Uncategorized

Dogecoin, Cardano’s ADA Lead Market Gains as Bitcoin Traders Eye Next Fed Meeting

Bitcoin (BTC) flirted with $100,000 Thursday as major cryptocurrencies including dogecoin (DOGE) and Cardano’s ADA led crypto market gains, boosted by dovish signals from the Federal Reserve and a pending trade deal teased by U.S. President Donald Trump.

DOGE added 5% and ADA jumped 4%, while ether (ETH), BNB Chain’s BNB, xrp (XRP) and Solana’s SOL gained 2%-3%. The broad-based CoinDesk 20 (CD20), a liquid index tracking the largest tokens, rose 2.2%.

In a social media post late Wednesday, Trump said the U.S. will unveil a “big” trade deal with a “highly respected country” at a press conference slated for 10 a.m. ET. Bloomberg, the Financial Times and New York Times all identified the country as the U.K.

The announcement would mark the start of “many” such deals, Trump added, raising speculation that months of tariff-fueled uncertainty is set to ease, possibly reviving risk appetite across global markets.

Tariff concerns have rocked equities and commodities in recent weeks. Any resolution that improves cost dynamics for U.S. businesses could serve as a tailwind for risk assets, including crypto.

Meanwhile, the Federal Reserve’s decision to hold interest rates steady on Wednesday was no surprise, though it left markets divided on when cuts might begin.

The CME FedWatch Tool shows probabilities for a July cut to the 4.00%-4.25% range at 55%, even as traders priced in a cumulative 100 basis points of easing by year-end.

“Bitcoin is inching back up to $100k with the steady Fed rate decision and the topic of future rate cuts having more consideration by traders,” said Semir Gabeljic, head of Pythagoras Investments. “Based on the current administration’s pressure on the Fed chair, anything is a possibility—uncertainty is the only certainty.”

Other observers warned that policymakers could be walking into a period of stagflation, which occurs when high inflation, stagnant economic growth and rising unemployment occur simultaneously — considered highly detrimental for a healthy economy.

“The Federal Reserve faces an intensifying policy dilemma that threatens both sides of its dual mandate,” said Gabe Selby, head of research at CF Benchmarks, told CoinDesk in a message.

“With businesses largely passing rising tariff costs onto consumers … inflation is expected to reaccelerate over the next six months, while labor market indicators point to a deteriorating employment outlook,” Selby said.

Selby added that while CF Benchmarks still anticipates “around 100bps of rate cuts by year-end,” the Fed could err by acting too late, risking further economic pain.

“In this volatile macro backdrop, bitcoin has clearly emerged as a key beneficiary,” Selby noted, citing record inflows into U.S. spot bitcoin ETFs, including BlackRock’s IBIT, which has seen $4.3 billion in inflows over the past month.

Meanwhile, Jupiter Zheng, a partner at HashKey Capital, said BTC’s recent price moves are part of a broader structural shift.

“Bitcoin’s rise is a testament to its hedge against macroeconomic and geopolitical volatility,” Zheng said. “Investors increasingly view crypto as a core part of resilient portfolios.”

Read more: Fed Stagflation Risk Signal Could Be Bullish for Bitcoin, Analyst Says

Uncategorized

Is Ethereum’s DeFi Future on L2s? Liquidity, Innovation Say Perhaps Yes

Ethereum is in the midst of a paradox. Even as ether hit record highs in late August, decentralized finance (DeFi) activity on Ethereum’s layer-1 (L1) looks muted compared to its peak in late 2021. Fees collected on mainnet in August were just $44 million, a 44% drop from the prior month.

Meanwhile, layer-2 (L2) networks like Arbitrum and Base are booming, with $20 billion and $15 billion in total value locked (TVL) respectively.

This divergence raises a crucial question: are L2s cannibalizing Ethereum’s DeFi activity, or is the ecosystem evolving into a multi-layered financial architecture?

AJ Warner, the chief strategy officer of Offchain Labs, the developer firm behind layer-2 Arbitrum, argues that the metrics are more nuanced than just layer-2 DeFi chipping at the layer 1.

In an interview with CoinDesk, Warner said that focusing solely on TVL misses the point, and that Ethereum is increasingly functioning as crypto’s “global settlement layer,” a foundation for high-value issuance and institutional activity. Products like Franklin Templeton’s tokenized funds or BlackRock’s BUIDL product launch directly on Ethereum L1 — activity that isn’t fully captured in DeFi metrics but underscores Ethereum’s role as the bedrock of crypto finance.

Ethereum as a layer-1 blockchain is the secure but relatively slow and expensive base network. Layer-2s are scaling networks built on top of it, designed to handle transactions faster and at a fraction of the cost before ultimately settling back to Ethereum for security. That’s why they’ve become so appealing to traders and builders alike. Metrics like TVL, the amount of crypto deposited in DeFi protocols, highlight this shift, as activity is moved to L2s where lower fees and quicker confirmations make everyday DeFi far more practical.

Warner likens Ethereum’s place in the ecosystem to a wire transfer in traditional finance: trusted, secure and used for large-scale settlement. Everyday transactions, however, are migrating to L2s — the Venmos and PayPals of crypto.

“Ethereum was never going to be a monolithic blockchain with all the activity happening on it,” Warner told CoinDesk. Instead, it’s meant to anchor security while enabling rollups to execute faster, cheaper and more diverse applications.

Layer 2s, which have exploded over the last few years because they are seen as the faster and cheaper alternative to Ethereum, enable whole categories of DeFi that don’t function as well on mainnet. Fast-paced trading strategies, like arbitraging price differences between exchanges or running perpetual futures, don’t work well on Ethereum’s slower 12-second blocks. But on Arbitrum, where transactions finalize in under a second, those same strategies become possible, Warner explained. This is apparent, as Ethereum has had fewer than 50 million transactions over the last month, compared to Base’s 328 million transactions and Arbitrum’s 77 million transactions, according to L2Beat.

Builders also see L2s as an ideal testing ground. Alice Hou, a research analyst at Messari, pointed to innovations like Uniswap V4’s hooks, customizable features that can be iterated far more cheaply on L2s before going mainstream. For developers, quicker confirmations and lower costs are more than a convenience: they expand what’s possible.

“L2s provide a natural playground to test these kinds of innovations, and once a hook achieves breakout popularity, it could attract new types of users who engage with DeFi in ways that weren’t feasible on L1,” Hou said.

But the shift isn’t just about technology. Liquidity providers are responding to incentives. Hou said that data shows smaller liquidity providers increasingly prefer L2s where yield incentives and lower slippage amplify returns. Larger liquidity providers, however, still cluster on Ethereum, prioritizing security and depth of liquidity over bigger yields.

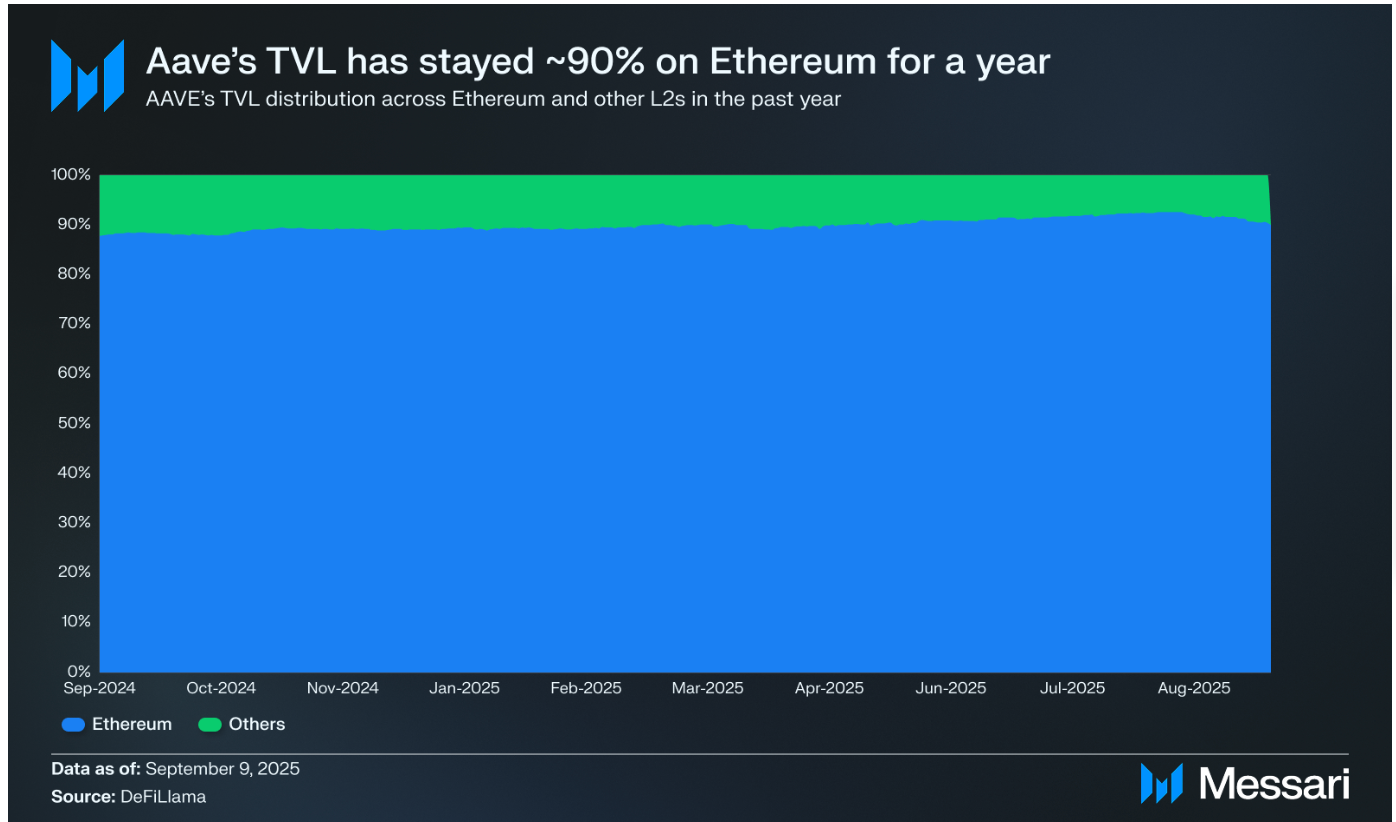

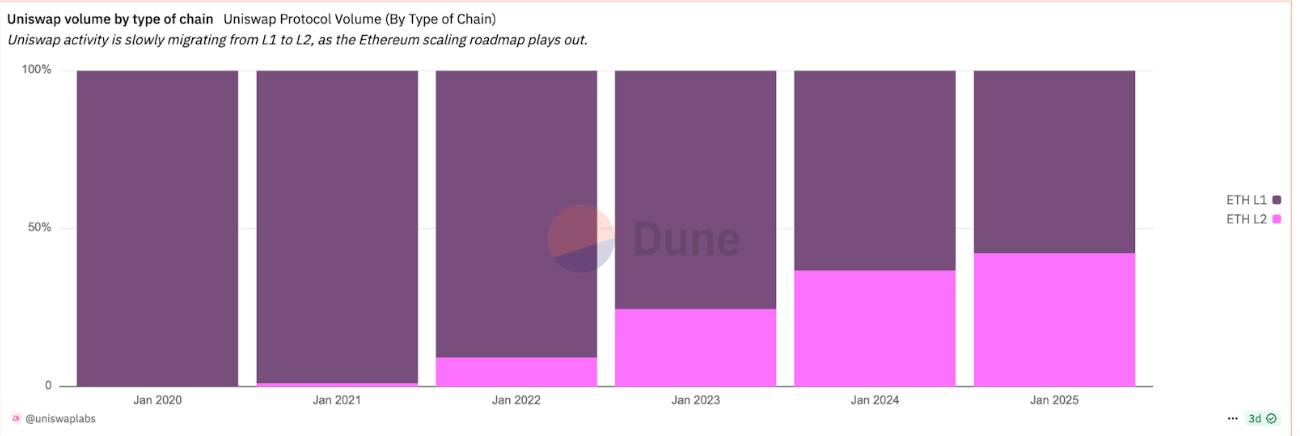

Interestingly, while L2s are capturing more activity, flagship DeFi protocols like Aave and Uniswap still lean heavily on mainnet. Aave has consistently kept about 90% of its TVL on Ethereum. With Uniswap however, there’s been an incremental shift towards L2 activity.

Another factor accelerating L2 adoption is user experience. Wallets, bridges and fiat on-ramps increasingly steer newcomers directly to L2s, Hou said. Ultimately, the data suggests the L1 vs. L2 debate isn’t zero-sum.

As of September 2025, about a third of L2 TVL still comes bridged from Ethereum, another third is natively minted, and the rest comes via external bridges.

“This mix shows that while Ethereum remains a key source of liquidity, L2s are also developing their own native ecosystems and attracting cross-chain assets,” Hou said.

Ethereum thus as a base layer appears to be cementing itself as the secure settlement engine for global finance, while rollups like Arbitrum and Base are emerging as execution layers for fast, cheap and creative DeFi applications.

“Most payments I make use something like Zelle or PayPal… but when I bought my home, I used a wire. That’s somewhat parallel to what’s happening between Ethereum layer one and layer twos,” Warner of Offchain Labs said.

Read more: Ethereum DeFi Lags Behind, Even as Ether Price Crossed Record Highs

Uncategorized

CoinDesk 20 Performance Update: Avalanche (AVAX) Gains 4.6% as Index Moves Higher

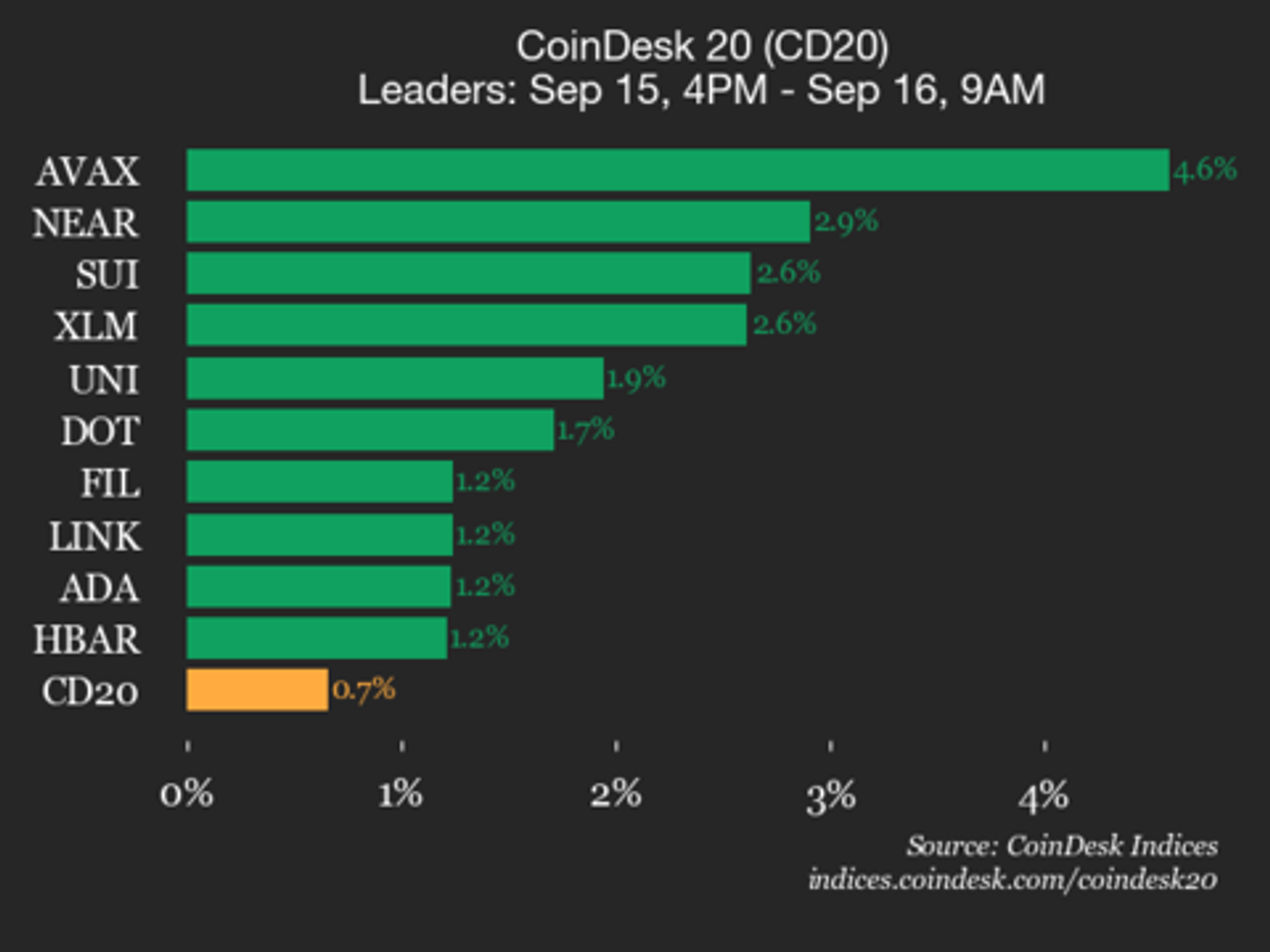

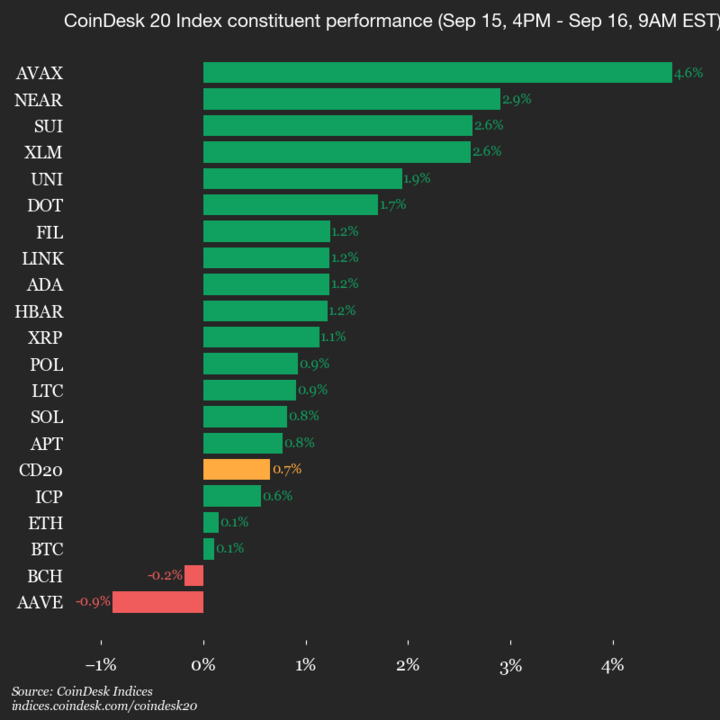

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 4267.12, up 0.7% (+27.81) since 4 p.m. ET on Monday.

Eighteen of 20 assets is trading higher.

Leaders: AVAX (+4.6%) and NEAR (+2.9%).

Laggards: AAVE (-0.9%) and BCH (-0.2%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Uncategorized

Santander’s Openbank Starts Offering Crypto Trading in Germany, Spain Coming Soon

The digital banking arm of Spanish financial giant Santander Group, Openbank, opened cryptocurrency trading for customers in Germany, with plans to add its home market in the next few weeks.

The new service allows users to buy, sell and hold five popular cryptocurrencies: bitcoin (BTC), ether (ETH), litecoin (LTC), polygon (MATIC) and cardano (ADA), according to a press release. The cryptocurrencies are available alongside stocks, ETFs and investment funds.

Customers can trade without moving funds to an external platform, keeping all investments in one place under Santander’s umbrella, the bank said.

“By incorporating the main cryptocurrencies into our investment platform, we are responding to the demand of some of our customers,” said Coty de Monteverde, head of crypto at Grupo Santander.

The bank charges a 1.49% fee per transaction, with a 1 euro ($1.2) minimum, and does not include custody fees. The bank said it plans to add more cryptocurrencies and new features, such as crypto-to-crypto conversions, in coming months.

Santander Private Bank was back in 2023 making headlines when it started letting clients with accounts in Switzerland trade BTC and ETH. It selected crypto safekeeping technology firm Taurus for custody.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars