Uncategorized

Bitcoin Traders Brace for ‘Sell in May and Go Away’ as Seasonality Favours Bears

A bitcoin (BTC) breakout earlier this week has traders eyeing the $100,000 level in the coming days, a euphoric trade that could be short-lived as May’s seasonality approaches.

“Historically, the next couple of months have been weak for financial markets, with many investors abiding by the Sell in May and Walk Away adage,” Jeff Mei, COO at BTSE, told CoinDesk in a Telegram message.

“That being said, markets have significantly underperformed over the last few months, but this year could buck the trend, with Bitcoin hitting $97K and other growth stocks coming back over the last few weeks. This past week’s weak GDP numbers coming out of the US indicate some risk, as another report of negative GDP growth next quarter would indicate a recession, but rate cuts could lead to a rebound as well,” Mei added.

The adage “Sell in May and go away” is a long-standing seasonal saying in traditional financial markets.

It suggests that investors should sell their holdings at the beginning of May and return to the market around November, based on the belief that equity markets underperform during the summer due to lower trading volumes, reduced institutional activity, and historical returns data.

The phrase dates back to the early days of London Stock Exchange and was originally “Sell in May and go away, come back on St. Leger’s Day,” referencing a mid-September horse race.

What data shows

Historically, U.S. stock markets have shown weaker performance from May through October than from November through April, leading to the strategy becoming a seasonal rule-of-thumb for some investors.

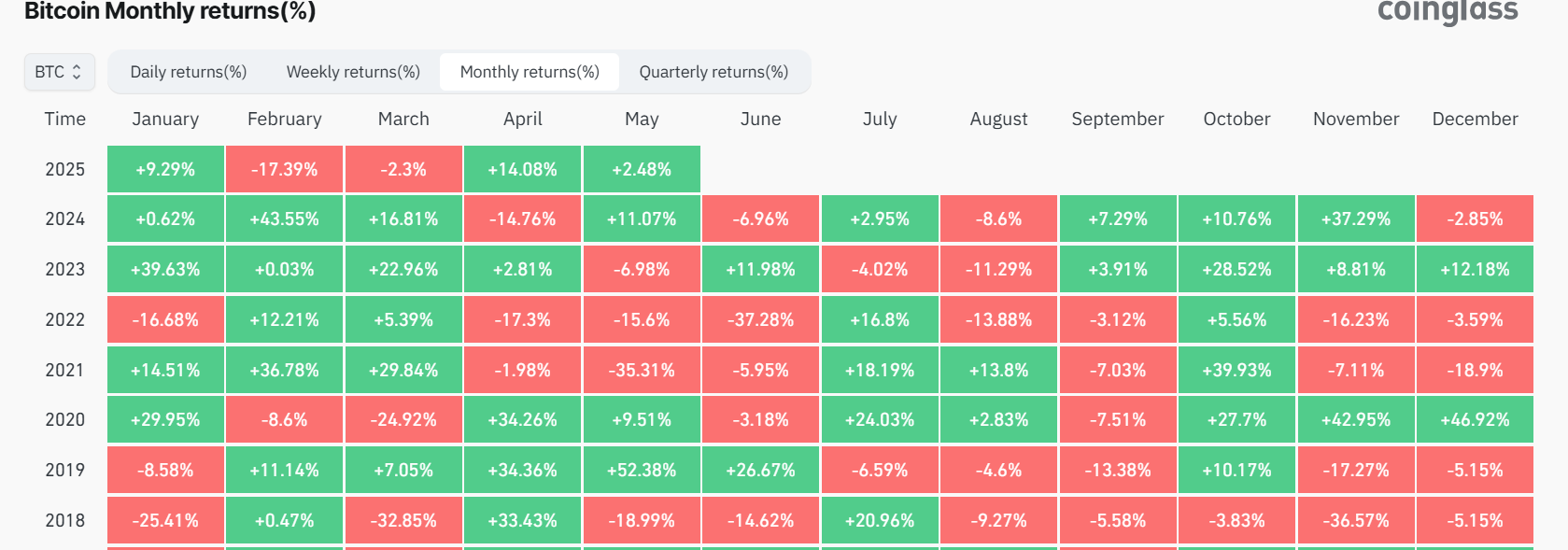

Bitcoin also shows recurring seasonal patterns, often influenced by macro cycles, institutional flows, and retail sentiment. CoinGlass data show the asset’s May performance has been negative or muted recently.

In 2021, BTC dropped 35%, one of its worst months that year. In 2022, May was again negative, with a 15% drop amid Luna’s collapse. In 2023, BTC was flat to mildly positive, reflecting muted volatility.BTC popped up 11% last May and ended May 2019 up 52% — a standout performance from all months following 2018, when crypto markets are generally thought to have matured after that year’s altcoin cycle.

Red May months are followed by more declines in June, the data shows, with four of the past five June months ending in red.

These patterns don’t guarantee future performance, they suggest that crypto markets may be increasingly reacting to the same macro and seasonal sentiment as equities, especially as more institutional capital enters the space.

Sign of caution?

Traders may grow cautious based on historical price seasonality and fading momentum after strong Q1 rallies. Altcoins, especially meme coins, may be particularly vulnerable to pullbacks, given their recent hype-driven rallies and speculative flows.

“Since 1950, the S&P 500 has delivered an average gain of just 1.8% from May through October, with positive returns in about 65% of those six-month periods—well below the stronger performance seen from November through April,” Vugar Usi Zade, COO at crypto exchange Bitget, told CoinDesk in a Telegram message.

Over the past 12 years, average Q2 returns (April–June) for BTC have stood at 26%, but with a median of only 7.5% — a sign of outlier-driven performance and recurring volatility.

By Q3 (July–September), the average return drops to 6%, and the median turns slightly negative, suggesting a pattern of post-Q2 fatigue or consolidation, Zade added, citing data.

“This seasonality overlap suggests caution heading into May. Historically, Q4 marks Bitcoin’s strongest seasonal period, with an average return of +85.4% and a median of +52.3%, whereas Q3 tends to deliver more muted or negative outcomes,” Zade said.

In short, while Wall Street calendars don’t bind crypto, market psychology still responds to narratives, and “Sell in May” could become a self-fulfilling prophecy — especially if technicals start to crack and sentiment flips.

Uncategorized

‘Like Spitting on a Fire’: Tether CEO Slams EU Deposit Protections Amid Bank Failure Warnings

Tether CEO Paolo Ardoino is sounding the alarm on Europe’s financial system, warning that a wave of bank failures could hit the continent in the near future due to the intersection of risky lending and new cryptocurrency rules.

Ardoino, during an interview with the Less Noise More Signal podcast, took aim at the European Union’s regulatory framework for stablecoins, which he said pushes companies like Tether to keep the bulk of their reserves—up to 60%—in uninsured bank deposits.

In his scenario, that could mean holding 6 billion euros of a 10 billion euros-pegged stablecoin in small banks with minimal protection. “The bank insurance in Europe is only 100,000 euros,” he said. “If you have 1 billion euros, that’s like spitting on a fire.”

European banks, like every other bank, operate on a fractional reserve, Ardoino added. “They can lend out 90% of it to people that want to buy a house, start a business, and all of that.” In his hypothetical 6 billion euros scenario, this would mean 5.4 billion euros would be lent out by the bank.

He likened the setup to the lead-up to Silicon Valley Bank’s collapse in 2023, when a flood of redemptions exposed the mismatch between deposits and actual liquidity. Ardoino warned that European banks operate under similar fractional reserve models that could unravel under pressure. A 20% redemption event, he estimated, could leave banks short billions.

«As a stablecoin issuer, you go bankrupt — not because of you, but because of the bank. So the bank goes bankrupt and you go bankrupt, and the government would say, ‘Told you so, stablecoins are very dangerous,” Ardoino said.

Regulations in Europe, he added, are made to try to help banks in the bloc and bring them liquidity, but this created “huge systemic risk.” The largest banks in Europe, like UBS, would “not bank stablecoins,” pushing stablecoin issuers to use smaller banks, furthering the risk.

The comments come as Tether plans to launch a U.S.-based stablecoin product, and as the stablecoin issuer keeps investing in various projects outside of the ecosystem, having recently raised its stake in Latin American producer Adecoagro.

Uncategorized

CME Group Crypto Derivatives Volume Soars 129% in April With ETH Leading the Charge

CME Group’s cryptocurrency derivatives market posted a steep increase in trading activity in April, reaching a new average daily volume (ADV) of 183,000 contracts worth $8.9 billion in notional terms, the firm reported.

That marks a 129% jump compared to the same month last year, suggesting growing institutional interest in crypto markets.

Ether led the growth. CME’s ether futures ADV surged 239% to 14,000 contracts, while micro ether futures climbed 165% to 63,000. Micro bitcoin futures followed with a 115% increase to 78,000 contracts.

The CME’s bitcoin and ether futures contracts have a larger notional value, of 5 BTC and 50 ETH, respectively. Micro contracts, meanwhile, enable more precise trading, representing just 0.1 of each cryptocurrency.

The exchange operator had already reported record cryptocurrency derivatives volumes in the first quarter of the year. For the month of April, its overall ADV reached a record 35.9 million contracts, rising 36% year-over-year.

Ether, after significantly underperforming the wider cryptocurrency market, rose just 1.1% over the past 30 days, while the price of bitcoin rose 15.8%. The broader crypto market, measured through the coinDesk 20 (CD20) index, saw a 12.1% rise.

Uncategorized

State of Crypto: IRS Departures

The IRS, alongside many other regulators, has been pretty active in the crypto world over recent years. On Friday, two directors left.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

Deferred resignations

The narrative

Over 20,000 IRS employees accepted deferred resignation offers made by the Donald Trump administration, including two directors tasked with overseeing digital assets rulemaking.

Why it matters

Raj Mukherjee and Seth Wilks went on paid administrative leave Saturday, though individuals familiar with the situation told CoinDesk that their departures should not indicate any change in the IRS’ approach to crypto rules.

Breaking it down

Wilks, the IRS’ executive director of digital asset strategy and development, and Mukherjee, the executive director of the digital assets office, accepted deferred resignation offers and left the IRS on Friday, two individuals told CoinDesk.

They joined thousands of other IRS employees who accepted the offer, which puts them on paid administrative leave until September.

Both of CoinDesk’s sources said Wilks and Mukherjee left ahead of expected widespread layoffs at the IRS.

Stories you may have missed

- Inside Movement’s Token-Dump Scandal: Secret Contracts, Shadow Advisers and Hidden Middlemen: CoinDesk’s Sam Kessler published a blockbuster investigation into Movement Labs, its recent agreements with a market maker and how its current internal investigation into whether it was misled into signing an agreement which gave that market maker control over a significant number of its tokens came to be.

- Fed Joins OCC, FDIC in Withdrawing Crypto Warnings for U.S. Banks: The Federal Reserve withdrew its crypto guidance advising banks to get pre-approvals before entering crypto activity (and other details).

- TRUMP Coin Jumps 70% on President’s Dinner Event for Top Token Holders: The 220 individuals who hold the most TRUMP tokens will be able to attend a dinner with Donald Trump in May. The news sparked a surge in the token’s price.

- Trump’s Truth Social Mulls Launching Token for Subscriptions in Latest Crypto Push: Truth Social, the social media company owned by Donald Trump’s Trump Media & Technology Group, said in a shareholder letter that it was exploring launching a utility token.

- Bitcoin-Friendly Poilievre Loses Seat as Carney’s Liberals Win 2025 Election: Canada voted, and the Liberal Party is forming a minority government with Mark Carney staying on as the Prime Minister. Conservative Party leader Pierre Poilievre lost his seat.

- Unicoin CEO Rejects SEC’s Attempt to Settle Enforcement Probe: Unicoin rejected a settlement negotiation meeting with the U.S. Securities and Exchange Commission, CEO Alex Konanykhin told shareholders in a letter.

- Senator and Ex-Bridgewater CEO McCormick Invests More in Bitcoin as Bill in Works: Pennsylvania Republican Dave McCormick, who won his seat in last year’s election and now sits on the Senate Banking Committee, disclosed investing up to $450,000 in Bitwise’s Bitcoin exchange-traded fund (ETF).

- New SEC Chief Atkins Says Agency Doesn’t Have to Wait to Impose Crypto Policy: Paul Atkins, who was sworn in as SEC chair last week, said the agency was considering special-purpose broker dealers and custody policies at the latest crypto roundtable hosted by the agency, and that it may not need to wait for new laws to act.

- FBI Says Americans Lost $9.3B to Crypto Scams in 2024: The FBI’s latest Internet Crime Complaint Center report said Americans lost $9.3 billion to crypto crimes last year, a 66% year-over-year rise. Total losses added up to $16.6 billion, and the overall year-over-year increase was 33%.

DOJ’s mixers

Prosecutors and defense attorneys in the Department of Justice’s case against the developers of Samourai Wallet filed a joint memo asking the federal judge overseeing the case to pause it for a few weeks while the DOJ considers a request from the defense to drop it entirely.

An attorney for Roman Storm, asked if the Tornado Cash developer’s team had made a similar request, declined to comment.

This same week, a federal judge ruled that the U.S. Treasury Department cannot sanction Tornado Cash again, saying the Office of Foreign Asset Control did «not suggest they will not sanction Tornado Cash again, and they may seek to ‘reenact precisely the same [designation] in the future.'»

Last month, Leah Moushey, an attorney with Miller & Chevalier, told CoinDesk that the judge may decide to reject OFAC’s argument that the case was moot because of previous cases where agencies tried to keep the ability to redesignate someone after a court case was resolved.

The judge indeed appeared to buy into that view in his ruling.

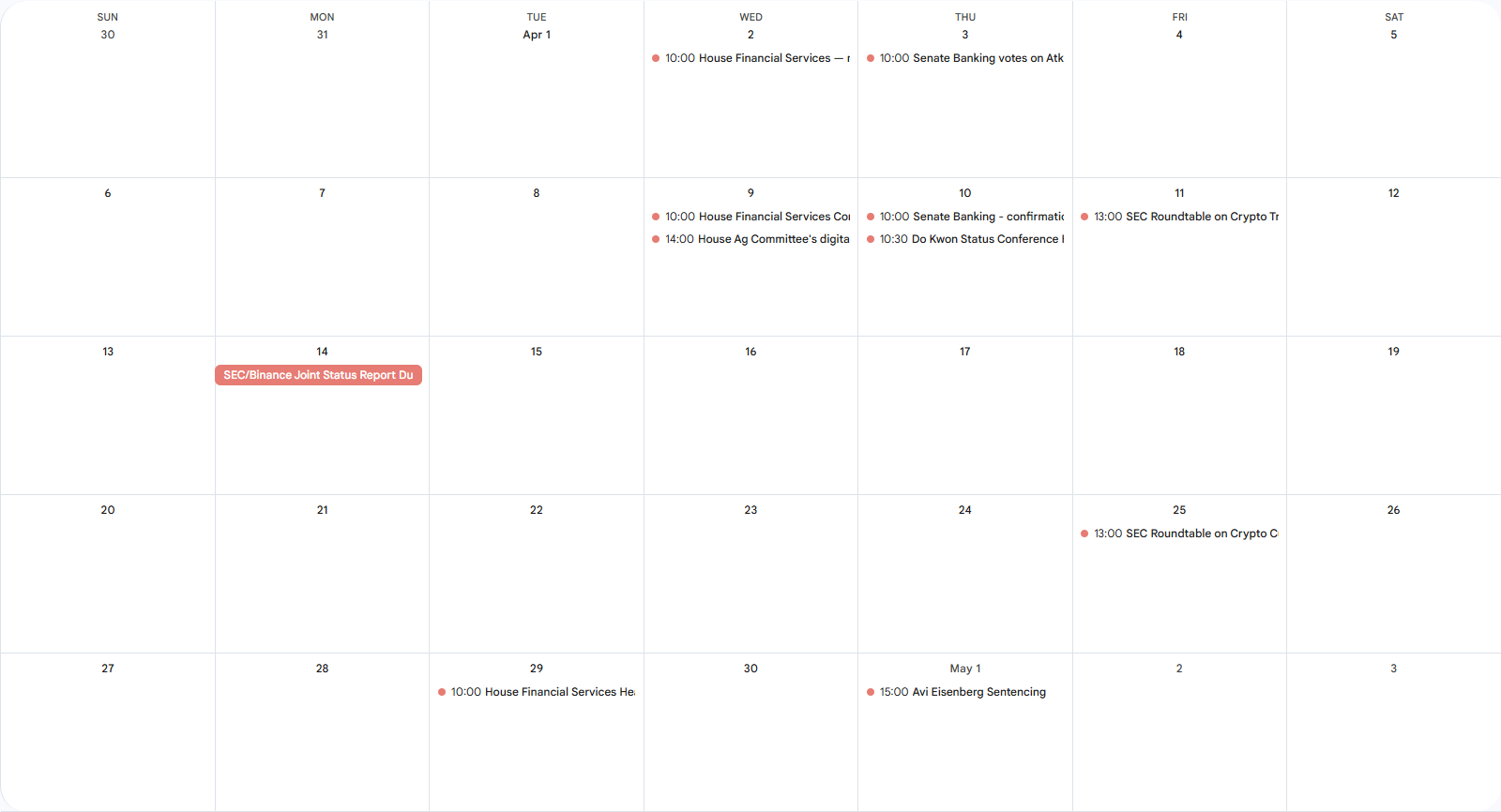

This week

Tuesday

- 14:00 UTC (10:00 a.m. ET) The House Financial Services Committee held a subcommittee hearing titled «Hearing Entitled: Regulatory Overreach: The Price Tag on American Prosperity.»

Thursday

- 19:00 UTC (3:00 p.m. ET) Avraham Eisenberg, who was arrested and tried for his $110 million exploit of Mango Markets, was sentenced to just over four years in prison after pleading guilty to possession of child sexual abuse material. During the sentencing hearing, the federal judge overseeing the case said he was open to a retrial on the Mango Markets-related charges.

Elsewhere:

- (The New York Times) The Times dug into Donald Trump’s entry and deepening connections into the crypto industry.

- (The Washington Post) The Post published a list of the top donors to Trump’s inauguration fund. Included in this list: Ripple Labs ($4.9 million donated), Robinhood Markets ($2 million), Fred Ehrsam, Circle, Coinbase, Crypto.com, Galaxy Digital, Ondo Finance, Kraken and Solana Labs ($1 million each). Several of these companies have since filed to go public, seen the SEC drop lawsuits and investigations against them or announced partnerships with Trump-affiliated businesses.

- (Politico) The Senate is likely to vote on stablecoin legislation before the end of May, Majority Leader John Thune said at a Republican conference lunch.

- (The New York Times) The Times also published a deep dive into Tether and its own deepening ties to Washington, D.C.

- (Reuters) North Korean employees set up corporate entities in the U.S. to target crypto firms.

- (The New York Times) This is a very bonkers story of some folks who stole some crypto. Just read it.

- (Politico) This is a fascinating read by Politico’s Victoria Guida about Canadian Prime Minister Mark Carney’s experience and views.

- (404 Media) Researchers claiming to be part of the University of Zurich set up a «large-scale experiment in which they secretly deployed AI-powered bots into a popular debate subreddit» to see whether AI would change people’s minds. These bots used fake backstories and made over 1,700 comments. Reddit said it was issuing «formal legal demands» to the researchers in response.

- (The New York Times) Roger Ver, i.e. «Bitcoin Jesus,» hired Roger Stone to try and lobby for legal changes that might help Ver, who is accused of tax charges.

- (Semafor) A number of prominent venture capitalists and tech executives, including crypto company executives, have private group chats that Semafor reports show a growing political divide.

- (Wired) Spain and Portugal suffered a massive blackout earlier this week. Wired dug into some of the technical issues at play.

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at nik@coindesk.com or find me on Bluesky @nikhileshde.bsky.social.

You can also join the group conversation on Telegram.

See ya’ll next week!

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors