Uncategorized

Monero’s 51% Attack Problem: Inside Qubic’s Controversial Network Takeover

Monero, the leading privacy-focused cryptocurrency, is facing one of the most serious security challenges in its history.

Qubic, a project led by IOTA co-founder Sergey Ivancheglo, says it now controls more than 51% of the network’s hashrate. In blockchains secured by proof-of-work algorithms, that’s the same method used by Bitcoin, that level of control can allow an attacker to rewrite transaction history, block transactions or carry out double-spend attacks.

In a blog post, Quibic described the takeover as an «experiment» that was a «strategic, and at times combative, application of game theory.»

Developers, miners and security experts are now debating whether the network’s decentralization is as robust as many believed.

What is a 51% attack?

In a proof-of-work blockchain, miners compete to add new blocks of transactions to the chain. If one group controls more than half of the total computing power, they can outpace every other participant.

That level of control opens the door to a range of capabilities that can undermine confidence in the network. These include chain reorganizations, commonly abbreviated to «reorg,» which involves replacing previously confirmed blocks with new ones. It also covers double spends, meaning sending the same token twice,

Arguably the most impactful part of a 51% attack is censoring transactions —preventing some payments from being confirmed — which is particularly pertinent in the case of Monero given its focus on privacy

These attacks are not theoretical. Ethereum Classic was hit several times in 2020, costing millions. Bitcoin Gold faced similar incidents in 2018 and 2020. Smaller tokens like Verge have been targeted and destabilized.

Why Monero is still at risk

Monero uses the RandomX algorithm to discourage mining using application specific integrated circuits (ASICs), encouraging CPU mining instead. This design was meant to keep the network decentralized. That is why Qubic’s rapid rise is so significant. From less than 2% of Monero’s hashrate in May, it grew to more than 25% by late July, and now claims to have crossed the 51% threshold.

Qubic runs a “useful proof-of-work” system that turns Monero mining rewards into USDT, then uses those funds to buy and burn its own QUBIC tokens. The mechanism is unusual, combining a mining strategy with a token supply sink. And it has steadily increased Qubic’s control over Monero’s hashpower.

Ledger CTO Charles Guillemet said that «sustaining this attack is estimated to cost $75 million per day,» before adding that while it is potentially lucrative, «it threatens to destroy confidence in the network almost overnight. Other miners are left with no incentive to continue.»

BitMEX research added: «Qubic say the end goal is to takeover all the block rewards of Monero, which essentially means full and sustained selfish mining. It is not clear whether they can actually achieve that. If this can be achieved, the value of the coin may fall.»

It did. Monero’s XMR is currently trading at $252, down 6% over the past 24 hours to compound a 13.5% decline over the past seven days.

What does this mean for Monero?

In the blog post, Qubic said the takeover was not about breaking Monero, but about proving that economic incentives and a coordinated mining strategy can give a smaller protocol effective control over a much larger one.

The experiment, Qubic says, was to test whether mining resources could be profitably diverted from a target network into another protocol’s economic loop.

At its peak, Qubic claims its Monero mining was nearly three times more lucrative than traditional Monero mining. A restructuring of its reward system, approved by its community, boosted payouts to its validators and drew miners away from other Monero pools.

Qubic’s first push for majority control was met with sustained distributed denial-of-service (DDOS) attacks that disrupted peripheral services for over a week but failed to take down its core network.

Those DDOS attacks continued on Tuesday, Ivancheglo revealed on X, in what he decribes as «Monero Maxis returning the favor.»

Qubic claims it has so far stopped short of fully taking over consensus, citing concerns about the potential impact on XMR’s price.

Are other blockchains vulnerable to attack?

Bitcoin’s hashrate is so high that a 51% attack would be prohibitively expensive. But mid-tier proof-of-work coins are more vulnerable. The cost of gaining majority hashpower on Monero, Ethereum Classic or Bitcoin Gold is far lower.

Privacy-focused coins face an added challenge. Their censorship-resistant nature means that if one party controls the network, it undermines the very privacy they are designed to protect.

Uncategorized

London Stock Exchange Unveils Blockchain-Based Platform for Private Funds

The London Stock Exchange Group (LSEG) said it facilitated the first transaction on a new blockchain-based platform for private funds.

LSEG’s Digital Markets Infrastructure (DMI), built using Microsoft Azure, is designed to use blockchain technology across the full lifecycle of an asset, from issuance to settlement, with greater scale and efficiencies than existing systems, according to a Monday announcement.

Investment manager MembersCap and digital asset exchange Archax were onboarded as DMI’s first clients and conducted the first transaction, which raised money for MembersCap’s MCM Fund 1.

LSEG said it will ensure DMI works with current market services in blockchain technology as well as traditional finance (TradFi).

DMI and its first transaction are «significant milestones demonstrating the appetite for end-to-end, interoperable, regulated financial markets» blockchain technology, Dark Hajdukovic, LSEG’s head of digital markets infrastructure, said in the statement.

TradFi exchanges in numerous markets have been embedding blockchain technology into their platforms as a means of increasing efficiency and reducing costs. Last week, the Nasdaq filed a proposal with the U.S. Securities and Exchange Commission (SEC) to tokenize stocks on its exchange for trading on the blockchain with trades assigned the same priority as the legacy method.

Uncategorized

Bitcoin Cohorts Return to Net Selling as Market Continues to Consolidate

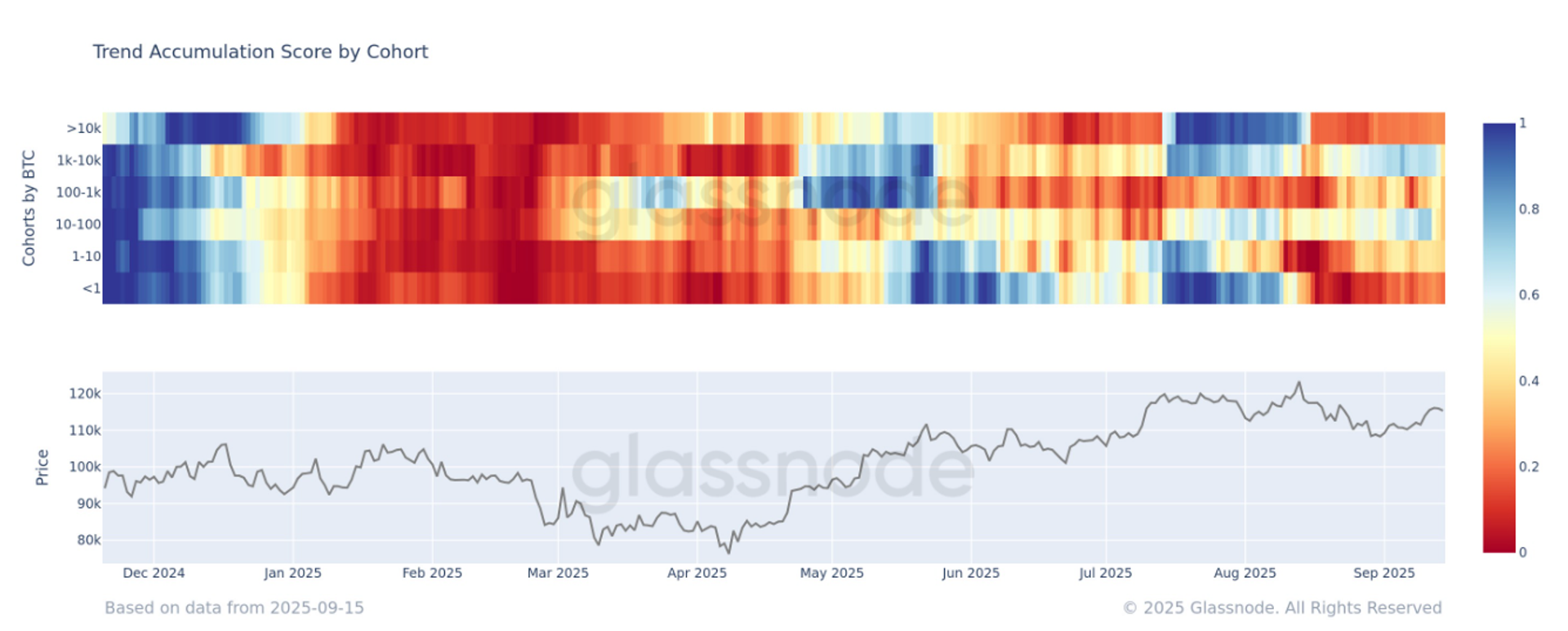

Glassnode data shows that all wallet cohorts have returned to distribution mode, with a net selling of bitcoin, according to the Accumulation Trend Score breakdown by wallet cohort.

This metric disaggregates the Accumulation Trend Score to show the relative behavior of different groups of wallet. It measures the strength of accumulation for each balance size based on both the entities’ size and the volume of coins acquired over the past 15 days. (For more details on the methodology, see this Academy entry.)

- A value closer to 1 signals accumulation by that cohort.

- A value closer to 0 signals distribution.

Exchanges, miners and other similar entities are excluded from the calculation.

Currently, all cohorts, from wallets holding less than one bitcoin to those holding more than 10,000, are net sellers. This follows last week’s rally, when some whales — most notably the 10-100 BTC and 1,000-10,000 BTC cohorts were buying. They have since flipped back to selling.

Bitcoin was recently hovering near $117,000 after Asia’s trading session pushed it up from $115,000 dollars over the weekend. Over the past three months, Asia has consistently driven bitcoin roughly 10 percent higher, according to Velo data. In contrast, the European trading session has been marked by pullbacks, which has been seen on Monday so far. In addition, bitcoin is down more than 10% in the EU market over the past three months.

Overall, the market remains in consolidation, a trend likely to persist through September. On current data, the $107,000 marked at the start of September still appears to be the most probable bottom.

Uncategorized

Memecoins Under Pressure as SHIB, Dogecoin Slide After Shibarium Loses $2.4M in Hack

Top meme tokens traded under pressure as a multimillion dollar hack of Shiba Inu’s layer-2 network, Shibarium, dented investor confidence in joke cryptocurrencies.

On Sunday, Shibarium fell victim to a flash loan attack on its validator system, which drained about $2.4 million in ether (ETH) and SHIB. The CoinDesk Memecoin Index has dropped 6.6% in the past 24 hours. The broader market CoinDesk 20 Index (CD20) is down just 2.3%.

The attacker borrowed 4.6 million BONE, the governance token for the Shiba Inu ecosystem, often linked to the decentralized exchange (DEX) ShibaSwap, through a flash loan to gain control of the majority of validator keys. The keys act as gatekeepers of the network, confirming transactions and ensuring security.

With that control, the attacker was able to game the system into approving unauthorized transactions and walk away with a large amount of crypto assets from the bridge that connects Shibarium with the Ethereum blockchain. The process is akin to someone temporarily taking over a bank’s security system to approve unauthorized withdrawals. A flash loan is a loan raised with no upfront collateral and returns the borrowed assets within the same blockchain transaction.

The Shiba inu team was able to prevent a bigger, more serious breach because the BONE tokens used to gain control were reportedly tied to validator 1 and remained locked by the staking rules.

Nevertheless, markets reacted negatively breach, which again underscores the perennial security issues with blockchain technology.

Memecoins drop, broader market bid

SHIB fell by the most in three weeks on Sunday (UTC), losing 4% $0.00001369, and has continued to weaken to trade recently at $0.00001359. The cryptocurrency experienced considerable volatility throughout the 23-hour trading window ended Sept. 15 at 02:00 UTC, with the aggregate range encompassing $0.000006191, a 4% oscillation from peak to trough.

The session commenced with pre-dawn fragility as SHIB retreated from $0.000014156 to establish a pivotal trough of $0.000013547 at 14:00 UTC. Volume of 1.064 trillion tokens surpassed the 24-hour mean, signaling robust distribution pressure and prospective capitulation, according to CoinDesk Research’s technical analysis model.

The BONE token, which initially doubled to over 36 cents, is now down over 2% on a 24-hour basis, trading at around 20 cents.

According to the technical analysis model:

- SHIB established a critical underpinning at $0.000013547 during elevated volume selling pressure exceeding 1.064 trillion tokens.

- The token constructed successive higher lows and consolidation parameters between $0.000013600-$0.000013780.

- Recovery momentum is demonstrated by ascending channel formations with sustained higher lows, indicating potential continuation towards the $0.000014000 resistance.

- Volume patterns exceeded 24-hour averages during the decline phase, confirming potential capitulation levels.

- Terminal hour trading exhibited decisive upward momentum with 1% appreciation, confirming a breach above the resistance threshold.

Large DOGE transfers add to bearish sentiment

Meanwhile, SHIB’s peer dogecoin (DOGE) fell 4% to 27.80 cents on Sunday and has since lost further 5% to 27.36 cents, according CoinDesk data.

A massive transfer of DOGE to a centralized exchange likely added to the bearish mood in the market. According to Whale Alert, crypto exchange OKX received 119,306,143 DOGE, worth over $34 million, from an unknown wallet. Such large transfers are typically associated with an intention to liquidate holdings.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars