Uncategorized

Crypto Daybook Americas: Bitcoin Owners HODL as Sunny Second Quarter Nears

By Omkar Godbole (All times ET unless indicated otherwise)

The sun shone on crypto markets early Wednesday, with bitcoin having another go at $88,000 amid growing chatter about bullish seasonality factors as March draws to a close and the second quarter looms.

The last 10 years of price data tracked by analyst Miles Deutscher show April as the turning point for the market, with a 75% chance of upside between now and year-end. The pattern was noted by QCP Capital as well, which pointed to the second quarter, and April in particular, as bullish for crypto.

«The S&P 500 has delivered an average annualized return of 19.6% in Q2, while Bitcoin has also recorded its second-best median performance during this stretch — again, trailing only Q4,» the Singapore-based firm said on Telegram.

Seasonality factors are not as reliable as standalone indicators, but when coupled with other signs, such as the recent halt in selling by long-term holders, they appear credible.

The so-called 1Y+HODL wave indicator, which tracks the proportion of Bitcoin addresses (or wallets) that have kept their BTC for at least one year, has turned upward, signaling a shift into a holding strategy, according to data source Bitbo Charts. See Chart of the Day, below, too.

Reports that the Federal Deposit Insurance Corporation (FDIC) is drafting rules to remove reputational risk from its bank supervision were labeled “a big win for crypto» by White House crypto czar David Sacks. «In practice, this vague and subjective criteria was used to justify the debanking of lawful crypto businesses through Operation Chokepoint 2.0,» Sacks said on X.

Speaking of the wider market, social media talk about stablecoins has picked up, with observers pointing to $31.8 billion in stablecoins sitting on the sidelines on Binance as potential dry powder waiting for a catalyst. BlackRock’s decision to debut a physical bitcoin exchange-traded product in Europe with a reduced total expense ratio of 15 bps is seen as highly positive as well, considering fees are generally higher there than in the U.S., capping widespread adoption.

Still, macroeconomic uncertainty has the potential to play spoilsport and keep animal spirits at bay. While recent media reports suggest President Donald Trump’s expected reciprocal tariffs on April 2 may be softer than expected, there is still considerable confusion concerning the legality of the tariffs and the countries and sectors that will be targeted.

The deeper slide in U.S. consumer confidence in March and the death cross in the USD/JPY pair, indicating a strengthening of the yen, a haven currency, ahead, don’t help matters either. So stay alert!

What to Watch

Crypto:

March 26, 10:37 a.m.: Ethereum’s Hoodi testnet will activate the Pectra hard fork network upgrade at epoch 2048.

March 27: Walrus (WAL) mainnet goes live.

April 1: Metaplanet (3350) 10-for-1 stock split becomes effective.

Macro

March 27, 8:30 a.m.: The U.S. Bureau of Economic Analysis releases (Final) Q4 GDP data.

GDP Growth Rate QoQ Est. 2.3% vs. Prev. 3.1%

Core PCE Prices QoQ Est. 2.7% vs. Prev. 2.2%

PCE Prices QoQ Est. 2.4% vs. Prev. 1.5%

Real Consumer Spending QoQ Est. 4.2% vs. Prev. 3.7%

March 27, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended March 22.

Initial Jobless Claims Est. 225K vs. Prev. 223K

March 27, 10:00 a.m.: The U.S. Senate Banking Committee will hold a hearing on the nomination of Paul Atkins to the chair of the U.S. Securities and Exchange Commission (SEC). Livesteam link.

March 27, 3:00 p.m.: Mexico’s central bank announces its interest rate decision.

Target Rate Est. 9% vs. Prev. 9.5%

March 28, 8:00 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases February unemployment rate data.

Unemployment Rate Est. 6.8% vs. Prev. 6.5%

March 28, 8:00 a.m.: Mexico’s National Institute of Statistics and Geography releases February unemployment rate data.

Unemployment Rate Est. 2.6% vs. Prev. 2.7%

March 28, 8:30 a.m.: Statistics Canada releases January GDP data.

GDP MoM Est. 0.3% vs. Prev. 0.2%

March 28, 8:30 a.m.: The U.S. Bureau of Economic Analysis releases February consumer income and expenditure data.

Core PCE Price Index MoM Est. 0.3% vs. Prev. 0.3%

Core PCE Price Index YoY Est. 2.7% vs. Prev. 2.6%

PCE Price Index MoM Est. 0.3% vs. Prev. 0.3%

PCE Price Index YoY Est. 2.5% vs. Prev. 2.5%

Personal Income MoM Est. 0.4% vs. Prev. 0.9%

Personal Spending MoM Est. 0.5% vs. Prev. -0.2%

April 2, 12:01 a.m.: The Trump administration’s reciprocal tariffs plan goes live.

Earnings (Estimates based on FactSet data)

March 27: KULR Technology Group (KULR), post-market, $-0.02

March 28: Galaxy Digital Holdings (GLXY), pre-market, C$0.38

Token Events

Governance votes & calls

Sky DAO is discussing redirecting the Boost program’s budget to promote USDS on non-Ethereum networks and stop Sky token buybacks to instead direct surplus toward Sky takers.

DYdX DAO is discussing the allocation of $10 million to fund the most profitable traders on the platform in a bid to attract talent. The DAO is also voting on creating a new liquidity tier designed for markets introduced through the Instant Market Listings feature.

Venus DAO is discussing the potential acquisition of a 33% stake in Thena.fi for $4.5 million to position Venus to “build a comprehensive DeFi SuperApp on the BNB Chain.”

Balancer DAO is discussing the establishment of a Balancer Alliance Program, which would see the protocol share a portion of the revenue it generates with key ecosystem partners in the form of USDC as veBAL.

March 26, 8 a.m.: Kaia Chain to hold a Community Town Hall to discuss its next moves and latest business and governance insights.

March 26, 10 a.m.: Conflux Network to host its quarterly Community Call with founders Fan Long and YanJie Zhang.

March 26, 12 p.m.: Helium Foundation to hold a Community Call to discuss the protocol and key ecosystem updates.

March 27, 9 a.m.: PancakeSwap and EOS Network Foundation to host an Ask Me Anything (AMA) session.

March 27, 12 p.m.: Cardano Foundation to hold a livestream with its CTO breaking down the project’s roadmap.

Unlocks

March 31: Optimism (OP) to unlock 1.93% of its circulating supply worth $28.88 million.

April 1: Sui (SUI) to unlock 2.03% of its circulating supply worth $164.34 million.

April 1: ZetaChain (ZETA) to unlock 6.05% of its circulating supply worth $14.39 million.

April 2: Ethena (ENA) to unlock 0.77% of its circulating supply worth $17.29 million.

April 3: Wormhole (W) to unlock 47.64% of its circulating supply worth $143.5 million.

April 7: Kaspa (KAS) to unlock 0.59% of its circulating supply worth $11.98 million.

April 9: Movement (MOVE) to unlock 2.04% of its circulating supply worth $27.29 million.

Token Listings

March 27: Walrus (WAL) to be listed on Gate.io and Bybit.

March 28: Binance to delist Aergo (AERGO).

March 31: Binance to delist USDT, FDUSD, TUSD, USDP, DAI, AEUR, UST, USTC, and PAXG.

Conferences

CoinDesk’s Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Day 3 of 3: Merge Buenos Aires

Day 2 of 2: PAY360 2025 (London)

Day 2 of 3: Mining Disrupt (Fort Lauderdale, Fla.)

Day 2 of 4: Boao Forum for Asia (BFA) Annual Conference 2025 (Boao, China)

March 26: Crypto Assets Conference (Frankfurt)

March 26: DC Blockchain Summit 2025 (Washington)

Day 1 of 3: Real World Crypto Symposium 2025 (Sofia, Bulgaria)

March 27: Building Blocks (Tel Aviv)

March 27: Digital Euro Conference 2025 (Frankfurt)

March 27: Web3 Banking Symposium 2.0 (Lugano, Switzerland)

March 27: WIKI Finance EXPO Hong Kong 2025

March 27-28: Money Motion 2025 (Zagreb, Croatia)

Token Talk

By Shaurya Malwa

PumpSwap has rapidly gained new users and over $1.2 billion in trading volumes just days after going live and now accounts for nearly 15% of on-chain trading activity on Solana.

Pump Fun introduced PumpSwap last week as its own decentralized exchange (DEX), aiming to streamline token migrations and trading.

Pump Fun, a prominent Solana-blockchain platform, gained traction for enabling rapid token creation and deployment, often associated with memecoins. It has facilitated over 1.5 million token launches since its early 2024 debut, finding an audience looking to trade microcap tokens on Solana’s low-cost, high-speed network.

Tokens migrated to Solana DEX Raydium after they hit a $69,000 market capitalization on Pump.Fun. With PumpSwap, the tokens (and trading fees) never leave the broader Pump ecosystem.

Abracadabra Money’s gmCauldrons suite suffered a hack on Tuesday. resulting in a $13 million MIM loss. The rest of the Abracadabra product ecosystem was not affected, with the DAO outlining a recovery plan in «Abracadabra Money: The Path Forward.»

The DAO treasury, holding $19 million in assets, has already acquired 6.5 million MIM to repay 50% of the loss, with plans to cover the remaining amount in the coming months, demonstrating a proactive response to mitigate the impact.

Derivatives Positioning

SHIB’s perpetual futures open interest has risen by 14%, outpacing other major cryptocurrencies, while BTC and ETH open interest has dropped by under 1% in the past 24 hours.

A meme token receiving more net inflows than other assets is often a precursor to a market correction.

Perpetual funding rates for most major tokens, excluding TRX, BNB and SUI, remain positive, but below an annualized 10%, signifying a moderately bullish positioning.

Deribit’s BTC and ETH options continue to cast doubts on the recent price recovery, sporting a bullish call bias only after May expiries.

Block flows featured a BTC bull call spread in the September expiry involving $90K and $125K strikes. In ETH’s case, flows leaned slightly bearish with outright longs in put options at $1.9K and $2K strikes.

Market Movements:

BTC is up 0.14% from 4 p.m. ET Monday at $88,019.03 (24hrs: +1.02%)

ETH is down 0.25% at $2,060.34 (24hrs: -0.22%)

CoinDesk 20 is up 0.28% at 2,811.12 (24hrs: +0.96%)

Ether CESR Composite Staking Rate is up 4 bps at 2.95%

BTC funding rate is at 0.0101% (3.6869% annualized) on Binance

DXY is unchanged at 104.23

Gold is unchanged at $3,024.80/oz

Silver is up 0.5% at $34.17/oz

Nikkei 225 closed +0.65% at 38,027.29

Hang Seng closed +0.6% at 23,483.32

FTSE is unchanged at 8,668.40

Euro Stoxx 50 is down 0.65% at 5,439.52

DJIA closed on Tuesday unchanged at 42,587.50

S&P 500 closed +0.16 at 5,776.65

Nasdaq closed +0.46% at 18,271.86

S&P/TSX Composite Index closed +0.14% at 25,339.50

S&P 40 Latin America closed +1.03% at 2,480.80

U.S. 10-year Treasury rate is up 1 bps at 4.33%

E-mini S&P 500 futures are down 0.15% at 5,817.50

E-mini Nasdaq-100 futures are down 0.2% at 20,448.50

E-mini Dow Jones Industrial Average Index futures are down 0.12% at 42,854.00

Bitcoin Stats:

BTC Dominance: 61.46 (-0.03%)

Ethereum to bitcoin ratio: 0.02344 (-0.85%)

Hashrate (seven-day moving average): 838 EH/s

Hashprice (spot): $50.17

Total Fees: 13.1 BTC / $1,152,066

CME Futures Open Interest: 147,550 BTC

BTC priced in gold: 29.1 oz

BTC vs gold market cap: 8.26%

Technical Analysis

The yen-dollar’s 50-day simple moving average (SMA) has crossed under its 200-day SMA, confirming a so-called death cross bearish momentum pattern.

It’s a sign of an impending rally in the yen, seen as a haven currency, which could destabilize risk assets, including cryptocurrency.

The yen-bullish pattern comes as talk of Bank of Japan rate increases gathers pace.

Crypto Equities

Strategy (MSTR): closed on Monday at $341.81 (+1.81%), up 0.47% at $343.40 in pre-market

Coinbase Global (COIN): closed at $204.23 (+0.59%), down 0.11% at $204

Galaxy Digital Holdings (GLXY): closed at C$18.65

MARA Holdings (MARA): closed at $14.25 (-2.46%), down 0.35% at $14.30

Riot Platforms (RIOT): closed at $8.51 (-2.41%), down 0.12% at $8.50

Core Scientific (CORZ): closed at $8.66 (-6.98%), down 0.12% at $8.65

CleanSpark (CLSK): closed at $8.73 (-0.68%), down 0.11% at $8.72

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $15.65 (-4.05%)

Semler Scientific (SMLR): closed at $42.38 (-1.17%)

Exodus Movement (EXOD): closed at $56.04 (+6.46%), up 0.82% at $56.50

ETF Flows

Spot BTC ETFs:

Daily net flow: $26.8 million

Cumulative net flows: $36.24 billion

Total BTC holdings ~ 1,115 million.

Spot ETH ETFs

Daily net flow: -$3.3 million

Cumulative net flows: $2.43 billion

Total ETH holdings ~ 3.415 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

The chart shows represents the proportion of crypto addresses — or wallets — that have held their bitcoin for at least one year without any outgoing transactions.

The metric has turned up in recent weeks, rising from 61.8% to 63.4% in a sign of renewed holding sentiment.

While You Were Sleeping

Russia, Ukraine Agree to Sea, Energy Truce; Washington Seeks Easing of Sanctions (Reuters): Shortly after the Washington-brokered truce was announced, Moscow said the pause in maritime and energy attacks wouldn’t begin unless sanctions on certain Russian banks were removed.

Top Federal Reserve Official Says Market Angst Over Inflation Would Be ‘Red Flag’ (Financial Times): The Chicago Fed president said the central bank might delay rate cuts if investors start expecting inflation to stay high.

Movement’s MOVE Token Soars 25% as Strategic Reserve Is Unveiled After Malicious Market Maker Activity (CoinDesk): Movement is establishing a $38 million strategic reserve to buy its MOVE token using funds recovered from a market maker accused of breaching contract terms.

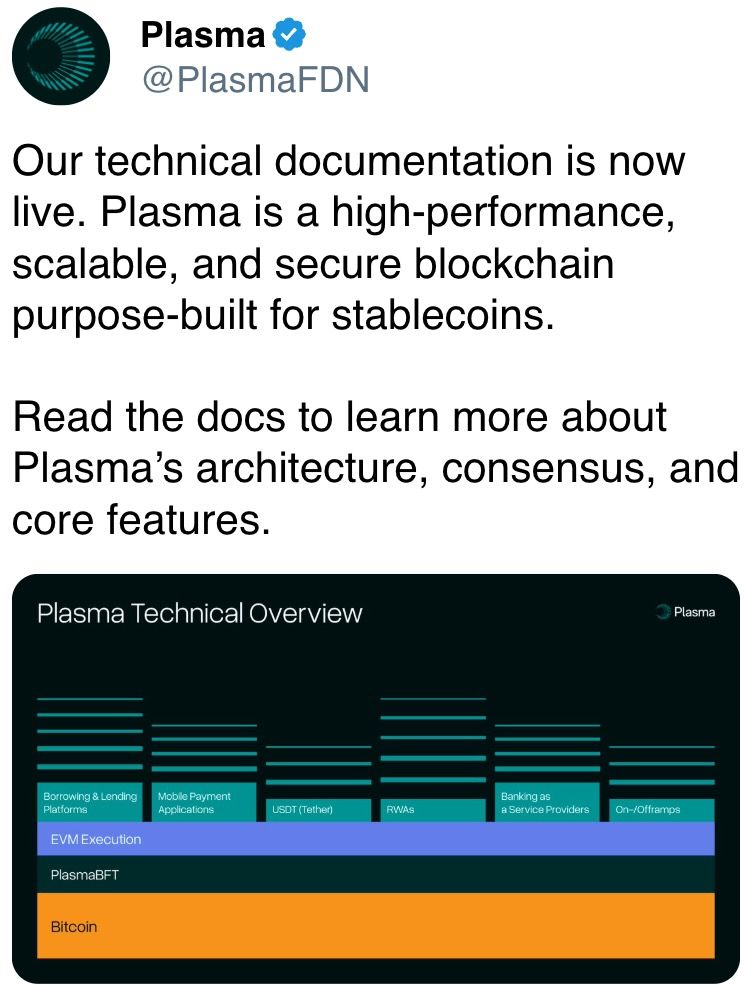

Peter Thiel-Backed Plasma Unveils ‘HotStuff-Inspired Consensus’ for High-Frequency Global Stablecoin Transfers (CoinDesk): Features include custom gas tokens, zero-charge USDT transfers and confidential transactions.

Celo Migration to Layer-2 Network Is Done, Bringing in New Era for the Blockchain (CoinDesk): Celo completed its transition from a layer-1 blockchain to an Ethereum layer-2 chain after a nearly two-year process.

Canada and India Look to Reset Ties in Counter to Trump’s Duties (Bloomberg): The two countries are reportedly considering mending their diplomatic rift, which began in September 2023, as they brace for the impact of potential new U.S. tariffs.

In the Ether

Business

Crypto Trading Firm Keyrock Buys Luxembourg’s Turing Capital in Asset Management Push

Crypto trading firm Keyrock said it’s expanding into asset and wealth management by acquiring Turing Capital, a Luxembourg-registered alternative investment fund manager.

The deal, announced on Tuesday, marks the launch of Keyrock’s Asset and Wealth Management division, a new business unit dedicated to institutional clients and private investors.

Keyrock, founded in Brussels, Belgium and best known for its work in market making, options and OTC trading, said it will fold Turing Capital’s investment strategies and Luxembourg fund management structure into its wider platform. The division will be led by Turing Capital co-founder Jorge Schnura, who joins Keyrock’s executive committee as president of the unit.

The company said the expansion will allow it to provide services across the full lifecycle of digital assets, from liquidity provision to long-term investment strategies. «In the near future, all assets will live onchain,» Schnura said, noting that the merger positions the group to capture opportunities as traditional financial products migrate to blockchain rails.

Keyrock has also applied for regulatory approval under the EU’s crypto framework MiCA through a filing with Liechtenstein’s financial regulator. If approved, the firm plans to offer portfolio management and advisory services, aiming to compete directly with traditional asset managers as well as crypto-native players.

«Today’s launch sets the stage for our longer-term ambition: bringing asset management on-chain in a way that truly meets institutional standards,» Keyrock CSO Juan David Mendieta said in a statement.

Read more: Stablecoin Payments Projected to Top $1T Annually by 2030, Market Maker Keyrock Says

Business

Crypto Trading Firm Keyrock Buys Luxembourg’s Turing Capital in Asset Management Push

Crypto trading firm Keyrock said it’s expanding into asset and wealth management by acquiring Turing Capital, a Luxembourg-registered alternative investment fund manager.

The deal, announced on Tuesday, marks the launch of Keyrock’s Asset and Wealth Management division, a new business unit dedicated to institutional clients and private investors.

Keyrock, founded in Brussels, Belgium and best known for its work in market making, options and OTC trading, said it will fold Turing Capital’s investment strategies and Luxembourg fund management structure into its wider platform. The division will be led by Turing Capital co-founder Jorge Schnura, who joins Keyrock’s executive committee as president of the unit.

The company said the expansion will allow it to provide services across the full lifecycle of digital assets, from liquidity provision to long-term investment strategies. «In the near future, all assets will live onchain,» Schnura said, noting that the merger positions the group to capture opportunities as traditional financial products migrate to blockchain rails.

Keyrock has also applied for regulatory approval under the EU’s crypto framework MiCA through a filing with Liechtenstein’s financial regulator. If approved, the firm plans to offer portfolio management and advisory services, aiming to compete directly with traditional asset managers as well as crypto-native players.

«Today’s launch sets the stage for our longer-term ambition: bringing asset management on-chain in a way that truly meets institutional standards,» Keyrock CSO Juan David Mendieta said in a statement.

Read more: Stablecoin Payments Projected to Top $1T Annually by 2030, Market Maker Keyrock Says

Business

Gemini Shares Slide 6%, Extending Post-IPO Slump to 24%

Gemini Space Station (GEMI), the crypto exchange founded by Cameron and Tyler Winklevoss, has seen its shares tumble by more than 20% since listing on the Nasdaq last Friday.

The stock is down around 6% on Tuesday, trading at $30.42, and has dropped nearly 24% over the past week. The sharp decline follows an initial surge after the company raised $425 million in its IPO, pricing shares at $28 and valuing the firm at $3.3 billion before trading began.

On its first day, GEMI spiked to $45.89 before closing at $32 — a 14% premium to its offer price. But since hitting that high, shares have plunged more than 34%, erasing most of the early enthusiasm from public market investors.

The broader crypto equity market has remained more stable. Coinbase (COIN), the largest U.S. crypto exchange, is flat over the past week. Robinhood (HOOD), which derives part of its revenue from crypto, is down 3%. Token issuer Circle (CRCL), on the other hand, is up 13% over the same period.

Part of the pressure on Gemini’s stock may stem from its financials. The company posted a $283 million net loss in the first half of 2025, following a $159 million loss in all of 2024. Despite raising fresh capital, the numbers suggest the business is still far from turning a profit.

Compass Point analyst Ed Engel noted that GEMI is currently trading at 26 times its annualized first-half revenue. That multiple — often used to gauge whether a stock is expensive — means investors are paying 26 dollars for every dollar the company is expected to generate in sales this year. For a loss-making company in a volatile sector, that’s a steep price, and could be fueling investor skepticism.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars