Uncategorized

IntoTheBlock and Trident Merge With $25M Backing to Build Institutional DeFi Gateway

Decentralized finance (DeFi) firms IntoTheBlock and Trident Digital have merged to form Sentora, joining forces to bring institutional investors onchain.

The new company, helmed by Anthony DeMartino, co-founder of Trident and former head of risk strategies at Coinbase (COIN), is also on track to close a $25 million founding round with New Form Capital leading the investment. Ripple, Tribe Capital, UDHC, Joint Effects also participated in the fundraising round, with further backing from strategic ecosystem investors including Curved Ventures, Flare and Bankai Ventures. While most investors have already closed the investment, two firms will close the process by June, the company told CoinDesk.

The merger comes at a time when DeFi is maturing from its «wild west» beginnings into a blockchain-based financial economy with offerings increasingly catered towards sophisticated investors.

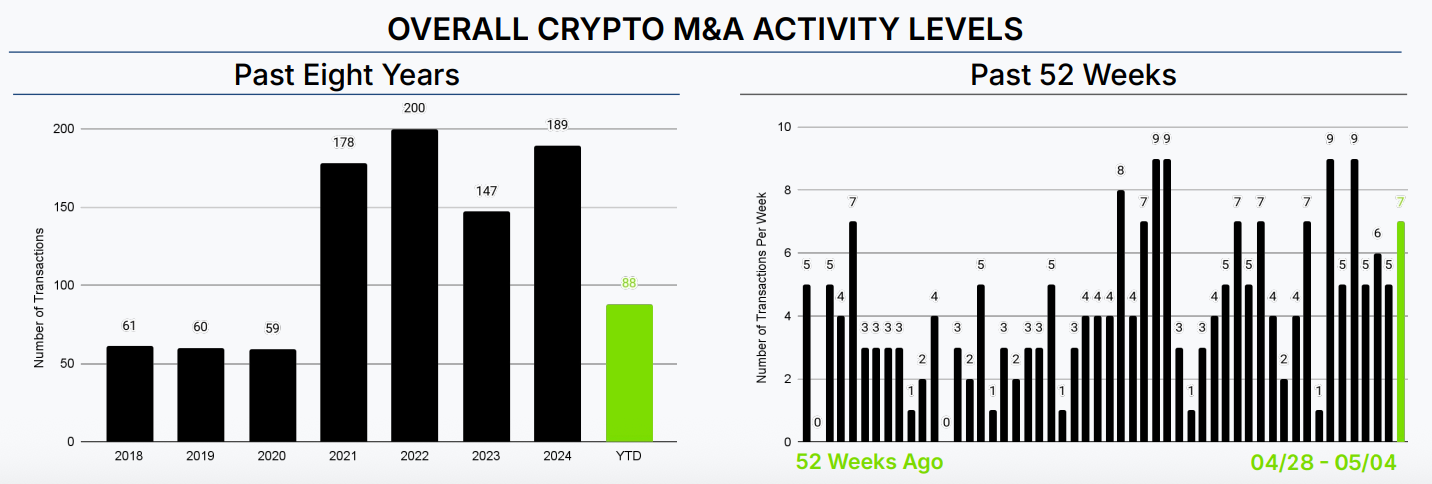

It also underscores the ongoing trend of consolidation within the crypto industry. There were 88 mergers and acquisitions in the first four months of 2025, according to Architect Partners, putting this year on track to surpass the record years of 2022 and 2024.

Sentora combines IntoTheBlock’s track record in DeFi analytics—spanning over $3 billion in institutional deployments—with Trident’s experience structuring liquidity programs and financial products.

The platform aims to provide a one-stop shop for institutional investors, offering yield strategies, compliance, risk management and access to structured products all under one hood.

«The vision is to build all the core primitives that are needed for any institution whether it’s a crypto institution, DAO foundation, traditional finance investor or individual family office, to interact with DeFi in a way that feels intelligent, that feels safe, that feels secure,» Jesus Rodriguez, co-founder of IntoTheBlock and now CTO of Sentora, said in an interview with CoinDesk.

A key roadblock that has hindered asset managers entering DeFi at scale is that the space is getting increasingly complex and fragmented across new chains and protocols, DeMartino explained.

«It shouldn’t be this hard,» he said. «You shouldn’t have to learn about a new chain and learn about a whole bunch of different protocols and understand bridging and different wallets every time you want to go to a new chain.»

What can help bridge this gap and attract even traditional finance firms on-chain, according to DeMartino, is to abstract away from interacting with individual protocols with a single platform that handles all the risk management and liquidity, while keeping transparency about the underlying plumbing.

«DeFi rails are the future of finance, but it’s still a very small market,» he said. DefiLlama data shows that there are less than $130 billion of assets on DeFi protocols, dwarfed by the the multiple trillions of assets under management at the likes of BlackRock and Fidelity Investments.

«We’re building the rails for the next 130 trillion of assets to come onchain,» he said.

Read more: Beyond Incentives: How to Build Durable DeFi

Uncategorized

CFTC Drops Appeal in Kalshi Election Betting Case

The U.S. Commodity Futures Trading Commission (CFTC) has dropped its appeal in its case against Kalshi, a New York-based prediction market, according to a Monday court filing, finally clearing the way for the platform to offer political event contracts.

Under the conditions of the motion for voluntary dismissal, which is still subject to court approval, both parties will pay their own legal costs and Kalshi waives any right to sue the CFTC for the litigation.

«Today is historic. We have always believed that doing things the right way, no matter how hard, no matter how painful, pays off. This result is proof of that,” Kalshi CEO Tarek Mansour said in a statement. “Kalshi’s approach has officially and definitively secured the future of prediction markets in America.»

Kalshi’s fight with the CFTC began in 2023, when the regulator denied Kalshi’s plan to let users bet on which party would control the chambers of Congress. At the time of the denial, the CFTC — then under the leadership of former Chair Rostin Behnam — claimed that such contracts involved unlawful gaming and were “contrary to the public interest.”

That November, Kalshi sued the CFTC in Washington, D.C., claiming that the CFTC had overstepped its authority in attempting to block the contracts, and asking a judge to vacate the decision. The court sided with Kalshi in September 2024, clearing the way for the platform to list the political contracts.

Immediately after losing the case, the CFTC scrambled to undo the district judge’s decision. It applied for a 14-day stay of the order — basically, a two-week delay on Kalshi’s ability to list the contracts while the CFTC prepared for an appeal — and was denied. Then, it filed an appeal, reiterating many of the same arguments it had used in its original defense.

However, shortly after oral arguments in early January, U.S. President Donald Trump returned to office. His eldest son, Don Jr., joined Kalshi as a strategic advisor on January 13. Rob Schwartz, the CFTC’s general counsel at the time the appeal was filed, left the agency in April after withdrawing from the case in March.

Under the leadership of acting Chair Caroline Pham, the agency has changed its approach to crypto, cutting several pieces of crypto-related guidance and narrowing down its once-wide variety of enforcement task forces down to just two, in an effort to simplify its regulation and enforcement of the crypto industry.

Uncategorized

New Hampshire Becomes First State to Approve Crypto Reserve Law

New Hampshire has become the first state to allow the investment of its public funds into crypto assets with its governor signing the new law on Tuesday.

The state beat a number of others to the punch this year as what had started as a surge in state lawmaker momentum had run into roadblocks over recent weeks. As the first to authorize its treasurer to set up such a reserve, New Hampshire could very well beat the U.S. government in forming a stockpile, too.

«New Hampshire is once again first in the Nation,» New Hampshire Governor Kelly Ayotte, a Republican who’s in her first year in office, posted on social media site X.

The New Hampshire bill allows the investment of up to 5% of public funds in a digital asset that has at least $500 billion in market capitalization, currently leaving bitcoin (BTC) as the only qualifying asset.

State House Republicans there also posted on X Tuesday, boasting that their state is «OFFICIALLY the first state to lay the groundwork for a strategic bitcoin reserve.»

«The Live Free or Die state is leading the way in forging the future of commerce and digital assets,» they wrote.

Though Arizona had been the first state to get a similar measure to its governor’s desk, that legislation was vetoed. Florida has also withdrawn its own effort, joining a number of other states where the reserve push has fizzled.

President Donald Trump had called for his administration to set up its own bitcoin reserve and a separate crypto stockpile, though the Treasury Department is still examining what the federal government has on hand that can be redirected into those eventual funds.

Read More: Trump’s Crypto Sherpa Bo Hines Says Crypto Legislation on Target for Quick Completion

Uncategorized

Stabledollars: The Third Act of Dollar Reinvention

Eight decades of dollar history can be read as a three-act play.

Act I was the Eurodollar—off-shore bank deposits that sprang up in 1950s London so the Soviet bloc, European exporters, and eventually every multinational could hold dollars outside U.S. regulation, spawning a multi-trillion-dollar shadow banking base.

Act II was the Petrodollar. After 1974, OPEC’s decision to price crude in dollars hard-wired global energy demand to U.S. currency and gave Washington an automatic bid for its Treasury bills.

John deVadoss will appear in the “IEEE x Consensus Research Symposium: What’s next in Agentic AI?” at Consensus 2025 on May 16 at 11:00am-12:30pm.

Act III is unfolding now. USD-backed Stabledollars (a.k.a. stablecoins)—on-chain tokens fully collateralized by T-bills and cash—have leapt past $230 billion in circulating supply and, on many days, settle more value than PayPal and Western Union combined. The dollar has reinvented itself again—this time as a monetary API: a permissionless, programmable unit that clears in seconds for a fraction of a cent.

Follow the incentives and the shape of the future appears. A Lagos merchant can accept USDC on her phone, skip 20% naira slippage, and restock inventory the same afternoon. A Singapore hedge fund parks cash in tokenized T-bill vaults yielding 4.9%, then routes those dollars into a swap at 8 a.m. New-York time without a correspondent bank. A Colombian gig worker converts weekend wages to digital dollars, bypasses capital controls, and withdraws pesos at a neighborhood ATM—no Friday-to-Monday lag, no 7% remit fee.

Stablecoins haven’t replaced the banking system; they have tunneled around its slowest, most expensive choke points.

Scale begets legitimacy. The GENIUS Act moving through the U.S. Senate would charter stable-coin issuers nationally and, for the first time, open a path to Fed master accounts. Treasury staff already model a $2 trillion stable-coin float by 2028—enough to rival the entire Eurodollar stock of the early 1990s.

That projection is plausible: Tether and Circle command over 90% share with reserves lodged almost entirely in short-dated U.S. debt, meaning foreigners are effectively holding digitized T-bills that settle in 30 seconds. The dollar’s network-effect is migrating from SWIFT messages to smart-contract calls, extending hegemony without printing a single new note.

Yet, the Stabledollar epoch is no risk-free triumph. Private tokens that wrap sovereign money raise hard questions. Who conducts monetary policy when a third of the offshore float lives in smart contracts? What recourse does a Venezuelan family have if an issuer black-lists its wallet? Will Europe—or the BRICS—tolerate a rails-level dependence on a U.S.-regulated asset? These are governance puzzles, but they are solvable if policymakers treat stablecoins as critical dollar infrastructure, not as speculative irritants.

The playbook is straightforward:

- Impose Basel-style capital and liquidity rules on issuers.

- Post real-time reserve attestations on-chain so collateral is transparent by default.

- Mandate inter-operability across blockchains to prevent winner-take-all custodianship.

- Extend FDIC-like insurance to tokenized deposits so end-users enjoy the same safety net as with bank accounts.

Do that, and the United States creates a digital-dollar moat wider than any rival’s CBDC, including China’s. Shrug, and issuance will migrate offshore, leaving Washington to police a shadow system it no longer controls.

Dollar hegemony has always advanced by hitching itself to the dominant trade flow of the age: Eurodollars financed post-war reconstruction; petrodollars lubricated the fossil-fuel century; Stabledollars are wiring the high-velocity, software-eaten economy. Ten years from now, you won’t see them; they will simply be the water we swim in. Your local café will quote prices in pesos or pounds but settle in tokenized dollars under the hood. Brokerages will sell “notes” that are really bearer instruments programmable for collateral calls. Payroll will arrive in a wallet that auto-routes savings, investments, and charitable gifts the instant it clears.

The only open question is whether the United States will steward the upgrade it accidentally birthed. Stablecoins are already the fastest-growing quasi-sovereign asset class. Harness them with serious rules and the dollar’s third great reinvention writes itself. Ignore them, and that future still arrives—just without the U.S. in the driver’s seat.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors