Uncategorized

Asia Morning Briefing: BTC Mining Industry Not Worried About New Round of Trump Tariffs

Good Morning, Asia. Here’s what’s making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. For a detailed overview of U.S. markets, see CoinDesk’s Crypto Daybook Americas.

Manufacturers of bitcoin (BTC) mining equipment won’t be feeling the pinch of a new round of tariffs the White House has imposed on the semiconductor industry, as the largest chip manufacturers like TSMC and Samsung have an exemption from the new rules due to their investments in the U.S.

Officials in Taiwan confirmed to local press that TSMC would have an exemption from the 100% tariffs because of its facilities in Phoenix, which opened in 2023. South Korean officials also confirmed that Samsung would have a similar exemption because of its fabs in Texas.

TSMC and Samsung manufacture the Application Specific Integrated Circuits (ASICs) designed by BTC mining companies like Bitmain, Canaan, and Bitdeer.

Bitmain and Canaan didn’t respond to a request for comment from CoinDesk.

A spokesperson for Bitdeer confirmed that they partner with TSMC to manufacture the ASICs used for their miners, and thus wouldn’t feel the pinch of tariffs. The spokesperson also said that they expect to bring online a U.S.-based factory to assemble the miners within a year.

Broadly speaking, the market seems to have shrugged off the new tariffs. In Taipei, the TAIEX, an index of Taiwan’s stock market, is set to open trading Friday up 2.3% with TSMC up 3% and approaching record highs.

Even the targets of these tariff policies are in the green.

SMIC, the Shanghai-based rival to TSMC, which lacks a U.S. facility, is up on the week in Hong Kong, outperforming the Hang Seng index.

Market Movers:

BTC: Bitcoin has entered a bullish cooldown after hitting a $123K all-time high, now trading at $117,386.04, with softer momentum and weaker on-chain signals pointing to short-term consolidation or mild downside risk, according to a report by CryptoQuant.

ETH: Glassnode data shows short-term capital flow has shifted from Solana to Ether, with ETH/SOL at a year-to-date low and ETH/BTC breaking above its 200-day EMA for the first time in two years, as ETH trades at $3,905.42 (+6.43%) and approaches $4K, with open interest at $58B and network activity at record highs.

Gold: Gold is trading at $3,387, up 0.5%, as the market weighs the impact of tariffs on India for importing Russian oil.

Nikkei 225: Asia-Pacific markets opened mixed Friday, with Japan’s Nikkei 225 up 1.18% and the Topix hitting a record 3,031.78, led by sharp gains in Nippon Chemical Industrial, Miyakoshi Holdings, J-Lease, and Japan Electronic Materials.

S&P 500: Stocks rose Wednesday, with the S&P 500 up 0.73% to 6,345.06, as Apple jumped 5% on news it will boost U.S. manufacturing investment by $100B to a total of $600B over four years.

Elsewhere in Crypto:

Uncategorized

CoinDesk 20 Performance Update: Index Drops 2.5% as Nearly All Constituents Decline

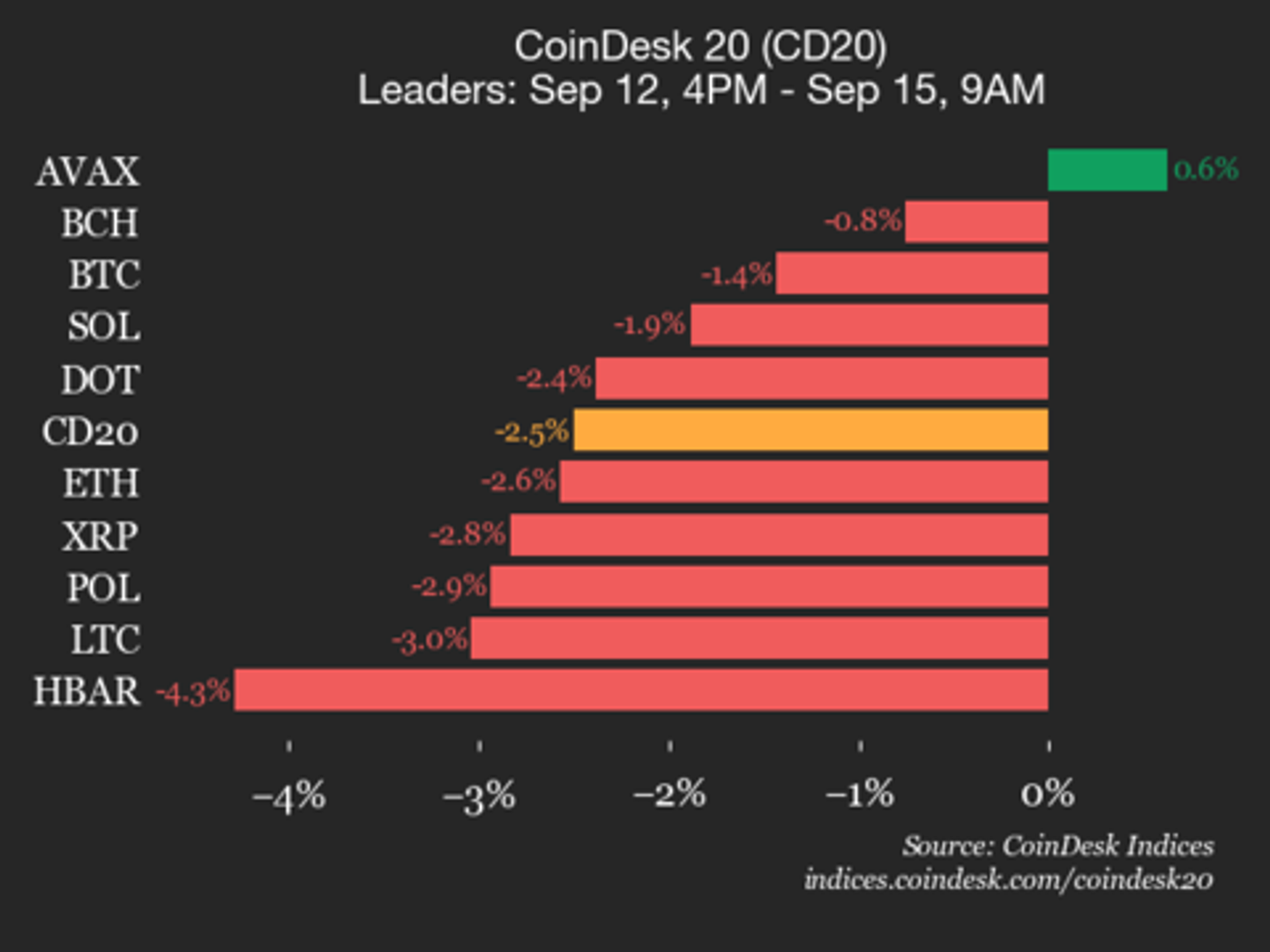

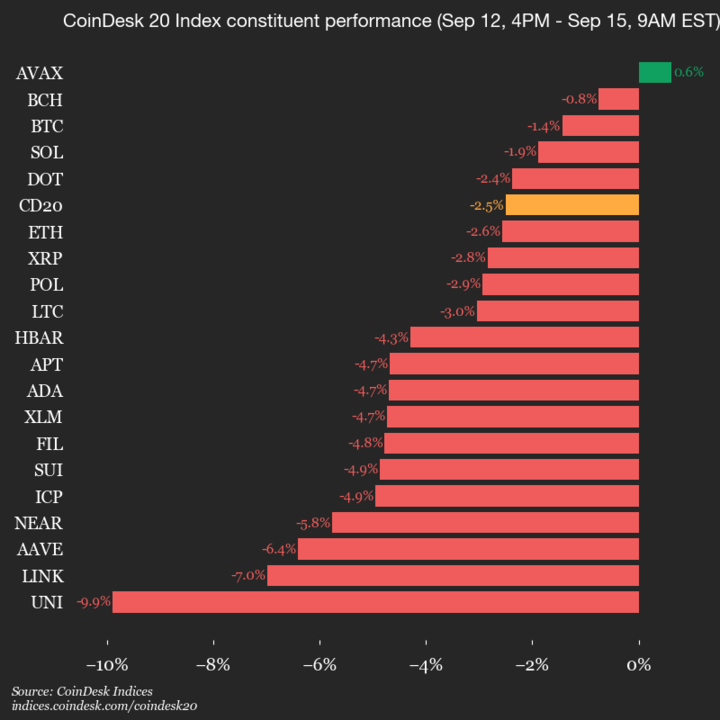

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 4248.74, down 2.5% (-109.09) since 4 p.m. ET on Monday.

One of 20 assets is trading higher.

Leaders: AVAX (+0.6%) and BCH (-0.8%).

Laggards: UNI (-9.9%) and LINK (-7.0%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Uncategorized

Pantera-Backed Solana Treasury Firm Helius Raises $500M, Stock Soars Over 200%

Helius Medical Technologies (HSDT) announced on Monday it’s raising more than $500 million in a private financing round to create a Solana-focused treasury company.

The vehicle will hold SOL, the native token of the Solana blockchain, as its reserve asset and aims to expand to more than $1.25 billion via stock warrants tied to the deal, the press release said.

The financing was led by Pantera Capital and Summer Capital, with participation from investors including Animoca Brands, FalconX and HashKey Capital.

Shares of the firm rallied over 200% above $24 in pre-market trading following the announcement. Solana was down 4% over the past 24 hours.

The firm is joining the latest wave of new digital asset treasuries, or DATs, with public companies pivoting to raise funds and buy cryptocurrencies like bitcoin (BTC), ether (ETH) or SOL.

Helius is set to rival with the recently launched Forward Industries (FORD) with a $1.65 billion war chest backed by Galaxy Digital and others. That firm confirmed on Monday that has already purchased 6.8 million tokens for roughly $1.58 billion last week.

Helius’ plan is to use Solana’s yield-bearing design to generate income on the holdings, earning staking rewards of around 7% as well as deploying tokens in decentralized finance (DeFi) and lending opportunities. Incoming executive chairman Joseph Chee, founder of Summer Capital and a former UBS banker, will lead the firm’s digital asset strategy alongside Pantera’s Cosmo Jiang and Dan Morehead.

«As a pioneer in the digital asset treasury space, having participated in the formation of the strategy at Twenty One Capital (CEP) with Tether, Softbank and Cantor, Bitmine (BMNR) with Tom Lee and Mozayyx as well as EightCo (OCTO) with Dan Ives and Sam Altman, we have built the expertise to set up the pre-eminent Solana treasury vehicle,» Cosmo Jiang, general partner at Pantera Capital, said in a statement.

«There is a real opportunity to drive the flywheel of creating shareholder value that Michael Saylor has pioneered with Strategy by accelerating Solana adoption,» he added.

Read more: Solana Surges as Galaxy Scoops Up Over $700M Tokens From Exchanges

Uncategorized

American Express Introduces Blockchain-Based ‘Travel Stamps’

American Express has introduced Ethereum-based ‘travel stamps’ to create a commemorative record of travel experiences, as part of the firm’s revamped travel app.

The travel experience tokens, which are technically NFTs (ERC 721 tokens), are minted and stored on Coinbase’s Base network, said Colin Marlowe , VP, Emerging Partnerships at Amex Digital Labs.

The travel stamps, which can be collected anytime a traveler uses their card, are not tradable NTF tokens, Marlowe explained, and neither do they function like blockchain-based loyalty points – at least for the time being.

“It’s a valueless ERC-721, so technically an NFT, but we just didn’t brand it as such. We wanted to speak to it in a way that was natural for the travel experience itself, and so we talk about these things as stamps, and they’re represented as tokens,” Marlowe said in an interview.

“As an identifier and representation of history the stamps could create interesting partnership angles over time. We weren’t trying to sell these or sort of generate any like short term revenue. The angle is to make a travel experience with Amex feel really rich, really different, and kind of set it apart,” he said.

The Amex travel app also includes a range of tools for travels and Centurion Lounge upgrades, the company said.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars