Uncategorized

SOL Strategies Buys $18M of Solana Tokens With First Tranche of $500M Note Deal

SOL Strategies (HODL), the Toronto-listed digital asset firm focusing on Solana (SOL), said on Tuesday it has acquired over $18 million worth of SOL tokens, using proceeds from a newly secured financing deal.

The company purchased 122,524 SOL for $18.25 million at an average price of $148.96 per token, according to a press release. The acquisition follows the initial $20 million closing of a planned $500 million convertible note facility with investment firm ATW Partners, announced last month.

Shares of the company slid 10% to around CA$2.6 in the early Tuesday hours of the session, extending the slump for late April’s peak over CA$3.3. Still, the stock is up nearly 80% in two weeks.

«With the closing of our initial $20 million tranche from the ATW facility, we’re executing exactly as promised – strategically acquiring SOL to expand our validator operations and ecosystem position,» said CEO Leah Wald. «These purchases directly strengthen our three-pillar strategy of enterprise grade validators, strategic SOL holdings, and solana technology innovation.»

Validator operations are core infrastructure in proof-of-stake blockchains like Solana, where participants help secure the network and earn staking rewards. By acquiring SOL, the firm can increase its validator stake, potentially boosting both influence and revenue within the ecosystem.

Sol Strategies’ move highlights a growing trend among public companies applying the playbook of Michael Saylor’s Strategy with bitcoin (BTC)—using capital markets to accumulate large cryptocurrency holdings in the hopes delivering upside to shareholders.

Last month, real estate fintech firm Janover (JNVR), now rebranded as DeFi Development, pivoted to focusing on accumulating SOL and building out a validator business on the Solana network.

Read more: DeFi Development Plans to Raise $1 Billion to Buy More Solana

Disclaimer: This article, or parts of it, was generated with assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Uncategorized

Senate Democrat Says He’s Looking Into Trump’s Crypto Businesses

The leading Senate Democrat on a panel tasked with investigating corruption and mismanagement is scrutinizing U.S. President Donald Trump’s recent crypto activities and whether they’re part of a «pay-to-play scheme to provide access to the Presidency to the highest bidder.»

Richard Blumenthal, the ranking Democrat on the Senate Permanent Subcommittee on Investigations — a panel housed within the Committee on Homeland Security and Government Affairs — wrote letters to Bill Zanker of Fight Fight Fight LLC and Zach Witkoff, a co-founder of World Liberty Financial on Tuesday, asking them a series of questions about the ownership and investment structure for Trump-affiliated entities, including Fight Fight Fight LLC (the company behind the TRUMP memecoin), CIC Digital LLC (which issued Trump’s NFTs and co-owns Fight Fight Fight), Celebration Cards LLC (another entity affiliated with Trump’s NFTs) and DTTM Operations LLC (which manages Trump’s IP rights), as well as World Liberty Financial and its affiliated entities.

«The Permanent Subcommittee on Investigations is conducting a preliminary inquiry into potential conflicts of interest and violations of the law from President Trump’s cryptocurrency ventures … and associated businesses’ financial dealings with foreign nationals, foreign governments and other cryptocurrency firms,» the letters both said, with one pointing to World Liberty Financial and the other to the $TRUMP memecoin.

The letters went on to say that the businesses «may be enabling the violation of government ethics requirements,» before posing a number of questions for the companies’ respective executives.

These questions include asking how the companies identify or block investments from foreign governments, how much revenue they’ve generated and whether individuals facing prosecution or investigations can participate.

The letters also ask the executives to produce records tied to the Trump-affiliated crypto businesses.

Because Democrats are currently the minority party in the Senate, Blumenthal does not have subpoena power unless his Republican counterpart, Sen. Ron Johnson, also signs on. A spokesperson for Johnson did not immediately return a request for comment.

Democrats have sounded the alarm over Trump’s crypto businesses in recent days. Earlier Tuesday, Rep. Maxine Waters, who leads her party on the House Financial Services Committee, objected to a joint hearing with the House Agriculture Committee to address market structure legislation and instead hosted her own hearing focused on these crypto tie-ups.

A weekend statement from Sen. Ruben Gallego and a handful of other Democrats saying the lawmakers would not vote for the Senate’s stablecoin bill also seems to stem from Trump’s crypto ties — in particular the announcement by Eric Trump that Abu Dhabi-based investment firm MGX would use the Trump-affiliated USD1 stablecoin to close a $2 billion investment into Binance.

Sen. Chris Murphy also introduced a bill Tuesday which would ban the U.S. president and other senior government officials from issuing memecoins or other financial assets.

Uncategorized

Bitcoin Dominance Soars Ahead of FOMC as Volatility Burst Looms, Says Analyst

Bitcoin (BTC) tightened its grip on the crypto market on Tuesday, with dominance surging to fresh four-year high as crypto traders rotated into the market’s anchor asset ahead of tomorrow’s key Federal Reserve policy meeting.

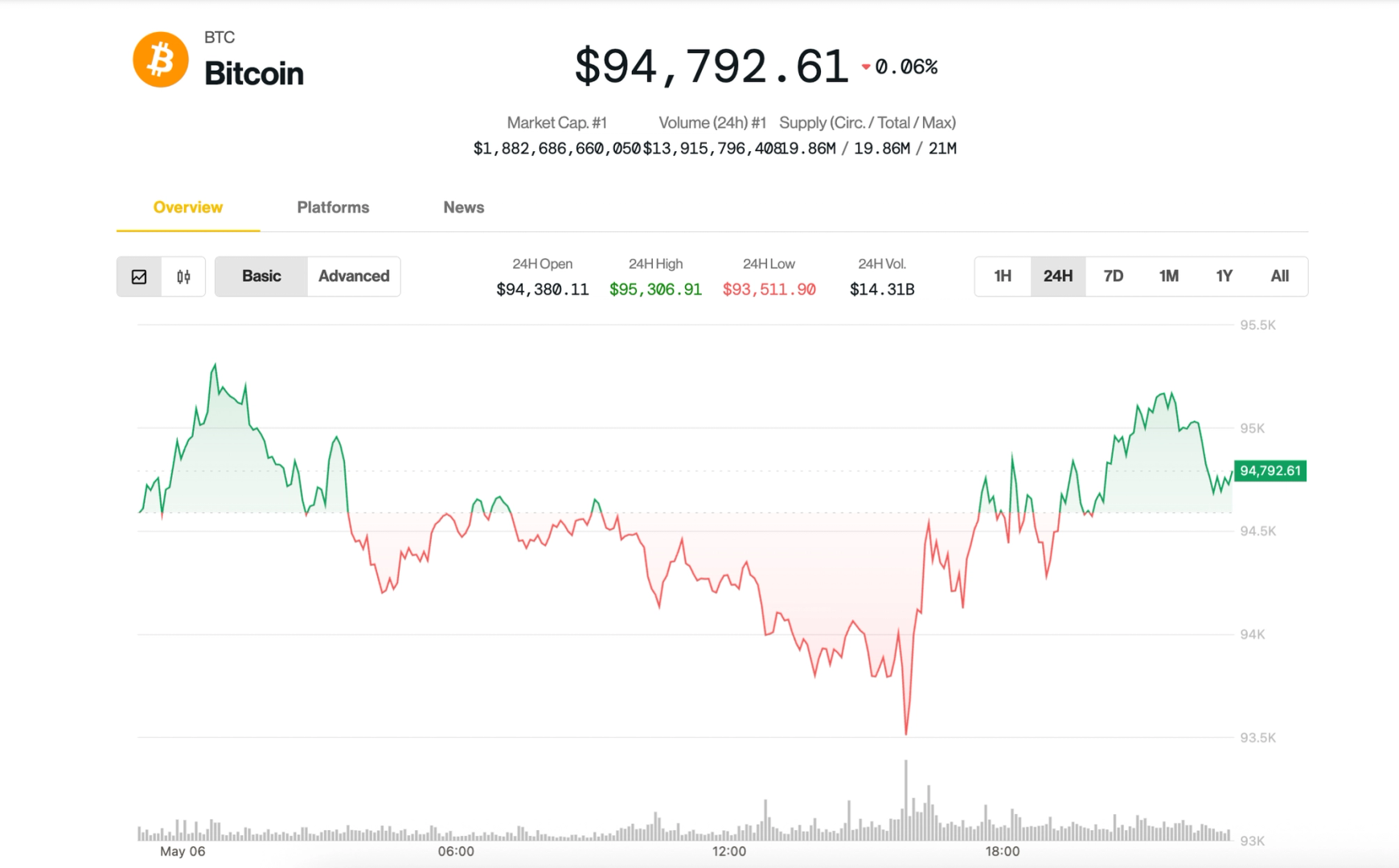

BTC held steady around the $94,000-$95,000 area, up a modest 0.4% over the past 24 hours and extending a tight-range trading pattern that has persisted since the weekend.

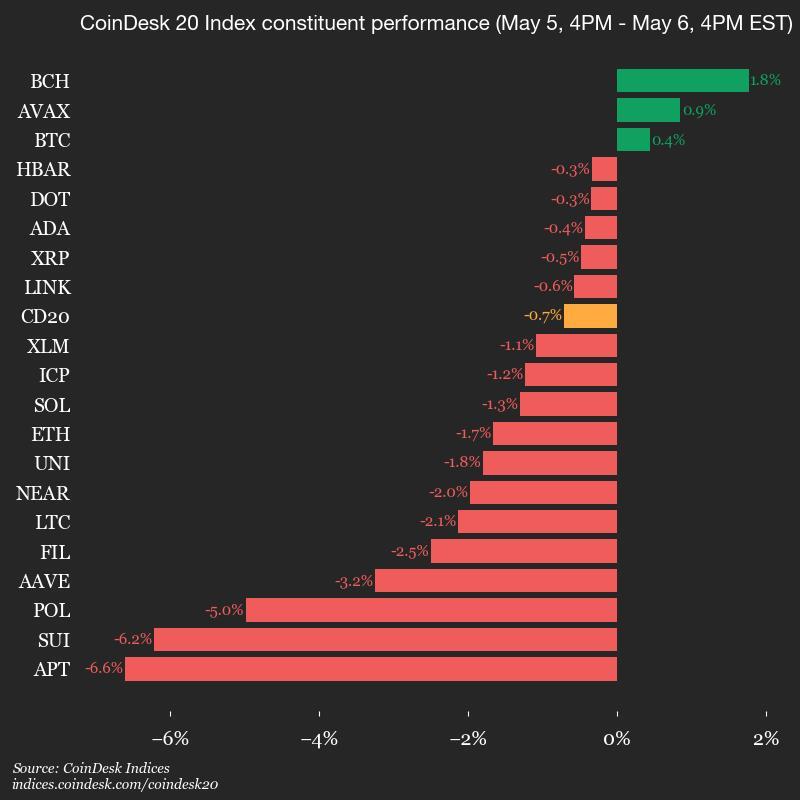

Meanwhile, the broad-market CoinDesk 20 Index slipped 0.7% lower, with Ethereum’s ether (ETH), and native tokens of Sui (SUI), Aptos (APT) and Polygon (POL) dragging the benchmark lower.

A check on traditional markets showed stocks booking back-to-back losses, with the S&P 500 and the tech-heavy Nasdaq closing 0.7%-0.8% down, once again underperforming BTC.

Despite the lack of major price action, focus has increasingly turned to bitcoin’s growing share of the overall crypto market: The so-called Bitcoin Dominance metric surpassed 65%, its highest reading since 2021 January, according to TradingView data, signaling capital consolidating into the asset perceived as the most resilient in the face of macroeconomic uncertainty.

Joel Kruger, market strategist at LMAX Group, described the current landscape as one of pause and anticipation. «The cryptocurrency market has remained largely stagnant since the weekly open, with prices settling into a holding pattern as investors await a pivotal catalyst,» he noted. «This impetus may arise from traditional markets, driven by updates on tariff-related economic impacts or the Federal Reserve’s anticipated FOMC decision on May 7.»

The Federal Reserve is widely expected to hold interest rates steady, according to the CME FedWatch Tool, but traders are on edge for any shift in Fed Chair Jerome Powell’s tone that could impact risk appetite.

Bitcoin volatility burst on the horizon

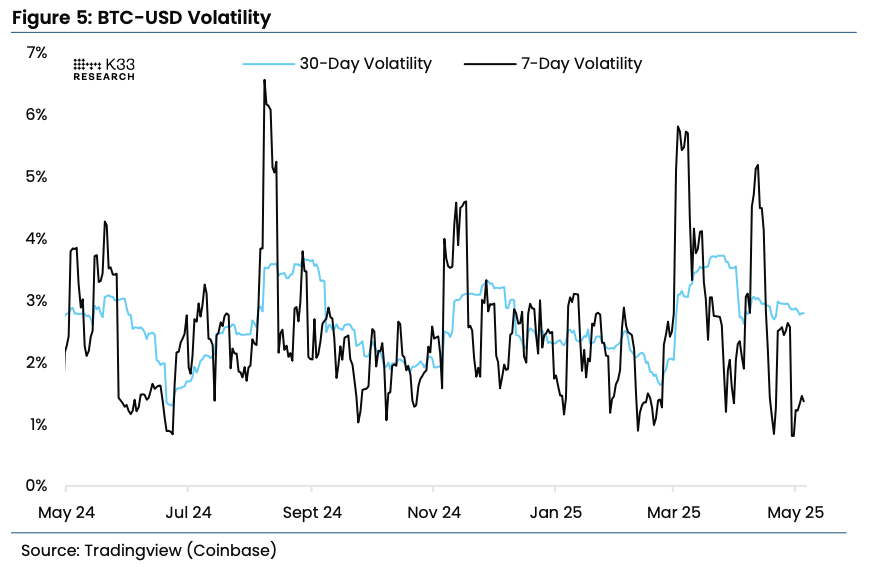

With bitcoin’s recent price action being extremely flat, the upcoming FOMC meeting «is rigged to cause significant volatility,» said Vetle Lunde, head of research at K33. He noted in a Tuesday report that BTC’s short term volatility is «abnormally compressed,» with the 7-day average dropping to the lowest level last week in 563 days.

«Such low volatility regimes in BTC tend to be short-lived,» Lunde said. «Violent volatility outbursts typically follow this form of stability once prices start to move, as leveraged trades are unwound and traders are reactivated into the market.»

He said that a significant cascade lower is unlikely, as funding rates for perpetual swaps are consistently negative. Similar periods historically offered good buying opportunities for medium and long-term investors, Lunde added, favoring «aggressive spot exposure» ahead.

Uncategorized

CFTC Drops Appeal in Kalshi Election Betting Case

The U.S. Commodity Futures Trading Commission (CFTC) has dropped its appeal in its case against Kalshi, a New York-based prediction market, according to a Monday court filing, finally clearing the way for the platform to offer political event contracts.

Under the conditions of the motion for voluntary dismissal, which is still subject to court approval, both parties will pay their own legal costs and Kalshi waives any right to sue the CFTC for the litigation.

«Today is historic. We have always believed that doing things the right way, no matter how hard, no matter how painful, pays off. This result is proof of that,” Kalshi CEO Tarek Mansour said in a statement. “Kalshi’s approach has officially and definitively secured the future of prediction markets in America.»

Kalshi’s fight with the CFTC began in 2023, when the regulator denied Kalshi’s plan to let users bet on which party would control the chambers of Congress. At the time of the denial, the CFTC — then under the leadership of former Chair Rostin Behnam — claimed that such contracts involved unlawful gaming and were “contrary to the public interest.”

That November, Kalshi sued the CFTC in Washington, D.C., claiming that the CFTC had overstepped its authority in attempting to block the contracts, and asking a judge to vacate the decision. The court sided with Kalshi in September 2024, clearing the way for the platform to list the political contracts.

Immediately after losing the case, the CFTC scrambled to undo the district judge’s decision. It applied for a 14-day stay of the order — basically, a two-week delay on Kalshi’s ability to list the contracts while the CFTC prepared for an appeal — and was denied. Then, it filed an appeal, reiterating many of the same arguments it had used in its original defense.

However, shortly after oral arguments in early January, U.S. President Donald Trump returned to office. His eldest son, Don Jr., joined Kalshi as a strategic advisor on January 13. Rob Schwartz, the CFTC’s general counsel at the time the appeal was filed, left the agency in April after withdrawing from the case in March.

Under the leadership of acting Chair Caroline Pham, the agency has changed its approach to crypto, cutting several pieces of crypto-related guidance and narrowing down its once-wide variety of enforcement task forces down to just two, in an effort to simplify its regulation and enforcement of the crypto industry.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors