Uncategorized

Michael Saylor’s MicroStrategy Makes Mammoth BTC Purchase, Adding 55,500 Tokens for $5.4B

Bitcoin Development Company MicroStrategy (MSTR) added 55,500 of the largest cryptocurrency for $5.4 billion, bringing its holdings to 386.700 BTC worth nearly $38 billion.

The company paid an average $97,862 per bitcoin in thjs latest purchase, according to a statement Monday morning, and the buys took place over the six days ended yesterday. Overall, its 386,700 bitcoin were acquired for $21.9 billion, or an average price of $56,761. BTC was trading around $97,500 at the time of publication.

The company, which adopted the bitcoin-purchase strategy in 2020, has been in the spotlight in recent weeks due to its continuing large BTC acquisitions a run-up in its share price. A 515% increase this year briefly took it into the top 100 largest U.S. publicly traded companies by market cap.

This purchase comes after MicroStrategy’s last week completed its latest sale of convertible debt, raising $3 billion on the note due 2029 with a 0% coupon and a 55% conversion premium. The conversion premium equates to a share price of about $672.40. The shares are higher are by 3.3% premarket to $436.

The Nasdaq 100 is approaching its annual reranking, the announcement takes place on Dec. 13, with the rebalancing occurring after market close on Dec. 20. MicroStrategy is waiting in the wings to find out if it has been included in the index.

Uncategorized

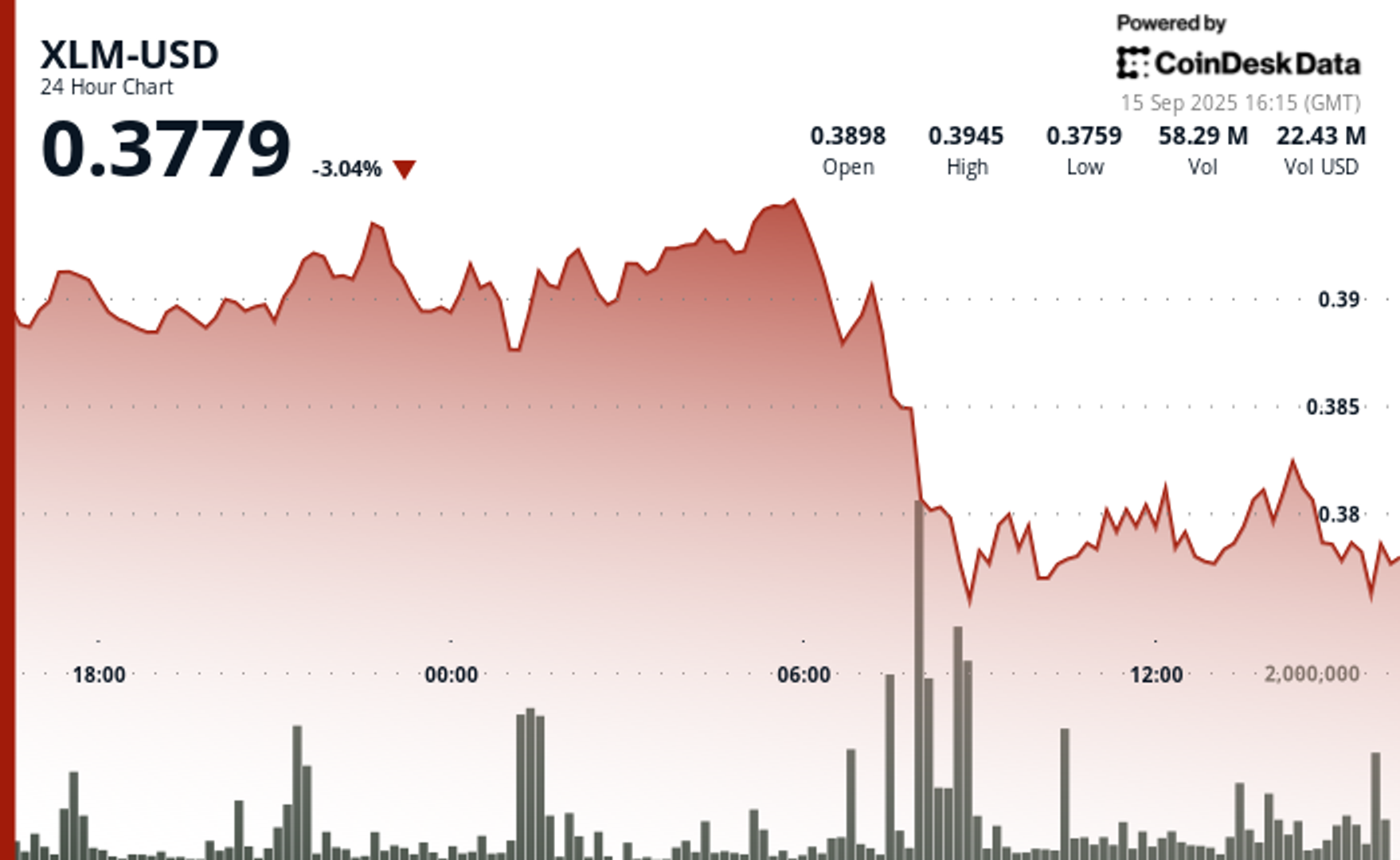

XLM Sees Heavy Volatility as Institutional Selling Weighs on Price

Stellar’s XLM token endured sharp swings over the past 24 hours, tumbling 3% as institutional selling pressure dominated order books. The asset declined from $0.39 to $0.38 between September 14 at 15:00 and September 15 at 14:00, with trading volumes peaking at 101.32 million—nearly triple its 24-hour average. The heaviest liquidation struck during the morning hours of September 15, when XLM collapsed from $0.395 to $0.376 within two hours, establishing $0.395 as firm resistance while tentative support formed near $0.375.

Despite the broader downtrend, intraday action highlighted moments of resilience. From 13:15 to 14:14 on September 15, XLM staged a brief recovery, jumping from $0.378 to a session high of $0.383 before closing the hour at $0.380. Trading volume surged above 10 million units during this window, with 3.45 million changing hands in a single minute as bulls attempted to push past resistance. While sellers capped momentum, the consolidation zone around $0.380–$0.381 now represents a potential support base.

Market dynamics suggest distribution patterns consistent with institutional profit-taking. The persistent supply overhead has reinforced resistance at $0.395, where repeated rally attempts have failed, while the emergence of support near $0.375 reflects opportunistic buying during liquidation waves. For traders, the $0.375–$0.395 band has become the key battleground that will define near-term direction.

Technical Indicators

- XLM retreated 3% from $0.39 to $0.38 during the previous 24-hours from 14 September 15:00 to 15 September 14:00.

- Trading volume peaked at 101.32 million during the 08:00 hour, nearly triple the 24-hour average of 24.47 million.

- Strong resistance established around $0.395 level during morning selloff.

- Key support emerged near $0.375 where buying interest materialized.

- Price range of $0.019 representing 5% volatility between peak and trough.

- Recovery attempts reached $0.383 by 13:00 before encountering selling pressure.

- Consolidation pattern formed around $0.380-$0.381 zone suggesting new support level.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Uncategorized

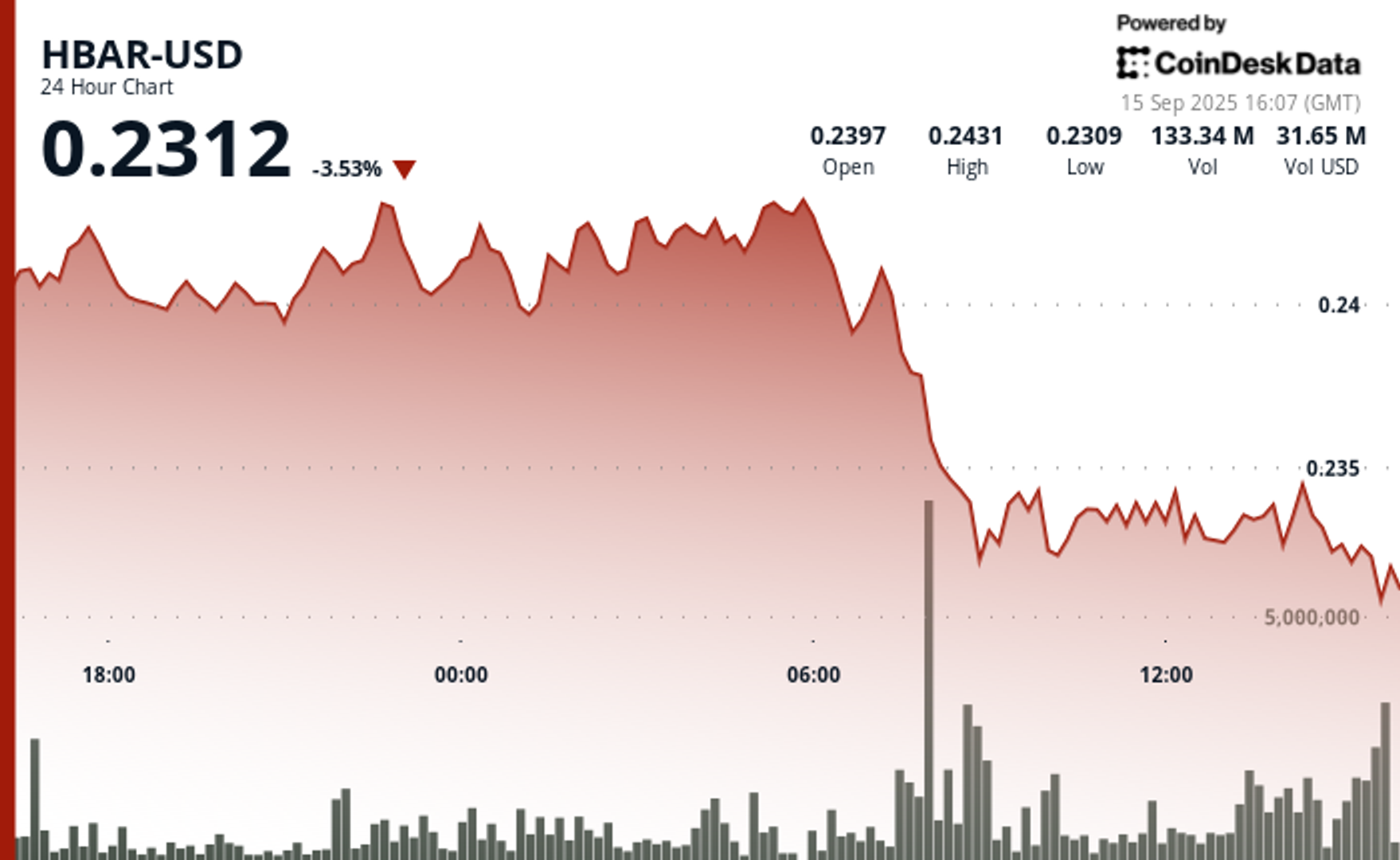

HBAR Tumbles 5% as Institutional Investors Trigger Mass Selloff

Hedera Hashgraph’s HBAR token endured steep losses over a volatile 24-hour window between September 14 and 15, falling 5% from $0.24 to $0.23. The token’s trading range expanded by $0.01 — a move often linked to outsized institutional activity — as heavy corporate selling overwhelmed support levels. The sharpest move came between 07:00 and 08:00 UTC on September 15, when concentrated liquidation drove prices lower after days of resistance around $0.24.

Institutional trading volumes surged during the session, with more than 126 million tokens changing hands on the morning of September 15 — nearly three times the norm for corporate flows. Market participants attributed the spike to portfolio rebalancing by large stakeholders, with enterprise adoption jitters and mounting regulatory scrutiny providing the backdrop for the selloff.

Recovery efforts briefly emerged during the final hour of trading, when corporate buyers tested the $0.24 level before retreating. Between 13:32 and 13:35 UTC, one accumulation push saw 2.47 million tokens deployed in an effort to establish a price floor. Still, buying momentum ultimately faltered, with HBAR settling back into support at $0.23.

The turbulence underscores the token’s vulnerability to institutional distribution events. Analysts point to the failed breakout above $0.24 as confirmation of fresh resistance, with $0.23 now serving as the critical support zone. The surge in volume suggests major corporate participants are repositioning ahead of regulatory shifts, leaving HBAR’s near-term outlook dependent on whether enterprise buyers can mount sustained defenses above key support.

Technical Indicators Summary

- Corporate resistance levels crystallized at $0.24 where institutional selling pressure consistently overwhelmed enterprise buying interest across multiple trading sessions.

- Institutional support structures emerged around $0.23 levels where corporate buying programs have systematically absorbed selling pressure from retail and smaller institutional participants.

- The unprecedented trading volume surge to 126.38 million tokens during the 08:00 morning session reflects enterprise-scale distribution strategies that overwhelmed corporate demand across major trading platforms.

- Subsequent institutional momentum proved unsustainable as systematic selling pressure resumed between 13:37-13:44, driving corporate participants back toward $0.23 support zones with sustained volumes exceeding 1 million tokens, indicating ongoing institutional distribution.

- Final trading periods exhibited diminishing corporate activity with zero recorded volume between 13:13-14:14, suggesting institutional participants adopted defensive positioning strategies as HBAR consolidated at $0.23 amid enterprise uncertainty.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Uncategorized

Dogecoin Inches Closer to Wall Street With First Meme Coin ETF

The first exchange-traded fund (ETF) built around a meme coin could hit the market this week, after multiple delays and much speculation.

The DOGE ETF — formally called the Rex Shares-Osprey Dogecoin ETF (DOJE) — was originally slated to debut last week, alongside a handful of politically themed and crypto-related ETFs. Those included funds tied to Bonk (BONK), XRP, Bitcoin (BTC) and even a Trump-themed fund. But DOJE’s debut never materialized.

Now, Bloomberg ETF analysts Eric Balchunas and James Seyffart believe Wednesday is the most likely launch date, though they caution nothing is certain.

“It’s more likely than not,” Seyffart said. “That seems like the base case.”

Ahead of the introduction of the ETF, DOGE has been among the top performers over the past month, ahead 15% even including a decline of 3.5% over the past 24 horus.

If launched, DOJE would mark a milestone as the first U.S. ETF to focus on a meme coin — cryptocurrencies that generally lack utility or a clear economic purpose. These include tokens like Dogecoin, Shiba Inu (SHIB) and Bonk, which often surge in popularity thanks to internet culture, celebrity endorsements and speculative trading.

Balchunas described DOJE’s significance in a post on X: “First-ever US ETF to hold something that has no utility on purpose.”

DOJE is not a spot ETF. That means it won’t hold DOGE directly. Instead, the fund will use a Cayman Islands-based subsidiary to gain exposure through futures and other derivatives. This approach sidesteps the need for physical custody of the coin while still offering traders a way to bet on its performance within a traditional brokerage account.

The ETF was approved earlier this month under the Investment Company Act of 1940, which is typically used for mutual funds and diversified ETFs. That sets it apart from the wave of bitcoin ETFs that received green lights under the Securities Act of 1933, a framework used for commodity-based and asset-backed products. In short, DOJE is structured more like a mutual fund than a commodity trust.

More direct exposure may be coming soon. Several firms have filed applications to launch spot DOGE ETFs, which would hold the meme coin itself rather than derivatives. These applications are still under review by the U.S. Securities and Exchange Commission (SEC), which has grown more comfortable with crypto ETFs since approving a slate of bitcoin products in early 2024.

The broader crypto market has shown that investor demand can outweigh fundamental critiques. Meme coins have long drawn skepticism for having no underlying value or use case, but that hasn’t kept them from drawing billions in speculative capital.

Seyffart said the ETF market is likely to follow the same path. “There’s going to be a bunch of products like this, whether you love it or need it, they’re going to be coming to market,” he said.

He added that many existing financial products serve no deeper purpose than providing a vehicle for short-term bets. “There’s plenty of products out there that are just being used as gambling or short-term trading,” he said. “So if there’s an audience for this in the crypto world, I wouldn’t be surprised at all if this finds an audience in the ETF and TradFi world.”

Whether the DOJE ETF opens the door to more meme coin funds — or just proves the concept is viable — may depend on how the market responds this week. Either way, it signals a new phase in the merging of internet culture and traditional finance.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars