Uncategorized

Citi, Switzerland’s SDX Join Forces to Tokenize $75B Pre-IPO Shares Market

Banking giant Citi and SIX Digital Exchange (SDX), the digital assets-focused arm of Switzerland’s main stock exchange, are teaming up to tokenize non-publicly traded shares in a move to streamline a $75 billion market that’s littered with PDFs and paper documents.

Citi will act as a custodian and issuer agent for tokenized versions of late stage, pre-IPO equities on SDX’s regulated blockchain-based Central Securities Depository (CSD) platform, the companies said on Tuesday.

Citi said the platform, which is expected to go live in the third quarter, will exclude U.S. investors, but is otherwise global with an initial focus on Switzerland, Singapore and other parts of Asia.

Private shares in high-growth, venture-backed companies are a large and appealing subset of an alternative asset class that’s valued in the trillions of dollars.

Firms with valuations of a billion dollars and more are remaining private for longer as market conditions dictate delays in IPOs for many. That means the companies are looking to secondary markets to help investors and employees get liquidity. But there’s an access problem, and the transactions themselves are manual and cumbersome.

“The most notable characteristic of private markets is that there is no infrastructure, at least nothing scalable,” Nisha Surendran, digital asset emerging solutions lead at Citi Ventures, said in an interview.

Investors are typically faced with a daunting set of PDFs and paper documents to get through, and the settlement of a transaction can take from five to eight weeks — a process that has to be repeated when the investor wants to exit the position, Surendran explained.

“These investments are also hampered by the fact they don’t flow into investors’ wealth statements like other public securities do. Rather, they end up encapsulated in PDFs or paper documents or on other platforms,” she said.

While recent years have seen many traditional financial institutions looking at the tokenization of real-world assets, the very early days of this trend saw lots of attention focused on blockchain-enabled private markets, but with little actually delivered.

SDX CEO David Newns said many hopeful Web3 projects, which saw blockchain rails as a way to streamline outdated processes and enable easy access and distribution for private markets, came up against regulatory hurdles.

“There’s a very mature digital-securities regulatory environment in Switzerland where we’ve been doing this now since 2021,” Newns said in an interview. “That isn’t the case elsewhere. The technology may have looked like it could address all the challenges, but problems around distribution, holding the instrument, and what that instrument represents legally from an investment perspective were not really solved.”

SDX’s blockchain-based securities depository is built on R3’s Corda distributed ledger technology. Investors get access through the dematerialized securities legal construct in Switzerland, via their broker and custodian, Newns said.

“It means effectively, they turn up in your bank account in the same way that a normal security does,” he said. “It doesn’t require that you as an investor do anything special to access these investment instruments.”

The announcement also marks Citi becoming a custodian on SDX, a move that reflects the bank’s strategy to provide clients with access to new digital asset markets globally including to private market assets, said Nadine Teychenne, Citi’s global head of digital assets, investor services and issuer services.

“This is part of a joined-up project across multiple businesses at Citi,” Teychenne said in an interview.

Digital asset banking group Sygnum and Singapore-based financial institution SBI Digital Markets will help with access to the pre-IPO equities that Citi will bring onto the SDX platform, according to a press release.

Read more: Citigroup Unveils Token Services for Institutional Clients

Uncategorized

Bitcoin Dominance Soars Ahead of FOMC as Volatility Burst Looms, Says Analyst

Bitcoin (BTC) tightened its grip on the crypto market on Tuesday, with dominance surging to fresh four-year high as crypto traders rotated into the market’s anchor asset ahead of tomorrow’s key Federal Reserve policy meeting.

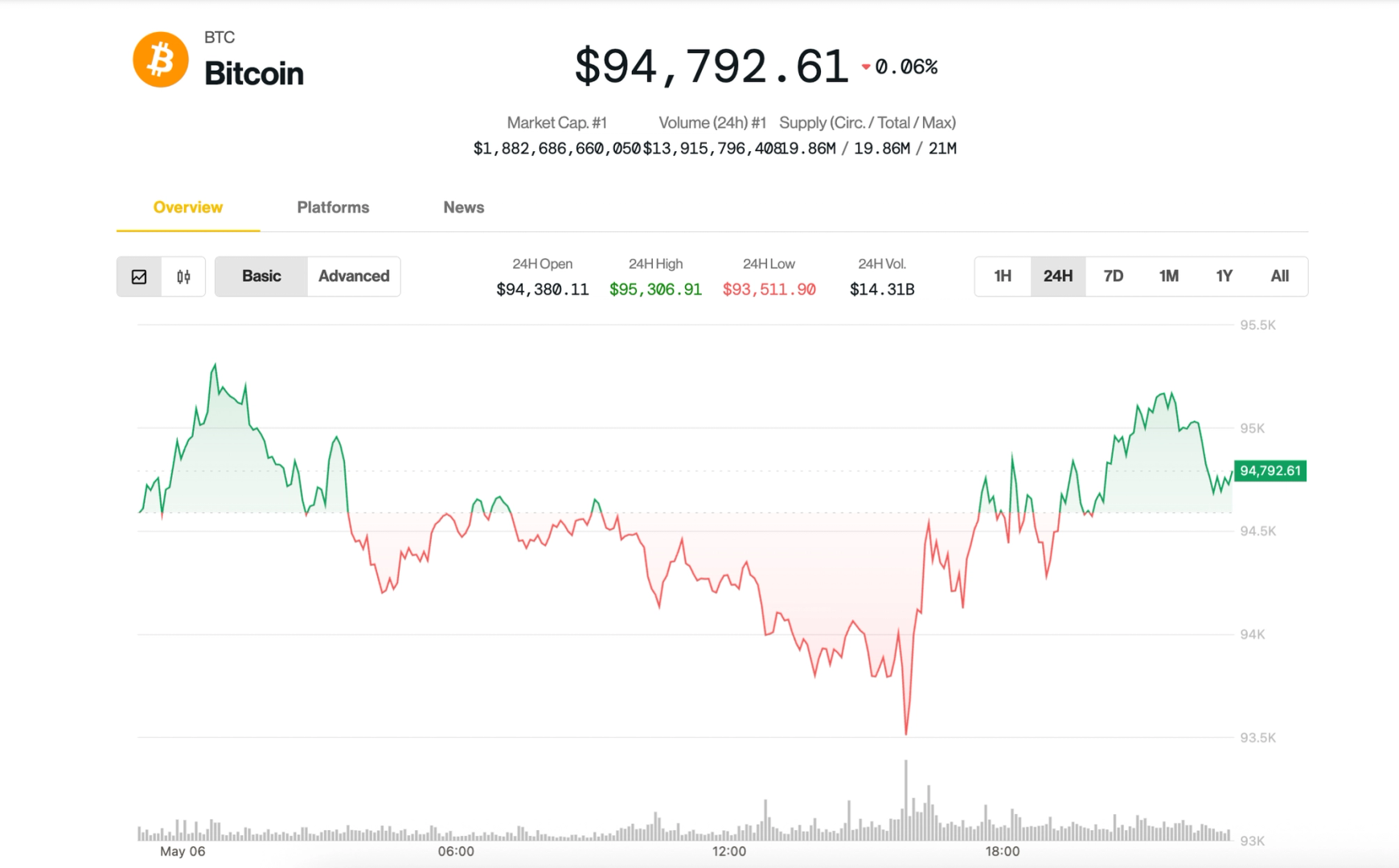

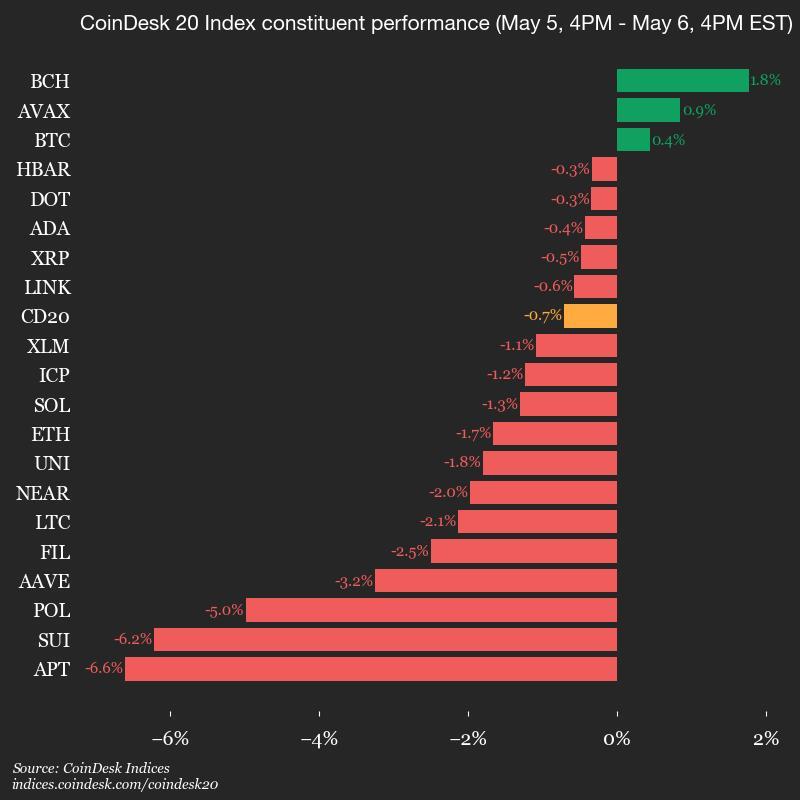

BTC held steady around the $94,000-$95,000 area, up a modest 0.4% over the past 24 hours and extending a tight-range trading pattern that has persisted since the weekend.

Meanwhile, the broad-market CoinDesk 20 Index slipped 0.7% lower, with Ethereum’s ether (ETH), and native tokens of Sui (SUI), Aptos (APT) and Polygon (POL) dragging the benchmark lower.

A check on traditional markets showed stocks booking back-to-back losses, with the S&P 500 and the tech-heavy Nasdaq closing 0.7%-0.8% down, once again underperforming BTC.

Despite the lack of major price action, focus has increasingly turned to bitcoin’s growing share of the overall crypto market: The so-called Bitcoin Dominance metric surpassed 65%, its highest reading since 2021 January, according to TradingView data, signaling capital consolidating into the asset perceived as the most resilient in the face of macroeconomic uncertainty.

Joel Kruger, market strategist at LMAX Group, described the current landscape as one of pause and anticipation. «The cryptocurrency market has remained largely stagnant since the weekly open, with prices settling into a holding pattern as investors await a pivotal catalyst,» he noted. «This impetus may arise from traditional markets, driven by updates on tariff-related economic impacts or the Federal Reserve’s anticipated FOMC decision on May 7.»

The Federal Reserve is widely expected to hold interest rates steady, according to the CME FedWatch Tool, but traders are on edge for any shift in Fed Chair Jerome Powell’s tone that could impact risk appetite.

Bitcoin volatility burst on the horizon

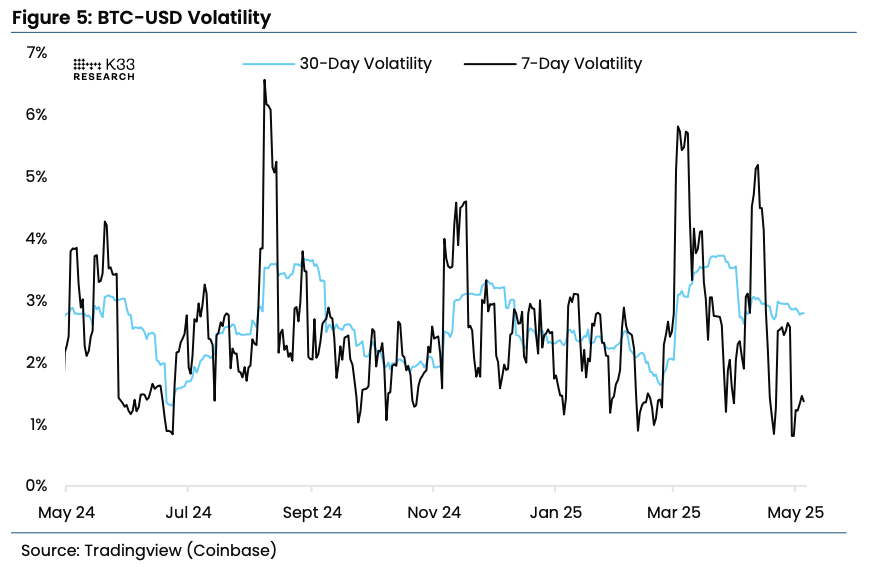

With bitcoin’s recent price action being extremely flat, the upcoming FOMC meeting «is rigged to cause significant volatility,» said Vetle Lunde, head of research at K33. He noted in a Tuesday report that BTC’s short term volatility is «abnormally compressed,» with the 7-day average dropping to the lowest level last week in 563 days.

«Such low volatility regimes in BTC tend to be short-lived,» Lunde said. «Violent volatility outbursts typically follow this form of stability once prices start to move, as leveraged trades are unwound and traders are reactivated into the market.»

He said that a significant cascade lower is unlikely, as funding rates for perpetual swaps are consistently negative. Similar periods historically offered good buying opportunities for medium and long-term investors, Lunde added, favoring «aggressive spot exposure» ahead.

Uncategorized

CFTC Drops Appeal in Kalshi Election Betting Case

The U.S. Commodity Futures Trading Commission (CFTC) has dropped its appeal in its case against Kalshi, a New York-based prediction market, according to a Monday court filing, finally clearing the way for the platform to offer political event contracts.

Under the conditions of the motion for voluntary dismissal, which is still subject to court approval, both parties will pay their own legal costs and Kalshi waives any right to sue the CFTC for the litigation.

«Today is historic. We have always believed that doing things the right way, no matter how hard, no matter how painful, pays off. This result is proof of that,” Kalshi CEO Tarek Mansour said in a statement. “Kalshi’s approach has officially and definitively secured the future of prediction markets in America.»

Kalshi’s fight with the CFTC began in 2023, when the regulator denied Kalshi’s plan to let users bet on which party would control the chambers of Congress. At the time of the denial, the CFTC — then under the leadership of former Chair Rostin Behnam — claimed that such contracts involved unlawful gaming and were “contrary to the public interest.”

That November, Kalshi sued the CFTC in Washington, D.C., claiming that the CFTC had overstepped its authority in attempting to block the contracts, and asking a judge to vacate the decision. The court sided with Kalshi in September 2024, clearing the way for the platform to list the political contracts.

Immediately after losing the case, the CFTC scrambled to undo the district judge’s decision. It applied for a 14-day stay of the order — basically, a two-week delay on Kalshi’s ability to list the contracts while the CFTC prepared for an appeal — and was denied. Then, it filed an appeal, reiterating many of the same arguments it had used in its original defense.

However, shortly after oral arguments in early January, U.S. President Donald Trump returned to office. His eldest son, Don Jr., joined Kalshi as a strategic advisor on January 13. Rob Schwartz, the CFTC’s general counsel at the time the appeal was filed, left the agency in April after withdrawing from the case in March.

Under the leadership of acting Chair Caroline Pham, the agency has changed its approach to crypto, cutting several pieces of crypto-related guidance and narrowing down its once-wide variety of enforcement task forces down to just two, in an effort to simplify its regulation and enforcement of the crypto industry.

Uncategorized

New Hampshire Becomes First State to Approve Crypto Reserve Law

New Hampshire has become the first state to allow the investment of its public funds into crypto assets with its governor signing the new law on Tuesday.

The state beat a number of others to the punch this year as what had started as a surge in state lawmaker momentum had run into roadblocks over recent weeks. As the first to authorize its treasurer to set up such a reserve, New Hampshire could very well beat the U.S. government in forming a stockpile, too.

«New Hampshire is once again first in the Nation,» New Hampshire Governor Kelly Ayotte, a Republican who’s in her first year in office, posted on social media site X.

The New Hampshire bill allows the investment of up to 5% of public funds in a digital asset that has at least $500 billion in market capitalization, currently leaving bitcoin (BTC) as the only qualifying asset.

State House Republicans there also posted on X Tuesday, boasting that their state is «OFFICIALLY the first state to lay the groundwork for a strategic bitcoin reserve.»

«The Live Free or Die state is leading the way in forging the future of commerce and digital assets,» they wrote.

Though Arizona had been the first state to get a similar measure to its governor’s desk, that legislation was vetoed. Florida has also withdrawn its own effort, joining a number of other states where the reserve push has fizzled.

President Donald Trump had called for his administration to set up its own bitcoin reserve and a separate crypto stockpile, though the Treasury Department is still examining what the federal government has on hand that can be redirected into those eventual funds.

Read More: Trump’s Crypto Sherpa Bo Hines Says Crypto Legislation on Target for Quick Completion

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors