Uncategorized

Crypto Daybook Americas: Bitcoin Steady Before Jobs Data, Shrugs Off Eric Trump Endorsement

By Omkar Godbole (All times ET unless indicated otherwise)

The crypto market remains directionless, with bitcoin (BTC) languishing below $100,000 before the U.S. jobs report. It’s surprising prices have not yet crossed that threshold, especially after President Donald Trump’s son, Eric, encouraged the family-linked WLFI to invest in BTC in a post on X on Thursday.

Typically, such endorsements during a bull run lead to substantial gains. That that hasn’t materialized is a sign markets are no longer buoyed by talk alone and Trump needs to walk the walk. Early this week, the administration said it’s evaluating the feasibility of a strategic BTC reserve.

Another possibility is that caution ahead of nonfarm payrolls is capping the upside. If that’s the case, a breakout may occur once the data is out, especially if the figure prints weaker than estimated, potentially driving Treasury yields and the dollar index lower.

Crypto newsletter service LondonCryptoClub recommends keeping an eye on revisions in the previous figures. «Bloomberg Intelligence expecting some large downside revisions suggesting the Labour market not as strong in 2024 as first appeared We still think the market (and the Fed themselves) are massively under pricing the rate cuts that will need to come,» the newsletter service’s founders said on X.

At press time, Volmex’s one-day bitcoin implied volatility index stood at an annualized 51%, suggesting a daily price swing of 2.6%, or about $2,600. In other words, the figure could move the spot price by $2,600 in either direction. Notably, some traders are buying put options, bracing for potential downside volatility should the data come in strong.

In other news, the «Strategic Bitcoin Reserve» bill passed the House in the state of Utah and will now move to the Senate. Bloomberg ETF analyst James Seyffart reported that the U.S. SEC has acknowledged Grayscale’s Solana 19b-4 filing. And VanEck predicted a $500 price for SOL, more than double its current value of around $180.

Additionally, FOX reporter Eleanor Terrett shared that U.S. House Financial Services Committee Chairman French Hill and Digital Assets Subcommittee Chairman Bryan Steil have released a stablecoin regulation discussion draft, which proposes a two-year ban on stablecoins backed solely by self-issued digital assets and mandates a Treasury study on their risks.

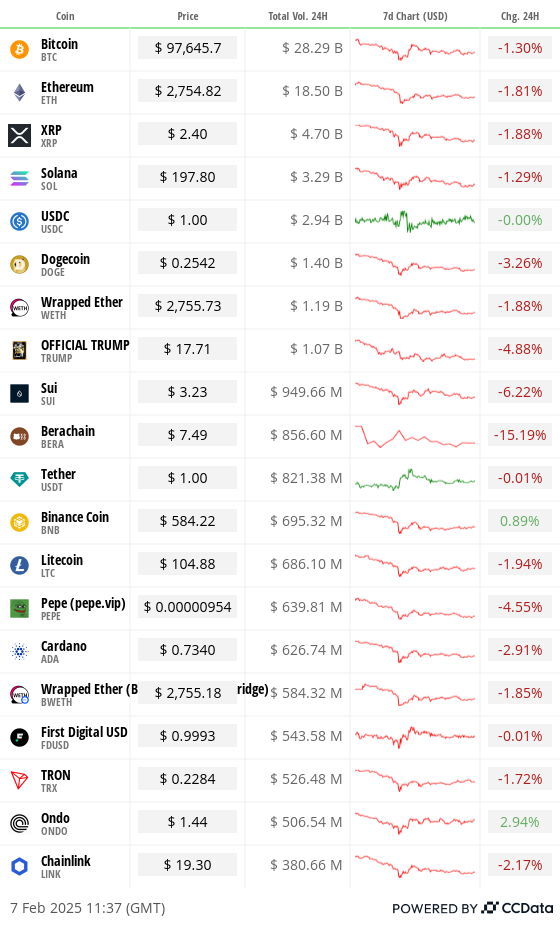

And finally, Berachain’s BERA token, which debuted yesterday, has already recorded a staggering perpetual trading volume of $4.8 billion, with its price currently sitting at $7.60, a significant drop from yesterday’s peak of $14. Stay alert!

What to Watch

Crypto:

Feb. 13: Start of Kraken’s gradual delisting of the USDT, PYUSD, EURT, TUSD, UST stablecoins for EEA clients. The process ends March. 31.

Feb. 18, 10:00 a.m.: FTX Digital Markets, the Bahamas-based subsidiary of FTX, will start reimbursing creditors.

Macro

Feb. 7, 8:30 a.m.: U.S. Bureau of Labor Statistics (BLS) releases January’s Employment Situation report.

Non Farm Payrolls Est. 170K vs. Prev. 256K

Unemployment Rate Est. 4.1% vs. Prev. 4.1%

Feb. 8, 8:30 p.m.: China’s National Bureau of Statistics (NBS) releases January’s Consumer Price Index (CPI) report.

Inflation Rate MoM Prev. 0%

Inflation Rate YoY Prev. 0.1%

PPI YoY Prev. -2.3%

Earnings

Feb. 10: Canaan (CAN), pre-market, $-0.08

Feb. 11: HIVE Digital Technologies (HIVE), post-market, $-0.11

Feb. 11: Exodus Movement (EXOD), post-market, $0.14 (2 ests.)

Feb. 12: Hut 8 (HUT), pre-market, $0.04

Feb. 12: IREN (IREN), post-market, $-0.01

Feb. 12 (TBA): Metaplanet (TYO:3350)

Feb. 12: Reddit (RDDT), post-market, $0.25

Feb. 12: Robinhood Markets (HOOD), post-market, $0.41

Feb. 13: Coinbase Global (COIN), post-market, $1.61

Token Events

Governance votes & calls

OsmosisDAO is discussing a change to the use of taker fees collected in OSMO to burn 50% of collected fees.

Threshold DAO is discussing the creation of a bond program to address its stablecoin’s liquidity challenges.

Sky DAO is voting on an an executive proposal to lower savings rates, sweep over 400K DAI in PauseProxy into the Surplus Buffer and allocate 3 million DAI for integration boost funding, among other things.

Yearn DAO is discussing the elimination of the Protocol Guardian Role over concerns surrounding its use to override previous democratic decisions and potential legal risks.

Feb. 7, 1 p.m.: Sweat Economy (SWEAT) to hold a token holders briefing discussing tokenomics, product roadmap and partnerships.

Feb. 8, 1:08 p.m.: A dYdX Foundation vote on granting the dYdX Operations subDAO signer market authority over the market map and eliminate revenue sharing for that function is on track to pass.

Feb. 10, 10:30 a.m.: OKX to hold a listings AMA with Chief Marketing Officer Haider Rafique and Head of Product Marketing Matthew Osofisan.

Unlocks

Feb. 9: Movement (MOVE) to unlock 2.17% of circulating supply worth $31.41 million.

Feb. 10: Aptos (APT) to unlock 1.97% of circulating supply worth $68.99 million.

Feb. 12: Aethir (ATH) to unlock 10.21% of circulating supply worth $22.72 million.

Token Launches

Feb. 7: Avalon Labs (AVL) to be listed on Bybit.

Feb. 13: EthereumPoW (ETHW) and Polygon (MATIC) to no longer be supported at Deribit.

Conferences

CoinDesk’s Consensus to take place in Hong Kong on Feb. 18-20 and in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Feb. 7: Solana APEX (Mexico City)

Feb. 13-14: The 4th Edition of NFT Paris.

Feb. 18-20: Consensus Hong Kong

Feb. 19: Sui Connect: Hong Kong

Feb. 23 to March 2: ETHDenver 2025 (Denver, Colorado)

Feb. 25: HederaCon 2025 (Denver)

Token Talk

By Shaurya Malwa

BNB Chain speculators are gambling with a random TST token after an educational video showed its creation.

TST, or Test Token, was issued on the BNB Chain using the BEP-20 standard. It was not officially launched by Binance, but rather used in a token creation tutorial video by the BNB Chain team.

The price surged after the video was shared by Binance founder Changpeng Zhao on X because users took it to be an official Binance token even though Zhao no longer has a formal role at the company.

Zhao deleted his repost of the video later.

TST skyrocketed to a market cap of around $40 million shortly after Zhao’s post, reaching trading volumes of over $90 million at peak.

Derivatives Positioning

Perpetual funding rates for BERA are deeply negative, showcasing a strong bias for short positions. SOL, BNB, SHIB and BCH also have negative rates.

QCP Capital noted demand for BTC puts at $90K and $80K strikes expiring on Feb. 28 in a sign of persistent downside worries.

Block flows featured a BTC calendar spread betting on prices staying below $120K by the end of April, but eventually rising past $170K the end of December. Plus, an outright long in the $88K Feb expiry put crossed the tape.

ETH flows featured an outright long in the Feb. 14 expiry call at the $2,800 strike.

Market Movements:

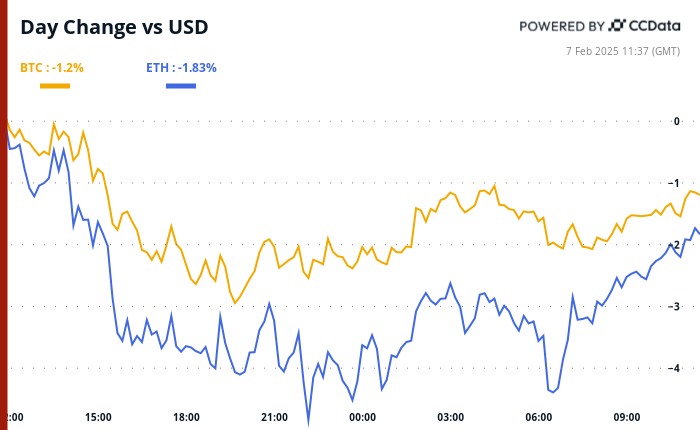

BTC is up 1.24 % from 4 p.m. ET Thursday to $97,686.16 (24hrs: -1.07%)

ETH is up 1.61% at $2,757.18 (24hrs: -1.75%)

CoinDesk 20 is up 1.99% to 3,215.42 (24hrs: -1.83%)

CESR Composite Staking Rate is down 3 bps to 3.06%

BTC funding rate is at 0.0052% (5.72% annualized) on Binance

DXY is up 0.08% at 107.78

Gold is up 0.37% at $2,866.78/oz

Silver is up 0.29% to $32.26/oz

Nikkei 225 closed down 0.72% at 38,787.02

Hang Seng closed up 1.15% at 21,133.54

FTSE is down 0.29% at 8,703.92

Euro Stoxx 50 is down 0.15% at 5,348.71

DJIA closed -0.28% to 44,747.63

S&P 500 closed +0.36% at 6,083.57

Nasdaq closed +0.51% at 19,791.99

S&P/TSX Composite Index closed -0.14% at 25,534.49

S&P 40 Latin America closed +1.87% at 2,437.08

U.S. 10-year Treasury was unchanged at 4.44%

E-mini S&P 500 futures are unchanged at 6,104.00

E-mini Nasdaq-100 futures are unchanged at 21,855.75

E-mini Dow Jones Industrial Average Index futures are unchanged at 21,853.00

Bitcoin Stats:

BTC Dominance: 61.62 (-0.48%)

Ethereum to bitcoin ratio: 0.02823 (1.40%)

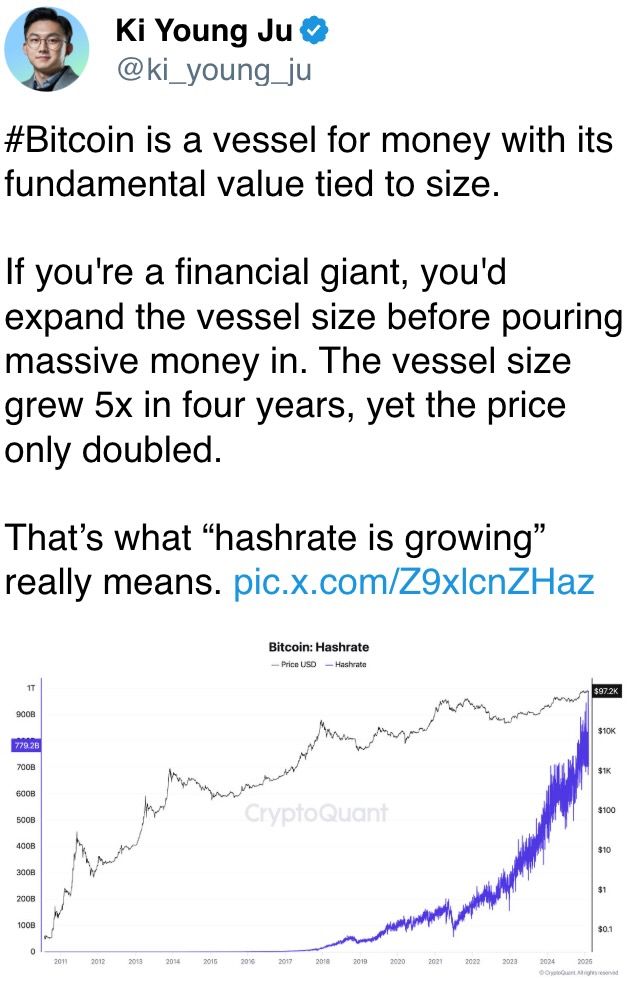

Hashrate (seven-day moving average): 808 EH/s

Hashprice (spot): $57.2

Total Fees: 5.17 BTC / $514,435

CME Futures Open Interest: 163,140 BTC

BTC priced in gold: 33.7 oz

BTC vs gold market cap: 9.58%

Technical Analysis

Bitcoin seems to be crossing below the Ichimoku cloud used by traders to gauge momentum and trend strength.

Crosses below the indicator are taken to represent a bearish shift in trend.

Crypto Equities

MicroStrategy (MSTR): closed on Thursday at $325.46 (-3.34%), up 0.63% at $327.50 in pre-market.

Coinbase Global (COIN): closed at $270.37 (-1.73%), up 0.75% at $272.39 in pre-market.

Galaxy Digital Holdings (GLXY): closed at C$27.07 (-2.13%)

MARA Holdings (MARA): closed at $16.80 (-1.35%), up 0.89% at $16.95 in pre-market.

Riot Platforms (RIOT): closed at $11.61 (-1.11%), up 0.69% at $11.69 in pre-market.

Core Scientific (CORZ): closed at $12.53 (-1.42%), up 0.32% at $12.57 in pre-market.

CleanSpark (CLSK): closed at $10.38 (+0.68%), up 6.84% at 11.09 in pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $22.76 (+1.34%), down 0.06% at $22.70 in pre-market.

Semler Scientific (SMLR): closed at $49.92 (-3.61%), up 2.14% at $50.99 in pre-market.

Exodus Movement (EXOD): closed at $48.01 (-6.52%), unchanged in pre-market.

ETF Flows

Spot BTC ETFs:

Daily net flow: -$140.2 million

Cumulative net flows: $40.53 billion

Total BTC holdings ~ 1.174 million.

Spot ETH ETFs

Daily net flow: $10.7 million

Cumulative net flows: $3.18 billion

Total ETH holdings ~ 3.783 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

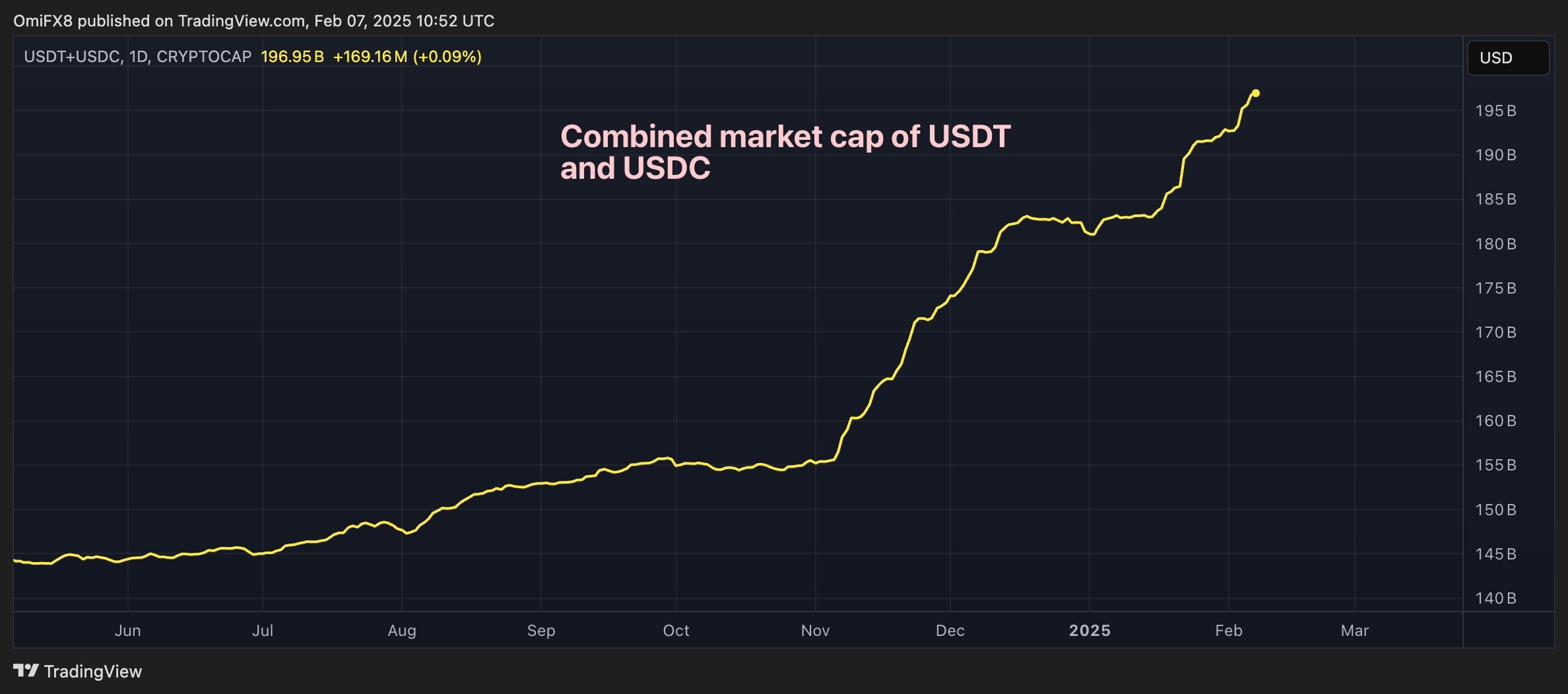

The combined market capitalization of top two stablecoins, USDT and USDC, continues to grow and is fast nearing $200 billion.

The relentless rise represents an influx of money into the crypto market, hinting at bullish prospects.

While You Were Sleeping

Bitcoin in a Mire, Gold Eyes 6th Straight Week of Gains as Jobs Data Looms (CoinDesk): With BTC struggling to find its footing amid declining Bitcoin network activity, today’s U.S. jobs data will give some clues on what the Fed may do next.

Solana’s SOL Could Hit $520 by 2025-End, VanEck Says (CoinDesk): Investment firm VanEck expects the SOL price to reach $520 by year-end. The forecast is based on growing demand for smart-contract platforms and an expanding U.S. M2 money supply.

Fed’s Waller Says Stablecoins Could Back Dollar’s Reserve Status (Bloomberg): While giving a speech in Washington, Fed Governor Christopher Waller expressed support for stablecoins as long as appropriate «regulatory rails» are in place to «make sure the money is there.»

Trump’s Memecoin Copycats Spark Fears for Investors (Financial Times): According to an FT analysis, since Donald Trump and his wife launched official memecoins, over 700 copycat tokens have flooded his official Solana wallet, prompting investor warnings.

India’s Central Bank Cuts Rates for First Time in Nearly 5 Years; Signals Less Restrictive Approach (Reuters): The Reserve Bank of India (RBI) reduced its repo rate by 25 basis points while maintaining a neutral policy stance in an attempt to stimulate a sluggish economy amid lower growth expectations.

Look to India, Japan for ‘Quality Alpha’ Amid Market Uncertainty, Investor Says (CNBC): According to alternative investment firm PAG, it’s hard to find alpha in China right now due to a lackluster economy and uncertainty over the impact of a trade war with the U.S.

In the Ether

Uncategorized

London Stock Exchange Unveils Blockchain-Based Platform for Private Funds

The London Stock Exchange Group (LSEG) said it facilitated the first transaction on a new blockchain-based platform for private funds.

LSEG’s Digital Markets Infrastructure (DMI), built using Microsoft Azure, is designed to use blockchain technology across the full lifecycle of an asset, from issuance to settlement, with greater scale and efficiencies than existing systems, according to a Monday announcement.

Investment manager MembersCap and digital asset exchange Archax were onboarded as DMI’s first clients and conducted the first transaction, which raised money for MembersCap’s MCM Fund 1.

LSEG said it will ensure DMI works with current market services in blockchain technology as well as traditional finance (TradFi).

DMI and its first transaction are «significant milestones demonstrating the appetite for end-to-end, interoperable, regulated financial markets» blockchain technology, Dark Hajdukovic, LSEG’s head of digital markets infrastructure, said in the statement.

TradFi exchanges in numerous markets have been embedding blockchain technology into their platforms as a means of increasing efficiency and reducing costs. Last week, the Nasdaq filed a proposal with the U.S. Securities and Exchange Commission (SEC) to tokenize stocks on its exchange for trading on the blockchain with trades assigned the same priority as the legacy method.

Uncategorized

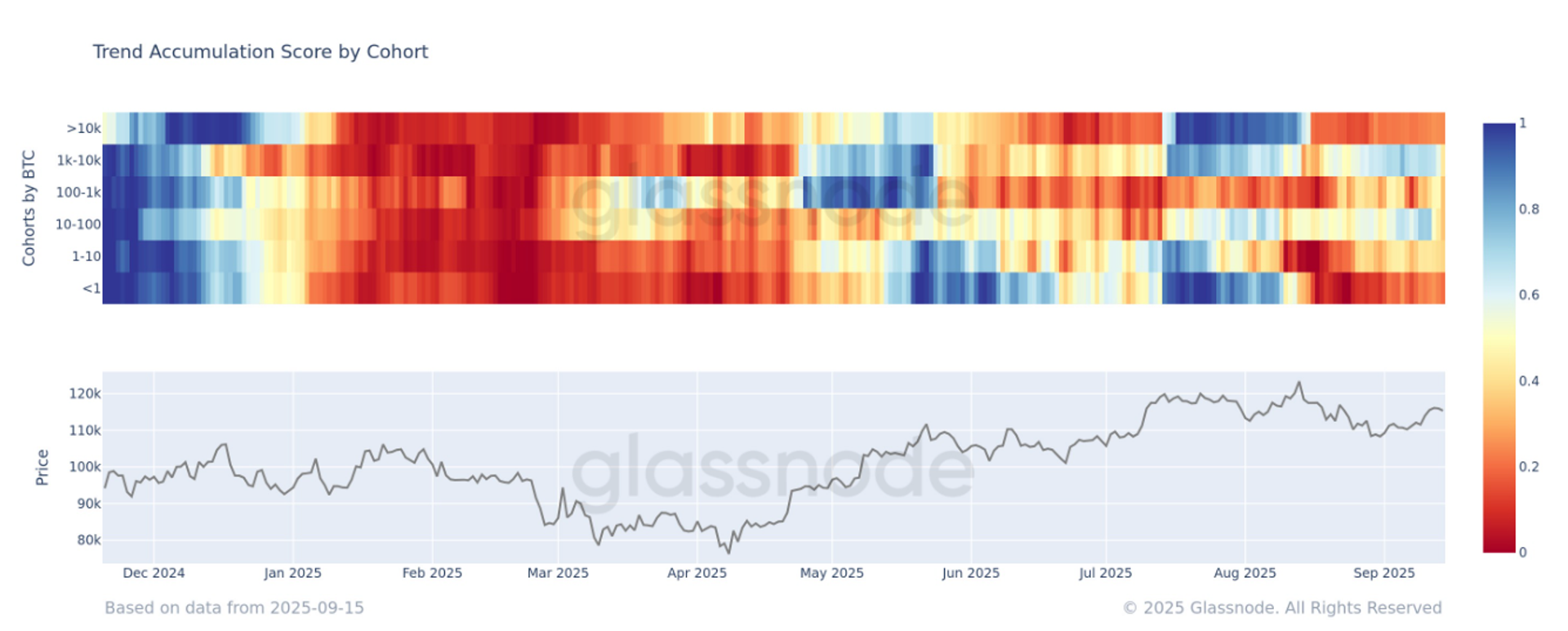

Bitcoin Cohorts Return to Net Selling as Market Continues to Consolidate

Glassnode data shows that all wallet cohorts have returned to distribution mode, with a net selling of bitcoin, according to the Accumulation Trend Score breakdown by wallet cohort.

This metric disaggregates the Accumulation Trend Score to show the relative behavior of different groups of wallet. It measures the strength of accumulation for each balance size based on both the entities’ size and the volume of coins acquired over the past 15 days. (For more details on the methodology, see this Academy entry.)

- A value closer to 1 signals accumulation by that cohort.

- A value closer to 0 signals distribution.

Exchanges, miners and other similar entities are excluded from the calculation.

Currently, all cohorts, from wallets holding less than one bitcoin to those holding more than 10,000, are net sellers. This follows last week’s rally, when some whales — most notably the 10-100 BTC and 1,000-10,000 BTC cohorts were buying. They have since flipped back to selling.

Bitcoin was recently hovering near $117,000 after Asia’s trading session pushed it up from $115,000 dollars over the weekend. Over the past three months, Asia has consistently driven bitcoin roughly 10 percent higher, according to Velo data. In contrast, the European trading session has been marked by pullbacks, which has been seen on Monday so far. In addition, bitcoin is down more than 10% in the EU market over the past three months.

Overall, the market remains in consolidation, a trend likely to persist through September. On current data, the $107,000 marked at the start of September still appears to be the most probable bottom.

Uncategorized

Memecoins Under Pressure as SHIB, Dogecoin Slide After Shibarium Loses $2.4M in Hack

Top meme tokens traded under pressure as a multimillion dollar hack of Shiba Inu’s layer-2 network, Shibarium, dented investor confidence in joke cryptocurrencies.

On Sunday, Shibarium fell victim to a flash loan attack on its validator system, which drained about $2.4 million in ether (ETH) and SHIB. The CoinDesk Memecoin Index has dropped 6.6% in the past 24 hours. The broader market CoinDesk 20 Index (CD20) is down just 2.3%.

The attacker borrowed 4.6 million BONE, the governance token for the Shiba Inu ecosystem, often linked to the decentralized exchange (DEX) ShibaSwap, through a flash loan to gain control of the majority of validator keys. The keys act as gatekeepers of the network, confirming transactions and ensuring security.

With that control, the attacker was able to game the system into approving unauthorized transactions and walk away with a large amount of crypto assets from the bridge that connects Shibarium with the Ethereum blockchain. The process is akin to someone temporarily taking over a bank’s security system to approve unauthorized withdrawals. A flash loan is a loan raised with no upfront collateral and returns the borrowed assets within the same blockchain transaction.

The Shiba inu team was able to prevent a bigger, more serious breach because the BONE tokens used to gain control were reportedly tied to validator 1 and remained locked by the staking rules.

Nevertheless, markets reacted negatively breach, which again underscores the perennial security issues with blockchain technology.

Memecoins drop, broader market bid

SHIB fell by the most in three weeks on Sunday (UTC), losing 4% $0.00001369, and has continued to weaken to trade recently at $0.00001359. The cryptocurrency experienced considerable volatility throughout the 23-hour trading window ended Sept. 15 at 02:00 UTC, with the aggregate range encompassing $0.000006191, a 4% oscillation from peak to trough.

The session commenced with pre-dawn fragility as SHIB retreated from $0.000014156 to establish a pivotal trough of $0.000013547 at 14:00 UTC. Volume of 1.064 trillion tokens surpassed the 24-hour mean, signaling robust distribution pressure and prospective capitulation, according to CoinDesk Research’s technical analysis model.

The BONE token, which initially doubled to over 36 cents, is now down over 2% on a 24-hour basis, trading at around 20 cents.

According to the technical analysis model:

- SHIB established a critical underpinning at $0.000013547 during elevated volume selling pressure exceeding 1.064 trillion tokens.

- The token constructed successive higher lows and consolidation parameters between $0.000013600-$0.000013780.

- Recovery momentum is demonstrated by ascending channel formations with sustained higher lows, indicating potential continuation towards the $0.000014000 resistance.

- Volume patterns exceeded 24-hour averages during the decline phase, confirming potential capitulation levels.

- Terminal hour trading exhibited decisive upward momentum with 1% appreciation, confirming a breach above the resistance threshold.

Large DOGE transfers add to bearish sentiment

Meanwhile, SHIB’s peer dogecoin (DOGE) fell 4% to 27.80 cents on Sunday and has since lost further 5% to 27.36 cents, according CoinDesk data.

A massive transfer of DOGE to a centralized exchange likely added to the bearish mood in the market. According to Whale Alert, crypto exchange OKX received 119,306,143 DOGE, worth over $34 million, from an unknown wallet. Such large transfers are typically associated with an intention to liquidate holdings.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars