Uncategorized

The Protocol: Vana Introduces Token Standard for Data-Backed Assets

Welcome to The Protocol, CoinDesk’s weekly wrap-up of the most important stories in cryptocurrency tech development. I’m Ben Schiller.

In this issue:

Vana launches token standard

Hashgraph to debut private blockchain

ASICs will look more like servers

An interview with Gensyn’s Ben Fielding

This article is featured in the latest issue of The Protocol, our weekly newsletter exploring the tech behind crypto, one block at a time. Sign up here to get it in your inbox every Wednesday.

Network News

VANA’S DATA-BACKED TOKEN STANDARD: Crypto enthusiasts might have heard of the ERC-20 token standard, which provides guidelines to ensure that tokens created on the Ethereum smart contract blockchain are compatible and can interact with other tokens and applications within the network. A similar standard for data-backed tokens, called VRC-20, has now emerged. Vana, an EVM-compatible Layer 1 blockchain that helps users monetize personal data by bundling it into DataDAOs for AI model training, introduced the new standard early this week to boost trust and transparency in the market for data-backed digital assets. The VRC-20 standard design includes specific criteria such as fixed supply, governance, and liquidity rules while ensuring real data access by tying tokens to actual data utility. Additionally, it promotes continuous liquidity through rewards that ensure market stability. «This isn’t speculation. This is real financialization of data,» Vana noted on X. Vana launched its mainnet in December, with VANA as its native cryptocurrency. Since then, the network has onboarded over 12 million data points through multiple DataDAOs, reflecting strong demand for user-owned data. DataDAOs or data liquidity pools are decentralized marketplaces that bring data on-chain as transferable digital tokens. DLPs are where data is contributed, tokenized and made ready for use in applications such as AI model training. — Omkar Godbole Read more.

HASHGRAPH LINES UP Q3 PRIVATE CHAIN: Hashgraph, the blockchain development firm focusing on the Hedera (HBAR) network, is building a private, permissioned blockchain for enterprises in highly regulated industries with plans to debut in the third quarter of 2025. HashSphere, built with Hedera’s technology, aims to bridge private and public distributed ledgers, ensuring compliance with regulations while maintaining interoperability, the company said Monday. Hashgraph is looking to provide services to asset managers, banks and payment providers seeking secure, low-cost cross-border transactions with stablecoins.While public blockchains offer security and transparency, enterprises in industries like finance and payments often face compliance challenges, particularly with know your customer (KYC) and anti-money laundering (AML) requirements. HashSphere addresses this by restricting access to verified participants, enabling firms to develop tokenized assets, AI-powered services and other blockchain-based products while meeting regulatory standards. The network also integrates Hedera’s existing tools, including the Token Service for managing digital assets and the Consensus Service for recording transactions with trusted timestamps. The platform is compatible with the Ethereum Virtual Machine (EVM), allowing developers to deploy decentralized applications using Solidity and other EVM languages. — Kris Sandor Read more.

ASICS TO BE MORE LIKE SERVERS: In the beginning, there were only CPUs, then GPUs, for bitcoin mining. Then came the mighty ASIC in 2013, and with it, the “shoebox” form factor that has become emblematic of the bitcoin mining industry. What comes next? ASIC manufacturers are increasingly betting on a hydro-cooled server rack design to become a substantial portion of bitcoin mining fleets, leaning into the “direct-to-chip” cooling for further efficiency gains. Last September, Bitmain announced its model U3S21EXPH developed in a partnership with Hut 8. Its U3 design means that one unit takes up three spaces in a traditional server rack. MicroBT soon followed with its M63 Hydro series, as did Bitdeer’s Sealminer A2 Hydro unit. Following suit, Auradine released its server rack model, the AH3880, this March. Its U2 design, which occupies two server slots, is a bit smaller, but it packs more hashrate per unit of space at 600 TH/s (or 300 TH/s per slot) versus Bitmain’s 860 TH/s (286.66 TH/s per slot). The benefit of a server rack ASIC lies in standardization. Bitcoin miners are increasingly marching in step with the traditional datacenter industry, and that industry could see 40% adoption of direct liquid-to-chip cooling by 2026, according to data center developer Cyrus One. If miners adopt this design, then theoretically, they can optimize their supply chains by converging on server designs that are becoming best practice in the big-boy data center sector. — Colin Harper, Blockspace Read more.

GENSYN CEO BEN FIELDING: Ten years ago, when he was still a young AI researcher beginning his PhD track, Ben Fielding explored how “swarms” of AI — clusters of many different models — could talk to each other and learn from each other, which might improve the collective whole. There was just one problem: He was handcuffed by the realities of that noisy machine beneath his desk. And he knew he was outgunned by Google and other Big Tech. Compute constraints would always be an issue, he realized. The solution? Decentralized AI. Fielding co-founded Gensyn (along with Harry Grieve) in 2020, or years before Decentralized AI became fashionable. The project was initially known for building decentralized compute, but the vision is actually something wider: “The network for machine intelligence.” They’re building solutions up and down the tech stack. And now, a decade after Fielding’s noisy desk annoyed his lab-mates, the early tools of Gensyn are out in the wild. Gensyn recently released its “RL Swarms” protocol (a descendant of Fielding’s PhD work) and just launched its Testnet — which brings blockchain into the fold. Fielding talked with Jeff Wilser about AI Swarms, how blockchain snaps into the puzzle, and shares why all innovators — not just tech giants — “should have the right to build machine learning technologies.” — Jeff Wilser Read more.

In Other News

Web3 lacks a dedicated memory layer, making its current architecture inefficient and difficult to scale. Random Linear Network Coding (RLNC) offers a solution by enhancing data propagation and storage efficiency in decentralized systems. Implementing RLNC can address Web3’s scalability challenges by optimizing memory and data access without compromising decentralization, says Muriel Médard, co-founder of Optimum. Read her op-ed here.

Ripple, an enterprise-focused blockchain service closely tied to the XRP Ledger (XRP), said on Wednesday it has integrated its stablecoin to the company’s cross-border payments system to boost adoption for Ripple USD (RLUSD). Select Ripple Payments customers including cross-border payment providers BKK Forex and iSend are already using the stablecoin to improve their treasury operations, the company said. Ripple plans to further expand the token’s availability of its token to payments customers. RLUSD reached a $244 million market capitalization, growing 87% over the past month. — Kris Sandor reports.

Regulatory and Policy

The U.S. Securities and Exchange Commission has dropped or paused over a dozen ongoing cases (and lost one) since U.S. President Donald Trump retook office just over two months ago and appointed Commissioner Mark Uyeda as acting chair. Here is a rundown of what’s left on the SEC’s enforcement docket. — Nik De reports.

Calendar

April 8-10: Paris Blockchain Week

April 30-May 1: Token 2049, Dubai

May 14-16: Consensus, Toronto

May 20-22: Avalanche Summit, London

May 27-29: Bitcoin 2025, Las Vegas

June 30-July 3: EthCC, Cannes

Oct. 1-2: Token2049, Singapore

Uncategorized

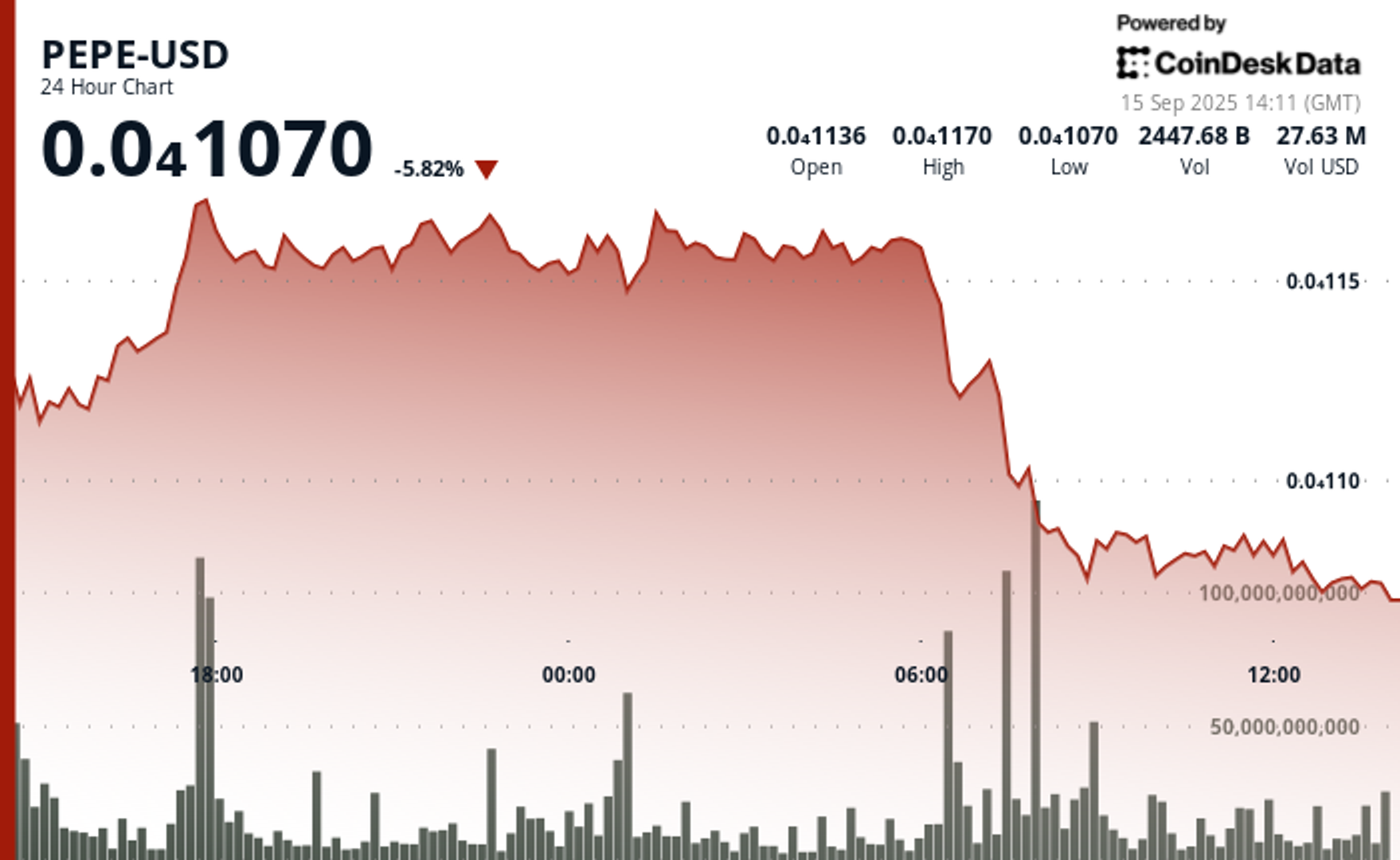

PEPE Price Sinks 6% Amid Market Sell-Off as Whales Accumulate

Meme-inspired cryptocurrency PEPE has lost nearly 6% of its value in the last 24-hour period, sliding to a $0.0000107 low even as large investors accumulate.

Trading volumes for the cryptocurrency surged into the trillions of tokens amid the drop, as the token kept failing to find support amid the intense selling pressure. The drop came amid a wider crypto market drawdown, where the broader CoinDesk 20 (CD20) index lost 1.8% of its value.

Memecoins were especially hard hit in the sell-off. The CoinDesk Memecoin Index (CDMEME) dropped nearly 5% over the last 24 hours, while bitcoin saw a drop of 0.8%.

The drop comes just days after altcoin season speculation grew among cryptocurrency circles over the Federal Reserve’s expected interest rate cut later this week, which is expected to be a boon for risk assets.

Data from Nansen shows that over the past week, the top 100 non-exchange addresses holding PEPE on the Ethereum network have seen their holdings grow by 1.38% to 307.33 trillion tokens, while exchange wallets had a 1.45% drop in holdings to 254.4 trillion tokens.

Technical Analysis Overview

PEPE’s price action pointed to a market in retreat, according to CoinDesk Research’s technical analysis data model. The token dropped from $0.000011484 to $0.000010782, with sellers dominating the chart.

Price peaked at $0.000011732 during a resistance test, but volume swelled to 5.5 trillion tokens at that level, before the market ultimately turned lower.

Support showed signs of buckling during the next phase, with the token brushing against $0.000010746. Trading activity intensified again, hitting 7.7 trillion tokens and reinforcing bearish sentiment.

The cryptocurrency’s price whipsawed within a 9% intraday range, a sign that traders remain unsure whether support levels are going to hold.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Uncategorized

Ether Bigger Beneficiary of Digital Asset Treasuries Than Bitcoin or Solana: StanChart

Digital asset treasuries (DATs), publicly traded firms that hold crypto on their balance sheets, have been hit hard in recent weeks as their market NAVs (mNAVs) slid below 1, Standard Chartered’s Geoff Kendrick said in a new report.

Looking ahead, ether (ETH) DATs appear to have the most staying power thanks to staking yield, regulatory clarity, and room to grow, argued Kendrick.

The mNAV ratio is crucial. When it falls, these firms lose the incentive (and sometimes the ability) to keep buying crypto, threatening a key source of demand for bitcoin (BTC), ether and solana (solana).

Kendrick said that the next phase for DATs will be one of differentiation. The winners will be those that can raise funds at the lowest cost, achieve scale that draws liquidity and investor attention, and, crucially, earn staking yield. That last point tilts the playing field toward ether and solana treasuries over bitcoin, which lacks yield.

Market saturation is also at play. Strategy’s success as the flagship BTC treasury has inspired a flood of copycats, nearly 90 at last count, who together now hold more than 150,000 BTC, up sixfold this year, the analyst noted.

But if mNAVs stay below 1, Standard Chartered expects consolidation. For BTC treasuries, that could mean firms like Saylor’s Strategy buying out rivals rather than buying new bitcoin on the open market, a coin rotation, not fresh demand.

Ether treasuries look better positioned. They have been aggressively accumulating, with 3.1% of ETH’s circulating supply purchased since June. The largest player, Bitmine (BMNR) is well-placed to keep adding to its 2 million ETH stack, the report said.

For crypto markets, this matters. DAT buying has been a key driver of bitcoin and ether prices in 2025. But with BTC treasuries facing consolidation pressure and solana treasuries still relatively small, Standard Chartered sees ETH as the likely beneficiary going forward.

Read more: Strategy’s S&P 500 Snub Is a Cautionary Signal for Corporate Bitcoin Treasuries: JPMorgan

Uncategorized

Ethereum Foundation Starts New AI Team to Support Agentic Payments

The Ethereum Foundation (EF) is creating a dedicated artificial intelligence (AI) group to make Ethereum the settlement and coordination layer for what it calls the “machine economy,” according to research scientist Davide Crapis.

Crapis, who announced the initiative Monday on X, said the new dAI Team will pursue two priorities: enabling AI agents to pay and coordinate without intermediaries, and building a decentralized AI stack that avoids reliance on a small number of large companies. He said Ethereum’s neutrality, verifiability and censorship resistance make it a natural base layer for intelligent systems.

Ethereum Foundation background

The EF is a non-profit organization based in Zug, Switzerland, that funds and coordinates the development of the Ethereum blockchain. It does not control the network but plays a catalytic role by supporting researchers, developers and ecosystem projects.

Its remit includes funding upgrades such as Ethereum 2.0, zero-knowledge proofs and layer-2 scaling, alongside community programs like the Ecosystem Support Program. The foundation also organizes events such as Devcon to foster collaboration and acts as a policy advocate for blockchain adoption.

In 2025, EF restructured to handle Ethereum’s growth, emphasizing ecosystem acceleration, founder support and enterprise outreach. The new dAI Team represents a continuation of this shift toward specialized units addressing emerging technologies.

Crapis’s role

Crapis is a research scientist at the EF and will lead the new dAI Team. He said the group will connect its work with both the EF’s protocol group and its ecosystem support arm.

“Ethereum makes AI more trustworthy, and AI makes Ethereum more useful,” he wrote, adding that the team intends to fund public goods and projects at the intersection of AI and blockchains.

ERC-8004 and Trust Standards

The group will build on recent work around ERC-8004, a proposed Ethereum standard that Crapis described as a way to prove who an AI agent is and whether it can be trusted. By offering identity and reputation systems for autonomous agents, the standard is intended to allow coordination without centralized gatekeepers.

Crapis said the team will support new standards and upgrades as they emerge, guided by Ethereum’s values and the “d/acc” philosophy of decentralized acceleration. The goal, he explained, is to ensure AI development remains open and verifiable while giving humans greater agency over how intelligent systems interact with the economy.

Why it matters

For Ethereum, the move signals a growing ambition to anchor emerging technologies beyond finance.

If AI agents begin transacting at scale, demand could grow for settlement rails, reputation systems and standards that run natively on Ethereum. For the AI community, the initiative offers an alternative to centralized platforms that currently dominate AI infrastructure.

“The more intelligent agents transact, the more they need a neutral base layer for value and reputation,” Crapis said. “Ethereum benefits by becoming that layer and AI benefits by escaping lock-in to a few centralized platforms.”

The team has begun hiring and publishing resources, according to Crapis. He said EF intends to work “with purpose and urgency” to connect AI developers with the Ethereum ecosystem and to accelerate research at the boundary of the two fields.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars