Uncategorized

Nvidia Continues to Keep Crypto at Arm’s Length

Arbitrum (ARB) was set to make a splash.

The Layer 2 network, home to a growing number of decentralized AI platforms, was preparing to announce a milestone: it had been named Nvidia’s exclusive Ethereum partner for the chipmaker’s new Ignition AI Accelerator, an offshoot of its Inception program that supports promising AI startups with infrastructure credits and mentorship.

Then came the pivot.

“We received some last-minute comms from Nvidia requesting to pause the announcement, however, they didn’t provide any specific details as to why,” a spokesperson told CoinDesk in an email.

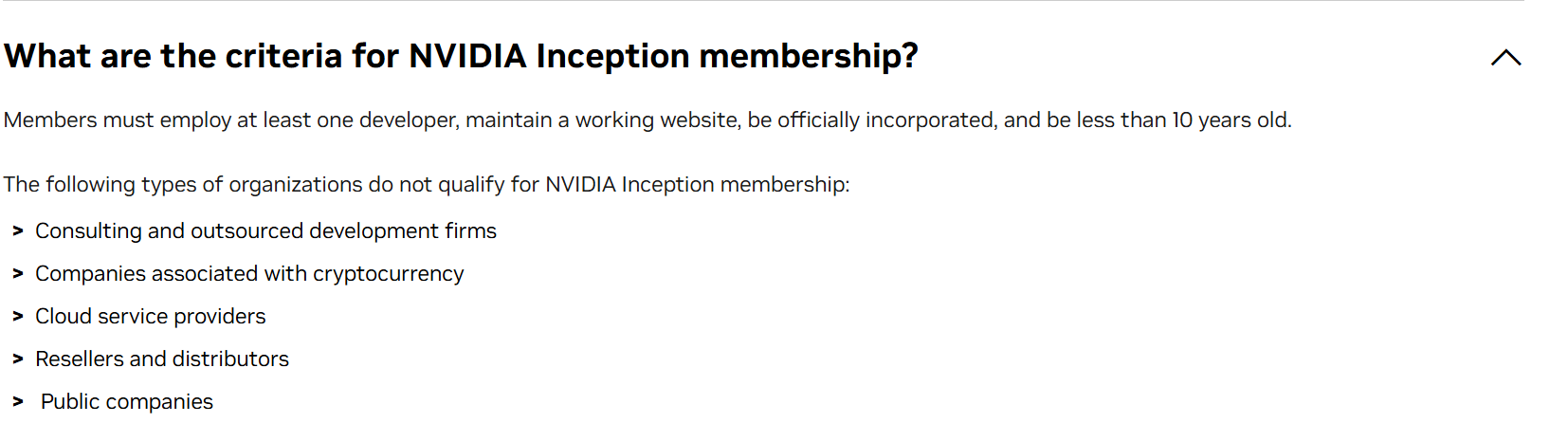

It’s a telling moment, and a reminder that despite crypto’s continued efforts to align with the booming AI sector, Nvidia’s programs still explicitly exclude crypto-related projects. A quick look at the Inception Accelerator’s criteria (Ignition is an offshoot of it, given the Inception badge on its site) shows a clear disqualifier: cryptocurrency.

This stance isn’t new, and while it may frustrate crypto developers looking to tap into Nvidia’s ecosystem, it reflects a longer history of distance, and occasional disparagement, from the company’s leadership.

Back in 2018, co-founder and CEO Jensen Huang described the fallout from the ICO boom as giving Nvidia a “crypto hangover.” Ethereum’s price collapse left the company saddled with unsold GPU inventory, and Nvidia later paid a $5.5 million fine over how it reported crypto-related revenue impact.

Years later, in a 2023 interview with The Guardian, Nvidia CTO Michael Kagan was more direct: “Crypto doesn’t bring anything useful for society,” he said, adding, “I never believed that [crypto] is something that will do something good for humanity,” contrasting it to AI.

This skepticism has stood in stark contrast to Nvidia’s embrace of artificial intelligence, and occasional tolerance of blockchain.

At the company’s 2024 Graphics Technology Conference, Huang appeared onstage with Illia Polosukhin, co-author of Attention Is All You Need, the paper that introduced Transformer models, which are the foundation for modern AI tools like ChatGPT. While Polosukhin also co-founded the NEAR blockchain, the discussion centered squarely on AI, not crypto.

The closest nod to the industry came when Huang, in characteristically broad strokes, said: “We got programmable humans, we got programmable proteins, we got programmable money.” The remark, likely rhetorical, wasn’t a signal of support for crypto, despite the AI token bulls, and indeed not of any strategic shift.

Even though Nvidia has been clear on its position about crypto, some in the industry continue to interpret moments like these as cracks in the door, a potential softening that might eventually lead to inclusion. But with crypto still formally excluded from Nvidia’s flagship programs and the company declining to comment on its current stance, the door appears just as firmly shut.

For now, Nvidia’s message seems clear: crypto’s not invited.

Uncategorized

Nasdaq Tells SEC Precise Crypto Labeling Will Be Everything in Future Regulation

Nasdaq, the operator of one of the premier U.S. stock exchanges and a crypto index, is advising the U.S. regulators to carefully focus on defining digital assets in four buckets that will clearly determine which agency acts as referee, according to a 23-page letter sent to the Securities and Exchange Commission’s crypto task force.

«While a stock by any other word would still be a stock, the existing market ecosystem can readily absorb digital assets by establishing the proper taxonomy and calibrating certain rules to reflect what is truly new and novel about digital assets,» the letter argued in response to the invitation issued by the task force’s chief, Commissioner Hester Peirce, to weigh in on future regulations.

The four future categories of digital assets, in Nasdaq’s view, should be:

- financial securities (tokens tied to assets that are securities under existing definitions, like stocks, bonds and exchange-traded funds (ETFS), which Nasdaq said should be treated just the same as their underlying assets);

- digital asset investment contracts (tokenized contracts that check all the securities boxes under a «clarified version» of the Supreme Court’s so-called Howey test);

- digital asset commodities (meeting the U.S. definition of commodities)

- other digital assets (stuff that doesn’t fall anywhere else and shouldn’t have rules for securities or commodities imposed on it)

The securities categories belong in the hands of the SEC, which will be working with its cousin agency, the Commodity Futures Trading Commission, that will handle the commodities. Those agencies — presumably directed at some point by a new crypto law hatched by Congress — will figure out the precise border between their jurisdictions.

The letter, signed by John Zecca, the company’s chief regulator executive, argued that «digital assets that constitute financial securities must trade as they do today.»

Nasdaq also suggested that the two agencies should formulate a kind of crossover trading designation for platforms that can handle digital asset investment contracts, commodities and other types of assets under one roof.

In the letter, Nasdaq underlined its digital-asset credibility, saying its «trading and clearing services, market and trading surveillance, and central securities depository technology support digital assets platforms on six continents.» It contended that the regulators should consider imposing safety measures or further constraints on firms that want to handle investors’ activity from top to bottom, which is the common approach of existing crypto firms.

Read More: SEC ‘Earnest’ About Finding Workable Crypto Policy, Commissioners Say at Roundtable

Uncategorized

Want to Have Dinner With the U.S. President? All You Would Need Is to Hold $420 Worth of TRUMP

The team behind the Trump memecoin said Thursday that the top 220 holders on its list, where the smallest wallet holds $420 worth of TRUMP, are eligible to win dinner with President Donald Trump, contrary to rumors that a six-figure token stash was required.

“We want to clarify a few things people seem confused by on X and in the Media,” the team’s X account posted. “You need $300K+ to participate (You Don’t); That we’re unlocking into this competition (We’re Not).”

TRUMP surged 70% this week, trading at around $12 as of Thursday, mainly driven by hype around the so-called “Dinner with Trump” event, according to CoinDesk’s earlier reporting.

Some users on X claimed that only holders with more than $300,000 in tokens could participate. Others speculated that the wallet ranked 220 on a blockchain explorer was the minimum cutoff.

The team dismissed both claims, stating that users must register via the official leaderboard and that only time-weighted holdings during the competition will count.

Currently, the leaderboard’s top wallet, under the pseudonym “Sun,” holds over 1.1 million TRUMP tokens, worth nearly $14 million. The 220th spot was held by “HAR,” with just 35.3 TRUMP tokens, or about $420 in dollar terms.

Twenty five wallets are listed as VIPs on the leaderboard, where the cut-off holder sits on over $400,000 worth of TRUMP.

The team also addressed concerns about token unlocks affecting the leaderboard, stating that both the cliff unlock and subsequent daily unlocks would remain inaccessible for 90 days, outlasting the competition itself.

“We want to say again that the tokens from the initial cliff unlock and the following 3 months of daily unlocks will remain locked, each for an additional 90 days,” it said.

Uncategorized

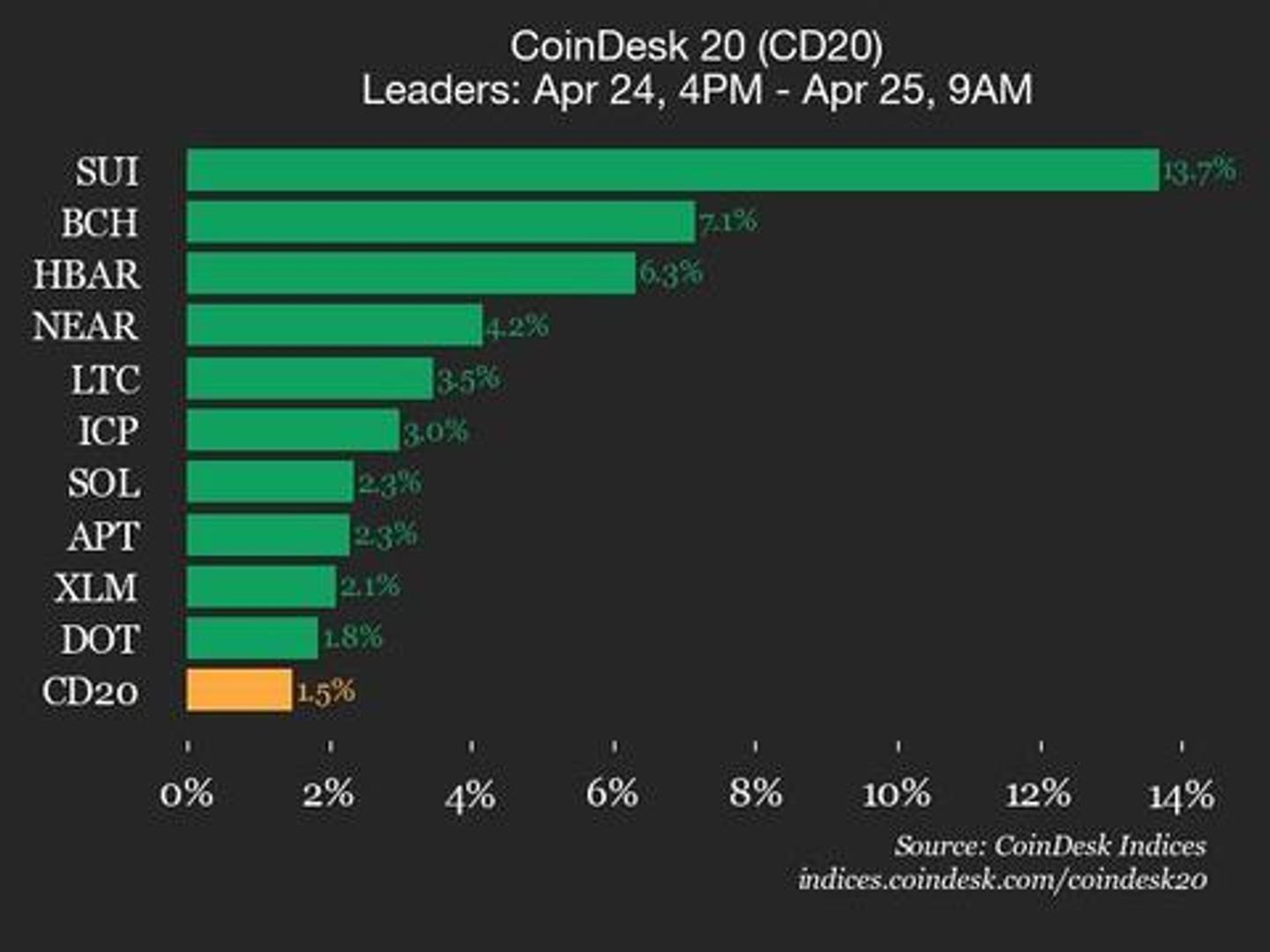

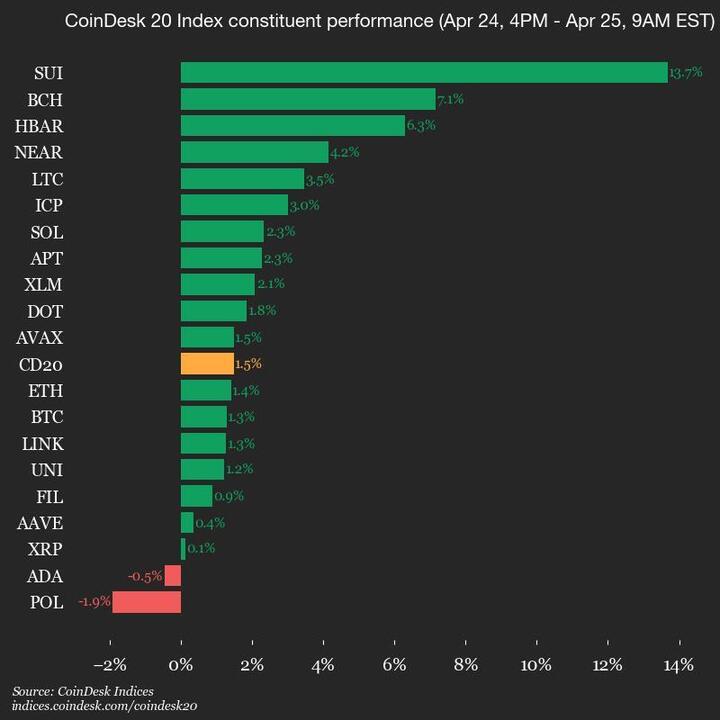

CoinDesk 20 Performance Update: SUI Surges 13.7% as Index Trades Higher from Thursday

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 2774.43, up 1.5% (+40.48) since 4 p.m. ET on Thursday.

Eighteen of 20 assets are trading higher.

Leaders: SUI (+13.7%) and BCH (+7.1%).

Laggards: POL (-1.9%) and ADA (-0.5%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

-

Fashion6 месяцев ago

Fashion6 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment6 месяцев ago

Entertainment6 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion6 месяцев ago

Fashion6 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment6 месяцев ago

Entertainment6 месяцев agoThe old and New Edition cast comes together to perform

-

Business6 месяцев ago

Business6 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports6 месяцев ago

Sports6 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment6 месяцев ago

Entertainment6 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports6 месяцев ago

Sports6 месяцев agoSteph Curry finally got the contract he deserves from the Warriors