Uncategorized

Coinbase Adds DEX Trading to U.S. Platform in Push Toward Becoming an ‘Everything App’

Coinbase (COIN) is rolling out decentralized exchange (DEX) trading inside its main app for customers across the U.S., with the exception of New York State, the company said Friday. The move is part of its broader ambition to turn the platform into an “everything app” for crypto.

The new feature will route trades on-chain through DEX aggregators such as 0x and 1inch, pulling liquidity from decentralized markets including Uniswap and Aerodrome, said Max Branzburg, Coinbase’s vice president of product. By integrating DEX trading, Coinbase is giving users the ability to interact directly with blockchain-based liquidity pools without moving funds off-platform.

At launch, traders will be able to discover and swap an expanding list of Base-native tokens. That roster includes assets from Virtuals AI Agents, Reserve Protocol’s decentralized tokenized funds (DTFs), Centrifuge’s real-world asset products, SoSo Value’s index tokens, as well as Auki Labs and Super Champs.

DEX trading appeals to some crypto users because it allows for self-custody and permissionless access. Instead of relying on a central exchange to match and settle orders, transactions are executed on the blockchain itself. For traders, this can mean access to a wider range of assets, faster listings for new tokens and, in some cases, lower fees. It also removes the need to trust an intermediary with holding funds — though it comes with its own risks, like exposure to smart contract bugs or volatile, thinly traded markets.

The update strengthens Coinbase’s position as a gateway to both centralized and decentralized crypto markets. It also underscores the company’s continued push to embed Web3 tools directly into its core platform, positioning it to capture users who want more control over how they trade and store digital assets.

The move follows the relative success of platforms like HyperLiquid, a decentralized derivatives exchange that has notched $11 billion in volume over the past month. It also gives users a non-custodial option to trade, essentially removing counterparty risk that came to the spotlight after FTX’s momentous implosion in 2022.

Decentralized exchange volume has embarked on a notable uptrend throughout the recent bull market, data from DefiLlama shows that daily volume is at $12.8 billion, dwarfing Coinbase’s total of $3.5 billion, while monthly DEX volume has surpassed $407 billion.

Uncategorized

Crypto Markets Today: XMR Rallies Despite 18-Block Reorg

Bitcoin traded in the red having failed to establish a foothold above $116,000 as whales rotated more funds into ether.

Uncategorized

Bitcoin Fails to Hold $116K as OGs Rotate Into Ether: Crypto Daybook Americas

By Omkar Godbole (All times ET unless indicated otherwise)

The crypto market has stalled since Saturday, with bitcoin (BTC) once again failing to keep gains above $116,000 alongside continued selling by wallets of early adopters, or OGs.

According to blockchain analyst Lookonchain, on Sunday an eight-year BTC holder moved 1,176 BTC worth over $136 million to Hyperliquid and started dumping. This holder is known to have exchanged 35,991 BTC for 886,731 ETH in recent months.

Other long-term holders have also been liquidating coins in recent months as the market continues to adjust to a six-figure price as the new normal for BTC.

But the latest selling is not just limited to long-term holders. On-chain data tracked by Glassnode showed that wallets of all sizes are back to distributing coins.

In ether’s case, whale wallets continue to scale exposure, suggesting ether outperformance relative to bitcoin. The ether-bitcoin ratio on Binance, however, fell for a third consecutive day, unable to capitalize on the descending trendline breakout confirmed on Friday.

Memecoins, the recent outperformers, have also come under pressure, with top tokens, DOGE and SHIB, losing 10% and 6%, respectively, over the past 24 hours.

Solana’s native token SOL traded over 2% lower at $234 despite key industry participants taking steps to accelerate the adoption of Solana-native decentralized finance (DeFi).

Kyle Samani, chairman of Nasdaq-listed Solana treasury company Forward Industries, said on X that the company plans to deploy funds into the Solana-based DeFi protocols. Last week, Forward raised $1.65 billion in a private placement led by Multicoin Capital, Galaxy Digital and Jump Crypto.

Samani was responding to an idea raised by a crypto trader, Ansem, who called for corporate treasury funds to invest in Solana-based DeFi to boost the network’s DeFi appeal relative to industry giant Ethereum.

In traditional markets, investor positioning in the S&P 500 looked totally biased bullish. «Sentiment is at extremes. Careful out there,» pseudonymous observer The Short Bear said on X. Stay alert!

What to Watch

- Crypto

- None scheduled.

- Macro

- None scheduled.

- Earnings (Estimates based on FactSet data)

- None scheduled.

Token Events

- Governance votes & calls

- Curve DAO is voting to update donation-enabled Twocrypto contracts, refining donation vesting so unlocked portions persist after burns. Voting ends Sept. 16.

- Unlocks

- Sept. 15: Starknet (STRK) to unlock 5.98% of its circulating supply worth $17.09 million.

- Sept. 15: Sei (SEI) to unlock 1.18% of its circulating supply worth $18.06 million.

- Token Launches

- Sept. 15: OpenLedger (OPENLEDGER) to be listed on Crypto.com.

Conferences

- Day 4 of 4: ETHTokyo 2025

- Day 1 of 7: Budapest Blockchain Week 2025

- Sept. 15: TGE Summit 2025 (New York)

Token Talk

By Oliver Knight

- Monero’s blockchain suffered its deepest-ever reorg on Monday, rolling back 18 blocks.

- A blockchain reorganization, or reorg, happens when nodes abandon part of the existing chain to follow a longer one with more proof-of-work. The shift occurs during a temporary fork, when two versions of the chain compete.

- Monero’s XMR token remained unperturbed during the porcess; rallying by 5% despite the attack by Qubic, a layer-1 AI-focused blockchain and mining pool that attempted to take over the Monero blockchain by amassing 51% of the mining power last month.

- The event rewrote roughly 36 minutes of transaction history and invalidated about 118 confirmed transactions, prompting concerns about the security of the network.

- Crypto podcaster xenu claimed that Qubic’s reorg was an attempt to «stop the bleeding» of XMR’s price after it tumbled from $344 to $235 during the initial 51% attack in August.

- XMR currently trades at $304 having brushed aside negative sentiment with daily trading volume rising by 78% to $136 million.

Derivatives Positioning

by Omkar Godbole

- The top 25 coins have experienced a decline in futures open interest (OI) over the past 24 hours, with memecoins, such as DOGE, PEPE and FARTCOIN, registering double-digit capital outflows. This contrasts with the pre-Fed bounce being seen in most tokens.

- BTC’s global futures OI tally has pulled back to 720K BTC from the near-record high of 744K BTC last week. Total market-wide OI has pulled back to $90 billion from $95 billion over the weekend.

- ETH’s tally grew to over 14 million ether from roughly 13.2 million ether early this month, indicating renewed capital inflows. However, this does not necessarily indicate bullish positioning, as the OI-normalized cumulative volume delta (CVD) for ETH has been negative for the past 24 hours. That’s a sign of net selling pressure.

- Most major tokens have seen a negative CVD for the past 24 hours.

- Activity in the CME-listed futures looks to be picking up the pace, with OI bouncing to 141.69K BTC from the multimonth low of 133.25K BTC early this week. The annualized rate on a three-month basis remains below 10%, extending the consolidation. ETH’s CME OI remains below 2 million ether.

- On Deribit, put bias in BTC and ETH has eased significantly across all tenors as markets anticipate Fed rate cuts in the coming months. The implied volatility term structure remains in contango, with December expiry expected to be more volatile.

Market Movements

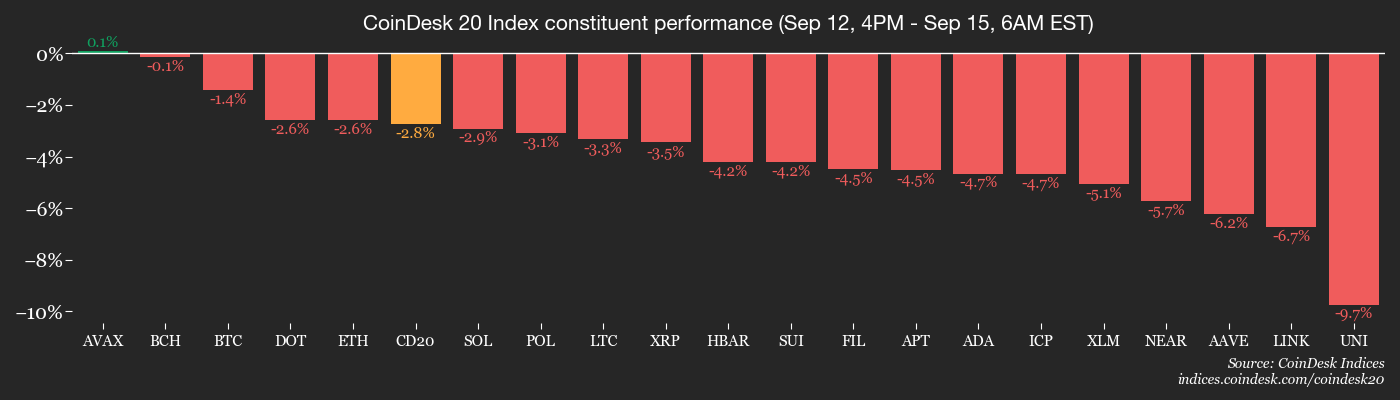

- BTC is down 1.1% from 4 p.m. ET Friday at $114,933.52 (24hrs: -1%)

- ETH is down 3.1% at $4,528.04 (24hrs: -3.22%)

- CoinDesk 20 is down 2.73% at 4,245.39 (24hrs: -3.35%)

- Ether CESR Composite Staking Rate is down 2 bps at 2.82%

- BTC funding rate is at 0.0081% (8.829% annualized) on Binance

- DXY is unchanged at 97.48

- Gold futures are down 0.29% at $3,675.80

- Silver futures are down 0.56% at $42.59

- Nikkei 225 closed up 0.89% at 44,768.12

- Hang Seng closed up 0.22% at 26,446.56

- FTSE is down 0.1% at 9,273.57

- Euro Stoxx 50 is up 0.6% at 5,423.13

- DJIA closed on Friday down 0.59% at 45,834.22

- S&P 500 closed unchanged at 6,584.29

- Nasdaq Composite closed up 0.44% at 22,141.10

- S&P/TSX Composite closed down 0.42% at 29,283.82

- S&P 40 Latin America closed unchanged at 2,857.80

- U.S. 10-Year Treasury rate is unchanged at 4.059%

- E-mini S&P 500 futures are unchanged at 6,594.50

- E-mini Nasdaq-100 futures are unchanged at 24,098.00

- E-mini Dow Jones Industrial Average Index are up 0.22% at 45,957.00

Bitcoin Stats

- BTC Dominance: 58.11% (0.57%)

- Ether to bitcoin ratio: 0.03938 (-1.38%)

- Hashrate (seven-day moving average): 1,025 EH/s

- Hashprice (spot): $53.81

- Total Fees: 3.13 BTC / $362,347

- CME Futures Open Interest: 141,690 BTC

- BTC priced in gold: 31.5 oz

- BTC vs gold market cap: 8.90%

Technical Analysis

- DOGE has dropped from 30.7 cents to 26 cents, penetrating the bullish trendline from Sept. 6 lows.

- The breakdown suggests renewed seller momentum.

- Prices have also found acceptance below the Ichimoku cloud. Crossovers below the cloud are said to represent a bearish shift in trend.

Crypto Equities

- Coinbase Global (COIN): closed on Friday at $323.04 (-0.28%), -0.34% at $321.95 in pre-market

- Circle (CRCL): closed at $125.32 (-6.27%), +1.81% at $127.59

- Galaxy Digital (GLXY): closed at $29.70 (+2.88%), -0.47% at $29.56

- Bullish (BLSH): closed at $51.84 (-3.98%), +1.72% at $52.73

- MARA Holdings (MARA): closed at $16.31 (+3.82%), -0.67% at $16.20

- Riot Platforms (RIOT): closed at $15.89 (+1.53%), -0.44% at $15.82

- Core Scientific (CORZ): closed at $15.86 (+1.99%), -0.38% at $15.80

- CleanSpark (CLSK): closed at $10.35 (+1.47%), unchanged in pre-market

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $37.32 (+4.63%)

- Exodus Movement (EXOD): closed at $28.36 (-1.73%), unchanged in pre-market

Crypto Treasury Companies

- Strategy (MSTR): closed at $331.44 (+1.66%), -0.53% at $329.68

- Semler Scientific (SMLR): closed at $29.19 (+2.28%)

- SharpLink Gaming (SBET): closed at $17.7 (+8.19%), -2.26% at $17.30

- Upexi (UPXI): closed at $6.76 (+18.93%), +1.55% at $6.86

- Lite Strategy (LITS): closed at $3.07 (+10.43%)

ETF Flows

Spot BTC ETFs

- Daily net flow: $642.4 million

- Cumulative net flows: $56.79 billion

- Total BTC holdings ~ 1.31 million

Spot ETH ETFs

- Daily net flow: $405.5 million

- Cumulative net flows: $13.38 billion

- Total ETH holdings ~ 6.48 million

Source: Farside Investors

While You Were Sleeping

- What’s Next for Bitcoin and Ether as Downside Fears Ease Ahead of Fed Rate Cut? (CoinDesk): Amberdata’s Greg Magadini says a routine quarter-point cut could mean gradual gains, while a half-point move might trigger an explosive rally in BTC, ETH, SOL and gold.

- Bank of England’s Proposed Stablecoin Ownership Limits Are Unworkable, Say Crypto Groups (CoinDesk): Executives say the U.K.’s proposed caps could be impossible to enforce and risk pushing innovation abroad, while U.S. and EU rules set standards without limiting holdings.

- LSE Group Starts Blockchain Platform for Access by Private Funds (Bloomberg): LSEG’s Digital Markets Infrastructure, built to boost efficiency, was used in a MembersCap fundraising for MCM Fund 1 with crypto exchange Archax serving the role of nominee.

- Trump Administration Claims Vast Powers as It Races to Fire Fed Governor Before Meeting (The New York Times): In Sunday’s filing to a federal appeals court, Justice Department lawyers argued Trump’s authority to oust Fed governor Lisa Cook was both “unreviewable” and “reasonable.”

- BOE Expected to Leave Key Rate on Hold, but Slow Quantitative Tightening (The Wall Street Journal): Signs of internal resistance have cast doubt on near-term rate cuts, with four MPC members opposing the last move and BoE Governor Andrew Bailey warning inflation pressures complicate policy choices.

Uncategorized

Crypto Miners Rally in Pre-Market Trading Amid Tesla’s Surge

Markets are seeing sharp moves this morning with crypto mining stocks continuing their rally and Tesla jumping on Elon Musk’s latest share purchase.

Bitfarms (BITF) is up 15% pre-market to $2.55, extending its weekly rally of 75%. AI-focused mining stocks continue their strong performance as well, with IREN (IREN) rising 3% pre-market and up over 230% year-to-date. Hive Blockchain (HIVE) gained 5% pre-market, adding to its 40% rise over the past month.

KindlyMD (NAKA), a bitcoin treasury company holding 5,765 BTC, is down 50% pre-market and off 96% from its all-time high.

Tesla (TSLA) is trading at $420 pre-market, up 6% from Friday’s close after a 7% surge last week. An SEC filing revealed Elon Musk purchased nearly 2.6 million shares.

While, CapitalB (ALCPB) acquired 48 BTC, bringing its total holdings to 2,249 BTC, up 15% in European markets.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars