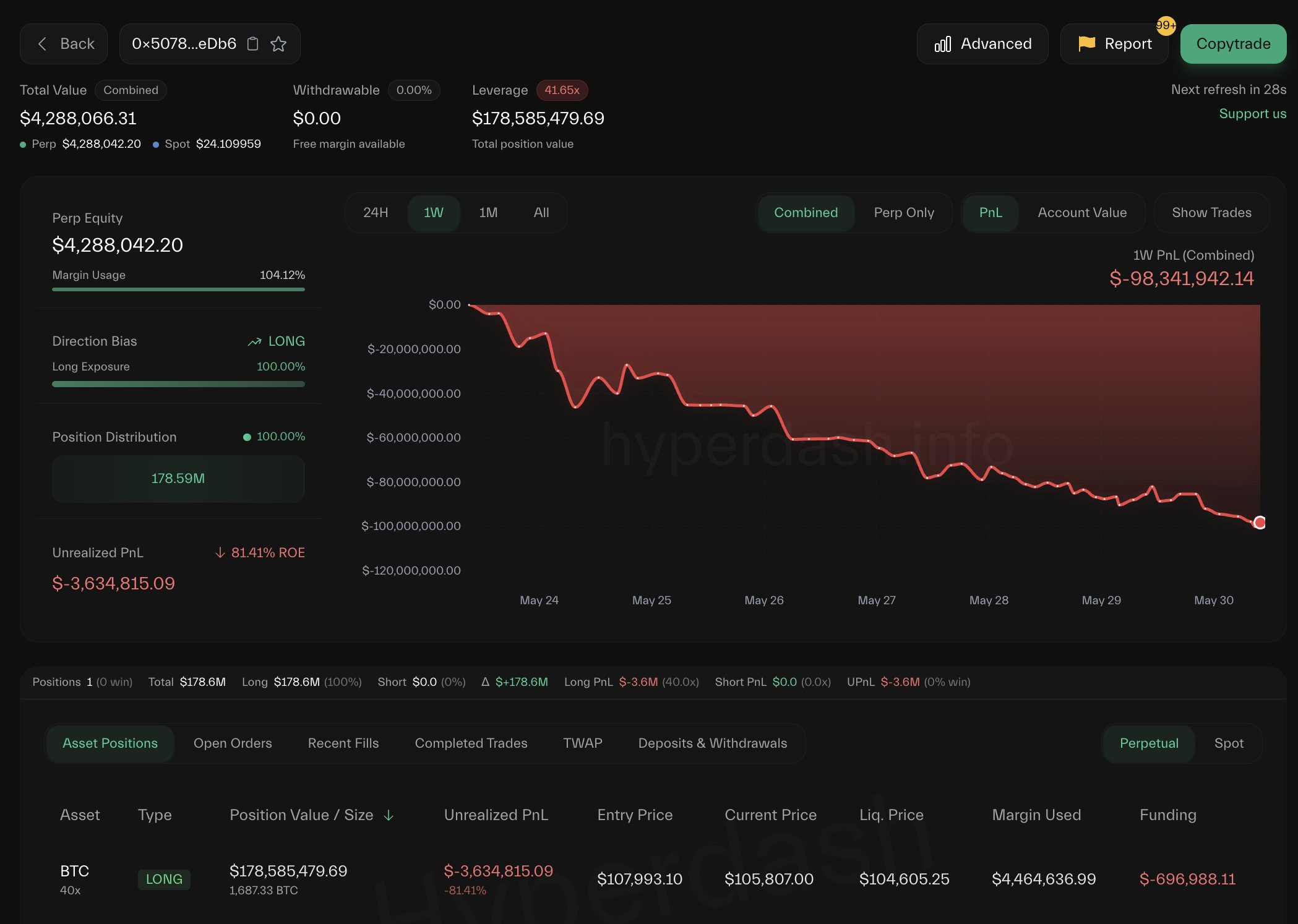

Meet James Wynn, the pseudonymous trader on Hyperliquid who became famous for his $1 billion bitcoin short bet, could now be gaining a new kind of fame: as crypto’s own “Inverse Cramer.”

For those unfamiliar with the Cramer lore: he’s the high-octane, loud-money mascot of CNBC’s Mad Money, a former hedge fund manager turned stock picker with a hit-or-miss track record that turned into a meme. Many retail traders started doing the exact opposite of his recommendations, and the idea became so famous that an “Inverse Cramer ETF” was launched (it was later shut down, but the meme lives on).

Now, crypto traders might have found their new «Inverse Jim Cramer» in James Wynn’s trading wallet.

«The winning strategy lately? Do the opposite of James Wynn,» said blockchain sleuth Lookonchain in an X post, pointing to a trader who has been making millions by doing exactly the opposite of James Wynn’s trades.

«0x2258 has been counter-trading James Wynn—shorting when James Wynn goes long, and going long when James Wynn shorts. In the past week, 0x2258 has made ~$17M, while James Wynn has lost ~$98M,» Lookonchain said in the post.

Seventeen million dollars in a week just by inverse-betting on one trader is not a bad payday. However, this might be a short-term trade, and one should be very cautious as things can change lightning fast in the trading world, leaving punters millions in losses if not hedged properly.

Even James Wynn said, «I’ll run it back, I always do. And I’ll enjoy doing it. I like playing the game,” after the trader got fully liquidated over the weekend.

So, maybe this Reddit gem: «How much money would you have made if you did the exact opposite of Jim Cramer?» would never translate to include James Wynn. But the sentiments, though, are loud and clear: in a market where perception is half the trade, even your PnL can get memed!

A bonus read: Jim Cramer Doesn’t Know Bitcoin«

Uncategorized

XRP’s Indecisive May vs. Bullish Bets – A Divergence Worth Watching

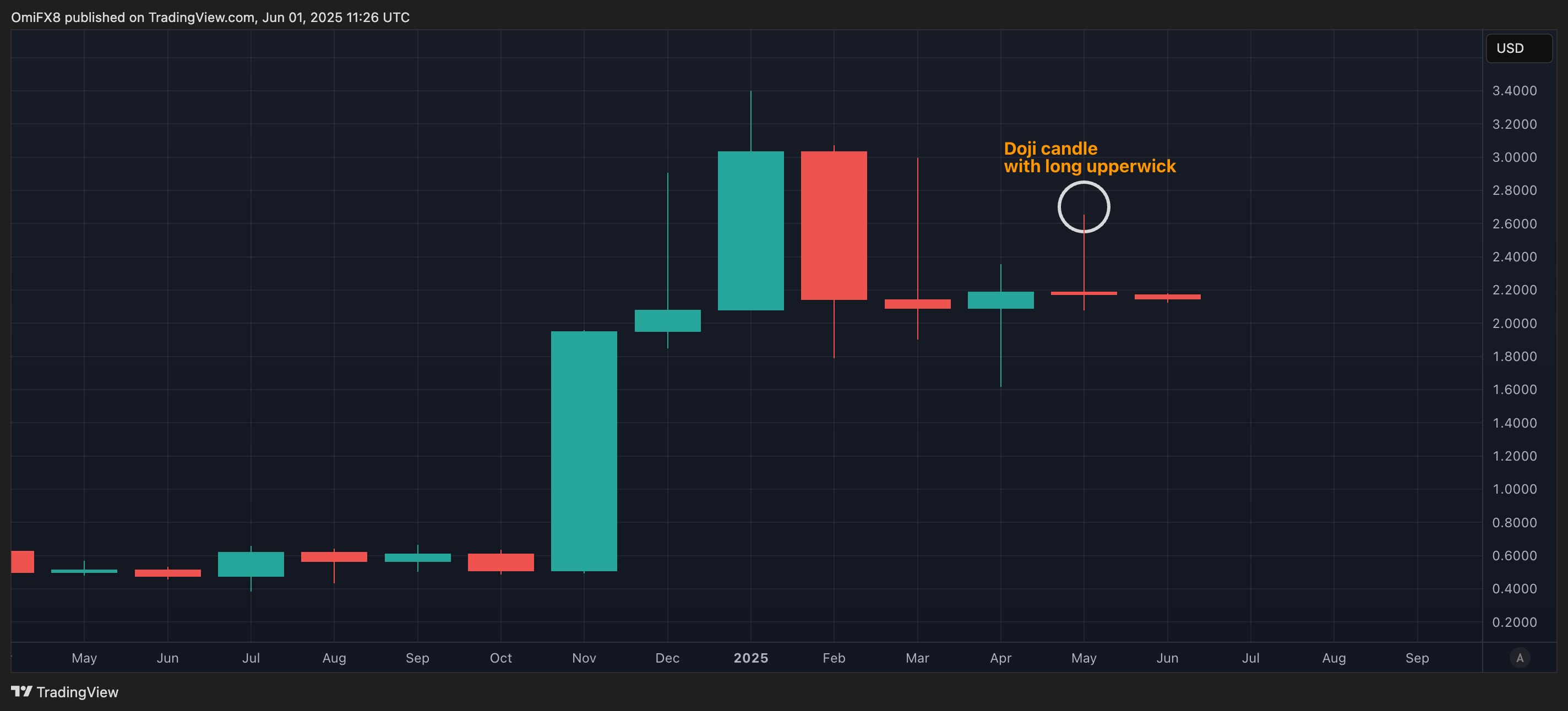

XRP, used by Ripple to facilitate cross-border transactions, ended May with signs of indecision. Still, activity on the dominant crypto options exchange, Deribit, suggests that bulls aren’t ready to back down yet.

The payments-focused cryptocurrency formed a «doji» with a long upper shadow in May, a classic sign of indecision in the market, according to charting platform TradingView.

The long upper wick suggests that bulls pushed prices higher to $2.65, but bears stepped in and rejected those levels, driving prices down to near the level seen at the start of the month.

The appearance of the doji suggests the recovery rally from the early April lows near $1.60 has likely run out of steam. Doji candles appearing after uptrends often prompt technical analysts to call for bull exhaustion and a potential turn lower.

Accordingly, last week, some traders purchased the $ 2.40 strike put option expiring on May 30. A put option offers insurance against price drops.

Bullish options open interest

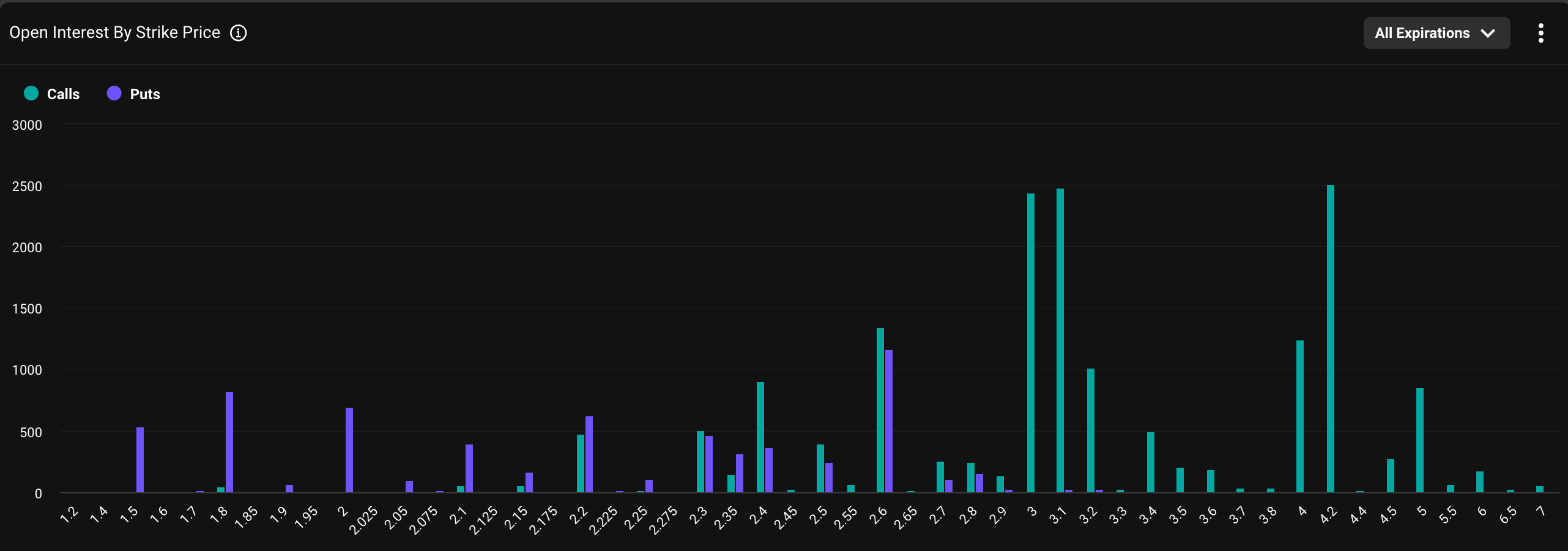

The overall picture remains bullish, with options open interest concentrated in higher-strike calls in a sign of persistent positive sentiment. Open interest refers to the number of active contracts at a given time. A call option gives the purchaser an asymmetric upside exposure to the underlying asset, in this case, XRP, representing a bullish bet.

«XRP open interest on Deribit is steadily increasing, with the highest concentration of strikes clustered on the upside between $2.60 and $3.0+, reflecting a notably bullish sentiment while the spot price currently trades at $2.16,» Luuk Strijers, CEO of Deribit, told CoinDesk.

The chart shows that the $4 call option is the most popular, with a notional open interest of $5.39 million. Calls at the $3 and $3.10 strikes have an open interest (OI) of over $5 million each. Notional open interest refers to the dollar value of the number of active contracts.

«XRP option open interest is split across June and September expiries, with monthly notional volumes approximating $65–$70 million, of which over 95% is traded on Deribit,» Strijers said.

The bullish mood likely stems from XRP’s positioning as a cross-border payments solution and mounting expectations of a spot XRP ETF listing in the U.S. Furthermore, the cryptocurrency is gaining traction as a corporate treasury asset.

Ripple, which uses XRP to facilitate cross-border transactions, recently highlighted its potential to address inefficiencies in SWIFT-based cross-border payments. The B2B cross-border payments market is projected to increase to $50 trillion by 2031, up 58% from $31.6 trillion in 2024.

Uncategorized

ETH Price Dips Below $2,500 on Whale Exit Fears, Then Bounces Back Above Key Level

Ethereum (ETH) faced renewed downside pressure in late trading, tumbling below the $2,500 level as selling volume surged and broader risk sentiment weakened. Global trade tensions and renewed U.S. tariff risks have triggered risk-off flows, with digital assets increasingly mirroring traditional markets in their reaction to geopolitical uncertainty.

On-chain data revealed sizable inflows to centralized exchanges — most notably 385,000 ETH to Binance —a dding to speculation that institutional players may be trimming positions. Although ETH has since recovered modestly to trade around $2,506, market observers are closely watching whether buyers can defend this level or if another leg lower is imminent.

Technical Analysis Highlights

- ETH traded within a volatile $48.61 range (1.95%) between $2,551.09 and $2,499.09.

- Price action formed a bullish ascending channel before breaking down in the final hour.

- Heavy selling emerged near $2,550, with profit-taking accelerating into a sharp reversal.

- ETH dropped from $2,521.35 to $2,499.09 between 01:53 and 01:54, with combined volume exceeding 48,000 ETH across two minutes.

- Volume normalized shortly after, and price recovered slightly, consolidating around the $2,504–$2,508 band.

- The $2,500 level is now acting as interim support, though momentum remains fragile with signs of distribution still evident in recent volume patterns.

External References

- «Ethereum Price Analysis: Is ETH Dumping to $2K Next as Momentum Fades?«, CryptoPotato, published May 31, 2025.

- «Ethereum Bulls Defend Support – Key Indicator Hints At Short-Term Rally«, NewsBTC, published May 31, 2025.

-

Fashion8 месяцев ago

Fashion8 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion8 месяцев ago

Fashion8 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoThe old and New Edition cast comes together to perform

-

Business8 месяцев ago

Business8 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports8 месяцев ago

Sports8 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment8 месяцев ago

Entertainment8 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoDisney\’s live-action Aladdin finally finds its stars