Uncategorized

State of Crypto: IRS Departures

The IRS, alongside many other regulators, has been pretty active in the crypto world over recent years. On Friday, two directors left.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

Deferred resignations

The narrative

Over 20,000 IRS employees accepted deferred resignation offers made by the Donald Trump administration, including two directors tasked with overseeing digital assets rulemaking.

Why it matters

Raj Mukherjee and Seth Wilks went on paid administrative leave Saturday, though individuals familiar with the situation told CoinDesk that their departures should not indicate any change in the IRS’ approach to crypto rules.

Breaking it down

Wilks, the IRS’ executive director of digital asset strategy and development, and Mukherjee, the executive director of the digital assets office, accepted deferred resignation offers and left the IRS on Friday, two individuals told CoinDesk.

They joined thousands of other IRS employees who accepted the offer, which puts them on paid administrative leave until September.

Both of CoinDesk’s sources said Wilks and Mukherjee left ahead of expected widespread layoffs at the IRS.

Stories you may have missed

- Inside Movement’s Token-Dump Scandal: Secret Contracts, Shadow Advisers and Hidden Middlemen: CoinDesk’s Sam Kessler published a blockbuster investigation into Movement Labs, its recent agreements with a market maker and how its current internal investigation into whether it was misled into signing an agreement which gave that market maker control over a significant number of its tokens came to be.

- Fed Joins OCC, FDIC in Withdrawing Crypto Warnings for U.S. Banks: The Federal Reserve withdrew its crypto guidance advising banks to get pre-approvals before entering crypto activity (and other details).

- TRUMP Coin Jumps 70% on President’s Dinner Event for Top Token Holders: The 220 individuals who hold the most TRUMP tokens will be able to attend a dinner with Donald Trump in May. The news sparked a surge in the token’s price.

- Trump’s Truth Social Mulls Launching Token for Subscriptions in Latest Crypto Push: Truth Social, the social media company owned by Donald Trump’s Trump Media & Technology Group, said in a shareholder letter that it was exploring launching a utility token.

- Bitcoin-Friendly Poilievre Loses Seat as Carney’s Liberals Win 2025 Election: Canada voted, and the Liberal Party is forming a minority government with Mark Carney staying on as the Prime Minister. Conservative Party leader Pierre Poilievre lost his seat.

- Unicoin CEO Rejects SEC’s Attempt to Settle Enforcement Probe: Unicoin rejected a settlement negotiation meeting with the U.S. Securities and Exchange Commission, CEO Alex Konanykhin told shareholders in a letter.

- Senator and Ex-Bridgewater CEO McCormick Invests More in Bitcoin as Bill in Works: Pennsylvania Republican Dave McCormick, who won his seat in last year’s election and now sits on the Senate Banking Committee, disclosed investing up to $450,000 in Bitwise’s Bitcoin exchange-traded fund (ETF).

- New SEC Chief Atkins Says Agency Doesn’t Have to Wait to Impose Crypto Policy: Paul Atkins, who was sworn in as SEC chair last week, said the agency was considering special-purpose broker dealers and custody policies at the latest crypto roundtable hosted by the agency, and that it may not need to wait for new laws to act.

- FBI Says Americans Lost $9.3B to Crypto Scams in 2024: The FBI’s latest Internet Crime Complaint Center report said Americans lost $9.3 billion to crypto crimes last year, a 66% year-over-year rise. Total losses added up to $16.6 billion, and the overall year-over-year increase was 33%.

DOJ’s mixers

Prosecutors and defense attorneys in the Department of Justice’s case against the developers of Samourai Wallet filed a joint memo asking the federal judge overseeing the case to pause it for a few weeks while the DOJ considers a request from the defense to drop it entirely.

An attorney for Roman Storm, asked if the Tornado Cash developer’s team had made a similar request, declined to comment.

This same week, a federal judge ruled that the U.S. Treasury Department cannot sanction Tornado Cash again, saying the Office of Foreign Asset Control did «not suggest they will not sanction Tornado Cash again, and they may seek to ‘reenact precisely the same [designation] in the future.'»

Last month, Leah Moushey, an attorney with Miller & Chevalier, told CoinDesk that the judge may decide to reject OFAC’s argument that the case was moot because of previous cases where agencies tried to keep the ability to redesignate someone after a court case was resolved.

The judge indeed appeared to buy into that view in his ruling.

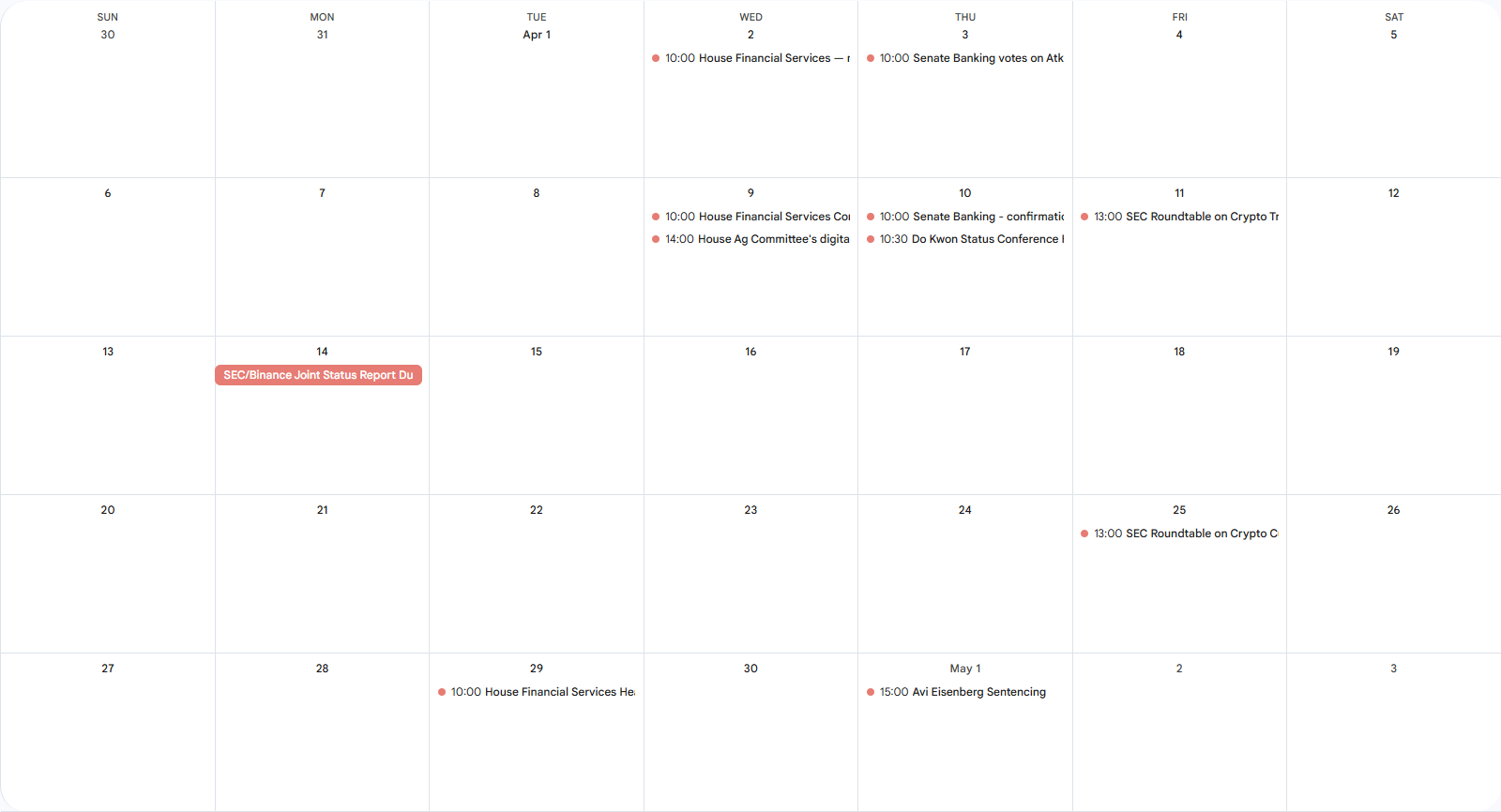

This week

Tuesday

- 14:00 UTC (10:00 a.m. ET) The House Financial Services Committee held a subcommittee hearing titled «Hearing Entitled: Regulatory Overreach: The Price Tag on American Prosperity.»

Thursday

- 19:00 UTC (3:00 p.m. ET) Avraham Eisenberg, who was arrested and tried for his $110 million exploit of Mango Markets, was sentenced to just over four years in prison after pleading guilty to possession of child sexual abuse material. During the sentencing hearing, the federal judge overseeing the case said he was open to a retrial on the Mango Markets-related charges.

Elsewhere:

- (The New York Times) The Times dug into Donald Trump’s entry and deepening connections into the crypto industry.

- (The Washington Post) The Post published a list of the top donors to Trump’s inauguration fund. Included in this list: Ripple Labs ($4.9 million donated), Robinhood Markets ($2 million), Fred Ehrsam, Circle, Coinbase, Crypto.com, Galaxy Digital, Ondo Finance, Kraken and Solana Labs ($1 million each). Several of these companies have since filed to go public, seen the SEC drop lawsuits and investigations against them or announced partnerships with Trump-affiliated businesses.

- (Politico) The Senate is likely to vote on stablecoin legislation before the end of May, Majority Leader John Thune said at a Republican conference lunch.

- (The New York Times) The Times also published a deep dive into Tether and its own deepening ties to Washington, D.C.

- (Reuters) North Korean employees set up corporate entities in the U.S. to target crypto firms.

- (The New York Times) This is a very bonkers story of some folks who stole some crypto. Just read it.

- (Politico) This is a fascinating read by Politico’s Victoria Guida about Canadian Prime Minister Mark Carney’s experience and views.

- (404 Media) Researchers claiming to be part of the University of Zurich set up a «large-scale experiment in which they secretly deployed AI-powered bots into a popular debate subreddit» to see whether AI would change people’s minds. These bots used fake backstories and made over 1,700 comments. Reddit said it was issuing «formal legal demands» to the researchers in response.

- (The New York Times) Roger Ver, i.e. «Bitcoin Jesus,» hired Roger Stone to try and lobby for legal changes that might help Ver, who is accused of tax charges.

- (Semafor) A number of prominent venture capitalists and tech executives, including crypto company executives, have private group chats that Semafor reports show a growing political divide.

- (Wired) Spain and Portugal suffered a massive blackout earlier this week. Wired dug into some of the technical issues at play.

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at nik@coindesk.com or find me on Bluesky @nikhileshde.bsky.social.

You can also join the group conversation on Telegram.

See ya’ll next week!

Uncategorized

Gold-Backed Crypto Minting Volume Hits 3-Year High as Central Bank Buying Drops

The gold market is seeing a shift in activity, with central bank buying slowing and demand from exchange-traded funds and gold-backed cryptocurrencies growing. The latter recently moved to a three-year high, as measured by the net minting volume for tokens backed by the precious metal.

Over $80 million worth of these tokens were minted over the past month, according to data from rwa.xyz. That boost helped push the sector’s market cap up 6% to $1.43 billion. Meanwhile, monthly transfer volume rose 77% to $1.27 billion, marking a sharp resurgence of interest in digital representations of the precious metal.

The rise in token activity mirrors a broader trend in the gold market.

The World Gold Council’s latest report shows that total gold demand in the first quarter of the year reached 1,206 tonnes—a 1% year-over-year increase and the strongest first quarter since 2016. The surge came despite a slowdown in central bank purchases, which fell to 244 tonnes, down from 365 tonnes in the fourth quarter.

Gold ETFs played a central role in the shift. Investment demand has more than doubled to 552 tonnes, suggesting investors are moving into the precious metal, a move central banks are known for historically.

Those inflows helped push the average quarterly price of gold to a record $2,860 per ounce, up 38% from the previous year. Yet the price dipped 2.35% last week, after rising 23.5% year-to-date, while risk assets, including cryptocurrencies, rose. Spot gold is currently trading at $3,240.

While traditional gold demand, such as jewelry, saw a downturn—dropping to pandemic-era lows—bar and coin demand stayed elevated, especially in China.

Read more: Tokenized Gold Surges Above $2B Market Cap as Tariff Fears Spark Safe Haven Trade

Uncategorized

A Tiny Company Wants to Buy $20M TRUMP Token to Change U.S.-Mexico Trade Deals

Freight Technologies (FRGT), a $4.8 million market cap logistics tech firm focused on cross-border trade between the U.S. and Mexico, has entered an agreement to buy up to $20 million in the Official Trump Token (TRUMP) to build out its crypto treasury.

The company said it secured the funding through a convertible note facility with an institutional investor, with an initial $1 million tranche already committed. The capital will be used solely to acquire TRUMP tokens, making it one of the first publicly listed companies to do so.

The decision follows a separate investment in AI-linked FET tokens currently valued at $8 million, which the company says supports AI tools used across its logistics platforms.

Buying digital assets for publicly traded companies isn’t a new strategy.

Michael Saylor championed it with a bitcoin strategy, and others, such as Semler Scientific (SMLR), followed through. Most recently, Cantor (CEP) is making a splash with huge dry powder to do the same. Meanwhile, companies such as Sol Strategies (HODL) and Janover (JNVR) are buying up SOL tokens to give investors exposure to the cryptocurrency.

The trend is also picking up in Japan, where hotel firm Metaplanet has recently hit 5,000 BTC on its balance sheet and issued $25 million in bonds to fund additional purchases. Smaller firms, including Value Creation, Remixpoint, NEXON, Anap Holdings, and WEMADE are also accumulating the cryptocurrency.

However, Freight’s mandate is slightly different: to influence the U.S.-Mexico trade deal amid President Trump’s all-out trade war.

«We believe that the addition of the Official Trump tokens are an excellent way to diversify our crypto treasury, and also an effective way to advocate for fair, balanced, and free trade between Mexico and the US,» Javier Selgas, the company’s CEO, said in a press release on April 30.

While such a strategy could help a company such as Freight, influencing presidential decisions by buying a memecoin could bring up the question of conflict of interest. Just recently, Trump said he will hold a private dinner with top token holders, drawing outcry from Democratic lawmakers, who cited the president’s involvement with the token as potential grounds for impeachment.

On April 25, Sen. Jon Ossoff (D-Ga.) pointed to the crypto project offering its top holders an invitation to a dinner event with President Trump, calling it a clear case of selling access to the presidency.

For Freight, whose stock price plunged nearly 90% in the last 12 months and is heavily tied to cross-border trading, it seems this might be the best way to keep share prices afloat.

“At the heart of Fr8Tech’s mission is the promotion of productive and active commerce between the United States and Mexico. Mexico is the United States’ top goods trading partner, with Mexico being the leading destination for US exports and the top source for US imports,» Selgas added.

After announcing the move, Freight Technologies’ shares jumped over 111% before the closing bell on Friday. However, in after-hours trading, the stock plunged 21.6%.

Freight Technologies’ product lineup includes a suite of applications, ranging from cross-border freight booking to transportation management, all aimed at modernizing the flow of goods in North America.

Other companies have made investments in the crypto space linked to the U.S. President. Last month, DWF Labs invested $25 million in the decentralized finance protocol backed by Trump and his family, World Liberty Financial (WLFI), as it moved to establish a physical presence in the U.S.

The investment gives DWF Labs a governance stake in the project, which has been accumulating various cryptocurrencies and is set to soon launch a stablecoin backed by short-term U.S. Treasury bills and other cash equivalents, called USD1.

TRUMP tokens are trading at $12.7, up just 0.1% for the day and 42% in the last 30 days.

Read more: Why Trump’s Tariffs Could Actually be Good for Bitcoin

Uncategorized

Arizona Governor Calls Crypto an ‘Untested Investment,’ Vetoes Bitcoin Reserve Bill

Arizona will not be investing in bitcoin (BTC), at least not this year.

Governor Katie Hobbs vetoed a bill on Friday that would have allowed the state to hold the digital asset as part of its official reserves.

The legislation, known as Senate Bill 1025, proposed using seized funds to invest in BTC and create a digital assets reserve managed by the state. After passing the state House in a narrow 31–25 vote, the bill reached Hobbs’ desk, where it was swiftly struck down.

“The Arizona State Retirement System is one of the strongest in the nation because it makes sound and informed investments. Arizonans’ retirement funds are not the place for the state to try untested investments like virtual currencу,” Hobbs wrote in a statement.

The veto ends a push that could have made Arizona the first state to set up a cryptocurrency reserve, and it could have even outpaced the U.S. Treasury Department in doing so.

Read more: As One State Gets Closer on a Crypto Reserve, Others Jump Into the Fray

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors