Uncategorized

Nasdaq Tells SEC Precise Crypto Labeling Will Be Everything in Future Regulation

Nasdaq, the operator of one of the premier U.S. stock exchanges and a crypto index, is advising the U.S. regulators to carefully focus on defining digital assets in four buckets that will clearly determine which agency acts as referee, according to a 23-page letter sent to the Securities and Exchange Commission’s crypto task force.

«While a stock by any other word would still be a stock, the existing market ecosystem can readily absorb digital assets by establishing the proper taxonomy and calibrating certain rules to reflect what is truly new and novel about digital assets,» the letter argued in response to the invitation issued by the task force’s chief, Commissioner Hester Peirce, to weigh in on future regulations.

The four future categories of digital assets, in Nasdaq’s view, should be:

- financial securities (tokens tied to assets that are securities under existing definitions, like stocks, bonds and exchange-traded funds (ETFS), which Nasdaq said should be treated just the same as their underlying assets);

- digital asset investment contracts (tokenized contracts that check all the securities boxes under a «clarified version» of the Supreme Court’s so-called Howey test);

- digital asset commodities (meeting the U.S. definition of commodities)

- other digital assets (stuff that doesn’t fall anywhere else and shouldn’t have rules for securities or commodities imposed on it)

The securities categories belong in the hands of the SEC, which will be working with its cousin agency, the Commodity Futures Trading Commission, that will handle the commodities. Those agencies — presumably directed at some point by a new crypto law hatched by Congress — will figure out the precise border between their jurisdictions.

The letter, signed by John Zecca, the company’s chief regulator executive, argued that «digital assets that constitute financial securities must trade as they do today.»

Nasdaq also suggested that the two agencies should formulate a kind of crossover trading designation for platforms that can handle digital asset investment contracts, commodities and other types of assets under one roof.

In the letter, Nasdaq underlined its digital-asset credibility, saying its «trading and clearing services, market and trading surveillance, and central securities depository technology support digital assets platforms on six continents.» It contended that the regulators should consider imposing safety measures or further constraints on firms that want to handle investors’ activity from top to bottom, which is the common approach of existing crypto firms.

Read More: SEC ‘Earnest’ About Finding Workable Crypto Policy, Commissioners Say at Roundtable

Uncategorized

Monero’s XMR Rockets 40% as XRP Leads Crypto Majors Gains

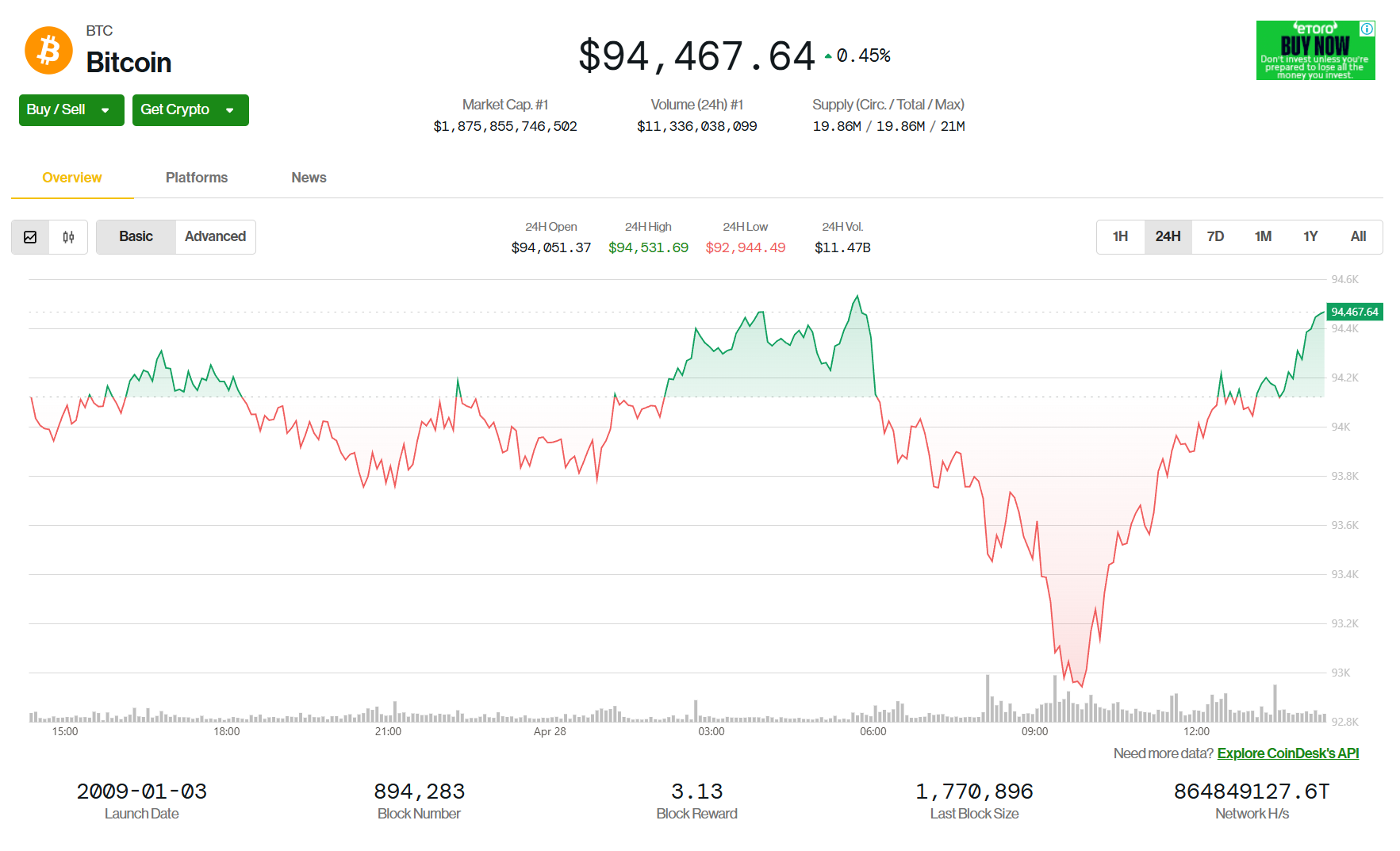

Crypto markets traded flat during the Asia morning hours, with bitcoin (BTC) trading above $94,000 and the CoinDesk 20, a measure of the performance of the largest cryptocurrencies, little changed.

XRP led majors gains with a 4% move higher from the past day, driven by a ProShares ETF approval that will see three futures-tracked products go live on April 30. Cardano’s ADA, BNB Chain’s BNB and ether (ETH) showed moves between 1% and 3%.

One exception to the relatively dormant market has been privacy coin Monero (XMR), up more than 40% in the past 24 hours. It traded over $320 in Asian morning hours Monday, a level last seen in May 2021.

Trading volumes zoomed from an average of $50 million on a 7-day rolling basis to over $220 million in the past 24 hours.

«There appears to be no clear catalyst behind $XMR’s recent rally,” Min Junng, a research analyst at Presto told CoinDesk in a Telegram message, Network activity remains consistent with typical levels, suggesting the move may be more speculative in nature.»

The privacy-centric token is based on the CryptoNote protocol, which ensures that all its transactions are unlinkable and untraceable.

Sentiment among traders carries over from last week with a near-term bullish view intact but with a cautious attitude as macroeconomic headwinds remain.

“Bitcoin has maintained a relatively stable range above $92k as Trump’s administration soften tariff policies of the crypto industry,” Jupiter Zheng, Partner, Liquid Fund and Research, HashKey Capital, told CoinDesk in a Telegram message. “This crypto-friendly attitude can boost Bitcoin and other cryptocurrencies to develop their own market direction, less correlated with US equities, and enable more growth and innovation in the industry.»

Broader equity markets showed mixed movements on Monday. A regional gauge advanced 0.6% while futures for the S&P 500 declined 0.6%, indicating a four-day US equities rally may snap. Gold pared last week’s gains after a record-breaking rally. Hong Kong’s Hang Seng index was also flat as were other major indexes around Asia.

Uncategorized

ProShares Gets SEC Greenlight for Three XRP ETFs

Exchange-traded funds (ETF) issuer ProShares will introduce three XRP-tracked products this week after a tacit U.S. Securities and Exchange Commission (SEC) approval.

It will launch an Ultra XRP ETF (2x leverage), a Short XRP ETF and an Ultra Short XRP ETF (-2x leverage), filings show. Its spot XRP approval stays hanging, however. The SEC has acknowledged several XRP spot ETF applications so far, with fund manager Grayscale’s filing facing a critical May 22 deadline.

ProShares’ approvals come weeks after Teucrium’s 2x XRP ETF started trading earlier this month, becoming the first XRP ETF in the U.S. It racked over $5 million in trading volumes on the first day, becoming the firm’s “most successful” launch to date.

Last week, the CME Group added XRP futures to its largest derivatives exchange in the U.S., alongside BTC, ETH and SOL products.

The flurry of ETFs tracking XRP comes after closely related company Ripple’s long-standing court battle against the SEC, which was fully concluded in March, clearing extensive regulatory headwinds for the tokens.

Uncategorized

Chart of the Week: Tariff Carnage Starting to Fulfill Bitcoin’s ‘Store of Value’ Promise

April has been a month of extreme volatility and tumultuous times for traders.

From conflicting headlines about President Donald Trump’s tariffs against other nations to total confusion about which assets to seek shelter in, it has been one for the record books.

Amid all the confusion, when traditional «haven assets» failed to act as safe places to park money, one bright spot emerged that might have surprised some market participants: bitcoin.

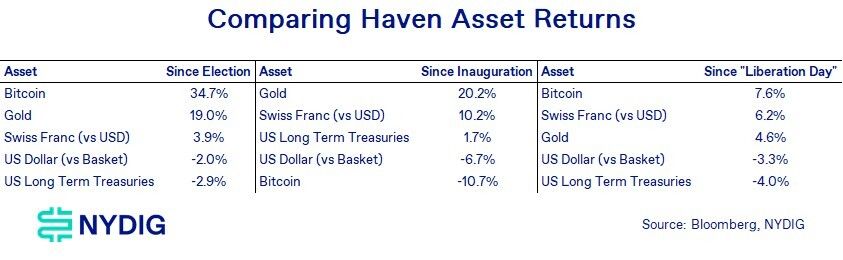

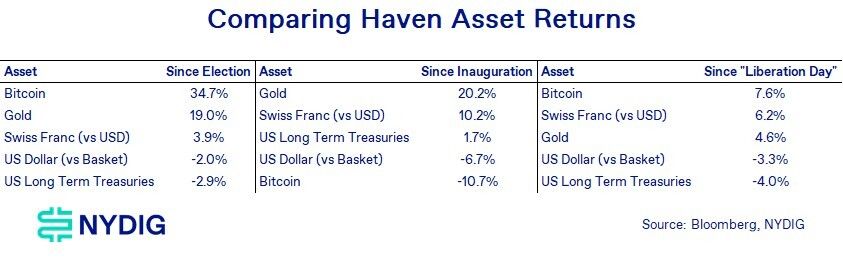

«Historically, cash (the US dollar), bonds (US Treasuries), the Swiss Franc, and gold have fulfilled that role [safe haven], with bitcoin edging in on some of that territory,» said NYDIG Research in a note.

NYDIG’s data showed that while gold and Swiss Franc had been consistent safe-haven winners, since ‘Liberation Day’—when President Trump announced sweeping tariff hikes on April 2, kicking off extreme volatility in the market—bitcoin has been added to the list.

«Bitcoin has acted less like a liquid levered version of levered US equity beta and more like the non-sovereign issued store of value that it is,» NYDIG wrote.

Zooming out, it seems that as the «sell America» trade gains momentum, investors are taking notice of bitcoin and the original promise of the biggest cryptocurrency.

«Though the connection is still tentative, bitcoin appears to be fulfilling its original promise as a non-sovereign store of value, designed to thrive in times like these,» NYDIG added.

Read more: Gold and Bonds’ Safe Haven Allure May be Fading With Bitcoin Emergence

-

Fashion6 месяцев ago

Fashion6 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment6 месяцев ago

Entertainment6 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion6 месяцев ago

Fashion6 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment6 месяцев ago

Entertainment6 месяцев agoThe old and New Edition cast comes together to perform

-

Business6 месяцев ago

Business6 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports6 месяцев ago

Sports6 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment6 месяцев ago

Entertainment6 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports6 месяцев ago

Sports6 месяцев agoSteph Curry finally got the contract he deserves from the Warriors