Uncategorized

AVAX Surges 10.7% as Bullish Breakout Signals Strong Momentum

Avalanche’s AVAX token has broken out of its multi-week correction phase, demonstrating remarkable strength despite ongoing geopolitical tensions affecting cryptocurrency markets.

The broader market gauge, CoinDesk 20 Index (DLCS), has demonstrated exceptional bullish momentum, surging from 1403.33 to 1461.17 in the last 48 hours, representing a 4.12% gain, while the overall range spans 95.56 points (6.97%) from the low of 1365.61 to the high of 1461.17.

The recent price action of AVAX shows accelerated momentum with the formation of a bull flag pattern and decisive breakout above $20.40, coinciding with significant institutional developments in the ecosystem, according to CoinDesk Research’s technical analysis data.

Technical Analysis Highlights

- AVAX demonstrated remarkable strength, surging from 18.87 to 20.89, representing a 10.7% gain.

- Price action reveals a clear bullish trend with higher lows forming a strong support trendline around 19.50.

- After consolidating between 19.30-19.70 on April 20, AVAX experienced a significant breakout on April 21, with volume increasing substantially as the price pushed above 20.00.

- The most recent 48 hours show accelerated momentum with the formation of a bull flag pattern and a decisive breakout above 20.40, suggesting further upside potential.

- Key resistance at 20.90 now becomes the level to watch, with Fibonacci extension targets pointing to 21.50 as the next significant objective.

- In the last 100 minutes, AVAX surged from 20.61 to 21.04, representing a 2.1% gain.

- After consolidating between 20.50-20.60 during the 13:20-13:40 timeframe, price formed a solid base before initiating a powerful upward move.

- The decisive breakout occurred at 14:40 with extraordinary volume (146,387 units), creating a strong support level at 20.80.

- Multiple high-volume candles followed between 14:44-14:48, pushing the price through the critical 21.00 psychological barrier with the highest volume spike (142,112 units) at 14:47.

- This breakout completes the bullish pattern established in the previous 48 hours, with Fibonacci extension targets now suggesting 21.50 as the next significant objective.

Disclaimer: This article was generated with AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. This article may include information from external sources, which are listed below when applicable.

External References:

- «Avalanche (AVAX), Toncoin (TON) and Kaspa (KAS): Can They Recover?« — CryptoDaily, published April 2025.

- «Avalanche (AVAX), Polkadot (DOT) Rebound on the Horizon? Harmonic Pattern Signals Bullish Move» — Bitzo, published April 2025. — Bitzo, published April 2025. — Bitzo, published April 2025.

- «Avalanche Price Prediction« — Cryptopolitan, published April 2025.

- «Avalanche Card Unveiled: Will It Spark Bullish Momentum for AVAX?« — Coinpedia, published April 2025.

Uncategorized

Tesla Reports $951M in Crypto Holdings as it Misses Earnings

Tesla (TSLA) still holds almost $1 billion in bitcoin, according to the automaker’s latest earnings report.

The electric vehicle firm reported digital asset holdings worth $951 million as of March 31, down from $1.076 billion on Dec. 30. Tesla currently holds 11,509 bitcoin in its balance sheet, according to Bitcoin Treasuries data.

The change is almost certainly due to bitcoin’s price depreciating between the two quarters. Data from Arkham Intelligence indicates that Tesla did not perform any transactions in the last three months. Arkham marks Tesla’s holdings as being currently worth $1.049 billion.

A new rule from the Financial Accounting Standards Board (FASB) requires corporate holders of digital assets to begin marking those assets to market each quarter.

Tesla also reported $19.34 billion in revenue for the first quarter of the year; analysts had expected the carmaker to rake in $21.37 billion.

The TSLA shares were up more than 2% in after-hours trading.

Uncategorized

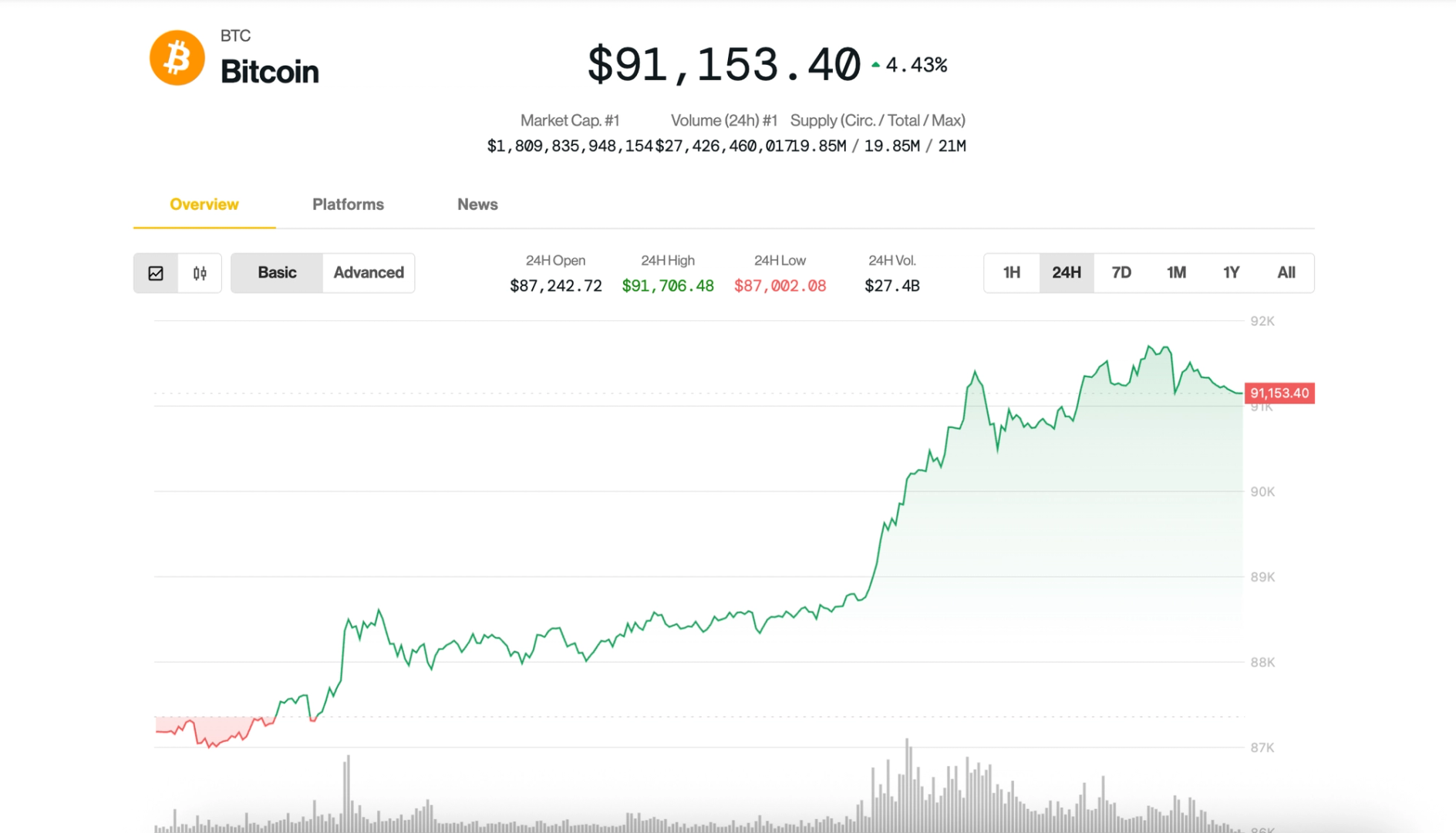

Bitcoin Tops $91K as Trade Optimism Fuels Crypto Rally But Demand Headwinds Remain

Bitcoin (BTC) surged past $91,000 on Tuesday, climbing nearly 5% amid renewed investor optimism and fresh hopes of a thaw in U.S.-China trade tensions, but headwinds persist that could cap further upside, analytics firm CryptoQuant cautioned.

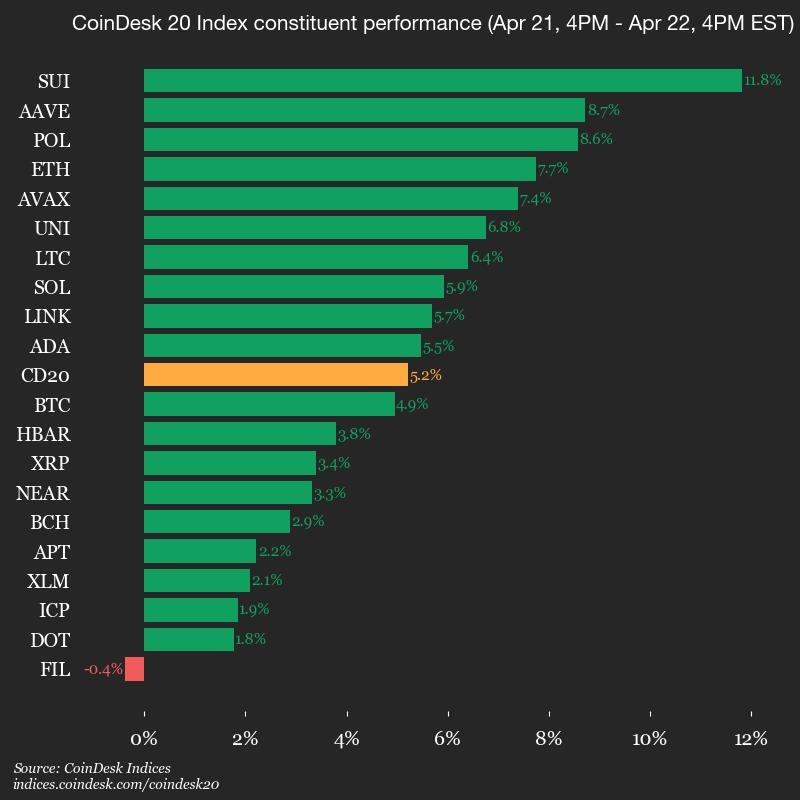

The largest crypto by market capitalization hit $91,700 in the U.S. afternoon, its strongest price since early March. Altcoins followed BTC higher, with Ethereum’s ether (ETH) rising 8% over the past 24 hours above $1,700, and dogecoin (DOGE) and Sui’s native token (SUI) gaining 8.6% and 11.7%, respectively. The broad-market crypto benchmark CoinDesk 20 Index advanced 5.2%.

Markets were buoyed by remarks from U.S. Treasury Secretary Scott Bessent, who reportedly told investors at a closed-door JPMorgan event that the tariff standoff with China was unsustainable. Bessent said de-escalation would come “in the very near future,” characterizing current conditions as a “trade embargo.” However, he cautioned that a more comprehensive deal between the two nations could take even years.

Stocks recovered from yesterday’s decline, with the S&P 500 and the tech-heavy Nasdaq finishing the session 2.5% and 2.7% higher, respectively. Gold, meanwhile, sharply reversed from its record price of $3,500 during the day and was down 1%.

«As capital rotates into safe-haven and inflation-hedging assets, BTC and gold are proving to be key beneficiaries of the exodus from USD risk,» analysts at hedge fund QCP Capital said in a Telegram broadcast.

They highlighted rejuvenating inflows to spot U.S.-listed BTC ETFs and the return of the so-called Coinbase price premium, suggesting demand from American institutional investors. BTC ETF booked over $381 million net inflows on Monday adding to Thursday’s $107 million, according to Farside Investors data.

But not all signs point to a sustained breakout.

Despite the price jump, on-chain data points to fragility beneath the surface, CryptoQuant analysts said in a Tuesday report. Bitcoin’s apparent demand has decreased by 146,000 BTC over the past 30 days—an improvement from the sharp drop in March, but still negative. CryptoQuant’s demand momentum metric, which tracks new investor interest, has deteriorated further to its the most bearish level since October 2024, the report noted.

Market liquidity remains soft, with the report using USDT’s market cap growth as a proxy for crypto liquidity. USDT grew $2.9 billion over the past two months, below its 30-day average. Historically, BTC rallies coincided with USDT growth above $5 billion and above trend — a threshold not yet met.

Adding to the caution, bitcoin is now facing a key resistance zone between $91,000 and $92,000 at around the «Trader’s On-chain Realized Price» metric, a level that has often served as resistance in bearish conditions. CryptoQuant’s on-chain bull score classified current market conditions as bearish, suggesting a pause or pullback could follow if sentiment weakens.

Uncategorized

Unicoin CEO Rejects SEC’s Attempt to Settle Enforcement Probe

Unicoin has rebuffed the U.S. Securities and Exchange Commission’s (SEC) attempt to negotiate a settlement agreement to close an ongoing probe into the Miami-based crypto company, its CEO Alex Konanykhin revealed in a Tuesday letter to investors.

In his letter, Konanykhin said Unicoin was given an “ultimatum” by the SEC to attend a settlement negotiation meeting last week, on April 18.

“We declined to show up,” Konanykhin told CoinDesk, adding that the SEC had made demands ahead of the meeting that he found “unacceptable.” He declined to share specifics, telling CoinDesk that the communication between Unicoin’s lawyers and the SEC was confidential.

Unicoin received a Wells notice — a sort of official heads-up from the SEC that it intends to file an enforcement action against the recipient — in December, shortly before former Chair Gary Gensler stepped down, alleging violations related to fraud, deceptive practices, and the offer and sale of unregistered securities. No official enforcement action has yet been filed.

Since President Donald Trump took office, the SEC has reversed its once-aggressive stance toward crypto regulation, backing off from many of its open investigations into crypto companies, including blockchain gaming firm Immutable and non-fungible token (NFT) marketplace OpenSea, and even some of its ongoing litigation, including against Coinbase and Cumberland DRW.

Other SEC enforcement cases against crypto companies, including its cases against Binance and Tron, have been paused while the parties attempt to negotiate a settlement. The agency recently reached a settlement agreement with Nova Labs, the parent company behind the Helium blockchain, that saw Nova Labs pay a $200,000 fine to settle civil securities fraud charges, and the SEC dropped its claims that Helium (HNT) and other related tokens were securities.

In his letter to investors, Konanykhin claimed that the SEC’s probe has caused “multi-billion-dollar damage” to the company and its investors.

“We would likely be a $10B+ publicly traded company by now if the SEC had not blocked our ICO, stock exchange listing and fundraising,” Konanykhin wrote, adding that the SEC had prevented Unicoin from acting on the “very favorable market opportunities.”

“We were forced into a standstill,” Konanykhin wrote.

The SEC did not respond to a request for comment.

-

Fashion6 месяцев ago

Fashion6 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment6 месяцев ago

Entertainment6 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion6 месяцев ago

Fashion6 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment6 месяцев ago

Entertainment6 месяцев agoThe old and New Edition cast comes together to perform

-

Sports6 месяцев ago

Sports6 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Business6 месяцев ago

Business6 месяцев agoUber and Lyft are finally available in all of New York State

-

Entertainment6 месяцев ago

Entertainment6 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports6 месяцев ago

Sports6 месяцев agoSteph Curry finally got the contract he deserves from the Warriors