Business

BitMEX Co-founder Arthur Hayes Dumps HYPE for a Ferrari, Then Tells Followers Not to Worry

Arthur Hayes, the BitMEX co-founder who now runs crypto venture fund Maelstrom, sold his personal stash of Hyperliquid’s HYPE tokens just weeks after predicting the asset could rally 126-fold.

Ferrari jokes and blockchain receipts

Blockchain analytics service Lookonchain reported on Sunday that Hayes unloaded 96,628 HYPE — worth about $5.1 million — booking a profit of roughly $823,000, or 19%, in a month.

Not long after, Hayes confirmed the move with his trademark irreverence, posting on X: “Need to pay my deposit on the new Rari 849 Testarossa.” The comment fueled backlash from traders who accused him of pumping HYPE in August before quickly exiting.

Hayes pushed back on Monday, insisting the sale was tied to concerns laid out by his firm. “This is why we dumped $HYPE today. But don’t worry 126x is still possible 2028 is a long way off,” he wrote.

Maelstrom warns of $11.9B supply unlocks

Earlier today, Maelstrom published a lengthy X post outlining what it called HYPE’s “first true test.”

Starting Nov. 29, 237.8 million HYPE will begin vesting linearly over two years — unlocking nearly $500 million of tokens per month. At current prices of around $50, that represents $11.9 billion of supply entering circulation.

The post estimated Hyperliquid’s buyback program could only absorb about 17% of that flow, leaving a potential $410 million monthly overhang. “Has the market priced in the sheer scale of these unlocks?” Maelstrom asked.

Maelstrom framed the looming supply shock as natural for a fast-growing protocol but warned that large vested allocations may tempt early developers and insiders to sell. The firm also noted that even large decentralized autonomous treasury (DAT) deals, such as Sonnet’s $583 million HYPE raise, won’t offset the scale of the unlocks.

Still betting on a decentralized Binance

The remarks contrasted sharply with Hayes’s Aug. 27 blog post, where he called Hyperliquid a “decentralized Binance” and argued HYPE could climb 126x by 2028. That thesis relied on bold assumptions: a $10 trillion stablecoin market, Hyperliquid capturing a Binance-level trading share, and fee structures holding steady.

Despite selling his tokens, Hayes reiterated that long-term view on Monday, describing the upcoming unlock as a hurdle, not a death blow. In his words, “2028 is a long way off.”

Hyperliquid has surged to become a dominant player in decentralized perpetual futures, and its HYPE token remains central to governance, staking and fee distribution. Whether the market can digest nearly $12 billion in new supply may determine if Hayes’s forecast proves prescient — or overly ambitious.

Business

Crypto Exchange Ripio Reveals $100M Crypto Treasury, Second Largest in Latin America

The company’s holdings, which include bitcoin and ether, have been managed through trading and hedging strategies since 2017.

Business

Ray Dalio Still Owns Bitcoin, but Says Traceability and Quantum Threat Are Concerns

The billionaire founder of hedge fund Bridgewater believes Bitcoin faces major hurdles before it can become a global reserve currency.

Business

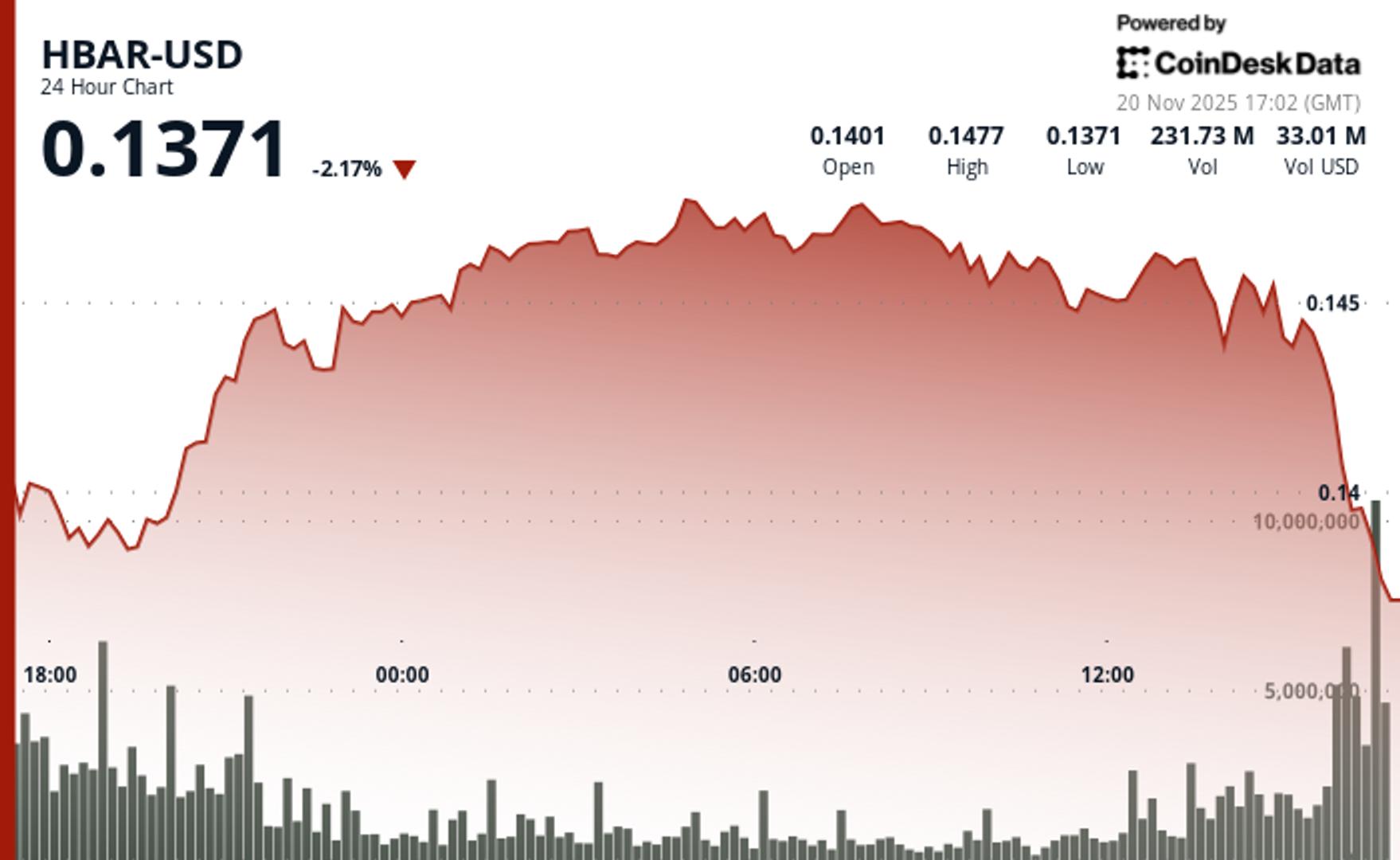

HBAR Faces Fresh Liquidity Alarms After Breakdown to $0.1373

Hedera’s token slipped below key support levels as a late-session trading halt, collapsing volume, and failed recovery attempts point to mounting structural and liquidity stress.

-

Uncategorized5 месяцев ago

Uncategorized5 месяцев agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts

-

Business1 год ago

Business1 год ago3 Ways to make your business presentation more relatable

-

Fashion1 год ago

Fashion1 год agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment1 год ago

Entertainment1 год ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment1 год ago

Entertainment1 год ago10 Artists who retired from music and made a comeback

-

Business1 год ago

Business1 год ago15 Habits that could be hurting your business relationships

-

Entertainment1 год ago

Entertainment1 год agoNew Season 8 Walking Dead trailer flashes forward in time

-

Entertainment1 год ago

Entertainment1 год agoMeet Superman\’s grandfather in new trailer for Krypton