Uncategorized

Want Americans to Trust AI? Decentralize It

A decade ago, Bitcoin felt like the internet in the early ‘90s—niche, experimental, and easy to dismiss. Today? It’s front and center on Capitol Hill.

What began as a decentralized outlier many labeled as fringe is slowly becoming a pillar of America’s economy that many consider the future. People can now invest in Bitcoin through their 401(k)s, IRAs, and brokerage accounts. This year, the U.S. created a Strategic Bitcoin Reserve. Roundtables and summits are being hosted at the White House, and pro-Bitcoin positions are showing up in campaign platforms.

That shift wasn’t accidental. Bitcoin gained momentum because its core values—open access, transparency, and distributed control—offered an alternative when public trust in traditional finance was eroding.

A similar pattern is unfolding today with artificial intelligence.

AI Has a Trust Problem

AI is booming, but so are questions about who controls it. If you’re wondering where your data is going when you use a chatbot, who benefits from it, and why you have to surrender your privacy in the first place, you’re not alone.

According to a new Harris poll commissioned by DCG, 74% of U.S. respondents believe AI would benefit more people if it weren’t controlled by just a few big companies and 65% don’t trust elected officials to steer AI’s development. The public loves the potential of AI; they just don’t trust the players in charge.

That trust gap isn’t new, and Bitcoin confronted it head-on with decentralization: when trust in institutions erodes, the answer isn’t more gatekeepers—it’s building systems that don’t require them. Decentralized technologies rebuild trust by removing human intermediaries, who are often prone to bias, error, or self-interest, and eliminating single points of control. By replacing these flawed gatekeepers with transparent, distributed systems, decentralization offers a more reliable and accountable foundation for trust and confidence, rooted in transparency, resilience, and user-aligned governance.

This shift—from human-controlled to technologically decentralized systems—is what makes trust possible again.

Decentralized AI: The Internet of Intelligence

Unlike Big Tech models controlled by centralized entities, decentralized AI (deAI) is built, trained, and operated across a distributed network, preventing any single party from controlling the system. Decentralized AI (deAI) flips the script on traditional AI by putting power in the hands of users, not corporations. Networks like Bittensor (see Note below) are leading the way by enabling open, permissionless access to AI infrastructure where anyone can contribute models, computing power, or data. This approach levels the playing field for students, startups, and independent developers who would otherwise be shut out of today’s centralized AI giants.

Instead of gatekeepers, Bittensor coordinates contributions transparently across a global network, using blockchain to embed trust and reward real value. The result is AI that’s more open, resilient, and fair, where incentives are based on merit, not monopolies.

Voters Are Ahead of Lawmakers on Decentralized AI

While Americans are still in the earlier stage of learning about AI technologies, they can already intuitively anticipate the advantages of decentralized AI.

The Harris poll of 2,000 US adults found:

- 75% say decentralized AI better supports innovation

- 71% say it’s more secure for personal data

Three out of four respondents say decentralized AI drives more innovation than closed AI, and 71% believe it offers stronger protection for personal data. What’s missing for consumers using AI is transparency and control, and they want to know they’re not just training someone else’s profit engine.

Policy Can’t Ignore Infrastructure and Ownership

Even with strong public support, the promise of decentralized AI depends on whether policymakers understand a simple fact: the structure of a system determines its behavior and outcomes.However, the regulatory conversation around AI is still catching up, and in many cases, seems to be missing a crucial point. We’re seeing big debates around safety and existential risk, but almost no airtime for how the foundational structure of these systems impacts trust. A centralized model run by a few powerful players is inherently vulnerable, opaque, and exclusionary and will ultimately erode trust. To encourage trust, technological adoption and innovation, policymakers should:

- Incentivize innovation in open ecosystems

- Ensure people can benefit from their data

- Avoid enshrining Big Tech dominance through regulation

The same gatekeepers who shaped today’s AI shouldn’t control its future, especially with the public calling for real alternatives. The current Administration has taken a refreshingly pragmatic approach to AI, prioritizing innovation and American competitiveness over heavy-handed regulation and we hope Congress will do the same. Emphasizing private sector innovation and decentralized development lays the groundwork for a more open and resilient AI future.

It’s Not Fringe. It’s the Future

Decentralized AI is a forward-looking solution to one of the most urgent challenges of our time: how to ensure AI serves the public, not just the powerful. Just as Bitcoin moved from the margins to the mainstream, decentralized AI is quickly becoming the foundation for a more open, secure, and competitive AI ecosystem.

The public gets it. Now policymakers must catch up. The choice is clear: protect open networks, reward real builders, and defend the freedom to innovate—or hand the future of intelligence to a few corporate gatekeepers.

Decentralized AI isn’t fringe. It’s the foundation for a freer, fairer digital future. Let’s not miss the moment.

Note: DCG owns $TAO, the native token of the Bittensor network, and may hold interests in projects built on or supporting Bittensor and other deAI ecosystems.

Uncategorized

XRP Down 4% as Global Economic Tensions Trigger Market Selloff

XRP fell as much as 6% over the past 24 hours as global economic tensions rattled financial markets, triggering a wave of liquidations and pushing prices below key support levels.

The token dropped from $2.20 to $2.14 as the broader crypto market shed 3.81% of its value, settling at a total market cap of $3.3 trillion.

The volatility comes in the wake of the U.S. Court of International Trade’s decision to overturn Trump’s trade tariffs, reigniting trade policy concerns and sending ripples across risk assets.

XRP wasn’t immune, with over $29.68 million in long positions liquidated as traders scrambled to adjust their exposure.

News Background

- China-based Webus International said Friday it plans to raise up to $300 million through non-equity financing to support its global chauffeur payment network with an XRP reserve.

- The initiative aims to integrate XRP’s cross-border settlement capabilities into Webus’ ecosystem, including on-chain booking records and a Web3-based loyalty program.

- Webus is renewing its partnership with Tongcheng Travel Holdings to use the XRP Ledger for settling cross-border rides and driver payouts.

- Bitget listed Ripple’s RLUSD stablecoin late Thusday.

- Ripple published a cross-border payments report on Friday. Cross-border payments underpin the $31.6 trillion B2B market, projected to hit $50 trn by 2032. Traditional multi-intermediary rails are slow, costly and opaque, facing regulatory and transparency hurdles.

- Blockchain-based solutions like Ripple’s stablecoin network promise near-instant, cheaper, visible settlement, enhancing liquidity, global expansion, talent payments and customer trust, while reducing failed transfers, the report said.

Price-Action

Technically, XRP found strong selling pressure at the $2.21 resistance level, failing to mount a sustained recovery. A notable support zone emerged near $2.11, with high-volume buying during the 03:00 hour preventing further downside.

Recent consolidation between $2.13 and $2.14 suggests potential stabilization — though the pattern of lower highs indicates sellers remain in control.

In the final trading hour, XRP formed a higher-low pattern around $2.135, signaling potential short-term support.

However, the token also faced resistance at $2.144-$2.145, forming a tight range that traders will be watching closely for the next breakout or breakdown.

Technical Analysis Recap

- XRP dropped 5.7% from $2.20 to $2.14 over the past 24 hours.

- A price range of $0.13 (5.9%) was observed between a high of $2.22 and a low of $2.09.

- Significant resistance formed at $2.21 during the 16:00 and 22:00 hours, triggering heavy selling.

- Strong buying at $2.11 during the 03:00 hour prevented further downside.

- Recent consolidation between $2.13 and $2.14 suggests potential stabilization, though lower highs persist.

- A higher low at $2.135 formed in the last hour, with resistance at $2.144-$2.145 capping any rebound.

- XRP closed the session at $2.137, indicating consolidation after a volatile day.

As XRP navigates the crosswinds of macroeconomic tensions and technical headwinds, traders will be closely watching for any signs of sustained support or further breakdown.

Uncategorized

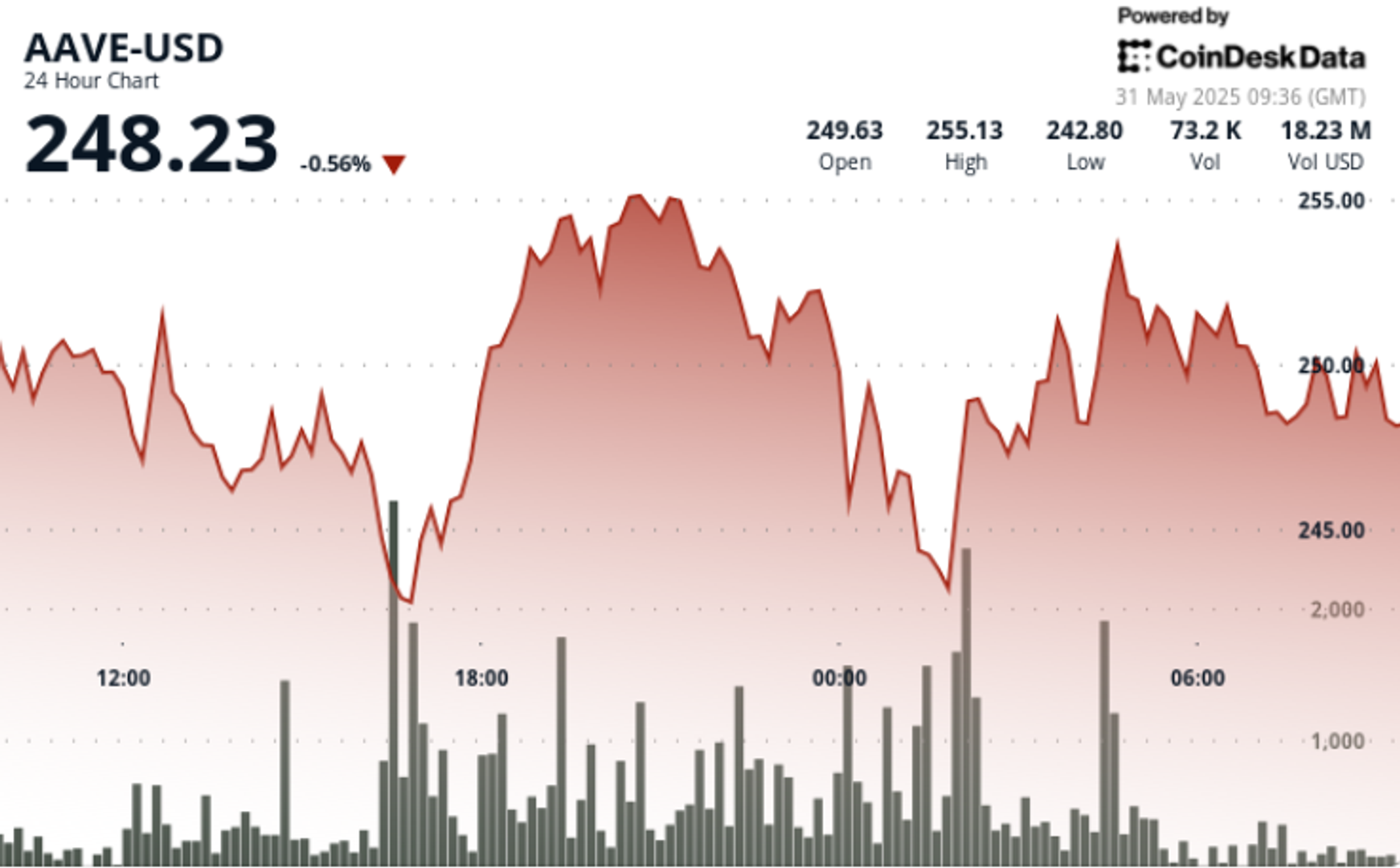

AAVE Rebounds From 15% Drop as DeFi Yield Markets Gain Momentum

AAVE has demonstrated remarkable resilience in the face of global market turbulence, rebounding from a 15% price drop over four days as buyers stepped in to capitalize on DeFi’s growing momentum.

The protocol’s price climbed from $240 to above $250, buoyed by expanding tokenized yield markets that are drawing increased institutional and retail interest.

The price action comes as global trade tensions and new tariff uncertainties — including reports of China violating its trade agreement with the U.S. — injected volatility across risk assets.

Despite these headwinds, the DeFi sector is showing renewed strength, with total value locked (TVL) surging to $178.52 billion. AAVE remains a key leader in the space, commanding a TVL of $25.41 billion.

News Background

- A key driver of AAVE’s recent rebound has been its integration with Pendle’s tokenized yield markets, which saw new markets reach their supply caps within hours of launch, underscoring the strong demand for yield-generating products in the DeFi ecosystem.

- The Ethereum Foundation (EF) borrowed $2 million in GHO, Aave’s decentralized stablecoin pegged to the U.S. Dollar, earlier this week.

- This move, facilitated by supplying ETH as collateral, highlighted EF’s strategy of leveraging its crypto holdings to fund operations while supporting Aave’s protocol.

- Aave’s GHO stablecoin is fully overcollateralized within the Aave ecosystem, with EF’s loan backed by 1,403,519.94 Gwei of ETH (valued at $0.01 in the transaction).

- Interest payments on this loan support Aave’s DAO treasury, reinforcing a community-driven financial model that incentivizes participation and governance.

- Aave’s lending dominance is underscored by its 45% market share from January 2023 to May 2025, according to IntoTheBlock data.

- This figure highlights Aave’s steady recovery from the 2023 DeFi dip and cements its status as the largest decentralized lending protocol by volume and activity.

Technical Analysis Recap

- AAVE established a high-volume support zone around $242.70 during the 16:00-17:00 and 01:00-02:00 hours, attracting strong buying with volumes exceeding 90,000 units.

- A bullish ascending triangle pattern formed, with higher lows indicating accumulation despite recent resistance.

- After peaking at $255.96 at 20:00, AAVE set resistance at $253.75 before stabilizing at $248-$250.

- A notable volume spike between 07:51-07:52 coincided with a sharp rise from $248.98 to $249.82, creating a new resistance level.

- A cup-and-handle pattern formed, with the handle developing between 07:56-08:00, suggesting accumulation after the recent pullback.

- Short-term consolidation near $249, coupled with increasing volume on upward moves, hints at potential bullish momentum building for a test of $250 resistance.

As DeFi yield markets continue to expand, AAVE’s ability to integrate new products and sustain high-volume support levels positions it as a key player in the sector’s growth — despite the broader market’s macroeconomic challenges.

Disclaimer: Portions of this article were generated with the assistance of AI tools and reviewed by CoinDesk’s editorial team for accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Uncategorized

BNB Down 4% as Global Trade Tensions Overshadow SEC Victory

Binance Coin (BNB) dropped nearly 4% over the past 24 hours, rattled by renewed global trade tensions and broad market volatility that overshadowed positive regulatory news.

The token fell from $672.53 to a low of $646.27, with selling accelerating during high-volume trading hours as traders reacted to macroeconomic developments.

News Background

- President Trump’s announcement of new tariffs on Canada and Mexico reignited fears of a trade war, sending shockwaves across financial markets.

- The crypto market wasn’t immune, with BNB underperforming despite the SEC’s voluntary dismissal of its lawsuit against Binance and founder Changpeng Zhao.

- That case, which had alleged Binance facilitated trading of unregistered securities, had hung over the exchange for nearly two years.

- BNB Chain saw an active week with BSC recording 1.93 million daily active users and opBNB surpassing 2 million. Total weekly trading volume hit $69.75B, while TVL stands at $10.5 billion.

- Key projects launched include UpTop (DeFi), Volare Finance (options trading), and WeApe by Wello (stablecoin payments).

- The chain also launched an incentive program for real-world assets, went live with its AI Bot, and activated the Maxwell Hardfork on testnet for faster block times.

- The BNB AI Hack announced winners for its latest batch, and the Featured Activities Series now offers upward of $60,000 in rewards on DappBay.

Price-Action

Technically, BNB established a high-volume resistance zone around $669.68 after repeated failures to sustain bullish momentum. A second wave of selling hit during the midnight hour, with volume spiking to 81,409 units as prices broke below the $650 support level. Although BNB has managed a modest recovery from its cycle lows, forming potential support between $646-$648, the overall trend remains bearish with lower highs and lower lows.

Technical Analysis Recap

- BNB fell from $672.53 to $646.27, a 3.91% decline over the 24-hour period.

- Most dramatic selling occurred at 16:00 with volume spiking to 100,471 units, establishing key resistance at $669.68.

- Additional selling pressure hit at midnight, with volume reaching 81,409 units as prices fell below $650.

- A modest support zone formed between $646-$648, though the broader trend remains bearish.

- The hourly chart shows higher lows forming an ascending support trendline, suggesting a short-term bullish attempt that could stall further downside.

As global trade tensions weigh on risk assets, BNB’s resilience will be tested as traders weigh regulatory clarity against macroeconomic headwinds.

Disclaimer: Portions of this article were generated with the assistance of AI tools and reviewed by CoinDesk’s editorial team for accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

-

Fashion8 месяцев ago

Fashion8 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion8 месяцев ago

Fashion8 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoThe old and New Edition cast comes together to perform

-

Business8 месяцев ago

Business8 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports8 месяцев ago

Sports8 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment8 месяцев ago

Entertainment8 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoDisney\’s live-action Aladdin finally finds its stars