Uncategorized

Lido Goes Modular With Vault-Based ‘V3’ Upgrade

The developers behind Lido, the largest staking service on Ethereum, have proposed revamping the staking platform with modular «vaults.»

The new framework would introduce stVaults, a customizable component designed to help Lido accommodate institutions and more complex staking strategies.

Lido currently allows investors to pool their ether (ETH) together and «stake» their crypto — locking up their tokens with the network, helping to secure it in exchange for interest.

Lido pioneered liquid staking: users get a receipt on their deposits called Lido staked ETH (stETH) that they can trade at any time. With liquid staking on Lido, entering and exiting staking positions became as simple as buying and selling stETH tokens.

Lido V3’s stVaults are “modular smart contracts designed to meet the diverse and evolving needs of Ethereum participants,” according to a press release shared with CoinDesk. The upgrade would enable staking setups beyond cut-and-dry liquid staking.

Specifically, stVaults will be able to help institutional stakers who want to personalize their staking setups, node operators who want to attract high-volume stakers, and asset managers who want to create new staking use cases.

The move reflects the growing institutional interest in Ethereum staking as financial firms explore ways to integrate yield-generating crypto products into their portfolios. The stVaults are supposed to accommodate that interest by introducing modular building blocks that cater to different staking needs.

“What is important to understand with customizable infrastructure, is that you can in general build even more complex products,” said Konstantin Lomashuk, the founder of the Lido staking protocol.

The goal is «for Lido to be rebuilt as a foundation layer,» said Lomashuk.»It’s neutral infrastructure: everybody can use, stake their assets, utilize it, restake or leverage and have more liquidity.”

The developers vision for V3 is to evolve Lido into an «open staking marketplace,»user will be able to opt into whichever staking setup fits their objective and risk profile — a departure from Lido’s catch-all approach to staking, where all users stake the same way, through the same interface, in exchange for the same interest rate.

The shift brings Lido further in line with other modular decentralized finance (DeFi) products, like Morpho and Symbiotic, which employ vault mechanisms for lending and restaking, respectively. The upgrade also makes Lido more useful for restaking — where ETH is «restaked» to secure other protocols in addition to Ethereum. “You can restake your stVault,» explained Lomashuk. «Liquid restaking tokens can utilize this infrastructure to grow the APR.»

Lido V3 was formally presented by a group of core developers to the Lido DAO, the decentralized autonomous organization that governs the protocol, on Tuesday. If the DAO approves the proposal, V3 could go live on Ethereum’s mainnet as early as the third quarter of 2025.

“Now it’s a new phase,” Lomashuk told CoinDesk.

Read more: Lido Co-Founder Teases ‘Second Foundation’ for Ethereum Amid Community Backlash

Uncategorized

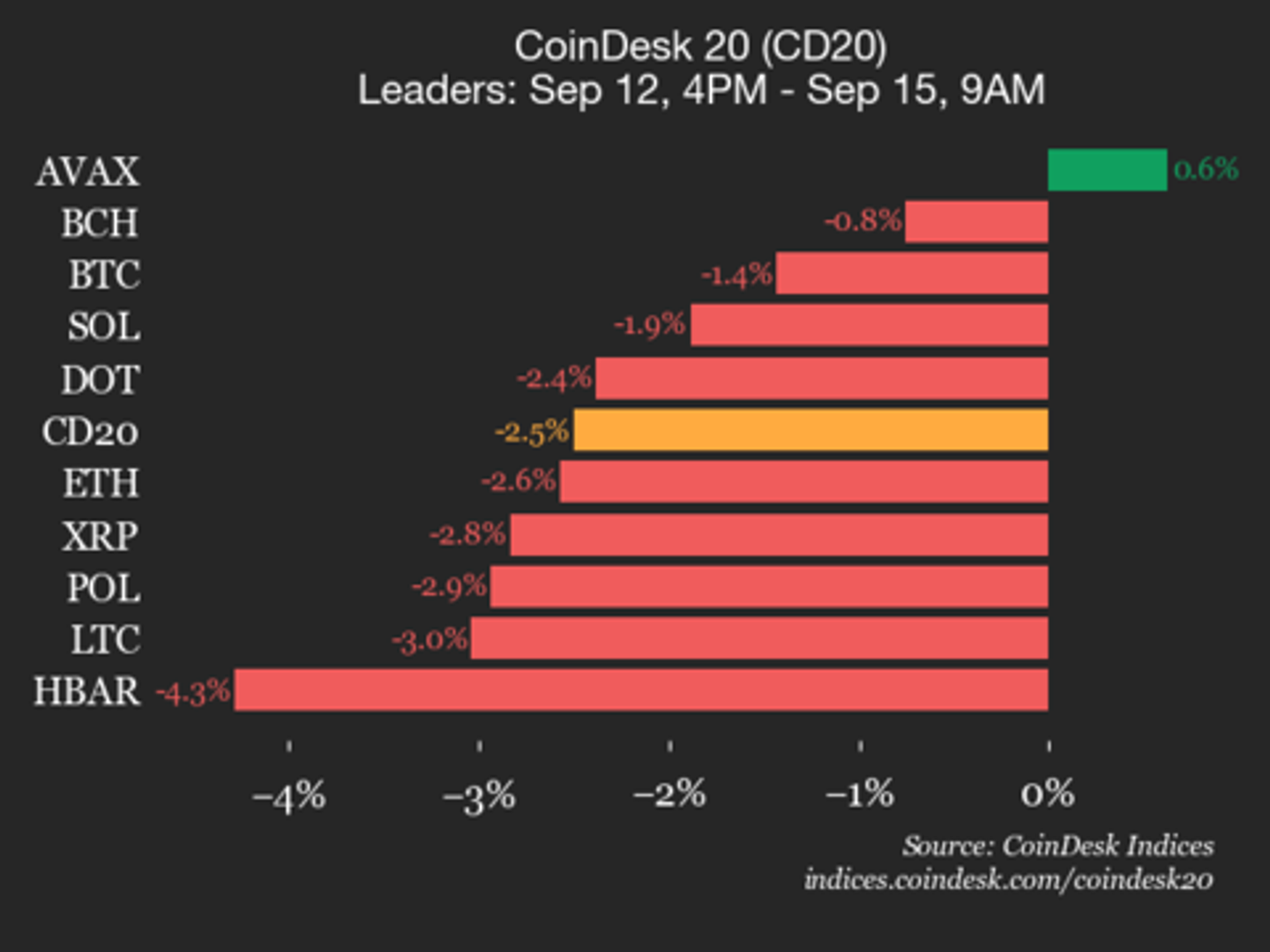

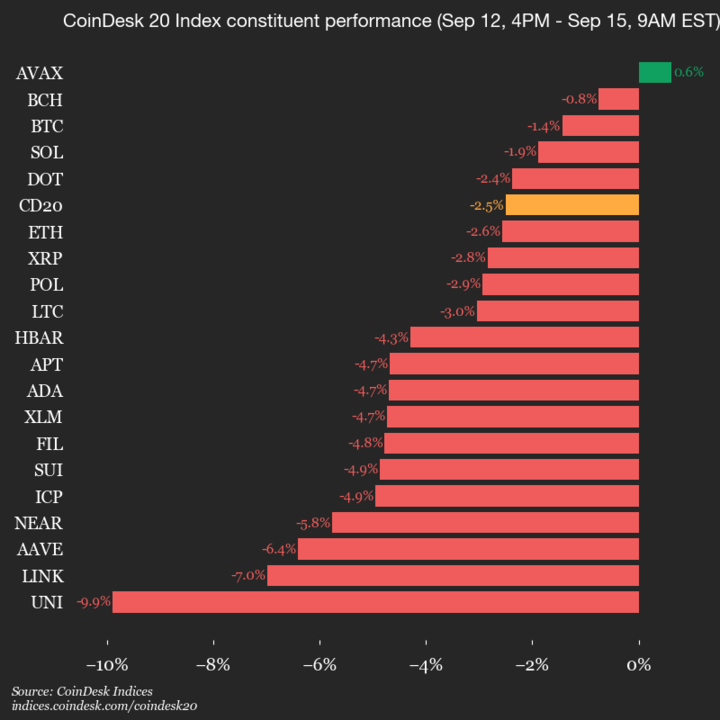

CoinDesk 20 Performance Update: Index Drops 2.5% as Nearly All Constituents Decline

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 4248.74, down 2.5% (-109.09) since 4 p.m. ET on Monday.

One of 20 assets is trading higher.

Leaders: AVAX (+0.6%) and BCH (-0.8%).

Laggards: UNI (-9.9%) and LINK (-7.0%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Uncategorized

Pantera-Backed Solana Treasury Firm Helius Raises $500M, Stock Soars Over 200%

Helius Medical Technologies (HSDT) announced on Monday it’s raising more than $500 million in a private financing round to create a Solana-focused treasury company.

The vehicle will hold SOL, the native token of the Solana blockchain, as its reserve asset and aims to expand to more than $1.25 billion via stock warrants tied to the deal, the press release said.

The financing was led by Pantera Capital and Summer Capital, with participation from investors including Animoca Brands, FalconX and HashKey Capital.

Shares of the firm rallied over 200% above $24 in pre-market trading following the announcement. Solana was down 4% over the past 24 hours.

The firm is joining the latest wave of new digital asset treasuries, or DATs, with public companies pivoting to raise funds and buy cryptocurrencies like bitcoin (BTC), ether (ETH) or SOL.

Helius is set to rival with the recently launched Forward Industries (FORD) with a $1.65 billion war chest backed by Galaxy Digital and others. That firm confirmed on Monday that has already purchased 6.8 million tokens for roughly $1.58 billion last week.

Helius’ plan is to use Solana’s yield-bearing design to generate income on the holdings, earning staking rewards of around 7% as well as deploying tokens in decentralized finance (DeFi) and lending opportunities. Incoming executive chairman Joseph Chee, founder of Summer Capital and a former UBS banker, will lead the firm’s digital asset strategy alongside Pantera’s Cosmo Jiang and Dan Morehead.

«As a pioneer in the digital asset treasury space, having participated in the formation of the strategy at Twenty One Capital (CEP) with Tether, Softbank and Cantor, Bitmine (BMNR) with Tom Lee and Mozayyx as well as EightCo (OCTO) with Dan Ives and Sam Altman, we have built the expertise to set up the pre-eminent Solana treasury vehicle,» Cosmo Jiang, general partner at Pantera Capital, said in a statement.

«There is a real opportunity to drive the flywheel of creating shareholder value that Michael Saylor has pioneered with Strategy by accelerating Solana adoption,» he added.

Read more: Solana Surges as Galaxy Scoops Up Over $700M Tokens From Exchanges

Uncategorized

Boundless Launches Mainnet on Base, Ushering in Universal Zero-Knowledge Compute

Boundless, the zero-knowledge (ZK) compute marketplace incubated by RISC Zero, has officially launched its Mainnet on Base, giving every blockchain access to verifiable compute.

The milestone builds on the network’s incentivized testnet, which went live in July and stress-tested Boundless’ architecture under real-world conditions.

During that Beta phase, Boundless operated like a decentralized marketplace where developers seeking ZK proofs for applications such as rollups, bridges and privacy protocols could connect with independent provers, or ZK miners, who generated those proofs.

The launch introduced Proof of Verifiable Work, an incentive mechanism that rewards provers based on the volume, speed and complexity of their computations. Community participation was strong, fueled in part by the anticipation of $ZKC token rewards.

With Monday’s mainnet launch, those capabilities are now operational at scale. The team behind Boundless says it can deliver verifiable compute across chains, enabling developers to build applications that preserve privacy while scaling seamlessly between ecosystems.

Some key protocols have started to integrate Boundless into their systems. Wormhole is integrating Boundless to add ZK verification to Ethereum consensus, making cross-chain transfers more secure.

BOB, a hybrid Bitcoin rollup, is tapping Boundless to allow EVM applications to interoperate with Bitcoin using proofs that inherit Bitcoin’s security while drawing on Ethereum’s liquidity. And staking protocol Lido is deploying Boundless to secure validator exits with transparent proofs, strengthening trust and auditability for its crypto assets.

“For the first time, developers on any chain can access abundant zero-knowledge compute to build complex applications that scale across ecosystems without sacrificing decentralization,” said Shiv Shankar, the CEO of Boundless.

Read more: Risc Zero’s ‘Boundless’ Incentivized Testnet Goes Live

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars