Uncategorized

XRP Could Rocket to $8 as Focus Shifts to Crypto Majors After Bitcoin’s Record Run: Traders

Attention is turning to major tokens as bitcoin (BTC) set fresh highs earlier this week, with some pointing out that institutional demand and a clear regulatory environment pave the way for strong moves among the top coins.

Bitcoin was hovering just under $111,000 during the Asian morning hours on Friday, seeing a slight pullback on profit-taking as is expected after upward moves. Cardano’s ADA, dogecoin (DOGE) and Solana’s SOL added as much as 4%, while ether (ETH), XRP, and BNB Chain’s BNB rose less than 1.5%.

The broad-based CoinDesk 20 (CD20), a liquid index tracking the largest tokens by market cap, rose 1.2% in the past 24 hours.

Bitget Research’s Chief Analyst Ryan Lee told CoinDesk in a Telegram message that a potential dip in bitcoin dominance could kick off a broader alt season, with high-profile names like XRP and Solana in prime position to benefit.

Lee pointed to XRP’s improving regulatory clarity and recent technical breakout patterns as reasons traders are eyeing a move toward $3–$8 in the medium term.

XRP recently formed a golden cross against BTC on the weekly chart — a historically bullish signal suggesting a long-term trend reversal may be underway. The ratio has been locked in a sideways channel since late 2020, but that may now be breaking after last month’s SEC decision not to pursue further appeals against Ripple.

SOL could climb toward $220–$300 on ETF speculation, while ADA shows potential for a breakout between $1 and $3, Lee added.

Singapore-based QCP Capital said in a Thursday broadcast that the latest BTC move confirmed a robust trend supported by improved structural fundamentals and relatively low volatility.

«This rally feels more structurally sound than the last with less frothy momentum-chasing and stronger fundamental underpinnings,” the firm said, adding that the brief dip following BTC’s initial record high break triggered put-side profit-taking, but buyers were “quick to reload on the upside.”

Still, broader macro risks remain in play. Renewed tariff concerns, rising U.S. yields, and a stronger dollar could all inject volatility into the system, especially for altcoins, QCP said. Traders are urged to stay selective, focusing on assets with strong fundamentals and clear regulatory narratives.

Meanwhile, FxPro’s Alex Kuptsikevich shared in an email that bitcoin’s sentiment index is hovering just below “extreme greed” as of Friday, a sign that the rally may still have room to run in the coming days.

Uncategorized

Strategy Slumps 6%, Leading Crypto Names Lower as Bitcoin Treasury Strategies Are Questioned

Crypto stocks suffered a red day on Friday, especially bitcoin BTC treasury companies such as Strategy (MSTR) and Semler Scientific (SMLR) — each down roughly 6% even as bitcoin slipped only a bit more than 2%. Japan-listed Metaplanet is lower by 24%.

The picture looks even worse when zooming out: changing hands at $376 early Friday afternoon, MSTR shares are more than 30% below their all-time high hit late in 2024 even as bitcoin has pumped to a new record this week.

The price action comes amid a continuing debate taking place on social media about the sustainability of Michael Saylor’s (and those copycatting him) bitcoin-vacuuming playbook.

“Bitcoin treasury companies are all the rage this week. MSTR, Metaplanet, Twenty One, Nakamoto,” said modestly well-followed bitcoin twitter poster lowstrife. “I think they’re toxic leverage is the worst thing which has ever happened to bitcoin [and] what bitcoin stands for.”

The issue, according to lowstrife, is that the financial engineering that Strategy and other BTC treasury firms are employing to accumulate more bitcoin essentially rests on mNAV — a metric that compares a company’s valuation to its net asset value (in these cases, their bitcoin treasuries).

As long as their mNAV remains above 1.0, a given company can keep raising capital and buying more bitcoin, because investors are showing interest in paying a premium for exposure to the stock relative to the firm’s bitcoin holdings.

If mNAV dips below that level, however, it means the value of the company is even lower than the value of its holdings. This can create significant problems for a firm’s ability to raise capital and, say, pay dividends on some of the convertible notes or preferred stock it may have issued.

Shades of GBTC

Something similar happened to Grayscale’s bitcoin trust, GBTC, prior to its conversion into an ETF. A closed-end fund, GBTC during the bull market of 2020 and 2021 traded at an ever-growing premium to its net asset value as institutional investors sought quick exposure to bitcoin.

When prices turned south, however, that premium morphed into an abysmal discount, which contributed to a chain of blowups beginning with highly-leverage Three Arrows Capital and eventually spreading to FTX. The resultant selling pressure took bitcoin from a record high of $69,000 all the way down to $15,000 in just one year.

“Just like GBTC back in the day, the entire game now — the whole thing — is figuring out how much more BTC these access vehicles will scoop up, and when they will blow up and spit it all back out again,” Nic Carter, partner at Castle Island Ventures, posted in response to lowstrife’s thread.

The thread also triggered replies from MSTR bulls, among them Adam Back, Bitcoin OG and CEO of Blockstream.

“If mNAV < 1.0 they can sell BTC and buy back MSTR and increase BTC/share that way, which is in share-holder interests,” he posted. “Or people see that coming and don’t let it go there. Either way this is fine.»

Uncategorized

Crypto Market Sees $300M Liquidations as Trump Tariff Threats Flush Late Bulls

Crypto traders betting on a steady bitcoin BTC rally got a sharp reminder of headline risk from Donald Trump’s latest tariff threats.

Over $300 million worth of leveraged derivatives positions were liquidated across centralized exchanges in the past four hours, according to CoinGlass data, as crypto prices plunged following the news.

Nearly all liquidations came from long positions—traders betting on higher prices. BTC longs accounted for $107 million of the total, while Ethereum’s ether ETH followed with close to $87 million. Other tokens, including Solana’s SOL SOL, dogecoin DOGE, and SUI SUI saw liquidations ranging between $10 million and $18 million.

«Nice aggregate flush of long leverage and de-risk selling from spot,» well-followed crypto trader Skew noted in an X post early Friday. «All driven by headlines once again.»

The sell-off came after Trump proposed a 50% tariff on imports from the European Union starting next month, along with a 25% tariff on iPhones manufactured outside the U.S., reigniting fears of an escalating trade war.

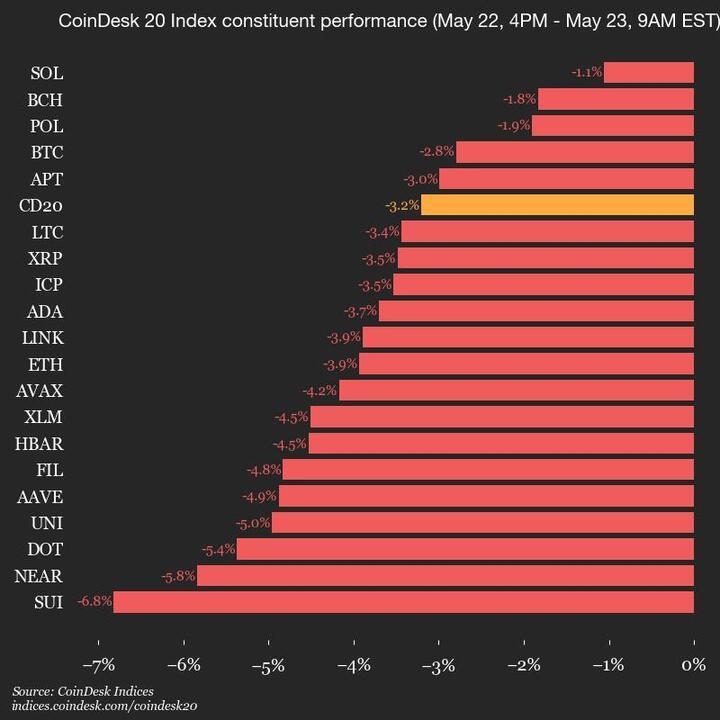

As a result, BTC and major altcoins such as Ether ETH, XRP XRP, and Cardano ADA fell 3% to 4%, while smaller-cap tokens like Uniswap UNI and SUI SUI dropped 5% to 7% over the past 24 hours.

Crypto trader named James Wynn, who gained attention recently opening a $1.1 billion BTC long bet with 40x leverage on the Hyperliquid exchange, also slipped underwater on the massive position. Currently, the trader is sitting on $7.5 million of unrealized losses, and the position could be liquidated if BTC slips to $102,000, according to a screenshot shared on X.

Interestingly, the long liquidations came amid a recent unusual tilt toward short positions in BTC derivatives despite record prices, CoinDesk reported on Thursday.

Read more: Why Are Bitcoin Traders Aggressively Shorting as BTC Hits New Record High?

Uncategorized

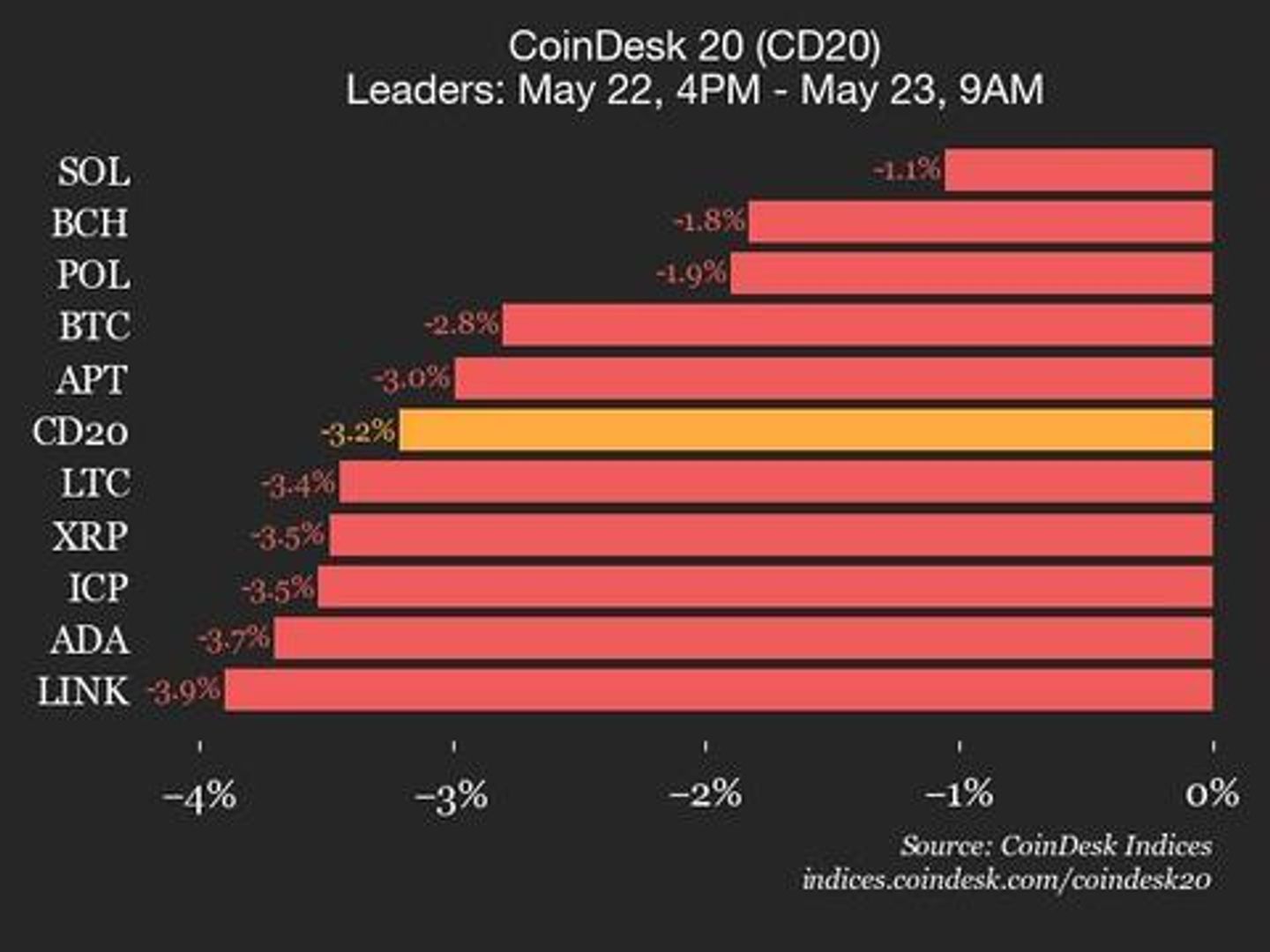

CoinDesk 20 Performance Update: Index Declines 3.2% as All Assets Trade Lower

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 3239.11, down 3.2% (-107.44) since 4 p.m. ET on Thursday.

None of the 20 assets are trading higher.

Leaders: SOL (-1.1%) and BCH (-1.8%).

Laggards: SUI (-6.8%) and NEAR (-5.8%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors