Uncategorized

Bitcoin Debate on Looser Data Limits Brings to Mind the Divisive Ordinals Controversy

Bitcoin developers are again at odds over how the world’s oldest and largest blockchain should handle storing information on-chain, with a proposal to relax long-standing limits on the size of data held sparking fierce debate reminiscent of 2023’s battles over Ordinals.

The blockchain’s OP_RETURN feature allows people attach a small piece of extra data to a transaction It is often used for things like notes, timestamps or digital records. The proposed change, put forward by developer Peter Todd, would remove the 80-byte cap on such data, a limit originally designed to discourage spam and preserve the blockchain’s financial integrity.

Supporters argue the current limit is pointless because users are already bypassing it by using Taproot transactions, to hide data inside parts of the transaction meant for cryptographic signatures. This is how Ordinals and Inscriptions work (and why they have their critics): They embed images or text into Taproot transactions that are often unspendable, turning the Bitcoin blockchain into a kind of data storage system.

Bitcoin Core developer Luke Dashjr, a vocal critic of Ordinals, which he has long labeled a “spam attack” on the blockchain, called the proposal “utter insanity” and warned that loosening data restrictions would accelerate what he sees as the degradation of Bitcoin’s financial-first purpose.

“It should be needless to say, but this idea is utter insanity,” Dashjr posted. “The bugs should be fixed, not the abuse embraced.”

Critics of the proposal also have another concern. The change could normalize illegal content storage, degrade the chain’s fungibility, and turn node operators into unwitting hosts of malware and copyright violations.

To demonstrate the potential maelstrom this may bring, one Ordinals team inscribed a whole Nintendo 64 emulator onto the blockchain, which may get the attention of Nintendo, a company known for being protective of its intellectual property.

Supporters of the change, including Pieter Wuille and Sjors Provoost, argued that relaxing OP_RETURN limits may actually reduce what’s known as UTXO (unspent transaction output) bloat, a phenomenon that slows down the blockchain when the network gets cluttered with non-financial transactions, and mempool fragmentation.

UTXO bloat is a documented side effect of Ordinals and Inscriptions using Taproot transactions. For example, in May 2023, at the height of Ordinals’ popularity, the Bitcoin blockchain became so congested Binance had to suspend bitcoin (BTC) withdrawals for a number of hours.

“The demand exists,” Wuille wrote. “And pushing it outside the public relay network only causes greater harm.”

For now, the proposal remains under review. One thing is for certain: The intensity of debate on GitHub and blockchain developer mailing lists shows the battle for Bitcoin’s identity is far from over.

Uncategorized

AI-Powered Court System Is Coming to Crypto With GenLayer

What if there were a crypto protocol that specialized in arbitrating on-chain disputes?

Imagine if, whenever prediction markets like Polymarket settled in a controversial manner, users had a formal way to appeal through a sort of neutral on-chain court system. Or if decentralized autonomous organizations (DAOs) could rely on an efficient, knowledgeable third party to help them make decisions. Or if insurance contracts could automatically execute payouts when specific real-world events occurred.

That’s essentially what Albert Castellana Lluís and his team are building with GenLayer, a crypto project that markets itself as a decision-making system, or trust infrastructure.

“We’re using a blockchain that has multiple AIs coordinate and reach agreement on subjective decisions, as if they were a judge,» Castellana, co-founder and CEO of YeagerAI told CoinDesk in an interview. «We’re basically building a global synthetic jurisdiction that has an embedded court system that doesn’t sleep, that’s super cheap, and that’s super fast.”

The demand for such an arbitration project may spike in the coming years with the development of AI agents — sophisticated programs powered by artificial intelligence that are capable of carrying out complex tasks in an autonomous manner.

When it comes to crypto markets, AI agents can be used in all kinds of ways: for trading memecoins, arbitraging bitcoin on exchanges, monitoring the security of DeFi protocols, or providing market insights through in-depth analysis, to cite only a few use-cases. AI agents will also be able to hire other AI agents in order to complete even more complex assignments.

Such agents may proliferate at an unexpected rate, Castellana said. In his view, most crypto market participants could be managing a handful of them by the end of 2025.

“These agents, they work super fast, they don’t sleep, they don’t go to jail. You don’t know where they are. Are they going to pass anti-money laundering rules? Are they going to have a bank account? Can they even use a Visa card?” Castellana said. “How can we enable fast transactions between them? And how can trust happen in a world like this?”

Thanks to its unique architecture, GenLayer could provide a solution by allowing entities — human or AI — to get a reliable, neutral opinion to weigh in on any decision in record time. “Anywhere where you normally would have a third party made of a bunch of humans… We replace them with a global network that provides a consensus between different AIs, a network that can make decisions in a way that is as correct and as unbiased as possible,” Castellana said.

Synthetic court system

GenLayer doesn’t seek to compete with other blockchains like Bitcoin, Ethereum or Solana — or even DeFi protocols such as Uniswap or Compound. Rather, the idea is for any existing crypto protocol to be able to connect to GenLayer and make use of its infrastructure.

GenLayer’s chain is powered by ZKsync, an Ethereum layer 2 solution. Its network counts 1,000 validators, each one connected to a large language model (LLM) such as OpenAI’s ChatGPT, Google’s Bert or Meta’s Llama.

Let’s say a market on Polymarket settles in a controversial manner. If Polymarket is connected to GenLayer, users of the prediction market have the ability to raise the issue (or, as Castellana put it, to create a “transaction”) with its synthetic court system.

As soon as the transaction comes in, GenLayer picks five validators at random to rule on it. These five validators query an LLM of their choice in order to find information on the topic at hand, and then vote on a solution. That produces a ruling.

But the Polymarket users, in our example, don’t necessarily need to be satisfied with the ruling: they can decide to appeal the decision. In which case, GenLayer picks another set of validators — except this time, their number jumps to 11. Just like before, the validators issue a ruling based on the information they gather from LLMs. That decision can also be appealed, which makes GenLayer pick 23 validators for another ruling, then 47 validators, then 95, and so on and so forth.

The idea is to rely on Condorcetʼs Jury Theorem, which according to GenLayer’s pitch deck states that “when each participant is more likely than not to make a correct decision, the probability of a correct majority outcome increases significantly as the group grows larger.” In other words, GenLayer finds wisdom in the crowd. The more validators are involved, the more likely they are to zero in on an accurate answer.

“What this means is that we can start small and very efficiently, but also we can escalate to a point where something very, very tricky, they can still get right,” Castellana said.

The average transaction takes roughly 100 seconds to process, Castellana said, and the court’s decision becomes final after 30 minutes — a timeframe that can be elongated if multiple appeals occur. But that means the protocol can reach a decision on major issues in a very short period of time, day or night, instead of going through arduous real-world litigation processes which may take months or even years.

Looking at incentives

GenLayer’s mission naturally raises a question: is it possible to game the system? For example, what if all of the validators select the same AI (say, ChatGPT) to solve a given proposal? Wouldn’t that mean that ChatGPT will have essentially issued the ruling?

Every time you query an LLM, you generate a new seed, Castellana said, so you obtain a different answer. On top of that, validators have the freedom of choosing which LLM to use based on the topic at hand. If it’s a relatively easy question, perhaps there’s no need to use an expensive LLM; on the other hand, if the question is particularly complex, the validator may opt for a higher-quality AI model.

Validators may even end up in a situation where they feel like they’ve seen a certain type of question so many times that they can pre-train a small model for a specific purpose. “We think that, over time, there’s just going to be endless new models,” Castellana said.

There’s a strong incentive for validators to be on the winning side of the decision-making process, because they’re financially rewarded for it — while the losing side ends up incurring costs associated with using computation, without collecting any rewards.

In other words, the question is not whether one’s validator is providing a correct answer, but whether it manages to side with the majority.

Since validators have no idea what other validators are voting, the goal is for them to use the necessary resources to provide accurate information with the expectation that other validators will converge on that information as well — because arriving at the same incorrect answer would probably require rigorous coordination.

And if that gambit doesn’t work out, the appeal system is ready to kick in.

“If I know that I’m reusing a good LLM, and I think that other people are using a bad LLMs and that’s why I lost, then I have quite a big incentive to appeal, because I know that with more people, there’s going to be an incentive for them to be using better LLMs as well” since other validators will want to earn the rewards from a successful appeal, Castellana said.

The system makes it hard for validators to collude, because they only have 100 seconds to reach a decision, and they don’t know whether they will be picked to settle specific questions. An entity would need to control between 33% and 50% of the network to be able to attack it, Castellana said.

Like Ethereum, GenLayer will be using a native token for its financial incentives. With a testnet already launched, the project should go live by the end of the year, according to Castellana. “There’s going to be a very big incentive for people to come and build things on top,” he said.

Uncategorized

How Alpha-Generating Digital Asset Strategies Will Reshape Alternative Investing

Mainstream conversations around digital assets largely focus on the dramatic price performance of bitcoin and ether. For years, retail and institutional investors have targeted beta exposure, or returns that mirror the broader crypto market. However, the introduction of products like bitcoin exchange-traded funds (ETFs) and exchange-traded products (ETPs) have made achieving beta more accessible, with these products drawing over $100 billion in institutional capital.

But as the asset class matures, the conversation is shifting. More institutions are now pursuing alpha, or returns that exceed the market, through actively managed strategies.

The role of uncorrelated returns in diversification

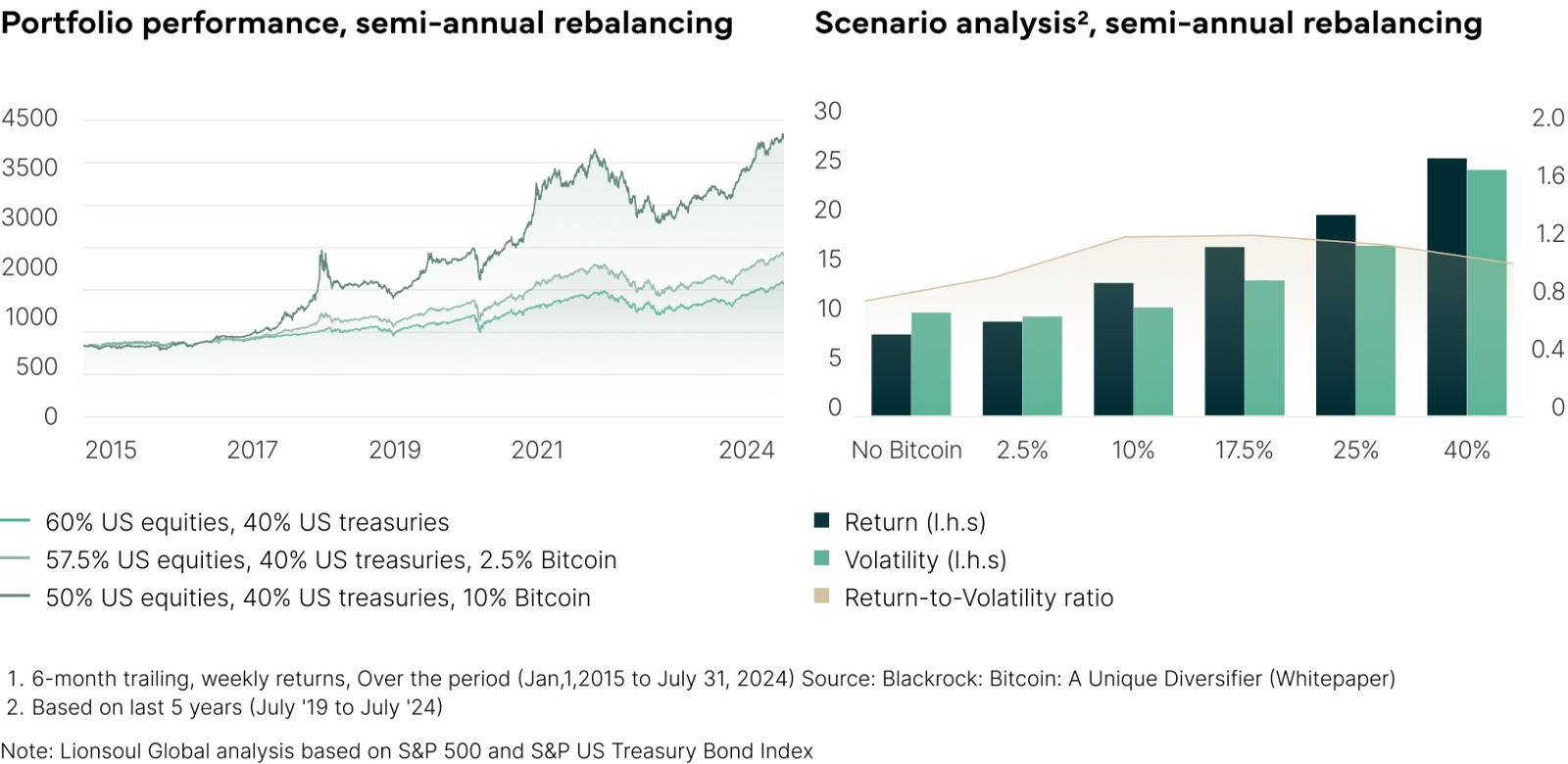

Low correlation to traditional assets enhances the role of digital assets in diversified portfolios. Since 2015, bitcoin’s daily correlation to the Russell 1000 Index has been just 0.231, meaning that bitcoin’s daily returns move only weakly in the same direction as the Russell 1000 Index, with gold and emerging markets remaining similarly low. A modest 5% allocation to bitcoin in a 60/40 portfolio, a portfolio containing 60% equities and 40% fixed income, has been shown to boost the Sharpe ratio (the measure of risk-adjusted return on a portfolio) from 1.03 to 1.43. Even within crypto itself, varying correlations allow for intra-asset diversification. This makes digital assets a powerful tool for risk-adjusted return enhancement [see exhibit 1].

Digital assets enter the active era

Just as hedge funds and private equity redefined traditional markets, digital assets are now evolving beyond index-style investing. In traditional finance, active management represents over 60% of global assets. With informational asymmetries, fragmented infrastructure and inconsistent pricing, digital assets present a compelling landscape for alpha generation.

This transition mirrors the early stages of the alternatives industry, when hedge funds and private equity capitalized on inefficiencies long before these strategies were adopted by the mainstream.

Market inefficiencies

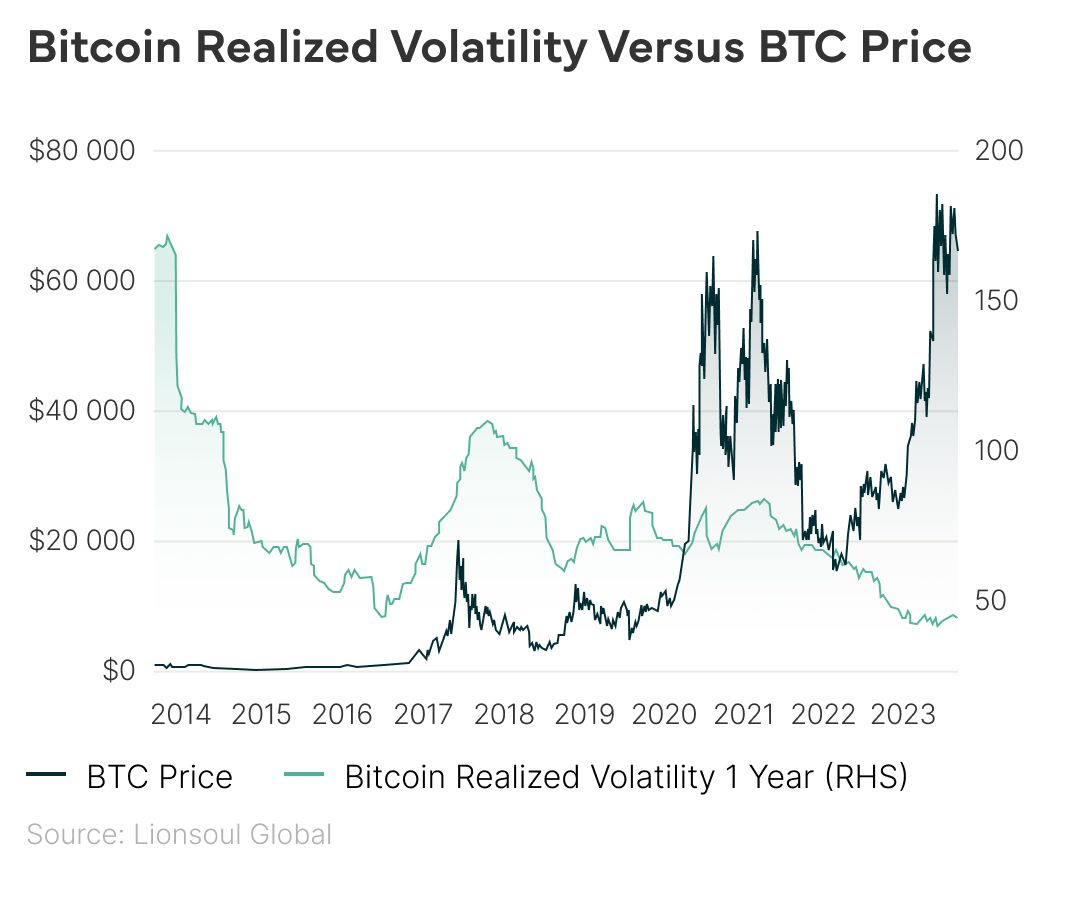

Crypto markets remain volatile and structurally inefficient. Though bitcoin’s annualized volatility fell below 40% in 2024, it remains more than twice that of the S&P 500. Pricing inconsistencies across exchanges, regulatory fragmentation and the dominance of retail behavior create significant opportunities for active managers.

These inefficiencies — combined with limited competition in institutional-grade alpha strategies — present a compelling case for specialized investment approaches.

- Arbitrage strategies: Utilization of trading strategies such as cash and carry, which captures spreads between spot and futures prices, or basis trading, which involves entering long positions in discounted assets and shorts in premium ones, enables alpha generation by utilizing market inefficiencies within the digital assets market.

- Market making strategies: Market makers earn returns by placing bid/ask quotes to capture spread. Success relies on managing risks like inventory exposure and slippage, especially in fragmented or volatile markets.

- Yield farming: Yield farming taps into Layer 2 scaling solutions, decentralized finance (DeFi) platforms and cross-chain bridges. Investors can earn yields through lending protocols or by providing liquidity on decentralized exchanges (DEXs), often earning both trading fees and token incentives.

- Volatility arbitrage strategy: This strategy targets the gap between implied and realized volatility in crypto options markets, offering market-neutral alpha through advanced forecasting and risk management.

High upside and an expanding universe

Meanwhile, new opportunities continue to emerge. Tokenized real-world assets (RWAs) are projected to exceed $10.9 trillion by 2030, while DeFi protocols, which have amassed 17,000 unique tokens and business models while accumulating $108 billion+ in assets, are expected to surpass $500 billion in value by 2027. All of this points towards an ever expanding, ever developing digital asset ecosystem that is ideal for investors to utilize as a legitimate alpha generating medium.

Bitcoin’s price has surged over the years, while its long-term realized volatility has steadily declined, signaling a maturing market.

Uncategorized

AI Crypto Agents Are Ushering in a New Era of ‘DeFAI’

Imagine your investments working around the clock, scanning global markets for the best opportunities — all without you having to lift a finger. Sound futuristic? It’s already a reality.

In traditional finance (TradFi), algorithms handle nearly 70% of U.S. stock trades. Now, artificial intelligence (AI) agents are stepping up. These aren’t just basic bots but innovative systems that learn, adapt and make real-time decisions. VanEck predicts the number of AI agents will skyrocket from 10,000 to over a million by the end of 2025.

What this means for you

AI agents are already at work behind the scenes analyzing market trends, balancing portfolios and even managing liquidity across decentralized exchange platforms like SaucerSwap and Uniswap. They’re blurring the lines between TradFi and decentralized finance (DeFi), with cross-chain transactions expected to jump 20% in 2025.

Can we really trust AI with our money?

Autonomous finance isn’t new, but today’s AI agents operate with increased autonomy and sophistication. So, can we trust these agents to manage billions in digital assets? What safeguards exist when decisions come from algorithms, not humans? Who would be held responsible for market manipulation performed by an agent?

These concerns are valid. As AI agents take on more responsibility, and especially as the convergence between crypto and TradFi accelerates, worries around transparency and market manipulation will grow. For example, some blockchains enable front running trades and sandwich attacks that can exploit blockchain consensus in a process known as Maximal Extractable Value (MEV). These transaction strategies harm fairness and market trust. Operating at machine speed, AI agents could supercharge these risks.

Enter DLT: the trust layer we need

Trust is key, and distributed ledger technology (DLT) offers a solution. DLT provides real-time transparency, immutability and decentralized consensus, ensuring decisions are trackable and auditable. The Identity Management Institute reported companies that integrated blockchain identity systems have already cut fraud by 40% and identity theft by 50%. Applying these guardrails to AI-driven finance can counter manipulation and promote fairness. Moreover, the use of DLTs with fair ordering is growing rapidly, ensuring transactions are sequenced fairly and unpredictably, addressing MEV concerns and promoting trust in decentralized systems.

DeFAI: where finance is headed

A blockchain-powered, trust-centric model could unlock a new paradigm, “DeFAI”, in which autonomous agents can operate freely without sacrificing oversight. Open-source protocols like ElizaOS, which have blockchain plugins, are already enabling secure and compliant AI interactions between agents across DeFi ecosystems.

Bottom line: trust will define the future of AI

As AI agents take on more complex roles, verifiable trust becomes non-negotiable. Verifiable compute solutions are already being built by firms like EQTY Lab, Intel and Nvidia to anchor trust on-chain. DLT ensures transparency, accountability and traceability. This is already in motion; on-chain agents are now operating that offer services ranging from trade execution to predictive analytics. We can trust AI when we have trust in the model input and output.

The question now isn’t if institutions will adopt autonomous finance, but whether frameworks can evolve fast enough. For this revolution to thrive, trust must be embedded into the foundation of the system.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors