Uncategorized

Three Predictions For 2025

No one can argue with 2024 being a breakthrough year for crypto. BTC and ETH ETFs launched, BlackRock spearheaded bitcoin adoption, a pro-crypto president was elected and BTC broke the 15-year all-time-high, to name a few. But the inflection point for crypto still awaits. Here are three predictions for 2025 that can help spark it:

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

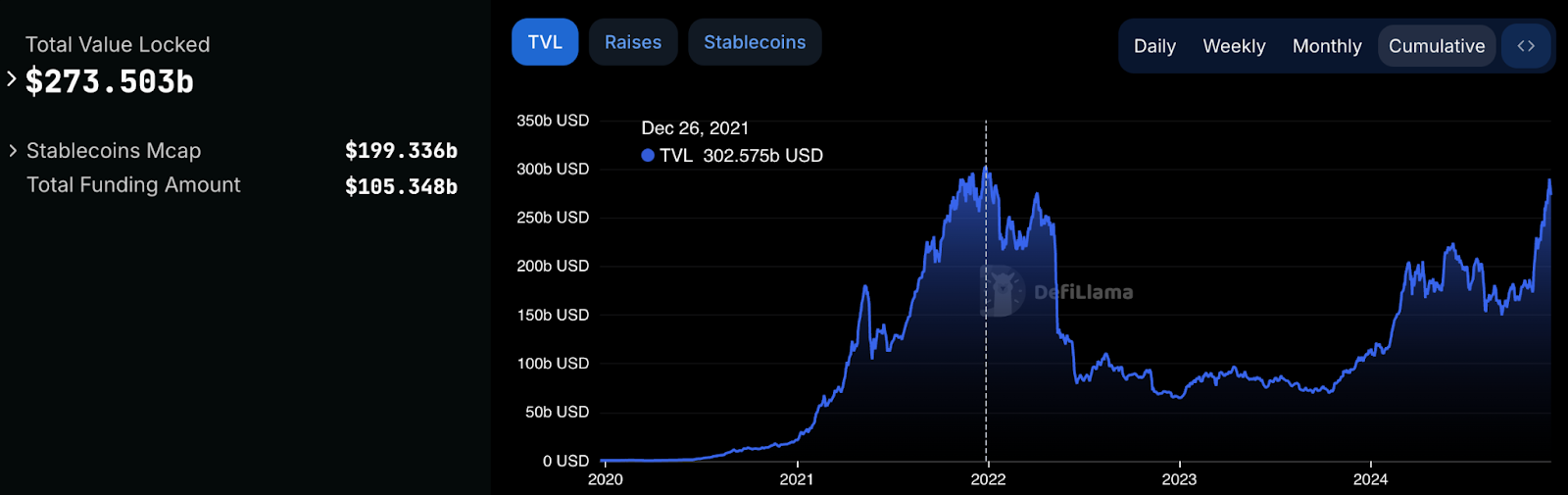

1. DeFi is about to skyrocket

DeFi is becoming more complex, much like traditional finance, in terms of its product suite. We’ve already seen this trend emerging with the adoption of products like Pendle, Ethena, EtherFi and Lombard. In 2025, DeFi usage will explode, with a wave of adoption for products such as options, swaps, and other derivatives like the interest rate swap market — the latter’s market size is at 465.9 trillion USD in TradFi.

Moreover, new institutional players are entering the crypto ecosystem, nurturing a new category: On-chain finance. Participation is no longer limited to buying blue-chip cryptocurrencies like BTC and ETH. These market participants also actively expand on-chain market depth by using tools such as lending markets and liquidity provision with RWA-backed digital assets, i.e. stablecoins. Securitize and BlackRock are great examples of companies pushing the frontier on this front.

DeFi is almost back to its all-time-high, Source: https://defillama.com/

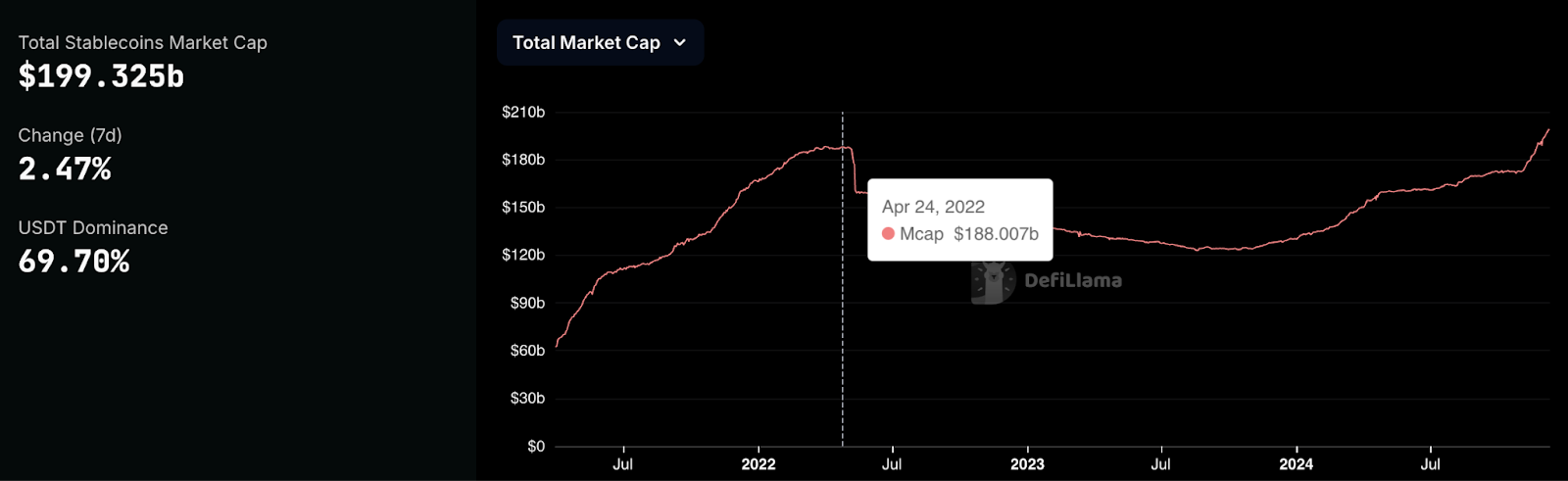

2. Stablecoins will continue to grow as the crypto killer use case

Stablecoins aren’t just another crypto product; they’re poised to become the digital backbone of the global financial system. Tether is the most profitable crypto company with a $5.2 billion profit in H1 2024, surpassing BlackRock.

The political landscape is shifting dramatically in favour of stablecoins, with Operation Choke Point 2.0 coming to an end. They are finally being viewed as a national asset that can strengthen the dominance of the U.S. dollar and address growing public debt. This shift also paves the way for major banks and payment companies like Visa and Mastercard to expand their efforts in the sector, especially when you consider Stripe’s acquisition of stablecoin platform Bridge for $1.1 billion (the biggest acquisition in crypto ever) and rumors of Revolut launching its stablecoin.

Stablecoins market cap is at an All-Time-High already at about $200 billion, Source: https://defillama.com/stablecoins

3. The race for retail adoption

ETFs will be key drivers for new capital to enter crypto. BTC ETFs are here, and soon we’ll see the success of Ethereum ETFs. After SOL’s undeniable growth over the last year, the SOL ETF will either catch the momentum and become a reality in the first half of 2025 or will delay until 2026 or later.

We’ll also see major Web3 social platforms compete with the LensChain mainnet launch and Farcaster’s further expansion. As the pie grows bigger, we can end up with the «Twitter/X and Facebook of crypto» platforms.

Notably, “Super Wallets” took off in Q4 2024. They aim to offer a comprehensive alternative to centralized exchanges for new users. The leading players are Infinex, launched by Kain Warwick, and DeFiApp, launched by seasoned builders in DeFi. Both are working on UX problems, something we have never done very well as an industry.

Bonus prediction: MiCA will power crypto expansion in Europe

Crypto regulations provide the foundations for new projects. They lay the groundwork for clear rules and guidelines of organizational structure. MiCA (Markets in Crypto-Assets Regulation) attempts to bring just that with an aim to increase the importance of EUR-related assets. This could potentially bridge crypto innovation between the U.S. and Europe.

Uncategorized

Bitcoin Closing In on Historic Breakout vs Nasdaq

Bitcoin (BTC) is on the cusp of breaking out relative to the Nasdaq 100 Composite, with the current BTC/Nasdaq ratio sitting at 4.96. This means it now takes nearly five Nasdaq units to match the value of one bitcoin. The previous record of 5.08 was set in January 2025, when bitcoin hit its all-time high of over $109,000.

Historically, each market cycle has seen the ratio reach new highs—2017, 2021, and now 2025—highlighting bitcoin’s continued outperformance against the Nasdaq.

Across multiple timeframes, bitcoin is increasingly diverging from U.S. tech stocks. Year-to-date, bitcoin is down just 6%, compared to the Nasdaq’s 15% decline. Since Donald Trump’s election victory in November 2024, bitcoin has rallied 30%, while the Nasdaq has fallen 12%.

When measured against the «Magnificent Seven» mega-cap tech stocks, bitcoin remains around 20% below its all-time high from February this year. This indicates that while bitcoin has shown strength, the top tech names are holding up better than the broader Nasdaq Composite.

Strategy (MSTR), a well-known proxy for bitcoin exposure, is also holding up better than the U.S tech stocks. Since joining the QQQ ETF on Dec. 23, MSTR is down 11%, while the ETF itself has dropped over 16%. The divergence has become more pronounced in 2025: MSTR is up 6% year-to-date, compared to QQQ’s 15% decline.

Uncategorized

Bitcoin Runs Into Resistance Cluster Above $88K. What Next?

This is a daily technical analysis by CoinDesk analyst and Chartered Market Technician Omkar Godbole.

Bitcoin’s (BTC) bullish advance has encountered a resistance zone above $88,000, marked by crucial levels that could make or break the ongoing recovery rally.

The resistance cluster’s first and perhaps most critical level is the 200-day simple moving average (SMA) at $88,356. The SMA is widely regarded as a key indicator of long-term momentum. Early this month, Coinbase institutional analysts called the downside break of the 200-day SMA in March a sign of the onset of a potential crypto winter.

So, a fresh move above the 200-day SMA could be taken to represent a renewed bullish shift in momentum.

Such a move would trigger a dual breakout, as the Ichimoku cloud’s upper end is located close to the 200-day SMA. A move above the Ichimoku cloud is also said to reflect a bullish shift in momentum.

Developed by a Japanese journalist in the 1960s, the Ichimoku cloud is a technical analysis indicator that offers a comprehensive view of market momentum, support, and resistance levels. The indicator comprises five lines: Leading Span A, Leading Span B, Conversion Line or Tenkan-Sen (T), Base Line or Kijun-Sen (K) and a lagging closing price line. The difference between Leading Span A and B forms the Ichimoku Cloud.

The third and final level forming the resistance cluster is the high of $88,804 on March 24, from where the market turned lower and fell back to $75,000.

A make-or-break resistance zone?

Behavioural aspects of trading come into play when an asset approaches a resistance zone, especially at key levels like the 200-day SMA and the Ichimoku cloud.

Prospect theory suggests that people are typically risk-averse with respect to gains and risk-seeking with respect to losses, known as the “reflection effect.» So, as traders, people tend to be risk-averse while locking in profits and keep losing trades open.

This tendency is amplified when an asset encounters a significant resistance zone. Traders who entered the bitcoin market around $75K, anticipating a rebound, may feel pressured to take profits as the price approaches this resistance. Such selling could, in turn, slow the price ascent or even trigger a new downturn.

Conversely, if bitcoin successfully breaks through the resistance zone, the fear of missing out could prompt more traders to make bullish bets, further fueling bullish momentum and pushing the price higher.

Uncategorized

Bithumb to Split in Two as Crypto Exchange Inches Toward South Korean IPO

Bithumb plans to split its core crypto exchange business from other activities as it reorganizes in preparation for an initial public offering (IPO).

The Seoul-based company will split in two, with Bithumb Korea focusing solely on operating the core crypto exchange business. Bithumb Korea will be the entity seeking a public listing, local media reported, citing the country’s corporate registry.

The other unit, a newly created company called Bithumb A, will oversee venture investments, asset management and new business initiatives. The restructuring is set to take effect on July 31.

Bithumb A will consolidate the exchange’s investment arms, including Bithumb Partners, which has shifted from NFT and metaverse projects to financial product investments such as equities, bonds and convertible bonds. According to local media, Bithumb is in talks with licensed entities to offer these services in the country.

Bithumb Investment, which manages equity stakes and strategic partnerships with external companies, will also fall under Bithumb A’s oversight.

Last year Bithumb was said to be considering a NASDAQ listing, but now its plans have shifted to a listing on South Korea’s Kosdaq first, with a U.S. listing as a secondary objective.

Bithumb posted an operating profit of 130.8 billion won ($95 million) in 2024, reversing a 149 billion-won loss from the previous year, local media reported.

-

Fashion6 месяцев ago

Fashion6 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment6 месяцев ago

Entertainment6 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion6 месяцев ago

Fashion6 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment6 месяцев ago

Entertainment6 месяцев agoThe old and New Edition cast comes together to perform

-

Sports6 месяцев ago

Sports6 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Business6 месяцев ago

Business6 месяцев agoUber and Lyft are finally available in all of New York State

-

Entertainment6 месяцев ago

Entertainment6 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports6 месяцев ago

Sports6 месяцев agoSteph Curry finally got the contract he deserves from the Warriors