Uncategorized

Tokenized Assets Can Redefine Portfolio Management

For decades, your investment portfolio has revolved around a key academic idea that hasn’t held up very well: efficient markets. There’s a direct line from the efficient markets theory of Eugene Fama in the 1960s to modern portfolio theory. It paved the way for index funds, a strategy that has not only weathered market cycles but also become the default for managing pensions and retirement accounts.

As we step into a new era of digital finance, tokenized assets may offer a way to broaden our investment horizons in ways that traditional models have overlooked.

The genesis of modern portfolio theory

Index fund investing didn’t arise by chance. In the early 1970s, amid vigorous debates over market efficiency, Burton Malkiel’s seminal work advocating index funds in 1973 (in his book “A Random Walk Down Wall Street”) was embodied in John Bogle’s launch of the Vanguard S&P 500 fund in 1975.

This cemented a strategy that focused on broad diversification and minimal trading. Astonishingly, passive index-investing has triumphed around the world, even though the theory underpinning it, that investors are always rational, hasn’t held up well.

Behavioral psychologists like Daniel Kahneman and Amos Tversky illuminated the flaws in our decision-making processes. This is highlighted in Daniel Kahneman’s award winning book, “Thinking Fast and Slow.”

In the ensuing decades, economists have reconciled efficient markets and irrational behavior into the concept of “pretty good markets.” Aggregated wisdom in the form of prices trends towards being right, over time, though from day to day and case to case there are significant gaps that investors can exploit. Index funds have held up well because exploiting those opportunities is hard to do consistently or cheaply.

At the same time, the regulatory framework governing institutional investing reinforces this reliance on proven strategies. Fund managers operate under strict fiduciary duties that require them to prioritize client interests and mitigate risk. As a result, they allocate the bulk of their portfolios to assets with long, established track records, typically government bonds and passive equity funds.

In short, the criteria for “acceptable” investments aren’t driven solely by potential returns; they are fundamentally tied to data history, reliability, and transparency. In case you were wondering, that means index funds.

In this environment, venturing into uncharted territory is not taken lightly. New asset classes, no matter how promising, are initially sidelined because they lack the long-term, daily data that makes them viable for inclusion in a fiduciary portfolio. Until now, almost all portfolio theory has been based on U.S. equities and government bonds. Although that universe has expanded over time to include index funds and bonds from other large economies, it still represents only a relatively small portion of the world’s assets. Portfolios are constrained at the intersection of regulations and data. And that’s all going to change.

Tokenization: Expanding the universe of investable assets

Tokenization and on-chain transactions don’t just offer a scalable way to package any kind of asset. They also offer a path to transparent, comparable data on asset values. By representing real-world assets, whether it’s Thai real estate, Nigerian oil leases, or New York taxi medallions as digital tokens on a blockchain, we can begin to generate the kind of daily, market-derived data that has traditionally been reserved for a narrow set of assets.

Consider a simple question: How much Thai real estate should feature in a diversified retirement portfolio? Under current models, the answer is obscured by a lack of reliable, continuous pricing data. But if Thai real estate were tokenized, establishing an on-chain market with daily closing prices, it could eventually be measured against the same metrics used for U.S. equities. In time, this would force a re-examination of the static, index-based approach that has dominated investment strategy for so long.

The implications for global finance

Right now, alternative strategies – as pension fund managers refer to anything that isn’t a stock or bond index – comprise no more than 15–20% of most funds. Changing academic data on investment options would put the other 80% up for grabs.

Imagine a future where a truly diversified portfolio isn’t limited by the confines of traditional equity and debt markets. With tokenization, investors from large institutional funds to individual savers could gain exposure to asset classes and geographic regions previously ignored due to data scarcity or illiquidity. The principles that underpin modern portfolio theory wouldn’t be discarded. Rather, they would be expanded upon to include a broader range of risk and return profiles.

As tokenized assets build track records, fiduciaries, who today favor the predictability of bonds and index funds, might find themselves compelled to recalibrate their strategies. It’s not that the pretty good market hypothesis will be rendered obsolete. Instead, the parameters of what constitutes “efficient” may widen considerably. A richer dataset could lead to better-informed risk assessments and, ultimately, to portfolios that capture a more accurate picture of global value.

A Measured but inevitable shift

This isn’t going to happen overnight. The fastest we’re likely to see changes emerge is about a decade, assuming time to build a wide portfolio of tokenized assets and 5-7 years to build a daily information track record. Once the data is present, however, change could come quickly, thanks to widespread use of artificial intelligence.

One thing that often slows the spread of change is a lack of intellectual bandwidth on the part of fund managers and consumers to adapt to new data. It took about 40 years to move pension fund investors from a 95%+ bonds model in the 1950s to a majority equity index fund model in the 1990s. It took about 30 years for index funds to become the dominant equity investment vehicle after the evidence showed they were the best option.

In a world of AI-driven automated investment tools, the transition might happen a whole lot faster. And with hundreds of trillions of dollars in assets under management, every percentage point change in allocation strategy is a little tsunami of change by itself. We’ll also be hosting a free session on the place digital assets will have in portfolios at the upcoming EY Global Blockchain Summit, 1 -3 April.

Business

Strategy Bought $27M in Bitcoin at $123K Before Crypto Crash

Strategy (MSTR), the world’s largest corporate owner of bitcoin (BTC), appeared to miss out on capitalizing on last week’s market rout to purchase the dip in prices.

According to Monday’s press release, the firm bought 220 BTC at an average price of $123,561. The company used the proceeds of selling its various preferred stocks (STRF, STRK, STRD), raising $27.3 million.

That purchase price was well above the prices the largest crypto changed hands in the second half of the week. Bitcoin nosedived from above $123,000 on Thursday to as low as $103,000 on late Friday during one, if not the worst crypto flash crash on record, liquidating over $19 billion in leveraged positions.

That move occurred as Trump said to impose a 100% increase in tariffs against Chinese goods as a retaliation for tightening rare earth metal exports, reigniting fears of a trade war between the two world powers.

At its lowest point on Friday, BTC traded nearly 16% lower than the average of Strategy’s recent purchase price. Even during the swift rebound over the weekend, the firm could have bought tokens between $110,000 and $115,000, at a 7%-10% discount compared to what it paid for.

With the latest purchase, the firm brought its total holdings to 640,250 BTC, at an average acquisition price of $73,000 since starting its bitcoin treasury plan in 2020.

MSTR, the firm’s common stock, was up 2.5% on Monday.

Business

HBAR Rises Past Key Resistance After Explosive Decline

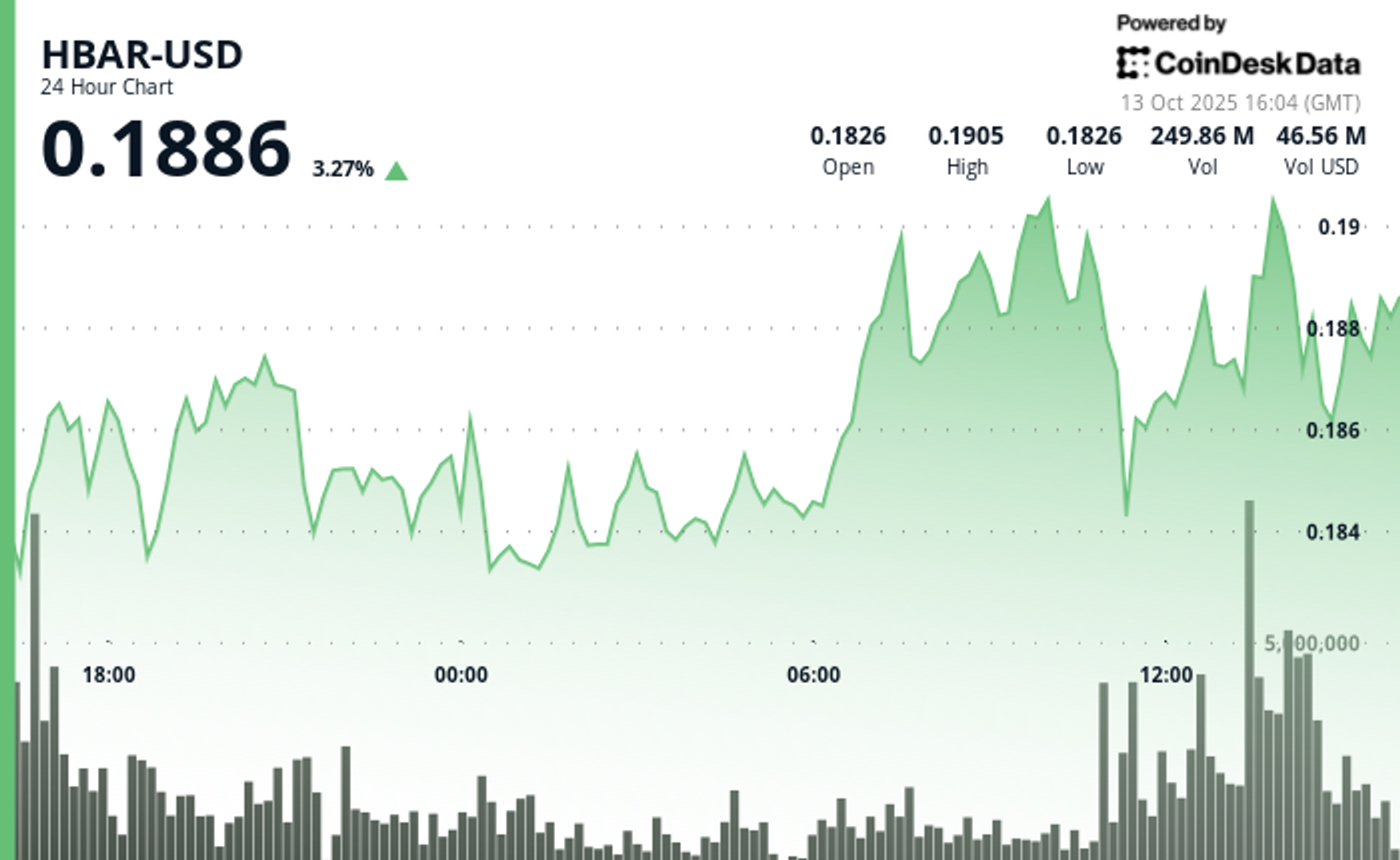

HBAR (Hedera Hashgraph) experienced pronounced volatility in the final hour of trading on Oct. 13, soaring from $0.187 to a peak of $0.191—a 2.14% intraday gain—before consolidating around $0.190.

The move was driven by a dramatic surge in trading activity, with a standout 15.65 million tokens exchanged at 13:31, signaling strong institutional participation. This decisive volume breakout propelled the asset beyond its prior resistance range of $0.190–$0.191, establishing a new technical footing amid bullish momentum.

The surge capped a broader 23-hour rally from Oct. 12 to 13, during which HBAR advanced roughly 9% within a $0.17–$0.19 bandwidth. This sustained upward trajectory was characterized by consistent volume inflows and a firm recovery from earlier lows near $0.17, underscoring robust market conviction. The asset’s ability to preserve support above $0.18 throughout the period reinforced confidence among traders eyeing continued bullish action.

Strong institutional engagement was evident as consecutive high-volume intervals extended through the breakout window, suggesting renewed accumulation and positioning for potential continuation. HBAR’s price structure now shows resilient support around $0.189–$0.190, signaling the possibility of further upside if momentum persists and broader market conditions remain favorable.

Technical Indicators Highlight Bullish Sentiment

- HBAR operated within a $0.017 bandwidth (9%) spanning $0.174 and $0.191 throughout the previous 23-hour period from 12 October 15:00 to 13 October 14:00.

- Substantial volume surges reaching 179.54 million and 182.77 million during 11:00 and 13:00 sessions on 13 October validated positive market sentiment.

- Critical resistance materialized at $0.190-$0.191 thresholds where price movements encountered persistent selling activity.

- The $0.183-$0.184 territory established dependable support through volume-supported bounces.

- Extraordinary volume explosion at 13:31 registering 15.65 million units signaled decisive breakout event.

- High-volume intervals surpassing 10 million units through 13:35 substantiated significant institutional engagement.

- Asset preserved support above $0.189 despite moderate profit-taking activity.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Business

Crypto Markets Today: Bitcoin and Altcoins Recover After $500B Crash

The crypto market staged a recovery on Monday following the weekend’s $500 billion bloodbath that resulted in a $10 billion drop in open interest.

Bitcoin (BTC) rose by 1.4% while ether (ETH) outperformed with a 2.5% gain. Synthetix (SNX, meanwhile, stole the show with a 120% rally as traders anticipate «perpetual wars» between the decentralized trading venue and HyperLiquid.

Plasma (XPL) and aster (ASTER) both failed to benefit from Monday’s recovery, losing 4.2% and 2.5% respectively.

Derivatives Positioning

- The BTC futures market has stabilized after a volatile period. Open interest, which had dropped from $33 billion to $23 billion over the weekend, has now settled at around $26 billion. Similarly, the 3-month annualized basis has rebounded to the 6-7% range, after dipping to 4-5% over the weekend, indicating that the bullish sentiment has largely returned. However, funding rates remain a key area of divergence; while Bybit and Hyperliquid have settled around 10%, Binance’s rate is negative.

- The BTC options market is showing a renewed bullish lean. The 24-hour Put/Call Volume has shifted to be more in favor of calls, now at over 56%. Additionally, the 1-week 25 Delta Skew has risen to 2.5% after a period of flatness.

- These metrics indicate a market with increasing demand for bullish exposure and upside protection, reflecting a shift away from the recent «cautious neutrality.»

- Coinglass data shows $620 million in 24 hour liquidations, with a 34-66 split between longs and shorts. ETH ($218 million), BTC ($124 million) and SOL ($43 million) were the leaders in terms of notional liquidations. Binance liquidation heatmap indicates $116,620 as a core liquidation level to monitor, in case of a price rise.

Token Talk

By Oliver Knight

- The crypto market kicked off Monday with a rebound in the wake of a sharp weekend leverage flush. According to data from CoinMarketCap, the total crypto market cap climbed roughly 5.7% in the past 24 hours, with volume jumping about 26.8%, suggesting those liquidated at the weekend are repurchasing their positions.

- A total of $19 billion worth of derivatives positions were wiped out over the weekend with the vast majority being attributed to those holding long positions, in the past 24 hours, however, $626 billion was liquidated with $420 billion of that being on the short side, demonstrating a reversal in sentiment, according to CoinGlass.

- The recovery has been tentative so far; the dominance of Bitcoin remains elevated at about 58.45%, down modestly from recent highs, which implies altcoins may still lag as capital piles back into safer large-cap names.

- The big winner of Monday’s recovery was synthetix (SNX), which rose by more than 120% ahead of a crypto trading competition that will see it potentially start up «perpetual wars» with HyperLiquid.

-

Business12 месяцев ago

Business12 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion12 месяцев ago

Fashion12 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Uncategorized4 месяца ago

Uncategorized4 месяца agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts

-

Business12 месяцев ago

Business12 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton