Uncategorized

Sei Foundation Explores Buying 23andMe to Put Genetic Data on Blockchain

The Sei Foundation, the nonprofit development organization behind the layer-1 blockchain Sei (SEI), is exploring the acquisition of bankrupt personal genomics company 23andMe and putting the genetic data of 15 million users on blockchain rails.

The foundation announced the initiative in an X post on Thursday, calling the plan its «boldest DeSci bet yet» — referring to the decentralized science movement. Earlier this year, it also launched a $65 million venture capital fund dedicated to DeSci startups building on the Sei network.

The foundation said that genomic data security is a national security matter, particularly as 23andMe grapples with financial difficulties. The company, known for its direct-to-consumer DNA testing services, filed for Chapter 11 bankruptcy protection earlier this week.

If the acquisition proceeds, the Sei Fundation plans to integrate 23andMe’s data onto its blockchain and give users ownership of their genetic data, ensuring privacy through encrypted transfers and allowing individuals to decide how their data is monetized.

«This isn’t just about saving a company, it’s about building a future where your most personal data remains yours to control,» the foundation said.

Numerous state attorneys general have warned 23andme customers to delete their data from the platform in recent days since the company’s bankruptcy filing.

SEI, the native token of the network, climbed as much as 3% following the news before giving back some of the gains.

Uncategorized

Senate Dems Gear Up Resistance as Stablecoin Bill Meets Test Most Think Will Succeed

A key crypto bill has opened a rift among Senate Democrats as another big test approaches for the viability of legislation to regulate stablecoin issuers. Most expect the bill to clear a significant procedural vote on Monday night, but Democrats are split.

The Senate’s most prominent crypto critic, Massachusetts Democrat Elizabeth Warren, is leading a faction trying to dig in their heels on the bill, raising objections that include national security threats, consumer hazards and the corruption of a White House that’s conflicted because of President Donald Trump’s own digital assets business interests.

The other group, including Senator Kirsten Gillibrand, one of the bill’s primary backers, has argued that presidential conflicts are already illegal under the U.S. Constitution, and the bill doesn’t need to have specific constraints added to clarify that point. That side also praises a number of changes to the legislation to improve consumer protections and to partially address worries that large corporations will issue stablecoins — the steady, typically dollar-based tokens that underpin so much of the crypto markets’ transaction activity.

The bill is set for what’s known as a cloture vote on Monday night, which will decide whether it advances into a formal and time-limited period of debate before final consideration. Cloture tends to be the most difficult test for Senate legislation, because it requires 60 votes — much more than a simple majority. A previous version of the bill failed such a vote once before, when Democrats demanded more time to make changes.

The stablecoin bill is one of two highly significant U.S. legislative efforts that will finally establish a set of rules and system of oversight for crypto in the U.S., and many in the industry believe it’ll usher in a flood of interest from investors who’ve waited on the sidelines until the sector is completely regulated. The supporters of the stablecoin legislation have set it up for this vote, suggesting they were able to wrangle enough backers to triumph.

The current Senate bill — known as the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act — is worse than doing nothing, according to the arguments from the camp led by Warren, who is the ranking Democrat on the Senate Banking Committee. «A strong bill would ensure that consumers enjoy the same consumer protections when using stablecoins as they do when using other payment systems, close loopholes that enable the illicit use of stablecoins by cartels, terrorists, and criminals, and reduce the risk that stablecoins take down our financial system,» according to a sheet issued on Monday by the committee’s Democratic staff. «The GENIUS Act does not meet those minimum standards.»

Gillibrand, however, said the bill has been written in a «truly bipartisan effort.»

«Stablecoins are already playing an important role in the global economy, and it is essential that the U.S. enact legislation that protects consumers, while also enabling responsible innovations,” the New York Democrat said in a statement last week.

Senator Mark Warner, a Virginia Democrat, also explained his view in choosing to support the bill. “It sets high standards for issuers, limits big tech overreach and creates a safer, more transparent framework for digital assets,» he said in a statement. «It’s not perfect, but it’s far better than the status quo.”

Read More: U.S. Stablecoin Bill Could Clear Senate Next Week, Proponents Say

In the hours before the planned Monday vote, a coalition of 46 consumer, labor and advocacy groups continued objecting to the legislation, which has been overhauled repeatedly.

«A vote for this legislation would enable and condone cryptobusiness activities by the Trump administration, organization, and family that raise unprecedented concerns about presidential conflicts of interest, corruption, and the abuse of public office for private gain,» they wrote in a letter to the Senate leadership.

The crypto industry itself has come together to support the legislation, with various lobbyist groups publishing statements arguing lawmakers should advance the legislation. Stand With Crypto, a Coinbase-backed group focused on getting voters to support crypto issues, warned lawmakers in a statement Monday that their votes would go into its sometimes arbitrary assignment of grades for politicians’ crypto sentiment.

While the stablecoin bill has drawn some political heat, it’s widely expected to be the easier of the two crypto efforts on Capitol Hill. The legislation to establish U.S. market rules for crypto is much more complex. For both bills, the House of Representatives is also working on parallel efforts.

If the bill clears cloture, it could speed toward Senate passage in a matter of days. Jaret Seiberg, a policy analyst with TD Cowen, expects it to clear the Senate this week

“That means it could become law by summer as we see the House moving quickly on the bill,” he wrote in a note to clients.

Warren wrote her own letter on Monday to the U.S. Department of the Treasury and the Department of Justice, pressing for answers about what’s being done about North Korean hackers who stole more than a billion dollars in assets from exchange Bybit earlier this year.

«These stolen assets have helped keep the regime afloat and supported continued investments in its nuclear and conventional weapons programs,» Warren and Senator Jack Reed, a Rhode Island Democrat, wrote to the Treasury secretary and attorney general. «Reports suggest there are potentially thousands of North Korean-affiliated crypto hackers around the globe.”

Uncategorized

Bitcoin Climbs to $105K; Crypto ETF Issuer Sees 35% Upside

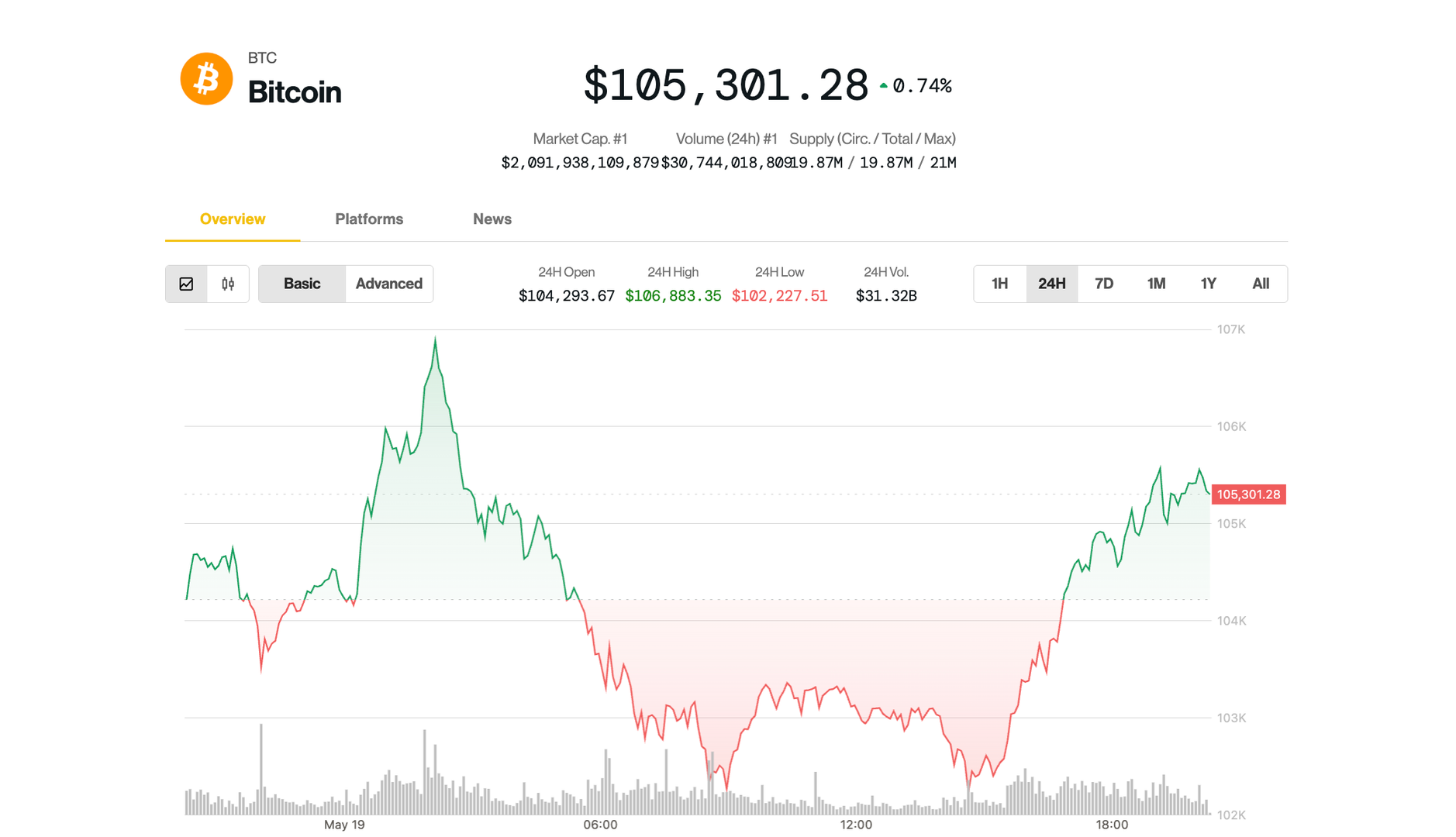

Cryptocurrencies regained footing on Monday after a rocky start to the trading session, mirroring a broader recovery in risk assets as traders digested Moody’s downgrade of U.S. government bonds.

Bitcoin BTC notched a strong rebound after slipping to as low as $102,000 early in the U.S. session, following its record weekly close at $106,600 overnight. The largest cryptocurrency by market cap climbed back to $105,000 in afternoon trading, up 0.4% over 24 hours. Ether ETH rose 1.2%, reclaiming the $2,500 level.

DeFi lending platform Aave AAVE outperformed most large-cap altcoins, while the majority of the broad-market CoinDesk 20 Index members still remained in the red despite advancing from their daily lows. Solana SOL, Avalanche AVAX and Polkadot DOT were down 2%-3%.

The bounce extended to U.S. stocks, too, with the S&P 500 and Nasdaq erasing their morning decline.

The early pullback in crypto and stocks came after Moody’s late Friday downgraded the U.S. credit rating from its AAA status. The move rattled bond markets, pushing 30-year Treasury yields above 5% and the 10-year note to over 4.5%.

Still, some analysts downplayed the downgrade’s long-term impact on asset prices.

«What does [the downgrade] mean for markets? Longer-term – really nothing,» said Ram Ahluwalia, CEO of wealth management firm Lumida Wealth. He added that in the short term there might be some selling pressure centered on U.S. Treasuries due to large institutional investors rebalancing, as some of them are mandated to hold assets only in AAA-rated securities.

«Moody’s is the last of the three major rating agencies to downgrade U.S. debt. This was the opposite of a surprise – it was a long time coming,» Callie Cox, chief market strategist at Ritholtz Wealth Management, said in an X post. «That’s why stock investors don’t seem to care.»

Bitcoin targets $138K this year

While BTC hovers just below its January record prices, digital asset ETF issuer 21Shares sees more upside for this year.

«Bitcoin is on the verge of a breakout,» research strategist Matt Mena wrote in a Monday report. He argued that BTC’s current rally is driven not by retail mania, but by a confluence of structural forces, including institutional inflows, a historic supply crunch and improving macro conditions that suggests a more durable and mature path to fresh all-time highs.

Spot Bitcoin ETFs have consistently absorbed more BTC than is mined daily, tightening supply while major institutions, corporations such as Strategy and newcomer Twenty One Capital accumulate and even states explore creating strategic reserves.

These factors combined could lift BTC to $138,500 this year, Mena forecasted, translating to a roughly 35% rally for the largest crypto.

Uncategorized

JPMorgan To Allow Clients To Buy Bitcoin, Says Jamie Dimon

Clients of JPMorgan Chase (JPM) will soon have the option to buy bitcoin BTC, according to CEO Jamie Dimon, who spoke at the bank’s annual Investor Day on Monday, signaling a shift in how the firm approaches the asset.

“We are going to allow you to buy it,” Dimon told shareholders, though he added the bank has no plans to hold the asset in custody.

Dimon, long known for his skepticism of cryptocurrency, doubled down in his closing remarks, saying he’s still “not a fan” of bitcoin, mainly because of its use for illegal activities, including sex trafficking and money laundering

He also pushed back on the industry’s hype around blockchain technology, arguing it’s less important than it’s made out to be — even as JPMorgan continues building in the space.

“We have been talking about blockchain for 12 to 15 years,» he said. «We spend too much on it. It doesn’t matter as much as you all think.»

The bank’s own blockchain platform, Kinexys, recently ran a test transaction on a public blockchain for the first time, settling tokenized U.S. Treasuries on Ondo Chain’s testnet.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors