Uncategorized

Crypto Daybook Americas: Bitcoin Steadies With One Eye on Trump’s First Inflation Report

By Omkar Godbole (All times ET unless indicated otherwise)

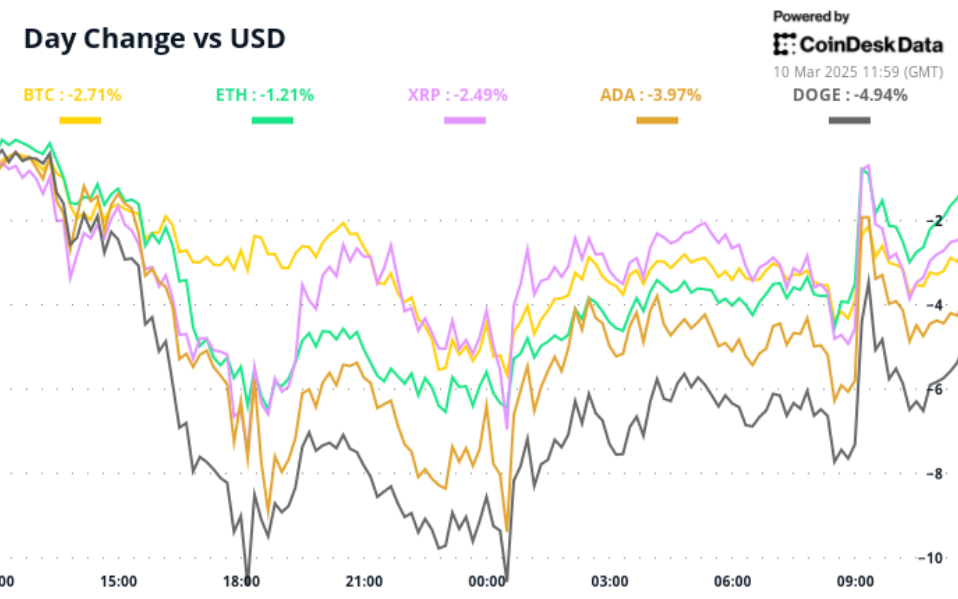

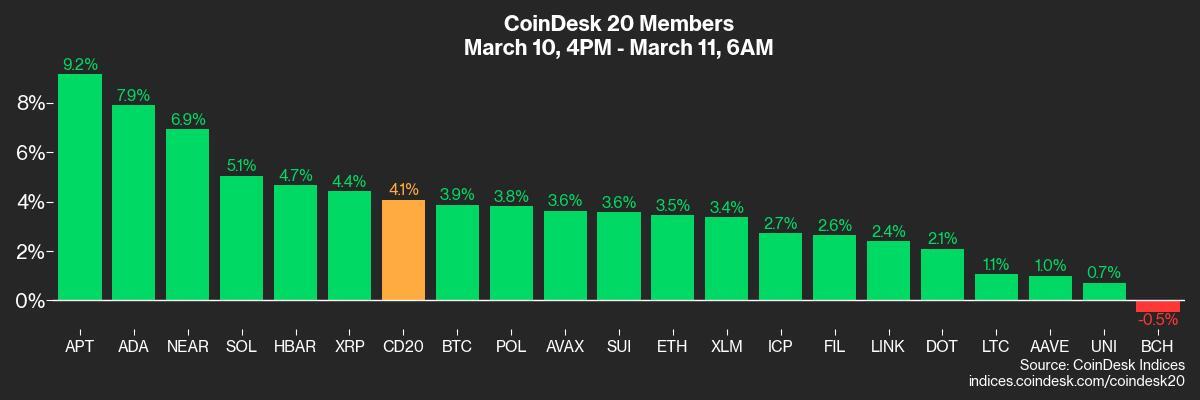

The crypto market is looking to regain poise, with bitcoin bouncing above $81,000 ahead of tomorrow’s U.S. inflation report. Broadly speaking, the recovery from overnight lows is led by layer-1 and layer-2 coins, with gaming tokens also rising.

The rebound comes amid indications of «peak fear» on Wall Street, a dynamic typically observed at market bottoms.

Interestingly, the spread between one- and six-month futures tied to the VIX, Wall Street’s so-called fear gauge, crossed above zero on Monday, signaling a rare positive reading and reflecting expectations for greater volatility in the short-term than six months out. Volmex’s Bitcoin volatility index shows a similar inversion, although that is more common in the crypto market.

«Is the worst behind us? It’s impossible to say,» noted Ilan Solot, senior global market strategist at Marex Solutions, in an email to CoinDesk. «However, the risk-reward for entering long positions in U.S. stocks is improving. The VIX index for volatility is now significantly inverted, meaning near-term contracts are priced higher than long-term ones. This is an important sign of stress, but it can also indicate extremes in sentiment.»

Meanwhile, bullish positioning in the yen appears stretched, suggesting the haven currency’s rally may soon lose steam, potentially providing relief to risk assets in the process.

The Truflation U.S. Inflation Index, which offers a daily, real-time measurement of inflation based on data from over 30 sources and 13 million price points, has dropped to 1.35%, extending a decline from February’s high of over 2%. This trend hints at the progress on inflation the Federal Reserve is looking for before considering rate cuts.

On Wednesday, the Bureau of Labor Statistics is expected to show a month-over-month increase of 0.3% for February. This would be a notable deceleration from January’s concerning 0.5%. A soft reading could validate traders’ expectations for rapid rate cuts starting in June, possibly leading to renewed risk-on sentiment. However, it’s important to note that Chairman Jerome Powell has indicated the Fed is waiting for clarity on President Trump’s policies before making its next move, suggesting that soft CPI data alone might not be enough.

On the other hand, a hotter-than-expected CPI print could derail recovery prospects, potentially setting the stage for a deeper slide in bitcoin and the broader crypto market. Some analysts even predict bitcoin could drop to $74,000.

«A bearish pattern persists on the daily timeframes, indicating a strengthening sell-off after failing to hold above the 200-day moving average. The scenario of a pullback to the $70,000 to $74,000 range still looks most probable,» said Alex Kuptsikevich, senior market analyst at FxPro, in an email to CoinDesk. Stay alert!

What to Watch

Crypto:

March 11, 9:00 a.m.: Horizen (ZEN) mainnet network upgrade to version ZEN 5.0.6 at block height 1,730,680.

March 11, 10:00 a.m.: U.S. House Financial Services Committee hearing about a federal framework for stablecoins and a CBDC. Livestream link.

March 11: The Bitcoin Policy Institute and Senator Cynthia Lummis co-host the invitation-only one-day «Bitcoin for America» event in Washington.

March 12: Hemi (HEMI), an L2 blockchain that operates on both Bitcoin and Ethereum, has its mainnet launch.

March 15: Athene Network (ATH) mainnet launch.

March 15: Reploy will close its V1 RAI staking program to new users as it transitions to a fully automated revenue-sharing protocol.

March 17.: CME Group launches solana (SOL) futures.

March 18: Zano (ZANO) hard fork network upgrade which activates “ETH Signature support for off-chain signing and asset operations.”

March 20: Pascal hard fork network upgrade goes live on the BNB Smart Chain (BSC) mainnet.

Macro

March 11, 8:00 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases January industrial production data.

Industrial Production MoM Est. 0.4% vs. Prev. -0.3%

Industrial Production YoY Est. 2.2% vs. Prev. 1.6%

March 11, 10:00 a.m.: The U.S. Department of Labor releases January’s JOLTs report (job openings, hires, and separations).

Job Openings Est. 7.75M vs. Prev. 7.6M

Job Quits Prev. 3.197M

March 12, 4:45 a.m.: European Central Bank President Christine Lagarde gives a speech at the 25th “ECB and Its Watchers” conference in Frankfurt.

March 12, 8:00 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) release February consumer price inflation data.

Inflation Rate MoM Est. 1.3% vs. Prev. 0.16%

Inflation Rate YoY Est. 5% vs. Prev. 4.56%

March 12, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases February consumer price inflation data.

Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.4%

Core Inflation Rate YoY Est. 3.2% vs. Prev. 3.3%

Inflation Rate MoM Est. 0.3% vs. Prev. 0.5%

Inflation Rate YoY Est. 2.9% vs. Prev. 3%

March 12, 9:45 a.m.: The Bank of Canada announces its interest rate decision followed by a press conference (livestream link) 45 minutes later.

Policy Interest Rate Est. 2.75% vs. Prev. 3%

March 12, 12:00 p.m.: Russia’s Federal State Statistics Service release February consumer price inflation data.

Inflation Rate MoM Est. 0.8% vs. Prev. 1.2%

Inflation Rate YoY Est. 10.1% vs. Prev. 9.9%

Earnings (Estimates based on FactSet data)

March 17 (TBC): Bit Digital (BTBT), $-0.05

March 18 (TBC): TeraWulf (WULF), $-0.04

March 24 (TBC): Galaxy Digital Holdings (TSE: GLXY), C$0.39

Token Events

Governance votes & calls

GMX DAO is voting on the decentralization and automation of the fee distribution process for the GMX ecosystem to ensure “real-time, trustless, and verifiable fee allocations.”

Frax DAO is discussing upgrading the protocol by renaming FXS to FRAX, making it the gas token on Fraxtal, implementing the Frax North Star hard fork, and introducing a tail emission plan with gradually decreasing emissions and other enhancements.

Uniswap DAO is discussing continuing treasury delegation to maintain governance stability and retain active delegates, including a renewed framework and structure expiration and allocation mechanisms.

March 13, 10 a.m.: Mantra to host a Community Connect call with its CEO and Co-Founder to discuss various major updates.

Unlocks

March 12: Aptos (APT) to unlock 1.93% of circulating supply worth $63.33 million.

March 15: Sei (SEI) to unlock 1.19% of its circulating supply worth $10.65 million.

March 16: Arbitrum (ARB) to unlock 2.1% of its circulating supply worth $30.76 million.

March 18: Fasttoken (FTN) to unlock 4.66% of its circulating supply worth $80 million.

March 21: Immutable (IMX) to unlock 1.39% of circulating supply worth $12.29 million.

Token Listings

March 11: Bybit to delist Bancor (BNT), Paxos Gold (PAXG), and Threshold.

March 11: Cookie DAO (COOKIE) to be listed on Coinbase.

March 11: PancakeSwap is retiring its crypto options product.

March 11: Mystery (MERY) was listed on the Crypto.com app.

March 31: Binance to delist USDT, FDUSD, TUSD, USDP, DAI, AEUR, UST, USTC, and PAXG.

Conferences

CoinDesk’s Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Day 2 of 2: MoneyLIVE Summit (London)

Day 2 of 3: AIBC Africa (Cape Town)

Day 1 of 2: VanEck Southern California Blockchain Conference 2025 (Los Angeles)

March 13-14: Web3 Amsterdam ‘25

March 16, 6:00 p.m.: Solana AI Summit (San Jose, Calif.)

March 18-20: Digital Asset Summit 2025 (New York)

March 18-20: Fintech Americas Miami 2025

March 19-20: Next Block Expo (Warsaw)

March 24-26: Merge Buenos Aires

March 25-26: PAY360 2025 (London)

March 25-27: Mining Disrupt (Fort Lauderdale, Fla.)

March 26: Crypto Assets Conference (Frankfurt)

March 26: DC Blockchain Summit 2025 (Washington)

March 26-28: Real World Crypto Symposium 2025 (Sofia, Bulgaria)

March 27: Building Blocks (Tel Aviv)

March 27: Digital Euro Conference 2025 (Frankfurt)

March 27: WIKI Finance EXPO Hong Kong 2025

March 27-28: Money Motion 2025 (Zagreb, Croatia)

March 28: Solana APEX (Cape Town)

Token Talk

By Shaurya Malwa

Grok Coin, a token inspired by, but not officially affiliated with, xAI’s Grok AI, was launched on Base using trading mechanisms from Bankr and Clanker.

The token’s AI-controlled wallet reportedly amassed over $200K in fees in the hours after going live.

It was further amplified by the official Base account on X, which posted, “icymi, @grok launched a token on Base,” and framing it as a futuristic step where “AI is owning wallets, making markets, and generating revenue.” This gave the impression of an endorsement from Base’s leadership.

The post prompted Base developers like Kawz, the founder of Time.fun, to express frustration over the lack of recognition for their own projects.

Calling the GrokCoin post unfair and selective, Kawz noted they’d spent months building an app on Base without a single tweet from @base.

Derivatives Positioning

ETH CME futures basis has dropped to an annualized 5%, the lowest since July.

BTC’s basis has stabilized between 5% and 10% in a positive sign for the market.

BTC options show a similar expectation pattern to gold, while ETH and other cryptocurrencies are similar to the expectation patterns of equities investors, data tracked by BloFin Academy show.

BTC and ETH risk reversals show bias for protective puts out to the May end expiry.

The $100K strike call is now the most popular BTC option on Deribit, as opposed to the $120K call a few weeks ago.

Market Movements:

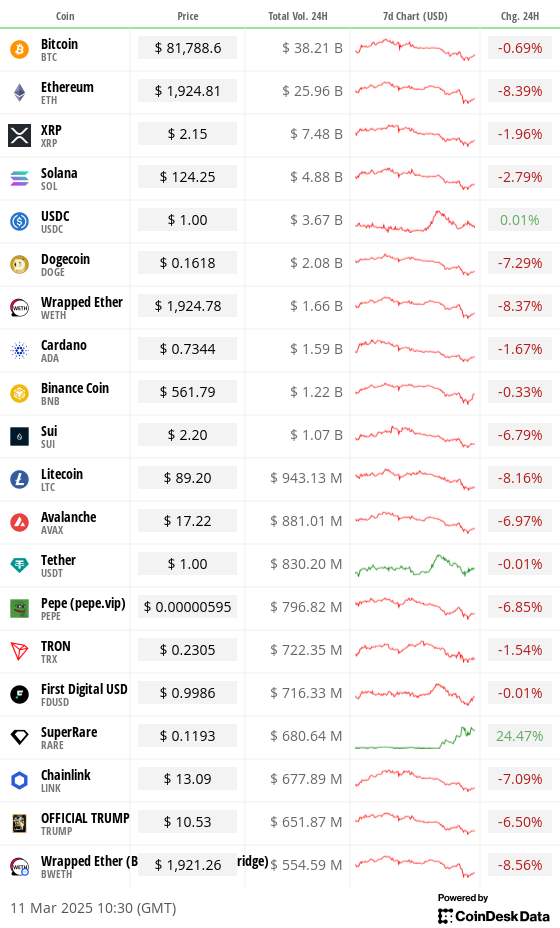

BTC is up 2.87% from 4 p.m. ET Monday at $81,425.03 (24hrs: -0.93%)

ETH is up 2.84% at $1,917.00 (24hrs: -8.65%)

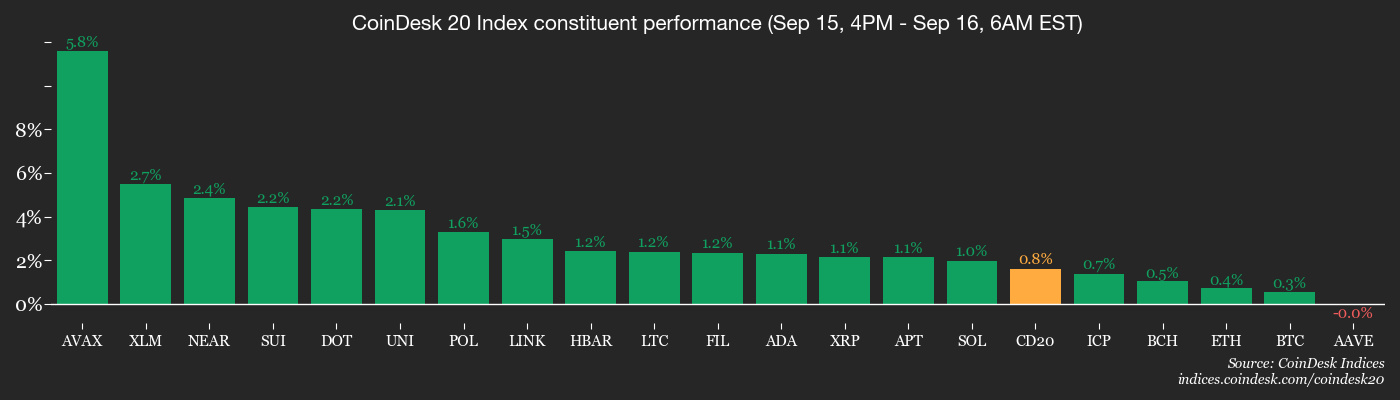

CoinDesk 20 is up 3.05% at 2,531.70 (24hrs: -3.66%)

Ether CESR Composite Staking Rate is up 10 bps at 3.11%

BTC funding rate is at 0.0001% (0.1% annualized) on Binance

DXY is down 0.38% at 103.44

Gold is up 0.66% at $2,911.70/oz

Silver is up 1.12% at $32.49/oz

Nikkei 225 closed -0.64% at 36,793.11

Hang Seng closed unchanged at 23,782.14

FTSE is down 0.25% at 8,578.37

Euro Stoxx 50 is up 0.48% at 5,413.02

DJIA closed on Monday -2.08% at 41,911.71

S&P 500 closed -2.7% at 5,614.56

Nasdaq closed -4% at 17,468.32

S&P/TSX Composite Index closed -1.53% at 24,380.71

S&P 40 Latin America closed -2.73% at 2,297.38

U.S. 10-year Treasury rate is down 4 bps at 4.21%

E-mini S&P 500 futures are down 0.28% at 5636.50

E-mini Nasdaq-100 futures are down 0.41% at 19533.25

E-mini Dow Jones Industrial Average Index futures are down 0.21% at 42,036.00

Bitcoin Stats:

BTC Dominance: 61.95 (-0.24%)

Ethereum to bitcoin ratio: 0.02354 (-0.80%)

Hashrate (seven-day moving average): 814 EH/s

Hashprice (spot): $45.2

Total Fees: 5.3 BTC / $429,994

CME Futures Open Interest: 141,395 BTC

BTC priced in gold: 28.2 oz

BTC vs gold market cap: 8.01%

Technical Analysis

Bitcoin’s RSI has carved out a higher low, hinting at a bullish divergence, or positive shift in momentum.

Traders who rely on charts may feel tempted to try out longs as prices are close to the key support of the March 2024 high of $73,757, offering an attractive risk-reward.

That, in turn, might see the recovery gather pace.

Crypto Equities

Strategy (MSTR): closed on Monday at $239.27 (-16.68%), up 4.57% at $250.20 in pre-market

Coinbase Global (COIN): closed at $179.23 (-17.58%), up 4.09% at $186.55

Galaxy Digital Holdings (GLXY): closed at C$17.46 (-7.32%)

MARA Holdings (MARA): closed at $13.41 (-16.29%), up 1.34% at $13.59

Riot Platforms (RIOT): closed at $7.56 (-9.68%), up 2.51% at $7.75

Core Scientific (CORZ): closed at $8.01 (+2.96%), up 3.62% at $8.30

CleanSpark (CLSK): closed at $7.98 (-9.63%), up 1.5% at $8.10

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $14.48 (-11.27%), up 3.04% at $14.92

Semler Scientific (SMLR): closed at $32.74 (-11.97%), unchanged in pre-market

Exodus Movement (EXOD): closed at $24.60 (-16.33%), down 5.65% at $23.21

ETF Flows

Spot BTC ETFs:

Daily net flow: -$278.4 million

Cumulative net flows: $35.93 billion

Total BTC holdings ~ 1,122 million.

Spot ETH ETFs

Daily net flow: -$34 million

Cumulative net flows: $2.69 billion

Total ETH holdings ~ 3.579 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

The chart shows the spread between yields on the 10-year U.S. and Japanese government bonds.

The gap has narrowed sharply, diving below a five-year-long uptrend line.

The narrowing of the yield spread favors strength in the yen, seen as an anti-risk, haven currency.

While You Were Sleeping

Global Markets Steady After Slowdown Fears Hit Wall Street (Financial Times): Stocks steadied globally as investors reassessed recession concerns following sharp Wall Street losses, while European defense and infrastructure shares continued to gain on expectations of increased government spending.

Bitcoin and Nasdaq Could Stabilize as Bull Positioning in Yen Appears Stretched (CoinDesk): Overstretched bullish bets on the yen could trigger a reversal, offering relief to risk assets, though the currency’s broader uptrend remains supported by a narrowing U.S.-Japan bond yield gap.

Latest Draft of U.S. Stablecoin Bill Aims to Split Power Between State and Federal Authorities (CoinDesk): States can oversee stablecoin issuers with a market cap under $10 billion, while larger issuers may remain under state supervision if they meet certain criteria.

Dormant Ether Whale Moves $13M in ETH to Kraken (CoinDesk): A wallet that has held ether since the cryptocurrency’s inception moved 7,000 ETH to Kraken after five months of inactivity as the price hit its lowest level since October 2023.

Citi Downgrades U.S. Stocks, Raises China as America First Fades (Bloomberg): Citigroup downgraded U.S. equities to neutral, citing expectations for «more negative US data prints,» while upgrading China to overweight due to attractive valuations and government support for the tech sector.

Ukraine Hits Moscow With Largest Drone Attack Hours Before Talks (The Wall Street Journal): Ahead of a high-level U.S.-Ukraine meeting in Saudi Arabia, Kyiv carried out its largest drone strike on the Russian capital, escalating tensions as discussions on potential peace efforts loom.

In the Ether

Uncategorized

Solana Steals the Spotlight as Fed Rate Cut Nears: Crypto Daybook Americas

By Omkar Godbole (All times ET unless indicated otherwise)

Suddenly, it’s all about Ethereum rival Solana and its native token SOL as the broader market holds its breath ahead of Wednesday’s Federal Reserve rate decision.

Michael Novogratz, the founder and CEO of Galaxy Investment, says Solana could evolve to become a settlement infrastructure in global finance. Why? Because the blockchain can handle over 6 billion transactions a day, which is way higher than the 400 million-700 million trades global securities markets usually deal with, he said. Speed matters.

At BaseCamp 2025, Coinbase’s layer-2 network hinted at plans for a token launch that could accelerate decentralization and unveiled a Solana bridge to boost cross-chain connectivity. Pantera Capital’s Dan Morehead announced that Solana is their largest bet, valued at $1.1 billion, calling it the fastest and best-performing blockchain, which has outpaced even Bitcoin over the past four years.

If that’s not enough, Kyle Samani, chairman of Nasdaq-listed Solana treasury company Forward Industries, said over the weekend that the company plans to deploy funds to boost the Solana-native decentralized finance ecosystem.

All these signs suggest SOL could outperform bitcoin (BTC), ether (ETH) and other major tokens if the Fed cuts rates by the 25 basis points this week, as expected. If it surprises with a 50-basis-point move, things could get wild. Keep your eyes on those SOL/BTC and SOL/ETH trading pairs.

Currently, SOL is trading around $235 after peaking near $250 over the weekend. Other major cryptocurrencies are stuck in neutral, trailing behind stocks, which continue to hit fresh highs.

On the stablecoin front, the Bank of England proposed limits on how the value of dollar-backed stablecoins an individual can hold, as low as 10,000 pounds ($13,600), citing systemic risks. Stani Kulechov, Aave’s CEO, called the move “absurd” and urged the crypto community to stand up against such regulations.

More countries, especially those with current account deficits, will likely consider similar measures to curb outflows that dodge traditional banks.

And as for the traditional markets, Monday’s mix of rising stocks and the VIX, Wall Street’s fear gauge, has some observers raising their eyebrows. History shows these moments often precede market corrections, so stay alert!

What to Watch

- Crypto

- Sept. 16, 12 p.m.: Solana Live event on X. Guests include Pump.fun co-founder Alon Cohen and Kyle Samani, chairman of Forward Industries (FORD) and the managing partner of Multicoin Capital.

- Macro

- Sept. 16, 8 a.m.: Brazil July unemployment rate Est. 5.7%.

- Sept. 16, 8:30 a.m.: Canada August headline CPI YoY Est. 2%, MoM Est. 0%; core YoY Est. N/A (Prev. 2.6%), MoM Est. N/A (Prev. 0.1%).

- Sept. 16, 8:30 a.m.: U.S. August retail sales YoY Est. N/A (Prev. 3.9%), MoM Est. 0.3%.

- Earnings (Estimates based on FactSet data)

- None scheduled.

Token Events

- Governance votes & calls

- Curve DAO is voting to update donation-enabled Twocrypto contracts, refining donation vesting so unlocked portions persist after burns. Voting ends Sept. 16.

- Sept. 16: Aster Network to host a community call.

- Sept. 18, 6 a.m.: Mantle to host Mantle State of Mind, a monthly downhill series.

- Sept. 16, 12 p.m.: Kava to host a community Ask Me Anything (AMA) session.

- Unlocks

- Sept. 16: Arbitrum (ARB) to unlock 2.03% of its circulating supply worth $45.92 million.

- Token Launches

- Sept. 16: Merlin (MRLN) to be listed on Binance Alpha, MEXC, BitMart, Gate.io, and others.

Conferences

- Day 2 of 7: Budapest Blockchain Week 2025 (Budapest, Hungary)

- Day 1 of 2: Real-World Asset Summit (New York)

Token Talk

By Oliver Knight

- As the crypto market stays within a tight range after a brief peak and trough on Monday, one token is running its own race: IMX is up 15% in the past 24 hours with daily trading volume doubling to $144 million.

- The rise lifted IMX, the native token of Web3 gaming platform Immutable, to a five-month high.

- Bullish sentiment around Immutable can be attributed to an SEC probe that was dropped earlier this year and general optimism around the gaming sector. Gaming is estimated to reach $200 billion in revenue this year with further growth forecast in 2026 alongside the release of Rockstar Gaming’s Grand Theft Auto 6.

- Immutable is well positioned to capitalize on that growth after teaming up with gaming giant Ubisoft on the next iteration of Might and Magic Fates in April.

- Blockchain technology could have a key role to play in gaming if trends shift toward in-game ownership of items, which could see the implementation of non-fungible tokens (NFTs) within a game that could then be collected or sold on for crypto tokens.

- IMX is currently trading at $0.736 having broken out of a key level of resistance. It will likely come back to test $0.70 as support before potentially moving higher, provided trading volume can sustain at these levels.

Derivatives Positioning

- Most major cryptocurrencies, including BTC and ETH, continued to experience capital outflows from futures, leading to a decline in open interest.

- AVAX stands out with OI rising over 14% as the token’s market cap looks to climb above $13 billion for the first time since Feb. 2.

- Solana OI has reached a record high of over 70 million SOL, with positive funding rates pointing to bullish capital inflows.

- On the CME, OI in solana futures pulled back to 7.63 million SOL from the record 8.12 million SOL on Sept. 12. Still, the three-month annualized premium holds well above 15%, offering an attractive yield for carry traders.

- BTC CME OI continues to improve, but overall positioning remains light relative to ether and SOL futures.

- On Deribit, the bias for BTC and ETH put options continues to ease across all tenors as traders anticipate Fed rate cuts. SOL and XRP options remain biased bullish.

- On OTC network Paradigm, block flows featured BTC calendar spreads and shorting of call and put options.

Market Movements

- BTC is unchanged from 4 p.m. ET Monday at $115,500.55 (24hrs: +0.54%)

- ETH is unchanged at $4,513.45 (24hrs: -0.49%)

- CoinDesk 20 is up 0.48% at 4,271.28 (24hrs: +0.71%)

- Ether CESR Composite Staking Rate is up 5 bps at 2.87%

- BTC funding rate is at 0.0059% (6.4616% annualized) on Binance

- DXY is down 0.32% at 96.99

- Gold futures are up 0.42% at $3,734.70

- Silver futures are up 0.53% at $43.19

- Nikkei 225 closed up 0.3% at 44,902.27

- Hang Seng closed unchanged at 26,438.51

- FTSE is down 0.22% at 9,256.41

- Euro Stoxx 50 is unchanged at 5,437.55

- DJIA closed on Monday up 0.11% at 45,883.45

- S&P 500 closed up 0.47% at 6,615.28

- Nasdaq Composite closed up 0.94% at 22,348.75

- S&P/TSX Composite closed up 0.5% at 29,431.02

- S&P 40 Latin America closed up 1.64% at 2,904.55

- U.S. 10-Year Treasury rate is unchanged at 4.037%

- E-mini S&P 500 futures are up 0.19% at 6,633.75

- E-mini Nasdaq-100 futures are up 0.29% at 24,380.00

- E-mini Dow Jones Industrial Average Index are unchanged at 45,902.00

Bitcoin Stats

- BTC Dominance: 58.11% (unchanged)

- Ether to bitcoin ratio: 0.03907 (-0.36%)

- Hashrate (seven-day moving average): 1,025 EH/s

- Hashprice (spot): $53.98

- Total Fees: 4.41 BTC / $508,109

- CME Futures Open Interest: 140,975 BTC

- BTC priced in gold: 31.2 oz

- BTC vs gold market cap: 8.82%

Technical Analysis

- The monthly chart shows that BTC is again probing the trendline connecting the previous bull market peaks.

- Bulls failed to establish a foothold above that trendline in July and August.

- A third straight failure could really embolden sellers, potentially yielding a deeper drop.

Crypto Equities

- Coinbase Global (COIN): closed on Monday at $327.02 (+1.23%), +0.27% at $327.91

- Circle (CRCL): closed at $134.05 (+6.97%), unchanged in pre-market

- Galaxy Digital (GLXY): closed at $30.77 (+3.6%), +0.58% at $30.95

- Bullish (BLSH): closed at $51.08 (-1.47%), +0.59% at $51.38

- MARA Holdings (MARA): closed at $16.24 (-0.43%), unchanged in pre-market

- Riot Platforms (RIOT): closed at $16.68 (+4.97%), +1.08% at $16.86

- Core Scientific (CORZ): closed at $16.32 (+2.9%), +0.37% at $16.38

- CleanSpark (CLSK): closed at $10.29 (-0.58%), +0.1% at $10.30

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $38.73 (+3.78%), +1.96% at $39.49

- Exodus Movement (EXOD): closed at $27.88 (-1.69%), -1.94% at $27.34

Crypto Treasury Companies

- Strategy (MSTR): closed at $327.79 (-1.1%), +0.34% at $328.89

- Semler Scientific (SMLR): closed at $28.39 (-2.74%)

- SharpLink Gaming (SBET): closed at $16.79 (-5.14%), +0.54% at $16.88

- Upexi (UPXI): closed at $6.33 (-6.29%), +0.95% at $6.39

- Lite Strategy (LITS): closed at $3.07 (+10.43%)

ETF Flows

Spot BTC ETFs

- Daily net flows: $259.9 million

- Cumulative net flows: $57.05 billion

- Total BTC holdings ~1.31 million

Spot ETH ETFs

- Daily net flows: $359.7 million

- Cumulative net flows: $13.74 billion

- Total ETH holdings ~6.53 million

Source: Farside Investors

While You Were Sleeping

- Gold Uptrend Intact, but Due for Correction Before Topping $4,000 in 2026 (Reuters): Gold has surged 40% in 2025, outpacing the S&P 500. Analysts warn it looks overbought and may decline before targeting $4,000 next year.

- Coinbase Policy Chief Pushes Back on Bank Warnings That Stablecoins Threaten Deposits (CoinDesk): Coinbase’s Faryar Shirzad said concerns of stablecoin deposit flight are myths, claiming banks are really defending profits from an outdated payments system.

- King Charles Rolls Out the Red Carpet to Woo Trump (The Wall Street Journal): U.K. Prime Minister Keir Starmer is using royal pageantry to sway Trump on tariffs and European security, while the visit will showcase new U.S.-U.K. cooperation in technology and energy.

- Deutsche Börse’s Crypto Finance Unveils Connected Custody Settlement for Digital Assets (CoinDesk): The Deutsche Börse subsidiary launched AnchorNote in Switzerland, letting institutions trade digital assets across venues while keeping them in custody to cut counterparty risk and improve capital efficiency.

Uncategorized

ORQO Debuts in Abu Dhabi With $370M in AUM, Sets Sight on Ripple USD Yield

ORQO Group, a new institutional asset manager with $370 million in assets under management, has launched on Tuesday with plans to build out a yield platform for Ripple’s RLUSD stablecoin.

The group, headquartered in Abu Dhabi, consolidates four entities from both traditional finance and digital assets: Mount TFI, a private debt specialist and licensed fund manager in Poland, Monterra Capital, a multi-strategy digital hedge fund in Malta, blockchain engineering studio Nextrope and decentralized finance (DeFi) protocol Soil compliant with MiCA, the EU’s crypto framework.

Already licensed in Poland and Malta, the group is seeking approval from the Financial Services Regulatory Authority at Abu Dhabi Global Market to expand services in the Middle East, a region it sees as a hub for regulated digital asset growth.

«It’s an opportunity to become a global on-chain asset manager,» ORQO CEO Nicholas Motz said in an interview with CoinDesk. «We have all the pieces: the off-chain asset management, and on-chain, too.»

ORQO’s effort is part of a larger trend that’s been reshaping crypto markets: moving traditional financial instruments like private credit, U.S. Treasuries, or trade finance deals onto blockchain networks. The process is also known as tokenization of real-world assets (RWAs). Data from rwa.xyz shows that the RWA market has grown into a nearly $30 billion sector, though it remains tiny compared to traditional finance markets such as the $2 trillion private credit sector. Still, the growth potential is immense: the tokenized RWA market could reach $18.9 trillion by 2033, a joint report by Ripple and BCG projected.

Yield platform Soil is a key piece in ORQO’s gameplan, connecting the firm’s RWA access with crypto capital capital. It aims to provide returns on stablecoins deposits from tokenized private credit, real estate and hedge fund strategies.

As part of the next stage, the firm plans to open several credit pools targeting holders of Ripple’s RLUSD stablecoin in the near future, allowing investors such as institutional treasuries or protocol reserves to earn a yield on their holdings.

Read more: Tokenization of Real-World Assets is Gaining Momentum, Says Bank of America

Uncategorized

Coinbase Policy Chief Pushes Back on Bank Warnings That Stablecoins Threaten Deposits

Contrary to claims from the U.S. banking industry, stablecoins do not pose a risk to the financial system, according to the chief policy officer at crypto exchange Coinbase (COIN), Faryar Shirzad. Banks’ claims that they do are are myths crafted to defend their revenues, he wrote in a Tueday blog post.

«The central claim — that stablecoins will cause a mass outflow of bank deposits — simply doesn’t hold up,» Shirzad wrote. «Recent analysis shows no meaningful link between stablecoin adoption and deposit flight for community banks and there’s no reason to believe big banks would fare any worse.»

Larger lenders still hold trillions of dollars at the Federal Reserve and if deposits were really at risk, he argued, they would be competing harder for customer funds by offering higher interest rates rather than parking cash at the central bank

According to Shirzad, the real reason for banks’ opposition is the payments business. Stablecoins, digital tokens whose value is pegged to a real-life asset such as the dollar, offer faster and cheaper ways to move money, threatening an estimated $187 billion in annual swipe-fee revenue for traditional card networks and banks.

He compared the current pushback to earlier battles against ATMs and online banking, when incumbents warned of systemic dangers but, he said, were ultimately trying to protect entrenched profits.

Shirzad also dismissed reports predicting trillions in potential outflows from deposits into stablecoins, whose total market cap is around $290 billion, according to data from CoinGecko. He stressed that stablecoins are primarily used as payment tools — for trading digital assets or sending funds abroad — not as long-term savings products.

Someone purchasing stablecoins to settle with an overseas supplier, he argued, is opting for a more efficient transaction method the going through their bank, not pulling money from a savings account.

He urged banks to embrace the technology instead of resisting it, saying stablecoin rails could cut settlement times, lower correspondent banking costs and provide round-the-clock payments. Those institutions willing to adapt, he wrote, stand to benefit from the shift.

The U.K., too, faces concerns about the effect of stablecoins on the financial industry.

The Financial Times reported Monday that the Bank of England is considering setting limits on how many «systemic» stablecoins people and companies can hold — setting thresholds as low as 10,000 pounds ($13,600) for individuals and about 10 million pounds for businesses.

Officials define systemic stablecoins as those already widely used for U.K. payments or expected to become so, and say the caps are needed to prevent sudden deposit outflows that could weaken lending and financial stability.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars