Uncategorized

XRP Holds Above $2.82 After Sharp Decline, Technicals Point to $3.30 Breakout Test

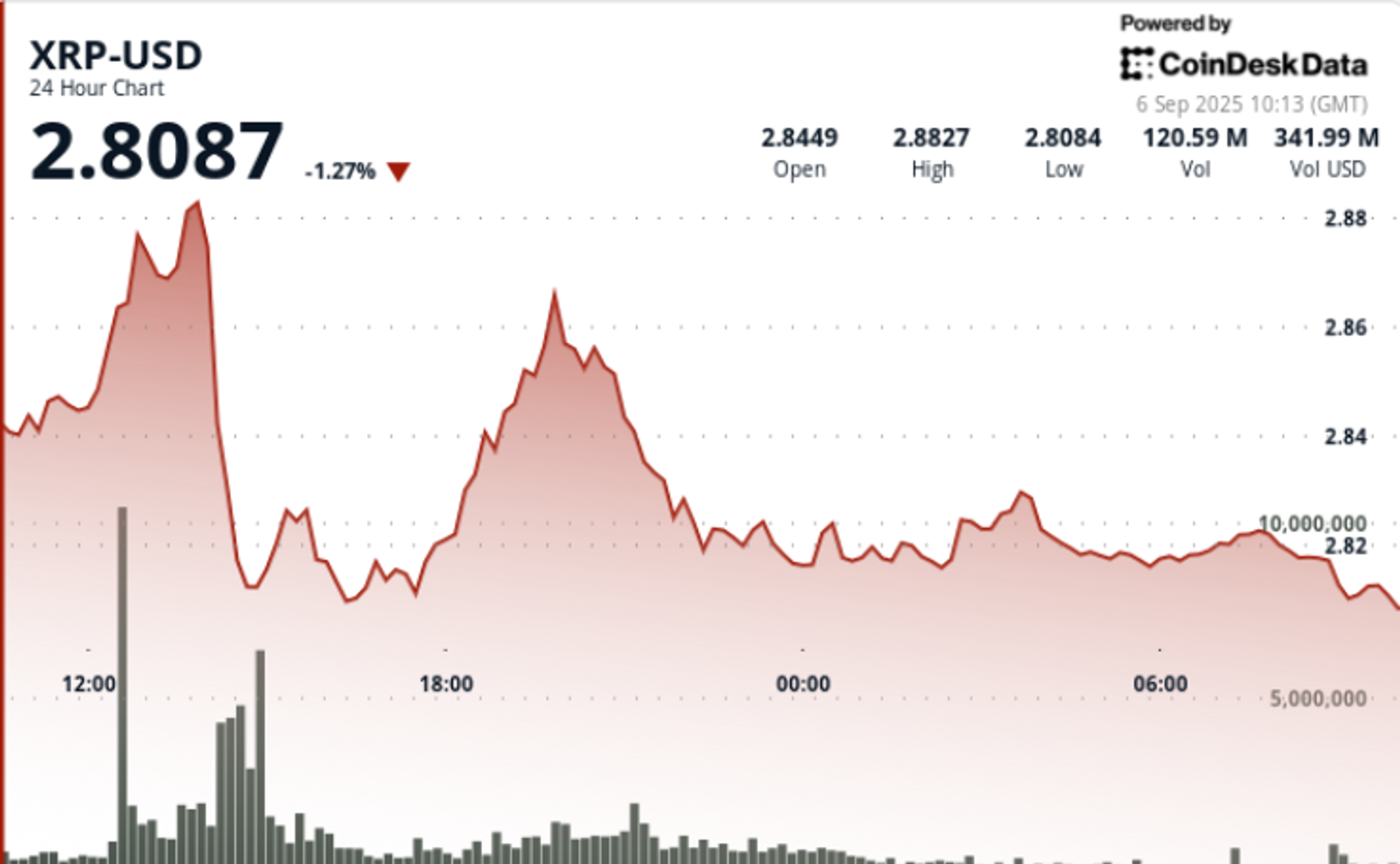

XRP failed to sustain momentum above $2.88–$2.89, triggering a 4% decline as institutional selling capped the advance. Heavy volume confirmed resistance at those levels, while buyers reappeared in the $2.81–$2.83 range to stabilize price action.

The move keeps XRP locked in a 47-day consolidation under $3.00, with traders now eyeing the $2.77 support pivot and October’s SEC ETF decisions as the next catalysts.

News Background

- Six institutional asset managers have filed spot XRP ETF applications, with SEC decisions expected in October.

- Whale accumulation continues, with roughly 340 million tokens purchased in recent weeks despite persistent volatility.

- Exchange balances remain elevated above 3.5 billion XRP, raising questions of potential supply pressure if selling resumes.

- Federal Reserve policy shifts and inflation prints are shaping broader liquidity conditions across risk assets.

- Previous attempts to break higher saw 227.7 million tokens trade near $2.88–$2.89, confirming that zone as firm resistance.

Price Action Summary

- XRP traded within a $0.08 range from $2.81 to $2.89, representing 3% volatility.

- The sharpest decline came at 14:00 on Sept 5, dropping from $2.88 to $2.81 on nearly 280 million tokens traded.

- Stabilization followed, with consolidation between $2.82 and $2.83 on lighter volume.

- Closing price near $2.82 kept XRP just above the $2.77 support pivot, viewed as the next key downside guardrail.

Technical Analysis

- Support: Strong bid zone identified at $2.77–$2.81 following repeated defenses.

- Resistance: Immediate ceiling at $2.88–$2.89, with $3.00 psychological level and $3.30 breakout threshold above.

- Indicators: RSI sits mid-50s, reflecting neutral-to-bullish bias.

- MACD histogram converges toward bullish crossover, signaling possible momentum shift if volume returns.

- Structure: Ongoing 47-day consolidation under $3.00, with a close above $3.30 opening potential path to $4.00+.

What Traders Are Watching

- Whether $2.77 holds as the decisive support level if selling resumes.

- Price behavior on retests of $2.88–$2.89 resistance, particularly if volume surpasses daily averages.

- How whale accumulation offsets elevated exchange balances, which suggest latent supply risk.

- October SEC decisions on spot XRP ETFs, viewed as a key institutional adoption catalyst.

- Macro drivers from Fed policy and inflation data releases that may influence flows across digital assets.

Uncategorized

Elon Musk vs. the regulators

Welcome back to TechCrunch Mobility, your hub for all things “future of transportation.”

Uncategorized

Nvidia’s AI empire: A look at its top startup investments

Over the last two years, Nvidia has used its ballooning fortunes to invest in over 100 AI startups. Here are the giant semiconductor’s largest investments.

Uncategorized

Dating app Cerca will show how Gen Z really dates at TechCrunch Disrupt 2025

Cerca is a dating app that sets users up with mutual friends.

-

Business12 месяцев ago

Business12 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion12 месяцев ago

Fashion12 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business12 месяцев ago

Business12 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Uncategorized4 месяца ago

Uncategorized4 месяца agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts