Uncategorized

Tokenization is Full Steam Ahead… with Tracks Still Needing to be Built

The tokenization of real world assets (RWAs) is gaining recognition from institutions seeking collateral mobility, issuers making private, alternative assets more accessible to retail investors and crypto enthusiasts engaging in more serious conversations as compared to the NFT and memecoin craze of past years.

As predicted earlier this year, tokenization is solidifying its position and moving into the «pragmatists» portion of the adoption bell curve. 2024 ended with a $50 billion market cap and as of May 2025 has surpassed $65 billion, excluding stablecoins.

A recent conference, TokenizeThis 2025, brought together industry leaders to dive deep into specific areas of the tokenization space, celebrating innovative accomplishments and evaluating how to tackle remaining challenges to reach mainstream adoption. While the conference panel topics delved into granular areas, a couple overarching themes to highlight include 1) collateral mobility and new utility enhancing real world assets and 2) the effects tokenization will have on investment strategies and workflows.

Adding utility and collateral mobility

“I think that’s actually what makes this technology so powerful is that you’re talking about the same token but it can be used in very different ways for very different investors as long as of course the risk framework is right,” said Maredith Hannon, head of business development, digital assets at WisdomTree.

While tokenizing assets is straightforward, the real opportunity lies in enabling more streamlined usage of assets compared to their traditional counterparts and addressing the needs of different participants. A panel dedicated to this topic shared examples of tokenized treasury products that can be used in both retail and institutional settings. Because blockchain allows an asset to move more freely, a money market fund could be used as collateral on a prime brokerage, eliminating the need to exit from that position thus still earning its corresponding yield for the investor. From a retail perspective, the same is possible with a different application where the fund units can be used for payment using a debit card linked to them. Utility can be added to other, higher risk investment products as well through different applications depending on the use case, with the common denominator being the use of blockchain technology.

Along the same lines, lending and borrowing is being disrupted thanks to tokenization. Going to a traditional lender (usually an institution) for cash is a cumbersome process.

“The end goal in my opinion would be that my kids when doing their first mortgage just apply anonymously on a mortgage saying ‘this is my situation I want to borrow this for that’ and then she just borrows it [from] many people at the same time and repaying stablecoins… it’s already quite daunting to talk to 20 banks because you want to buy one apartment, at least this is how it works in France right now,” said Jerome de Tychey, CEO at Cometh.

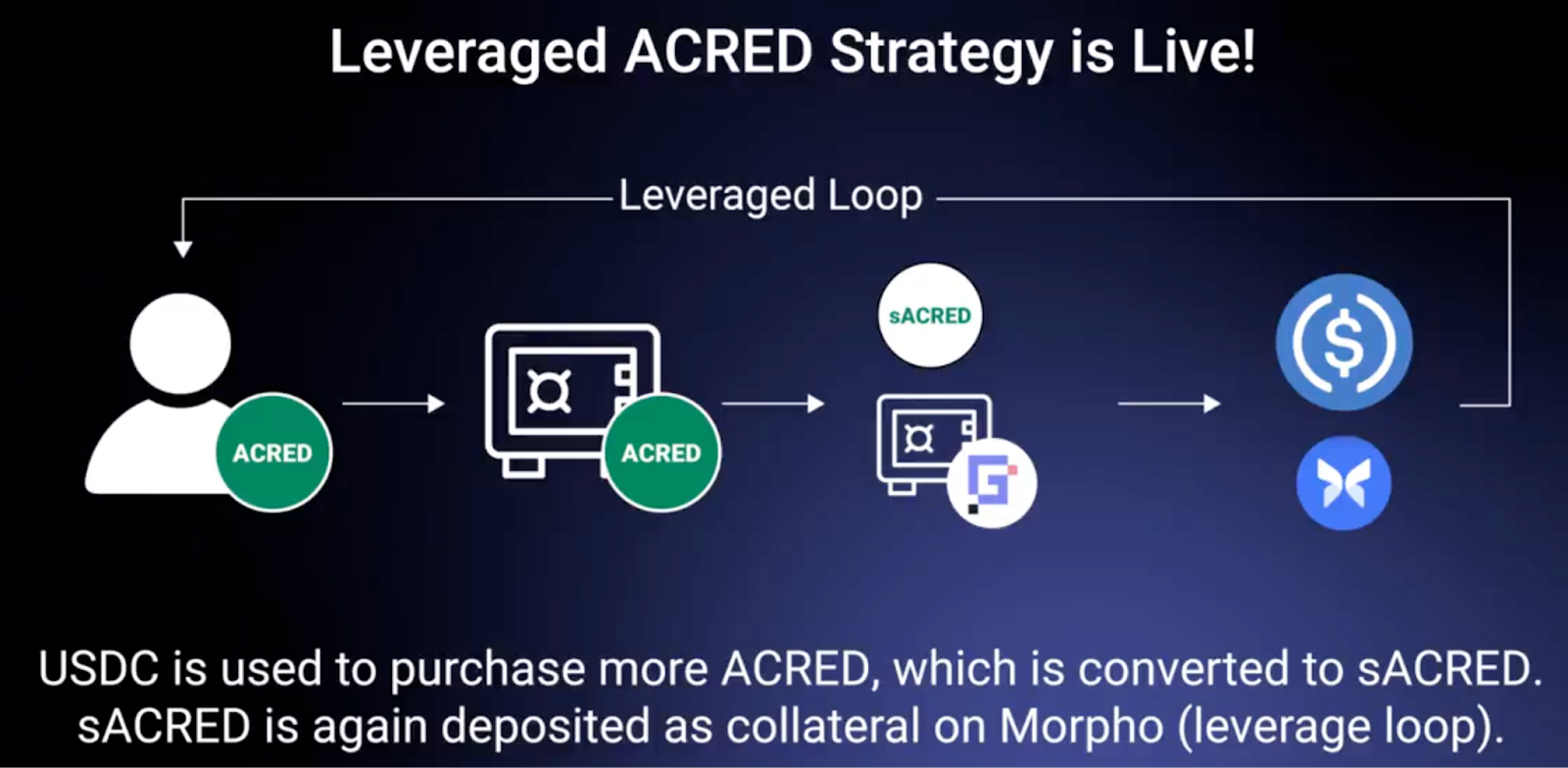

Jerome’s anecdote speaks to the power of decentralized finance for an individual and how it can fast-track a loan. Figure offers an internet-based solution for home equity lines of credit (HELOCs) and even they are using the blockchain in the backend. By issuing, warehousing and securitizing them, they’ve saved 150 bps out of the process — an operational advantage. From an investment standpoint, the DeFi vaults panel showcased how vaults streamline something similar but for investors, with an example being Apollo’s tokenized private credit fund now using this technology to enable leverage loops. This means borrowed stablecoin can be used to buy more of the asset, increasing yield while being subject to a built-in programmatic risk framework.

Source: Securitize

However, challenges remain to be solved before vaults can take off, such as high custody and liquidity provision costs, limited RWA composability in DeFi and minimal appeal to crypto-native users seeking higher returns. Despite these obstacles, participants expressed enthusiasm for future possibilities.

How RWAs are impacting traditional strategies and workflows

“The reason this technology is so powerful is because it’s a computer. If you think about all the middle and back office work from originating an asset to selling it, how many intermediaries touch it and take fees, how many people ensure loan tapes match with received funds — bringing that workflow on-chain is far more meaningful than just focusing on the asset itself,” said Kevin Miao, head of growth at Steakhouse Financial.

Traditional markets have had a challenging time incorporating less liquid, higher yielding assets into investment strategies due to complex back and middle office needs for transfers, servicing, reporting and other factors. Automating transfer processes and providing on-chain transparency would make it easier for these assets to be allocated in and out of, in addition to cryptocurrencies introducing new investment opportunities.

Cameron Drinkwater from S&P Dow Jones Indices and Ambre Soubiran from Kaiko discussed how blockchain will unlock previously inaccessible portfolio construction tools. They shared how this could result in blockchain-native investment strategies combining crypto and private asset allocations for greater diversification and new sources of yield.

Achieving this, however, requires interoperability between legacy and blockchain-based infrastructure and between blockchains themselves. Some critical elements include aligning workflows, price transparency, rebalancing, on-chain identity, risk assessment considerations and risk management solutions. Providing maximum visibility into these assets and tools to navigate markets on-chain is one key step in.

RWAs are shifting from theoretical blockchain to practical tokenized asset implementation in traditional and decentralized finance. The focus is now on enabling real utility through better collateral mobility, new financial products and more efficient workflows. By improving interoperability and identity frameworks, tokenization is expected to democratize illiquid assets and enhance financial efficiency. For additional recordings of the informational sessions, please visit STM TV on YouTube.

Uncategorized

Crypto Trader Opens $1.1B Long Bitcoin Bet on Hyperliquid Using 40X Leverage

A single trader has opened a massive $1.1 billion notional long position on bitcoin (BTC) using 40x leverage on the onchain decentralized exchange (DEX) Hyperliquid, a rare instance of a ten-figure position being open entirely on a blockchain-based platform.

The trade is tied to wallet address “0x507,” belonging to pseudonymous trader “James Wynn” on the platform.

Lookonchain data shows the position was opened at an entry price of $108,084, with a liquidation level just under $103,640 — meaning if BTC drops to that price, the position could be wiped out. The trade is sitting on over $40 million in unrealized profit as of early Thursday.

Wynn closed 540 BTC (~$60M) in European morning hours to lock in a $1.5 million profit. Notably, his past three exits were followed by sharp BTC pullbacks and traders may want to watch for a repeat, Lookonchain said.

Hyperliquid is built on its own high-performance layer 1 blockchain, HyperEVM, and offers features typically reserved for centralized platforms, like real-time order books, deep liquidity, and near-zero gas fees.

Its consensus mechanism, HyperBFT, reportedly handles over 200,000 transactions per second, allowing traders to execute quickly and transparently.

Unlike centralized exchanges that require KYC or restrict access, Hyperliquid allows anyone with a wallet to trade permissionlessly. The platform has rapidly gained popularity for its speed and capital efficiency, and this billion-dollar position may serve as a signal to other large players exploring onchain execution.

In many ways, it also marks a new phase of capital migration from centralized finance to decentralized finance (DeFi) — one where whales, not just retail, are willing to place big bets outside the traditional system.

Hyperliquid’s HYPE is up 15% in the past 24 hours as demand for the token increased.

Uncategorized

King Dollar Falls, Bitcoin Marches Toward Sound Money Highs

Bitcoin’s BTC dollar high succumbed on Thursday as the largest cryptocurrency rose past $111,800, a remarkable 50% gain from its April low near $75,000, but when measured against traditional stores of value like gold and silver, BTC — often dubbed «digital gold» — still has room to advance.

The bitcoin-to-gold ratio stands at 33.27 ounces, below its January peak of over 40 oz. BTC has also not reached an all-time high against silver, though it has just breached the 3,300 oz. level, compared with the record 3,530 oz.

The digital gold moniker reflects bitcoin’s fixed supply and decentralized nature, and it’s increasingly living up to the name. In recent weeks, it has outperformed U.S. equities, which remain sluggish for the year despite recovering from their April tariff-tantrum induced downturn.

In fiat terms, bitcoin is nearing significant psychological milestones across other currencies too. It currently trades around 82,500 British pounds, just shy of its all-time high of 88,300 pounds, and at 91,500 Swiss francs, versus a previous peak just under 100,000 francs. These levels hint at imminent breakthroughs as bitcoin gains further strength.

Notably, BTC has already achieved all-time highs relative to major financial instruments like the Nasdaq 100 and the iShares 20+ Year Treasury Bond ETF (TLT). Its continued outperformance of both bonds and tech stocks underscores a broader trend. The final frontier remains precious metals. Surpassing gold and silver benchmarks will mark a complete reversal of monetary dominance.

Uncategorized

Bitcoin Pizza Day Is Now a $1.1B Celebration

Bitcoin (BTC) Pizza Day is here and it just got its most fitting tribute yet: a new all-time high.

Bitcoin surged past $111,800 early Thursday, setting a fresh record. 15 years ago on this day developer Laszlo Hanyecz paid 10,000 BTC for two Papa John’s pizzas, then worth roughly $40.

The May 22, 2010, purchase marked the first recorded commercial transaction using BTC, a turning point that took the asset from cypherpunk code to actual currency.

That same 10,000 BTC can buy over 70 million pizzas at current prices. It is worth over $1.1 billion as of Thursday.

Hanyecz has long shrugged off the missed fortune” tag, telling CBS in 2019 that the transaction made bitcoin “real” to him. He mined the coins back when BTC was under a penny, and few could have predicted the multi-trillion-dollar asset it would become.

Still, the transaction remains a cultural milestone for the crypto market — a moment that showed internet money could work as actual currency. Now, it’s not just pizza being paid for with bitcoin. It’s property, cars, and in some countries, even taxes (briefly).

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors