Uncategorized

Weekly Recap: Crypto Emerges From the Tariff War

Tariffs, tariffs, tariffs.

Trump’s on-again, off-again import levies dominated the week. At the beginning, tariffs sent stocks and crypto appreciably lower. By the end, with all new non-China tariffs paused for 90 days, markets were up again.

Bitcoin returned to a level ($82,000) that it was at this time last week. And analysts debated whether, in the panic of the previous days, it showed “safe haven” qualities (like gold) or whether it was a risk-asset like many others. The consensus was that bitcoin performed resiliently rather than completely reassuringly.

Our Asia reporting team led the way on our markets coverage. Omkar Godbole started the week strong by revealing how the unwinding of the «basis trade» could impact bitcoin price. Sam Reynolds wrote on how Kalshi was set to win its legal battle in Nevada, hours before the prediction market got its first victory in the state. Shaurya Malwa reported on the first XRP ETF listing in the U.S. and how Teucrium’s leveraged fund received $5m during its first day of trading.

From our European team, there was some timely analysis from James Van Straten, and the All-Important U.S. 10-Year Yield Moving in the Wrong Direction for Trump, and a story showing the resilience of the decentralized economy from Oliver Knight, How DeFi ‘Defied’ Market Carnage as Traders Poured Millions Amid Panic. Our coverage expanded beyond just tariffs and market reactions, with Jamie Crawley’s scoop, Rootstock Prepares to Release SDKs for Bitcoin Layer 2s Using BitVMX after he took the opportunity offered by an embargoed press release to phone the company and interview the founder. And there was a nice DeFi follow-up on the repercussions of HyperLiquid’s price manipulation exploit from March by Oliver, How the Hype for HyperLiquid’s Vault Evaporated on Concerns Over Centralization.

Meanwhile, there was lots of news that wasn’t tariff-related.

Paul Atkins was confirmed as the new SEC chair. The Department of Justice closed down its crypto enforcement unit, prompting criticism, from Democrats and others, that it’s not serious about combating malfeasance. The SEC approved ETH ETF options, following a long delay. And President Trump put an end to a controversial DeFi accounting rule.

It was a week that showed how crypto was increasingly central to finance and even macro-economics. Fun times are ahead.

Uncategorized

CoinDesk 20 Performance Update: AVAX Falls 2.1% as Nearly All Assets Trade Lower

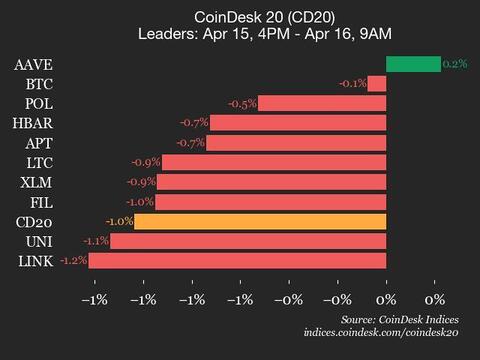

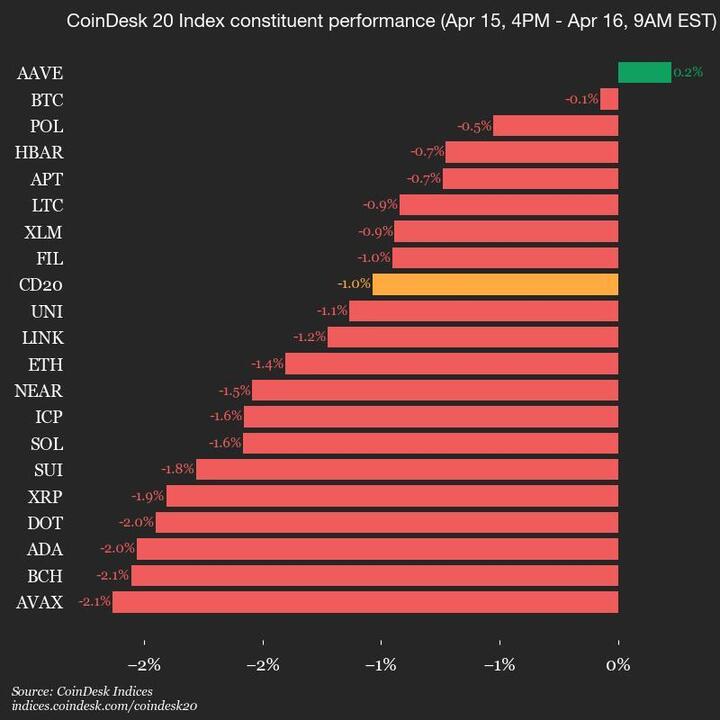

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 2428.16, down 1.0% (-25.41) since 4 p.m. ET on Tuesday.

One of 20 assets is trading higher.

Leaders: AAVE (+0.2%) and BTC (-0.1%).

Laggards: AVAX (-2.1%) and BCH (-2.1%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Uncategorized

Resolv Labs Raises $10M as Crypto Investor Appetite for Yield-Bearing Stablecoins Soars

Resolv Labs, the firm behind the $450 million decentralized finance (DeFi) protocol Resolv, has closed a $10 million seed round to expand its crypto-native yield platform and USR stablecoin, the team told CoinDesk in an exclusive interview.

The investment round was led by Cyber.Fund and Maven11, with additional backing from Coinbase Ventures, Susquehanna’s subsidiary SCB Limited, Arrington Capital, Gumi Cryptos, NoLimit Holdings, Robot Ventures, Animoca Ventures and others.

Stablecoins, a $230 billion and rapidly expanding class of cryptocurrencies with pegged prices to an external asset, are capturing attention well beyond their traditional use in payments and trading. A growing cadre of crypto protocols offer yield-bearing stablecoins or «synthetic dollars,» wrapping diverse investment strategies into a digital token with a stable price and passing on part of the earnings to holders.

«I view stablecoins as the perfect rails for yield distribution,» Ivan Kozlov, founder and CEO of Resolv, said in an interview with CoinDesk. «This may actually become larger than transaction stablecoins like [Tether’s] USDT in the future.»

The most notable example of the trend is Ethena’s $5 billion USDe token, which primarily pursues a delta-neutral position by holding cryptocurrencies like BTC, ETH and SOL and simultaneously shorting equal size of perpetual futures, scooping up yield from funding rates.

Resolv also pursues a similar strategy: its USR token, anchored to $1, is a delta-neutral stablecoin designed to deliver stable yields from crypto markets, while shielding holders from sharp price swings.

The protocol achieves this by splitting risk between two layers, inspired by Kozlov’s background in structured products in traditional finance. USR stablecoin holders sit in the less risky senior tranche earning stable but lower yields, with risk-tolerant investors in the protocol’s insurance layer represented by the RLP token with floating price. This model, borrowed from structured finance, aims to make crypto yields more predictable without sacrificing decentralization, Kozlov explained.

Following its launch in September 2024, the protocol quickly ballooned to over $600 million in assets driven by attractive yields during the crypto rally after Donald Trump’s election victory, DefiLlama data shows. However, as markets turned bearish and yields compressed, Resolv’s total value locked (TVL) also slid around $450 million this month.

With the new capital raise, Resolv plans to expand its yield sources to include bitcoin (BTC)-based strategies and deepening its integrations with institutional digital asset managers, Kozlov said. The protocol also aims to expand to new blockchains, widening its reach beyond early crypto adopters.

Uncategorized

Trump-Family Backed World Liberty Gets $25M Investment From DWF Labs

DWF Labs is investing $25 million in World Liberty Financial (WLFI), the decentralized finance protocol backed by U.S. President Donald Trump and his family.

The crypto market maker is also entering the U.S. market with a new office in New York City as part of its broader expansion plans, according to a press release on Wednesday.

By establishing a physical presence in the U.S., DWF aims to work more closely with traditional financial institutions, expand its local workforce and engage more directly with U.S. regulators.

The firm also plans to deepen ties with American colleges and universities to promote education on cryptocurrencies. The WLFI token purchase gives DWF Labs a governance stake in the project, which includes USD1, the project’s soon-to-launch stablecoin backed by short-term U.S. Treasury bills, cash, and equivalents.

DWF Labs said it will supply liquidity for the USD1 ecosystem, using its trading infrastructure to support activity on both centralized and decentralized platforms.

Zak Folkman, co-founder of WLFI, said DWF’s involvement is expected to accelerate “the next-generation infrastructure we’re actively building and deploying at WLFI.” DWF Labs Managing Partner Andrei Grachev, meanwhile, said that the firm’s physical presence in the U.S. reflects its confidence in “America’s role as the next growth region for institutional crypto adoption.”

WLFI is positioning USD1 as a stable, institutional-grade stablecoin designed to meet rising demand from “sovereign investors and major institutions.”

-

Fashion6 месяцев ago

Fashion6 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment6 месяцев ago

Entertainment6 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion6 месяцев ago

Fashion6 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment6 месяцев ago

Entertainment6 месяцев agoThe old and New Edition cast comes together to perform

-

Sports6 месяцев ago

Sports6 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Business6 месяцев ago

Business6 месяцев agoUber and Lyft are finally available in all of New York State

-

Entertainment6 месяцев ago

Entertainment6 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports6 месяцев ago

Sports6 месяцев agoSteph Curry finally got the contract he deserves from the Warriors