Uncategorized

How to Prepare for a Major Compliance Failure Settlement: The OKX Approach

Confidential protocols put in place to deal with news of regulatory failings by one of the top-five crypto exchanges, OKX, suggest that the company likely has been expecting a settlement with U.S. authorities for some time.

This happened on Monday when OKX announced a $500 million-plus settlement with the U.S. Department of Justice after failing to secure a money transmitter license and allegedly facilitating $5 billion in «suspicious transactions and criminal proceeds.»

OKX’s meticulous planning makes for some fascinating reading. The secret crisis management document seen by CoinDesk refers to a messaging “SWAT Team” that can be mobilized to implement various ways the firm’s top executives can communicate a settlement via social media and when speaking to reporters.

Well in advance of Monday’s large fine and forfeiture, OKX had produced specific guidance with regards to settling with the DOJ, as well as the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC, or sanctions watchdog), for example.

A favored approach is to point out that the entire crypto industry has been broadly under intense scrutiny and that OKX is cooperating fully with regulators, the document said. This was echoed in Monday’s press release which said OKX “appreciates” the DOJ’s “collaboration.”

Since the administration of President Donald Trump took over last month, the main focus for regulatory agencies in the crypto arena has been to reverse their previously aggressive enforcement stance, with the SEC dropping ongoing litigation and closing investigations. But not so in the case of OKX, which, like Kucoin with its recent $300 million penalty and Binance back in 2023, has been forced into costly settlements.

The guidance refers to what is expected from OKX founder Star Xu, President Hong Fang and other executives when it comes to “their social media actions in two scenarios: 1) Leak before OFAC settlement, 2) upon OFAC settlement.”

Also, on the issue of OFAC, if executives are asked if OKX has served sanctioned markets, one suggestion is to say: “Customers from sanctioned markets slipped through when we had immature compliance controls and systems […] It is a very small and insignificant part of the Okcoin or OKX customer base.”

Indeed, Monday’s press release from OKX acknowledged that U.S. customers were able to trade on the global exchange.

«The total number of U.S. customers involved – which are no longer on the platform – amounted to a small percentage of the Company’s worldwide customer population,» the release said.

Brand awareness

Another priority for OKX is how the firm choreographs its big-ticket sponsorship arrangements with the likes of Manchester City football club, F1 team McLaren and the Tribeca Film Festival. The firm estimates that around $100 million per annum has been spent on these partnerships over the past three years.

The action plan for brand partners involves the OKX marketing chief giving each partner a phone call “at the last hour before the news breaks.”

The recommended strategy here is to say OKX has prepared for a regulatory review, given the heightened scrutiny on crypto firms. If asked why the exchange did not share information about this before, the document states that these are pending inquiries and non-public matters. There is also a bullet point suggesting the CMO and OKX’s head of legal “review clauses in our brand partner contracts again.”

Don’t mention OKB

Another detail that gets attention in the OKX planning document is the exchange’s native cryptocurrency, OKB. An obvious concern in the aftermath of FTX is any suggestion that OKB has been used as collateral or to finance any operations of OKX, as was the case with FTX’s FTT token.

Of course, the OKB exchange token hasn’t been subject to anything like the iniquities of FTX’s exchange token. However, it was involved in a sudden flash crash in January 2024, after which OKX quickly offered to compensate users who had lost out. The token, which has a relatively thin trading volume and liquidity, saw 10 dormant wallets become active and begin trading just before the crash, according to Marina Khaustova, COO Crystal Intelligence, a blockchain analytics firm.

Not long after the OKB crash, OKX executives Tim Byun, the former CEO of OKcoin and head of global government relations, and Head of Product Wei Lan were let go by OKX. A source familiar with the situation said Byun was «sacrificed» following the OKB crash.

Unsurprisingly, the OKX comms protocol emphasizes that execs should “refrain from mentioning OKB and reference this only if asked.”

Media management

Another part of the puzzle is how the exchange should deal with media inquiries. Should OKX receive emails or a phone call from a journalist looking for comment about ongoing investigations, the SWAT Team and PR team should go into action to “buy time by offering up leadership schedules”

Meanwhile, the plan is “to contact key friendly publications for a parallel story to seed in a complimentary narrative to the originating story,” the document states.

“1. Push for delay 2. Confirm friendly publications 3. Asynchronously queue up internal / external comms, so we hit send as the story comes out,” it said.

OKX did not provide a comment by press time

Uncategorized

Wall Street Bank Citigroup Sees Ether Falling to $4,300 by Year-End

Wall Street giant Citigroup (C) has launched new ether (ETH) forecasts, calling for $4,300 by year-end, which would be a decline from the current $4,515.

That’s the base case though. The bank’s full assessment is wide enough to drive an army regiment through, with the bull case being $6,400 and the bear case $2,200.

The bank analysts said network activity remains the key driver of ether’s value, but much of the recent growth has been on layer-2s, where value “pass-through” to Ethereum’s base layer is unclear.

Citi assumes just 30% of layer-2 activity contributes to ether’s valuation, putting current prices above its activity-based model, likely due to strong inflows and excitement around tokenization and stablecoins.

A layer 1 network is the base layer, or the underlying infrastructure of a blockchain. Layer 2 refers to a set of off-chain systems or separate blockchains built on top of layer 1s.

Exchange-traded fund (ETF) flows, though smaller than bitcoin’s (BTC), have a bigger price impact per dollar, but Citi expects them to remain limited given ether’s smaller market cap and lower visibility with new investors.

Macro factors are seen adding only modest support. With equities already near the bank’s S&P 500 6,600 target, the analysts do not expect major upside from risk assets.

Read more: Ether Bigger Beneficiary of Digital Asset Treasuries Than Bitcoin or Solana: StanChart

Uncategorized

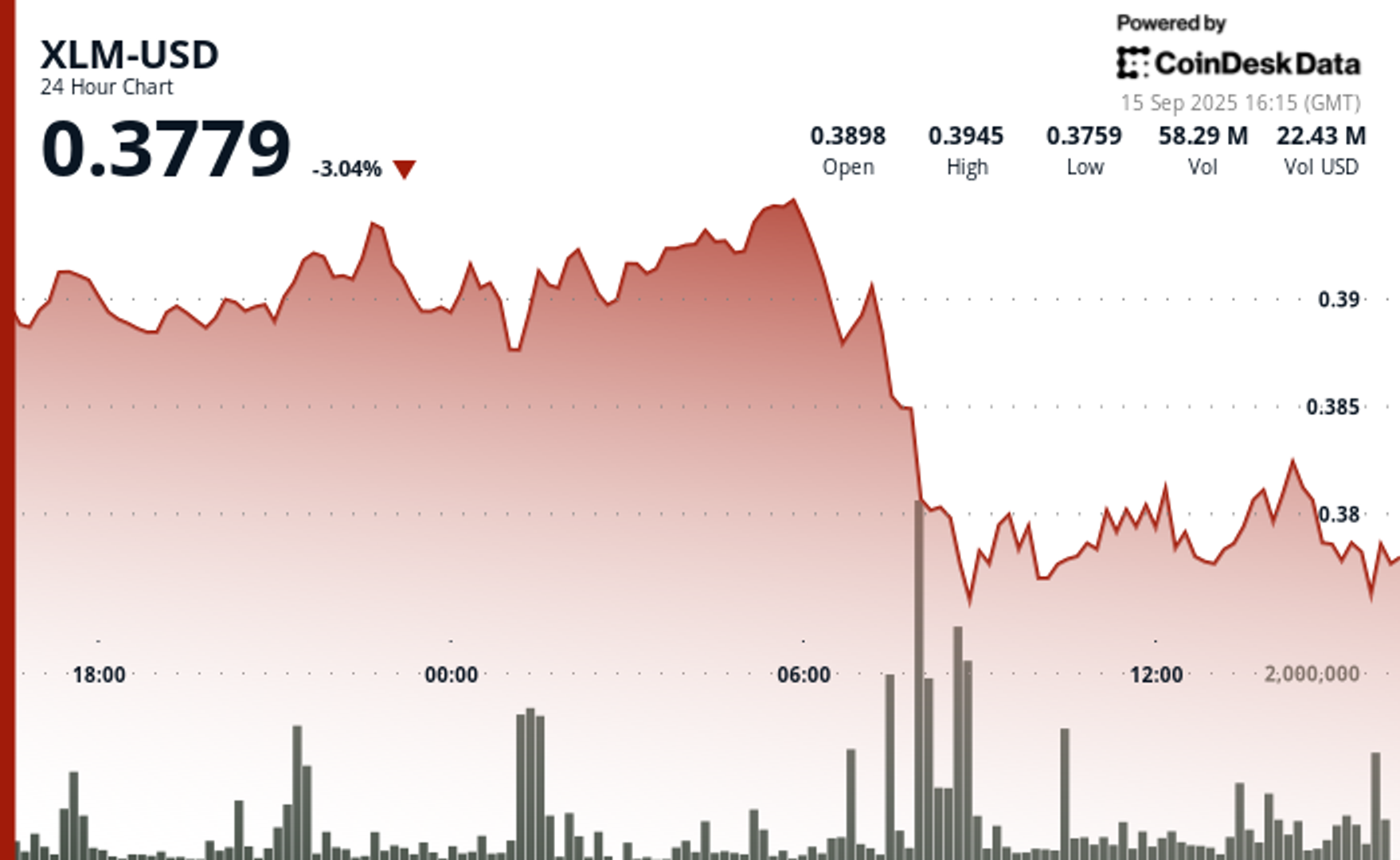

XLM Sees Heavy Volatility as Institutional Selling Weighs on Price

Stellar’s XLM token endured sharp swings over the past 24 hours, tumbling 3% as institutional selling pressure dominated order books. The asset declined from $0.39 to $0.38 between September 14 at 15:00 and September 15 at 14:00, with trading volumes peaking at 101.32 million—nearly triple its 24-hour average. The heaviest liquidation struck during the morning hours of September 15, when XLM collapsed from $0.395 to $0.376 within two hours, establishing $0.395 as firm resistance while tentative support formed near $0.375.

Despite the broader downtrend, intraday action highlighted moments of resilience. From 13:15 to 14:14 on September 15, XLM staged a brief recovery, jumping from $0.378 to a session high of $0.383 before closing the hour at $0.380. Trading volume surged above 10 million units during this window, with 3.45 million changing hands in a single minute as bulls attempted to push past resistance. While sellers capped momentum, the consolidation zone around $0.380–$0.381 now represents a potential support base.

Market dynamics suggest distribution patterns consistent with institutional profit-taking. The persistent supply overhead has reinforced resistance at $0.395, where repeated rally attempts have failed, while the emergence of support near $0.375 reflects opportunistic buying during liquidation waves. For traders, the $0.375–$0.395 band has become the key battleground that will define near-term direction.

Technical Indicators

- XLM retreated 3% from $0.39 to $0.38 during the previous 24-hours from 14 September 15:00 to 15 September 14:00.

- Trading volume peaked at 101.32 million during the 08:00 hour, nearly triple the 24-hour average of 24.47 million.

- Strong resistance established around $0.395 level during morning selloff.

- Key support emerged near $0.375 where buying interest materialized.

- Price range of $0.019 representing 5% volatility between peak and trough.

- Recovery attempts reached $0.383 by 13:00 before encountering selling pressure.

- Consolidation pattern formed around $0.380-$0.381 zone suggesting new support level.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Uncategorized

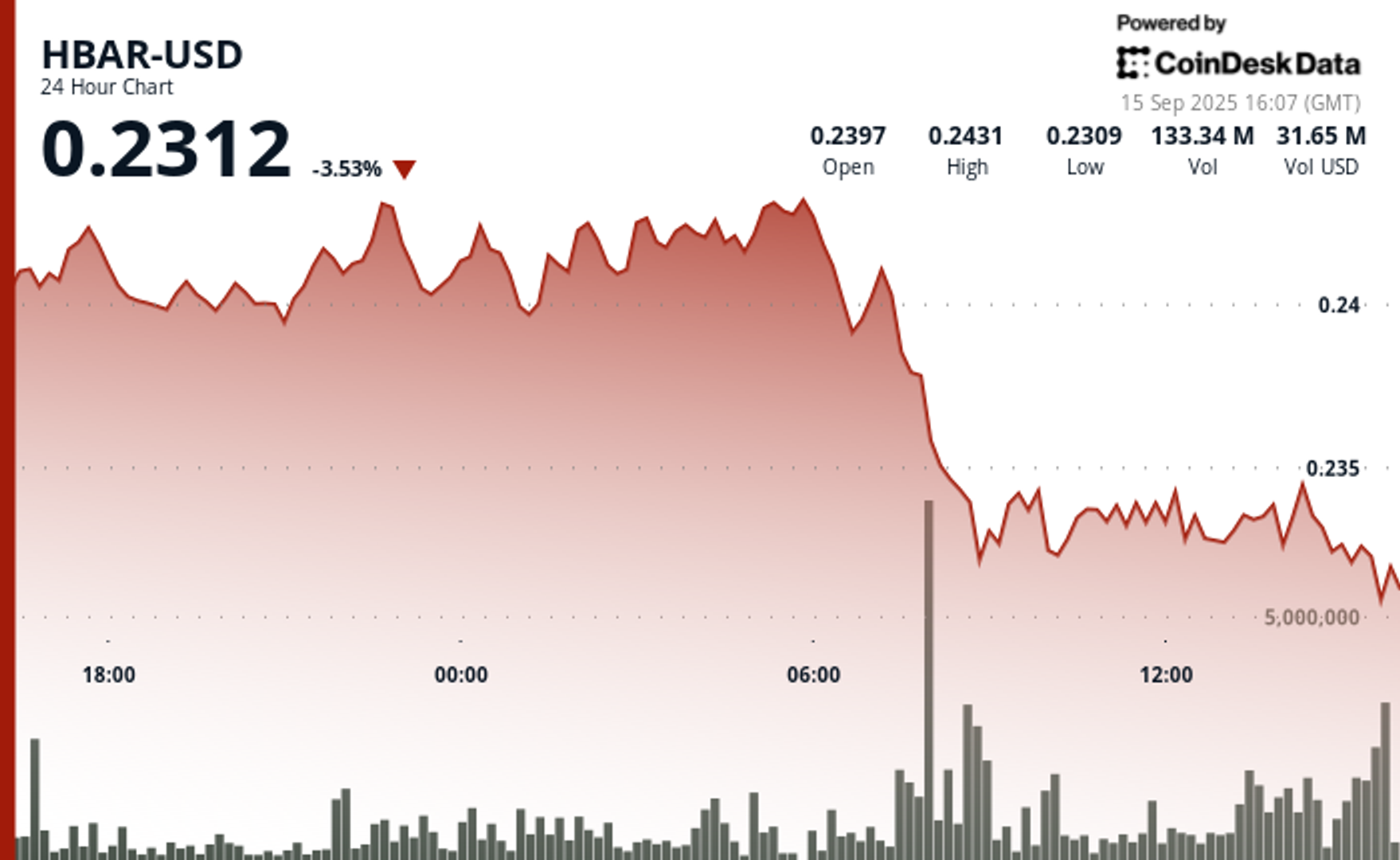

HBAR Tumbles 5% as Institutional Investors Trigger Mass Selloff

Hedera Hashgraph’s HBAR token endured steep losses over a volatile 24-hour window between September 14 and 15, falling 5% from $0.24 to $0.23. The token’s trading range expanded by $0.01 — a move often linked to outsized institutional activity — as heavy corporate selling overwhelmed support levels. The sharpest move came between 07:00 and 08:00 UTC on September 15, when concentrated liquidation drove prices lower after days of resistance around $0.24.

Institutional trading volumes surged during the session, with more than 126 million tokens changing hands on the morning of September 15 — nearly three times the norm for corporate flows. Market participants attributed the spike to portfolio rebalancing by large stakeholders, with enterprise adoption jitters and mounting regulatory scrutiny providing the backdrop for the selloff.

Recovery efforts briefly emerged during the final hour of trading, when corporate buyers tested the $0.24 level before retreating. Between 13:32 and 13:35 UTC, one accumulation push saw 2.47 million tokens deployed in an effort to establish a price floor. Still, buying momentum ultimately faltered, with HBAR settling back into support at $0.23.

The turbulence underscores the token’s vulnerability to institutional distribution events. Analysts point to the failed breakout above $0.24 as confirmation of fresh resistance, with $0.23 now serving as the critical support zone. The surge in volume suggests major corporate participants are repositioning ahead of regulatory shifts, leaving HBAR’s near-term outlook dependent on whether enterprise buyers can mount sustained defenses above key support.

Technical Indicators Summary

- Corporate resistance levels crystallized at $0.24 where institutional selling pressure consistently overwhelmed enterprise buying interest across multiple trading sessions.

- Institutional support structures emerged around $0.23 levels where corporate buying programs have systematically absorbed selling pressure from retail and smaller institutional participants.

- The unprecedented trading volume surge to 126.38 million tokens during the 08:00 morning session reflects enterprise-scale distribution strategies that overwhelmed corporate demand across major trading platforms.

- Subsequent institutional momentum proved unsustainable as systematic selling pressure resumed between 13:37-13:44, driving corporate participants back toward $0.23 support zones with sustained volumes exceeding 1 million tokens, indicating ongoing institutional distribution.

- Final trading periods exhibited diminishing corporate activity with zero recorded volume between 13:13-14:14, suggesting institutional participants adopted defensive positioning strategies as HBAR consolidated at $0.23 amid enterprise uncertainty.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars