Uncategorized

What the Key Metrics for Onchain Activity Say About SOL, ETH and Other Chains in 2025

Web3 is drowning in metrics, most of which paint an unclear picture. Transaction volumes, token prices and flashy headlines often mask what really matters: the quality of user engagement and the potential for organic, exponential growth. As the industry moves beyond the hype, reliable, data-driven signals of success are no longer optional — they’re essential.

Here’s the good news: the tools to cut through the noise already exist. By combining multiple on-chain metrics into a single “health index” score indicating the depth and quality of overall user engagement, we can identify which chains are truly thriving and poised for long-term growth. With 2024 coming to a close, let’s dig into what these signals reveal about today’s leading chains, and what we can expect in 2025.

Assessing user quality using aggregated, not isolated, data

When creating a sustainable on-chain ecosystem, it doesn’t make sense to optimize any single user action. What’s needed is context — a way to quantify not just everything users are doing, but how and why it matters. One promising approach to achieve this is to aggregate user behaviors into five core categories:

Transaction Activity, ranging from spot trades to smart contract interactions.

Token Accumulation in the medium-to-long-term, and other “investment” behaviors.

DeFi Engagement for activities like staking, lending and liquidity provision.

NFT Activity such as minting, trading and utility-driven interactions.

Governance Participation to quantify DAO or protocol governance contributions.

Crucially, these metrics should not be treated equally. A better approach is to weigh and combine them using a Bayesian model to generate a single top-line “score.” Unlike traditional scoring systems that rely on static thresholds or simple averages, this lets us incorporate both prior knowledge (what we expect from an “average” wallet) and new evidence (actual activity observed on-chain). These dynamic, multi-variate scores are much harder to game and therefore more likely to reveal accurate, actionable insights.

What the data tells us about 2024

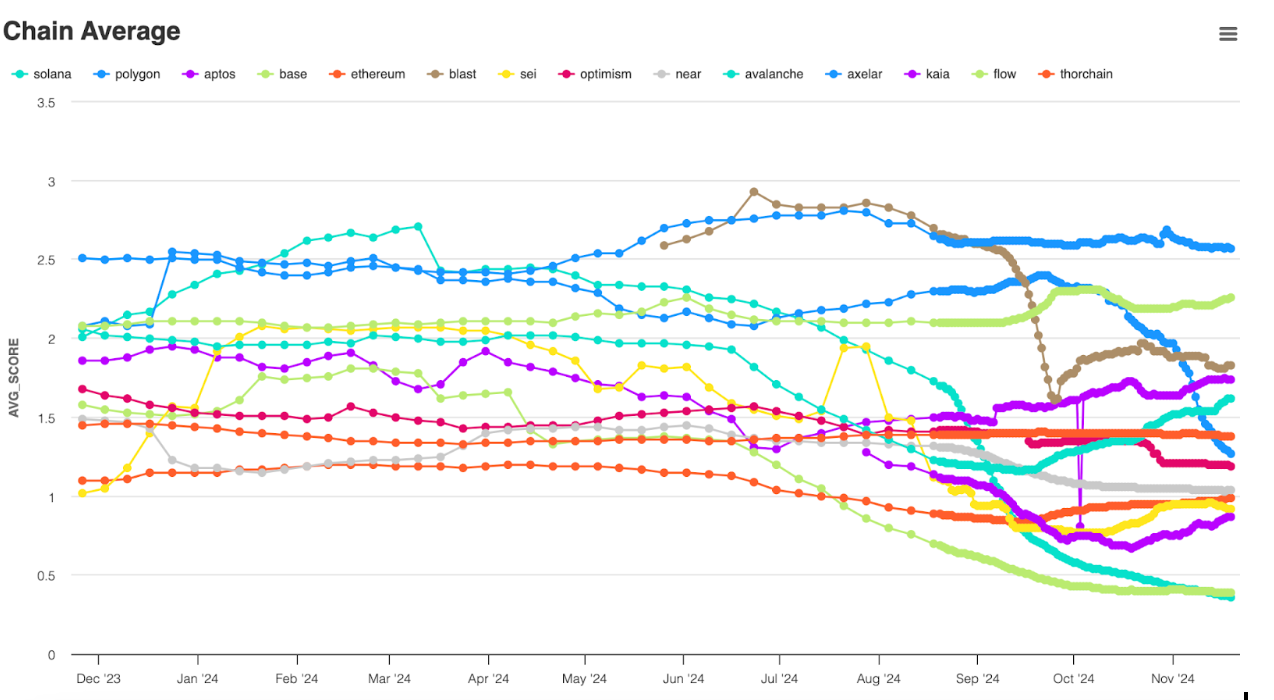

The above approach provides a fresh perspective on each chain’s user activity through 2024. Let’s zoom in on some of the more surprising findings.

Solana (the top light blue line that peaks at ~2.75) attracted a huge share of high-quality users between February and mid-March, but engagement quality has fallen since. Interestingly, this downslide coincided with SOL’s first price and trading volume spike of 2024, and has continued through the current memecoin mania. Repetitive actions have diminishing returns when assessed using a Bayesian model, meaning multiple token swaps yield smaller score improvements than engagement across multiple types of activities, for any given wallet. This suggests most Solana users are currently engaged in a narrow range of on-chain activities that aren’t contributing to Solana’s multi-sector growth.

As for Ethereum supporters (the bottom orange line that begins at just above 1) who expected this year’s ETH ETFs to be a game-changer, the numbers paint a different picture. Ethereum’s low and stable user score through H1 2024 suggests that this year’s bullish developments did not spur broader ecosystem participation such as DeFi activity and protocol governance.

It’s also worth noting that Axelar (the dark blue line that begins at 2.5) had the most active users across the broadest range of on-chain activities relative to its total user base, according to the data. While Axelar is currently much smaller by TVL than the legacy chains dominating today’s headlines, this is an intriguing signal that warrants closer inspection — and would have been missed if we were looking at market cap or trading volume alone.

The takeaway here isn’t that Solana is doomed and Axelar will inevitably become the world’s biggest chain. There is limited value in comparing these types of scores across chains, since each score is proportional to the user quality of its corresponding chain. In other words, a Solana user with a score of “4” may be very different from a “4” on Axelar, given the differences in each chain’s baseline activity. As such, these scores are most useful when tracking changes in the quality of a chain’s overall user activity over time, not cross-chain comparisons.

Predictions for 2025

With that said, what does each chain’s user quality track record tell us about next year?

For starters, it’s clear that Solana faces significant challenges and opportunities entering 2025. The chain’s trajectory depends on its ability to retain its massive casual user base and expand their range of on-chain interactions. Failure to do so could result in a significant slump once memecoins cool off — although data from early 2024 suggests the chain has a large contingent of quality users that will endure regardless of what happens short-term.

2024 demonstrated Axelar’s ability to attract a concentrated user base engaged in diverse, sustained on-chain activities, rather than speculative surges. Now, Axelar’s challenge will be upscaling its ecosystem without diluting the quality of its user base. This may involve prioritizing high-profile partnerships to unlock new audiences while creating more newbie-friendly onramps across its dApp ecosystem.

Ethereum’s fragmentation has shifted many active users to its faster, cheaper L2 ecosystem, and so we may see mainnet activity increasingly consolidate around core features protocol staking and governance. These activities are critical for the broader EVM ecosystem, but this trajectory may be penalized by scoring systems that reward diverse on-chain engagement.

This dynamic underscores a challenge for scoring systems: prioritizing wide-ranging user activity can present an incomplete picture when applied to task-specific networks (or general purpose chains that are evolving into something more specialized). As a result, it’s important to clearly define what success means for whatever chain is being evaluated and use a scoring system that captures the corresponding user actions.

A better way to define, and drive, on-chain growth

Web3 has spent too long chasing the wrong metrics and failing to view the data in aggregate. In 2025, the winners will be those who find multivariate ways to measure — and act on — what matters most: user quality.

By incorporating new scoring methods into their dashboards, on-chain intelligence platforms can provide more meaningful insights to investors and industry observers. At the same time, Web3 builders can use these scores to clarify top priorities and drive user engagement and value creation. Ultimately, this will help the entire industry shift away from hype-driven narratives to data-backed strategies that unlock the full potential of Web3 in 2025 and beyond.

Uncategorized

AVAX Surges 10.7% as Bullish Breakout Signals Strong Momentum

Avalanche’s AVAX token has broken out of its multi-week correction phase, demonstrating remarkable strength despite ongoing geopolitical tensions affecting cryptocurrency markets.

The broader market gauge, CoinDesk 20 Index (DLCS), has demonstrated exceptional bullish momentum, surging from 1403.33 to 1461.17 in the last 48 hours, representing a 4.12% gain, while the overall range spans 95.56 points (6.97%) from the low of 1365.61 to the high of 1461.17.

The recent price action of AVAX shows accelerated momentum with the formation of a bull flag pattern and decisive breakout above $20.40, coinciding with significant institutional developments in the ecosystem, according to CoinDesk Research’s technical analysis data.

Technical Analysis Highlights

- AVAX demonstrated remarkable strength, surging from 18.87 to 20.89, representing a 10.7% gain.

- Price action reveals a clear bullish trend with higher lows forming a strong support trendline around 19.50.

- After consolidating between 19.30-19.70 on April 20, AVAX experienced a significant breakout on April 21, with volume increasing substantially as the price pushed above 20.00.

- The most recent 48 hours show accelerated momentum with the formation of a bull flag pattern and a decisive breakout above 20.40, suggesting further upside potential.

- Key resistance at 20.90 now becomes the level to watch, with Fibonacci extension targets pointing to 21.50 as the next significant objective.

- In the last 100 minutes, AVAX surged from 20.61 to 21.04, representing a 2.1% gain.

- After consolidating between 20.50-20.60 during the 13:20-13:40 timeframe, price formed a solid base before initiating a powerful upward move.

- The decisive breakout occurred at 14:40 with extraordinary volume (146,387 units), creating a strong support level at 20.80.

- Multiple high-volume candles followed between 14:44-14:48, pushing the price through the critical 21.00 psychological barrier with the highest volume spike (142,112 units) at 14:47.

- This breakout completes the bullish pattern established in the previous 48 hours, with Fibonacci extension targets now suggesting 21.50 as the next significant objective.

Disclaimer: This article was generated with AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. This article may include information from external sources, which are listed below when applicable.

External References:

- «Avalanche (AVAX), Toncoin (TON) and Kaspa (KAS): Can They Recover?« — CryptoDaily, published April 2025.

- «Avalanche (AVAX), Polkadot (DOT) Rebound on the Horizon? Harmonic Pattern Signals Bullish Move» — Bitzo, published April 2025. — Bitzo, published April 2025. — Bitzo, published April 2025.

- «Avalanche Price Prediction« — Cryptopolitan, published April 2025.

- «Avalanche Card Unveiled: Will It Spark Bullish Momentum for AVAX?« — Coinpedia, published April 2025.

Uncategorized

Janover Buys Another $11.5M in SOL, Gets Renamed Amid Crypto Treasury Strategy Play

Janover (JNVR), the real estate-focused fintech company with a Solana (SOL) treasury strategy, has been renamed to DeFi Development Corp and purchased another $11.5 million worth of SOL tokens, the firm said on Tuesday.

The move brings the company’s total SOL holdings to 251,842, including staking rewards, the company said. That’s valued at around $36.5 million, with SOL currently trading around $145.

JNVR shares were down 2.5% today at $38.3, well below last week’s peak just shy of $80. However, the stock is still up over 800% since adopting the crypto treasury strategy. SOL advanced nearly 5% over the past 24 hours, with the broader crypto market climbing higher.

The purchase was part of the Boca Raton, Florida-based company’s new crypto bet to position itself as the first U.S.-listed company with a treasury strategy centered on Solana and its native token SOL.

As part of the strategy, the firm seeks to accumulate SOL and operate one or more validators to secure the blockchain. The pivot happened after a team of former executives of crypto exchange Kraken bought a majority stake in the firm earlier this month.

Read more: Janover Takes Page From Saylor Playbook, Doubling SOL Stack to $20M as Stock Soars 1700%

The purchase was made using funds from a $42 million financing round the company completed earlier this year. Based on the latest figures, each share of the company represents 0.17 SOL, up 62% from its last crypto purchase, according to the press release.

The firm will also change its ticker to DFSV on the Nasdaq exchange at a future date to reflect its new name.

Last week, the company announced a strategic partnership with Kraken with plans to delegate part of the exchange’s SOL holdings to stake to validators operated by DeFi Development Corp. The firm also teamed up with BitGo to acquire locked tokens via over-the-counter markets.

Uncategorized

Arch Labs Raises $13M in Funding for Bitcoin-Based Smart Contracts

Bitcoin decentralized finance (DeFi) developer Arch Labs raised $13 million in funding toward building «ArchVM,» which the developers say will provide smart-contract functionality on the original blockchain.

The funding round, which valued the company at $200 million, was led by Pantera Capital, according to an announcement on Tuesday.

Arch’s plans to enable decentralized applications and protocols natively on Bitcoin.

ArchVM will handle off-chain computations to enable «Turing-complete smart contracts at the Bitcoin base layer» and provide Solana-like transaction speeds, Arch Labs said in the announcement.

The goal of introducing smart contracts to Bitcoin began to gather steam in October with the release of the BitVM computing language.

Numerous projects are now using BitVM as the basis for bringing smart contracts to Bitvcoin via layer-2 networks or bridges. Arch’s aim is to avoid the need to bridge assets to layer-2s, which could present additional risks.

-

Fashion6 месяцев ago

Fashion6 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment6 месяцев ago

Entertainment6 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion6 месяцев ago

Fashion6 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment6 месяцев ago

Entertainment6 месяцев agoThe old and New Edition cast comes together to perform

-

Sports6 месяцев ago

Sports6 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Business6 месяцев ago

Business6 месяцев agoUber and Lyft are finally available in all of New York State

-

Entertainment6 месяцев ago

Entertainment6 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports6 месяцев ago

Sports6 месяцев agoSteph Curry finally got the contract he deserves from the Warriors