Uncategorized

Bitcoin Hovers Above $94K as Market Awaits News on U.S.- China Trade Deal

Bitcoin (BTC) opened the trading week flat above $94,000 as traders waited for news from Beijing on the progress of a trade deal with the U.S.

The CoinDesk 20 (CD20), a measure of the performance of major digital assets, was down 1.5%, trading below 2,700.

Major markets in Asia were closed on Monday, with Hong Kong, mainland China, Japan, and Korea closed, leading to thin liquidity and trading volumes.

A potential thaw in U.S.–China trade relations dominated macro headlines. Over the weekend, China’s Commerce Ministry said it was reviewing a U.S. proposal to resume negotiations, while President Trump hinted Beijing “wanted to do a deal.”

Polymarket bettors are skeptical, however, with prediction markets giving a 21% chance that a trade deal will be reached by June, and a 47% chance the White House will lower tariffs by the end of May.

Although details were vague on this potential trade deal, markets took notice. The Chinese yuan strengthened to a six-month high near ¥7.19, while regional currencies rallied.

The standout mover was the New Taiwan Dollar (NTD), which surged to a two-year high around NT$29.6 per U.S. dollar as last week ended.

The spike was driven by $1.4 billion (NT$42.9 billion) in foreign equity inflows and surging confidence in Taiwan’s tech sector after TSMC reported a 60% jump in quarterly profits. Taiwan’s central bank intervened to curb volatility but denied political pressure, calling the move market-driven.

BTC range bound?

Further compounding BTC’s relative stagnation is that its encountering significant resistance as it tests key technical and on-chain levels, according to a recent report by Glassnode.

Bitcoin is struggling to break through the $93,000–$95,000 range, an area aligned with both the short-term holder cost basis and the 111-day moving average, marking a crucial battleground for market momentum, the report argues.

«These levels represent a critical inflection point that must be upheld. Failure to stabilize above these levels would push the price back into the consolidation range, and return many investors to a state of meaningful unrealized loss,» the report reads.

However, above $100,000 there is less sell-side pressure due to a smaller volume of coins in that range. If bitcoin can overcome the resistance around $95,000-$98,000 it could enter a relatively clear path toward new price discovery and possibly a new all-time high, the report added.

Uncategorized

Ethereum Preps for Biggest Code Change Since the Merge With Pectra Upgrade

Ethereum developers are preparing for Wednesday’s much anticipated Pectra upgrade, set to bring the biggest code change to the blockchain since the Merge in 2022.

Pectra – a blend of the names Prague + Electra – consists of two upgrades happening on Ethereum’s consensus and execution layers at the same time.

The upgrade is focused on making the Ethereum blockchain more user-friendly and efficient. Pectra consists of 11 major code changes, or «Ethereum improvement proposals» (EIPs), that will improve the staking experience on the network, introduce new wallet features, and update the functionality of the blockchain.

One of the main changes coming to the blockchain is EIP-7702, which gives wallets smart contract capabilities, moving them towards a technological trend known as “account abstraction.” The change will allow wallets to add user-friendly features, like the ability to pay gas fees with currencies other than ether (ETH.)

Another major change, known as EIP-7251, will make the staking experience for validators easier. After Pectra, validators will be able to increase the maximum amount of ETH they can stake from 32 to 2,048, meaning those who stake across multiple validators can now consolidate them under one node. This should mean that it will take less time to spin up a new node and alleviate the cumbersome experience of setting up the equipment.

Some of the changes in Pectra have been planned for a few years, even though developers originally targeted this all to go live in 2024. However, due to the complexities of the code changes, Pectra was delayed until the first quarter of 2025. After the initial delay, developers tested the upgrade twice on two different testnets and both networks experienced bugs, requiring the developers to create a third test, delaying the upgrade once again.

“The Pectra fork is coming to Ethereum mainnet soon! Please don’t forget to update your nodes,” wrote Ethereum Foundation devops engineer Parithosh Jayanthi on X.

The price of ETH has fallen nearly 42% in the last 12 months, while the broader market gauge, CoinDesk 20 Index, dipped about 1.5%.

Read more: Ethereum Developers Lock in May 7 for Pectra Upgrade

Uncategorized

Chainlink to Start New Community Rewards Program for LINK Stakers

Chainlink is rolling out a new community rewards program to incentivize participation in its ecosystem, starting with a token distribution from decentralized data platform Space and Time (SXT).

The program, called Chainlink Rewards, allows those projects based on the network to reward eligible Chainlink node operators and community members who help secure the network.

Founded in 2022, Space and Time is a decentralized data network that uses zero-knowledge proofs to verify database queries and deliver them to smart contracts.

Space and Time has made 4% of their total SXT token supply (200 million) available to Chainlink ecosystem participants, including LINK Stakers. The first batch of SXT tokens, consisting of 100 million SXT, will become claimable by eligible historical and active LINK Stakers on May 8.

The remaining 100 million SXT, as well as any unclaimed SXT, are planned to be made available in a separate campaign in the future. SXT will be offered to both historical and active LINK stakers. Claims will remain open for 90 days.

Token incentives help drive money and users to a blockchain network, adding to demand for that network’s token and a user base that may have previously not interacted with that ecosystem.

Chainlink Rewards is expected to expand over time, with additional Build partners likely to participate in future reward seasons. While token distribution will be project-specific, the broader goal is to create new incentives for users to stake LINK and engage with the Chainlink network more actively.

No details have yet been shared about upcoming reward partners or the long-term schedule of the program as of Monday.

Uncategorized

Bitcoin’s Support at $88.8K in Focus After Trendline Break; XRP Eyes Death Cross: Technical Analysis

This is a daily technical analysis by CoinDesk analyst and Chartered Market Technician Omkar Godbole.

Bitcoin’s (BTC) weekend price movement has brought attention to the $88,800 support level, while XRP, the payments-focused cryptocurrency, seems close to confirming a bearish chart pattern known as the “death cross.»

BTC fell 1.5% on Sunday (UTC), diving out of a trendline connecting lows reached on April 9 and April 20, according to charts sourced from TradingView.

The breakdown of the rising trendline, a demand zone, indicates that the recovery rally from April 9 lows under $75,000 may have run its course, suggesting potential for a renewed price swoon. Prices crossing below the Ichimoku cloud on the hourly chart, a momentum indicator, also suggests the same.

On the downside, $88,800 could serve as a key support level, having previously capped upward moves on March 24 and April 2, which suggests it may act as a critical price point if tested again.

The bearish hourly chart set up risks invalidation on renewed above the Ichimoku cloud, which would reinstate the bullish outlook for rise to $100K.

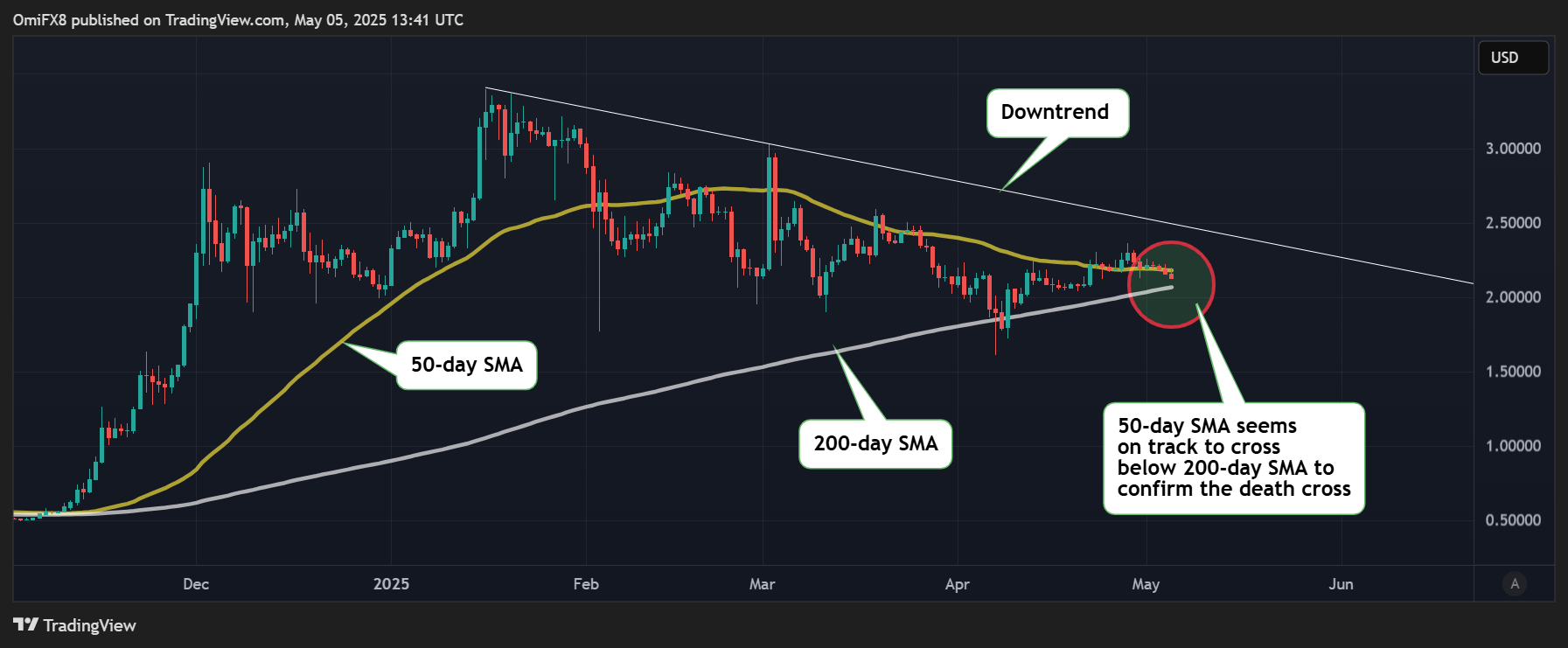

XRP death cross

XRP’s recovery from April 7 lows has run out of steam, too, with prices falling back below the 50-day simple moving average (SMA).

More importantly, the 50-day SMA appears on track to cross below the 200-day SMA in what is known as the death cross long-term bearish indicator.

The impending death cross, against the backdrop of the overall downward trend since mid-January, raises the risk of a deeper sell-off. Note, however, that the death cross’ record in predicting price trends has been mixed in both bitcoin and traditional markets.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors