Uncategorized

2025 Will Be the Year of Decentralization: 5 Predictions

It took a while, but 2024 was the year bitcoin fulfilled a million end-of-year predictions to finally hit $100,000. Uncork the champagne if you like, but I believe bitcoin’s breach of this historic barrier is the harbinger of something even bigger, and that 2025 will be the long-awaited Year of Decentralization.

The reason has very little to do with bitcoin’s soaring valuation. Anyone who’s had even half an eye on the decentralized technology landscape for the last year will have witnessed an explosion in new use cases. Many are quirky, others are cool and a few promise to solve some of the biggest challenges facing humanity today. Together, they are sending decentralization’s utility into the stratosphere via measurable impact rather than mere speculation. More importantly, they provide a host of compelling reasons for people to adopt and onboard to decentralization in 2025.

Buckle up then, as we take a whistlestop tour around my top five predictions for the year ahead.

1. Bitcoin takes a shot at the moon.

It wouldn’t be December without bold predictions about bitcoin’s price. But instead of tossing out another $250K or $500K figure like everyone else, let’s explore a more radical possibility: bitcoin becoming the foundation of a global strategic reserve.

The fundamentals support this possibility. If a major world power (or an unexpected one) officially adopts bitcoin as part of its treasury reserves, the current price predictions could bUe obliterated. We’re not just talking $500,000; $1 million or even higher could become the new normal, driven by nations’ scrambling to secure the world’s rarest digital asset.

Even without geopolitical adoption, bitcoin’s scarcity alone makes it a unique asset. There will only ever be 21 million BTC in existence, a far smaller number than the 60 million dollar millionaires worldwide. With institutions and now potentially governments buying up huge reserves of bitcoin, it’ll soon be a tiny minority who can hope to own just one — that is, unless they were smart enough to invest early.

Add in the continued growth of bitcoin’s utility as a decentralized network and its role as an alternative to fiat instability, and we’re looking at exponential growth.

But here’s the wildcard: what happens when bitcoin’s price is no longer driven just by markets, but by nations hedging against each other in the race for digital dominance? That’s where things truly get edgy. With several countries already piloting bitcoin treasury programs, $500,000 might just become the starting point.

2. Depinners get rich, quickly.

Someone has to admit it: the crypto industry sometimes does a bad job of selling its vision to the world. Phrases like “financial self-sovereignty” mean little to the average person in the street — unless, of course, they’ve had their bank account shut down.

So how’s this for a sales pitch? Decentralization enables you to earn money for doing absolutely nothing. No, it’s not too good to be true, because that’s what Depinners are already doing. By harnessing and “farming” your computer resources, such as the processor on your phone, anyone can earn passive income by contributing to the new paradigm of decentralized physical infrastructure (DePIN).

The DePIN revolution is a superb example of how decentralization transforms the concept of ownership and puts (earning) power into people’s hands. Equally important, it’s sparking incredible new use cases that are already solving problems from noise pollution to energy grid management to natural disaster alerts. Even though it’s still in its infancy, the almost infinite possibilities of DePIN applications mean that in 2025 early adopters could soon be earning up to 5% of the average person’s income — all without lifting a finger.

3. Memecoins get serious.

Here’s a prediction for what won’t happen in 2025: “serious” financial commentators still won’t accept that memecoins have any utility, or that they are anything other than an internet in-joke that went too far. And they’ll be increasingly, hilariously wrong.

In some respects, I can’t really blame them: on the face of it, most memecoins seem like a joke, especially the quintessential, ubiquitous DOGE. But ignore them at your peril: memecoins are growing up fast and they are evolving beyond their origins. These tokens’ value is driven less by speculation than by their ability to bring people together on projects ranging from the playful to the political.

In fact, memecoins have a great deal to teach us about the nature of community and participation in the decentralized world. In 2025, we’ll see brands wake up to memecoins’ extraordinary potential to reach new audiences, foster new communities and reimagine the relationship between businesses and consumers. To be sure, there’s money to be made in memecoins — but over the long-term, their value to forward-looking brands will be much more significant than their token price.

4. Time Magazine chooses an Android of the Year.

In 2025, I predict that Time Magazine’s Person of the Year…won’t be a person at all. For the first time in its 98-year existence, the annual award will go to what I’m calling “Mrs Humanoid” — a composite character symbolizing the rise of AI and robotics, and the integration of both into human society.

This humanoid robot (or “gynoid,” as they’re sometimes referred to) will represent the incredible impact that these twin technologies are making across a range of sectors, from healthcare to education, demonstrating capabilities that blur the lines between human and machine labor. Time Magazine has chosen some controversial characters in the past (check out its 1938 “Person of the Year”), but I don’t think there’s anything remotely strange about choosing a robot. I’d even go a step further and say that it would be irresponsible to not put one on the front cover.

The rapidity of the rise of robots’ should be sparking global discussions on the ethics of AI, as well as how work, privacy and human identity are being redefined. Many of these changes are incredibly positive, some are morally gray or still obscure, and a few are potentially incredibly alarming. This conversation should therefore take place alongside climate change as one of the defining issues of our century. Putting Mrs. Humanoid on Time’s cover would be an important step towards focusing minds, especially regulators’ and legislators’, about how we develop new regulatory frameworks to address the challenges and seize opportunities presented by such advanced AI systems.

5. Traditional search loses ground to AI.

Will 2024 be the last year we “Googled” something we didn’t know? With the advent of Gen AI applications, there’s every reason to think so.

Tools like ChatGPT and Perplexity represent the biggest change to search since the emergence of Google a quarter of a century ago. Harnessing the power of AI not only enables more accurate results, thanks to its ability to understand semantics, but also changes the dynamics of search.

These new applications pass the Turing Test with flying colors, enabling people to have meaningful conversations about everything from cooking to philosophy. As such, they represent a fundamental change in our emotional relationship with technology, and make “traditional” search — as exemplified by Google’s long, near-total monopoly— look positively prehistoric.

Just as the emergence of the internet sparked an “SEO arms race” among brands fighting for that all-important first results page of Google, in 2025 we’ll see businesses begin to figure out how to remain relevant in the age of AI-powered search.

One of the biggest changes we’ll see is the evolution of websites, which will increasingly cater to AI agents rather than humans. In 2025, we’ll see web domains take on a new significance, with the most successful brands being those that harness onchain domains to safeguard consumer data, integrate AI functionality and deliver revolutionary online experiences for their audiences.

Whether all, some, or none of these predictions come to pass, one thing is beyond doubt — as we cross into the latter half of the 2020s, decentralization is no longer the future; it’s about to become an inescapable, inextricable part of everybody’s present.

Uncategorized

Crypto Daybook Americas: Bitcoin Reasserts Itself as Stocks, Bonds Fall, Gold Hits Record High

By James Van Straten (All times ET unless indicated otherwise)

«There are decades where nothing happens; and there are weeks where decades happen.» Vladimir Ilyich Lenin

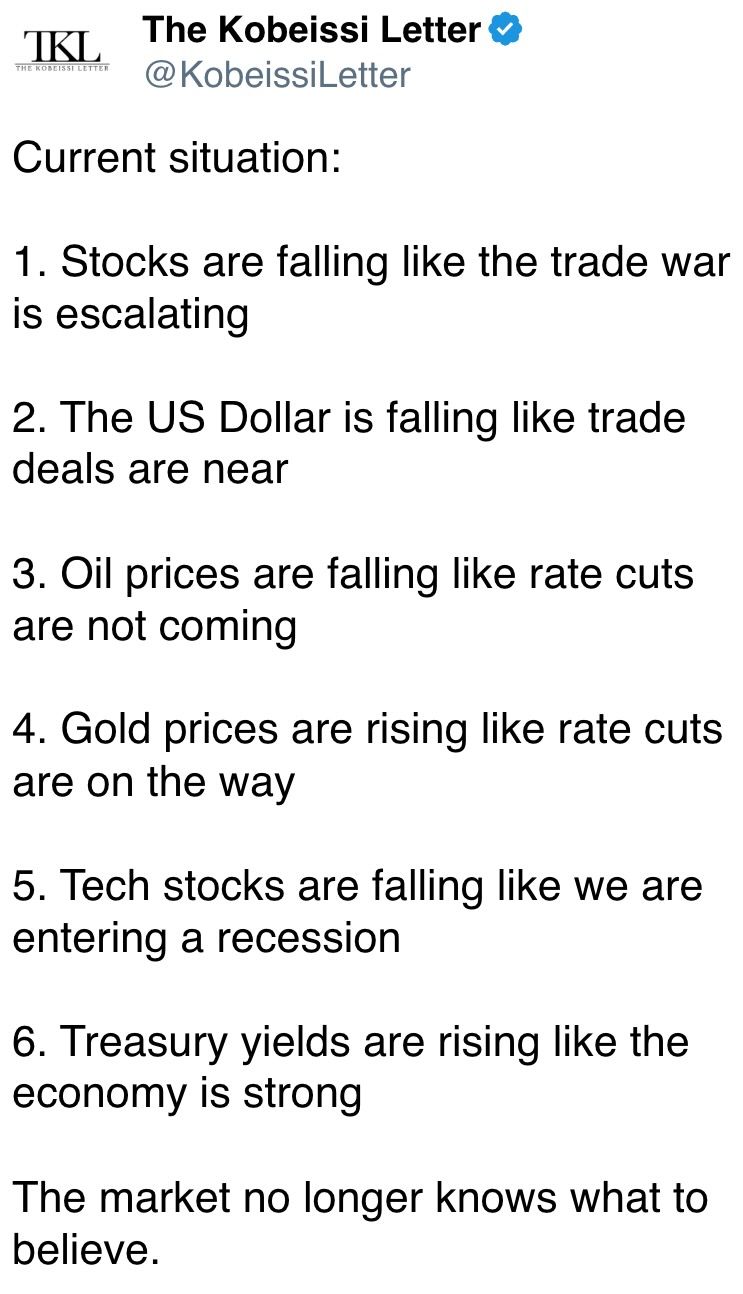

Few quotes better capture the current turbulence in global markets. For decades, the classic portfolio of 60% equities and 40% bonds was considered the cornerstone of balanced investing. This allocation typically offered protection in downturns through bonds, while equities drove returns in times of economic growth.

We saw this play out during crises like 2008 and 2020, when iShares 20+ Year Treasury Bond ETF (TLT) surged amid global uncertainty. Today, that dynamic has been upended. With persistent geopolitical tension ignited by President Donald Trump’s tariffs, stubborn inflation and slowing growth, Treasury yields have climbed and bond prices fallen. TLT is now down some 50% from its 2020 highs.

The equity side of the portfolio isn’t faring much better. U.S. stocks are underperforming, caught in what some are calling a broader «Sell America» trade. Even the dollar, which typically strengthens in risk-off environments, is weakening as capital flows shift toward the yen and euro.

In this new regime, alternative assets are taking center stage. Gold has surged to $3,500 an ounce for the first time, cementing its role as a haven. To underscore its meteoric rise: the precious metal has added about $6 trillion in market cap this year, triple the market cap of bitcoin (BTC) at its all-time high. Gold ETF inflows, measured over a 90-day rolling period, are approaching 9 million ounces, the biggest surge since 2022 and among the largest in the past decade.

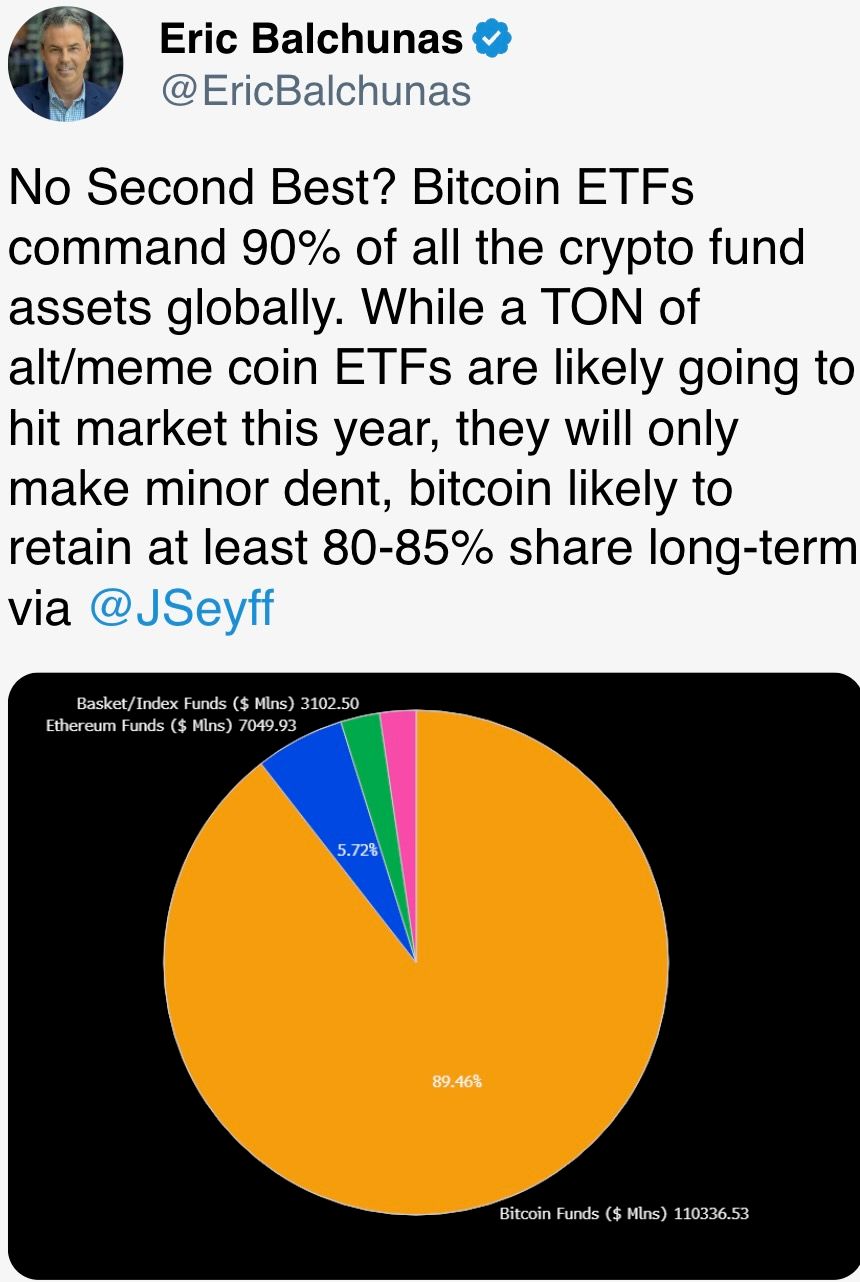

Bitcoin, while lagging behind gold, is also reasserting itself. It has reached new highs in dominance within the crypto market and is beginning to diverge from U.S. tech stocks. It’s increasingly behaving like an uncorrelated asset, valuable in a diversified portfolio. This Friday, $6.7 billion in bitcoin options are set to expire, including $330 million in call options at the $100,000 strike price, setting the stage for a potentially volatile final week of April. Stay alert!

What to Watch

- Crypto:

- April 22: The Lyora upgrade goes live on the Injective (INJ) mainnet.

- April 25, 1 p.m.: U.S. Securities and Exchange Commission (SEC) Crypto Task Force Roundtable on «Key Considerations for Crypto Custody«.

- April 28: Enjin Relaychain increases active validator slots to 25 from 15, to enhance decentralization.

- April 29, 1:05 a.m.: BNB Chain (BNB) — BSC mainnet hardfork.

- April 30, 9:30 a.m.: ProShares expects its XRP ETF, offering exposure through futures and swap agreements, to begin trading on NYSE Arca.

- April 30, 10:03 a.m.: Gnosis Chain (GNO), an Ethereum sister chain, will activate the Pectra hard fork on its mainnet at slot 21,405,696, epoch 1,337,856.

- Macro

- Day 2 of 6: World Bank (WB) and the International Monetary Fund (IMF) spring meetings in Washington.

- April 22, 8:30 p.m.: Statistics Canada releases March producer price inflation data.

- PPI MoM Est. 0.3% vs. Prev. 0.4%

- PPI YoY Prev. 4.9%

- April 22, 6 p.m.: Fed Governor Adriana D. Kugler will deliver a speech titled «Transmission of Monetary Policy.»

- April 23, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases retail sales data.

- Retail Sales MoM Prev. 0.6%

- Retail Sales YoY Prev. 2.7%

- April 23, 9:45 a.m.: S&P Global releases (flash) U.S. April purchasing managers’ index (PMI) data.

- Composite PMI Prev. 53.5

- Manufacturing PMI Est. 49.4 vs. Prev. 50.2

- Services PMI Est. 52.8 vs. Prev. 54.4

- Earnings (Estimates based on FactSet data)

Token Events

- Governance votes & calls

- Aave DAO is discussing partnering with Ether.fi to create a custom Aave market on EVM layer 2 to “facilitate on-chain credit for everyday payments through the Ether.fi Cash credit card program.”

- April 23, 9 p.m.: Manta Network to host a townhall meeting with its founders.

- April 24, 8 a.m.: Alchemy Pay to host an Ask Me Anything (AMA) session on its 2025 roadmap.

- April 30, 12 p.m.: Helium to host a community call meeting.

- Unlocks

- April 30: Optimism (OP) to unlock 1.89% of its circulating supply worth $21.83 million.

- May 1: Sui (SUI) to unlock 2.28% of its circulating supply worth $170.93 million.

- May 1: ZetaChain (ZETA) to unlock 5.67% of its circulating supply worth $10.46 million.

- May 2: Ethena (ENA) to unlock 0.73% of its circulating supply worth $11.92 million.

- May 7: Kaspa (KAS) to unlock 0.56% of its circulating supply worth $13 million.

- May 9: Movement (MOVA) to unlock 2.04% of its circulating supply worth $11.23 million.

- Token Launches

- April 22: Hyperlane to airdrop its HYPER tokens.

- April 22: BNB to be listed on Kraken.

- April 23: Zora to airdrop its ZORA tokens.

- April 24: Initia (INIT) to be listed on Binance, CoinW, WEEX, KuCoin, MEXC, and others.

Conferences:

- CoinDesk’s Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Day 1 of 3: Money20/20 Asia (Bangkok)

- April 23: Crypto Horizons 2025 (Dubai)

- April 23-24: Blockchain Forum 2025 (Moscow)

- April 24: Bitwise’s Investor Day for Bitcoin Standard Corporations (New York)

- April 26: Crypto Vision Conference 2025 (Manilla)

- April 26-27: Harvard Blockchain in Action Conference (Cambridge, Mass.)

- April 27: N Crypto Conference 2025 (Kyiv)

- April 27-30: Web Summit Rio 2025

- April 28-29: Blockchain Disrupt 2025 (Dubai)

- April 28-29: Staking Summit Dubai

- April 29: El Salvador Digital Assets Summit 2025 (San Salvador)

- April 29: IFGS 2025 (London)

Token Talk

By Shaurya Malwa

- Pope Francis’ death on Easter Monday triggered significant activity in crypto markets and prediction platforms as traders aimed to capitalize on the news.

- LUCE, a Solana-based memecoin tied to the Vatican’s Holy Year 2025 mascot, surged 45% in value, reaching $0.013, according to CoinGecko data.

- Daily trading volume in the token skyrocketed to $60.27 million from $5 million the previous day, despite the price being down 95% from its November peak of 30 cents.

- Although unaffiliated with the Vatican, LUCE has attracted around 44,800 holders.

- Meanwhile, a Polymarket bet on who will be the next pope has attracted over $3.5 million in volumes since going live on Dec. 31, with over 18 candidates in the mix.

- As of Tuesday morning, Pietro Parolin leads odds at 37%, followed by Luis Antonio Tagle at 23% and Matteo Zuppi at 11%.

Derivatives Positioning

- HBAR, XLM and TRX have seen the most growth in perpetual futures open interest among major tokens in the past 24 hours. However, only TRX has seen a positive cumulative volume delta, implying an influx of new money predominantly on the bullish side.

- BTC’s open interest in has increased to 695K BTC, the most since March 25. ETH’s open interest held shy of the recent record above 11.9 million ETH.

- Perpetual funding rates for most major tokens remain marginally positive in a sign of cautiously bullish sentiment.

- On Deribit, BTC’s short and near-dated calls are now trading at par or a slight premium to puts, another sign of renewed bullishness. ETH puts, however, continue to trade at a premium to calls.

- Block options flows have been muted on Paradigm, with calendar spreads and April put spreads lifted in BTC and ETH.

Market Movements:

- BTC is up 1.45% from 4 p.m. ET Monday at $88,539.04 (24hrs: +1.16%)

- ETH is up 3.43% at $1,628.60 (24hrs: -0.84%)

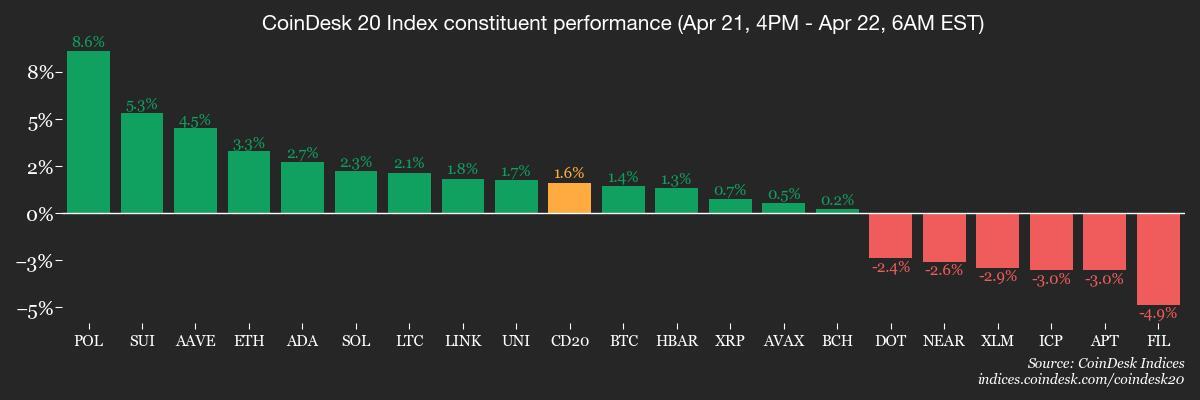

- CoinDesk 20 is up 1.49% at 2,544.64 (24hrs: -0.3%)

- Ether CESR Composite Staking Rate is up 3 bps at 2.98%

- BTC funding rate is at -0.0058% (-2.1353% annualized) on Binance

- DXY is up 0.1% at 98.38

- Gold is up 4.28% at $3,456.97/oz

- Silver is up 0.5% at $32.57/oz

- Nikkei 225 closed -0.17% at 34,220.60

- Hang Seng closed +0.78% at 21,562.32

- FTSE is up 0.49% at 8,315.81

- Euro Stoxx 50 is down 0.28% at 4,922.48

- DJIA closed on Monday -2.48% at 38,170.41

- S&P 500 closed -2.36% at 5,158.20

- Nasdaq closed -2.55% at 15,870.90

- S&P/TSX Composite Index closed -0.76% at 24,008.86

- S&P 40 Latin America closed unchanged at 2,384.47

- U.S. 10-year Treasury rate is unchanged at 4.42%

- E-mini S&P 500 futures are up 0.98% at 5,235.75

- E-mini Nasdaq-100 futures are up 1.02% at 18,105.00

- E-mini Dow Jones Industrial Average Index futures are up 0.87% at 38,660.00

Bitcoin Stats:

- BTC Dominance: 64.39% (-0.09%)

- Ethereum to bitcoin ratio: 0.01839 (1.88%)

- Hashrate (seven-day moving average): 840 EH/s

- Hashprice (spot): $45.0 PH/s

- Total Fees: 6.56BTC / $572,645

- CME Futures Open Interest: 139,765 BTC

- BTC priced in gold: 25.5 oz

- BTC vs gold market cap: 7.22%

Technical Analysis

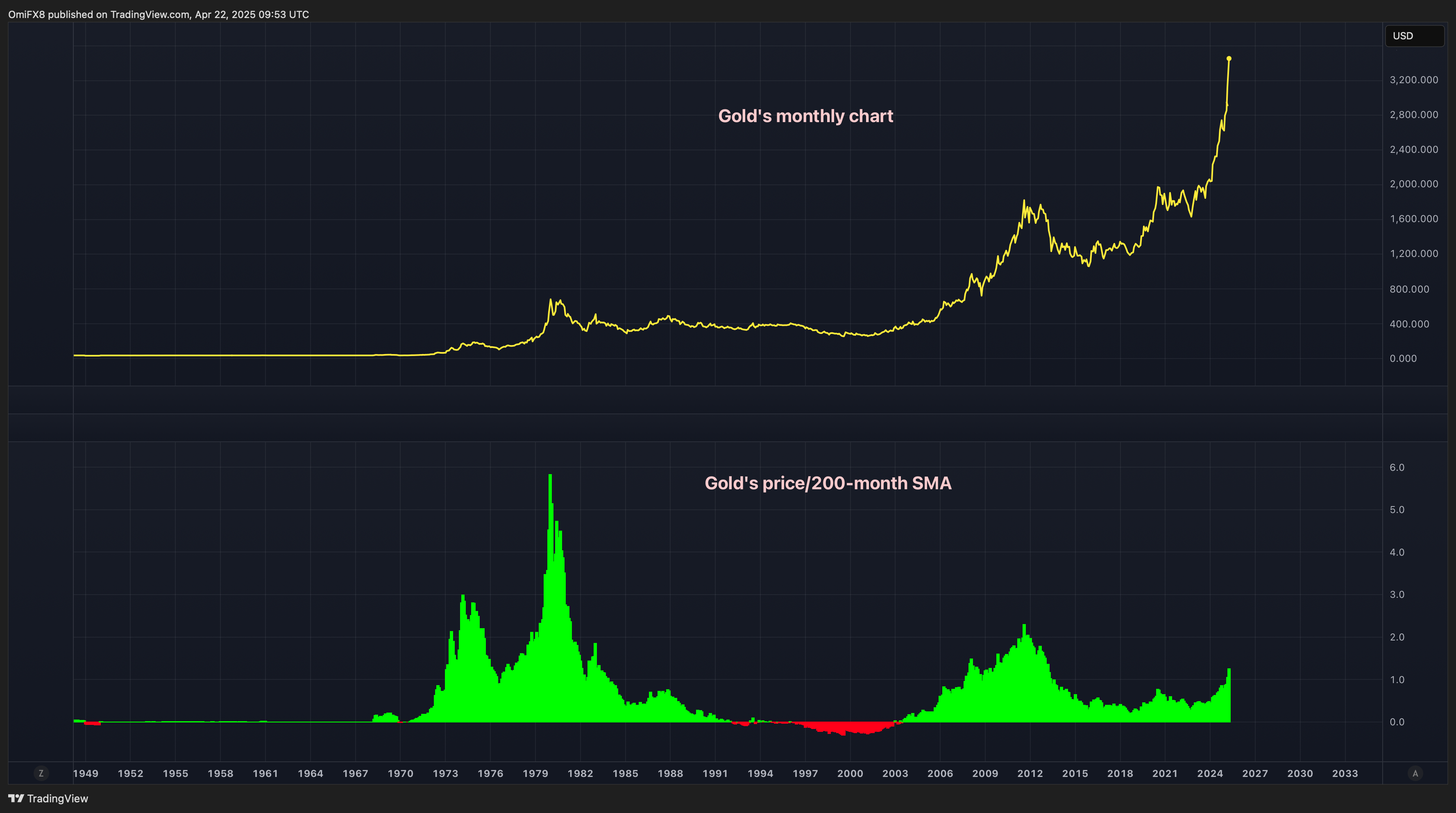

- If you feel gold’s rally is overstretched or overdone, think again.

- The ratio between gold’s spot price and its 200-day simple moving average, currently 1.3, is well below highs seen in 2011-2012 when the yellow metal rose to its then-record price of $2,000.

- The ratio went as high as 5.80 in the 1980.

- Bitcoin tends to follow gold with a lag of couple of months.

Crypto Equities

- Strategy (MSTR): closed on Monday at $317.76 +0.18%), up 2.02% at $324.19 in pre-market

- Coinbase Global (COIN): closed at $175 (-0.02%), up 1% at $176.75

- Galaxy Digital Holdings (GLXY): closed at C$15.38 (+0.13%)

- MARA Holdings (MARA): closed at $12.29 (-2.92%), up 2.36% at $12.59

- Riot Platforms (RIOT): closed at $6.29 (-2.63%), up 2.07% at $6.42

- Core Scientific (CORZ): closed at $6.39 (-3.62%)

- CleanSpark (CLSK): closed at $7.47 (-0.53%), up 2.68% at $7.67

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $11.74 (-2.49%)

- Semler Scientific (SMLR): closed at $29.83 (-8.17%)

- Exodus Movement (EXOD): closed at $36.59 (+0.03%), unchanged in pre-market

ETF Flows

Spot BTC ETFs:

- Daily net flow: $381.3 million

- Cumulative net flows: $35.86 billion

- Total BTC holdings ~ 1.11 million

Spot ETH ETFs

- Daily net flow: -$25.4 million

- Cumulative net flows: $2.24 billion

- Total ETH holdings ~ 3.30 million

Source: Farside Investors

Overnight Flows

Chart of the Day

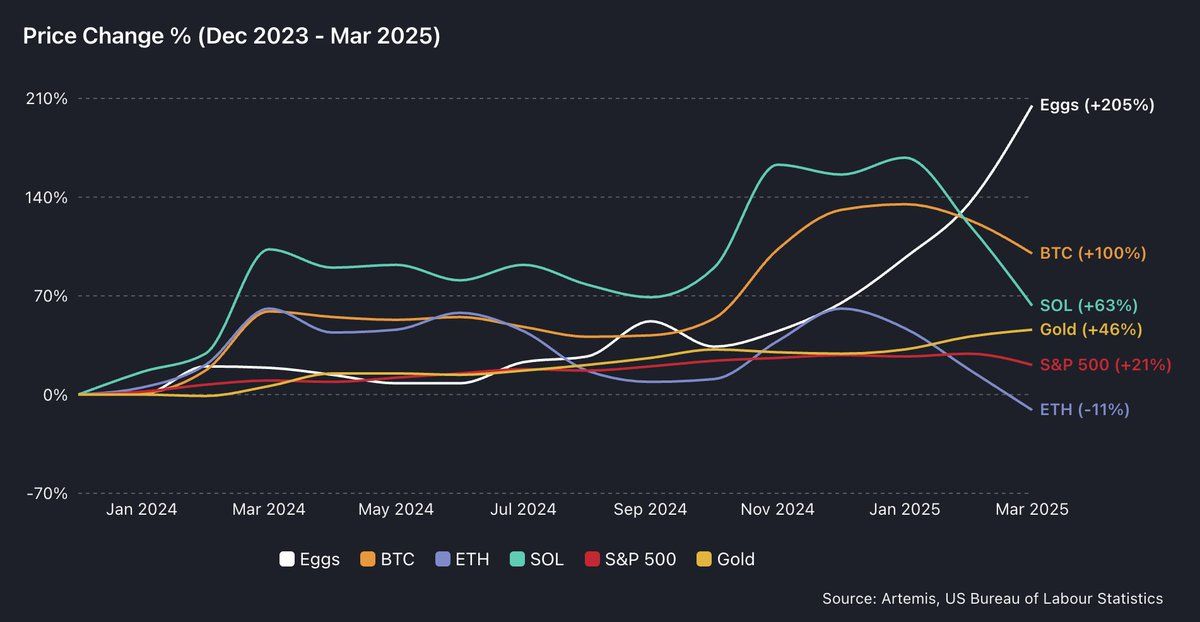

- The chart shows the price of eggs in the U.S. has increased by over 200% since 2024, outperforming BTC’s 100% surge. Gold and the S&P 500 have gained 46% and 21%, respectively, over the same period.

- In other words, asset price growth has failed to compensate holders for the inflation on Main Street.

While You Were Sleeping

- Bitcoin, Euro Options Signal Bullishness Against Dollar Amid Equity and Bond Market Downturns (CoinDesk): Preference for BTC and euro call options over dollar exposure suggests investors are rotating out of U.S. assets and into bitcoin, the euro and gold.

- Dow Headed for Worst April Since 1932 as Investors Send ‘No Confidence’ Signal (The Wall Street Journal): Scott Ladner, chief investment officer at Horizon Investments, said the Trump administration’s policies have made the U.S. economy increasingly unstable and difficult to gauge, deterring investment.

- Bitcoin Runs Into Resistance Cluster Above $88K. What Next? (CoinDesk): Behavioral aspects of trading could influence whether bitcoin rallies further or faces a new downturn from the resistance zone.

- Bearish Dollar Bets Move Toward Levels That Raise Risk of Recoil (Bloomberg): Despite widespread bets against the dollar, steady demand for Treasuries and technical signals suggest a rebound is likely, though gains may be limited or short-lived if negative news continues.

- Japanese Investors Sold $20B of Foreign Debt as Trump Tariffs Shook Markets (Financial Times): Much of Japan’s selling likely involves U.S. Treasuries and mortgage-backed securities guaranteed by the U.S. government, said Tomoaki Shishido, senior rates strategist at Nomura.

- Bitcoin, Stablecoins Command Over 70% of Crypto Market as BTC Pushes Higher (CoinDesk): Bitcoin dominance rose to 64.6%, the highest since January 2021, as ether slumped and the ETH-to-BTC ratio fell to a five-year low of 0.01765.

In the Ether

Uncategorized

Bitcoin Closing In on Historic Breakout vs Nasdaq

Bitcoin (BTC) is on the cusp of breaking out relative to the Nasdaq 100 Composite, with the current BTC/Nasdaq ratio sitting at 4.96. This means it now takes nearly five Nasdaq units to match the value of one bitcoin. The previous record of 5.08 was set in January 2025, when bitcoin hit its all-time high of over $109,000.

Historically, each market cycle has seen the ratio reach new highs—2017, 2021, and now 2025—highlighting bitcoin’s continued outperformance against the Nasdaq.

Across multiple timeframes, bitcoin is increasingly diverging from U.S. tech stocks. Year-to-date, bitcoin is down just 6%, compared to the Nasdaq’s 15% decline. Since Donald Trump’s election victory in November 2024, bitcoin has rallied 30%, while the Nasdaq has fallen 12%.

When measured against the «Magnificent Seven» mega-cap tech stocks, bitcoin remains around 20% below its all-time high from February this year. This indicates that while bitcoin has shown strength, the top tech names are holding up better than the broader Nasdaq Composite.

Strategy (MSTR), a well-known proxy for bitcoin exposure, is also holding up better than the U.S tech stocks. Since joining the QQQ ETF on Dec. 23, MSTR is down 11%, while the ETF itself has dropped over 16%. The divergence has become more pronounced in 2025: MSTR is up 6% year-to-date, compared to QQQ’s 15% decline.

Uncategorized

Bitcoin Runs Into Resistance Cluster Above $88K. What Next?

This is a daily technical analysis by CoinDesk analyst and Chartered Market Technician Omkar Godbole.

Bitcoin’s (BTC) bullish advance has encountered a resistance zone above $88,000, marked by crucial levels that could make or break the ongoing recovery rally.

The resistance cluster’s first and perhaps most critical level is the 200-day simple moving average (SMA) at $88,356. The SMA is widely regarded as a key indicator of long-term momentum. Early this month, Coinbase institutional analysts called the downside break of the 200-day SMA in March a sign of the onset of a potential crypto winter.

So, a fresh move above the 200-day SMA could be taken to represent a renewed bullish shift in momentum.

Such a move would trigger a dual breakout, as the Ichimoku cloud’s upper end is located close to the 200-day SMA. A move above the Ichimoku cloud is also said to reflect a bullish shift in momentum.

Developed by a Japanese journalist in the 1960s, the Ichimoku cloud is a technical analysis indicator that offers a comprehensive view of market momentum, support, and resistance levels. The indicator comprises five lines: Leading Span A, Leading Span B, Conversion Line or Tenkan-Sen (T), Base Line or Kijun-Sen (K) and a lagging closing price line. The difference between Leading Span A and B forms the Ichimoku Cloud.

The third and final level forming the resistance cluster is the high of $88,804 on March 24, from where the market turned lower and fell back to $75,000.

A make-or-break resistance zone?

Behavioural aspects of trading come into play when an asset approaches a resistance zone, especially at key levels like the 200-day SMA and the Ichimoku cloud.

Prospect theory suggests that people are typically risk-averse with respect to gains and risk-seeking with respect to losses, known as the “reflection effect.» So, as traders, people tend to be risk-averse while locking in profits and keep losing trades open.

This tendency is amplified when an asset encounters a significant resistance zone. Traders who entered the bitcoin market around $75K, anticipating a rebound, may feel pressured to take profits as the price approaches this resistance. Such selling could, in turn, slow the price ascent or even trigger a new downturn.

Conversely, if bitcoin successfully breaks through the resistance zone, the fear of missing out could prompt more traders to make bullish bets, further fueling bullish momentum and pushing the price higher.

-

Fashion6 месяцев ago

Fashion6 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment6 месяцев ago

Entertainment6 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion6 месяцев ago

Fashion6 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment6 месяцев ago

Entertainment6 месяцев agoThe old and New Edition cast comes together to perform

-

Sports6 месяцев ago

Sports6 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Business6 месяцев ago

Business6 месяцев agoUber and Lyft are finally available in all of New York State

-

Entertainment6 месяцев ago

Entertainment6 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports6 месяцев ago

Sports6 месяцев agoSteph Curry finally got the contract he deserves from the Warriors