Uncategorized

Crypto Daybook Americas: Trump Trade Tease Lifts Market While Movement’s Fees Evaporate

By Omkar Godbole (All times ET unless indicated otherwise)

The crypto market is a sea of green as traders look past the stagflation specter raised by the Fed on Wednesday and cheer President Donald Trump’s hint of a big trade-deal announcement with a major trading partner.

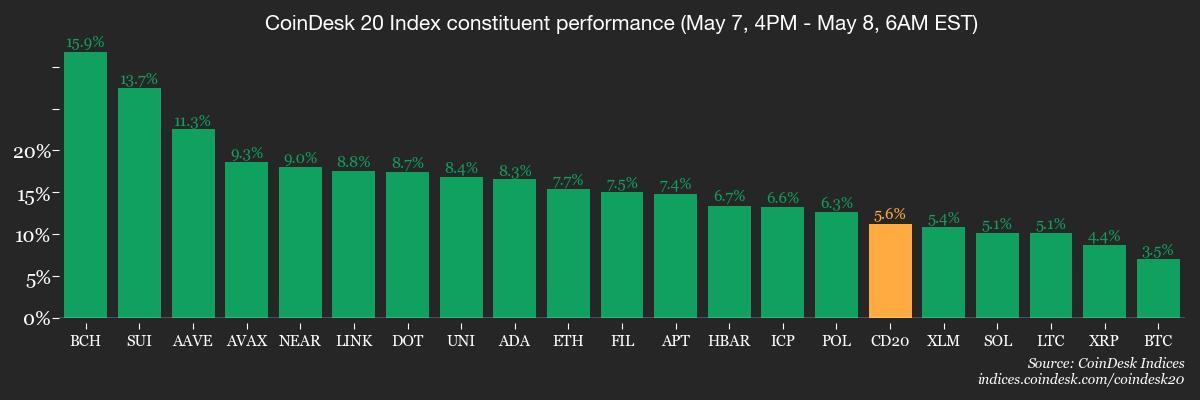

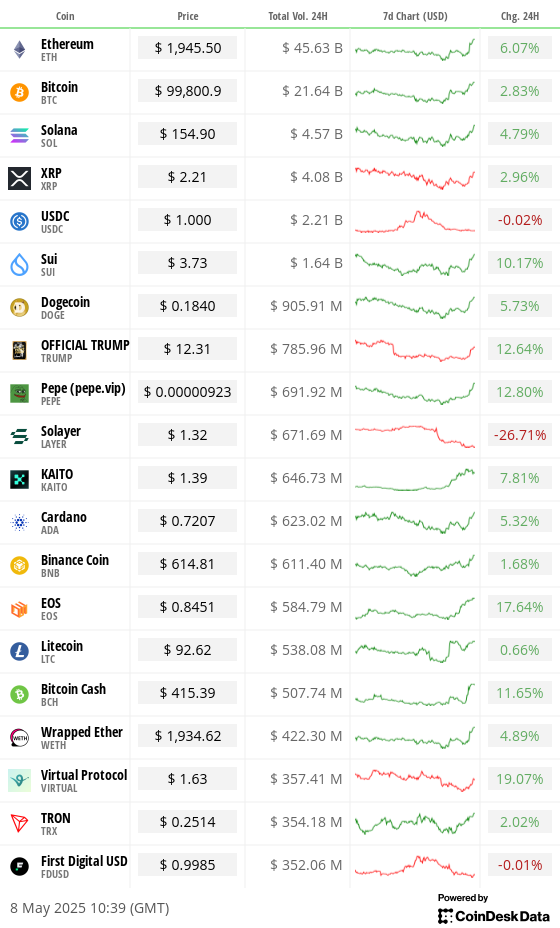

Bitcoin jumped 2.6%, nearing $100,000, even with the WSJ reporting that the announcement could be more of a framework for talks than actual confirmation of an agreement. The wider market put in bigger gains, with XRP, ETH, ADA, DOGE and several other coins rising 4% to 6%. Tokens associated with memecoin projects, layer 1s and DeFi are leading the market higher.

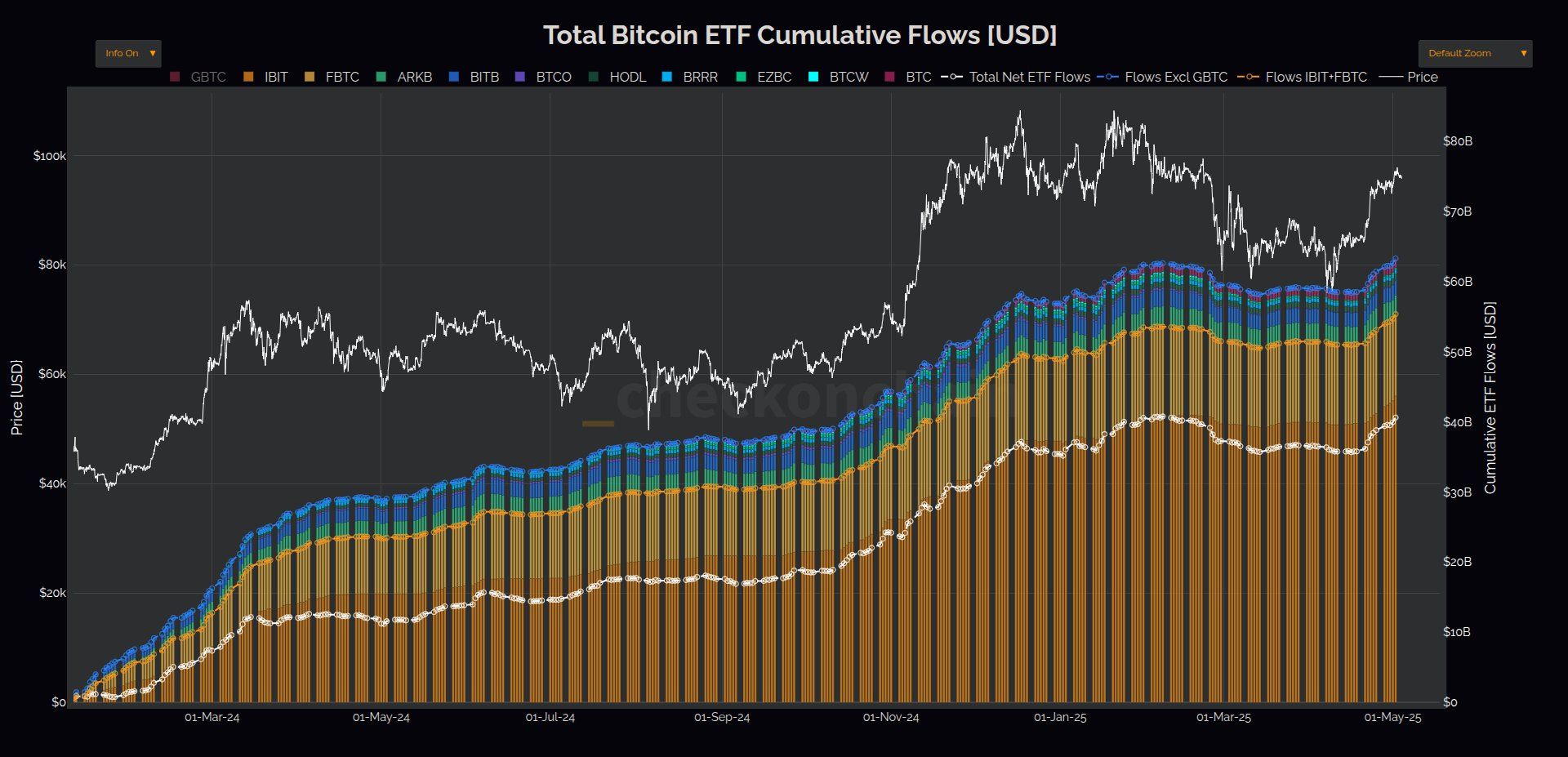

In key news, cumulative inflows into the U.S.-listed spot bitcoin exchange-traded funds (ETFs) have hit an all-time high of $40.62 billion, signaling continued institutional adoption. (Check Chart of the Day.)

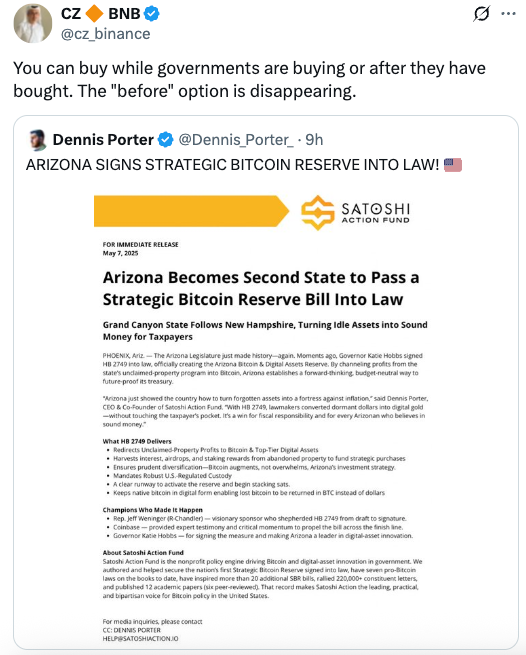

On Thursday, Arizona became the second U.S. state to pass a bitcoin reserve bill. The regulation allows the state to take ownership of abandoned coins in the event that the owner ignores messages sent within three years. It also lets the state make BTC investments.

An ether whale ICO participant sold 5,200 ETH at $9.54 million, extending a series of recent liquidations. The whale still holds 8,300 ETH ($15.28 million).

Decentralized layer-1 blockchain Avalanche’s C-Chain registered the highest amount of transactions in two years, with the median gas cost of just $0.00078. The AVAX token traded 7% higher at $21 at press time.

Stripe unveiled a new feature called Stablecoin Financial Accounts, powered by Bridge, unlocking access to dollar-denominated services in over 100 countries.

On the macro front, the first quarter U.S. unit labor cost data will be watched by traders for signs of sticky wage price inflation that could potentially delay the Fed rate cuts. Stay alert!

What to Watch

- Crypto:

- May 8: Judge John G. Koeltl will sentence Alex Mashinsky, the founder and former CEO of the now-defunct crypto lending firm Celsius Network, at the U.S. District Court for the Southern District of New York.

- May 12, 1 p.m. to 5:30 p.m.: A U.S. SEC Crypto Task Force Roundtable on «Tokenization: Moving Assets Onchain: Where TradFi and DeFi Meet» will be held at the SEC’s headquarters in Washington.

- Macro

- May 8, 7 a.m.: The Bank of England announces its interest-rate decision. The Monetary Policy Report Press Conference is livestreamed 30 minutes later.

- Bank Rate Est. 4.25% vs. Prev. 4.5%

- May 8, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended May 3.

- Initial Jobless Claims Est. 230K vs. Prev. 241K

- May 8, 10 a.m.: President Donald Trump will reportedly unveil the framework of a trade deal with the U.K. at a White House press conference.

- May 9-12: Chinese Vice Premier He Lifeng will hold trade talks with U.S. Treasury Secretary Scott Bessent during his visit to Switzerland.

- May 8, 7 a.m.: The Bank of England announces its interest-rate decision. The Monetary Policy Report Press Conference is livestreamed 30 minutes later.

- Earnings (Estimates based on FactSet data)

Token Events

- Governance votes & calls

- Arbitrum DAO is voting on whether to put the last $10.7 million from its 35 million ARB diversification plan into three low‑risk, dollar‑based funds from WisdomTree, Spiko and Franklin Templeton. Voting ends on May 8.

- Compound DAO is voting on which new collateral type to prioritize on Compound V3. Voting ends May 8.

- May 8, 10 a.m.: Balancer and Euler to host an Ask Me Anything (AMA) session.

- May 15, 10 a.m.: Moca Network to host a Discord townhall session discussing network updates.

- Unlocks

- May 9: Movement (MOVE) to unlock 2.04% of its circulating supply worth $8.08 million.

- May 11: Solayer (LAYER) to unlock 12.87% of its circulating supply worth $35.66 million.

- May 12: Aptos (APT) to unlock 1.82% of its circulating supply worth $57.45 million.

- May 13: WhiteBIT Coin (WBT) to unlock 27.41% of its circulating supply worth $1.14 billion.

- May 15: Starknet (STRK) to unlock 4.09% of its circulating supply worth $17.7 million.

- Token Launches

- May 8: AIXBT to be listed on Binance.US.

- May 8: Space and Time (SXT) to be listed on Binance, MEXC, BingX, KuCoin, Bitget and others.

- May 16: Galxe (GAL), Litentry (LIT), Mines of Dalarnia (DAR), Orion Protocol (ORN), and PARSIQ (PRQ) to be delisted from Coinbase.

Conferences

CoinDesk’s Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Day 3 of 3: Stripe Sessions (San Francisco)

- Day 2 of 3: SALT’s Bermuda Digital Finance Forum 2025 (Hamilton, Bermuda)

- May 9-10: Stanford Blockchain Governance Summit (San Francisco)

- May 11-17: Canada Crypto Week (Toronto)

- May 12-13: Dubai FinTech Summit

- May 12-13: Filecoin (FIL) Developer Summit (Toronto)

- May 12-13: Latest in DeFi Research (TLDR) Conference (New York)

- May 12-14: ACI’s 9th Annual Legal, Regulatory, and Compliance Forum on Fintech & Emerging Payment Systems (New York)

- May 13: Blockchain Futurist Conference (Toronto)

- May 13: ETHWomen (Toronto)

- May 14-16: CoinDesk’s Consensus 2025 (Toronto)

Token Talk

By Shaurya Malwa

- $3, just $3.

- That’s all Movement network earned in fees over the past 24 hours, DeFiLlama data shows, the lowest in a week for the embattled chain once valued at $1 billion.

- Daily DEX volumes have cratered below $500K, a dramatic fall from earlier exuberance that saw the network process more than $2 million a day.

- The slide comes days after CoinDesk reported irregularities with how the MOVE token was distributed and supplied to trading firms.

- Ironically, the MOVE token launched before the chain existed, raising millions via private sales while the actual blockchain infrastructure lagged far behind.

- The project handed out 66 million MOVE tokens (5% of supply) to a market-making firm called Rentech, which dumped nearly all of it for $38 million.

- Founder Rushi Manche was terminated on May 7, just days after being suspended. He admitted to “zero oversight” and blamed bad-faith advisers for the project’s collapse in X posts following the CoinDesk report.

- MOVE has fallen over 85% from its peak of $1.45 in December 2024 to just 15 cents.

- With no trust, no traction and, now, almost no fees, Movement has turned into the cautionary tale of 2025 — a billion-dollar paper promise with a $3 reality.

Derivatives Positioning

- BTC and ETH perpetual funding rates rose close to an annualized 10%, signaling a strengthening bullish mood in the market.

- BTC, ETH futures premium on the CME still remain under 10%.

- On Deribit, bitcoin and ether options risk reversals show a bullish bias for calls across multiple time frames.

- Notable block trades include a short position in the $85K BTC put expiring in June and a calendar spread involving calls at strikes $140K and $170K, expiring on Sept. 26 and Dec. 26, respectively.

Market Movements:

- BTC is up 3.49% from 4 p.m. ET Wednesday at $99,620.26 (24hrs: +2.77%)

- ETH is up 7.76% at $1,939.15 (24hrs: +5.11%)

- CoinDesk 20 is up 5.75% at 2,854.54 (24hrs: +3.81%)

- Ether CESR Composite Staking Rate is down 6 bps at 2.894%

- BTC funding rate is at 0.0048% (5.2242% annualized) on Binance

- DXY is up 0.48% at 100.09

- Gold is down 1.25% at $3,343.61/oz

- Silver is down 0.25% at $32.40/oz

- Nikkei 225 closed +0.41% at 36,928.63

- Hang Seng closed +0.37% at 22,775.92

- FTSE is up 0.39% at 8,592.98

- Euro Stoxx 50 is up 1.21% at 5,293.07

- DJIA closed on Wednesday +0.7% at 41,113.97

- S&P 500 closed +0.43% at 5,631.28

- Nasdaq closed +0.27% at 17,738.16

- S&P/TSX Composite Index closed +0.75% at 25,161.18

- S&P 40 Latin America closed -0.2% at 2,512.07

- U.S. 10-year Treasury rate is up 5 bps at 4.315%

- E-mini S&P 500 futures are up 1.03% at 5,170.00

- E-mini Nasdaq-100 futures are up 1.4% at 20,240.00

- E-mini Dow Jones Industrial Average Index futures are up 0.82% at 41,552.00

Bitcoin Stats:

- BTC Dominance: 65.08 (-0.44%)

- Ethereum to bitcoin ratio: 0.01942 (4.02%)

- Hashrate (seven-day moving average): 909 EH/s

- Hashprice (spot): $53.34

- Total Fees: 6.64 BTC / $661,908.40

- CME Futures Open Interest: 142,255 BTC

- BTC priced in gold: 29.5 oz

- BTC vs gold market cap: 8.37%

Technical Analysis

- The XRP-ETH ratio has dived out of the year-to-date ascending trendline.

- The breakdown suggests ether outperformance relative to XRP in the days ahead.

Crypto Equities

- Strategy (MSTR): closed on Monday at $392.48 (+1.78%), up 5.35% at $413.49 in pre-market

- Coinbase Global (COIN): closed at $196.56 (-0.17%), up 4.77% at $205.94

- Galaxy Digital Holdings (GLXY): closed at C$26.49 (+2.28%)

- MARA Holdings (MARA): closed at $13.33 (+1.37%), up 5.55% at $14.07

- Riot Platforms (RIOT): closed at $7.84 (-0.25%), up 5.1% at $8.24

- Core Scientific (CORZ): closed at $8.90 (-1%), up 5.28% at $9.37

- CleanSpark (CLSK): closed at $8.03 (-0.74%), up 5.23% at $8.45

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $14.59 (+0.34%), up 5.89% at $15.45

- Semler Scientific (SMLR): closed at $33.05 (-0.12%), up 4.99% at $34.70

- Exodus Movement (EXOD): closed at $40.01 (+1.34%), up 0.25% at $40.11

ETF Flows

Spot BTC ETFs:

- Daily net flow: $142.3 million

- Cumulative net flows: $40.68 billion

- Total BTC holdings ~ 1.17 million

Spot ETH ETFs

- Daily net flow: -$21.8 million

- Cumulative net flows: $2.48 billion

- Total ETH holdings ~ 3.45 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The chart shared by pseudonymous analyst Checkmate shows the cumulative inflows into the U.S.-listed spot bitcoin ETFs have hit a record high above $40 billion.

- Early this week, BlackRock’s IBIT surpassed the SPDR gold ETF in year-to-date inflows.

While You Were Sleeping

- Trump to Announce Trade-Deal Framework With Britain (The Wall Street Journal): The U.K. is seeking relief from steep U.S. tariffs on steel and autos in exchange for curbing a tax on digital services, according to people familiar with the talks.

- India and Pakistan May Have an Off-Ramp After Their Clash. Will They Take It? (New York Times): India and Pakistan signaled room for de-escalation after Indian strikes killed over 20 in Pakistan, with both sides portraying their responses as limited and back-channel talks reportedly underway.

- Binance Founder CZ Confirms He Has Applied for Trump Pardon After Prison Term (CoinDesk): CZ said his lawyers had applied for a presidential pardon after media reports in March wrongly claimed he had already done so.

- Arthur Hayes Says Bitcoin Will Hit $1M by 2028 as U.S.-China Craft Hollow Trade Deal (CoinDesk): The former BitMEX CEO predicted bitcoin will hit $1 million by 2028, citing Treasury-driven liquidity and geopolitical shifts while dismissing U.S.-China trade deals as largely symbolic.

- The EU Wants to End All Russian Gas Imports. Moscow’s Friends in the Bloc Say It’s a ‘Serious Mistake’ (CNBC): The European Commission’s plan to end all energy imports from Russia by 2027 was condemned by Hungary and Slovakia.

- Bankers Are Bouncing Back to Life as Hunger for Junk Debt Soars (Bloomberg): Some U.S. investors are moving into European junk bonds to diversify amid tariff-related uncertainty, drawn by expectations of faster rate cuts and demand for companies insulated from trade risks.

In the Ether

Uncategorized

Deutsche Börse’s Crypto Finance Unveils Connected Custody Settlement for Digital Assets

Crypto Finance, a subsidiary of Deutsche Börse Group, unveiled AnchorNote, a system designed for institutional clients who want to trade digital assets without moving them out of regulated custody.

The system integrates BridgePort, a network of crypto exchanges and custodians, enabling off-exchange settlement and connectivity to multiple trading venues. By keeping assets in custody while allowing real-time collateral movement, AnchorNote aims to improve capital efficiency and reduce counterparty risk, according to a press release.

The service allows clients to set up dedicated trading lines, with BridgePort handling messaging between venues and Crypto Finance acting as collateral custodian, the press release said. Institutions can manage collateral through a dashboard or integrate the service directly into their existing infrastructure using APIs, it said. APIs, or application programming interfaces, allow software programs to communicate directly with one another.

“Institutional clients face a constant tradeoff between security and capital efficiency,” said Philipp E. Dettwiler, head of custody and settlement at Crypto Finance. “AnchorNote is designed to bridge that gap.”

For traders, the setup eliminates the need for pre-funding exchanges while providing immediate access to liquidity across platforms. In practice, a Swiss bank could pledge bitcoin held in custody and deploy it instantly across multiple trading venues without moving the coins on-chain.

The rollout begins in Switzerland, with Crypto Finance planning to expand across Europe.

Uncategorized

Bitcoin, Ether, XRP, and Dogecoin Lag Stocks as VIX Stirs Up Some Nerves

It’s a risk-on environment, with stocks leading major cryptocurrencies higher, but Wall Street’s fear gauge, the VIX, is stirring up some nerves.

On Monday, Wall Street’s benchmark index, the S&P 500, set a record high for the fourth consecutive trading day, reaching 6,519 points. The tech-heavy Nasdaq index also hit lifetime highs, and the Dow Jones traded near the peak recorded on Thursday.

Equities rose, disregarding the bearish September manufacturing survey, as bond yields fell in anticipation of a 25-basis-point Fed rate cut on Wednesday. According to the Fed funds futures, traders expect rates to drop to 3% from the present 4.25% within the next 12 months.

Still, bitcoin (BTC) lacked clear direction, as it traded back and forth between $114,000 and $117,000, forming an indecisive Doji candle. As of writing, it changed hands at $115,860, continuing a lacklustre trading pattern below record highs of above $124,000 hit in August.

The dour price action is likely due to long-term holders continuing to take profits and countering the bullish pressure from spot ETF inflows.

Other major tokens such as ether (ETH), XRP (XRP) and dogecoin (DOGE) have lost upward momentum too.

Ethereum’s ether token has pulled back from nearly $4,800 to $4,500 in three days, having put in lifetime highs above $5,000 last month. The weakness is perplexing, as ether, popularly known as the internet bond due to its staking yield mechanism, stands to become an attractive investment with the impending Fed rate cuts.

The payments-focused XRP has pulled back to $3.00, marking a weak follow-through to the bullish breakout from the descending triangle confirmed last week. Meanwhile, dogecoin, the leading meme token by market value, has dropped sharply to 26.7 cents from 30.7 cents amid reports of whale selling.

Analysts said that a 25-basis-point rate cut could resume the slow grind higher in BTC. Meanwhile, a surprise 50 bps move could see stocks, crypto and gold go berserk.

Keep an eye on VIX and BTC vol indices

Monday’s rise in U.S. stocks was characterized by an uptick in the VIX index, which represents the options-based implied or expected volatility in the S&P 500 over the next 30 days.

The VIX rose over 6% to 15.68 points. While it still largely hovers at multi-month lows, the Tuesday spike warrants attention for two reasons: First, historically, the two have moved in opposite directions, as evident from the correlation of nearly -90 over a 90-day period.

Secondly, a breakdown in the negative correlation often precedes corrections, as noted by the quant-driven market intelligence platform Menthor Q on X.

«SPX rose with the VIX today. This often signals stretched upside positioning, traders grabbing calls or hedging downside [with puts], leaving markets vulnerable,» Menthor Q said.

The VIX is influenced by demand for options, and Tuesday’s rise in the index could have been led by traders seeking S&P 500 puts or downside protection.

Perhaps, market participants anticipate a correction following the expected 25-basis-point Fed rate cut on Wednesday.

BTC implied volatility rises

Volmex’s bitcoin implied volatility index, which represents the expected price turbulence over 30 days, also rose by 3% Monday, maintaining its positive correlation with VIX.

Note that BTC’s historic positive correlation with implied volatility indices has flipped negative since the spot ETFs went live in January last year and more so since President Trump’s electoral win in November last year.

Uncategorized

Asia Morning Briefing: Fragility or Back on Track? BTC Holds the Line at $115K

Good Morning, Asia. Here’s what’s making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. For a detailed overview of U.S. markets, see CoinDesk’s Crypto Daybook Americas.

Bitcoin (BTC) traded just above $115k in Asia Tuesday morning, slipping slightly after a strong start to the week.

The modest pullback followed a run of inflows into U.S. spot ETFs and lingering optimism that the Federal Reserve will cut rates next week. The moves left traders divided: is this recovery built on fragile foundations, or is crypto firmly back on track after last week’s CPI-driven jitters?

That debate is playing out across research desks. Glassnode’s weekly pulse emphasizes fragility. While ETF inflows surged nearly 200% last week and futures open interest jumped, the underlying spot market looks weak.

Buying conviction remains shallow, Glassnode writes, funding rates have softened, and profit-taking is on the rise with more than 92% of supply in profit.

Options traders have also scaled back downside hedges, pushing volatility spreads lower, which Glassnode warns leaves the market exposed if risk returns. The core message: ETFs and futures are supporting the rally, but without stronger spot flows, BTC remains vulnerable.

QCP takes the other side.

The Singapore-based desk says crypto is “back on track” after CPI confirmed tariff-led inflation without major surprises. They highlight five consecutive days of sizeable BTC ETF inflows, ETH’s biggest inflow in two weeks, and strength in XRP and SOL even after ETF delays.

Traders, they argue, are interpreting regulatory postponements as inevitability rather than rejection. With the Altcoin Season Index at a 90-day high, QCP sees BTC consolidation above $115k as the launchpad for rotation into higher-beta assets.

The divide underscores how Bitcoin’s current range near $115k–$116k is a battleground. Glassnode calls it fragile optimism; QCP calls it momentum. Which side is right may depend on whether ETF inflows keep offsetting profit-taking in the weeks ahead.

Market Movement

BTC: Bitcoin is consolidating near the $115,000 level as traders square positions ahead of expected U.S. Fed policy moves; institutional demand via spot Bitcoin ETFs is supporting upside

ETH: ETH is trading near $4500 in a key resistance band; gains are being helped by renewed institutional demand, tightening supply (exchange outflows), and positive technical setups.

Gold: Gold continues to hold near record highs, underpinned by expectations of Fed interest rate cuts, inflation risk, and investor demand for safe havens; gains tempered somewhat by profit‑taking and a firmer U.S. dollar

Nikkei 225: Japan’s Nikkei 225 topped 45,000 for the first time Monday, leading Asia-Pacific gains as upbeat U.S.-China trade talks and a TikTok divestment framework lifted sentiment.

S&P 500: The S&P 500 rose 0.5% to close above 6,600 for the first time on Monday as upbeat U.S.-China trade talks and anticipation of a Fed meeting lifted stocks.

Elsewhere in Crypto

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars