Uncategorized

Revolut to Strengthen Crypto Fraud Protections With Added Security, Risk Scores

Fintech giant Revolut plans to extend its battle-tested security wrapper, Revolut Pay, to crypto customers from the start of 2025 to improve protection against fraudulent attacks.

As it stands, Revolut says, there is limited visibility into card transactions and bank transfers its crypto customers make with exchanges, potentially exposing them to higher levels of fraud due to card mechanisms having limited anti-scam protections.

A 12-month pilot of firms using Revolut Pay’s enhanced due diligence, direct API integration and end-to-end control over the payment process showed crypto customers were exposed to about 50% fewer attempts to defraud them, Revolut said in a statement.

These enhancements include know-your-customer (KYC) name matching, fraud warning screens, proof of crypto delivery and the ability for crypto merchants to receive transaction risk scores.

Crypto has more than its fair share of fraudulent activity and scams, whether that involves identity theft, phishing scams and even the involvement of AI deep fakes and so on.

“In the crypto space, there’s a little bit of an issue with fraud outcomes,” said Alex Codina, general manager for merchant payments at Revolut in an interview. “Now, crypto firms, either exchanges or on-rampers, can integrate Revolut Pay as a payment method and by doing that we allow our users to directly buy crypto on those checkouts in a safer manner.”

Match your customer

Under the hood, the integration with third-party exchanges or on-ramps starts with KYC matching, so validating that the person who is buying on Revolut side is the same person who is KYC’d on the exchange’s side.

“If those names don’t match the transaction is rejected. In the card world, this would be the equivalent of a stolen card or something like that,” Codina said.

Beyond that, firms are in a running battle to combat a sophisticated array of investment scams, whereby customers are duped into thinking they need to perform some transaction or other to qualify for a fictitious reward of some kind, he added.

“These are the hardest ones to deal with,” Codina said. “Basically what we do is assess the risk score of the transaction based on information on our users, like if they have traded crypto in the past or not with Revolut, with a third party, and assess the probability of that transaction being part of an investment scam.”

Obviously, a balance has to be struck when it comes to user experience and safety, Codina said. The safety measures put in place by Revolut could be a question or two about the transaction, or in some cases the customer could be referred to a customer services manager to briefly chat about the transaction.

“We have a pretty robust model and framework where we can add some friction, depending on how risky we think the transaction is,” he said.

Uncategorized

First Solana ETF to Hit the Market This Week; SOL Price Jumps 5%

Solana SOL jumped about 5% Monday morning amid rumors that a SOL Staking exchange-trade fund (ETF) by Rex Shares and Osprey Funds could start trading on the market as soon as Wednesday.

The token later fell back slightly, now trading up about 2.3% over the past 24 hours at $157 at press time.

A spokesperson for Osprey confirmed to CoinDesk that the «fund will launch Wednesday,» following a post on X by the automated headline account «Unfolded.»

Just last week, Rex filed a letter with the Securities and Exchange Commission (SEC) asking whether comments had been resolved for their filing. Later that day, the asset manager posted on X that the ETF was “coming soon,” suggesting that the SEC had no further comments.

The REX-Osprey SOL+Staking ETF would be the first of its kind in the U.S. Several issuers are still awaiting approval for a spot SOL ETF which would likely also include staking capabilities.

Uncategorized

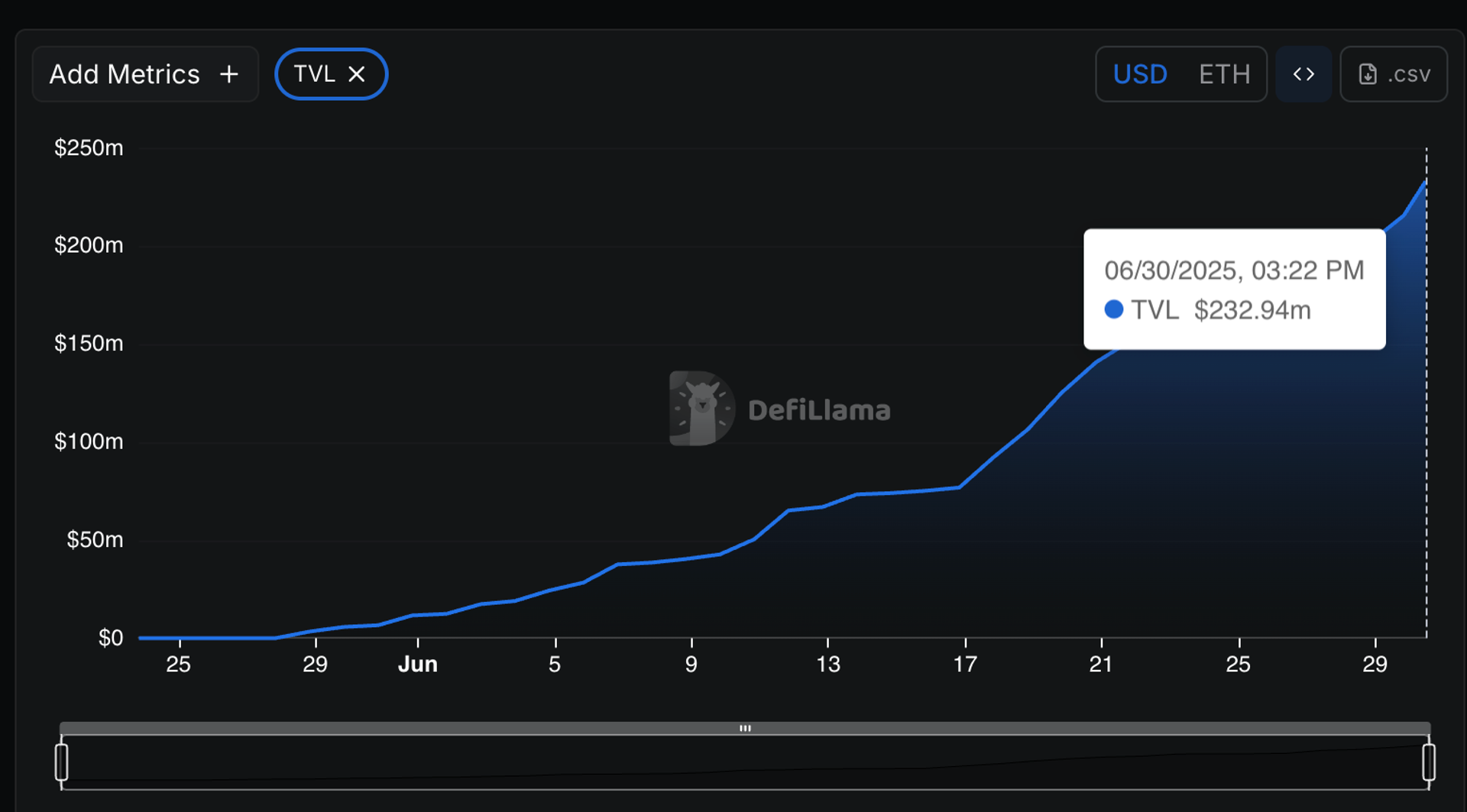

Katana Mainnet Goes Live as Pre-Deposits Hit $232M

Self described ‘DeFi-first’ layer-2 blockchain Katana has launched its mainnet after receiving $232 million in pre-deposits.

Deposits flooded in after Katana was revealed to the public less than a month ago. DefiLlama data shows that deposited jumped from $75M to $2320M between June 1 and June 30.

Depositors will receive randomized reward NFTs called Krates, as well as a share of 70 million KAT tokens, Katana’s native token. Upon launch, yield farmers will be able earn more KAT by staking on platforms like Morpho and Sushi.

The blockchain aims to solve one of DeFi’s largest problems: Liquidity.

A lack of liquidity can lead to a multitude of issues including slippage, inefficient pricing and unsustainable yields.

Some of the mechanisms Katana will use to solve that the issues is VaultBridge, which is a product that enables yield generation on deposited assets on Ethereum, as well as chain-owned liquidity (CoL), which allows Katana to retain 100% of net sequencer fees and convert them into liquidity reserves.

«Katana represents the endgame for how blockchains create value in DeFi,» Marc Boiron, co-contributor of Katana said in a press release.

The launch coincides with yield farming incentives including token rewards for liquidity providers on Morpho and Sushi.

Despite being based on Ethereum, Katana is blockchain agnostic so users can generate a yield on blockchains like Solana through Katana’s collaboration with Jito, a liquid staking protocol.

UPDATE (June 30, 2025, 17:46 UTC): Updates to reflect new numbers in pre-deposits.

Uncategorized

Why Are There No Big DApps on Ethereum?

On July 30, 2025, we will be celebrating a decade since Ethereum launched on mainnet. Inarguably, one of the biggest milestones in this industry’s short life.

When it launched as the world’s first smart contract platform, this was obviously something entirely new and a completely new way of thinking about software. Instead of renting access to someone else’s platform that could change the rules or lock you out at any moment, one could – in theory – now participate in systems that belonged to everyone and no one, where the rules were written in code and couldn’t be arbitrarily changed by a CEO’s whim. Users would own their date, and software would be maintained and managed by a network rather than a boardroom. The consequences seemed pretty utopian.

However, nearly ten years on from Ethereum’s launch and the dreams of a Web3 version of Amazon, eBay, Facebook or TikTok haven’t arrived, and are nowhere on the horizon.

Gavin Wood, Ethereum co-founder, and his vision of “Web3” envisaged exactly that. Joe Lubin, the renowned founder of Consensys, said that “Ethereum will have that same pervasive influence on our communications and our entire information infrastructure.»

The libertarian journalist Jim Epstein predicted a year after Ethereum’s launch that “the same types of services offered by companies like Facebook, Google, eBay, and Amazon will be provided instead by computers distributed around the globe.”

Vitalik Buterin himself envisaged Ethereum “law, cloud storage, prediction markets, trading decentralized hosting, [hosting] your own currency,” in his 2014 Bitcoin Miami speech, where he announced Ethereum to the world. “Perhaps even Skynet,” the fictional artificial neural network from the Terminator films. He has described the platform he created as both a threat and an opportunity to platforms like Facebook and Twitter back in 2021.

The Scale Problem

The barrier to achieving this vision is scale. The most successful consumer applications today serve hundreds of millions of users. Instagram processes more than 1 billion photo uploads daily. eBay handles roughly 17 billion dollars in transactions each quarter. Facebook’s messaging platforms process trillions of messages annually.

Ethereum processes about 14 transactions per second, and Solana can handle over 1000. Instagram handles over 1 billion photo uploads daily. eBay processes 17 billion dollars in transactions quarterly. The math doesn’t work.

Let’s entertain the decentralized eBay example for a moment. A truly decentralized eBay would demand far more than simple payments. Every listing creation or update would require onchain transactions for item metadata, pricing, and condition details. Auctions would need automatic bidding resolution with time-locked smart contracts. Escrow systems would have to hold funds until delivery confirmation, with DAO arbitration for disputes.

User reputation systems would require immutable rating storage tied to wallet addresses. Inventory management would need real-time stock tracking, possibly through tokenized goods. Shipping confirmations would demand oracle integration for delivery proofs. Marketplace fees and tax royalties would need smart contract enforcement. Optional identity verification systems would require decentralized credential management. Each interaction would multiply the transaction load exponentially beyond what current infrastructure could support.

It goes without saying that this would require a blockchain of unprecedented speed and throughput. Frankly, a decade after Ethereum, the infrastructure just hasn’t been there to support it.

The Economics Don’t Work

The business model hasn’t always made sense either. Modern applications need massive scale to generate revenue that covers development costs. Furthermore, layer 2 solutions fragment users across platforms, where (for example) Arbitrum users can’t directly interact with Polygon applications. This defeats the purpose of building unified global computing.

This isn’t theoretical. OpenSea struggled with profitability despite dominating NFT trading with high-value transactions & fee-tolerant users. If you can’t profit from selling digital art to crypto enthusiasts paying hundreds in fees, how do you build a marketplace for used goods? The economics are even worse for lower-value transactions that define mainstream commerce. A decentralized social network charging $5 per post would be dead on arrival.

Gaming applications that require a few dollars in transaction fees for every item trade won’t attract players who expect the same for free elsewhere. So far, the only viable on-chain businesses have been those that can extract massive value from relatively few users – essentially high-stakes financial applications and speculative trading.

The Calvary Is Coming

The industry accepted a false tradeoff: security and decentralization, or functionality and scale, but not both. But transaction throughput has steadily increased (and will continue to) across networks as the technology matures. We can now achieve massive scale even with proof of work chains, maintaining the security and decentralization that made blockchain revolutionary in the first place (rather than the premature embrace of proof of stake that compromised these principles).

Zero-knowledge proofs allow users to prove transaction validity locally, submitting only small cryptographic proofs that are aggregated recursively and in parallel by a network of provers. Networks can process millions of transactions without every node verifying each one individually. When users prove their own transactions, the marginal cost of adding an additional transaction approaches zero, and blockchains can finally support the economics that mainstream applications require.

But ten years on, it’s clear that the vision once laid out by the futurists of Web3 has moved at a disappointing pace. Let’s hope the next decade moves a little faster – and, fingers crossed – our blockchains too.

-

Business9 месяцев ago

Business9 месяцев ago3 Ways to make your business presentation more relatable

-

Entertainment9 месяцев ago

Entertainment9 месяцев ago10 Artists who retired from music and made a comeback

-

Fashion9 месяцев ago

Fashion9 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment9 месяцев ago

Entertainment9 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Business9 месяцев ago

Business9 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment9 месяцев ago

Entertainment9 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Entertainment9 месяцев ago

Entertainment9 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Tech9 месяцев ago

Tech9 месяцев ago5 Crowdfunded products that actually delivered on the hype