Uncategorized

Did Crypto Cash Break the U.S. Elections?

This is the second in a series of stories examining the crypto industry’s high-stakes 2024 foray into politics and campaigning. The first explored the <a href=»https://www.coindesk.com/news-analysis/2024/12/02/crypto-cash-fueled-53-members-of-the-next-u-s-congress» target=»_blank»>electoral track record</a> of Fairshake PAC’s strategy.

While politicians battled each other across the 2024 U.S. electoral map, the crypto industry ran an unprecedented test of a 14-year-old Supreme Court decision that had dynamited a new tunnel into politics for corporate cash.

Thanks to a 2010 high-court case, a company can spend as much as it likes to bolster political allies and destroy enemies. It’s constitutionally protected speech, and crypto businesses spoke loudly this year.

Seeing business interests influencing U.S. politics is nothing new, but there was something different about crypto’s Fairshake political action committee and the $169 million it ultimately gathered. The organization chose not to bother with the niceties sometimes seen from mega-industries coating their policy agendas in pro-American, economy-boosting rhetoric. The Fairshake super PAC and its affiliated PACs didn’t sugar-coat their aim: Getting as many crypto allies as possible on Capitol Hill, so they can write a crypto-friendly U.S. rulebook.

Three big crypto business names — Coinbase Inc. (COIN), Ripple Labs and Andreessen Horowitz (a16z) — came together and moved enormous sums into the coffers of the campaign-finance operation. The PACs began to heap million after million into congressional districts across the country in 2024, overwhelming many contests during the primaries. The flow of money was transparent, even if the people and strategies deploying it were not.

And it was all possible because of <a href=»https://www.scotusblog.com/case-files/cases/citizens-united-v-federal-election-commission/» target=»_blank»>the Supreme Court’s 2010 decision</a> commonly known as Citizens United, which along with a related cluster of cases has allowed corporations to purchase an unlimited amount of independent advertising for political campaigns. The PACs plowed $10 million into an effort to derail Representative Katie Porter’s bid to be a senator in California, nudging the Democrat out during the primary there and avoiding the ascension of a politician they feared would join Senator Elizabeth Warren’s crusade against crypto interests. The groups spent about $40 million in Ohio on the successful aim to oust Democratic Senator Sherrod Brown, who stood in the industry’s way as the chair of the Senate Banking Committee. But in many other places, it supported Democrat candidates, as long as they were also pro-crypto.

In the end, the industry backed seven winning senators and 46 members of next year’s House of Representatives. That amounted to 91% of candidates the industry spent significant funds on.

«We’re quite proud of the political effort that we put in motion,» said Faryar Shirzad, Coinbase’s chief policy officer who was once a former Goldman Sachs Group Inc. executive and a White House official. He told CoinDesk that the tens of millions in the U.S. who own crypto have been «targeted, mercilessly, by unelected bureaucrats, and the fact that the community has stood up for itself is a hallmark of what democratic processes are supposed to be about.»

Implications for democracy

The performance from the Fairshake political action committee may now offer a model for how niche business interests can round up their own swath of Congress. For some, that’s a bad sign for U.S. democracy.

«The results probably look awesome to someone who only cares about the success of the crypto sector,» said Rick Claypool, the research director at Public Citizen who has examined the sector’s election spending, but he said it may come at the cost of the voters’ larger interests getting shoved aside. «Lawmakers will be thinking about the super PAC cash, sort of pointed at them like a loaded gun when it comes to crypto.»

«It underlines the degree to which — as a result of Citizens United — this unlimited corporate spending poses a serious threat to democracy,» he said.

The high court’s controversial call on corporations in politics amplified what has long been a feature of how most U.S. politicians fund the expensive campaigns that win them office (or keep them there). Those who avoid corporate-tied money tend to be the rare exception. And in this category of campaign finance, the PACs aren’t even allowed to coordinate with the candidates, giving politicians a distance. The candidates can say they have no control over outsiders spending millions on their behalf.

Citizen United was about the fairness of giving businesses an unhindered voice in the public discourse. Follow that road to its logical end, the critics say, and you potentially have a voice so booming that it drowns out others, which is why groups such as Claypool’s Public Citizen have been shouting for a constitutional amendment to reverse the court’s ruling.

Even the most jaded campaign-finance experts will often argue that it’s impossible to accurately assess how dollars translate to votes. But if one is wondering whether money can steer a race, consider this fierce House primary in Arizona. In the 3rd Congressional District there, where the winner would almost certainly go on to win the general election in a Democrat-dominated region, two Democrats battled it out.

On one side was Raquel Terán, a progressive former state senator and chair of the Arizona Democratic Party who was supported by Elizabeth Warren. On the other was Yassamin Ansari, a former vice mayor in Phoenix who began touting crypto issues <a href=»https://www.coindesk.com/policy/2024/08/05/crypto-candidate-in-arizona-is-winning-so-far-despite-sen-warrens-headwinds» target=»_blank»>during her campaign</a>. Terán took in about $1.4 million in direct donations against Ansari’s $2.8 million, but the race remained closely matched.

Terán also netted about $1.9 million in outside support, which could have outmatched Ansari. But Ansari had friends in crypto, who provided $1.4 million in crypto cash to bring her outside ad spending to about $2.1 million. Even after that, the primary results gave Ansari only a 42-vote victory.

Almost all of that crypto cash came from the trio of companies that amassed a fortune, the kind of money that could have bought a village of 331 median U.S. homes or a fleet of 676 Lamborghini Huracáns. Coinbase CEO Brian Armstrong, Ripple CEO Brad Garlinghouse and the two leaders of a16z, Marc Andreessen and Ben Horowitz, chose to go all-in on the elections this year as the final answer to what so far hadn’t been working in Washington.

«I think we had a unique strength that made us successful,» Coinbase’s Shirzad said. «We were on the right side of the arguments.»

He contended that the digital assets sector’s success was rooted in an argument that resonated with Americans.

«They understood, at a moment when Washington is struggling with how to bring semiconductors and 5G technology back to the United States, how insane it would be to allow digital asset technology to go to China and not come back,» he said.

However, the super PACs his company backed weren’t making that case in the actual races they jumped into. With no pretense, Fairshake spent whatever it took to find the most politically expedient path toward friendly U.S. crypto policy. The PACs didn’t bother trying to bring people around to support crypto. The PACS instead bought ads to make whatever argument was most likely to help candidates win, <a href=»https://www.coindesk.com/policy/2024/06/26/crypto-giants-notch-wins-in-expensive-quest-to-sway-us-politics-without-mentioning-crypto» target=»_blank»>without mention of digital assets</a>. Their ads <a href=»https://www.youtube.com/watch?v=q7JItb5xCjA» target=»_blank»>touted candidates’ Democratic ideals</a> in some districts and stood up for <a href=»https://www.youtube.com/watch?v=PMjhP5IyCpg» target=»_blank»>Republican beliefs in others</a>.

«The industry certainly seems to have topped the charts this cycle, and I think in some ways, if there’s a precedent set, it’s the sort of nakedly transactional dynamic of it,» said Mark Hays, a senior policy analyst at Americans for Financial Reform, who has also worked on campaign finance issues. He wonders, too, about the philosophical questions the PACs may pose for crypto’s believers.

«You’re invested in an industry movement that claims it’s all about democratizing finance and making things fair and better for people, but the industry has basically perfected the same old pay-to-play politics,» he said. «Is it okay as long as you know your wallet is getting bigger?»

Once Fairshake located its crypto-fan candidates, it spent campaign-shattering levels of money that their opponents’ organic fundraising couldn’t compete with. If the opponent raised half a million in $20 donations from local constituents, Fairshake opened the fire hose to drown that candidate in a million dollars worth of ads.

Even in a district like Republican Riley Moore’s in West Virginia, where his $1.4 million campaign coffers easily outpaced his nearest GOP rival, Fairshake dropped in to make sure he’d come away with it, devoting an additional $726,000 to his primary win. Last month, he beat his Democratic opponent with 71% of the vote and is among the crypto-supporting newcomers to Congress next year.

«The public and elected officials and industry groups have full transparency in terms of what this industry is doing and investing in,» said Josh Vlasto, Fairshake’s spokesman, in an interview. The transparency, however, hasn’t extended to discussions about how the companies set up the political shop and how they’ve directed it.

One of the most telling statistics, Vlasto said, was that in cases in which Fairshake’s candidates were criticized by their political opponents for taking crypto money, the opponents all lost. «It was something that the public was not only comfortable with, but they continued to support the chosen candidates,» he said.

Money in politics

Still, this is about a large amount of money deployed by corporations to steer U.S. public policy. Consumer advocates like Hays believe a less demanding government oversight will mean bad industry behavior is likely to harm the same voters who put crypto candidates in office.

«Money in politics is corrosive,» he argued. «Politicians are less accountable to ordinary voters and more accountable to a wealthy set of donors.»

Health insurers, pharmaceutical giants, energy companies and Wall Street — to name a few sectors — have had a heavy hand in elections for generations. But even after Citizens United, they didn’t sprint into hyperdrive.

The crypto industry, compared with theirs, is a tiny sliver. While U.S. health insurers pulled in <a href=»https://content.naic.org/sites/default/files/topics-industry-snapshot-analysis-reports-2023-annual-report-health.pdf» target=»_blank»>almost $25 billion in profit</a> in 2023, digital assets businesses are quite a bit smaller. Coinbase earned <a href=»https://s27.q4cdn.com/397450999/files/doc_financials/2023/q4/Shareholder-Letter-Q4-2023.pdf» target=»_blank»>$95 million</a> in profit for 2023, for instance, and it still chose to devote some $74 million to the PAC.

Is there a lesson that smaller industries that commit to big political payouts can secure a significant number of friends in Congress? Is $139 million — the amount the PACs actually spent in this cycle — the going rate to buy congressional momentum?

Faryar and Vlasto said no, because it was about more than just money. «We were very effective, because we had the resources to execute a strategy that aligned with where the voters were,» Vlasto said.

But others see Fairshake’s success in these congressional elections providing a blueprint for others, a scenario in which we could see artificial-intelligence businesses or electric-car makers or timber harvesters scrape together $200 million to secure a policy.

«They have created a playbook that I think it would be foolish to think that other corporate sectors are going to not try to replicate,» Claypool said.

Uncategorized

Mike Novogratz’s Galaxy Digital Swaps $100M ETH for SOL, On-Chain Data Shows

Mike Novogratz’s Galaxy Digital has apparently swapped $100 million worth of ether (ETH) for solana’s SOL.

According to Wu Blockchain, on-chain data suggests that Galaxy has swapped out a considerable amount of its ETH holdings for SOL. Over the last two weeks, Galaxy has transferred 65,600 ETH – or about $105 million – to Binance and has withdrawn 752,240 SOL (approximately $98.37 million).

Galaxy may have made the move because ETH continues to be in «structural decline» according to a recent note from Standard Chartered, which slashed its year-end target price for the asset.

Data from an Arkham dashboard shows that the firm holds $87.9 million ETH versus $23.86 million SOL.

Galaxy did not immediately return a request for comment from CoinDesk.

Market data shows that in the last month, SOL is up 8% while ETH is down nearly 20%.

Standard Chartered estimated in its note that Base has cut $50 billion from its market cap, but also argued that tokenized real-world assets could help stabilize Ethereum.

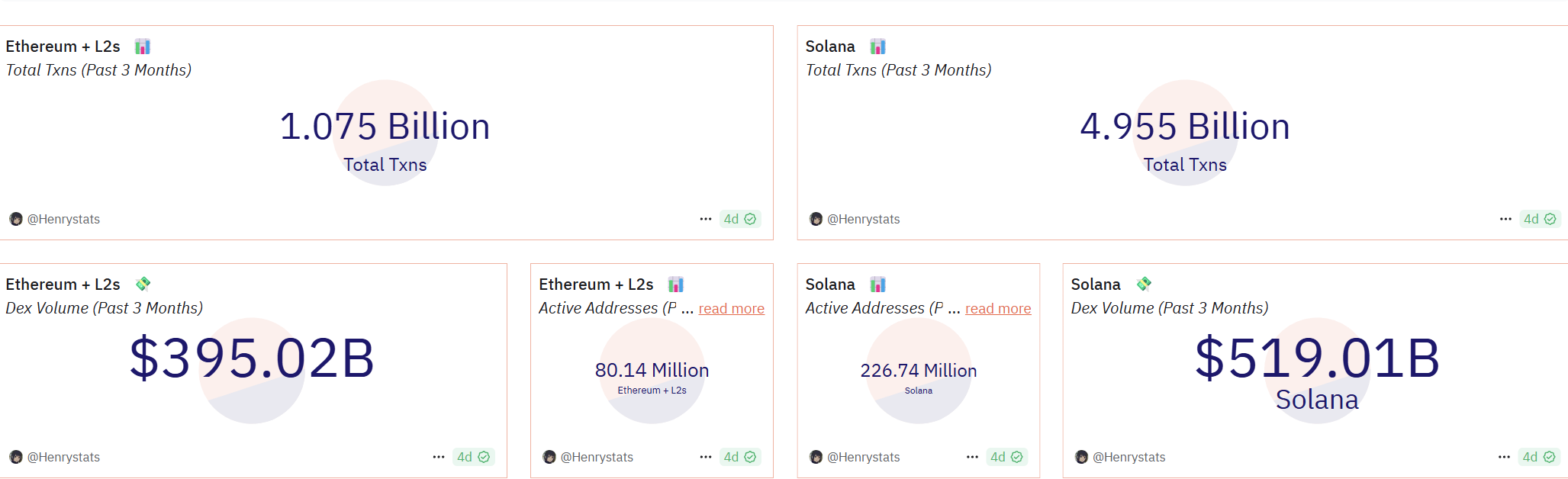

Many blockchain metrics would support Standard Chartered’s thesis, as transactions on Solana have rocketed past Ethereum in the last three months.

A Dune dashboard shows that decentralized exchange (DEX) volume on Solana has moved past $500 billion in the last three months, while DEX volume on Ethereum is less than $400 billion. Active addresses on Solana are over 220 million while Ethereum and Ethereum Layer-2 addresses are just over 80 million.

One idea, first proposed by Tron’s Justin Sun, to reverse this «structural decline» of Ethereum has been a tax on Layer-2s.

«All collected taxes will be used to repurchase ETH and burn it in a fully decentralized manner,» he wrote on X. This idea, however, hasn’t been formalized into an Ethereum Improvement Proposal (EIP) which would be the first step in it becoming reality.

Meanwhile, flow data from the Ether ETFs shows that investors moved nearly $600 million out of these listed products over the last two months.

Uncategorized

U.S. Derivatives Watchdog Weighs 24/7 Action With Crypto Oversight on Horizon

Bitcoin is the crypto sector’s top asset and is also universally defined by U.S. regulators and courts as a commodity, putting it under the jurisdiction of the Commodity Futures Trading Commission. That agency is now seeking public comments on whether it should open the wider world of derivatives to around-the-clock trading, as already executed for bitcoin and other digital assets.

Though the CFTC is expected to be established as a crypto market regulator in Congress’ ongoing effort to establish industry rules, the agency’s invitation for comments issued on Monday doesn’t explicitly discuss digital assets oversight. The request notes that «technological advancements and market demand» are pushing CFTC-regulated firms toward being able to handle transactions at all times.

“As I have long said, the CFTC must take a forward-looking approach to shifts in market structure to ensure our markets remain vibrant and resilient while protecting all participants,” said Acting Chairman Caroline Pham, in a statement. She was tapped by President Donald Trump to run the agency while it awaits the Senate confirmation of its chairman nominee, Brian Quintenz.

Trading without downtime presents a host of challenges for U.S. markets unaccustomed to it, according to the request, including «what governance frameworks, exchange staffing models and technologies would be necessary to ensure market integrity and operational resilience, as well as compliance with all core principles, under a continuous trading model.» Such an expansion would require firms to handle live maintenance and technology patches and human monitoring of the systems and markets during the extended hours, which are issues already long wrestled with by digital assets operations.

The CFTC would still need a change in law before it could have direct authority over actual spot-market trading of bitcoin and other tokens that aren’t eventually categorized as securities, which would get Securities and Exchange Commission oversight. If the agency is ultimately a major regulator of trading and of the platforms and firms that handle customers’ transactions, that’s a space in which 24-hour, seven-days-a-week activity is already the model.

Uncategorized

Can Bitcoin Benefit From Trump Firing Powell? Turkey’s Lira Crisis May Provide Clues

The week has begun on an interesting note, with the U.S. dollar crashing to three-year lows alongside losses on Wall Street, yet bitcoin, which usually follows the sentiment on Wall Street, stands tall.

This could just be the beginning.

The shift away from the USD and toward seizure and censorship-resistant assets like BTC and stablecoins could accelerate if President Donald Trump follows through with his reported plans to fire Federal Reserve Chairman Jerome Powell, which have pushed the DXY and U.S. stock markets lower today.

That’s the lesson from Turkey, which has seen its currency, the lira (TRY), collapse over the years mainly due to President Recep Tayyip Erdogan’s repeated interference in the central bank’s operations. The sliding lira has triggered a capital flight into BTC and stablecoins since at least 2020-21.

Trump’s issues with the Fed

Trump has feuded publicly with the Federal Reserve and its chairman, Jerome Powell, for years, criticizing Powell for being too late on rate cuts even during his first term when interest rates were way lower than today.

However, Trump’s criticism has recently reached a fever pitch with reports suggesting he is looking for ways to get rid of Powell, who recently warned of stagflation even as the President reiterated calls for lower borrowing costs while suggesting there is no inflation.

Powell’s patient approach follows a trade war-led spike in survey-based measures of inflation expectations, which could always become self-fulfilling.

Still, on Monday, Trump went further, calling Powell a «major loser» and warning that the economy could slow down unless interest rates are immediately lowered.

Lesson From Turkey

Erdogan began interfering in the central bank’s operations in 2019, and since then, the lira has collapsed sevenfold from 5.3 per dollar to 38 per dollar.

It all started with Turkey’s inflation rate reaching double digits in 2017. It remained elevated in the subsequent year, which prompted the country’s central bank to increase the one-week repo rate from 17.5% to 24% in September 2018.

The move likely didn’t go well with Erodgan, who issued the first decree dismissing Central Bank of Turkey (CBT) governor Murat Cetinkaya in July 2019. From then on until the end of 2021, Erdogan issued multiple decrees dismissing and hiring several CBT officials. Amid all this, inflation remained elevated, and the lira continued to depreciate at an alarming rate.

«We certainly don’t believe in high interest rates. We will pull down inflation and exchange rates with low-rate policy … High rates make the rich richer, the poor poorer. We won’t let that happen,» Erdogan said in 2021.

As of 2025, Turkey faces an inflation rate of nearly 40%, according to data source TradingEconomics.

This episode serves as a cautionary tale for Trump, highlighting that tampering with central bank independence — especially in the face of looming inflation — can erode investor confidence and send the domestic currency into a tailspin.

This does not necessarily mean that the USD will crash exactly like lira but may see significant devaluation.

Perhaps it could prove even more destabilizing for global markets, considering the dollar is a global reserve currency, and the U.S. Treasury market is the bedrock for international finance.

If better sense fails to prevail, U.S. investors may feel incentivized to move away from U.S. assets and into BTC and other alternative investments, just as Turks did.

-

Fashion6 месяцев ago

Fashion6 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment6 месяцев ago

Entertainment6 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion6 месяцев ago

Fashion6 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment6 месяцев ago

Entertainment6 месяцев agoThe old and New Edition cast comes together to perform

-

Sports6 месяцев ago

Sports6 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Business6 месяцев ago

Business6 месяцев agoUber and Lyft are finally available in all of New York State

-

Entertainment6 месяцев ago

Entertainment6 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports6 месяцев ago

Sports6 месяцев agoSteph Curry finally got the contract he deserves from the Warriors