Uncategorized

DOGE Mining Firm Z Squared To Go Public Through Merger

Z Squared, a firm that specializes in mining dogecoin (DOGE), the dog-themed memecoin that was propelled to mainstream recognition by Elon Musk in 2021, is merging with biopharmaceutical company Coeptis (COEP).

The merger will enable the resulting company to keep DOGE mining operations going, while Coeptis’ pharmaceutical business will be spun out and operated separately. As a result, the firm will become one of the largest publicly-traded companies with a primary focus mining dogecoin and other cryptocurrencies like litecoin (LTC).

“Going public provides us with broader access to capital markets to fuel the growth of our mining operations and pursue additional strategic opportunities we believe will be accretive to shareholders,” Z Squared CEO David Halabu told CoinDesk in an email.

The transaction is expected to close in the third quarter of 2025. The combined entity will have 9,000 U.S.-based DOGE mining machines. The company declined to share revenue figures with CoinDesk.

Spun out from Bitcoin (BTC) in 2013, Dogecoin follows a similar Proof-of-Work consensus mechanism, meaning that miners compete to solve an algorithmic problem in order to produce the next block on the blockchain; whoever solves it first is awarded coins for their efforts.

At $27 billion in market capitalization, DOGE is currently the eighth largest cryptocurrency, just ahead of Cardano’s ADA and Tron’s TRX.

With the bitcoin mining industry becoming extremely competitive in the last few years, mining operations are seeking new avenues for revenue — by dedicating resources for AI purposes, for example, or mining other cryptocurrencies like dogecoin and litecoin. Bitcoin mining firm BIT Mining (BTCM), for example, announced in December that it had made three times more money mining DOGE and LTC than BTC since it expanded into those cryptocurrencies.

Uncategorized

Bitcoin-Friendly Poilievre Loses Seat as Carney’s Liberals Win 2025 Election

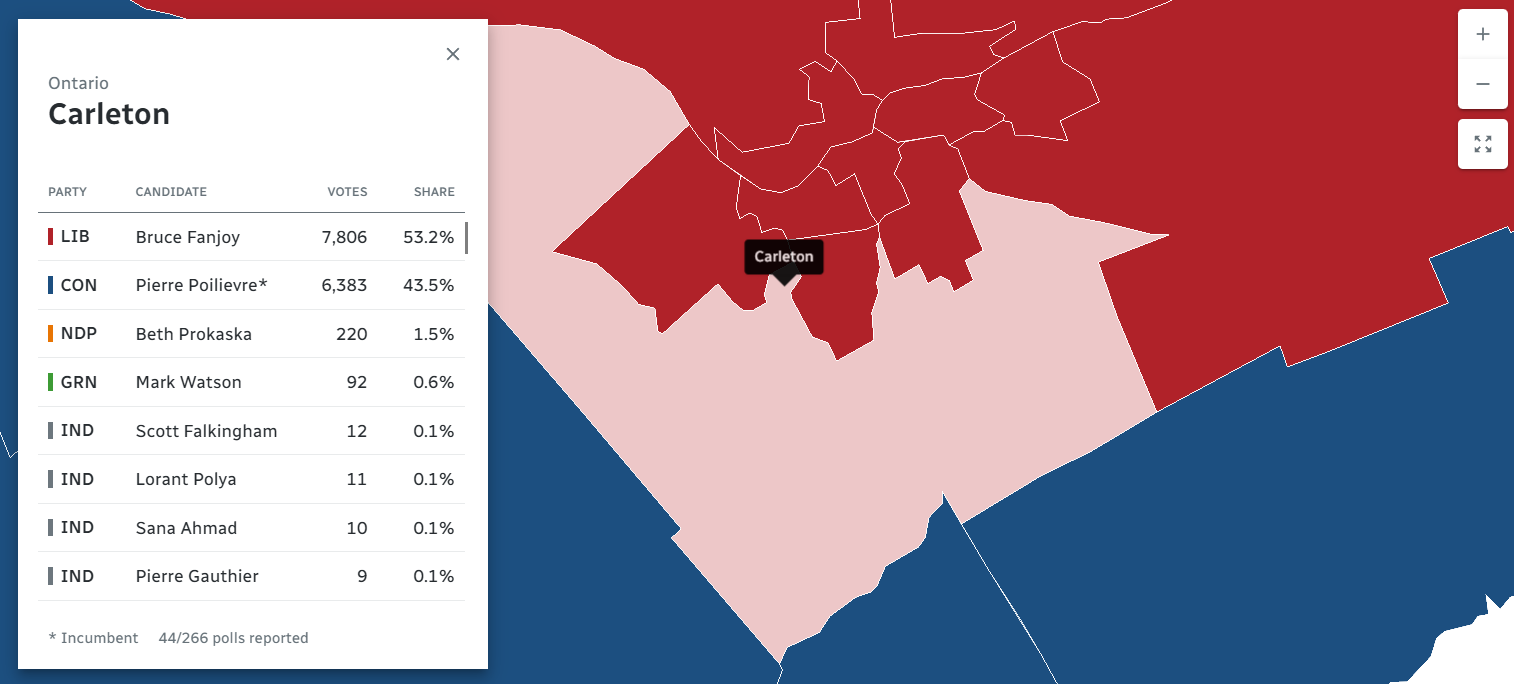

Bitcoin-friendly Conservative Leader Pierre Poilievre will no longer be a Member of Parliament after losing his seat in an election which saw Mark Carney’s Liberal Party secure enough seats to form at least a minority government.

Data from Elections Canada, reported by the CBC, shows Poilievre lost his Ottawa-area seat to Liberal Brunce Fanjoy on Monday night after a 5-week election cycle triggered by Carney, the current Prime Minister, last month.

Overall, the Liberal party took approximately 162 seats as of 12:00 a.m. Eastern Time, which is enough to form a minority government.

This is fewer than recent polls forecast, which projected that a Carney-led Liberal party would hit majority government territory — 172 seats — given the threats U.S. President Donald Trump made to the country’s sovereignty and the punitive tariffs the White House was directing northward.

However, CBC News noted as of midnight that votes were still coming in and it is not yet clear if the Liberals will win enough seats to form that majority government.

If present results stand under the U.K.-inspired Westminster system under which Canada operates, the Liberals would need the support of another opposition party, such as separatist-minded Bloc Quebecois, or the left-leaning New Democrat Party to pass bills in the House of Commons.

A Conservative-led non-confidence motion, should it have the support of another party, would be sufficient to trigger another election — though its far too early for this to be considered.

Unlike the United States, where crypto played an important role in moving the needle on winning Congressional races, and helping put Trump back in the White House, it seemed to be a muted affair in Canada.

While both Carney and Poilievre have discussed crypto in the past, the issue didn’t come up for either campaigns even though it was an important issue for many Conservative Members of Parliament.

On Polymarket, a contract asking bettors to predict the next Prime Minister of Canada crossed the $100 million mark (in U.S. dollars) in volume, and a dozen other election related questions had close to another $100 million in volume collectively.

Uncategorized

Bitcoin Holds Tight Despite Dismal Economic Data, Rising India/Pakistan Tensions

Bitcoin (BTC) fell early in the U.S. trading session, but mostly held firm as poor macroeconomic news rolled in.

The top cryptocurrency late in the day was trading just below $95,000, up 0.5% over the past 24 hours. The CoinDesk 20 — an index of the top 20 largest cryptocurrencies by market capitalization excluding memecoins, exchange coins and stablecoins — was roughly flat over the same time frame.

Crypto stocks like Coinbase (COIN), Strategy (MSTR) and the miners were losing modest ground after big gains last week. Notable exceptions included Janover (JNVR) and DeFi Technologies (DFTF), ahead 24% and 6.5%, respectively even as SOL — the token which both companies are aggressively accumulating — fell about 3% during the U.S. day.

Meanwhile, gold rose almost 1% and the dollar index fell 0.6%. The S&P 500 and Nasdaq each peaked into the green late in the session after earlier dipping more than 1%.

The Dallas Fed Manufacturing Index, a typically little-noticed economic data point, plunged to -35.8 from -16.3 last month — much worse than analysts’ expectations of a -14.1 print and the worst performance since COVID upended the world economy.

“Pretty horrible Dallas Fed Manufacturing Survey. Level hits the lowest since May 2020,” Joe Weisenthal, co-host of the Odd Lots podcast, posted on X. “All the comments are about tariffs and policy uncertainty. Add it to the list of bad soft/survey data.”

Hostilities between India and Pakistan might also have added to market jitters, with Pakistani Defense Minister Khawaja Muhammad Asif claiming that an Indian military incursion into Pakistan was imminent. Last week 26 people were killed in a terrorist attack in Pahalgam, a popular tourist destination in Indian-controlled Kashmir. The two countries have exchanged fire since.

Uncategorized

Kraken’s Former Legal Chief Marco Santori Joins Pantera Capital

Marco Santori, the former chief legal officer at Kraken, has joined Pantera Capital as a general partner on the investment team.

Santori, who stepped down from Kraken in January of 2025, will focus on expanding Pantera’s crypto portfolio, while acting as a resource for portfolio companies on regulatory compliance and strategic growth, according to a blogpost.

He will also continue his role in engaging with policymakers to advocate for clear, innovation-friendly regulations in the U.S. and globally, Pantera said.

The advancement of clear crypto regulations in the U.S. makes it an area of focus for firms readying themselves.

Sartori, who testified before the U.S. Congress on the subject of crypto regulation, is recognized for developing the “SAFT” (Simple Agreement for Future Tokens) framework, a cornerstone of compliant token sales.

“I’m joining Pantera at a pivotal moment for crypto on the world stage. After over a decade of work, governments have finally embraced the benefits of blockchain technology,” Sartori said in a statement. “The timing couldn’t be better, and Pantera couldn’t be better positioned to capitalize on it.”

-

Fashion6 месяцев ago

Fashion6 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment6 месяцев ago

Entertainment6 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion6 месяцев ago

Fashion6 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment6 месяцев ago

Entertainment6 месяцев agoThe old and New Edition cast comes together to perform

-

Business6 месяцев ago

Business6 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports6 месяцев ago

Sports6 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment6 месяцев ago

Entertainment6 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports6 месяцев ago

Sports6 месяцев agoSteph Curry finally got the contract he deserves from the Warriors