Uncategorized

The SEC Resets Its Crypto Relationship

The U.S. Securities and Exchange Commission is looking to reset its relationship with the crypto industry, even before a permanent chair is confirmed by Congress. The latest effort was Friday’s roundtable, hosted at the SEC’s headquarters in Washington, D.C. and featuring a dozen attorneys representing different views and positions within the crypto industry.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

Ostrich farms and orange groves

The narrative

The SEC’s reset began when Acting Chair Mark Uyeda launched a crypto task force and oversaw his agency withdraw Staff Accounting Bulletin 121, drop a number of ongoing lawsuits, pause a few more and publish multiple staff statements about how the agency might look at memecoins and proof-of-work mining.

Why it matters

The SEC is arguably the most important federal regulator in crypto at the moment. While its sister agency, the Commodity Futures Trading Commission, may be the regulator that might one day oversee crypto spot markets, right now it’s the SEC that most companies in the sector look to for guidance on what, exactly, it is they can do.

Breaking it down

The roundtable was split into two portions (three, if you count introductory remarks from the three commissioners): A roughly 90-minute moderated panel discussion, led by former SEC Commissioner and Paredes Strategies founder Troy Paredes, and a 90-minute town hall still moderated by Paredes but featuring questions from the general public.

You can read CoinDesk’s coverage of the panel discussion at this link.

Though the central question during the discussion was — as it has been for years — when and how exactly is a crypto or crypto transaction a security, panelists touched on everything from the role of crypto in boosting ransomware to how exactly companies should operate.

Chris Brummer, the CEO of Bluprynt and professor at Georgetown Law, opened up the discussion with his analysis of what the Howey Test actually means: We’re basically saying when you have savings, there’s an issue of investor protection. The common enterprise prong that we’re all familiar with is really addressing a kind of providing problem.»

«It really just goes to information asymmetries, and then the question of profits goes to investor psychology, greed and fear, the kinds of things that can distort decision-making,» he said. «And basically, when you have all those factors together, you have a mandated disclosure [rule].»

The SEC’s approach thus far has limited a number of crypto projects, Delphi Ventures General Counsel Sarah Brennan said. While many crypto projects are intended to have a broad initial distribution, «the specter of the applications of securities laws» means many projects act more like they’ll go public than actually embrace the crypto aspects of their projects.

«We see more and more the token is the product … there’s different ways that people are artificially supporting price and it’s generally been, I’d say, sort of toxic to the market,» she said.

John Reed Stark, a former SEC attorney, said that the «economic reality of the transaction» is critical.

«However you want to look at it, the people buying crypto are not collectors,» he said. «We all know that they’re investors, and the mission of the SEC is to protect investors.»

It remains to be seen how the SEC’s efforts will continue, but the agency is taking a more active role in publicly engaging with these questions and the industry seems to be responding. The SEC auditorium was about three-quarters full at times, to say nothing of anyone who tuned into the livestream.

Stories you may have missed

As Congress Talks Up Its Earth-Shaking Crypto Bill, Regulators Are Already at Work: Federal agencies aren’t waiting for Congress or even their permanent heads to get busy with crypto policymaking, Jesse Hamilton noted in this prescient analysis which came ahead of the SEC’s PoW mining statement and OCC’s reputational risk update.

Proof-of-Work Crypto Mining Doesn’t Trigger Securities Laws, SEC Says: Pooled and solo proof-of-work mining is outside the SEC’s jurisdiction, the agency said in a staff statement.

U.S. Bank Agency Cuts ‘Reputational Risk’ From Exams After Crypto Sector Cites Issues: The Office of the Comptroller of the Currency removed «reputational risk» from its supervision handbook, it told national banks on Thursday.

XRP Zooms 10% as Garlinghouse Says SEC Is Dropping Case Against Ripple: Ripple CEO Brad Garlinghouse said the SEC agreed to drop its appeal of a July 2023 ruling that said Ripple did not violate federal securities laws in selling XRP to retail investors by making it available through exchanges, and that the case itself is close to an end.

Digital Chamber Gets New Chief as Crypto Lobbyists Embrace Friendlier Washington: Digital Chamber founder and CEO Perianne Boring is stepping down next month and becoming the chair of its board. The lobby organization’s president, Cody Carbone, will take over as CEO.

Crypto Exchange Bithumb Raided by South Korean Prosecutors Over Embezzlement Allegations: Report: South Korean prosecutors have launched an investigation into crypto exchange Bithumb, looking into embezzlement allegations.

Inside Pump.fun’s Plan to Dominate Solana DeFi Trading: Pump.fun is launching a token swap service in an effort to get a slice of the fees generated by automated market makers on Solana.

Gotbit Founder Aleksei Andriunin Pleads Guilty to Wire Fraud, Market Manipulation: Aleksei Andriunin, the Russian national who told CoinDesk in 2019 that he ran a wash trading service to make cryptocurrencies appear to have a greater liquidity and market capitalization than they actually do, pleaded guilty to market manipulation and wire fraud charges in a plea deal.

Nasdaq Shift to Round-The-Clock Stock Trading Partly Due to Crypto, Says Exchange Executive: Nasdaq and the New York Stock Exchange are both working toward round-the-clock trading at least in part due to crypto trading already being round-the-clock, Nasdaq’s head of U.S. Equities and Exchange-traded Products Giang Bui said.

SEC Chair Nominee Paul Atkins to Face Senate Panel Next Week: SEC Chair nominee Paul Atkins and Comptroller nominee Jonathan Gould will face the Senate Banking Committee for their confirmation hearing next week.

U.S. Government Removes Tornado Cash Sanctions: A few months after the Fifth Circuit Court of Appeals ruled that the Treasury Department’s Office of Foreign Asset Control couldn’t sanction smart contracts, OFAC removed its sanctions against crypto mixer Tornado Cash.

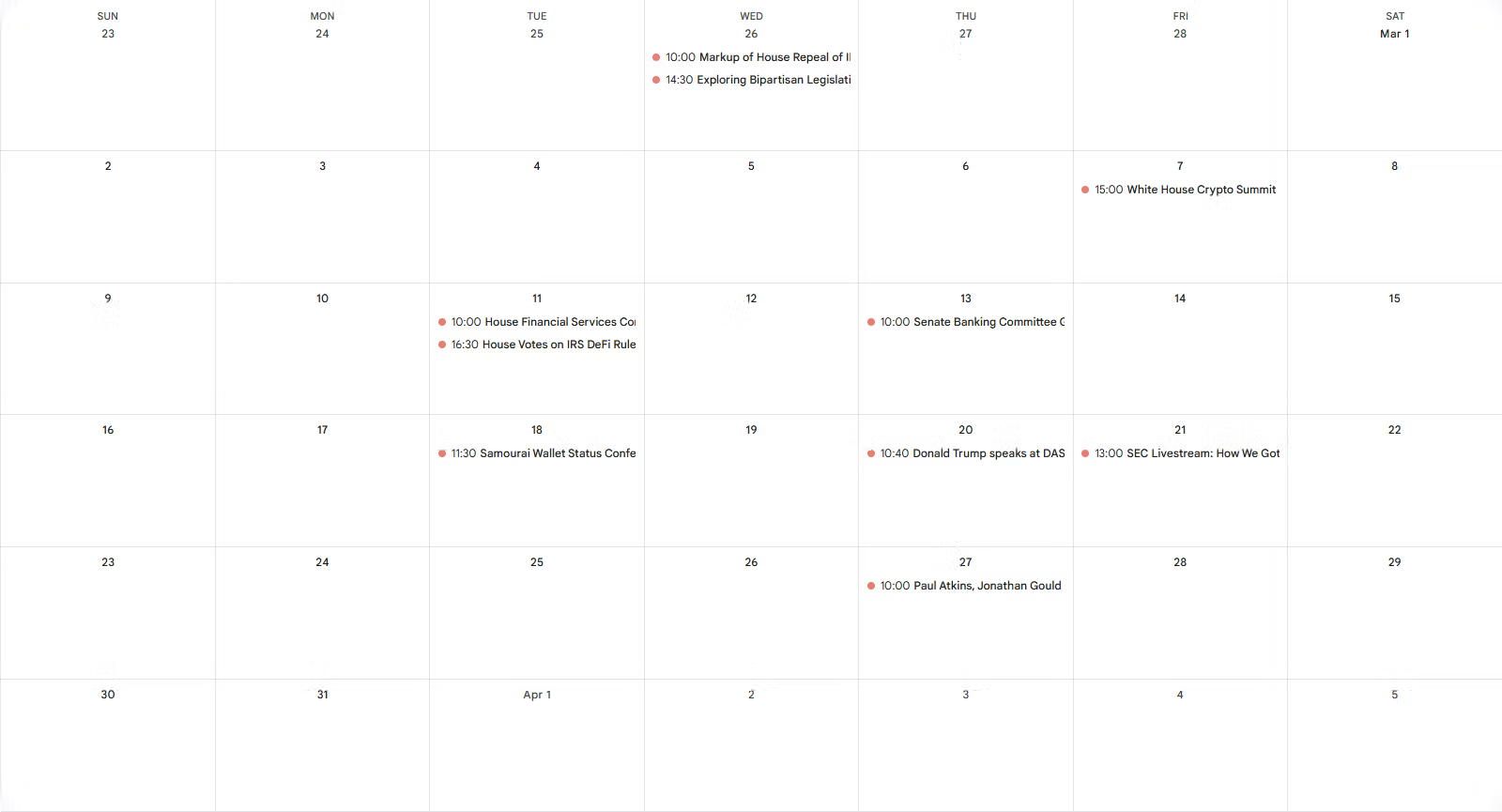

This week

Tuesday

15:30 UTC (11:30 a.m. ET) The federal judge overseeing the U.S. Department of Justice’s case against Samourai Wallet’s founders held a status conference hearing in the case. Per my colleague Cheyenne Ligon, who attended, the 7-minute long hearing addressed a few procedural matters but did not delve into the substance of the case.

Thursday

14:40 UTC (10:40 a.m. ET) U.S. President Donald Trump spoke to the audience at the Digital Asset Summit via a brief, pre-taped video largely reiterating comments he previously made at the White House crypto summit on March 7.

Friday

17:00 UTC (1:00 p.m. ET) The U.S. Securities and Exchange Commission held a roundtable event with legal experts from the crypto industry and SEC staff.

Elsewhere:

(Reuters) Another strain of bird flu — this time H7N9 — has hit the U.S. for the first time since 2017. This is on top of the ongoing H5N1 epidemic.

(CNN) Amtrak CEO Stephen Gardner said he would be stepping down from leading the quasi-public transit company at the White House’s direction.

(Bloomberg) Coinbase is in advanced talks to acquire derivatives platform Deribit, Bloomberg reported, following CoinDesk’s reporting last month that the exchange was interested in the firm.

(Wired) A former Meta employee wrote a tell-all book about her experiences at the company and Meta is going all out to limit its distribution. Careless People has since risen to become a best-seller on Amazon.

(Bloomberg) Bloomberg profiled New York Democrat Kirsten Gillibrand’s role in pushing for crypto legislation in the Senate.

(Politico) The Trump administration’s plans for USAID include reforming it and «leverag[ing] blockchain technology to secure transactions,» though this document Politico obtained does not include a lot more detail. «All distributions would also be secured and traced via blockchain technology to radically increase security, transparency and traceability,» the document says. If you’re one of the individuals pushing for blockchain integration with the U.S. government, let’s chat.

(The Guardian) The Trump administration renditioned more than 200 men of Venezuelan origin to an El Salvadorian prison, potentially in violation of a court order and without holding any hearings or trials. While the administration said in public statements that all 238 men had ties to the Tren de Aragua gang which in turn was taking direction from Venezuela’s government, officials said in court documents that many of the people flown to El Salvador did not have criminal records. Family members of many of these individuals say they were not criminals and did not have gang ties. Some of the individuals reportedly signed deportation papers and expected to be flown back to Venezuela. U.S. intelligence agencies seemingly also found that TdA was not tied to the Venezuelan government, the Times reported.

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at nik@coindesk.com or find me on Bluesky @nikhileshde.bsky.social.

You can also join the group conversation on Telegram.

See ya’ll next week!

Business

Crypto Trading Firm Keyrock Buys Luxembourg’s Turing Capital in Asset Management Push

Crypto trading firm Keyrock said it’s expanding into asset and wealth management by acquiring Turing Capital, a Luxembourg-registered alternative investment fund manager.

The deal, announced on Tuesday, marks the launch of Keyrock’s Asset and Wealth Management division, a new business unit dedicated to institutional clients and private investors.

Keyrock, founded in Brussels, Belgium and best known for its work in market making, options and OTC trading, said it will fold Turing Capital’s investment strategies and Luxembourg fund management structure into its wider platform. The division will be led by Turing Capital co-founder Jorge Schnura, who joins Keyrock’s executive committee as president of the unit.

The company said the expansion will allow it to provide services across the full lifecycle of digital assets, from liquidity provision to long-term investment strategies. «In the near future, all assets will live onchain,» Schnura said, noting that the merger positions the group to capture opportunities as traditional financial products migrate to blockchain rails.

Keyrock has also applied for regulatory approval under the EU’s crypto framework MiCA through a filing with Liechtenstein’s financial regulator. If approved, the firm plans to offer portfolio management and advisory services, aiming to compete directly with traditional asset managers as well as crypto-native players.

«Today’s launch sets the stage for our longer-term ambition: bringing asset management on-chain in a way that truly meets institutional standards,» Keyrock CSO Juan David Mendieta said in a statement.

Read more: Stablecoin Payments Projected to Top $1T Annually by 2030, Market Maker Keyrock Says

Business

Crypto Trading Firm Keyrock Buys Luxembourg’s Turing Capital in Asset Management Push

Crypto trading firm Keyrock said it’s expanding into asset and wealth management by acquiring Turing Capital, a Luxembourg-registered alternative investment fund manager.

The deal, announced on Tuesday, marks the launch of Keyrock’s Asset and Wealth Management division, a new business unit dedicated to institutional clients and private investors.

Keyrock, founded in Brussels, Belgium and best known for its work in market making, options and OTC trading, said it will fold Turing Capital’s investment strategies and Luxembourg fund management structure into its wider platform. The division will be led by Turing Capital co-founder Jorge Schnura, who joins Keyrock’s executive committee as president of the unit.

The company said the expansion will allow it to provide services across the full lifecycle of digital assets, from liquidity provision to long-term investment strategies. «In the near future, all assets will live onchain,» Schnura said, noting that the merger positions the group to capture opportunities as traditional financial products migrate to blockchain rails.

Keyrock has also applied for regulatory approval under the EU’s crypto framework MiCA through a filing with Liechtenstein’s financial regulator. If approved, the firm plans to offer portfolio management and advisory services, aiming to compete directly with traditional asset managers as well as crypto-native players.

«Today’s launch sets the stage for our longer-term ambition: bringing asset management on-chain in a way that truly meets institutional standards,» Keyrock CSO Juan David Mendieta said in a statement.

Read more: Stablecoin Payments Projected to Top $1T Annually by 2030, Market Maker Keyrock Says

Business

Gemini Shares Slide 6%, Extending Post-IPO Slump to 24%

Gemini Space Station (GEMI), the crypto exchange founded by Cameron and Tyler Winklevoss, has seen its shares tumble by more than 20% since listing on the Nasdaq last Friday.

The stock is down around 6% on Tuesday, trading at $30.42, and has dropped nearly 24% over the past week. The sharp decline follows an initial surge after the company raised $425 million in its IPO, pricing shares at $28 and valuing the firm at $3.3 billion before trading began.

On its first day, GEMI spiked to $45.89 before closing at $32 — a 14% premium to its offer price. But since hitting that high, shares have plunged more than 34%, erasing most of the early enthusiasm from public market investors.

The broader crypto equity market has remained more stable. Coinbase (COIN), the largest U.S. crypto exchange, is flat over the past week. Robinhood (HOOD), which derives part of its revenue from crypto, is down 3%. Token issuer Circle (CRCL), on the other hand, is up 13% over the same period.

Part of the pressure on Gemini’s stock may stem from its financials. The company posted a $283 million net loss in the first half of 2025, following a $159 million loss in all of 2024. Despite raising fresh capital, the numbers suggest the business is still far from turning a profit.

Compass Point analyst Ed Engel noted that GEMI is currently trading at 26 times its annualized first-half revenue. That multiple — often used to gauge whether a stock is expensive — means investors are paying 26 dollars for every dollar the company is expected to generate in sales this year. For a loss-making company in a volatile sector, that’s a steep price, and could be fueling investor skepticism.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars