Uncategorized

Coinbase Shares Could See $16B of Buying Pressure From S&P 500 Index Inclusion: Bernstein

Crypto exchange Coinbase (COIN) is soaring 16% early Tuesday after the Monday evening announcement of its inclusion into the S&P 500.

COIN will be added to the S&P 500 index after the close on Friday, replacing Discover Financial Services (DFS) which is being acquired by Capital One (COF).

Wall Street brokerage Bernstein estimates the move could lead to roughly $16 billion of buying pressure for Coinbase — around $9 billion from passive funds linked to the S&P 500 and $7 billion from active allocations.

Coinbase is the «first and only crypto company to join the S&P 500,» analysts led by Gautam Chhugani wrote.

Chhugani has an outperform rating on Coinbase shares with a $310 price target, or about another 30% upside from the current $240.

Investment bank KBW estimates that S&P 500 passive funds will need to buy 36 million Coinbase shares for index inclusion, which is about 4 days of average buying volume.

KBW further noted that as of April 30, 9.9 million Coinbase shares were held short, which is 1.4 days to cover.

«Since 2017, financial 500 adds have outperformed by 5.2% on the day after announcement,» KBW said, and Coinbase’s addition could pave the way for other crypto firms to join the index.

Read more: Coinbase Shares Jump 8% on S&P 500 Inclusion

Uncategorized

Slow Blockchain Governance Leaves Crypto Exposed to Quantum Threats

Quantum computing poses a real threat to crypto, and slow-moving governance processes risk leaving blockchains vulnerable, according to Colton Dillion, a co-founder of Quip Network, which provides quantum-proof vaults for storing digital assets.

While the technology, which uses the quantum states of subatomic particles to perform calculations instead of transistors and binary code, is still in its infancy, companies including Google and Microsoft are pressing forward with research and development. The goal is a massive step-up in speed that makes tough calculations like cracking encryption, such as that used to protect blockchains, faster and simpler.

And when quantum computing becomes available, any attacker is unlikely to announce their presence immediately.

“The threat won’t start with Satoshi’s keys getting stolen,» Dillion said in an interview. “The real quantum attack will look subtle, quiet, and gradual, like whales casually moving funds. By the time everyone realizes what’s happening, it’ll be too late.»

Dillion’s doomsday scenario involves a quantum-computing-powered double-spend attack. In theory, quantum computing could reduce the mining power required for a traditional 51% attack down to about 26%, Dillion said.

«So now you’ve compromised the 10,000 largest wallets. You rewind the chain, liquidate those 10,000 largest wallets, then double spend all the transactions, and now you’ve really got a nuclear bomb,” is how he imagines it.

The industry, of course, is working to find a solution.

Bitcoin developer Agustin Cruz, for instance, proposed QRAMP, a Bitcoin Improvement Proposal (BIP) that mandates a hard-fork migration to quantum-secure addresses. Quantum startup BTQ has proposed replacing the proof-of-work consensus system that underpins the original blockchain entirely with quantum-native consensus.

The problem is that the proposals must gain community approval. Blockchain governance, such as Bitcoin Improvement Proposals (BIPs) and their Ethereum equivalents, Ethereum Improvement Proposals (EIPs), tends to be rife with politics, making it a long, inherently cautious process.

For example, the Bitcoin community’s recent resolution on the OP_RETURN function was years in the making, with months of developer debates about what’s considered the «proper» use of the blockchain. Ethereum’s upgrades, like the Merge, also faced lengthy debates and delays.

Dillion argues that the governance process leaves crypto dangerously exposed because quantum computing threats will evolve much faster than the protocols can respond.

“Everyone’s trying to do this from the top down by starting with a BIP or an EIP and getting everyone’s buy-in together. But we think that this is a very difficult, heavy lift,” he said.

Quip Network’s quantum-proof vaults aim to circumvent the political inertia by allowing immediate user-level adoption without requiring protocol upgrades. The vaults leverage hybrid cryptography, blending classical cryptographic standards with quantum-resistant techniques to provide blockchain-agnostic security.

Effectively, they allow the whales, holders of large amounts of a cryptocurrency, to secure their stashes while waiting for the machinations of blockchain governance to get it together. Crypto communities can’t afford leisurely debates, he argues.

“The BIP and EIP processes are great for governance, but terrible for rapid threat response,” said Dillion. «When quantum hits, attackers won’t wait for community consensus.”

Colton Dillon is speaking at the IEEE Canada Blockchain Forum, part of Consensus 2025 in Toronto. The IEEE is a Knowledge Partner of Consensus.

Read more: Quantum Computing Group Offers 1 BTC to Whoever Breaks Bitcoin’s Cryptographic Key

Uncategorized

EToro Goes Public At $52 A Share, Far Exceeding Marketed Range

Shares of stock and crypto trading platform eToro (ETOR) have debuted at $52 a share after the company hit the Nasdaq exchange on Tuesday evening.

The company raised about $310 million from investors as it sold 6 million shares at a price of $52 a piece. The listing values the company at $4.2 billion.

The price is significantly higher than the marketed range, as the company received a much higher demand than previously anticipated.

EToro becomes the first company to go public after a rough couple of months in markets across the U.S., as President Donald Trump is in discussions to make several tariff deals with leaders around the world.

Because of that, many companies, including eToro, had delayed going public, but Bloomberg reported last week that the trading platform was resuming plans.

The company will trade under the ticker “ETOR”.

Uncategorized

Cantor Equity Partners Discloses $458M Bitcoin Acquisition

Cantor Equity Partners (CEP) disclosed a $458.7 million bitcoin BTC acquisition as part of a pending merger with Twenty One Capital, the BTC-focused investment vehicle backed by Tether, Bitfinex, and SoftBank, according to a regulatory filing on Tuesday.

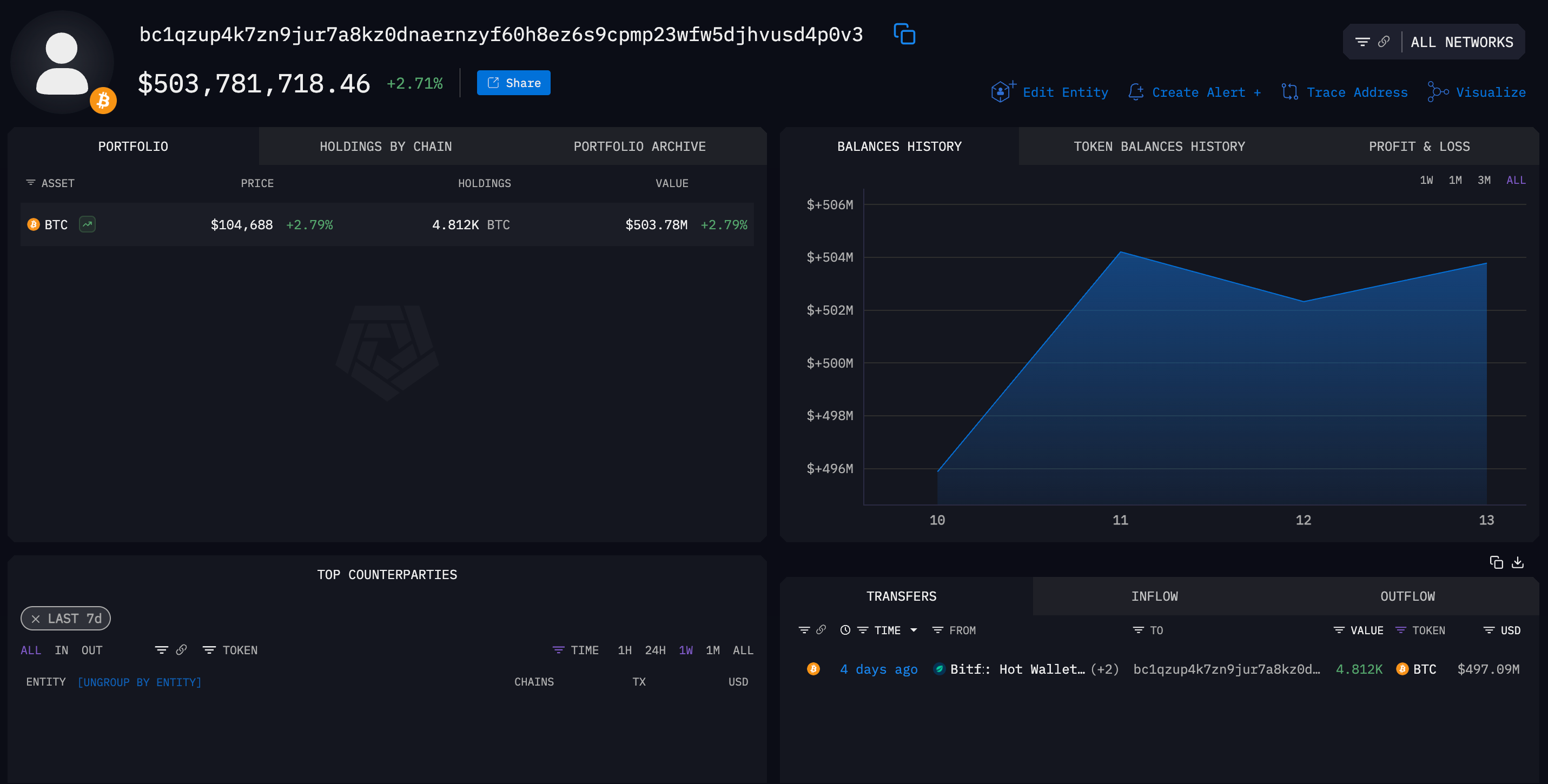

The transaction is structured through a complex business combination involving Tether Investments, the El Salvador affiliate of stablecoin issuer Tether, and iFinex, the parent company of Bitfinex, the filing shows. As part of the deal, Tether purchased some 4,812 BTC at an average price of $95,319, with the tokens held in escrow and later to be sold to the merged company.

Blockchain data shows that the escrow wallet, disclosed in the filing, received the tokens from a Bitfinex hot wallet on May 9. The wallet’s bitcoin holdings are worth $500 million at current prices, according to Arkham data.

Twenty One Capital is being launched by Brandon Lutnick—the son of U.S. Commerce Secretary and Cantor Fitzgerald chairman Howard Lutnick—via a SPAC structure using Cantor Equity Partners. The company will be led by Strike CEO Jack Mallers and majority-owned by Tether and Bitfinex’s parent company, iFinex. SoftBank will take a significant minority stake, the companies said

The company said it plans to have more than 42,000 BTC at launch.

CEP shares are higher by 3.7% in after hours trading.

Read more: Strike CEO Mallers to Lead Bitcoin Investment Company Backed by Tether, Softbank, Brandon Lutnick

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors