Uncategorized

Tokenized Apollo Credit Fund Makes DeFi Debut With Levered-Yield Strategy by Securitize, Gauntlet

DUBAI, UAE — Tokenization firm Securitize and decentralized finance (DeFi) specialist Gauntlet are planning to bring a tokenized version of Apollo’s credit fund to DeFi, a notable step in embedding real-world assets into the crypto ecosystem.

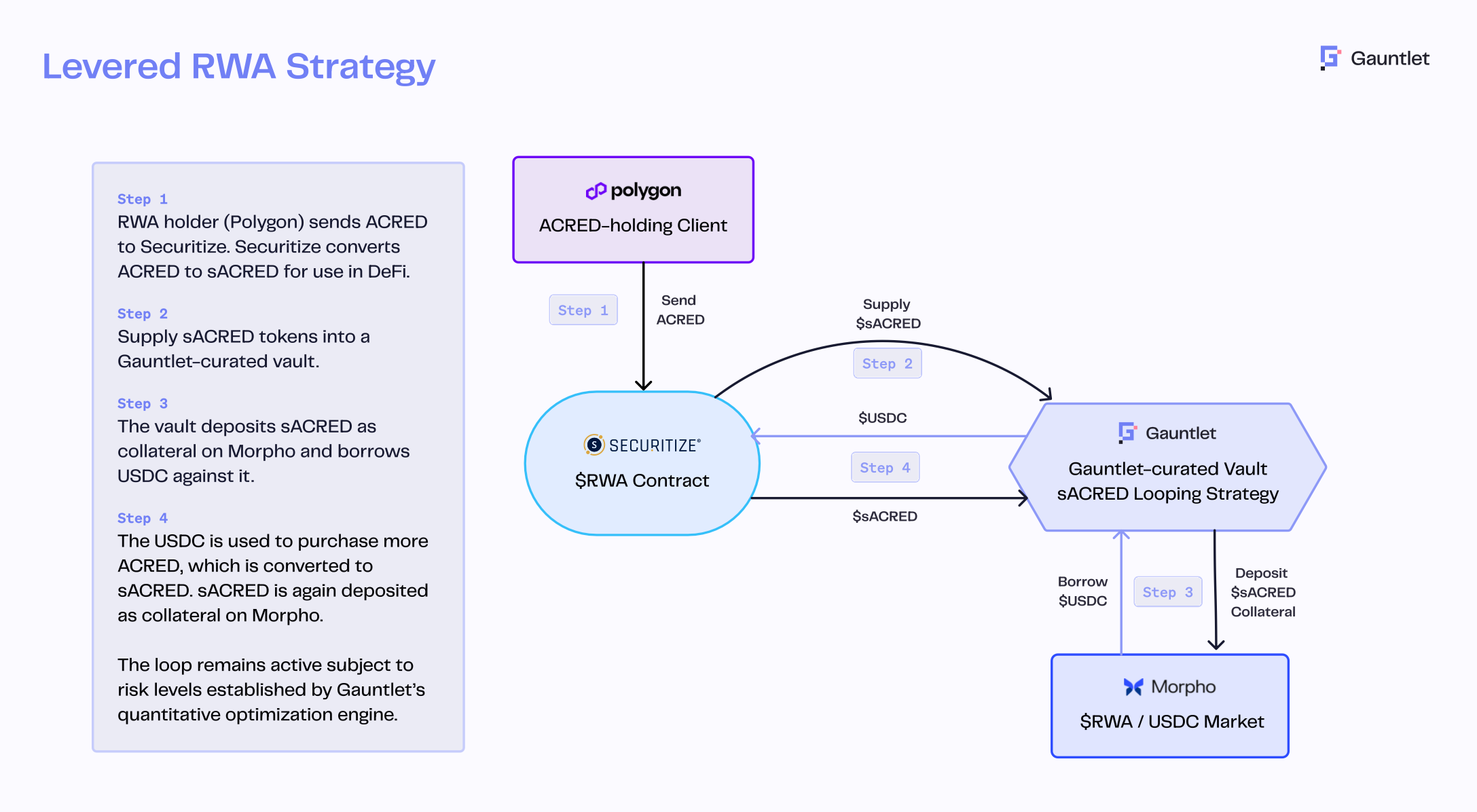

The two firms are unveiling Wednesday a leveraged-yield strategy offering centered on the Apollo Diversified Credit Securitize Fund (ACRED), a tokenized feeder fund that debuted in January and invests in Apollo’s $1 billion Diversified Credit Fund. The strategy will run on Compound Blue, a lending protocol powered by Morpho,

The offering, called Levered RWA Strategy, will be first available on Polygon (POL). It is expected to expand to the Ethereum mainnet and other blockchains after a pilot phase.

«The idea behind the product is we want our securities to be plug and play competitive with stablecoin strategies writ large,» Reid Simon, head of DeFi and credit solutions at Securitize, said in an interview with CoinDesk.

DeFi strategy built on tokenized asset

The introduction comes as tokenized RWAs — funds, bonds, credit products — gain traction among traditional finance giants. BlackRock, HSBC, and Franklin Templeton are among the firms exploring blockchain-based asset issuance and settlement. Tokenized U.S. Treasuries alone have pulled in over $6 billion, according to data from RWA.xyz.

While institutions are experimenting with tokenization, the next challenge is making these assets usable across DeFi applications. That includes enabling their use as collateral for loans, margin trading or building investment strategies not possible on legacy rails.

The strategy employs a DeFi-native yield-optimization technique called «looping», in which ACRED tokens deposited into a vault are used as collateral to borrow USDC, which is then used to purchase more ACRED. The process repeats recursively to enhance yield, with exposure adjusted dynamically based on real-time borrowing and lending rates.

All trades are automated using smart contracts, reducing the need for manual oversight. Risk is actively managed by Gauntlet’s risk engine, which monitors leverage ratios and can unwind positions in volatile market conditions to protect users.

«This is expected to deliver the institutional-grade DeFi that our industry has promised for years,» Morpho CEO and cofounder Paul Frambot said. «This use case uniquely demonstrates how DeFi enables investors in funds like ACRED to access financial composability that is simply not possible on traditional rails.”

The vault is also one of the first uses of Securitize’s new sToken tool, which allows accredited token holders to maintain compliance and investor protections within decentralized networks. In this case, ACRED investors first mint sACRED that they can use for broader DeFi strategies without breaking regulatory rules.

«This is a strong example of the institutional-grade DeFi we’ve been working to build: making tokenized securities not only accessible, but compelling to crypto-native investors seeking strategies that objectively outpace their traditional counterparts,” Securitize CEO Carlos Domingo said in a statement.

Uncategorized

Crypto Rebounds From Early Declines Alongside Reversal in U.S. Stocks

There was a bit of volatility in crypto on Wednesday, but most of the market continued the weeks’ trend of trading in a very tight range.

Shortly after the close of the U.S. stock market, bitcoin (BTC) was changing hands at $94,700, down just 0.4% over the past 24 hours. BTC was lower by nearly 2% at one point alongside a sizable early decline in stocks.

Hit harder during the early decline, altcoins also rebounded, but underperformed bitcoin The CoinDesk 20 slumped 2% in the last 24 hours, with litecoin (LTC), ripple (XRP), avalanche (AVAX) and chainlink (LINK) all dropping roughly 4%.

Crypto equities were modestly lower, but bitcoin miner Hut 8 (HUT) was a notable underperformer, falling 5.7%.

The major U.S. stock averages tumbled 2% or more early in the session following less than stellar economic news. They retook ground throughout the day though, with the S&P 500 closing slightly in the green and the Nasdaq dipping just 0.1%.

The continuing string of lame economic data, however, has not seemed to deter U.S. President Trump from his tariff policies.

“Somebody said all the shelves are going to be open,” Trump said early Wednesday. “Well, maybe the children will have two dolls instead of 30 dolls, and maybe the two dolls will cost a couple of bucks more than they would normally. … They have ships that are loaded up with stuff, much of which we don’t need.”

Uncategorized

Robinhood Tops Q1 Earnings Estimates, Boosts Buyback Authorization by $500M

Robinhood (HOOD) topped tempered analyst estimates in the first quarter of 2025, reporting adjusted earnings per share of $0.37 against forecasts for $0.33.

The popular trading platform reported $927 million in total revenue, down from $1 billion in the fourth-quarter, but beating Street expectations of $920.1 million. Crypto-related revenue was $252 million, up 100% from year-ago levels.

Transaction-based revenue of $583 million slipped 13% from $672 million in the fourth quarter.

Robinhood had seen explosive numbers in the fourth quarter, in part thanks to a surge in crypto trading amid euphoria stemming from U.S. President Donald Trump’s presidential win. But the froth in crypto and traditional markets quickly reversed following Trump’s inauguration.

The company added $500 million to its existing $1 billion share repurchase program. To date, HOOD has bought back $667 million, leaving another$833 million under the authorization.

Robinhood’s monthly crypto volumes have historically shown high correlation with Coinbase’s (COIN) retail volumes, but Barclays analyst Benjamin Buddish believes the COIN will have seen a less meaningful decline in trading volumes in the first quarter.

Coinbase is reporting earnings on May 8 and is expected to post a slight decline in revenue to $2.1 billion from $2.27 billion in the previous quarter, while exchange volume is expected to have dropped to $403.8 from $439 billion, according to analysts at FactSet.

HOOD shares are down 2.2% in after hours action.

Uncategorized

Visa and Baanx Launch USDC Stablecoin Payment Cards

Cryptocurrency debit card firm Baanx has partnered with Visa to launch stablecoin payment cards tied to self-custodial wallets, starting in the U.S. with Circle’s USDC dollar pegged token, the companies said.

The Visa cards enable holders to spend USDC directly from their crypto wallets, using smart contracts to move a stablecoin balance upon card authorization from the consumer to Baanx in real time, with Baanx converting the balance into fiat for payment, according to a press release on Wednesday.

Allowing people to manage their money on-chain with the help of major card networks like Visa and Mastercard is a fast growing segment within crypto. Baanx, a firm that specializes in crypto debit cards, is also working with Mastercard on a card linked to MetaMask wallets.

The stablecoin payments is also heating up with Circle recently announcing its own payment network focused initially on cross-border payments and remittances.

Baanx’s stablecoin-linked Visa cards promise a global reach with low-cost cross border payments in the mix, according to the release.

“In many regions, access to stable currency is a luxury. We’re giving people the ability to hold and spend USD-backed stablecoins seamlessly — in a self-custodial, real-time way — anywhere Visa is accepted. This is what the future of finance looks like,” said Simon Jones, chief commercial officer at Baanx in a statement.

“We know the payments ecosystem is still in the early innings of stablecoin adoption, but real-world utility is coming to the forefront, and we’re excited for what’s next,” said Rubail Birwadker, Visa’s head of growth products and partnerships in a statement.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors