Uncategorized

Market Rallies as Trump Opens 401(k) Floodgates: Crypto Daybook Americas

By Francisco Rodrigues (All times ET unless indicated otherwise)

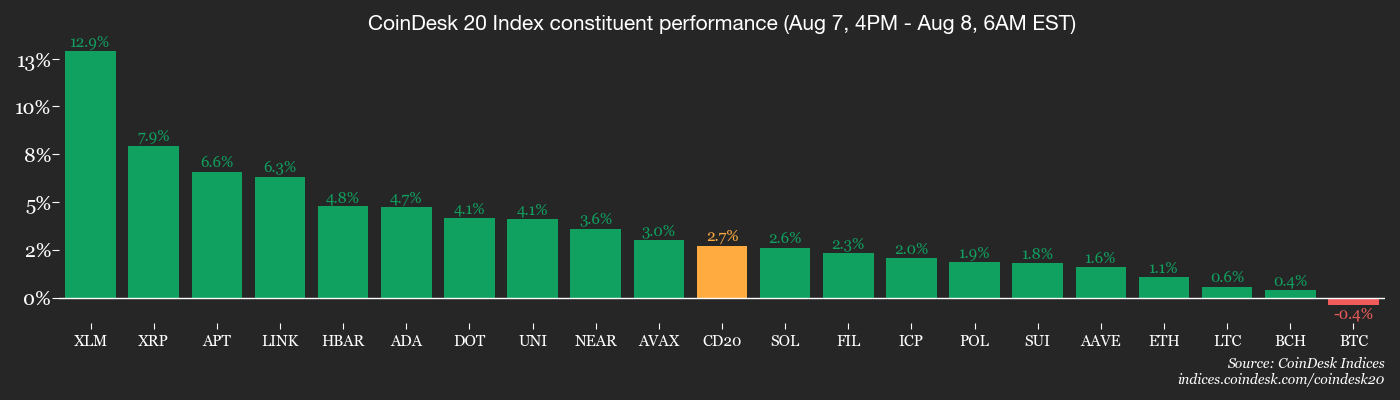

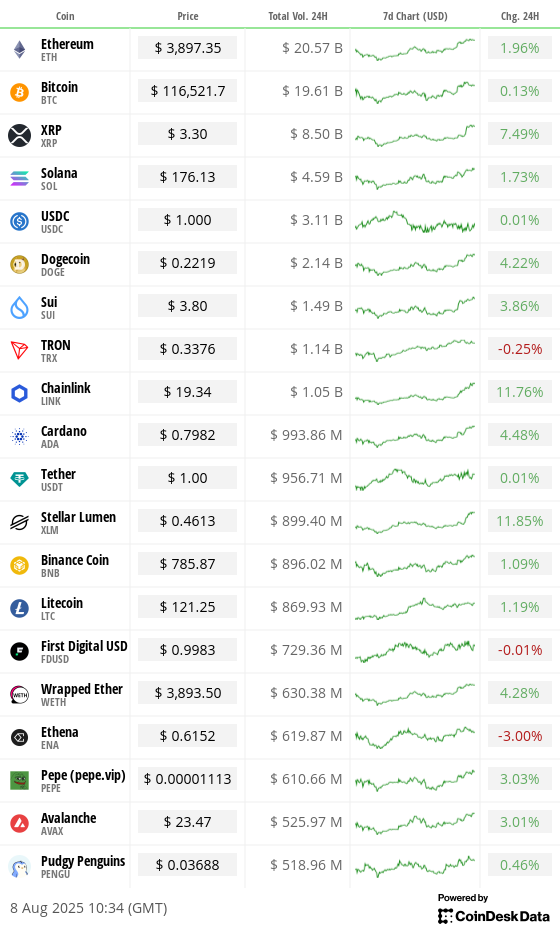

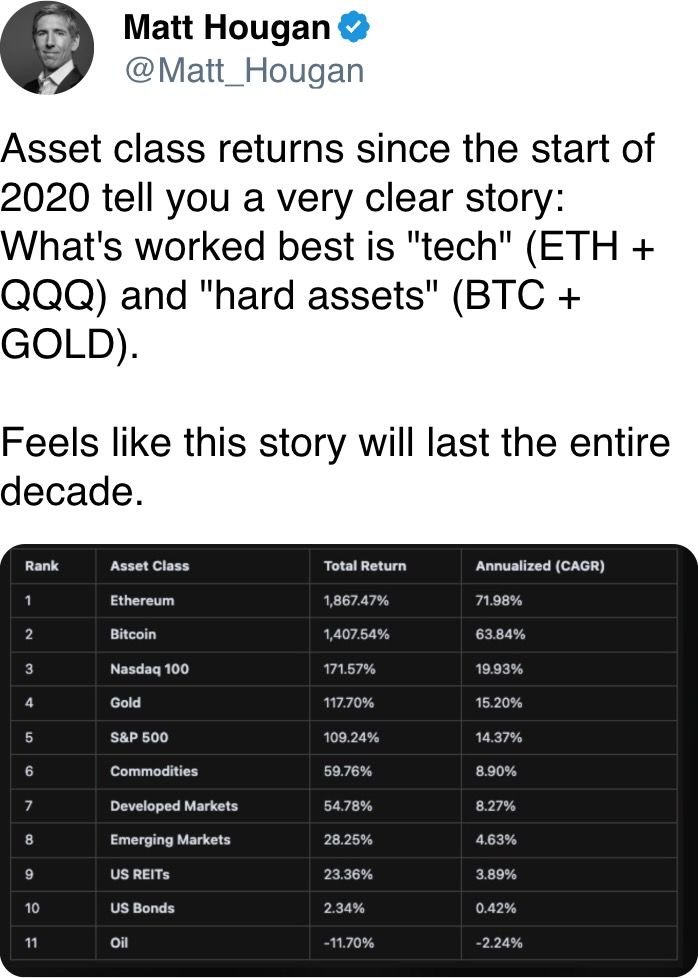

Crypto markets rallied in the past 24 hours, with the CoinDesk 20 (CD20) index rising 5.3% as fresh U.S. policy signals and regulatory clarity supported risk appetite across the sector. Bitcoin (BTC) gained a relatively muted 1.3% to $116,500.

The rally took off after President Donald Trump signed an executive order opening 401(k) retirement plans to a broader range of investments, including cryptocurrencies. The order directs the Department of Labor and Securities and Exchange Commission to publish new guidance for retirement accounts.

“This move effectively opens access to bitcoin and other cryptocurrencies for retirement investors, unlocking a staggering $8.7 trillion in assets under management.,” James Butterfill, head of research at CoinShares, said in an emailed statement.

Jake Ostrovskis, OTC trader at Wintermute, told CoinDesk that the impact of the move could not be understated.

“Just a 2% allocation to Bitcoin and Ethereum would represent 1.5x the total cumulative ETF inflows to date, while a 3% allocation would more than double the entire market,” Ostrovskis said. “Critically, these would be largely price-insensitive buyers focused on meeting allocation benchmarks rather than tactical trading.“

In practice, that means 401(k) funds would create “sustained, predictable demand flows that could provide a structural bid for digital assets regardless of short-term price volatility,” Ostrovskis added.

While crypto has never been formally banned from the retirement investments, previous guidance strongly discouraged fiduciaries from offering it.

Meanwhile, the Ethereum blockchain hit a new record for average daily transactions this week, according to data from Dune Analytics. The increase was underpinned by the SEC’s clarification earlier this week that certain liquid staking models don’t constitute securities under the 1933 Securities Act, making it safer for institutions to offer staking services.

Ether’s (ETH) price surged 4.6% over the past 24 hours to near $3,900.

While fireworks were going off in the crypto sector, TradFi was more subdued. The S&P 500 dropped in Thursday’s session, and the Nasdaq closed 0.35% higher, furthering the concentration of megacaps in the indexes. The 10 largest stocks now account for 76% of the entire stock market capitalization, data shared by Barchart shows.

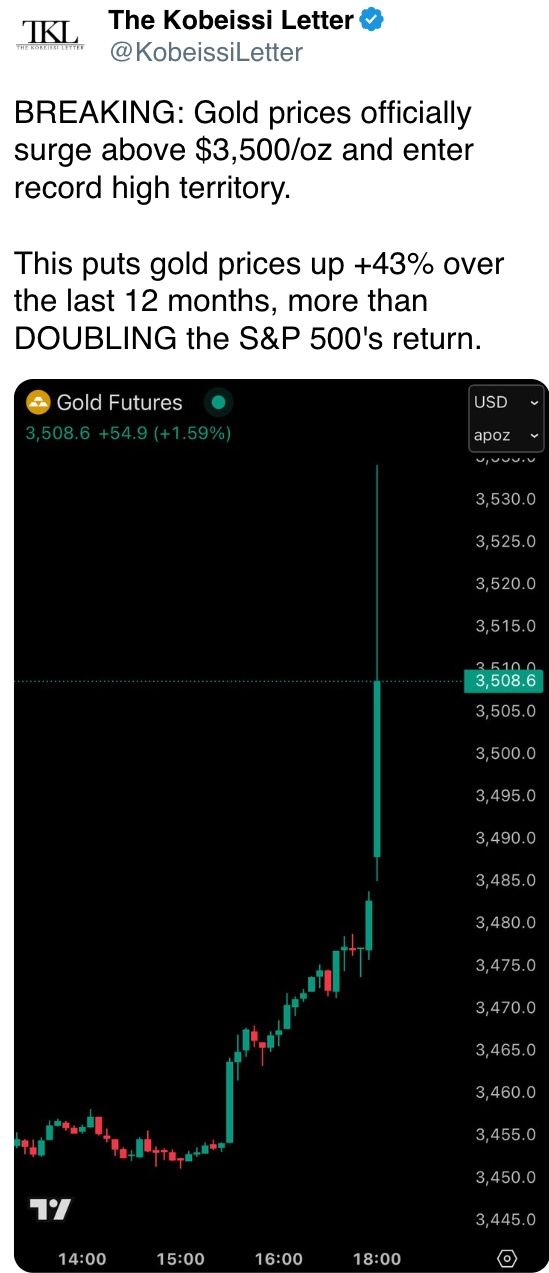

Gold rose on tariffs being imposed on some bullion bars. Looking ahead, investors are bracing for July’s inflation report, due next week, which may influence the odds of a dovish Fed interest-rate cut in September. Stay alert!

What to Watch

- Crypto

- Aug. 15: Record date for the next FTX distribution to holders of allowed Class 5 Customer Entitlement, Class 6 General Unsecured and Convenience Claims who meet pre-distribution requirements.

- Aug. 18: Coinbase Derivatives will launch nano SOL and nano XRP U.S. perpetual-style futures.

- Macro

- Aug. 8: Federal Reserve Governor Adriana D. Kugler’s resignation becomes effective, creating an early vacancy on the Board of Governors that allows President Trump to nominate a successor.

- Aug 8: President Trump’s deadline for Russia to commit to a ceasefire and peace deal in Ukraine, with intensified U.S. sanctions and secondary tariffs on countries purchasing Russian energy if the deadline is not met.

- Aug. 8: U.S. President Donald Trump hosts Armenian Prime Minister Nikol Pashinyan and Azerbaijani President Ilham Aliyev at the White House to sign a peace agreement. The U.S. will also sign bilateral economic agreements to promote trade and regional stability.

- Aug. 8, 7 p.m.: Colombia’s National Administrative Department of Statistics releases July consumer price inflation data..

- Inflation Rate MoM Est. 0.19% vs. Prev. 0.1%

- Inflation Rate YoY Est. 4.81% vs. Prev. 4.82%

- Aug. 12, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases July consumer price inflation data.

- Inflation Rate MoM Prev. 0.24%

- Inflation Rate YoY Prev. 5.35%

- Aug. 12, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases July consumer price inflation data.

- Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.2%

- Core Inflation Rate YoY Est. 3% vs. Prev. 2.9%

- Inflation Rate MoM Est. 0.2% vs. Prev. 0.3%

- Inflation Rate YoY Est. 2.8% vs. Prev. 2.7%

- Earnings (Estimates based on FactSet data)

Token Events

- Governance votes & calls

- BendDAO is voting on a plan to stabilize BEND by burning 50% of treasury tokens, restarting lender rewards, and launching monthly buybacks using 20% of protocol revenue. Voting ends Aug. 10.

- 1inch DAO is voting on a $1.88 million grant to fund its participation in nine global crypto events through late 2025. The proposal aims to boost developer engagement, grow institutional ties and expand adoption across ecosystems like Ethereum and Solana. Voting ends Aug. 10.

- Aug. 8, 11:30 a.m.: Axie Infinity to host a town hall on Discord.

- Unlocks

- Aug. 9: Immutable (IMX) to unlock 1.3% of its circulating supply worth $12.66 million.

- Aug. 12: Aptos (APT) to unlock 1.73% of its circulating supply worth $52.59 million.

- Aug. 15: Avalanche (AVAX) to unlock 0.39% of its circulating supply worth $39.25 million.

- Aug. 15: Starknet (STRK) to unlock 3.53% of its circulating supply worth $16.19 million.

- Aug. 15: Sei (SEI) to unlock 0.96% of its circulating supply worth $17.21 million

- Aug. 16: Arbitrum (ARB) to unlock 1.8% of its circulating supply worth $39.21 million.

- Aug. 18: Fasttoken (FTN) to unlock 4.64% of its circulating supply worth $91.6 million.

- Token Launches

- Aug. 8: Pudgy Penguins (PENGU) to be listed on Arkham Exchange.

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight. Space is limited. Use code CDB10 for 10% off your registration through Aug. 31.

- Day 3 of 5: Rare EVO (Las Vegas)

- Day 2 of 2: bitcoin++ (Riga, Latvia)

- Aug. 9-10: Baltic Honeybadger 2025 (Riga, Latvia)

- Aug. 9-10: Conviction 2025 (Ho Chi Minh City, Vietnam)

- Aug. 11: Paraguay Blockchain Summit 2025 (Asuncion)

- Aug. 11-13: AIBB 2025 (Istanbul)

- Aug. 11-17: Ethereum NYC (New York)

- Aug. 13-14: CryptoWinter ‘25 (Queenstown, New Zealand)

Token Talk

By Shaurya Malwa

- Ethereum’s seven-day average daily transactions hit a record 1.74 million as staked ETH levels climbed to an all-time high.

- Over 36 million ETH, nearly 30% of total supply, is now locked in staking contracts, according to Dune Analytics.

- The increase followed the SEC’s clarification that certain liquid staking activities and staking receipt tokens aren’t securities under the 1933 Act if they meet strict assumptions.

- The ruling reduced legal overhang, opening the door for greater institutional participation.

- The trend is also backed by yield-seeking holders and growing treasury allocations from publicly listed firms, tightening liquid supply.

- Public companies now control $11.77 billion in ETH, led by BitMine Immersion Technologies ($3.2 billion), SharpLink Gaming ($2 billion), and The Ether Machine ($1.3 billion).

- Vitalik Buterin said treasuries are “good and valuable” for Ethereum but warned that excessive leverage could spark cascading liquidations.

- ETH has rallied 163% from April lows with more than 500,000 ETH ($1.8 billion) staked in the first half of June alone — a pace CryptoQuant’s Onchainschool said reflects “rising confidence and a continued drop in liquid supply.”

Derivatives Positioning

- Total BTC futures open interest sits at $80.65 billion, flat on the day after a mild pullback earlier this week.

- CME remains dominant with a 20% share, underscoring steady institutional exposure. Binance and OKX flows were mixed, with OKX OI up 3.95% in the past 24 hours despite heavier intraday swings.

- ETH liquidations led the market over the past 24 hours at $188.7 million, dwarfing BTC’s $52.6 million and XRP’s $29 million.

- The largest liquidation was a $34.28 million ETH-USDT long position on HTX, reflecting concentrated leverage in ETH perps ahead of price swings.

- Liquidation data skews heavily to the short side, with $319 million in shorts wiped versus $91 million in longs, suggesting that the recent upside caught positioning off guard and may have forced momentum-driven covering across majors.

- BTC open interest distribution shows CME’s basis holding firm at 2.61%, suggesting sustained carry demand from TradFi desks, while Binance’s basis is muted at 0.61%, indicating less aggressive directional leverage from offshore traders.

- ETH funding rates remain elevated at or near exchange-imposed caps, signaling persistent long bias despite the heavy wipeout of shorts. This combination — high funding plus fresh OI — suggests traders are rotating back into directional plays rather than fully deleveraging.

Market Movements

- BTC is down 0.43% from 4 p.m. ET Thursday at $116,701.75 (24hrs: +0.22%)

- ETH is up 0.68% at $3,900.02 (24hrs: +2.08%)

- CoinDesk 20 is up 2.2% at 4,046.33 (24hrs: +3.94%)

- Ether CESR Composite Staking Rate is unchanged at 2.9%

- BTC funding rate is at 0.004% (4.4052% annualized) on Binance

- DXY is down 0.16% at 98.24

- Gold futures are up 1.12% at $3,492.50

- Silver futures are up 0.80% at $38.60

- Nikkei 225 closed up 1.85% at 41,820.48

- Hang Seng closed down 0.89% at 24,858.82

- FTSE is unchanged at 9,095.08

- Euro Stoxx 50 is up 0.13% at 5,339.07

- DJIA closed on Thursday down 0.51% at 43,968.64

- S&P 500 closed unchanged at 6,340.00

- Nasdaq Composite closed up 0.35% at 21,242.70

- S&P/TSX Composite closed down 0.57% at 27,761.27

- S&P 40 Latin America closed up 2.03% at 2,666.61

- U.S. 10-Year Treasury rate is up 0.6 bps at 4.25%

- E-mini S&P 500 futures are up 0.26% at 6,383.25

- E-mini Nasdaq-100 futures are up 0.28% at 23,562.75

- E-mini Dow Jones Industrial Average Index are up 0.17% at 44,155.00

Bitcoin Stats

- BTC Dominance: 60.82% (-0.31%)

- Ether to bitcoin ratio: 0.03343 (0.42%)

- Hashrate (seven-day moving average): 966 EH/s

- Hashprice (spot): $57.95

- Total Fees: 5.2 BTC / $602,389

- CME Futures Open Interest: 137,710 BTC

- BTC priced in gold: 34.4 oz

- BTC vs gold market cap: 9.73%

Technical Analysis

- The ETH/SOL ratio is testing a key weekly resistance (~22.4); a confirmed breakout could trigger strong continuation with ether rising toward the 34-36 SOL range.

- RSI shows strong momentum (70+) with no bearish divergence, supporting the breakout potential.

- Unless rejected, the setup favors ETH outperformance vs. SOL on confirmation.

Crypto Equities

- Strategy (MSTR): closed on Thursday at $402.01 (+4.85%), -0.25% at $401 in pre-market

- Coinbase Global (COIN): closed at $310.79 (+2.38%), +0.86% at $313.45

- Circle (CRCL): closed at $152.93 (-5.43%), +1.12% at $154.64

- Galaxy Digital (GLXY): closed at $28.09 (+2.74%), +1.35% at $28.47

- MARA Holdings (MARA): closed at $15.95 (+0.38%), -0.13% at $15.93

- Riot Platforms (RIOT): closed at $11.58 (-0.69%), +0.35% at $11.62

- Core Scientific (CORZ): closed at $14.35 (+1.7%), +0.84% at $14.47

- CleanSpark (CLSK): closed at $10.72 (-2.55%), unchanged in pre-market

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $25.37 (-1.4%)

- Semler Scientific (SMLR): closed at $37.54 (+5.27%), unchanged in pre-market

- Exodus Movement (EXOD): closed at $31.34 (+6.74%)

- SharpLink Gaming (SBET): closed at $23.36 (+5.51%), +2.57% at $23.96

ETF Flows

Spot BTC ETFs

- Daily net flows: $277.4 million

- Cumulative net flows: $54 billion

- Total BTC holdings ~1.29 million

Spot ETH ETFs

- Daily net flows: $222.3 million

- Cumulative net flows: $9.37 billion

- Total ETH holdings ~5.6 million

Source: Farside Investors

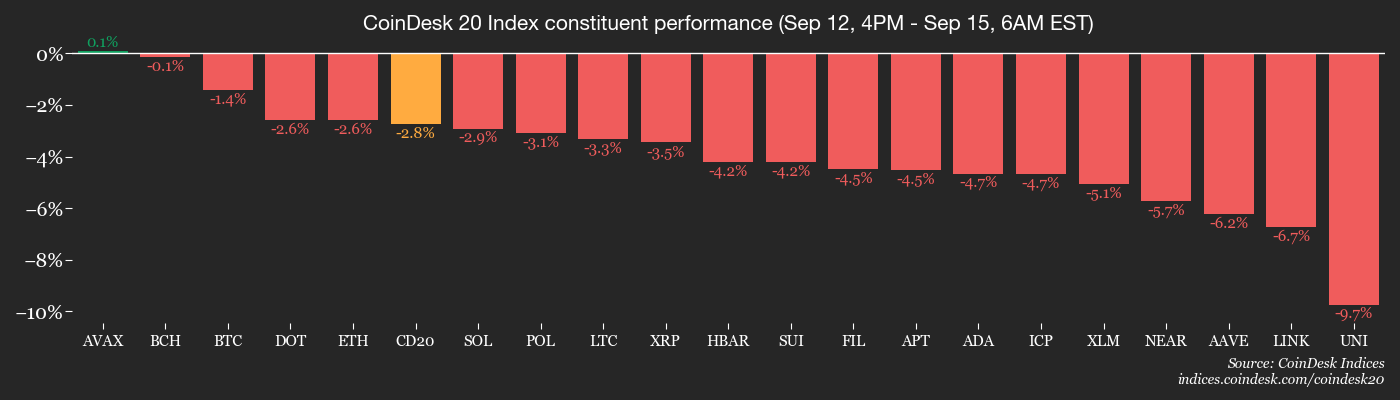

Overnight Flows

Chart of the Day

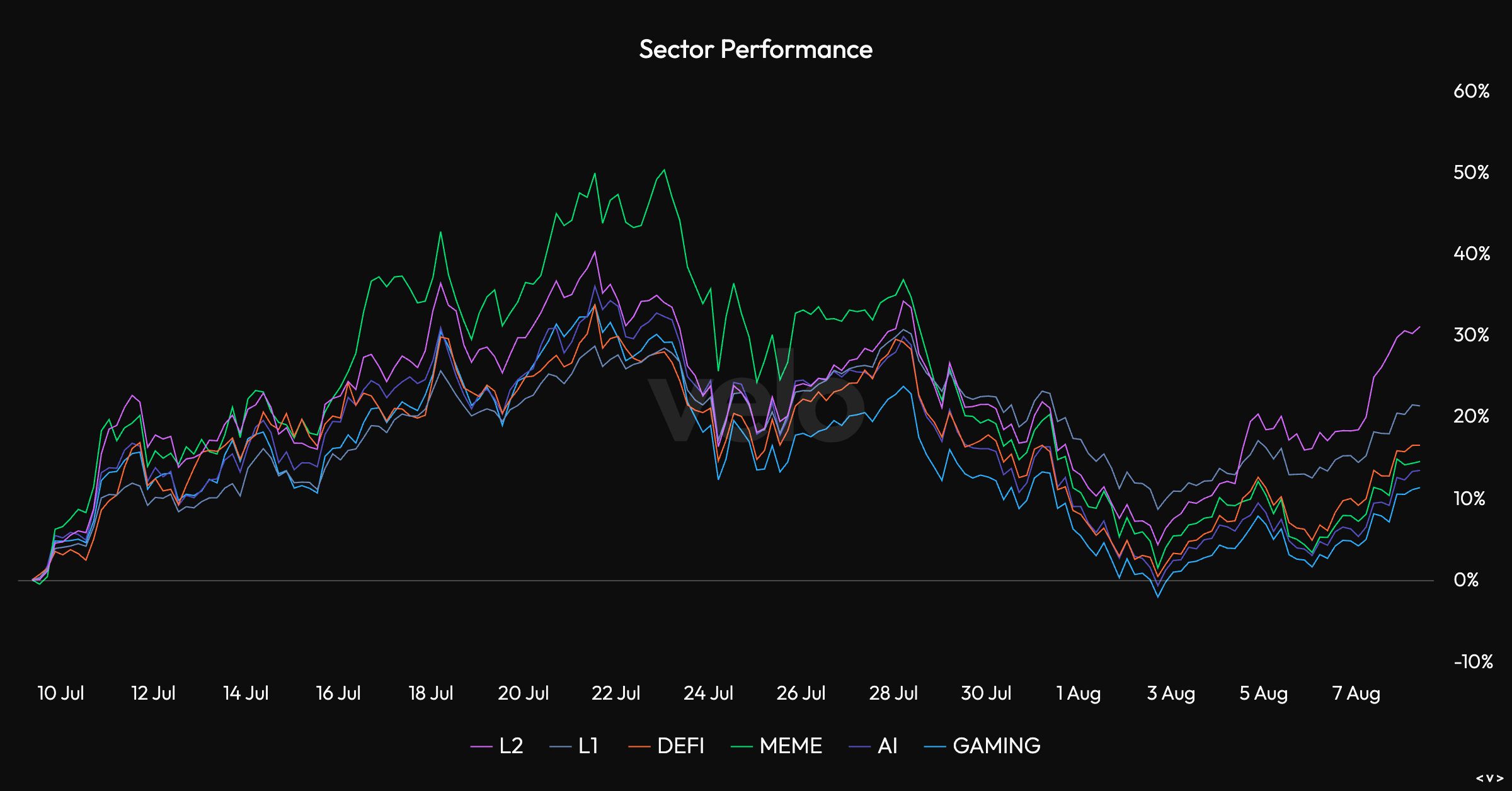

- The memecoin sector’s outperformance of the wider cryptocurrency market was short-lived, showing that while its heightened volatility could present opportunities, market timing is critical.

- Meanwhile, layer-2 tokens have outperformed in the past month, as Velo data shows.

- The worst-performing sector throughout the period were gaming-related tokens, which consistently underperformed.

While You Were Sleeping

- Ethereum Transactions Hit Record High as Staking, SEC Clarity Fuel ETH Rally (CoinDesk): The SEC’s softer stance on liquid staking is spurring institutional ETH accumulation, with nearly 30% of supply now locked in staking contracts and corporate treasuries holding more than $11 billion worth of ether.

- Crypto’s $25 Billion Spree Sparks Unease Even Among Insiders (Bloomberg): Several fund managers warned that if altcoin-focused treasury firms’ valuations fall below their crypto holdings’ value, forced selling could follow, deepening losses and potentially ending the current crypto bull cycle.

- XRP Surges 12% as Traders Bet on Big Price Swings with ‘Straddle’ Strategy (CoinDesk): Traders are placing large Deribit long straddles — buying calls and puts with identical strikes and expiries, risking only the premiums paid for potentially unlimited upside or sizable gains if prices plunge.

- Binance Teams Up With BBVA to Let Customers Keep Assets Off Exchange (Financial Times): After a massive U.S. fine, Binance is giving traders the option of storing collateral in U.S. Treasuries at BBVA, highlighting traditional banks’ deeper push into crypto markets.

- Israeli Security Cabinet Approves Gaza Control Plan (The Wall Street Journal): Prime Minister Benjamin Netanyahu’s proposal — seizing all of Gaza, then handing it to Arab coalition forces for day-to-day governance while keeping an Israeli-controlled perimeter — is drawing broad domestic and global pushback.

- Trump Tariffs on Russia’s Oil Buyers Bring Economic, Political Risks (Reuters): The U.S. president’s secondary tariffs, starting with India, could risk raising fuel prices, straining relations with China and India and hurting Republicans’ midterm election prospects with potentially no gain.

In the Ether

Uncategorized

Crypto Markets Today: XMR Rallies Despite 18-Block Reorg

Bitcoin traded in the red having failed to establish a foothold above $116,000 as whales rotated more funds into ether.

Uncategorized

Bitcoin Fails to Hold $116K as OGs Rotate Into Ether: Crypto Daybook Americas

By Omkar Godbole (All times ET unless indicated otherwise)

The crypto market has stalled since Saturday, with bitcoin (BTC) once again failing to keep gains above $116,000 alongside continued selling by wallets of early adopters, or OGs.

According to blockchain analyst Lookonchain, on Sunday an eight-year BTC holder moved 1,176 BTC worth over $136 million to Hyperliquid and started dumping. This holder is known to have exchanged 35,991 BTC for 886,731 ETH in recent months.

Other long-term holders have also been liquidating coins in recent months as the market continues to adjust to a six-figure price as the new normal for BTC.

But the latest selling is not just limited to long-term holders. On-chain data tracked by Glassnode showed that wallets of all sizes are back to distributing coins.

In ether’s case, whale wallets continue to scale exposure, suggesting ether outperformance relative to bitcoin. The ether-bitcoin ratio on Binance, however, fell for a third consecutive day, unable to capitalize on the descending trendline breakout confirmed on Friday.

Memecoins, the recent outperformers, have also come under pressure, with top tokens, DOGE and SHIB, losing 10% and 6%, respectively, over the past 24 hours.

Solana’s native token SOL traded over 2% lower at $234 despite key industry participants taking steps to accelerate the adoption of Solana-native decentralized finance (DeFi).

Kyle Samani, chairman of Nasdaq-listed Solana treasury company Forward Industries, said on X that the company plans to deploy funds into the Solana-based DeFi protocols. Last week, Forward raised $1.65 billion in a private placement led by Multicoin Capital, Galaxy Digital and Jump Crypto.

Samani was responding to an idea raised by a crypto trader, Ansem, who called for corporate treasury funds to invest in Solana-based DeFi to boost the network’s DeFi appeal relative to industry giant Ethereum.

In traditional markets, investor positioning in the S&P 500 looked totally biased bullish. «Sentiment is at extremes. Careful out there,» pseudonymous observer The Short Bear said on X. Stay alert!

What to Watch

- Crypto

- None scheduled.

- Macro

- None scheduled.

- Earnings (Estimates based on FactSet data)

- None scheduled.

Token Events

- Governance votes & calls

- Curve DAO is voting to update donation-enabled Twocrypto contracts, refining donation vesting so unlocked portions persist after burns. Voting ends Sept. 16.

- Unlocks

- Sept. 15: Starknet (STRK) to unlock 5.98% of its circulating supply worth $17.09 million.

- Sept. 15: Sei (SEI) to unlock 1.18% of its circulating supply worth $18.06 million.

- Token Launches

- Sept. 15: OpenLedger (OPENLEDGER) to be listed on Crypto.com.

Conferences

- Day 4 of 4: ETHTokyo 2025

- Day 1 of 7: Budapest Blockchain Week 2025

- Sept. 15: TGE Summit 2025 (New York)

Token Talk

By Oliver Knight

- Monero’s blockchain suffered its deepest-ever reorg on Monday, rolling back 18 blocks.

- A blockchain reorganization, or reorg, happens when nodes abandon part of the existing chain to follow a longer one with more proof-of-work. The shift occurs during a temporary fork, when two versions of the chain compete.

- Monero’s XMR token remained unperturbed during the porcess; rallying by 5% despite the attack by Qubic, a layer-1 AI-focused blockchain and mining pool that attempted to take over the Monero blockchain by amassing 51% of the mining power last month.

- The event rewrote roughly 36 minutes of transaction history and invalidated about 118 confirmed transactions, prompting concerns about the security of the network.

- Crypto podcaster xenu claimed that Qubic’s reorg was an attempt to «stop the bleeding» of XMR’s price after it tumbled from $344 to $235 during the initial 51% attack in August.

- XMR currently trades at $304 having brushed aside negative sentiment with daily trading volume rising by 78% to $136 million.

Derivatives Positioning

by Omkar Godbole

- The top 25 coins have experienced a decline in futures open interest (OI) over the past 24 hours, with memecoins, such as DOGE, PEPE and FARTCOIN, registering double-digit capital outflows. This contrasts with the pre-Fed bounce being seen in most tokens.

- BTC’s global futures OI tally has pulled back to 720K BTC from the near-record high of 744K BTC last week. Total market-wide OI has pulled back to $90 billion from $95 billion over the weekend.

- ETH’s tally grew to over 14 million ether from roughly 13.2 million ether early this month, indicating renewed capital inflows. However, this does not necessarily indicate bullish positioning, as the OI-normalized cumulative volume delta (CVD) for ETH has been negative for the past 24 hours. That’s a sign of net selling pressure.

- Most major tokens have seen a negative CVD for the past 24 hours.

- Activity in the CME-listed futures looks to be picking up the pace, with OI bouncing to 141.69K BTC from the multimonth low of 133.25K BTC early this week. The annualized rate on a three-month basis remains below 10%, extending the consolidation. ETH’s CME OI remains below 2 million ether.

- On Deribit, put bias in BTC and ETH has eased significantly across all tenors as markets anticipate Fed rate cuts in the coming months. The implied volatility term structure remains in contango, with December expiry expected to be more volatile.

Market Movements

- BTC is down 1.1% from 4 p.m. ET Friday at $114,933.52 (24hrs: -1%)

- ETH is down 3.1% at $4,528.04 (24hrs: -3.22%)

- CoinDesk 20 is down 2.73% at 4,245.39 (24hrs: -3.35%)

- Ether CESR Composite Staking Rate is down 2 bps at 2.82%

- BTC funding rate is at 0.0081% (8.829% annualized) on Binance

- DXY is unchanged at 97.48

- Gold futures are down 0.29% at $3,675.80

- Silver futures are down 0.56% at $42.59

- Nikkei 225 closed up 0.89% at 44,768.12

- Hang Seng closed up 0.22% at 26,446.56

- FTSE is down 0.1% at 9,273.57

- Euro Stoxx 50 is up 0.6% at 5,423.13

- DJIA closed on Friday down 0.59% at 45,834.22

- S&P 500 closed unchanged at 6,584.29

- Nasdaq Composite closed up 0.44% at 22,141.10

- S&P/TSX Composite closed down 0.42% at 29,283.82

- S&P 40 Latin America closed unchanged at 2,857.80

- U.S. 10-Year Treasury rate is unchanged at 4.059%

- E-mini S&P 500 futures are unchanged at 6,594.50

- E-mini Nasdaq-100 futures are unchanged at 24,098.00

- E-mini Dow Jones Industrial Average Index are up 0.22% at 45,957.00

Bitcoin Stats

- BTC Dominance: 58.11% (0.57%)

- Ether to bitcoin ratio: 0.03938 (-1.38%)

- Hashrate (seven-day moving average): 1,025 EH/s

- Hashprice (spot): $53.81

- Total Fees: 3.13 BTC / $362,347

- CME Futures Open Interest: 141,690 BTC

- BTC priced in gold: 31.5 oz

- BTC vs gold market cap: 8.90%

Technical Analysis

- DOGE has dropped from 30.7 cents to 26 cents, penetrating the bullish trendline from Sept. 6 lows.

- The breakdown suggests renewed seller momentum.

- Prices have also found acceptance below the Ichimoku cloud. Crossovers below the cloud are said to represent a bearish shift in trend.

Crypto Equities

- Coinbase Global (COIN): closed on Friday at $323.04 (-0.28%), -0.34% at $321.95 in pre-market

- Circle (CRCL): closed at $125.32 (-6.27%), +1.81% at $127.59

- Galaxy Digital (GLXY): closed at $29.70 (+2.88%), -0.47% at $29.56

- Bullish (BLSH): closed at $51.84 (-3.98%), +1.72% at $52.73

- MARA Holdings (MARA): closed at $16.31 (+3.82%), -0.67% at $16.20

- Riot Platforms (RIOT): closed at $15.89 (+1.53%), -0.44% at $15.82

- Core Scientific (CORZ): closed at $15.86 (+1.99%), -0.38% at $15.80

- CleanSpark (CLSK): closed at $10.35 (+1.47%), unchanged in pre-market

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $37.32 (+4.63%)

- Exodus Movement (EXOD): closed at $28.36 (-1.73%), unchanged in pre-market

Crypto Treasury Companies

- Strategy (MSTR): closed at $331.44 (+1.66%), -0.53% at $329.68

- Semler Scientific (SMLR): closed at $29.19 (+2.28%)

- SharpLink Gaming (SBET): closed at $17.7 (+8.19%), -2.26% at $17.30

- Upexi (UPXI): closed at $6.76 (+18.93%), +1.55% at $6.86

- Lite Strategy (LITS): closed at $3.07 (+10.43%)

ETF Flows

Spot BTC ETFs

- Daily net flow: $642.4 million

- Cumulative net flows: $56.79 billion

- Total BTC holdings ~ 1.31 million

Spot ETH ETFs

- Daily net flow: $405.5 million

- Cumulative net flows: $13.38 billion

- Total ETH holdings ~ 6.48 million

Source: Farside Investors

While You Were Sleeping

- What’s Next for Bitcoin and Ether as Downside Fears Ease Ahead of Fed Rate Cut? (CoinDesk): Amberdata’s Greg Magadini says a routine quarter-point cut could mean gradual gains, while a half-point move might trigger an explosive rally in BTC, ETH, SOL and gold.

- Bank of England’s Proposed Stablecoin Ownership Limits Are Unworkable, Say Crypto Groups (CoinDesk): Executives say the U.K.’s proposed caps could be impossible to enforce and risk pushing innovation abroad, while U.S. and EU rules set standards without limiting holdings.

- LSE Group Starts Blockchain Platform for Access by Private Funds (Bloomberg): LSEG’s Digital Markets Infrastructure, built to boost efficiency, was used in a MembersCap fundraising for MCM Fund 1 with crypto exchange Archax serving the role of nominee.

- Trump Administration Claims Vast Powers as It Races to Fire Fed Governor Before Meeting (The New York Times): In Sunday’s filing to a federal appeals court, Justice Department lawyers argued Trump’s authority to oust Fed governor Lisa Cook was both “unreviewable” and “reasonable.”

- BOE Expected to Leave Key Rate on Hold, but Slow Quantitative Tightening (The Wall Street Journal): Signs of internal resistance have cast doubt on near-term rate cuts, with four MPC members opposing the last move and BoE Governor Andrew Bailey warning inflation pressures complicate policy choices.

Uncategorized

Crypto Miners Rally in Pre-Market Trading Amid Tesla’s Surge

Markets are seeing sharp moves this morning with crypto mining stocks continuing their rally and Tesla jumping on Elon Musk’s latest share purchase.

Bitfarms (BITF) is up 15% pre-market to $2.55, extending its weekly rally of 75%. AI-focused mining stocks continue their strong performance as well, with IREN (IREN) rising 3% pre-market and up over 230% year-to-date. Hive Blockchain (HIVE) gained 5% pre-market, adding to its 40% rise over the past month.

KindlyMD (NAKA), a bitcoin treasury company holding 5,765 BTC, is down 50% pre-market and off 96% from its all-time high.

Tesla (TSLA) is trading at $420 pre-market, up 6% from Friday’s close after a 7% surge last week. An SEC filing revealed Elon Musk purchased nearly 2.6 million shares.

While, CapitalB (ALCPB) acquired 48 BTC, bringing its total holdings to 2,249 BTC, up 15% in European markets.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars