Uncategorized

Chainlink Gains as Exchange Outflows Point to Strong Accumulation

Chainlink’s price action demonstrates remarkable resilience amid mixed global economic conditions.

The token has established a well-defined rising channel pattern, with technical indicators supporting continued bullish momentum.

After successfully breaking above the 200-day moving average, LINK has maintained its upward trajectory despite short-term resistance.

Exchange outflows remain consistently negative, with $11.27 million worth of LINK exiting exchanges this week following $55.2 million in outflows last week. This pattern of decreasing exchange balances typically signals investor accumulation rather than selling pressure.

Meanwhile, Chainlink’s technology continues gaining traction in the DeFi sector, with recent integrations including JPMorgan, Ondo Finance, and Solana mainnet.

Analysts project LINK could reach $20 in the near term, with longer-term forecasts suggesting potential growth to $50 by 2028 and $100 by 2030 as adoption of its Cross-Chain Interoperability Protocol (CCIP) expands across the blockchain ecosystem.

Technical Analysis Highlights

- LINK established strong support at $15.60 with high-volume buying emerging at the $15.27-$15.30 zone during the 18-19 hour timeframe on May 20th.

- A significant volume spike (3.08M) during the 11:00 hour on May 21st coincided with LINK testing the $16.24 resistance level.

- The overall trend remains bullish with higher lows forming a clear upward channel.

- LINK demonstrated significant bullish momentum in the last hour, surging from $15.67 to a peak of $15.91, representing a 1.5% gain.

- A notable volume spike occurred at 13:30, catalyzing a sharp upward movement that established a new support level around $15.75.

- The price action formed an ascending channel with higher lows, though some profit-taking emerged near the $15.90 resistance level.

- Final minutes showed consolidation around $15.85, with volume patterns suggesting accumulation rather than distribution.

External References

- «Chainlink Price Prediction: Can Increased Network Adoption Rejuvenate Bullish Momentum for LINK?«, CoinPedia, published May 20, 2025.

- «Chainlink price prediction 2025-2031: A strong buy sentiment for LINK?«, Cryptopolitan, published May 20, 2025.

- «Chainlink In Rally Mode: Rising Channel Formation Signals Continued Climb«, NewsBTC, published May 21, 2025.

- «Chainlink price targets $20 as exchange outflows surge«, crypto.news, published May 21, 2025.

Uncategorized

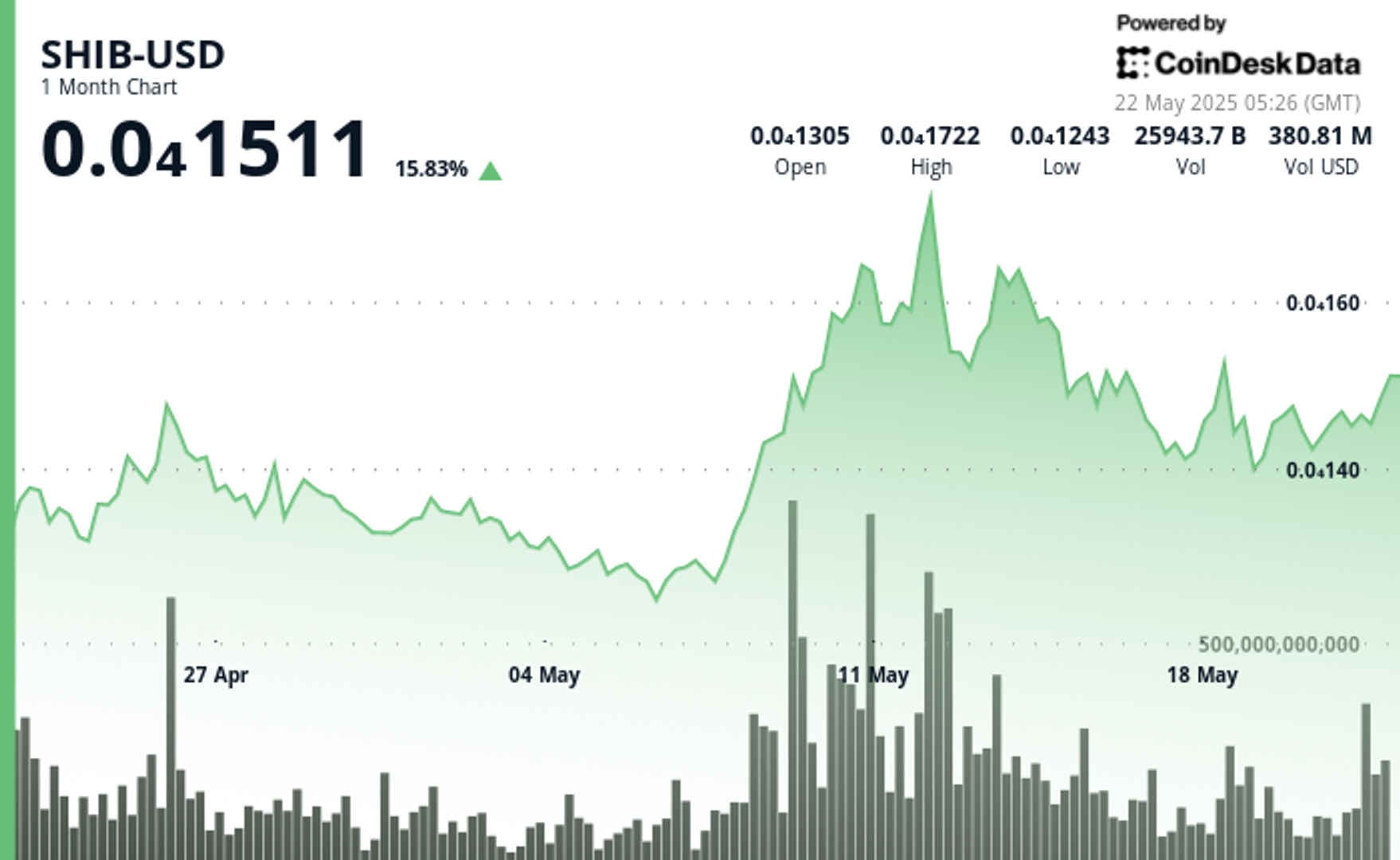

SHIB Holds Strong Above Key Support as Volume Spikes Nearly 4x

SHIB’s remarkable resilience during the recent trading session demonstrates growing investor confidence despite market turbulence.

The token’s ability to recover from a sudden drop to 0.0000143 with extraordinary volume support suggests institutional accumulation rather than retail panic.

With the psychological support at 0.000015 holding firm and multiple tests of upper resistance, SHIB appears poised for potential continuation of its upward trajectory if current accumulation patterns persist.

Technical Analysis Highlights

- SHIB demonstrated remarkable resilience over the 24-hour period, climbing from 0.0000146 to 0.0000150, representing a 2.85% gain with a range of 0.00000081 (5.64%).

- The token experienced significant volatility at 17:00 when price plummeted to 0.0000143 before finding strong volume support.

- A massive 2.83 trillion volume spike—nearly 4x the average—provided crucial support during the recovery phase.

- Key resistance at 0.0000151 was tested twice during the period, with accumulation patterns forming in the final hours.

- Three consecutive high-volume candles (23:00-01:00) established a solid foundation above the 0.000015 psychological level.

- In the last hour, SHIB exhibited notable volatility with a significant price surge at 01:22 when it broke above the 0.0000151 resistance level, reaching 0.00001514 by 01:31.

- Elevated trading volumes supported the bullish momentum, particularly during the 01:36 candle which recorded nearly 80 billion in volume.

- A sharp correction at 01:37-01:38 dropped the price 5% to 0.00001505, before establishing a consolidation pattern.

External References

- «Analyst Says When This Shiba Inu Breakout Happens, You’ll Want a Piece of SHIB«, The Crypto Basic, published May 21, 2025.

- «Shiba Inu (SHIB) Primed for Breakout as Accumulation and Burn Rate Surge«, Coin Edition, published May 21, 2025.

Uncategorized

Bitcoin Smashes Past $111K, Setting New Record Highs, on Institutional Fervor

Bitcoin (BTC) broke through $111,000 for the first time early Thursday, setting a fresh all-time high as capital continues to pour into the asset from an increasingly institutional class of buyers.

BTC rose nearly 3.5% to touch $111,878 during Asian morning hours, CoinGecko data shows, lifting overall market capitalization 1.7%. Major tokens from xrp to dogecoin (DOGE) showed little movement

The demand isn’t just coming from crypto-native funds or retail traders. Publicly listed companies increasingly treat BTC as a treasury asset, using capital markets to raise cash and buy more of the token.

“We think that large institutions are driving Bitcoin’s rally,” said Jeff Mei, COO at BTSE, said in a Telegram message. “This trend will likely continue, especially as more companies tap public markets and ETF inflows remain strong. May alone saw $3.6 billion in net ETF demand.

”Options traders have taken note. Contracts for $110,000, $120,000 — and even $300,000 — expiring in late June currently hold the most open interest on Deribit, suggesting traders are positioning for more upside before summer ends.»

After years of public skepticism, JPMorgan Chase reportedly offers clients access to bitcoin, signaling a deeper shift in how traditional finance views crypto exposure.

“As the largest bank in the U.S., its decision adds a new layer of legitimacy to Bitcoin, potentially nudging other traditional financial institutions toward similar offerings to avoid falling behind,” said Ryan Lee, chief analyst at Bitget Research, in a message to CoinDesk.

Despite macroeconomic headwinds, including rising bond yields, geopolitical noise, and a downgraded U.S. credit rating, bitcoin has shown “remarkable resilience,” said QCP Capital in a Thursday note.

“A breakout to new highs could ignite a fresh wave of FOMO,” they added, “dragging in sidelined retail capital and pushing prices even higher.”

Uncategorized

Trump’s Memecoin Dinner Draws Crowded Cast of Democratic Protesters from Congress

As President Donald Trump’s biggest memcoin buyers such as Tron founder Justin Sun bask in his attention over dinner on Thursday, Democratic lawmakers and advocacy groups have arrayed a series of protests and complaint sessions to decry the president’s crypto event as fundamentally corrupt.

Trump will host his dinner for more than 200 of his leading memecoin investors, whose money will fill the coffers of the president’s own business entities. They’ve reportedly been invited to his capital-area golf course, the Trump National Golf Club Washington, D.C., outside of which the memecoin buyers may encounter protesters.

Some of the counter-programming for his dinner will start earlier in the day in front of the Capitol Building. At 12:45 p.m., Representative Maxine Waters, the top Democrat on the House Financial Services Committee, will round up other lawmakers in front of the House steps to rail against Trump, accusing him of abusing his White House powers to «shamelessly promote and profit from a series of crypto ventures tied to himself and his family,» according to a notice about the event.

Waters will also introduce a new messaging bill «to block Trump’s memecoin and stop his crypto corruption, once and for all.» The legislation, which is unlikely to make headway in a Republican-majority Congress, would ban presidents, vice presidents, members of Congress and their families from «engaging in similar crypto crime.»

It’s the same type of ban that Democrats had been seeking to insert into crypto legislation, but Republicans have declined to let Trump-targeting language into the current digital assets bills, including the Senate stablecoin effort getting close to the finish line.

Later on Wednesday at 2:30 p.m., another press conference of Democratic lawmakers will feature Senators Chris Murphy and Elizabeth Warren, both of whom have been prominent in congressional criticism against Trump’s crypto actions. Murphy had introduced his own bill with a similar aim to Waters’, the Modern Emoluments and Malfeasance Enforcement (MEME) Act to stop federal officials from using their positions to profit from digital assets.

That event — also outside the Capitol — will additionally feature Senator Jeff Merkley, who also intends to join an evening protest right outside Trump’s golf course, hosted by progressive groups under the banner of Our Revolution. The message of the «America Is Not For Sale» rally is to push back on «a blatant example of political access being sold to the highest bidder,» according to the group.

The guest list for the memecoin dinner hasn’t been made public, but analysis of the buying of those coins suggest that the biggest spenders devoted millions for the privilege of joining the president at the event. The attendees’ anonymity is part of the problem, according to critics, who say that foreign buyers are gaining access to the president without the knowledge of the public.

Debate over the president’s crypto ties temporarily delayed progress on the U.S. stablecoin legislation meant to set up rules for domestic issuers, but the bill got back on track this week to clear an important procedural hurdle in the Senate on Monday.

Trump’s team has downplayed accusations of corruption. White House official Bo Hines said last week at CoinDesk’s Consensus 2025 conference in Toronto that the Trump family’s crypto ventures do not pose conflicts of interest, and they have «the right to engage in capital markets.»

Read More: Justin Sun Emerges as Donald Trump Memecoin’s Top Holder With $21.9M Stake

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors