Uncategorized

Crypto Daybook Americas: It May Not Feel Like It, but the Market Correction Is Normal

By James Van Straten (All times ET unless indicated otherwise)

Two contradictory philosophies jump to mind when considering bitcoin’s (BTC) price action of late.

Do you «buy when there is blood in the streets»? Or perhaps «don’t catch a falling knife.»?

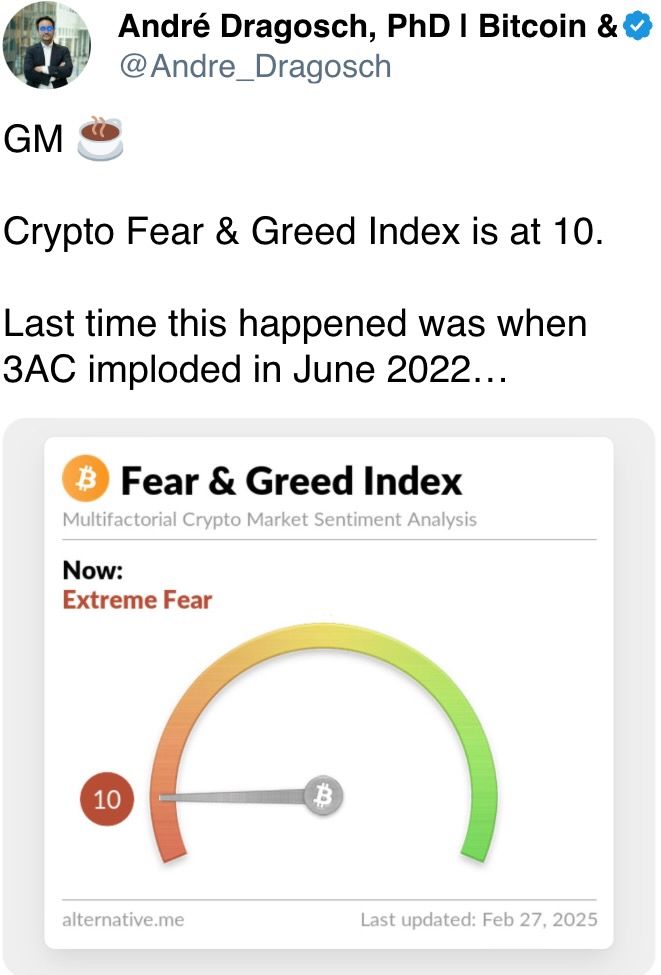

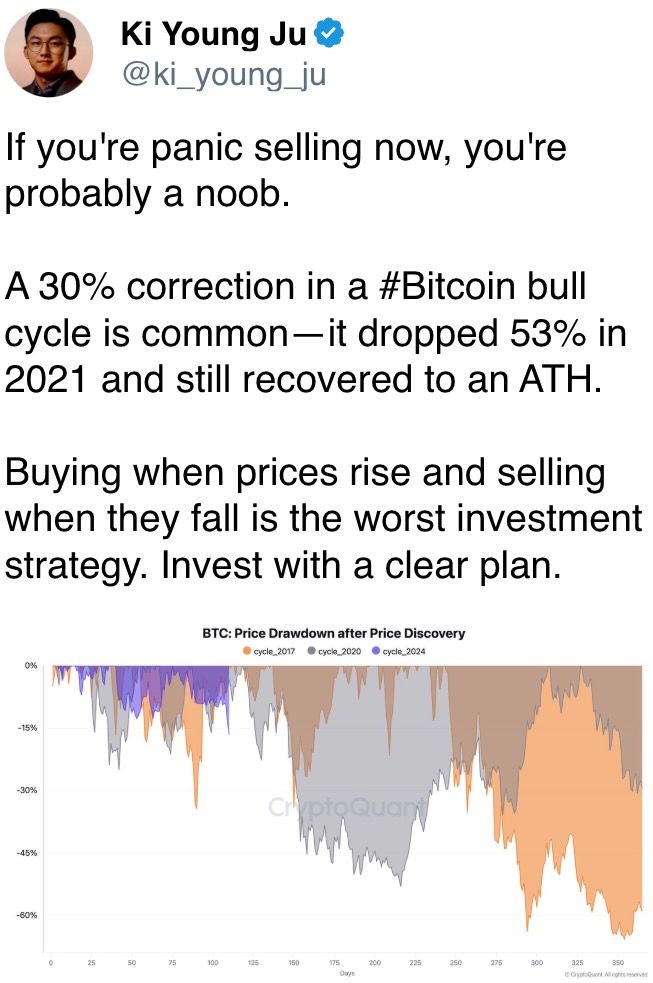

Which applies in today’s market, the day after the largest cryptocurrency posted its steepest three-day decline since the collapse of FTX in 2022? The drop left BTC 25% below January’s all-time high, despite the advent of President Donald Trump’s pro-crypto administration.

It’s no surprise the largest hack in crypto history has shaken investor sentiment. Add to that the memecoin frenzy, which pulled liquidity out of the broader market.

That said, in previous cycles so-called bull-market corrections have sent bitcoin tumbling as much as 35%. Given that BTC hasn’t had a meaningful pullback since the yen carry trade unwind last August, the current situation is almost normal.

CoinDesk research showed that bitcoin was trading in an extremely tight range for a meaningful period, and a break in the channel was inevitable. On-chain data tells us that bitcoin recently bounced off its 200-day-moving average or roughly $81,800. While short-term holders are selling — panic sales, perhaps? — at the highest level since August, because they have held BTC for 155 days or less they are usually seen as a signal of some form of capitulation in the market.

BlackRock’s IBIT saw record outflows on Wednesday. However, it’s not all bad news. A huge expansion deal was made for Core Scientific (CORZ), while MARA Holdings (MARA) reported strong earnings, with both stocks more than 10% before the open. Meanwhile, NVIDIA (NVDA) topped fourth-quarter estimates to calm investors’ nerves. Stay alert!

What to Watch

Crypto:

Feb. 27: Solana-based L2 Sonic SVM (SONIC) mainnet launch (“Mobius”).

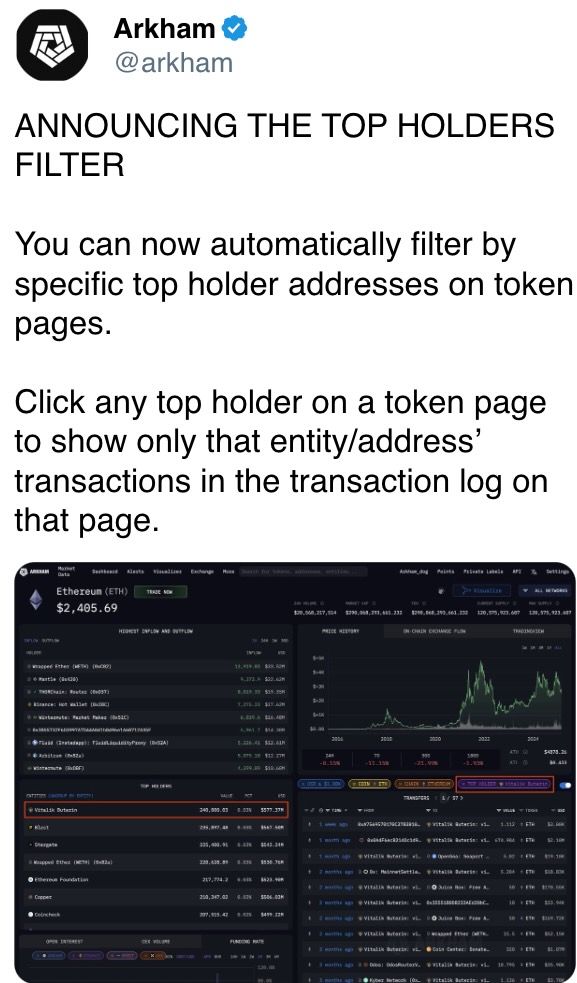

March 1: Spot trading on the Arkham Exchange goes live in 17 U.S. states.

March 5 (provisional): At epoch 222464, testing of Ethereum’s Pectra upgrade on the Sepolia testnet starts.

Macro

Day 2 of 2: 2025’s first G20 finance ministers and central bank governors meeting (Cape Town, South Africa).

Feb. 27, 7:00 a.m.: Brazil’s Institute of Geography and Statistics (IBGE) releases January employment data.

Unemployment Rate Est. 6.6% vs. Prev. 6.2%

Feb. 27, 7:00 a.m.: Mexico’s National Institute of Statistics and Geography releases January employment data

Unemployment Rate Est. 2.7% vs. Prev. 2.4%

Feb. 27, 8:30 a.m.: The U.S. Bureau of Economic Analysis releases Q4 GDP (2nd estimate).

Core PCE Prices QoQ Est. 2.5% vs. Prev. 2.2%

PCE Prices QoQ Est. 2.3% vs. Prev. 1.5%

GDP Growth Rate QoQ Est. 2.3% vs. Prev. 3.1%

Feb. 27, 8:30 a.m.: The U.S. Department of Labor releases Unemployment Insurance Weekly claims for the week ended Feb. 22.

Initial Jobless Claims Est. 221K vs. Prev. 219K

Feb. 28, 8:30 a.m.: The U.S. Bureau of Economic Analysis releases January personal consumption data.

Core PCE Price Index MoM Est. 0.3% vs. Prev. 0.2%

Core PCE Price Index YoY Est. 2.6% vs. Prev. 2.8%

PCE Price Index MoM Est. 0.3% vs. Prev. 0.3%

PCE Price Index YoY Est. 2.5% vs. Prev. 2.6%

Personal Income MoM Est. 0.3% vs. Prev. 0.4%

Personal Spending MoM Est. 0.1% vs. Prev. 0.7%

Earnings

March 6 (TBC): Bitfarms (BITF), $-0.04

March 17 (TBC): Bit Digital (BTBT), $-0.05

March 18 (TBC): TeraWulf (WULF), $-0.03

March 24 (TBC): Galaxy Digital Holdings (TSE: GLXY), C$0.38

Token Events

Governances votes & calls

DYdX DAO is voting on distributing $1.5 million in DYDX tokens from the community treasury to qualifying users in trading season 9 as part of its incentives program.

Feb. 27, 11 a.m.: IOTA (IOTA) to host an Ask Me Anything (AMA) session with co-founder Dominik Schiener and Thoralf, senior software engineer for its smart contract platform and dev tools.

Feb. 27, 2 p.m.: VeChain (VET) to cover its monthly updates in a community call.

Unlocks

Feb. 28: Optimism (OP) to unlock 2.32% of circulating supply worth $36.67 million.

Mar. 1: DYdX to unlock 1.14% of circulating supply worth $6.13 million.

Mar. 1: ZetaChain (ZETA) to unlock 6.48% of circulating supply worth $13.58 million.

Mar. 1: Sui (SUI) to unlock 0.74% of circulating supply worth $67.52 million.

Mar. 2: Ethena (ENA) to unlock 1.3% of circulating supply worth $17.79 million.

Mar. 7: Kaspa (KAS) to unlock 0.63% of circulating supply worth $14.23 million.

Mar. 8: Berachain (BERA) to unlock 9.28% of circulating supply worth $77.80 million.

Token Listings

Feb. 27: Venice token (VVV) to be listed on Kraken.

Feb. 28: Worldcoin (WLD) to be listed on Kraken.

Feb. 28: Zcash (ZEC) and Dash (DASH) are being delisted from Bybit

Conferences

CoinDesk’s Consensus to take place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Day 5 of 8: ETHDenver 2025 (Denver)

March 2-3: Crypto Expo Europe (Bucharest)

March 8: Bitcoin Alive (Sydney)

March 10-11: MoneyLIVE Summit (London)

March 13-14: Web3 Amsterdam ‘25 (Netherlands)

March 19-20: Next Block Expo (Warsaw)

March 26: DC Blockchain Summit 2025 (Washington)

March 28: Solana APEX (Cape Town)

Token Talk

By Shaurya Malwa

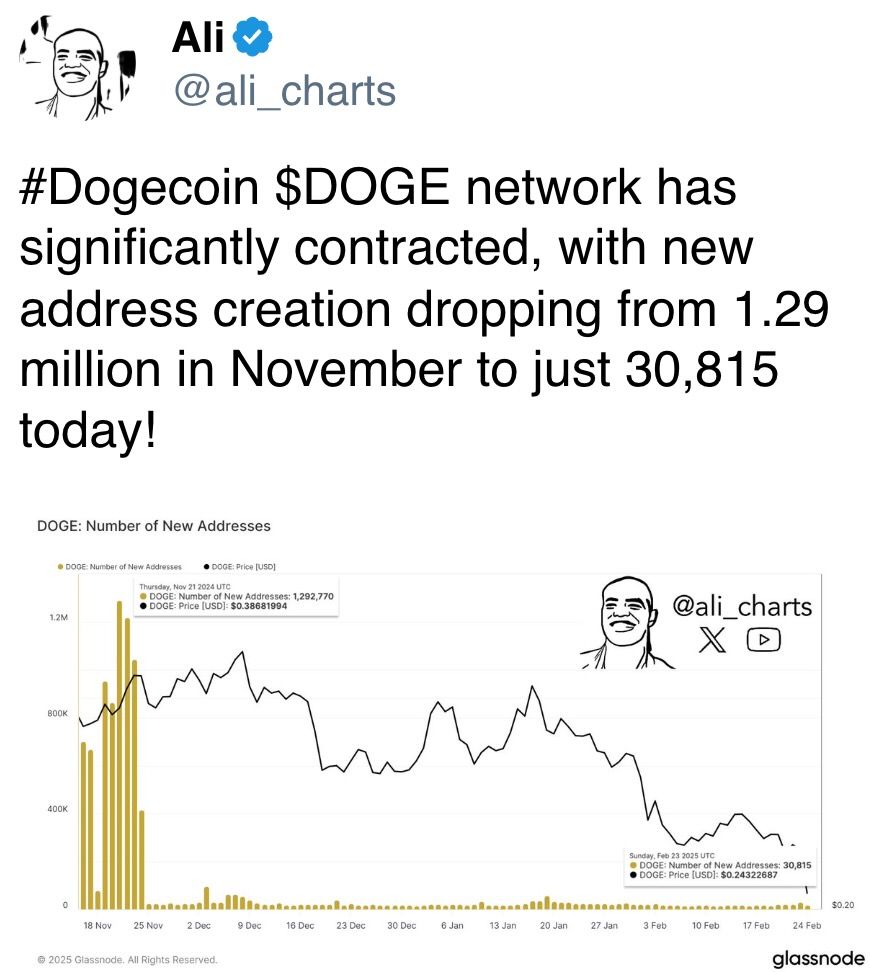

Pump.fun, a Solana-based memecoin launchpad, has seen a sharp decline in token launches and graduations amid a falling market.

The platform hit a peak in October 2024, creating over 36,000 tokens in a day and generating a record $3 billion market cap for its ecosystem, but activity has since plummeted, with daily token launches dropping more than 60%.

Data from Dune Analytics shows Pump.fun’s token graduation rate remains low at around 1%-2%, with many tokens failing to sustain value post-launch, contributing to the downturn.

The decline comes as Solana’s SOL has dropped more than 40% since the start of the year.

Derivatives Positioning

Open interest in perceptual futures tied to APT, one of the best-performing coins of the past 24 hours, has increased, but funding rates and the cumulative volume delta are negative. That’s a sign of traders hedging downside risks.

SOL and LTC have also seen increases in open interest, but with positive funding rates.

BTC and ETH options on Deribit now indicate downside concerns extending until the end of March, while later expirations continue to show a preference for call options.

Block flows on Paradigm have been mixed, with puts and OTM call spreads lifted. The SOL March 7 expiry put option at the $120 strike was purchased.

Market Movements:

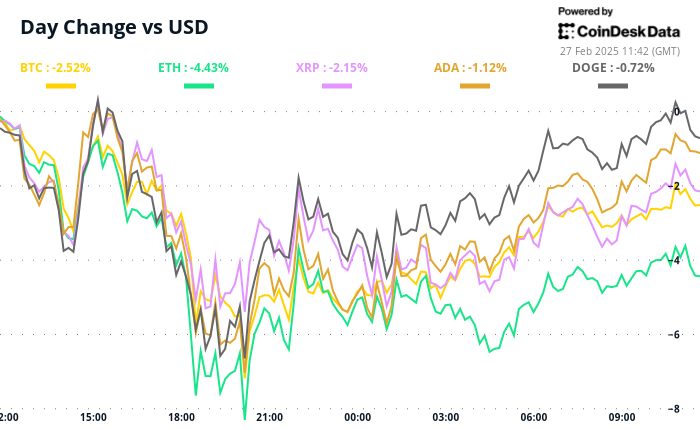

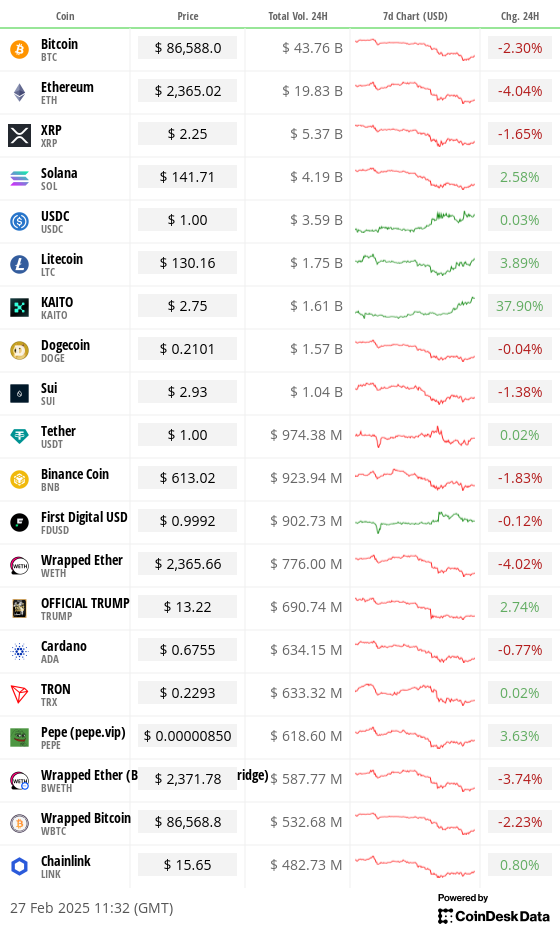

BTC is up 3% from 4 p.m. ET Wednesday at $86,735.19 (24hrs: -2.12%)

ETH is up 1.98% at $2,378.49 (24hrs: -3.49%)

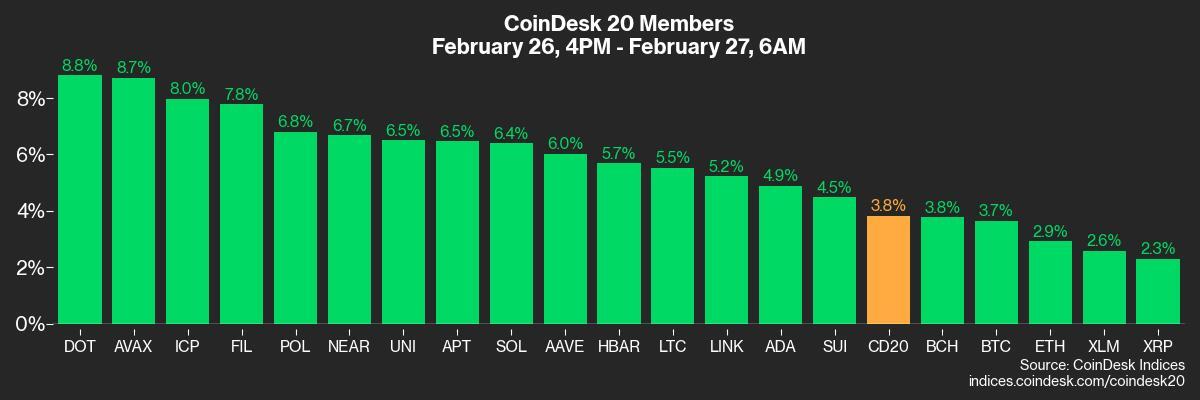

CoinDesk 20 is up 2.98% at 2,821.02 (24hrs: -1.13%)

Ether CESR Composite Staking Rate is down 26 bps at 3.02%

BTC funding rate is at 0.0039% (4.26% annualized) on Binance

DXY is up 0.23% 106.66

Gold is down 0.77% at $2,893.59/oz

Silver is down 0.27% at $31.83/oz

Nikkei 225 closed +0.3% at 38,256.17

Hang Seng closed -0.29% at 23,718.29

FTSE is up 0.19% at 8,748.36

Euro Stoxx 50 is down 0.72% at 5,487.97

DJIA closed on Wednesday -0.43% at 43,433.12

S&P 500 closed unchanged at 5,956.06

Nasdaq closed +0.26% at 19,075.26

S&P/TSX Composite Index closed +0.49% at 25,328.36

S&P 40 Latin America closed -0.46% at 2,379.84

U.S. 10-year Treasury rate is up 5 bps at 4.31%

E-mini S&P 500 futures are up 0.57% at 6,005.00

E-mini Nasdaq-100 futures are up 0.64% at 21,322.25

E-mini Dow Jones Industrial Average Index futures are up 0.24% at 43,612.00

Bitcoin Stats:

BTC Dominance: 60.77 (0.31%)

Ethereum to bitcoin ratio: 0.02744 (-1.05%)

Hashrate (seven-day moving average): 766 EH/s

Hashprice (spot): $50.5

Total Fees: 10.9 BTC / $915,415

CME Futures Open Interest: 155,270 BTC

BTC priced in gold: 29.6 oz

BTC vs gold market cap: 8.42%

Technical Analysis

BTC’s double top breakdown has exposed the former resistance-turned-support below $74,000.

On the price chart, there is no other support between $90K and $74K.

Crypto Equities

MicroStrategy (MSTR): closed on Wednesday at $263.27 (+5.09%), up 2.82% at $270.70 in pre-market

Coinbase Global (COIN): closed at $212.96 (+0.22%), up 3.22% at $219.81

Galaxy Digital Holdings (GLXY): closed at C$20.16 (+0.35%)

MARA Holdings (MARA): closed at $12.45 (+0.28%), up 12.93% at $14.06

Riot Platforms (RIOT): closed at $8.94 (-4.08%), up 3.69% at $9.27

Core Scientific (CORZ): closed at $10.02 (+2.66%), up 18.46% at $11.87

CleanSpark (CLSK): closed at $7.88 (-3.31%), up 3.43% at $8.15

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $17.22 (+1.06%)

Semler Scientific (SMLR): closed at $43.91 (+3.51%), up 1.41% at $44.53

Exodus Movement (EXOD): closed at $44.48 (+11.59%), up 8.48% at $48.25

ETF Flows

Spot BTC ETFs:

Daily net flow: -$754.6 million

Cumulative net flows: $37.13 billion

Total BTC holdings ~ 1,139 million.

Spot ETH ETFs

Daily net flow: -$94.3 million

Cumulative net flows: $2.93 billion

Total ETH holdings ~ 3.714 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

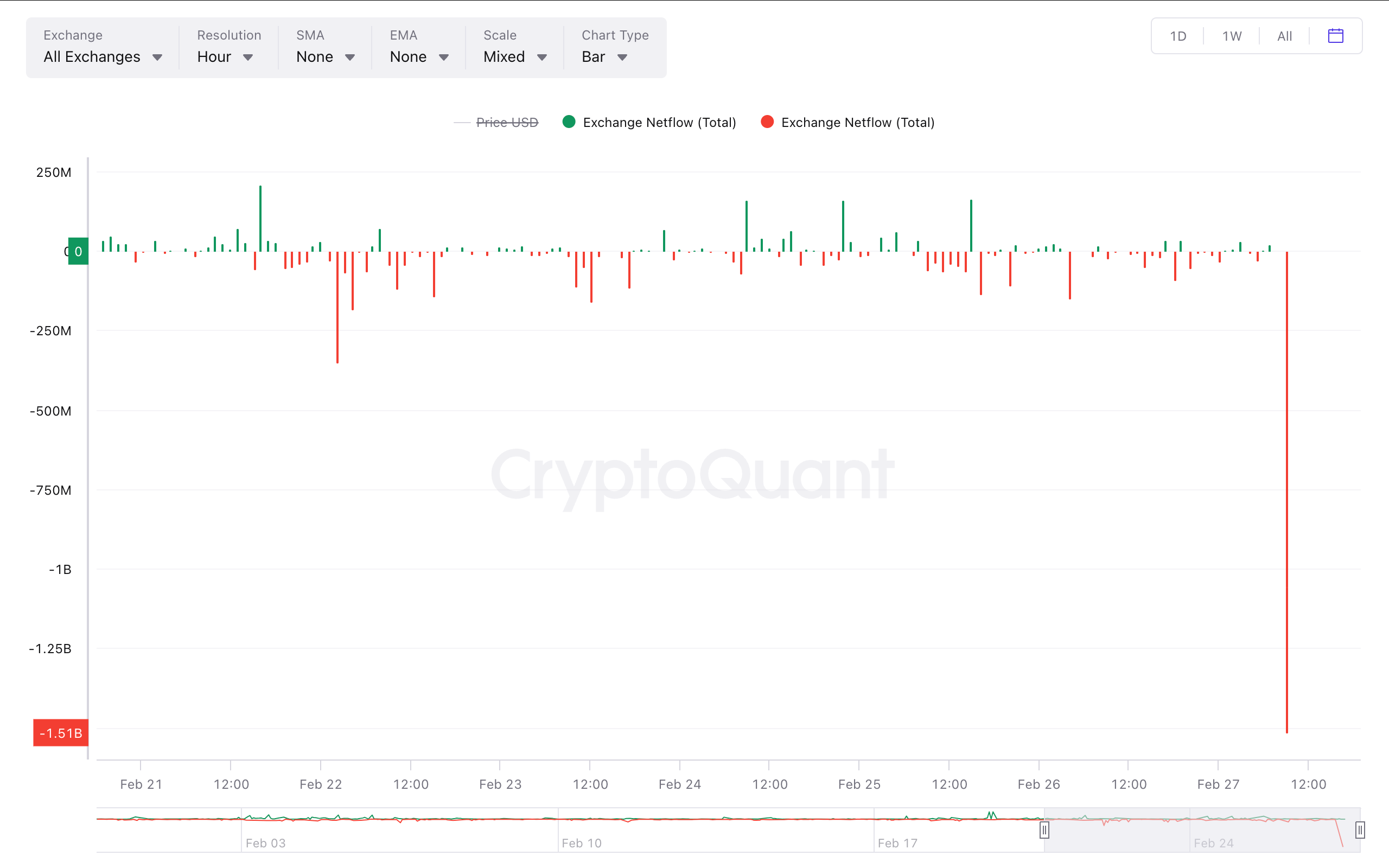

The chart shows a large outflow of the Tether’s dollar-pegged stablecoin USDT from centralized exchanges.

It may be a sign of traders preparing for deeper market downturns or rotation of liquidity out of centralized avenues into decentralized platforms.

While You Were Sleeping

Bitcoin Registers Biggest 3-Day Price Slide Since FTX Debacle. What Next? (CoinDesk): The slide was driven by tighter fiat liquidity and weakening institutional demand. Technical analysis shows the price could drop to around $70,000.

FBI Seeks Crypto Industry Help to Track, Block Laundering of Bybit Hack Funds (CoinDesk): In a public service announcement, the Federal Bureau of Investigation (FBI) listed Ethereum addresses tied to crypto assets recently stolen from Bybit.

Metaplanet Seeks to Raise Over $13M From Bond Sale to Buy More Bitcoin (CoinDesk): Japanese firm Metaplanet Inc (3350) said it is raising another 2 billion yen ($13.3 million) by selling additional ordinary bonds with a 0% interest.

Investors Bet on Sharpest U.S.-Europe Inflation Divergence Since 2022 (Reuters): Data from inflation swap markets suggests stronger growth and tariff pressures will keep U.S. inflation higher than in the eurozone, where falling energy costs will help keep prices in check.

Trump Shocks Europe Into Chasing Billions for Military Buildup (Bloomberg): European leaders are overhauling defense funding by revising fiscal rules, enabling joint borrowing and repurposing recovery funds to boost military capabilities amid rising security challenges.

Trump Axes Chevron’s Venezuela Oil License, Citing Lack of Electoral Reforms (Reuters): President Trump announced on Truth Social that he is reversing a two-year-old Biden-era license that allowed Chevron (CVX) to operate in Venezuela.

Argentina Memecoin Scandal Dents Milei’s Hunt for Election Allies (Reuters): President Milei’s promotion of the LIBRA token — which crashed shortly after launch — and the subsequent investigations have complicated his efforts to build political alliances ahead of midterm elections.

In the Ether

Uncategorized

Wall Street Bank Citigroup Sees Ether Falling to $4,300 by Year-End

Wall Street giant Citigroup (C) has launched new ether (ETH) forecasts, calling for $4,300 by year-end, which would be a decline from the current $4,515.

That’s the base case though. The bank’s full assessment is wide enough to drive an army regiment through, with the bull case being $6,400 and the bear case $2,200.

The bank analysts said network activity remains the key driver of ether’s value, but much of the recent growth has been on layer-2s, where value “pass-through” to Ethereum’s base layer is unclear.

Citi assumes just 30% of layer-2 activity contributes to ether’s valuation, putting current prices above its activity-based model, likely due to strong inflows and excitement around tokenization and stablecoins.

A layer 1 network is the base layer, or the underlying infrastructure of a blockchain. Layer 2 refers to a set of off-chain systems or separate blockchains built on top of layer 1s.

Exchange-traded fund (ETF) flows, though smaller than bitcoin’s (BTC), have a bigger price impact per dollar, but Citi expects them to remain limited given ether’s smaller market cap and lower visibility with new investors.

Macro factors are seen adding only modest support. With equities already near the bank’s S&P 500 6,600 target, the analysts do not expect major upside from risk assets.

Read more: Ether Bigger Beneficiary of Digital Asset Treasuries Than Bitcoin or Solana: StanChart

Uncategorized

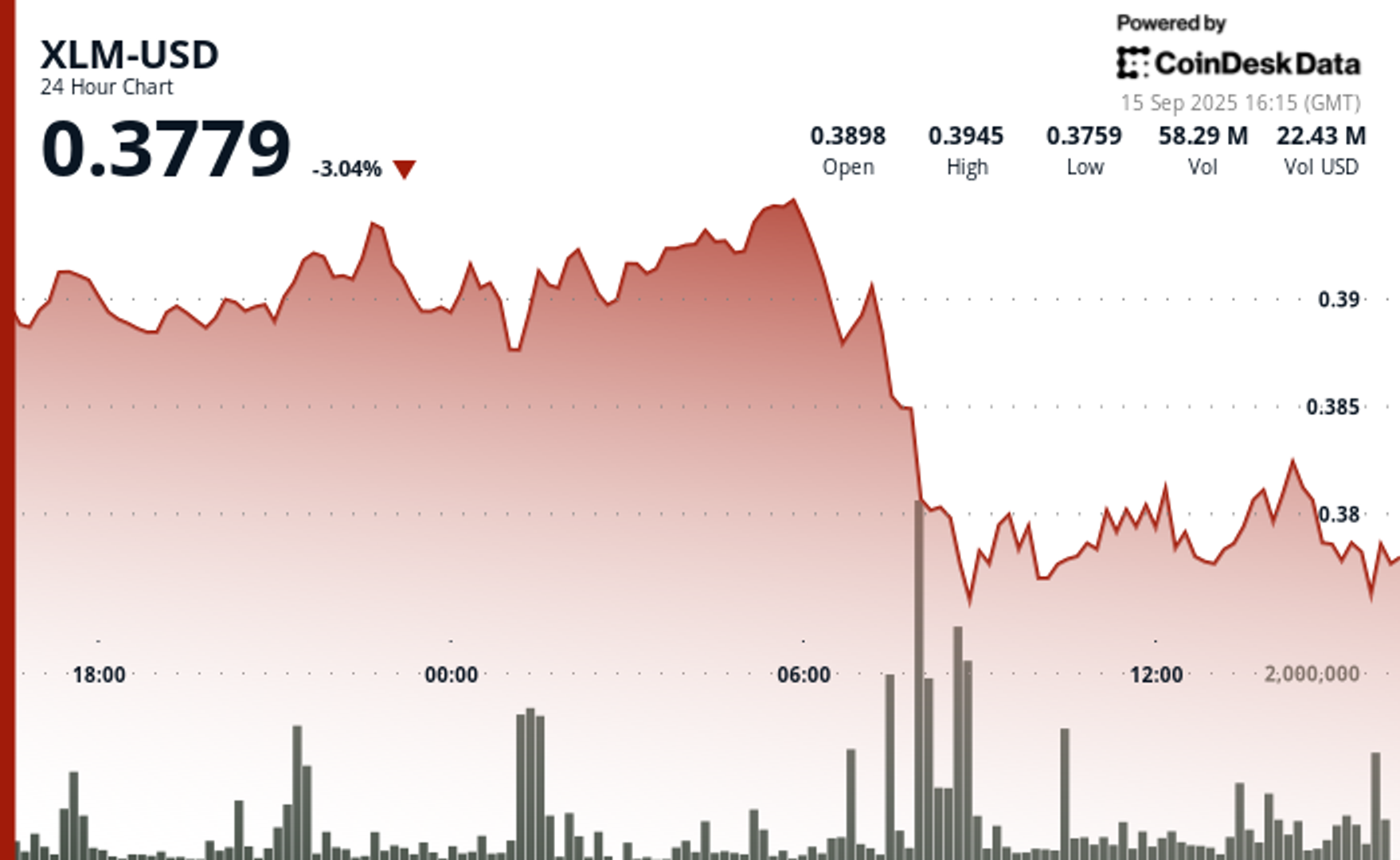

XLM Sees Heavy Volatility as Institutional Selling Weighs on Price

Stellar’s XLM token endured sharp swings over the past 24 hours, tumbling 3% as institutional selling pressure dominated order books. The asset declined from $0.39 to $0.38 between September 14 at 15:00 and September 15 at 14:00, with trading volumes peaking at 101.32 million—nearly triple its 24-hour average. The heaviest liquidation struck during the morning hours of September 15, when XLM collapsed from $0.395 to $0.376 within two hours, establishing $0.395 as firm resistance while tentative support formed near $0.375.

Despite the broader downtrend, intraday action highlighted moments of resilience. From 13:15 to 14:14 on September 15, XLM staged a brief recovery, jumping from $0.378 to a session high of $0.383 before closing the hour at $0.380. Trading volume surged above 10 million units during this window, with 3.45 million changing hands in a single minute as bulls attempted to push past resistance. While sellers capped momentum, the consolidation zone around $0.380–$0.381 now represents a potential support base.

Market dynamics suggest distribution patterns consistent with institutional profit-taking. The persistent supply overhead has reinforced resistance at $0.395, where repeated rally attempts have failed, while the emergence of support near $0.375 reflects opportunistic buying during liquidation waves. For traders, the $0.375–$0.395 band has become the key battleground that will define near-term direction.

Technical Indicators

- XLM retreated 3% from $0.39 to $0.38 during the previous 24-hours from 14 September 15:00 to 15 September 14:00.

- Trading volume peaked at 101.32 million during the 08:00 hour, nearly triple the 24-hour average of 24.47 million.

- Strong resistance established around $0.395 level during morning selloff.

- Key support emerged near $0.375 where buying interest materialized.

- Price range of $0.019 representing 5% volatility between peak and trough.

- Recovery attempts reached $0.383 by 13:00 before encountering selling pressure.

- Consolidation pattern formed around $0.380-$0.381 zone suggesting new support level.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Uncategorized

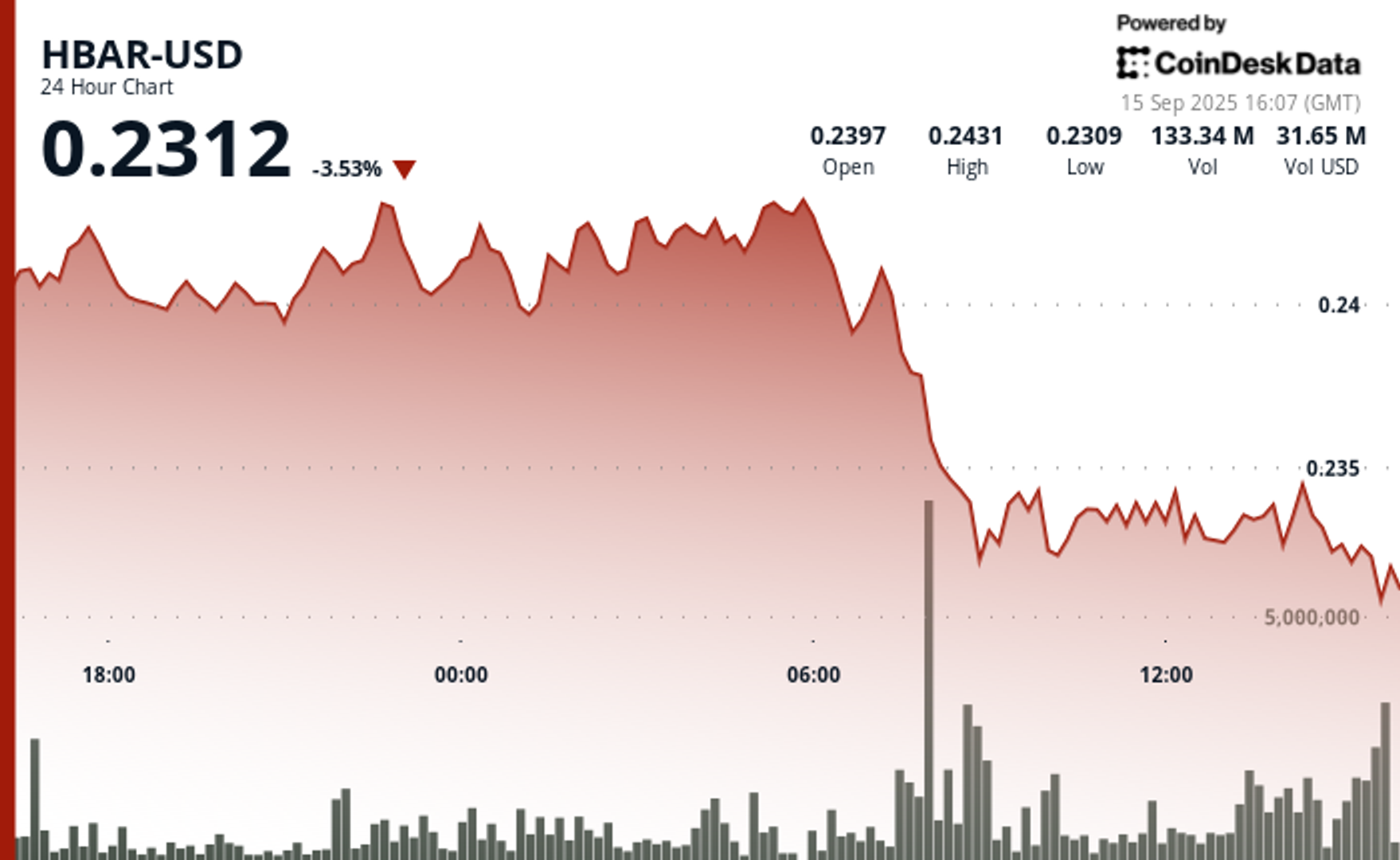

HBAR Tumbles 5% as Institutional Investors Trigger Mass Selloff

Hedera Hashgraph’s HBAR token endured steep losses over a volatile 24-hour window between September 14 and 15, falling 5% from $0.24 to $0.23. The token’s trading range expanded by $0.01 — a move often linked to outsized institutional activity — as heavy corporate selling overwhelmed support levels. The sharpest move came between 07:00 and 08:00 UTC on September 15, when concentrated liquidation drove prices lower after days of resistance around $0.24.

Institutional trading volumes surged during the session, with more than 126 million tokens changing hands on the morning of September 15 — nearly three times the norm for corporate flows. Market participants attributed the spike to portfolio rebalancing by large stakeholders, with enterprise adoption jitters and mounting regulatory scrutiny providing the backdrop for the selloff.

Recovery efforts briefly emerged during the final hour of trading, when corporate buyers tested the $0.24 level before retreating. Between 13:32 and 13:35 UTC, one accumulation push saw 2.47 million tokens deployed in an effort to establish a price floor. Still, buying momentum ultimately faltered, with HBAR settling back into support at $0.23.

The turbulence underscores the token’s vulnerability to institutional distribution events. Analysts point to the failed breakout above $0.24 as confirmation of fresh resistance, with $0.23 now serving as the critical support zone. The surge in volume suggests major corporate participants are repositioning ahead of regulatory shifts, leaving HBAR’s near-term outlook dependent on whether enterprise buyers can mount sustained defenses above key support.

Technical Indicators Summary

- Corporate resistance levels crystallized at $0.24 where institutional selling pressure consistently overwhelmed enterprise buying interest across multiple trading sessions.

- Institutional support structures emerged around $0.23 levels where corporate buying programs have systematically absorbed selling pressure from retail and smaller institutional participants.

- The unprecedented trading volume surge to 126.38 million tokens during the 08:00 morning session reflects enterprise-scale distribution strategies that overwhelmed corporate demand across major trading platforms.

- Subsequent institutional momentum proved unsustainable as systematic selling pressure resumed between 13:37-13:44, driving corporate participants back toward $0.23 support zones with sustained volumes exceeding 1 million tokens, indicating ongoing institutional distribution.

- Final trading periods exhibited diminishing corporate activity with zero recorded volume between 13:13-14:14, suggesting institutional participants adopted defensive positioning strategies as HBAR consolidated at $0.23 amid enterprise uncertainty.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars