Uncategorized

CFTC’s Christy Goldsmith Romero to Leave Agency at End of Month

Christy Goldsmith Romero, one of the four commissioners at the Commodity Futures Trading Commission, will depart the federal regulator at the end of the month, she announced Friday.

Goldsmith Romero joins fellow Commissioner Summer Mersinger, who announced earlier this week that she would leave on May 30 after being named the next CEO of the Blockchain Association, a Washington, D.C.-based lobbying group for the crypto industry.

In a statement, Goldsmith Romero said that derivatives markets, which the agency oversees, «experienced significant growth while remaining resilient and financially stable through times of market stress and volatility» during her time on the Commission.

«I wish to also recognize the members of the CFTC Technology Advisory Committee, which I sponsored, for their landmark reports and public forums on future of finance issues,» she said. «… Under my sponsorship, TAC released landmark reports on Responsible AI in Financial Markets and on Decentralized Finance, and sponsored public forums on AI, cybersecurity, blockchain, digital identity and digital assets.»

Acting Chairman Caroline Pham is also set to leave soon, CoinDesk reported earlier this week. Pham has told people she would leave after former Commissioner Brian Quintenz, President Donald Trump’s pick to lead the agency, is confirmed by the Senate.

Goldsmith Romero had previously announced her departure from the CFTC, also tying it to Quintenz’s confirmation. However, the Senate Agriculture Committee has not yet scheduled a confirmation hearing for Quintenz. After that hearing, the committee would need to schedule a vote. Quintenz would then need to be confirmed by a majority of the full Senate, and only then would he be sworn in.

Goldsmith Romero’s departure on May 31 will leave the CFTC with just two commissioners, and that number will likely remain static after Quintenz’s confirmation until Trump nominates up to three more commissioners (two Republicans and a Democrat) to fill the empty seats.

Uncategorized

ETH, DOGE, XRP Down 3% as Moody’s Downgrades U.S. Credit Rating

Major tokens slumped Saturday as investors digested the implications of Moody’s Ratings downgrading the U.S. credit score, with ether (ETH), XRP, and dogecoin (DOGE) dropping roughly 3%.

The broader crypto market held at $3.3 trillion, paring earlier gains after briefly touching the week’s high.

The move came after rating giant Moody’s cut the U.S. sovereign credit rating to Aa1 from Aaa, citing the country’s swelling deficits, rising interest expenses, and a lack of political will to rein in spending.

The firm now joins Fitch and S&P in assigning a rating below the once-unblemished triple-A status long held by the world’s largest economy.

As such, the White House was quick to respond, with spokespersons for President Donald Trump criticizing the decision as politically motivated.

The downgrade had an immediate effect on traditional markets: U.S. Treasury yields jumped, with the 10-year note rising to 4.49%, while S&P 500 futures dipped 0.6% in after-hours trading.

Historically, concerns about U.S. debt sustainability and dollar debasement have served as tailwinds for bitcoin and other decentralized assets. However, credit downgrades can also trigger short-term risk-off behavior, particularly if macro uncertainty leads institutional traders to reduce exposure.

Meanwhile, some traders warned of a deeper sell-off in the near term on general profit-taking before the next rally.

“Bitcoin is holding the $104,000 mark as a key level and the positive factor is that sellers have not yet managed to seize control of the market,” Alex Kuptsikevich, the FxPro chief market analyst, told CoinDesk in an email. “However, resilience at high levels may be temporary before the next bounce, and there is considerable pressure near the upper boundary of the current range.”

“In other words, the short-term outlook suggests a decline from current levels,” Kuptsikevich opined.

Uncategorized

Undervalued Ether Catching Eye of ETF Buyers as Rally Inbound: CryptoQuant

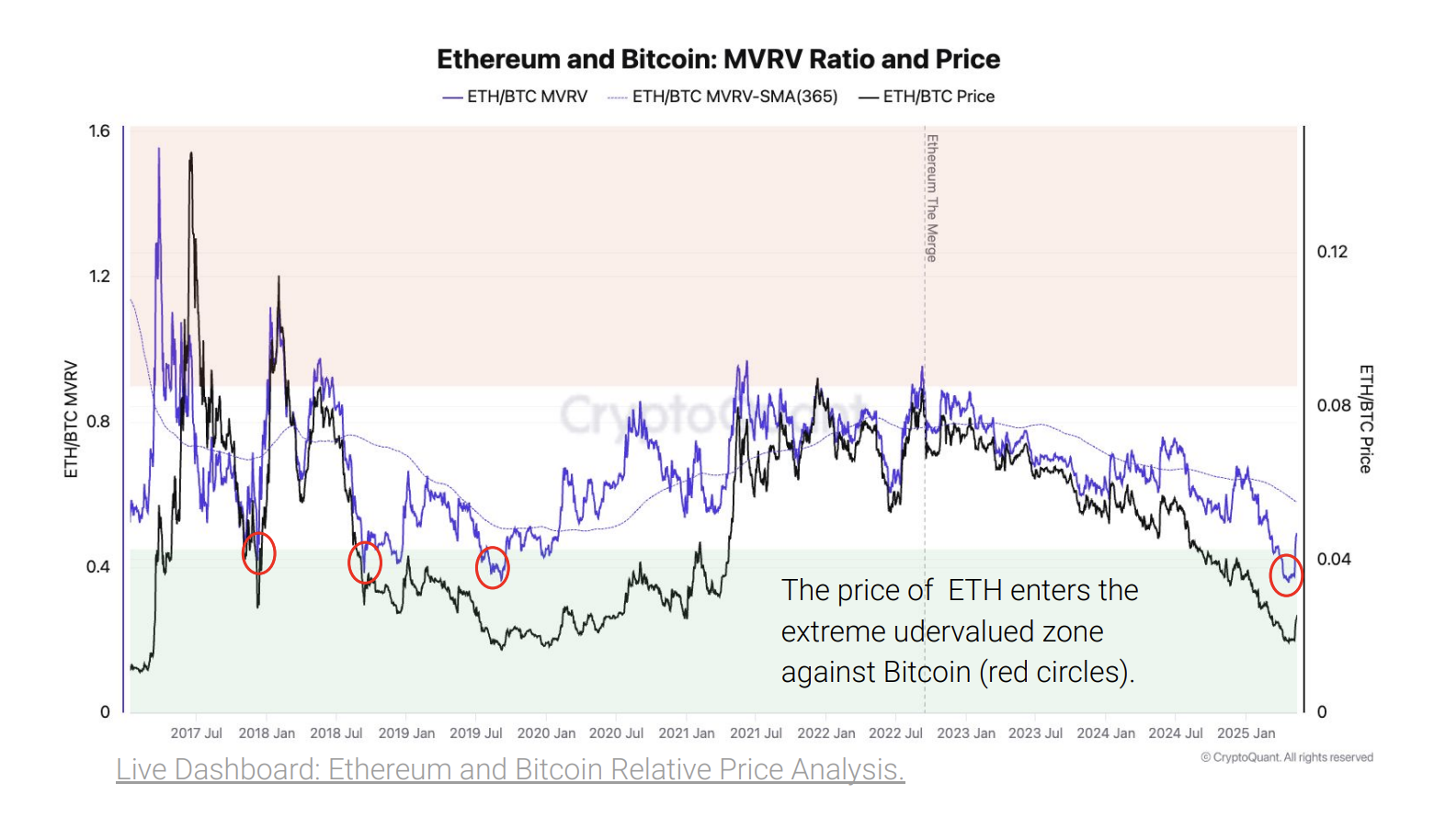

ETH has quietly slipped into historically rare territory as one market signal shows its deeply undervalued compared to bitcoin (BTC), at a ratio not seen since 2019, a new CryptoQuant report says.

The signal comes from Ethereum’s ETH/BTC Market Value to Realized Value (MVRV) metric, a gauge of relative valuation that measures market sentiment and historical trading patterns.

Historically, whenever this indicator has reached similarly low levels, ETH has subsequently delivered significant gains and substantially outperformed BTC.

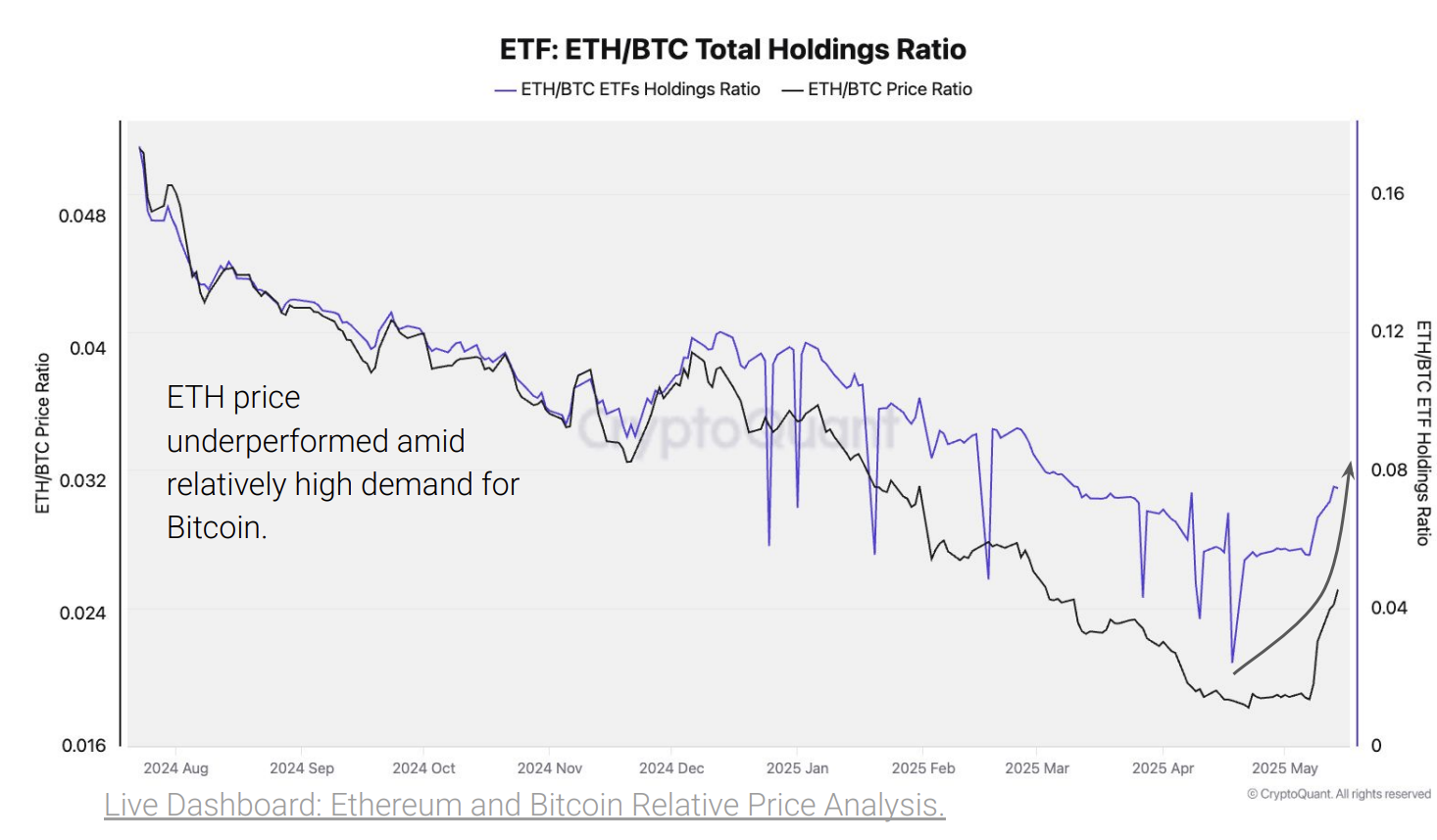

Investors appear to be taking notice. Demand for the ETH ETF has sharply picked up, with the ETH/BTC ETF holdings ratio rising steeply since late April, according to data from CryptoQuant.

This shift in allocation suggests institutional investors anticipate ETH will outperform BTC, potentially fueled by the recent Pectra upgrade or a more favorable macroeconomic environment.

Already, the ETH/BTC price ratio has rebounded 38% from its weakest level since January 2020, suggesting investors and traders are betting the bottom is in and an «alt season» could soon follow.

This echoes what some market participants have been telling CoinDesk.

March Zheng, General Partner of Bizantine Capital, said in a recent message that traders should remember that ETH has typically been the main on-chain altcoin indicator for risk-on, and its sizable upticks generally lead to broader altcoin rallies.

On-chain data further supports this optimism. ETH spot trading volume relative to BTC surged to 0.89 last week, its highest since August 2024, signaling renewed appetite from investors. A similar trend occurred between 2019 and 2021, when ETH went on to outperform BTC by fourfold.

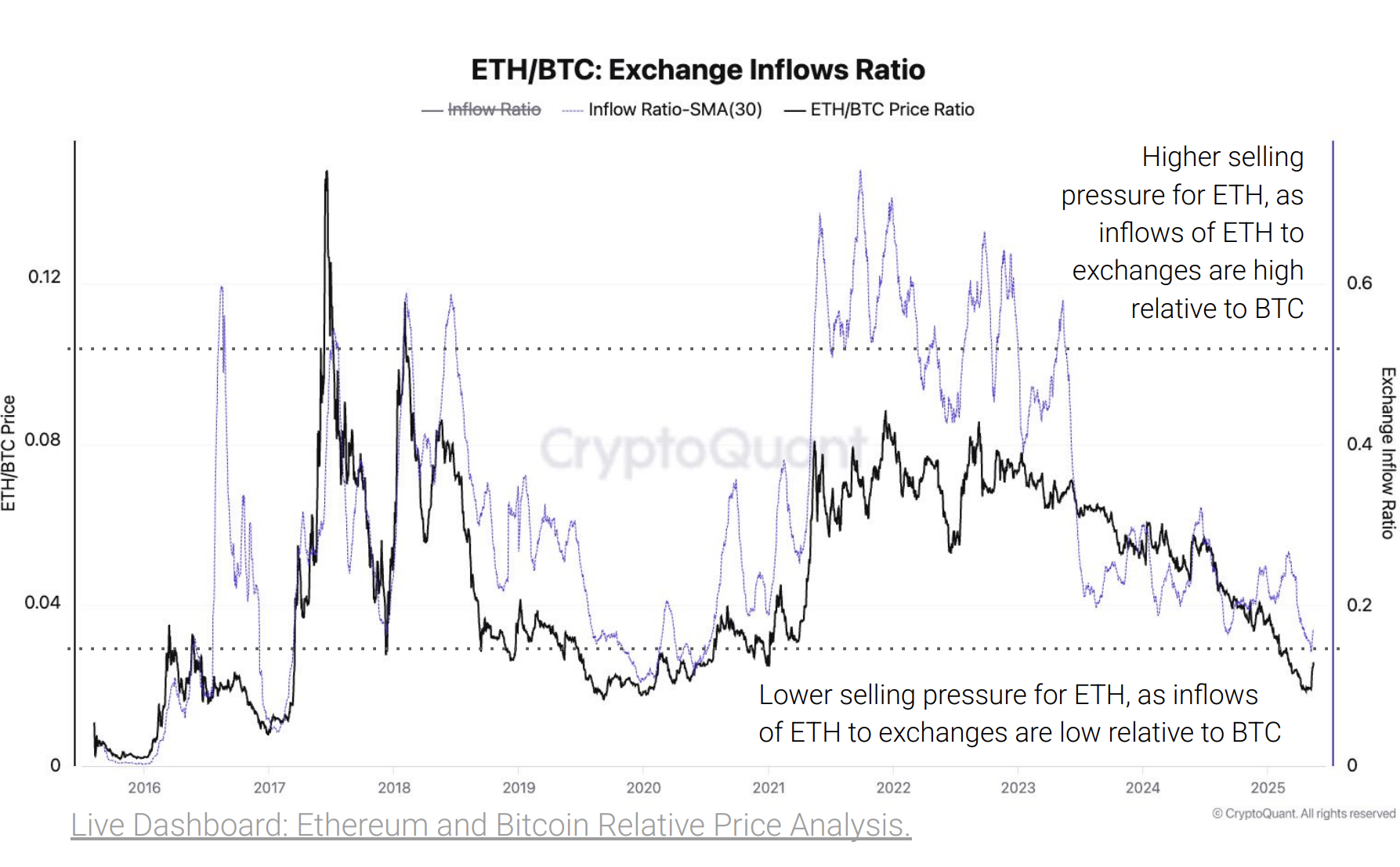

CryptoQuant also notes that ETH exchange deposits, often an indicator of selling pressure, have dropped to their lowest relative level since 2020, implying investors anticipate higher prices ahead.

For now, confirmation hinges on ETH decisively breaking above its key 365-day moving average against BTC.

Still, with compelling undervaluation, rising institutional interest, and diminishing selling pressure, ETH appears positioned for significant upside in the coming months.

But one thing ETH is still lagging on is network activity, as CryptoQuant flagged in a prior report. Without more people using Ethereum, it will be tough for the token’s price to lift off and head to the moon.

Uncategorized

U.S. Stablecoin Bill Could Clear Senate Next Week, Proponents Say

Despite recent setbacks, U.S. legislation to regulate stablecoin issuers may be heading toward debate and passage next week, according to the backers of the bill known as the «Guiding and Establishing National Innovation for U.S. Stablecoins» (GENIUS) Act.

“Next week, the Senate will make history when we debate and pass the GENIUS Act that establishes the first ever pro-growth regulatory framework for payment stablecoins,” said Senator Hagerty, a Tennessee Republican who sponsored the bill to set U.S. standards for stablecoins, which are typically dollar-based tokens such as Circle’s USDC and Tether’s USDT that are vital to crypto trading activity.

The latest draft of the bill began circulating this week, and a copy seen by CoinDesk showed language had been adjusted in modest ways to help satisfy Democrats concerned with consumer protection and national security elements. In one addition, the bill insisted the big public companies such as Meta wouldn’t be approved as issuers of the tokens, though consumer advocates cautioned that private companies such as Elon Musk’s social media site X would be eligible.

Hagerty paired his statement with one from Senator Kirsten Gillibrand, the New York Democrat who has also pushed this legislation. Her sentiment carried what may have been a shade less confidence about the outcome, and the two lawmakers have ample reason to put a strong public face on a negotiation that’s faced headwinds.

“Stablecoins are already playing an important role in the global economy, and it is essential that the U.S. enact legislation that protects consumers, while also enabling responsible innovations,” Gillibrand said in the statement, contending that «robust consumer protections» are included in the latest version. “The crafting of this bill has been a true bipartisan effort, and I’m optimistic we can pass it in the coming days.”

The Senate has experienced considerable volatility on the bill in the past two weeks, with its recent failure to clear a so-called cloture vote that would have moved it forward into a formal debate. It’s headed toward a second vote on Monday in which it needs 60 votes to advance, which would need to include several Democrats. The Senate would then have some time to continue debating the language and possibly make changes before moving on to actually passing the bill.

Democrats had been critical of its potential for abuse and for stablecoin involvement from corporate giants, but the biggest stink has been raised around President Donald Trump’s own interest in crypto businesses, including World Liberty Financial’s stablecoin play.

Read More: U.S. Senate’s Stablecoin Push Still Alive as Bill May Return to Floor: Sources

A previous version of the bill had easily advanced out of the Senate Banking Committee with a bipartisan vote before some of the same Democrats that approved it later raised objections. But the Senate has more crypto-friendly Democrats in this session than the last, when the Senate Banking Committee denied any progress for crypto bills.

The House of Representatives is also working on its own version, which would have to be melded with the Senate’s before Trump could sign the new standards into law. Representative French Hill, the Republican chairman of the House Financial Services Committee, acknowledged at Consensus 2025 in Toronto that Trump’s crypto involvement has added friction to the lawmakers’ negotiations.

Read More: Trump’s Memecoin, Crypto Stake Make Legislating ‘More Complicated’: Rep. French Hill

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors