Uncategorized

El Salvador Dispatch: Berlín, the Bitcoin Marvel Hidden in the Mountains

In El Salvador, about two hours away from the capital, up in the mountains, lies a town named Berlín. It’s a mid-sized city by Salvadoran standards, with a population of roughly 20,000. It has a bank, law firms, police, food stores, hardware stores, bars, restaurants, hotels, pharmacies, clinics, churches — and one of the largest Bitcoin circular economies in the world.

Walking down any street, you find all kinds of local businesses accepting bitcoin (BTC) payments, from fruit vendors to motorcycle repair shops. If you live full-time in Berlín, you can pay for almost all of your expenses in bitcoin.

Bitcoin acceptance isn’t solely to attract curious foreigners, though that dynamic certainly exists. Whereas El Zonte — the surfing village known as Bitcoin Beach, home to El Salvador’s very first Bitcoin circular economy — has grown into a tourism hotspot, Berlín is still relatively unknown, and its expat community is very small (only 14 to 20 people depending on the month, according to the Bitcoin Community Center). What makes Berlín different is that Salvadorans themselves have begun using bitcoin for their everyday purchases.

That’s a big deal. Back in 2021, when President Nayib Bukele made bitcoin legal tender — giving it the same status as the country’s official currency, the U.S. dollar — and rolled out a government-backed wallet named Chivo, there was an expectation in crypto that Salvadorans would quickly adopt Bitcoin and transact with the digital currency on a nationwide level.

More than 70% of the population, at the time, had no access to banking services. Forget loans and mortgages; most people didn’t even have savings accounts. Bitcoin, it was said, would drastically reduce the fees incurred by Salvadorans working in the U.S. and sending remittances to their families. It could also, theoretically, protect Salvadorans from the inflation of the U.S. dollar, which in 2022 reached its highest point in roughly 40 years.

That’s not what happened. The vast majority of the population stayed away from all things Bitcoin. In 2023, 88% of Salvadorans hadn’t used the cryptocurrency, according to a survey by the Central American University. Critics argued that El Salvador’s Bitcoin experiment had failed.

But the idyllic town of Berlín, located to the west of the Tecapa volcano, more than 1,000 meters above sea level, offers a different story.

When I drove up there at the end of January, I expected to find a clique of foreign Bitcoiners using the city as a base, like how Brits invade the southern coast of Spain every winter, or how party animals flock to Bangkok for the nightlife. I was wrong. I’ve never seen anything quite like Berlín.

The Bitcoin Community Center

Berlín’s Bitcoin Community Center is smack in the heart of town. It’s a lovely little place, with a cafeteria, a classroom, a podcast-recording room, an administrative office and a garden. Most activities happen in the cafeteria; people can sit and chat, buy cookies, use a bitcoin ATM, work on their projects, or simply read Bitcoin-related books.

“It’s a community center, it’s a social hub. It’s everything. It’s pretty loose in terms of structure and how it works,” Pierre Bonbury, a Canadian expat who lightheartedly described himself as the office’s tour guide, explained to me. “Whatever idea you have — business, training, education, social events — anyone who wants to contribute can come here.”

Two sizable maps indicate all the places in town that now accept bitcoin payments. More than 150 businesses are on board, which is roughly 25% of the total businesses in Berlín, according to the community center. And the pace of adoption is accelerating. Whereas the team used to go out knocking on doors to explain the benefits of using Bitcoin, Berlíners now tend to show up to the office of their own initiative, at a rate of 3-5 new people per week, according to the center.

They also regularly come in to learn. The team in Berlín provides Bitcoin 101 classes in local high schools, tech training, and English and Spanish lessons. Bitcoin professionals (like wallet developers) are also encouraged to run seminars when they come to visit. Most of the training, however, is informal and on-the-spot, whenever a local business owner needs help figuring out something Bitcoin-related on a practical level.

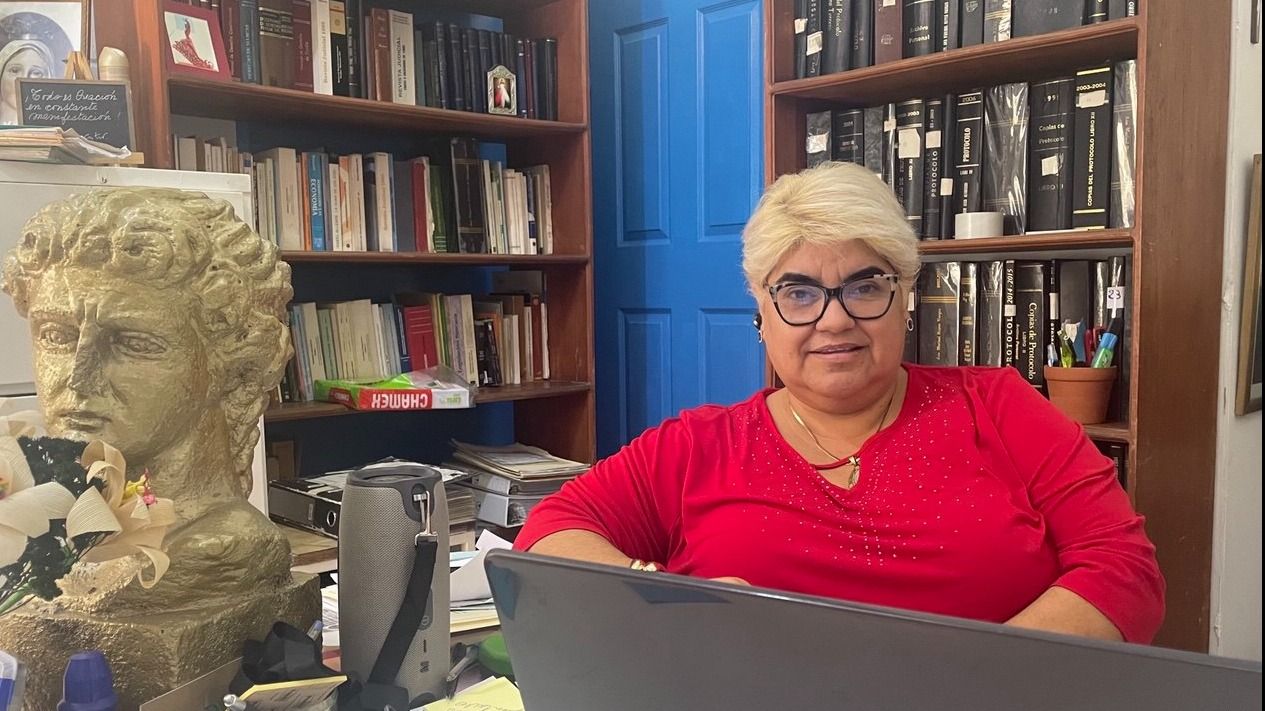

There’s a great vibe. People of all ages are continuously popping in and out. Patricia Rosales, who was born and raised in Berlín and has been part of the project from the very beginning, is the center’s main administrator. She is supported by an army of volunteers, including Daniela Alvarenga and Edgar Cruz, two Salvadoran 19-year-olds who learned about Bitcoin in school and love to hang out at the office.

Rosales had come back to Berlín in 2014 after living in San Salvador, the nation’s capital, for almost a decade. However, she’d struggled to find fulfilling work opportunities that also allowed her to raise her son. “But life takes you along the way, it helps you. It was moving the pieces for me to find Bitcoin,” she told me. “My son learned about Bitcoin as I did. It’s more than I could have ever hoped for. Now he’s 11 years old, and using a bitcoin ATM is the easiest thing in the world for him. That’s my greatest happiness, that I was able to bring him with me on this journey.”

Like many Salvadorans, Rosales first heard about Bitcoin when Bukele made the cryptocurrency legal tender in 2021. Curious about the technology, she ended up attending a seminar by Gerardo Linares and Evelyn Lemus — a young Salvadoran couple that was looking to kickstart a Bitcoin circular economy in a mid-sized town, based on El Zonte’s model.

“I stayed with them and they began the project of implementing Bitcoin in Berlín,” Rosales said. “I had a feeling something good was on the way, and I was getting along very well with them, so I didn’t want to let go of them.”

The Salvadorans behind the movement

Lemus was the first one to really look deeply into Bitcoin, according to Linares, who remembers her listening to crypto podcasts before Bukele ever mentioned the digital asset. Linares himself came fully onboard once the government passed the Bitcoin law. “I realized that an enormous historical event was happening here,” he told me. “Evelyn and I, we love travelling, so we visited all kinds of different towns in El Salvador to see where we could pay in bitcoin. We didn’t really find any place except El Zonte. And we were supposed to be the Bitcoin Country!”

So they took matters into their own hands. They needed a city that wasn’t too big, such as San Salvador, nor too small, with only a handful of businesses. They liked the idea of starting something in the mountains. One day Lemus stopped in Berlín for coffee with her sister on their way back from San Miguel, and it was love at first sight.

Berlín was perfect. Between the volcano, the long hiking trails, the coffee farms, the museums and Alegría’s volcanic lake only 30 minutes away, Berlín was a place with a lot of potential for tourism — but very few tourists actually came to town. The locals were hungry for new ideas. “What we found in Berlín is that people wanted change, but they weren’t quite sure of the direction to take,” said Lemus. “They needed someone to organize them and give practical advice.”

The project, which officially launched in August 2023, originally counted four members: Lemus, Linares, Rosales and Charlie Stevens, an Irishman whom I did not get to meet. They had few resources to start with. “Nobody had a salary. We all had other jobs on the side. For a year and a half we were volunteers, and we just learned as we went,” Rosales said. “The cafeteria, for example, was just an idea that helped us keep the project going. We got creative.”

Gaining the community’s trust required work. The Bitcoiners decided to pour their energy into social projects: Cleaning the streets, repainting the park, offering educational projects. Berlíners are proud of their town, Linares said, and they naturally wanted to help make the place nicer to live in. Bitcoin was only talked about once the work was done.

It wasn’t all smooth sailing. Since 2021, Salvadorans have tended to associate Bitcoin-related things to Bukele; a lot of people are wary of using what they believe to be the government’s cryptocurrency. The Chivo wallet — which by all accounts was horrendous to operate — only made things worse.

Injecting bitcoin into Berlín’s local economy was also difficult. In the beginning, the only satoshis circulating were the ones spent by Lemus and Linares when they bought food in places that accepted the cryptocurrency. Merchants questioned the wisdom of going through all of the trouble of installing a Bitcoin wallet for such little money.

That problem was solved once foreigners started coming to Berlín to check out El Salvador’s second Bitcoin circular economy — but it was a process that took time. Yet Lemus is delighted with the way things turned out. “There’s a lot of foreigners that only come for a day or two. It’s a very healthy type of tourism,” she said. “They’re not here to party, they’re just curious to see the lady who’s selling pupusas and accepting bitcoin. They come to involve themselves in the community, even just for a day.”

Berlín’s history

Everybody in Berlín seems to have heard of Bitcoin, whether they use it or not. A 28-year-old construction worker told me he doesn’t use the cryptocurrency for two reasons: He doesn’t know how to, and he doesn’t have any savings. However, he had no issue with the town’s Bitcoin initiative.

Further down the street, the owner of a clothing shop told me that, although she accepts bitcoin payments, very few tourists come to her store. But she uses Bitcoin in a personal capacity every once in a while; her daughter, in her teens, told me she liked spending sats on pupusas.

I walked into the offices of Marisol Reyes, a local lawyer whose great-grandfather was the city’s first mayor. Her business does not display a Bitcoin sign, but she does use it on occasion.

“It’s easier to use it than to go to the bank,” Reyes told me. “Sometimes you need to wait 30 minutes, an hour, two hours, three hours at the bank to make a transaction. So Bitcoin makes that a lot easier.”

Berlín has prospered thanks to the Bitcoin initiative, Reyes said. Foreigners are coming in and spending their money, economic activity is increasing, and the community’s wealth, as a whole, is growing. All of this has led to some changes, she noted — for example, a few landowners have significantly raised the price of their properties, looking to profit from the Bitcoin boom, but in her view they’re misunderstanding the phenomenon.

“Not everyone is coming to invest,” she said. “I think there are more people who come to Berlín because they think it’s a safe place.”

Berlín has been shaped by El Salvador’s violent history. During the Salvadoran Civil War, which raged from 1979 to 1992, the city was overtaken for five days by the Farabundo Martí National Liberation Front (FMNL), back then a coalition of left-wing guerilla groups. The federals bombarded Berlín, forcing the FMNL to withdraw; over 250 residents were killed in the battle, as well as 20 government officials. “I was 14 or 15 years old,” Reyes said. “Parts of the city burned.”

The conflict made the people of Berlín create strong community bonds, she said. That’s why the town never suffered from MS-13 and Barrio 18 — the two violent gangs that took control of the country in the 1990s and were recently neutralized by Bukele’s administration. Whenever a gang member was sighted, the community would immediately inform the police, which in turn would keep the intruders under close watch and prevent them from organizing themselves. Yes, a few strolled into town, but they never caused any real trouble.

Marisol’s perspective was shared by another Salvadoran at the Bitcoin Community Center, who did not wish his name to be publicized. He said the community realized early on that they needed to prevent gang members from ever taking root in Berlín, because once they settled, nothing could be done. With the help of the church, they formed groups to educate Berlín’s teenagers — especially young men — on the ways the gangs operated, special emphasis being placed on each crew’s initiation rituals.

To join MS-13, for example, boys had to let the gang beat them to a pulp, without defending themselves, for 13 seconds. Girls could also choose that option, or they could offer themselves up for sexual assault. The educational drive prevented Berlín teenagers from joining the few gang members that did roll in.

All of this to say that Berlíners are dynamic and independent-minded; they look after each other, and they’re not in the habit of waiting for the government to fix their problems. If Bitcoin offers a way to transact without anyone’s permission, that’s interesting to them. “The bank controls your money transfers,” Reyes said. “With Bitcoin, there are no controls.”

The Tech Hippies of Berlín

I spent the night at The Standard, a cozy, rustic hostel with a spectacular view. It runs on bitcoin donations — Berlín’s expats love hanging out there. When I first reached out, the hostel’s operator (who asked to only be identified as Tim) gave me prices in bitcoin; 40,000 satoshis for a room with a shared bath, 60,000 for a private two-room apartment.

I took the first option. My neighbour was a German 22-year-old going by the name of Markus S. He’d come to Berlín to find himself after completing his physics studies. Tim was letting him stay for free in exchange for a bit of manual labour in the garden.

“My contribution is that I can provide accommodation for smart people. Hopefully it rubs off on me,” Tim said with a laugh. Bitcoin flourished in Berlín, he said, because it allowed people to take part in something bigger than themselves. Sometimes locals care more about the identity of the person they’re selling property to, than the price at which they’re selling. “It’s all relationships in this town. Money means nothing,” he said.

Bonbury, the Canadian expat, shared the sentiment. The town’s Bitcoin culture is anchored in community values, he noted; in that sense, it’s very different from crypto spaces focused on financial gains or technological breakthroughs. Nor is it anywhere close to typical Bitcoin maximalism, which preaches increasing one’s bitcoin holdings above all else.

When I described Berlín’s expat community as a group of tech hippies, Tim and Bonbury laughed and nodded. “We have a good time,” said Bonbury. “People make fun of you if you use cash. It happened to me yesterday. We were at a restaurant, I got up to pay, but my phone was dead. I had to use dollars — they all made jokes.”

Bonbury had warned me that I wouldn’t have enough time to see everything, and he was right. But I was on a mission. I drove off in the morning, heading to the Conchagua volcano in the hopes of finding traces of Bitcoin City, the futuristic metropolis that Bukele promised to build back in 2021.

When I met Lemus a couple of days later at Plan B, she asked me if I’d found anything in Conchagua. I shook my head. She smiled. “Yet Bitcoin City already exists,” she said. “It’s called Berlín.”

Uncategorized

CoinDesk 20 Performance Update: Index Drops 2.5% as Nearly All Constituents Decline

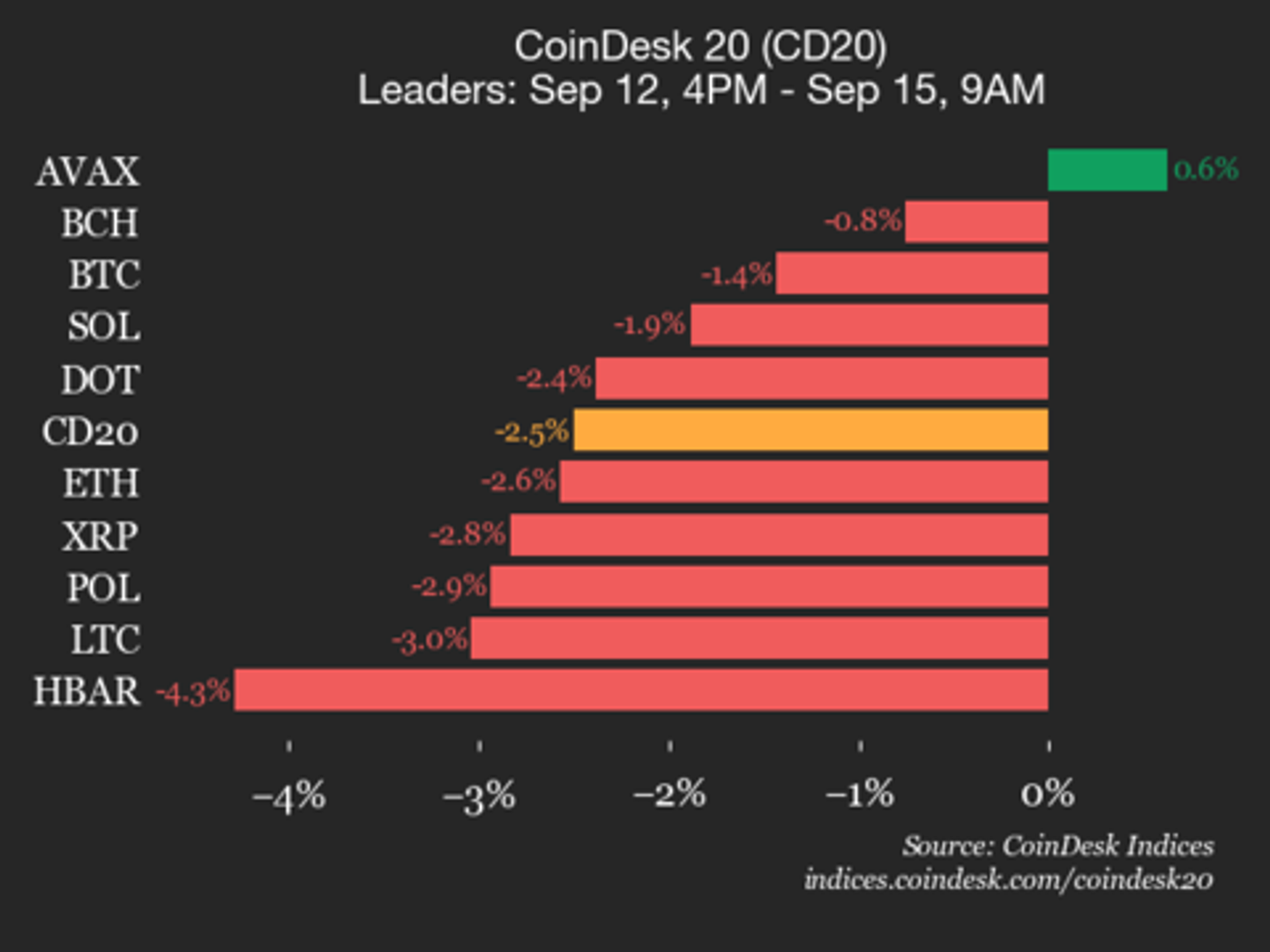

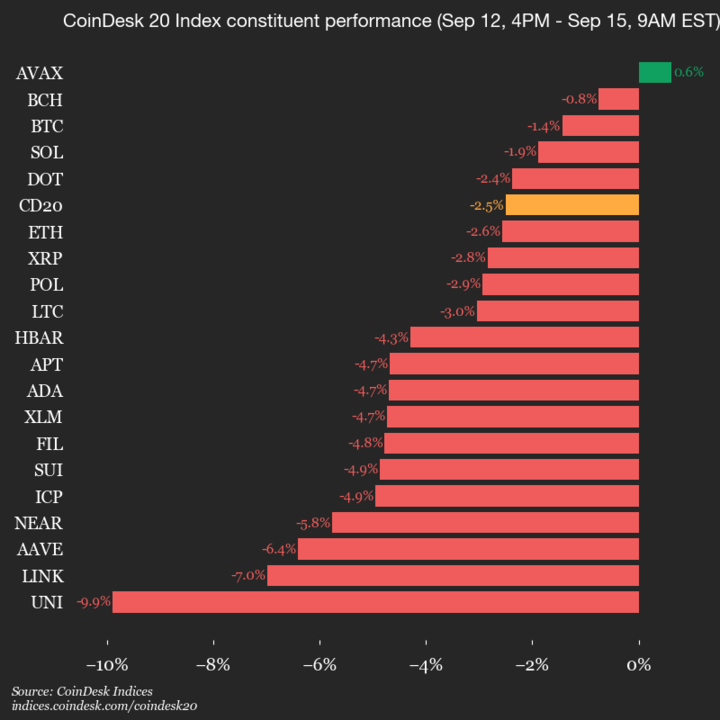

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 4248.74, down 2.5% (-109.09) since 4 p.m. ET on Monday.

One of 20 assets is trading higher.

Leaders: AVAX (+0.6%) and BCH (-0.8%).

Laggards: UNI (-9.9%) and LINK (-7.0%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Uncategorized

Pantera-Backed Solana Treasury Firm Helius Raises $500M, Stock Soars Over 200%

Helius Medical Technologies (HSDT) announced on Monday it’s raising more than $500 million in a private financing round to create a Solana-focused treasury company.

The vehicle will hold SOL, the native token of the Solana blockchain, as its reserve asset and aims to expand to more than $1.25 billion via stock warrants tied to the deal, the press release said.

The financing was led by Pantera Capital and Summer Capital, with participation from investors including Animoca Brands, FalconX and HashKey Capital.

Shares of the firm rallied over 200% above $24 in pre-market trading following the announcement. Solana was down 4% over the past 24 hours.

The firm is joining the latest wave of new digital asset treasuries, or DATs, with public companies pivoting to raise funds and buy cryptocurrencies like bitcoin (BTC), ether (ETH) or SOL.

Helius is set to rival with the recently launched Forward Industries (FORD) with a $1.65 billion war chest backed by Galaxy Digital and others. That firm confirmed on Monday that has already purchased 6.8 million tokens for roughly $1.58 billion last week.

Helius’ plan is to use Solana’s yield-bearing design to generate income on the holdings, earning staking rewards of around 7% as well as deploying tokens in decentralized finance (DeFi) and lending opportunities. Incoming executive chairman Joseph Chee, founder of Summer Capital and a former UBS banker, will lead the firm’s digital asset strategy alongside Pantera’s Cosmo Jiang and Dan Morehead.

«As a pioneer in the digital asset treasury space, having participated in the formation of the strategy at Twenty One Capital (CEP) with Tether, Softbank and Cantor, Bitmine (BMNR) with Tom Lee and Mozayyx as well as EightCo (OCTO) with Dan Ives and Sam Altman, we have built the expertise to set up the pre-eminent Solana treasury vehicle,» Cosmo Jiang, general partner at Pantera Capital, said in a statement.

«There is a real opportunity to drive the flywheel of creating shareholder value that Michael Saylor has pioneered with Strategy by accelerating Solana adoption,» he added.

Read more: Solana Surges as Galaxy Scoops Up Over $700M Tokens From Exchanges

Uncategorized

American Express Introduces Blockchain-Based ‘Travel Stamps’

American Express has introduced Ethereum-based ‘travel stamps’ to create a commemorative record of travel experiences, as part of the firm’s revamped travel app.

The travel experience tokens, which are technically NFTs (ERC 721 tokens), are minted and stored on Coinbase’s Base network, said Colin Marlowe , VP, Emerging Partnerships at Amex Digital Labs.

The travel stamps, which can be collected anytime a traveler uses their card, are not tradable NTF tokens, Marlowe explained, and neither do they function like blockchain-based loyalty points – at least for the time being.

“It’s a valueless ERC-721, so technically an NFT, but we just didn’t brand it as such. We wanted to speak to it in a way that was natural for the travel experience itself, and so we talk about these things as stamps, and they’re represented as tokens,” Marlowe said in an interview.

“As an identifier and representation of history the stamps could create interesting partnership angles over time. We weren’t trying to sell these or sort of generate any like short term revenue. The angle is to make a travel experience with Amex feel really rich, really different, and kind of set it apart,” he said.

The Amex travel app also includes a range of tools for travels and Centurion Lounge upgrades, the company said.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars